Global Arterial Blood Collection Market

Market Size in USD Billion

CAGR :

%

USD

1.27 Billion

USD

2.48 Billion

2025

2033

USD

1.27 Billion

USD

2.48 Billion

2025

2033

| 2026 –2033 | |

| USD 1.27 Billion | |

| USD 2.48 Billion | |

|

|

|

|

Arterial Blood Collection Market Size

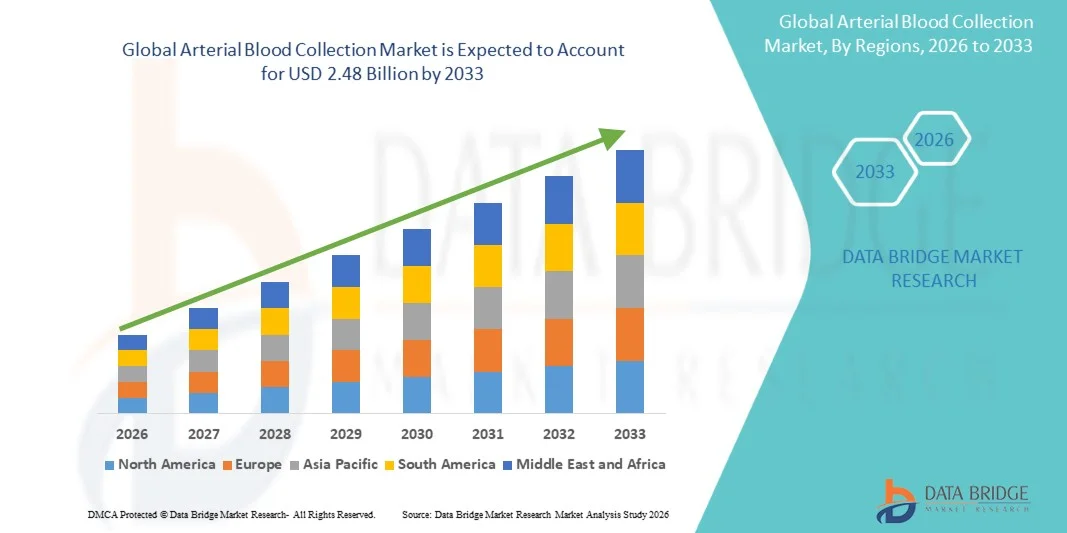

- The global arterial blood collection market size was valued at USD 1.27 billion in 2025 and is expected to reach USD 2.48 billion by 2033, at a CAGR of 8.78% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic and critical diseases, such as cardiovascular and respiratory disorders, which necessitate frequent and accurate arterial blood diagnostics

- Furthermore, rising demand for precise clinical diagnostics and early disease detection, coupled with expanding healthcare infrastructure and awareness of the importance of arterial blood analysis in critical care settings, is establishing arterial blood collection solutions as essential tools in modern healthcare workflows. These converging factors are accelerating the uptake of arterial blood collection products, thereby significantly boosting the industry’s growth

Arterial Blood Collection Market Analysis

- Arterial blood collection devices, enabling safe and precise blood sampling from arteries, are increasingly essential components in modern clinical diagnostics, critical care, and hospital laboratories due to their accuracy, reliability, and compatibility with automated analysis systems

- The escalating demand for arterial blood collection devices is primarily driven by the rising prevalence of chronic and critical diseases, growing adoption of advanced diagnostic procedures, and the need for rapid, accurate blood analysis in intensive care and surgical settings

- North America dominated the arterial blood collection market with the largest revenue share of 40.9% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and the presence of key industry players, with the U.S. witnessing substantial adoption in hospitals, diagnostic labs, and ambulatory care centers due to innovations in safety-enhanced and user-friendly devices

- Asia-Pacific is expected to be the fastest-growing region in the arterial blood collection market during the forecast period due to increasing healthcare investments, growing hospital and laboratory networks, and rising awareness of early disease detection and critical care diagnostics

- Needles segment dominated the arterial blood collection market with a market share of 44.2% in 2025, driven by their established safety standards, ease of use, and widespread compatibility with existing laboratory systems

Report Scope and Arterial Blood Collection Market Segmentation

|

Attributes |

Arterial Blood Collection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Arterial Blood Collection Market Trends

“Advancements in Safety-Engineered and Automated Devices”

- A significant and accelerating trend in the global arterial blood collection market is the adoption of safety-engineered and automated collection devices that minimize risk of needlestick injuries and improve sample accuracy

- For instance, the BD Neoflon™ Safety Arterial Catheter incorporates a retractable needle mechanism to protect healthcare workers during and after blood collection, while other devices integrate automated sample handling features

- Automation and safety integration enable real-time monitoring, reduced sample contamination, and improved procedural efficiency, enhancing workflow in hospitals and diagnostic labs

- The seamless integration of arterial blood collection systems with laboratory information systems (LIS) and automated analyzers allows centralized tracking of samples, reducing human error and enabling faster diagnostics

- This trend toward safer, automated, and workflow-optimized blood collection systems is fundamentally reshaping clinical laboratory practices. Consequently, companies such as Terumo and Smiths Medical are developing advanced devices with built-in safety mechanisms and automated blood handling features

- The demand for arterial blood collection devices that ensure safety, efficiency, and compatibility with automated clinical workflows is growing rapidly across both hospital and outpatient diagnostic settings

- Rising adoption of wireless-enabled arterial collection systems for real-time data capture and connectivity is enhancing efficiency and reducing manual errors in critical care settings

- Integration of ergonomic and user-friendly designs in collection devices is improving clinician comfort and procedural accuracy, further driving market acceptance globally

Arterial Blood Collection Market Dynamics

Driver

“Increasing Demand Due to Rising Chronic Diseases and Hospitalization Rates”

- The increasing prevalence of chronic and critical diseases, coupled with rising hospital admissions, is a significant driver for the heightened demand for arterial blood collection devices

- For instance, in March 2025, BD announced enhancements to its arterial blood collection line aimed at improving safety and accuracy in high-volume hospital laboratories, demonstrating key players’ strategies to support market growth

- As hospitals and diagnostic labs prioritize precise and timely blood analysis, arterial blood collection devices offer advanced features such as safety needles, reduced contamination risk, and reliable sample integrity

- Furthermore, the expanding adoption of automated laboratory systems and point-of-care diagnostics is making arterial blood collection devices integral for streamlined clinical workflows

- The convenience of reduced procedural errors, compatibility with automated analyzers, and safe handling of blood samples are key factors propelling adoption in hospital and laboratory settings

- Increasing government initiatives and funding to improve hospital infrastructure and laboratory capabilities in emerging markets are further boosting the demand for arterial blood collection devices

- Rising awareness among clinicians and healthcare providers about the critical role of arterial blood analysis in disease management and critical care is enhancing adoption rates globally

Restraint/Challenge

“Needlestick Injury Risk and Regulatory Compliance Hurdles”

- Concerns surrounding needlestick injuries and strict regulatory requirements pose significant challenges to broader market penetration. As arterial blood collection involves invasive procedures, safety and compliance are critical issues for healthcare providers

- For instance, reports of accidental needlestick injuries in hospitals have made some institutions hesitant to adopt devices without certified safety features

- Addressing these concerns through safety-engineered needles, staff training, and adherence to regulatory standards is crucial for market acceptance. Companies such as Terumo and Smiths Medical emphasize compliance and safety in product design to reassure healthcare providers

- In addition, relatively high costs of advanced arterial blood collection systems compared to conventional syringes can be a barrier for budget-conscious hospitals, especially in developing regions

- Overcoming these challenges through enhanced safety features, regulatory compliance, and development of cost-effective solutions will be vital for sustained market growth

- Variations in regional regulatory standards and certification requirements can delay product launches and increase operational costs for manufacturers

- Limited availability of skilled personnel trained to handle advanced arterial blood collection systems in some regions may hinder adoption and operational efficiency

Arterial Blood Collection Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the arterial blood collection market is segmented into blood collection tubes, lancets, needles, vacuum blood collection systems, microfluidic systems, and others. The needles segment dominated the market with the largest revenue share of 44.2% in 2025, driven by their established use in hospitals and laboratories for routine arterial blood collection procedures. Needles are favored for their accuracy, reliability, and compatibility with existing diagnostic equipment, making them a standard choice in clinical workflows. Hospitals and diagnostic labs prioritize needle-based devices due to their safety-enhanced designs and proven effectiveness in reducing contamination risks. The strong presence of manufacturers producing safety-engineered and ergonomic needles also supports market dominance. Their widespread adoption is reinforced by clinician familiarity and training, ensuring consistent and precise sample collection. In addition, needle-based devices remain cost-effective compared to more advanced automated systems, further strengthening their market position.

The vacuum blood collection systems segment is anticipated to witness the fastest growth rate of 7% CAGR from 2026 to 2033, fueled by the increasing adoption in hospitals, outpatient clinics, and laboratories seeking automation and standardized collection processes. These systems minimize manual handling, reduce procedural errors, and improve workflow efficiency. The integration of safety features, including retractable needles and closed-system designs, enhances protection for healthcare personnel. Moreover, these devices are compatible with automated analyzers, allowing faster processing and reducing sample rejection rates. The growing focus on patient comfort and procedural safety further drives adoption in both developed and emerging markets.

- By Application

On the basis of application, the arterial blood collection market is segmented into arterial blood gas (ABG) sampling and intraoperative blood salvage. The ABG sampling segment dominated the market with the largest revenue share of 55% in 2025, owing to its critical role in monitoring oxygenation, carbon dioxide levels, and pH in patients with respiratory or cardiac conditions. Hospitals and intensive care units rely heavily on ABG sampling for timely diagnosis and treatment planning, making this application a high-volume user of collection devices. Technological advancements in safety and automation for ABG sampling have further enhanced efficiency and reduced procedural errors. The rising prevalence of chronic respiratory and cardiovascular diseases globally drives consistent demand. In addition, the segment benefits from strong clinician familiarity and established procedural protocols, reinforcing its dominant market position.

The intraoperative blood salvage segment is expected to witness the fastest growth rate of 7% CAGR from 2026 to 2033, driven by rising surgical procedures and the need for efficient blood management during operations. These systems enable the collection, processing, and reinfusion of a patient’s own blood, reducing reliance on donor blood and minimizing complications. Increasing awareness of patient blood management (PBM) programs and technological innovations in automated salvage systems are boosting adoption. Hospitals and surgical centers are investing in devices that improve operational efficiency, reduce transfusion-related risks, and support patient safety initiatives. The growth is particularly strong in developed countries with high surgical volumes and expanding healthcare infrastructure in emerging markets.

- By End User

On the basis of end user, the arterial blood collection market is segmented into hospitals and clinics, blood banks, laboratories, and others. The hospitals and clinics segment dominated the market with the largest revenue share of 60% in 2025, owing to the high volume of arterial blood collection procedures in critical care, emergency, and surgical units. Hospitals prioritize the adoption of safety-engineered and automated devices to improve patient safety, reduce procedural errors, and optimize workflow efficiency. The segment benefits from ongoing investments in modernizing healthcare infrastructure, especially in developed regions. Frequent blood sampling for diagnosis, monitoring, and treatment planning makes hospitals the primary end users of these devices. In addition, hospitals often have dedicated staff trained to handle advanced collection systems, enhancing adoption and operational efficiency.

The laboratories segment is expected to witness the fastest growth rate of 7% CAGR from 2026 to 2033, fueled by the increasing number of diagnostic labs and the demand for high-throughput, standardized blood collection processes. Laboratories favor automated and vacuum-based collection systems that ensure sample integrity, minimize handling errors, and integrate seamlessly with analyzers. Growing outsourcing of diagnostic services and expansion of laboratory networks in emerging markets are driving adoption. Technological advancements in microfluidic and automated systems for laboratory applications further accelerate market growth. The segment also benefits from increasing demand for rapid and accurate testing in critical care and research applications.

Arterial Blood Collection Market Regional Analysis

- North America dominated the arterial blood collection market with the largest revenue share of 40.9% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and the presence of key industry players

- Healthcare providers in the region highly prioritize patient safety, accurate diagnostics, and efficient workflow, leading to widespread adoption of safety-engineered needles, vacuum blood collection systems, and automated arterial blood collection devices

- This strong adoption is further supported by high healthcare expenditure, a technologically advanced medical workforce, and ongoing investments in hospitals and diagnostic laboratories, establishing arterial blood collection devices as a standard in critical care and clinical diagnostics

U.S. Arterial Blood Collection Market Insight

The U.S. arterial blood collection market captured the largest revenue share of 82% in North America in 2025, fueled by advanced healthcare infrastructure and widespread adoption of modern diagnostic technologies. Hospitals and clinics are prioritizing safety-engineered needles, vacuum blood collection systems, and automated devices to enhance patient safety and improve procedural efficiency. The growing prevalence of chronic diseases and critical care requirements is driving high-volume usage of arterial blood collection systems. Furthermore, increasing adoption of automated laboratory analyzers and integration with laboratory information systems (LIS) supports workflow optimization. The rising emphasis on patient blood management programs and reducing procedural errors is further propelling market growth.

Europe Arterial Blood Collection Market Insight

The Europe arterial blood collection market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and safety standards in hospitals and laboratories. Increasing urbanization, growth in surgical procedures, and rising awareness of safe blood collection practices are fostering market adoption. Hospitals and diagnostic centers are investing in automated and safety-engineered devices to minimize errors and enhance patient outcomes. European healthcare providers value reliable, high-quality devices that integrate seamlessly with laboratory workflows. The demand is significant across hospitals, clinics, and research laboratories, particularly in Germany, France, and Italy.

U.K. Arterial Blood Collection Market Insight

The U.K. arterial blood collection market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising hospital admissions, chronic disease prevalence, and increasing awareness of patient safety. Healthcare providers are adopting keyless, automated, and safety-engineered blood collection systems to reduce procedural errors and minimize contamination risks. The U.K.’s robust healthcare infrastructure, well-trained medical workforce, and emphasis on clinical efficiency continue to stimulate market growth. Hospitals, diagnostic labs, and outpatient clinics are increasingly incorporating automated arterial blood collection devices to enhance workflow and sample integrity.

Germany Arterial Blood Collection Market Insight

The Germany arterial blood collection market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of patient safety, high adoption of modern diagnostic technologies, and stringent regulatory requirements. Hospitals and laboratories are investing in safety-engineered needles, vacuum blood collection systems, and automated solutions to improve efficiency and reduce risk. Germany’s well-developed healthcare infrastructure and focus on technological innovation support market growth. Integration with laboratory information systems and automated analyzers is increasingly prevalent, especially in critical care and research settings.

Asia-Pacific Arterial Blood Collection Market Insight

The Asia-Pacific arterial blood collection market is poised to grow at the fastest CAGR of 8% from 2026 to 2033, driven by increasing healthcare investments, rising hospital and laboratory networks, and growing prevalence of chronic and critical diseases in countries such as China, India, and Japan. The region’s focus on improving patient safety, adoption of automated and safety-engineered devices, and government initiatives for modern healthcare infrastructure are fueling growth. In addition, the expansion of private healthcare facilities and growing awareness of efficient blood collection practices among clinicians is boosting market adoption.

Japan Arterial Blood Collection Market Insight

The Japan arterial blood collection market is gaining momentum due to high healthcare standards, an aging population, and the adoption of advanced diagnostic technologies. Hospitals and clinics prioritize patient safety, accuracy, and efficiency, driving demand for automated and safety-engineered blood collection systems. Integration with laboratory information systems and hospital workflow management solutions is increasing. The country’s emphasis on clinical efficiency and procedural safety, combined with rising prevalence of chronic diseases, is fueling adoption across hospitals, outpatient clinics, and diagnostic laboratories.

India Arterial Blood Collection Market Insight

The India arterial blood collection market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising healthcare investments, and growing hospital and laboratory networks. Hospitals, diagnostic centers, and clinics are increasingly adopting safety-engineered needles, vacuum blood collection systems, and automated devices to enhance patient safety and workflow efficiency. The push towards smart hospitals and improved clinical standards, coupled with growing awareness of safe blood collection practices, is driving market growth. Affordable device options and expanding domestic manufacturing are further supporting market adoption in India.

Arterial Blood Collection Market Share

The Arterial Blood Collection industry is primarily led by well-established companies, including:

- BD (U.S.)

- Radiometer Medical ApS (Denmark)

- Terumo Corporation (Japan)

- ICU Medical, Inc. (U.S.)

- Greiner Bio-One International GmbH (Austria)

- NIPRO CORPORATION (Japan)

- SARSTEDT AG & Co. KG (Germany)

- Cardinal Health (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- QIAGEN (Netherlands)

- Bio-Rad Laboratories, Inc. (U.S.)

- Sekisui Diagnostics, LLC (U.S.)

- F.L. Medical S.r.l. (Italy)

- Zhejiang Gongdong Medical Technology Co., Ltd. (China)

- Improve Medical Instruments Co., Ltd. (China)

- Jiangsu Kanghua Medical Equipment Co., Ltd. (China)

- Hindustan Syringes & Medical Devices Ltd. (India)

- Narang Medical Limited (India)

What are the Recent Developments in Global Arterial Blood Collection Market?

- In March 2025, Vitestro unveiled Aletta™, the world’s first autonomous robotic phlebotomy device (ARPD™), designed to fully automate blood collection using AI-powered Doppler ultrasound and robotic needle control, aiming to improve precision, safety, and efficiency of routine blood draws in clinical settings

- In March 2025, Northwestern Medicine and Vitestro announced a multi-year collaboration to advance autonomous robotic phlebotomy, enrolling U.S. clinical sites in trials of Aletta™ to validate automated blood collection performance and enhance the patient experience amid staffing challenges

- In December 2024, Metropolis Healthcare Limited introduced an innovative UltraTouch™ Push Button Blood Collection Set aimed at enhancing patient comfort by minimizing pain and needle anxiety during blood draws across its diagnostic network in India, improving overall blood collection experience and efficiency in pathology services

- In December 2023, St. Antonius Hospital in the Netherlands signed an agreement to deploy two of Vitestro’s autonomous blood drawing devices once CE marking is completed, marking a key step toward clinical implementation of automated blood collection technology

- In September 2023, Vitestro started the A.D.O.P.T. global clinical trial for its autonomous blood drawing device, enrolling the first patients to evaluate efficacy, safety, and real-world performance in over 10,000 participants across multiple European clinical sites

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.