Global Augmented Bone Graft Market

Market Size in USD Million

CAGR :

%

USD

439.46 Million

USD

792.55 Million

2025

2033

USD

439.46 Million

USD

792.55 Million

2025

2033

| 2026 –2033 | |

| USD 439.46 Million | |

| USD 792.55 Million | |

|

|

|

|

Augmented Bone Graft Market Size

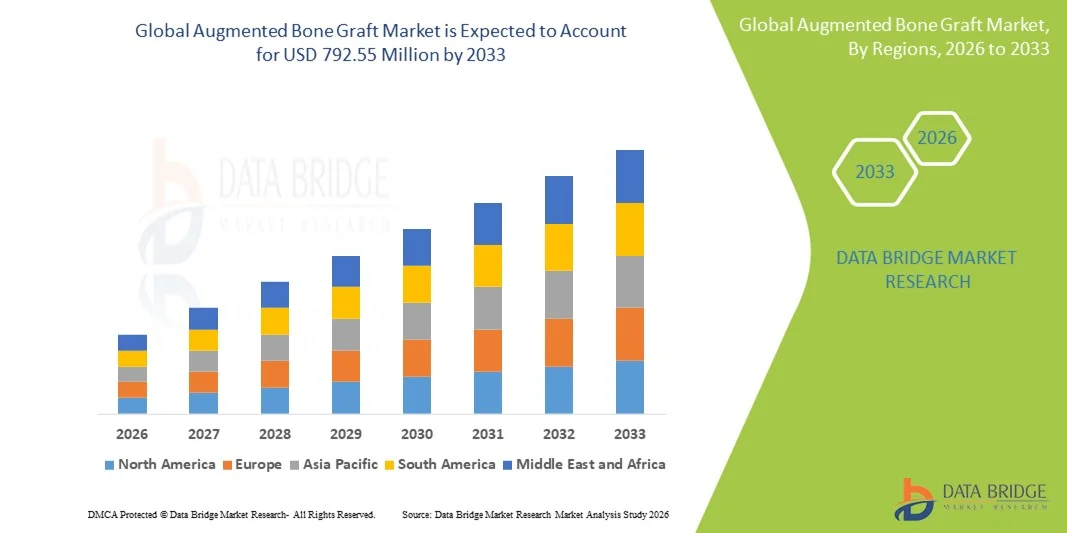

- The global augmented bone graft market size was valued at USD 439.46 million in 2025 and is expected to reach USD 792.55 million by 2033, at a CAGR of 7.65% during the forecast period

- The market growth is largely fueled by rapid advancements in grafting technologies rising volumes of orthopedic, dental, and trauma‑related surgeries, and an aging population with increasing prevalence of bone disorders, which together are driving higher adoption of augmented bone graft products

- Furthermore, growing awareness among healthcare providers and patients about the benefits of enhanced bone regeneration solutions, supportive regulatory pathways for innovative graft materials, and expanding healthcare infrastructure in emerging regions are establishing augmented bone grafts as preferred solutions for bone repair and regeneration. These converging factors are accelerating the uptake of augmented bone graft products, thereby significantly boosting the industry’s growth

Augmented Bone Graft Market Analysis

- Augmented bone grafts, including allografts, bone graft substitutes, and cell-based matrices, are increasingly vital components of orthopedic, dental, and trauma-related surgeries due to their enhanced bone regeneration capabilities, biocompatibility, and ability to integrate seamlessly with host bone tissue

- The escalating demand for augmented bone grafts is primarily fueled by the rising prevalence of bone-related disorders, an aging population, increasing volumes of orthopedic and dental procedures, and growing awareness among healthcare providers and patients about the benefits of advanced grafting solutions

- North America dominated the augmented bone graft market with the largest revenue share of 40% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key market players, with the U.S. experiencing substantial adoption in spinal fusion, joint reconstruction, and craniomaxillofacial surgeries, driven by innovations in cell-based matrices and bone graft substitutes

- Asia-Pacific is expected to be the fastest growing region in the augmented bone graft market during the forecast period due to increasing healthcare infrastructure, rising disposable incomes, and growing awareness of advanced bone repair solutions among surgeons and patients

- Allografts segment dominated the augmented bone graft market with a market share of 45.2% in 2025, driven by their established efficacy, availability, and widespread acceptance as alternatives to autografts

Report Scope and Augmented Bone Graft Market Segmentation

|

Attributes |

Augmented Bone Graft Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Augmented Bone Graft Market Trends

Advancements in 3D-Printed and Cell-Based Grafts

- A significant and accelerating trend in the global augmented bone graft market is the adoption of 3D-printed patient-specific grafts and advanced cell-based matrices, which are enhancing surgical precision and personalized bone regeneration outcomes

- For instance, 3D Bioprinting Solutions’ custom craniofacial grafts enable surgeons to create implants that perfectly match patient anatomy, reducing surgery time and improving post-operative recovery

- Cell-based matrices are being integrated with growth factors and stem cells to accelerate bone healing and improve graft incorporation. For instance, NuVasive’s cell-based spinal fusion grafts utilize proprietary technologies to enhance osteoinduction and bone integration

- These innovations facilitate more predictable surgical outcomes and reduce the risk of graft failure, particularly in complex orthopedic, spinal, and craniomaxillofacial procedures

- The trend towards advanced, personalized grafting solutions is fundamentally reshaping surgeon and patient expectations for bone repair, driving research and development in both synthetic and biologic graft technologies

- The demand for augmented bone grafts with 3D-printed customization and enhanced cellular integration is growing rapidly across hospitals and specialized surgical centers, as healthcare providers increasingly prioritize efficacy, safety, and faster recovery

- Increasing collaborations between medical device companies and research institutions to develop hybrid grafts combining synthetic and cell-based technologies are creating next-generation solutions for complex surgeries

- Growing integration of digital surgical planning software with augmented bone graft procedures is allowing surgeons to simulate graft placement and predict outcomes, further increasing clinical adoption

Augmented Bone Graft Market Dynamics

Driver

Increasing Surgical Volumes and Bone Disorder Prevalence

- The rising prevalence of orthopedic, dental, and trauma-related bone disorders, coupled with increasing surgical volumes, is a significant driver for augmented bone graft adoption

- For instance, in March 2025, Medtronic reported expanded adoption of its bone graft solutions in spinal fusion surgeries across North America, highlighting growing clinical reliance on advanced grafts

- As patient demand for faster recovery and improved surgical outcomes increases, augmented grafts provide superior osteoconductive, osteoinductive, and osteogenic properties compared to traditional autografts

- Furthermore, the expansion of elective orthopedic and dental procedures in emerging economies is making augmented bone grafts an essential component of modern surgical practice, supporting wider adoption

- The ability to provide patient-specific solutions, reduce surgical complications, and improve long-term bone regeneration outcomes is propelling the market growth across hospitals, clinics, and specialized surgical centers

- Increasing government initiatives and funding to improve orthopedic and dental healthcare infrastructure are further facilitating the adoption of advanced bone graft technologies

- Rising partnerships between graft manufacturers and hospitals to offer bundled surgical solutions and training programs are enhancing product penetration and driving market growth

Restraint/Challenge

High Cost and Regulatory Hurdles

- The relatively high cost of advanced augmented bone grafts, particularly 3D-printed and cell-based products, poses a significant challenge for widespread adoption in price-sensitive regions

- For instance, high-end spinal fusion grafts with integrated growth factors can cost several times more than traditional autografts, limiting accessibility in developing countries

- Strict regulatory approvals and compliance requirements for biologics and synthetic graft materials also slow market entry, making it challenging for new players to commercialize innovative products

- Healthcare providers must balance clinical benefits with cost-effectiveness, and hospitals may hesitate to adopt premium graft solutions without clear reimbursement support

- Addressing these challenges through cost optimization, regulatory support, and awareness programs for surgeons and patients will be crucial for sustaining market growth in both developed and emerging regions

- Limited availability of skilled surgeons trained in advanced grafting procedures can hinder market adoption, especially in emerging markets with constrained healthcare resources

- Potential complications or graft failures in high-risk patients may negatively impact clinical confidence, requiring additional research and monitoring to maintain market trust

Augmented Bone Graft Market Scope

The market is segmented on the basis of product, application, type, diagnosis, treatment, and end-user.

- By Product

On the basis of product, the augmented bone graft market is segmented into allografts, bone graft substitutes, and cell-based matrices. The allografts segment dominated the market with the largest market revenue share of 45.2% in 2025, driven by their established efficacy, widespread clinical acceptance, and ready availability as an alternative to autografts. Surgeons prefer allografts for spinal fusion, joint reconstruction, and craniomaxillofacial procedures due to predictable outcomes and reduced donor site morbidity. Hospitals and surgical centers value allografts for their standardized sterilization and proven clinical performance. The segment also benefits from strong trust among surgeons and consistent supply chains across key regions. These factors collectively contribute to its sustained dominance in the market.

The cell-based matrices segment is anticipated to witness the fastest growth rate of 12.8% from 2026 to 2033, fueled by innovations combining stem cells, growth factors, and synthetic scaffolds. These grafts enhance osteoinduction, bone healing, and integration, particularly in complex or revision surgeries. Growing adoption in regenerative medicine and clinical success stories are further driving growth. Increased R&D investment and collaboration between graft manufacturers and hospitals support product awareness and adoption. The ability to customize grafts for specific patient needs also contributes to accelerating market growth.

- By Application

On the basis of application, the market is segmented into craniomaxillofacial, dental, foot and ankle, joint reconstruction, long bone, and spinal fusion. The spinal fusion segment dominated the market in 2025, accounting for over 30% of revenue, due to the high global volume of spinal surgeries and the critical need for reliable graft materials. Surgeons prefer augmented grafts for spinal fusion because of superior osteoconductive and osteoinductive properties that improve fusion rates and reduce complications. Hospitals rely on these grafts to ensure predictable outcomes and shorter recovery times. The dominance is further supported by rising incidence of spinal disorders and increasing surgical expertise. Spinal fusion procedures represent a significant portion of hospital orthopedic revenue, reinforcing this segment’s market leadership.

The dental segment is expected to witness the fastest growth rate of 14.5% from 2026 to 2033, driven by rising prevalence of dental implants and oral bone disorders. Advanced grafts enable predictable bone augmentation and faster recovery in implantology. Patient awareness and minimally invasive procedures contribute to segment adoption. Surgeons increasingly prefer graft substitutes and cell-based matrices for complex dental restorations. The segment also benefits from growing investments in dental healthcare infrastructure and technological integration, supporting rapid growth.

- By Type

On the basis of type, the market is segmented into anemic anoxia, toxic anoxia, stagnant anoxia, and anoxic anoxia. The anemic anoxia segment dominated the market in 2025, due to the high prevalence of conditions reducing oxygen-carrying capacity in bone tissue, necessitating enhanced graft interventions. Augmented bone grafts provide vascularization and promote bone integration under low-oxygen conditions. Surgeons rely on grafts optimized for these physiological challenges to improve surgical outcomes. The segment benefits from clinical research and successful treatment outcomes in orthopedic and trauma surgeries. Hospitals and surgical centers prefer grafts that minimize complications in anemic patients. Rising awareness among clinicians regarding oxygen-sensitive bone healing supports continued adoption.

The anoxic anoxia segment is anticipated to witness the fastest growth rate of 10.5% from 2026 to 2033, driven by research on ischemic bone repair and hypoxia-targeted grafts. Advanced graft technologies are designed to function in oxygen-deficient environments, enhancing bone regeneration. Increasing clinical awareness and adoption of these specialized grafts contribute to rapid growth. Technological innovations in scaffold design and cell-based integration further support market expansion. Research investments in regenerative medicine targeting hypoxic tissues are rising globally. The segment’s potential in complex surgeries makes it an attractive growth area.

- By Diagnosis

On the basis of diagnosis, the market is segmented into MRI, CAT Scan, Evoked Potential Tests, and EEG. The MRI segment dominated the market in 2025, owing to its superior imaging resolution and ability to assess both bone and soft tissue health for pre-surgical planning. MRI facilitates precise graft placement, post-operative monitoring, and better surgical outcomes. Hospitals rely on MRI to ensure optimal integration of augmented bone grafts. Its dominance is further supported by widespread clinical availability and trusted diagnostic performance. Surgeons use MRI to evaluate graft healing and vascularization post-surgery. MRI’s role in personalized treatment planning strengthens its market position.

The CAT Scan segment is expected to witness the fastest CAGR of 11.2% from 2026 to 2033, driven by improvements in imaging speed, 3D reconstruction, and cost-effectiveness. CAT scans are increasingly used for pre-surgical assessment and post-operative follow-up in long bone, spinal, and joint surgeries. Enhanced visualization of bone structures supports accurate graft placement and monitoring. The segment benefits from growing adoption in emerging markets with expanding diagnostic infrastructure. Integration with surgical planning software increases its utility. Faster scanning times and reduced radiation exposure contribute to wider clinical acceptance.

- By Treatment

On the basis of treatment, the market is segmented into CPR, rehabilitation therapies, and medication. The rehabilitation therapies segment dominated the market in 2025, as augmented bone grafts are often paired with structured physiotherapy to optimize functional recovery and bone integration. Rehabilitation improves post-surgical outcomes and patient mobility. Hospitals and specialized centers emphasize therapy programs alongside grafting procedures. The segment’s dominance is reinforced by clinical evidence demonstrating higher success rates with rehabilitation. Patients benefit from reduced complications and improved long-term graft performance. Awareness among surgeons and patients drives consistent demand.

The medication segment is anticipated to witness the fastest growth rate of 13.0% from 2026 to 2033, fueled by adjunctive therapies that enhance bone regeneration, reduce inflammation, and support graft incorporation. Innovative pharmacological solutions improve graft outcomes in complex surgeries. Increasing clinical research and successful case studies contribute to rapid adoption. Hospitals integrate medication protocols with graft procedures to maximize success. Rising awareness of post-operative care and bone health supplements supports segment expansion. Medication-driven improvements in recovery time and efficacy accelerate growth.

- By End-User

On the basis of end-user, the market is segmented into hospitals and clinics, diagnostic centers, research institutes, rehabilitation centers, and others. The hospitals and clinics segment dominated the market in 2025, with over 55% share, due to the high volume of orthopedic, dental, and trauma-related surgeries performed in these settings. Hospitals provide infrastructure, skilled surgeons, and post-operative care essential for graft success. Adoption is driven by high patient inflow, clinical reliability, and long-term treatment outcomes. Hospitals prefer grafts with proven efficacy to minimize complications. Established supply chains and surgical expertise further reinforce dominance.

The research institutes segment is expected to witness the fastest growth rate of 14.7% from 2026 to 2033, fueled by increasing R&D investments in stem cell technologies, 3D printing, and novel graft materials. Research centers are driving innovations that eventually translate into clinical adoption. Collaborations with hospitals support technology transfer and validation. The segment benefits from funding for regenerative medicine research. Academic and private institutes focus on developing next-generation graft solutions. Rapid knowledge creation and clinical trials contribute to fast-paced growth.

Augmented Bone Graft Market Regional Analysis

- North America dominated the augmented bone graft market with the largest revenue share of 40% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key market players

- Hospitals and surgical centers in the region highly value the efficacy, reliability, and predictable outcomes offered by augmented bone grafts, particularly for spinal fusion, joint reconstruction, and craniomaxillofacial surgeries

- This widespread adoption is further supported by high healthcare expenditure, availability of skilled surgeons, and robust reimbursement frameworks, establishing augmented bone grafts as the preferred choice for complex bone repair and regenerative procedures across both clinical and specialty care settings

U.S. Augmented Bone Graft Market Insight

The U.S. augmented bone graft market captured the largest revenue share of 80% in North America in 2025, fueled by the high prevalence of orthopedic, spinal, and dental procedures and the advanced healthcare infrastructure. Surgeons and hospitals increasingly prioritize bone graft solutions that provide predictable outcomes, enhanced osteoinduction, and reduced donor site complications. The growing trend of minimally invasive surgeries, combined with widespread adoption of 3D-printed and cell-based graft technologies, further propels the market. Moreover, the integration of digital surgical planning and advanced graft materials is significantly contributing to clinical success and market expansion.

Europe Augmented Bone Graft Market Insight

The Europe augmented bone graft market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing orthopedic and dental surgical volumes and stringent healthcare standards. Rising awareness of advanced bone regeneration solutions and the growing adoption of minimally invasive procedures are fostering market growth. European hospitals and surgical centers increasingly invest in allografts and cell-based matrices for improved surgical outcomes. The market is seeing significant growth across spinal, joint reconstruction, and craniomaxillofacial applications, with grafts being incorporated into both new surgical protocols and revision surgeries.

U.K. Augmented Bone Graft Market Insight

The U.K. augmented bone graft market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for advanced bone repair solutions and improved surgical outcomes. Concerns regarding osteoporosis, trauma, and other bone-related disorders are encouraging healthcare providers to adopt high-quality graft materials. The U.K.’s emphasis on modern surgical technologies and the availability of skilled orthopedic and dental surgeons are expected to continue stimulating market growth. Increasing adoption of regenerative medicine techniques and patient-specific grafts is also contributing to the expansion of the market.

Germany Augmented Bone Graft Market Insight

The Germany augmented bone graft market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of bone health and the adoption of innovative graft materials in spinal and orthopedic procedures. Germany’s well-developed healthcare infrastructure, emphasis on medical innovation, and strict regulatory frameworks support the use of advanced graft technologies. Hospitals and specialty clinics are increasingly integrating allografts and cell-based matrices into standard care. The growing demand for personalized and sustainable treatment solutions is promoting the adoption of grafts in both residential surgical centers and large hospital networks.

Asia-Pacific Augmented Bone Graft Market Insight

The Asia-Pacific augmented bone graft market is poised to grow at the fastest CAGR of 24% from 2026 to 2033, driven by increasing surgical volumes, rising disposable incomes, and improving healthcare infrastructure in countries such as China, Japan, and India. The region’s growing inclination toward advanced orthopedic and dental treatments, supported by government initiatives to enhance healthcare access, is driving adoption. Furthermore, as APAC emerges as a manufacturing hub for graft materials and surgical tools, the affordability and accessibility of advanced bone graft solutions are expanding across hospitals and clinics.

Japan Augmented Bone Graft Market Insight

The Japan augmented bone graft market is gaining momentum due to the country’s high standard of healthcare, aging population, and emphasis on advanced surgical solutions. Adoption is driven by increasing numbers of orthopedic and dental surgeries and the integration of grafts with digital surgical planning and 3D-printed technologies. Hospitals prioritize grafts that improve recovery times and clinical outcomes. Moreover, Japan’s focus on minimally invasive procedures and patient-specific treatment solutions is fueling demand in both residential and commercial healthcare settings.

India Augmented Bone Graft Market Insight

The India augmented bone graft market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rapid urbanization, and growing healthcare infrastructure. India represents one of the largest emerging markets for orthopedic and dental surgeries, and augmented bone grafts are becoming increasingly popular in hospitals, specialty clinics, and rehabilitation centers. The push towards modernized hospitals, coupled with the availability of cost-effective graft solutions and strong domestic manufacturers, is a key factor propelling market growth in India.

Augmented Bone Graft Market Share

The Augmented Bone Graft industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Zimmer Biomet (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Bioventus (U.S.)

- LifeNet Health (U.S.)

- Smith+Nephew (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- RTI Surgical, Inc. (U.S.)

- NuVasive, Inc. (U.S.)

- Orthofix Medical Inc. (U.S.)

- SeaSpine Holdings Corporation (U.S.)

- Globus Medical, Inc. (U.S.)

- Arthrex, Inc. (U.S.)

- AlloSource (U.S.)

- Xtant Medical Holdings, Inc. (U.S.)

- Collagen Matrix, Inc. (U.S.)

- NovaBone Products, LLC (U.S.)

- B. Braun SE (Germany)

- Geistlich Pharma AG (Switzerland)

- Pyramid Biologics (U.S.)

What are the Recent Developments in Global Augmented Bone Graft Market?

- In September 2025, researchers at Sungkyunkwan University developed an innovative modified glue gun device capable of 3D printing bone‑such as graft material directly onto living tissue during surgery, signaling a potential paradigm shift in intraoperative custom graft fabrication that may influence future clinical bone repair strategies once regulatory clearance is achieved

- In June 2025, Cerapedics announced that the U.S. Food and Drug Administration (FDA) granted premarket approval (PMA) for PearlMatrix™ P‑15 Peptide Enhanced Bone Graft, the first and only bone growth accelerator proven to significantly speed lumbar fusion in single‑level TLIF procedures, offering surgeons a novel option to improve surgical efficiency and patient outcomes

- In July 2025, Cerapedics reported the completion of the first U.S. patient treatment using the newly approved PearlMatrix™ Bone Graft following regulatory clearance, marking a clinical milestone in applying accelerated fusion technology for degenerative disc disease in adult patients

- In April 2025, CGBIO, a Korean bio-regenerative medical company, received FDA Investigational Device Exemption (IDE) approval for NOVOSIS PUTTY, a novel bone graft substitute incorporating rhBMP-2, advancing toward pivotal clinical trials in spinal fusion procedures in the United States and marking the first Korean bio-combined graft device to reach this stage of U.S. regulatory progression

- In September 2024, Cerapedics won expanded FDA approval for its i-FACTOR P-15 Peptide Enhanced Bone Graft, extending its use for anterior cervical discectomy and fusion (ACDF) procedures with various interbody fusion devices, broadening clinical applications in spinal surgery and reinforcing its position as a trusted graft option

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.