Global Antiviral Drugs Market

Market Size in USD Billion

CAGR :

%

USD

78.12 Billion

USD

119.78 Billion

2024

2032

USD

78.12 Billion

USD

119.78 Billion

2024

2032

| 2025 –2032 | |

| USD 78.12 Billion | |

| USD 119.78 Billion | |

|

|

|

|

Antiviral Drugs Market Size

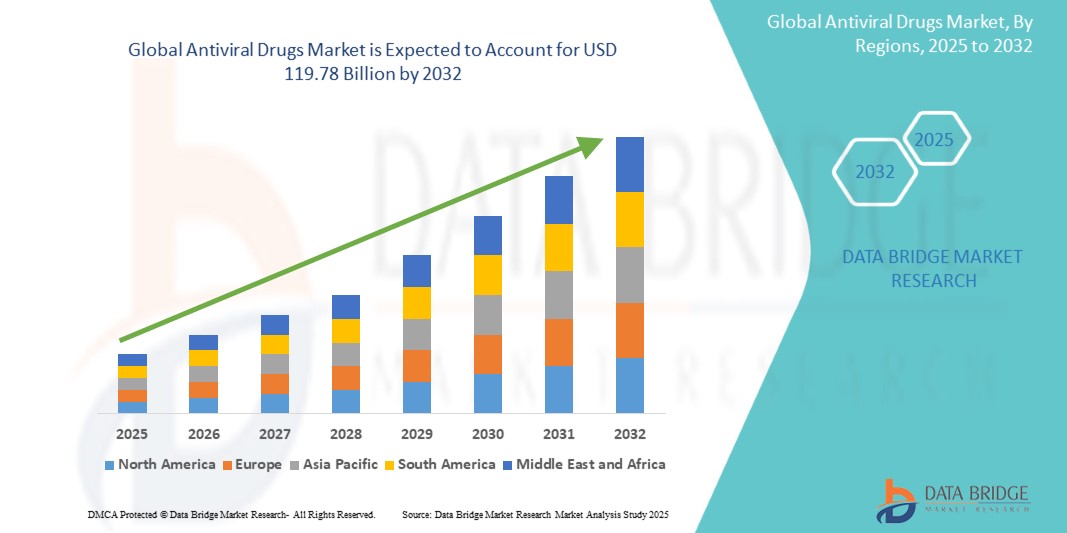

- The global antiviral drugs market size was valued at USD 78.12 billion in 2024 and is expected to reach USD 119.78 billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely fueled by the rising prevalence of viral infections such as HIV, hepatitis, influenza, and herpes, along with an increasing global focus on infectious disease prevention and control through advanced antiviral therapeutics

- Furthermore, technological advancements in drug development, growing investment in healthcare infrastructure, and expanding access to healthcare services in emerging markets are accelerating the adoption of antiviral drugs. These converging factors are driving robust demand across both developed and developing regions, thereby significantly boosting the industry’s growth

Antiviral Drugs Market Analysis

- Antiviral drugs, which inhibit the development and replication of viruses in the body, have become essential in the treatment and management of various viral infections across both acute and chronic settings due to their targeted action, ability to reduce viral load, and role in preventing disease progression and transmission

- The escalating demand for antiviral drugs is primarily driven by the rising global prevalence of infections such as HIV, hepatitis, and influenza, increasing healthcare access in emerging economies, advancements in drug formulations, and growing awareness of early diagnosis and timely antiviral intervention

- North America dominated the antiviral drugs market with a share of 58.66% in 2024 due to well-established pharmaceutical industry, strong healthcare infrastructure, and significant public and private investment in antiviral research and treatment programs

- Asia-Pacific is expected to grow at the fastest CAGR of 6.7% in the antiviral drugs market during the forecast period due to rising healthcare awareness, improving healthcare infrastructure, and a growing burden of viral infections

- The influenza segment dominated the antiviral drugs market with the largest market share of 34.54% in 2024 as these indications are more prevalent globally

Report Scope and Antiviral Drugs Market Segmentation

|

Attributes |

Antiviral Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Antiviral Drugs Market Trends

“Increasing Prevalence of Viral Infections”

- A significant and accelerating trend in the antiviral drugs market is the rising prevalence of viral infections such as HIV, hepatitis B and C, influenza, and emerging viral threats including coronavirus strains, which is intensifying the global focus on antiviral therapy development

- For instance, the global burden of hepatitis B affects over 250 million people, while annual influenza epidemics result in millions of severe cases and hundreds of thousands of deaths, prompting urgent demand for effective antiviral treatments

- The increasing frequency of zoonotic spillovers and the global spread of contagious viruses are prompting healthcare systems and pharmaceutical companies to prioritize antiviral preparedness and response, encouraging the development of both preventive and therapeutic solutions

- Governments and international health organizations are allocating greater funding toward antiviral research, surveillance programs, and stockpiling of essential antiviral drugs to strengthen public health readiness against viral outbreaks

- This trend is also driving interest in repurposing existing antivirals for multiple indications and accelerating the regulatory approval processes for fast-track treatment deployment during pandemics

- The mounting prevalence of viral infections worldwide is reshaping healthcare priorities and positioning antiviral drug development as a critical area of pharmaceutical innovation and public health investment

Antiviral Drugs Market Dynamics

Driver

“Advancements in New Antiviral Drug Development”

- The rapid pace of advancements in new antiviral drug development is a significant driver for the growth of the antiviral drugs market, with pharmaceutical companies investing in novel molecules, improved formulations, and targeted delivery systems to enhance efficacy and reduce resistance

- For instance, in January 2024, Pfizer initiated a Phase II trial for a next-generation oral antiviral targeting multiple influenza strains, reflecting a broader industry push toward developing broad-spectrum antivirals with pandemic preparedness in mind

- As the global threat of viral mutations and emerging pathogens grows, research is increasingly focused on creating antivirals with higher specificity, longer half-life, and fewer side effects, ensuring better patient compliance and treatment outcomes

- Pharmaceutical innovation is also being accelerated by advancements in molecular biology, high-throughput screening, and computational modeling, which are enabling faster drug discovery and design

- These innovations are fueling a more robust antiviral pipeline and are expected to transform treatment paradigms for chronic, acute, and emerging viral infections, thereby expanding the market potential across various healthcare segments

Restraint/Challenge

“High Cost of Antiviral Drugs”

- The high cost of antiviral drugs poses a significant challenge to widespread accessibility and sustained market growth, particularly in low- and middle-income countries where healthcare budgets and insurance coverage are often limited

- For instance, the price of branded antivirals such as those for hepatitis C or HIV can exceed thousands of dollars per treatment cycle, creating affordability barriers for both public health systems and individual patients

- Limited availability of cost-effective generic alternatives in certain regions further compounds the issue, restricting equitable access to essential medications and hindering treatment adherence

- Reimbursement challenges and inconsistent pricing policies across healthcare systems globally can delay adoption, especially in countries with underdeveloped pharmaceutical procurement frameworks

- Addressing this challenge will require coordinated efforts to support generic drug production, increase pricing transparency, and implement patient assistance programs to ensure that effective antiviral therapies are accessible to broader populations without compromising financial sustainability

Antiviral Drugs Market Scope

The market is segmented on the basis of indication, patient type, products, drug type, end user, and distribution channel.

- By Indication

On the basis of indication, the antiviral drugs market is segmented into Influenza, Human Immunodeficiency Virus (HIV), Hepatitis C Virus (HCV), Respiratory Syncytial Virus, Herpes Simplex Virus, Human Cytomegalovirus (HCMV), Varicella-Zoster Virus (VZV), Hepatitis B Virus (HBV), Coronavirus Infection, and Others. The Influenza segment is projected to dominate the global antiviral drugs market with a 34.54% share in 2024 primarily due to the widespread and recurring nature of influenza, which causes predictable seasonal epidemics and a substantial global burden of illness and mortality. This consistent demand is further amplified by the virus's constant evolution, necessitating continuous development of new antiviral drugs and updated vaccines, along with increasing awareness and robust public health initiatives promoting early diagnosis and treatment, particularly among vulnerable populations like the elderly and young children.

The HCV segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising diagnosis rates and curative treatment options through Direct-Acting Antivirals (DAAs). Increasing public health efforts to eliminate hepatitis C, particularly in Asia-Pacific and Eastern Europe, combined with price reductions through generic competition, are enhancing accessibility and adoption rates.

- By Patient Type

On the basis of patient type, the market is segmented into Child, Adult, and Geriatric. The geriatric segment is expected to dominate the global antiviral drugs market with a largest market share of 49.11% in 2024 primarily due to the aging global population and the inherent decline in immune function (immunosenescence) that occurs with age. This natural weakening of the immune system makes older adults significantly more susceptible to a wide range of viral infections, including common ones like influenza and respiratory syncytial virus (RSV), as well as more serious conditions like herpes and even chronic viral infections like HIV and hepatitis.

The adult segment is anticipated to experience the fastest growth from 2025 to 2032. The adult population, encompassing a broad age range, is highly susceptible to a wide array of viral infections, including chronic conditions like HIV/AIDS and hepatitis, as well as seasonal illnesses such as influenza and emerging viral threats. The increasing global prevalence and incidence of these viral diseases among adults create a constant and growing demand for effective antiviral treatments.

- By Products

On the basis of product type, the market is segmented into Oral, Topical, and Parenteral. The oral segment is expected to dominate the global antiviral drugs market with a largest market share of 64.44% in 2024 primarily due to the overwhelming preference for oral administration among both patients and healthcare providers. Oral medications offer unparalleled convenience, ease of self-administration at home, and are non-invasive, eliminating the pain and discomfort associated with injections. This significantly improves patient adherence to treatment regimens, particularly for chronic viral infections requiring long-term therapy (like HIV and hepatitis) or for early intervention in acute conditions (like influenza and COVID-19).

The parenteral segment is forecasted to grow at the fastest CAGR during 2025–2032. This is due to rising emphasis on long-acting injectable (LAI) antiviral therapies, particularly for chronic conditions like HIV and hepatitis. These LAIs offer significant advantages in terms of patient adherence by reducing the frequency of dosing from daily pills to monthly or even bimonthly injections, thereby improving treatment outcomes and quality of life. This is especially beneficial for patients who struggle with daily oral medication regimens or face challenges related to compliance.

- By Drug Type

On the basis of drug type, the market is categorized into Branded and Generic drugs. The generic segment is expected to dominate the global antiviral drugs market with a largest market share of 65.58% in 2024 primarily due to the expiration of patents for numerous blockbuster branded antiviral drugs. This patent cliff allows generic manufacturers to produce and market bioequivalent versions of these drugs at significantly lower prices. The inherent cost-effectiveness of generics makes them highly attractive to patients, healthcare providers, and governments worldwide, who are increasingly focused on controlling rising healthcare expenditures and improving access to affordable medication.

Meanwhile, the branded drug segment is expected to expand at the fastest rate from 2025 to 2032. This is due to relentless focus on innovation and the introduction of novel, highly effective therapies for unmet medical needs. While generics dominate in terms of volume due to their affordability, branded drugs are at the forefront of developing breakthrough treatments for difficult-to-treat or emerging viral infections where no generic alternatives exist. These include therapies with novel mechanisms of action, improved safety profiles, enhanced patient convenience (such as long-acting injectables or single-pill regimens for chronic conditions), and those targeting drug-resistant viral strains. Significant investments in research and development by major pharmaceutical companies, coupled with robust patent protection, allow them to command premium pricing for these innovative products.

- By End User

On the basis of end user, the market is segmented into Hospitals, Clinics, Home Healthcare, Specialty Centers, Ambulatory Centers, and Others. Hospitals held the dominant market share of 52.00% in 2024 due to their critical role in managing severe viral infections, inpatient care for high-risk groups, and immediate access to parenteral formulations. They also serve as primary centers for diagnosis, viral load monitoring, and treatment initiation, especially for life-threatening infections.

Home healthcare is projected to register the fastest CAGR from 2025 to 2032. With the expansion of oral antivirals and digital health solutions, more patients are managing chronic conditions such as HIV and HBV from home. Rising preference for decentralized care, the convenience of home delivery of medications, and increased availability of telemedicine consultations are key contributors to the shift.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy. Hospital pharmacies held the leading share of 54.07% in 2024 due to the centralization of drug dispensing in inpatient settings and the critical need for controlled administration of specialized antivirals. Hospitals often stock a broader range of formulations including injectables and emergency antivirals not readily available at retail.

The online pharmacy segment is expected to record the highest CAGR from 2025 to 2032. Factors such as increasing internet penetration, e-prescriptions, rising consumer inclination towards doorstep delivery, and the growing number of patients managing chronic infections at home are boosting this channel. Regulatory support and the rise of digital health platforms also play a key role in expanding online access to antiviral drugs.

Antiviral Drugs Market Regional Analysis

- North America dominated the antiviral drugs market with the largest revenue share of 58.66% in 2024, driven by well-established pharmaceutical industry, strong healthcare infrastructure, and significant public and private investment in antiviral research and treatment programs

- The region’s high prevalence of chronic viral infections such as HIV, HBV, and HCV, along with widespread access to advanced diagnostics and antiviral therapies, drives consistent market demand

- In addition, proactive government initiatives, extensive awareness campaigns, and early adoption of novel antiviral drugs contribute to North America's leading position in both treatment accessibility and innovation

U.S. Antiviral Drugs Market Insight

U.S. antiviral drugs market captured the largest revenue share of 74.87% of North America in 2024, propelled by the high disease burden, favorable regulatory pathways, and strong presence of global pharmaceutical companies. The growing incidence of influenza and sexually transmitted viral infections, coupled with continuous innovation in drug development and delivery mechanisms, further drives demand. Furthermore, the U.S. benefits from well-funded healthcare programs such as Medicaid and Medicare, which support widespread access to antiviral medications.

Europe Antiviral Drugs Market Insight

Europe antiviral drugs market is projected to witness robust growth during the forecast period, driven by rising government investments in infectious disease control and increasing adoption of preventive therapies. High awareness about viral diseases such as HIV, HCV, and seasonal flu among the population leads to consistent demand for both treatment and prophylactic antivirals. European health systems' emphasis on evidence-based medicine, early screening, and universal healthcare access enhances treatment coverage, while regulatory support for generic drug manufacturing is also reshaping market dynamics.

U.K. Antiviral Drugs Market Insight

U.K. antiviral drugs market is expected to grow at a notable CAGR, driven by increasing awareness of viral infections and the presence of strong public health infrastructure. The National Health Service (NHS) plays a key role in facilitating access to antiviral treatments, especially for chronic infections such as HIV and HBV. Moreover, ongoing clinical trials and collaborative efforts with academic research institutions are contributing to the development of next-generation antivirals.

Germany Antiviral Drugs Market Insight

Germany antiviral drugs market is forecasted to expand steadily, supported by high healthcare spending, robust pharmaceutical R&D, and a well-regulated drug approval process. Germany’s focus on early diagnosis and adherence to standardized treatment protocols has boosted the adoption of antiviral therapies, especially for conditions such as herpes, CMV, and influenza. The country’s aging population also drives demand for antiviral prophylaxis and therapies targeting immunocompromised individuals.

Asia-Pacific Antiviral Drugs Market Insight

Asia-Pacific antiviral drugs market is projected to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising healthcare awareness, improving healthcare infrastructure, and a growing burden of viral infections. Countries such as China, India, and Japan are experiencing increased access to diagnostics and treatments, supported by government initiatives and global health partnerships. The region's rising population, expanding middle class, and growing affordability of antivirals, particularly through generic manufacturing, are further fueling market expansion.

Japan Antiviral Drugs Market Insight

Japan antiviral drugs market is advancing due to the country’s proactive public health policies, high level of technological innovation, and significant elderly population. Japan places strong emphasis on seasonal immunization and early treatment of viral infections such as influenza and herpes. Its pharmaceutical companies are investing heavily in the development of novel antivirals, while digital health integration improves adherence and monitoring of antiviral regimens.

China Antiviral Drugs Market Insight

China antiviral drugs market accounted for the largest revenue share in Asia-Pacific in 2024, driven by government-supported healthcare reforms, rapid urbanization, and the rising prevalence of HBV, HCV, and HIV. China’s expanding biopharmaceutical industry, coupled with strong domestic manufacturing capacity, enhances both the availability and affordability of antiviral drugs. Ongoing public health efforts, including mass vaccination and screening campaigns, further contribute to sustained demand.

Antiviral Drugs Market Share

The antiviral drugs industry is primarily led by well-established companies, including:

- Gilead Sciences, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- GLAXOSMITHKLINE PLC (U.K.)

- Abbvie (U.S.)

- Merck & Co., Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Cipla Inc. (India)

- Aurobindo Pharma (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Zydus Pharmaceuticals, Inc. (India)

- Mylan Pharmaceuticals ULC (U.S.)

- Teva Pharmaceuticals USA, Inc. (U.S.)

- EMERGENT (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Avet Pharmaceuticals Inc. (U.S.)

- Pfizer Inc. (U.S.)

- SIGA Technologies (U.S.)

- NAVINTA LLC. (U.S.)

- Macleods Pharmaceuticals Ltd. (India)

- BioCryst Pharmaceuticals, Inc. (U.S.)

- Hetero (India)

Latest Developments in Global Antiviral Drugs Market

- In May 2023, the FDA approval of Paxlovid as the first oral antiviral pill for mild-to-moderate COVID-19 treatment in high-risk adults marked a major milestone in the antiviral drugs market. This approval increased market penetration of oral antivirals in the U.S. and globally, driving innovation and competition while reinforcing the shift toward more convenient, outpatient COVID-19 treatment options, thereby further propelling market expansion

- In January 2023, Merck, known as MSD, announced the successful completion of the cash tender offer, through a subsidiary, for all of the outstanding shares of common stock of Imago Biosciences, Inc. (Nasdaq: IMGO), at a purchase price of USD 36.00 per share in cash, without interest and subject to deduction for any required tax withholding. The acquisition will help in the growth of the revenue

- In January 2022, the launch of Molnupiravir by Lupin Limited in India under emergency use authorization significantly impacted the antiviral drugs market by expanding treatment options for COVID-19 patients at high risk of disease progression. This introduction helped boost the demand for oral antiviral therapies, especially in emerging markets, accelerating market growth amid the ongoing pandemic

- In April 2021, Zydus Pharmaceuticals, Inc. announced that it had received restricted emergency use approval from the Drug Controller General of India (DCGI) to use the antiviral drug Virafin for the treatment of moderate COVID-19 infections. This will help the company to increase its global presence and reputation in other regions of the globe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.