Global Asthma Device Market

Market Size in USD Billion

CAGR :

%

USD

4.65 Billion

USD

6.68 Billion

2025

2033

USD

4.65 Billion

USD

6.68 Billion

2025

2033

| 2026 –2033 | |

| USD 4.65 Billion | |

| USD 6.68 Billion | |

|

|

|

|

Asthma Device Market Size

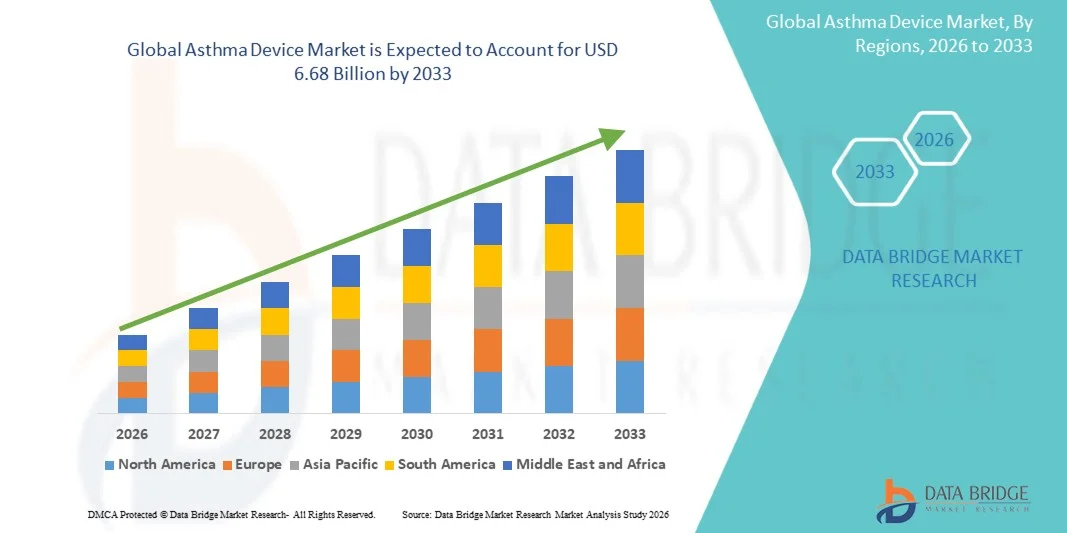

- The global asthma device market size was valued at USD 4.65 billion in 2025 and is expected to reach USD 6.68 billion by 2033, at a CAGR of 4.65% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in connected healthcare devices and digital health solutions, leading to improved asthma monitoring and patient management

- Furthermore, rising patient awareness, increasing prevalence of asthma, and the demand for user-friendly, integrated respiratory care devices are driving adoption of advanced Asthma Device solutions, thereby significantly boosting the industry’s growth

Asthma Device Market Analysis

- Asthma devices, offering innovative solutions for respiratory monitoring and treatment, are increasingly vital components of modern healthcare systems in both residential and clinical settings due to their enhanced convenience, real-time monitoring capabilities, and seamless integration with digital health ecosystems

- The escalating demand for asthma devices is primarily fueled by the widespread adoption of connected healthcare technologies, growing prevalence of asthma and respiratory disorders among patients, and a rising preference for user-friendly, effective, and integrated treatment solutions

- North America dominated the asthma device market with the largest revenue share of 42.7% in 2025, characterized by strong healthcare infrastructure, high awareness of respiratory diseases, and widespread adoption of advanced asthma management devices. The U.S. is experiencing substantial growth in Asthma Device installations, driven by innovations from leading medical device companies.

- Asia-Pacific is expected to be the fastest growing region in the asthma device market during the forecast period due to increasing urbanization, rising disposable incomes, and growing awareness of asthma management solutions

- The asthma segment dominated the largest market revenue share of 65.4% in 2025, fueled by rising global prevalence, particularly in children and young adults

Report Scope and Asthma Device Market Segmentation

|

Attributes |

Asthma Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asthma Device Market Trends

“Rising Adoption of Connected and Portable Asthma Devices”

- A significant and accelerating trend in the global asthma device market is the growing adoption of connected and portable devices designed to monitor and manage asthma symptoms effectively

- These devices provide real-time feedback on lung function, medication usage, and environmental triggers, improving disease management and patient outcomes

- For instances, Propeller Health’s digital inhaler platform has been widely implemented in the U.S., enabling patients and healthcare providers to track medication usage and identify triggers through a connected smartphone app

- The trend toward miniaturized, wearable, and portable asthma monitoring devices allows patients to manage their condition discreetly and continuously, enhancing adherence to prescribed therapies

- Furthermore, integration with mobile health platforms and patient management systems is enabling healthcare providers to offer personalized treatment plans and timely interventions, improving long-term asthma control

- Advances in sensor technology, such as electronic peak flow meters and smart inhalers, are making devices more accurate, reliable, and user-friendly, which is further driving adoption among both pediatric and adult populations

- Increasing awareness among patients and caregivers regarding the benefits of continuous monitoring and early detection of exacerbations is shaping patient expectations and boosting demand for innovative asthma management devices globally

Asthma Device Market Dynamics

Driver

“Increasing Prevalence of Asthma and Chronic Respiratory Diseases”

- The rising prevalence of asthma, particularly in children and adolescents, is a primary driver of market growth. According to the Global Asthma Report 2023, over 300 million people worldwide are affected by asthma, with increasing incidence in urban areas due to pollution and lifestyle factors

- For instance, in 2022, GlaxoSmithKline (GSK) expanded its Ellipta inhaler portfolio across Europe and Asia-Pacific to meet the growing demand for asthma devices among patients with moderate-to-severe asthma

- Growing patient awareness of disease management, along with an emphasis on reducing hospitalizations and emergency visits, is creating strong demand for effective asthma devices

- The trend toward home-based monitoring and self-management, driven by healthcare initiatives promoting telemedicine and remote patient care, is further supporting market expansion

- In addition, regulatory support for digital health solutions and reimbursement policies in key regions is enabling wider adoption of connected inhalers and monitoring devices

Restraint/Challenge

“High Cost of Advanced Devices and Limited Access in Developing Regions”

- The high cost of technologically advanced asthma devices, such as connected inhalers, digital peak flow meters, and portable spirometers, is a key restraint on market growth

- For instance, the Propeller Health digital inhaler system, while effective, is priced higher than standard inhalers, limiting accessibility in price-sensitive regions of Asia and Africa

- Limited reimbursement policies in many countries and the lack of awareness about advanced asthma management solutions further restrict market penetration

- Challenges related to device maintenance, calibration, and patient training can also impede adoption, particularly among elderly or low-literacy populations

- Overcoming these challenges through cost-effective device development, improved healthcare coverage, and patient education programs will be critical for sustained market growth

Asthma Device Market Scope

The market is segmented on the basis of type, indication, technology, and end-user.

• By Type

On the basis of type, the Asthma Device market is segmented into inhalers, nebulizers, dry powder inhalers (DPIs), metered-dose inhalers (MDIs), and mesh nebulizers. The inhalers segment dominated the largest market revenue share of 42.8% in 2025, driven by their widespread use, portability, and ease of administration. Inhalers are preferred by patients due to their rapid onset of action, compact design, and suitability for both adult and pediatric populations. The segment also benefits from ongoing innovation in DPI and MDI formulations, improved drug delivery efficiency, and patient adherence programs. Regulatory approvals for advanced inhaler devices and strong awareness campaigns by pharmaceutical companies further reinforced adoption. Urbanization, rising asthma prevalence, and increased healthcare access contribute to the segment’s continued dominance. Manufacturers focus on product differentiation through ergonomic designs and dose counters. Inhalers’ compatibility with smart monitoring devices and digital adherence tools has strengthened their leadership position. The segment’s consistent revenue generation and high prescription rates keep it at the forefront of the market, highlighting robust clinical acceptance. Healthcare providers recommend inhalers as first-line therapy for asthma management, which sustains their dominance. Market growth is supported by global treatment guidelines emphasizing quick-relief and maintenance therapy.

The nebulizers segment is expected to witness the fastest CAGR of 19.3% from 2026 to 2033, driven by rising adoption in homecare and hospital settings. Nebulizers are favored for pediatric and geriatric patients due to ease of use, minimal patient coordination, and ability to deliver high drug doses effectively. Advances in mesh nebulizer technology, portable battery-operated designs, and smart connectivity have made them increasingly convenient for chronic disease management. Rising COPD prevalence and co-morbid respiratory conditions fuel demand. Hospitals and homecare providers prefer nebulizers for severe or acute exacerbations. Insurance coverage expansion and reimbursement policies further support growth. The availability of drug combinations and maintenance solutions tailored for nebulizers enhances adoption. Educational initiatives and patient training programs encourage home use. Nebulizers’ integration with telehealth and digital monitoring platforms is emerging as a key growth driver. The segment is witnessing significant interest in emerging markets where hospital and homecare infrastructure is expanding. Manufacturers are investing in research to improve aerosol efficiency and minimize drug wastage.

• By Indication

On the basis of indication, the Asthma Device market is segmented into asthma and chronic obstructive pulmonary disease (COPD). The asthma segment dominated the largest market revenue share of 65.4% in 2025, fueled by rising global prevalence, particularly in children and young adults. Asthma management requires consistent use of inhalation therapies and devices, which increases demand for both maintenance and rescue treatments. Increased awareness programs by healthcare authorities and patient education campaigns reinforce proper device usage. Urban pollution, climate change, and allergen exposure contribute to rising incidence, further strengthening market dominance. Prescription-based treatment, combined with over-the-counter options, ensures broad access to devices. Healthcare infrastructure improvements in emerging markets allow better diagnosis and monitoring. Asthma-focused guidelines by WHO and national health agencies emphasize device adherence. Physicians recommend personalized therapy plans involving DPIs, MDIs, and nebulizers. Pharmaceutical companies continuously innovate with new formulations targeting asthma. The segment benefits from collaborations with digital health providers for adherence tracking. Growth is further supported by technological integration with smart inhalers providing feedback to patients.

The COPD segment is expected to witness the fastest CAGR of 16.8% from 2026 to 2033, driven by increasing prevalence among aging populations globally. COPD patients often require combination therapies delivered via nebulizers or DPIs, which fuels device adoption. Rising awareness of early diagnosis and intervention encourages device usage. Hospitalization and homecare treatment strategies are expanding device deployment. Advancements in digitally operated devices allow remote monitoring and adherence management. COPD-specific inhaler programs and patient support initiatives increase prescription and compliance rates. Emerging markets with high smoking prevalence and environmental pollutants contribute to accelerated demand. The segment benefits from integration with telemedicine and mobile health apps. Regulatory approvals for new COPD-targeted formulations boost market confidence. Global reimbursement initiatives improve affordability for chronic patients. Manufacturers are focusing on user-friendly designs to enhance compliance.

• By Technology

On the basis of technology, the Asthma Device market is segmented into manually operated and digitally operated devices. The manually operated segment dominated the largest market revenue share of 57.6% in 2025, due to long-standing adoption, cost-effectiveness, and ease of use. These include traditional MDIs, DPIs, and standard nebulizers that require minimal training. Healthcare providers continue to recommend them for both hospital and home use. Manual devices are reliable in regions with limited electricity and infrastructure. The availability of multiple formulations, compact designs, and portability ensures consistent patient adherence. Strong global manufacturing base supports wide distribution. The segment benefits from widespread physician familiarity and patient comfort. Manual devices have low maintenance costs and minimal technical complexity. Their reliability and proven efficacy across decades maintain dominance. Established supply chains and brand recognition strengthen their market share. Manufacturers continue incremental improvements to enhance dose accuracy and ergonomics.

The digitally operated segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, propelled by connected inhalers, smart nebulizers, and mobile health integration. Digitally operated devices provide real-time feedback on inhalation technique, dosage, and adherence. Integration with mobile apps and cloud platforms allows remote monitoring by healthcare providers. Patients can receive reminders and data analytics for optimized therapy. Rising telemedicine adoption accelerates demand for smart devices. Technological innovations focus on sensor-based drug delivery and AI-driven adherence solutions. Market growth is supported by increasing patient preference for convenience and self-management. Regulatory encouragement for digital health technologies enhances uptake. Pharmaceutical partnerships with tech companies drive product development. Emerging markets are increasingly adopting digitally operated solutions. Cost reductions and insurance coverage expansion improve accessibility.

• By End-Users

On the basis of end-users, the Asthma Device market is segmented into hospitals, retail pharmacies, and online pharmacies. The hospitals segment dominated the largest market revenue share of 48.9% in 2025, driven by inpatient treatment, acute exacerbation management, and availability of trained medical staff. Hospitals offer a wide variety of devices, including inhalers, nebulizers, and DPIs, ensuring patient access to preferred therapies. Emergency care, chronic management, and patient education programs further strengthen hospital demand. Government and private hospital expansions in emerging markets support growth. Hospitals act as major distribution channels for clinical trials and new device launches. Frequent physician recommendations sustain high prescription-based adoption. Hospitals also adopt advanced devices with smart monitoring capabilities. Bulk procurement agreements and contracts with manufacturers maintain dominant revenue contribution. Specialized respiratory units increase device penetration. Hospital end-user adoption ensures rapid dissemination of innovations.

The online pharmacies segment is expected to witness the fastest CAGR of 23.7% from 2026 to 2033, fueled by increasing e-commerce penetration, convenience, and rising digital literacy. Patients can order inhalers and nebulizers directly to their homes, supported by prescription validation and home delivery. Telehealth consultations further boost online pharmacy purchases. Online platforms offer a wide range of device brands and competitive pricing. Rapid delivery services and subscription models enhance patient adherence. COVID-19 accelerated digital adoption, increasing trust in online pharmacies. Integration with mobile apps for order tracking and adherence support enhances usage. Marketing campaigns and digital awareness programs expand reach. Younger demographics increasingly prefer online channels for convenience. Global expansion of e-commerce platforms drives cross-border device availability.

Asthma Device Market Regional Analysis

- North America dominated the asthma device market with the largest revenue share of 42.7% in 2025

- Supported by well-established healthcare infrastructure, high awareness of respiratory disease

- Strong adoption of technologically advanced asthma management devices

U.S. Asthma Device Market Insight

The U.S. asthma device market accounted for the majority of North America’s market share in 2025. Growth is driven by the increasing use of connected inhalers, smart nebulizers, and patient monitoring systems. Leading medical device companies and digital health startups are introducing innovative solutions, further boosting adoption across hospitals, specialty clinics, and home care settings.

Europe Asthma Device Market Insight

The Europe asthma device market is projected to grow at a substantial CAGR throughout the forecast period, driven by increasing awareness of asthma management, rising prevalence of respiratory diseases, and improving access to technologically advanced devices across hospitals and clinics. The adoption of digital inhalers and smart monitoring solutions is increasing.

U.K. Asthma Device Market Insight

The U.K. asthma device market is expected to grow steadily, supported by rising patient awareness, government initiatives promoting respiratory health, and increasing adoption of smart asthma management solutions. Hospitals and specialty clinics are the major end-users driving this growth.

Germany Asthma Device Market Insight

The Germany asthma device market is anticipated to expand at a notable CAGR, fueled by high healthcare standards, strong presence of medical device manufacturers, and patient preference for technologically advanced asthma devices. Adoption of connected inhalers and monitoring systems in hospitals and clinics is increasing.

Asia-Pacific Asthma Device Market Insight

Asia-Pacific asthma device market is expected to be the fastest-growing region in the Asthma Device market during the forecast period, driven by increasing urbanization, rising disposable incomes, expanding healthcare access, and growing awareness of asthma management solutions across emerging economies such as China and India. Governments are promoting respiratory health initiatives, while adoption of connected and smart devices continues to rise.

Japan Asthma Device Market Insight

The Japan asthma device market is gaining momentum due to the country’s high technological adoption, aging population, and growing awareness of respiratory disease management. Hospitals and specialty clinics are increasingly using smart inhalers and monitoring systems.

China Asthma Device Market Insight

The China asthma device market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding middle class, and rising adoption of connected health and digital asthma management devices. The growth of hospitals and clinics offering advanced asthma care solutions further supports the market expansion.

Asthma Device Market Share

The Asthma Device industry is primarily led by well-established companies, including:

- Philips (Netherlands)

- GE Healthcare (U.S.)

- Medtronic (Ireland)

- Smiths Medical (U.K.)

- Hill-Rom (U.S.)

- Becton Dickinson (U.S.)

- Omron Healthcare (Japan)

- Propeller Health (U.S.)

- Boehringer Ingelheim (Germany)

- AstraZeneca (U.K.)

- Teva Pharmaceuticals (Israel)

- Microlife (Switzerland)

- Spiracare (U.S.)

- ConvaTec (U.K.)

- Fisher & Paykel Healthcare (New Zealand)

- BD Diagnostics (U.S.)

- Honeywell Life Care Solutions (U.S.)

- Trudell Medical International (Canada)

- Sanofi (France)

Latest Developments in Global Asthma Device Market

- In January 2023, the U.S. Food and Drug Administration (FDA) approved Airsupra (a fixed‑dose combination of albuterol and budesonide) for medical use as the first inhaled corticosteroid + bronchodilator rescue inhaler, offering a new option for immediate relief in asthma patients and marking a key regulatory milestone in combination inhaler therapy. This approval reflects a significant advancement in asthma management, making treatment more streamlined for patients experiencing bronchoconstriction

- In April 2024, Adherium announced that its Hailie Smartinhaler received FDA 510(k) clearance for compatibility with AstraZeneca’s Airsupra and Breztri inhalation devices, enabling connected respiratory care via sensor‑based monitoring and digital data tracking to improve medication adherence in asthma and COPD. This clearance underscores the trend toward connected devices and data‑driven patient management

- In July 2024, Boehringer Ingelheim launched its Respimat Re‑usable inhaler in European markets featuring a refillable cartridge system that reduces plastic waste by approximately 83% compared to single‑use devices, aligning with sustainability goals in respiratory device manufacturing. This launch is part of a broader shift toward eco‑friendly medical devices without compromising drug delivery performance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.