Global Automated Microscopy Market

Market Size in USD Billion

CAGR :

%

USD

2.14 Billion

USD

3.79 Billion

2024

2032

USD

2.14 Billion

USD

3.79 Billion

2024

2032

| 2025 –2032 | |

| USD 2.14 Billion | |

| USD 3.79 Billion | |

|

|

|

Automated Microscopy Market Size

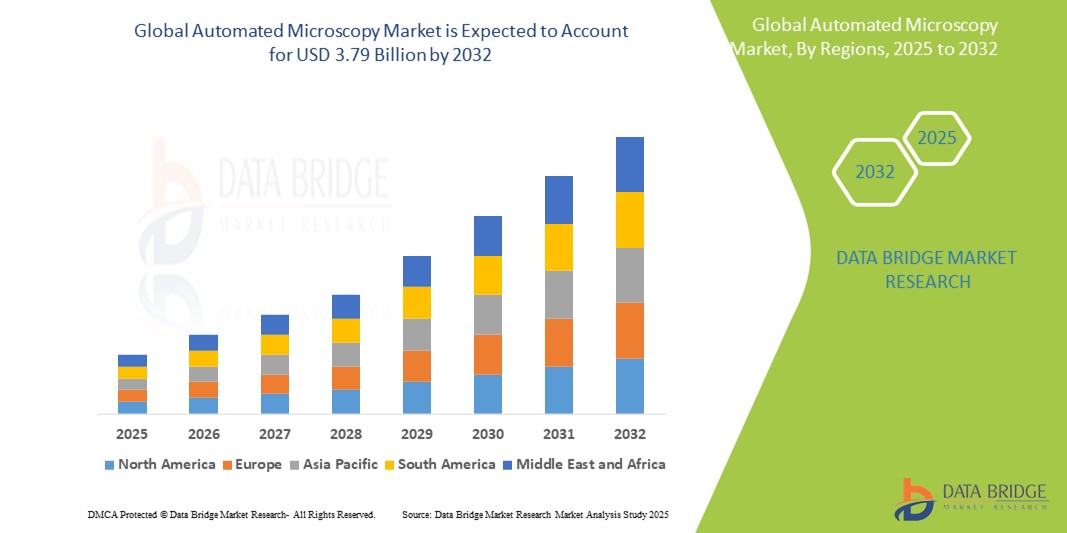

- The global automated microscopy market size was valued at USD 2.14 billion in 2024 and is expected to reach USD 3.79 billion by 2032, at a CAGR of 8.30% during the forecast period

- This growth is driven by factors such as the rising demand for high-resolution imaging in life sciences and medical diagnostics, along with increasing automation in research workflows and technological advancements in microscopy systems

Automated Microscopy Market Analysis

- Automated microscopy systems are essential tools in biomedical research, diagnostics, and material sciences, enabling high-throughput imaging, reproducibility, and real-time data acquisition with minimal human intervention

- The growth of this market is driven by increasing demand for high-resolution imaging, advancements in AI-powered image analysis, and rising R&D investments in life sciences and nanotechnology

- North America is expected to dominate the global automated microscopy market due to its strong research infrastructure, presence of major industry players, and significant healthcare and biotech investments

- Asia-Pacific is expected to be the fastest growing region in the market, attributed to rising government funding for research, expanding pharmaceutical sector, and growing adoption of advanced lab technologies

- Optical Microscope segment is expected to dominate the market with a market share of 50.05% due to its attributed to their cost-effectiveness, real-time imaging capabilities, and non-destructive nature, making them ideal for biological sample analysis

Report Scope and Automated Microscopy Market Segmentation

|

Attributes |

Automated Microscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automated Microscopy Market Trends

“Advancements in High-Resolution Imaging and Artificial Intelligence Integration”

- A significant trend in the automated microscopy market is the growing integration of artificial intelligence (AI) and machine learning (ML) algorithms with automated imaging systems

- These innovations enhance the ability of automated microscopes to process and analyze vast amounts of imaging data with speed and precision, reducing human error and accelerating research workflows

- For instance, AI algorithms can now automatically identify and classify cell types, detect anomalies in tissue samples, and even predict disease progression, which greatly improves diagnostic accuracy

- These advancements are revolutionizing various fields, including life sciences, medical diagnostics, and material science, driving demand for next-generation automated microscopy systems with advanced image analysis capabilities

Automated Microscopy Market Dynamics

Driver

“Rising Demand for High-Throughput Imaging in Life Sciences & Drug Discovery”

- The increasing need for high-throughput and high-resolution imaging in life sciences and drug discovery is a key driver of growth in the global automated microscopy market

- As pharmaceutical and biotech companies expand their R&D efforts, there's a greater reliance on automated microscopy systems to streamline the imaging and analysis of biological samples across thousands of experiments

- These systems significantly reduce manual labor, improve imaging consistency, and accelerate the drug development timeline, especially in areas such as cancer research, virology, and neurobiology

For instance,

- In October 2023, Thermo Fisher Scientific launched a new line of automated microscopes that integrate AI-powered analytics to boost cellular analysis efficiency in pharmaceutical labs, enabling researchers to handle large volumes of samples with greater accuracy

- As automation becomes increasingly critical to modern laboratory environments, the demand for sophisticated imaging platforms that offer speed, precision, and scalability continues to rise—driving the growth of the automated microscopy market

Opportunity

“AI-Driven Image Analysis to Revolutionize Research and Diagnostics”

- The integration of artificial intelligence (AI) into automated microscopy presents a transformative opportunity for enhancing the accuracy, speed, and scalability of imaging in both research and clinical settings

- AI-powered systems can automatically identify cell types, detect anomalies, and quantify changes in biological structures—enabling more consistent and objective analyses compared to manual methods

- These systems also facilitate real-time decision-making in diagnostic workflows, improving efficiency in pathology labs, drug discovery pipelines, and biomedical research

For instance,

- In November 2024, a study published in Nature Biomedical Engineering highlighted how AI-integrated microscopy platforms reduced diagnostic time by 45% in digital pathology labs, while maintaining diagnostic accuracy above 98%. The platform utilized deep learning algorithms to process and classify histopathological images at scale

- The continued advancement of AI technologies—combined with increased access to large-scale biomedical datasets—offers significant growth potential for automated microscopy. It enables labs and institutions to scale operations, reduce costs, and ultimately deliver more accurate and timely diagnoses, fueling market expansion

Restraint/Challenge

“High Equipment and Maintenance Costs Hindering Broader Adoption”

- The elevated cost of automated microscopy systems remains a significant barrier to widespread market penetration, especially for small- and medium-sized laboratories and academic institutions in cost-sensitive regions

- These systems can range from tens of thousands to over a hundred thousand dollars, depending on the complexity, resolution, and software integrations, with additional costs for regular maintenance and training

- High initial investment requirements can delay procurement or upgrades, particularly in emerging economies where research funding and healthcare budgets are often constrained

For instance,

- In September 2024, a report by Global Data Intelligence highlighted that the total cost of ownership for a fully equipped automated microscopy workstation—including AI-enhanced image processing and robotic sample handling—can exceed USD 250,000, making it inaccessible to many labs without external funding or institutional backing

- Consequently, this financial burden restricts access to advanced microscopy technologies, resulting in uneven distribution of innovation, slower adoption rates in developing regions, and limited scalability

Automated Microscopy Market Scope

The market is segmented on the basis of product type, application and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

In 2025, the Optical Microscope is projected to dominate the market with a largest share in product segment

The Optical Microscope segment is expected to dominate the automated microscopy market with the largest share of 50.05% in 2025 due to its cost-effectiveness, ease of use, and broad applicability in fields such as clinical diagnostics, life sciences, and education. These microscopes offer real-time, high-resolution imaging with minimal sample preparation, making them ideal for routine laboratory work. In addition, advancements in digital imaging and AI integration have further enhanced their functionality and adoption across various sector

The Medical Diagnosis is expected to account for the largest share during the forecast period in application market

In 2025, the Medical Diagnosis segment is expected to dominate the market with the largest market share of 33.05% due to its growing use in clinical pathology, histopathology, and hematology for accurate and rapid disease detection. The rising prevalence of chronic illnesses and the need for high-throughput, automated diagnostic solutions are driving adoption. In addition, automated microscopes enhance diagnostic accuracy and efficiency, reducing human error and improving patient outcomes

Automated Microscopy Market Regional Analysis

“North America Holds the Largest Share in the Automated Microscopy Market”

- North America leads the global automated microscopy market, primarily driven by strong research infrastructure, high R&D investment, and early adoption of advanced imaging technologies across academic, pharmaceutical, and biotech sectors

- U.S. holds a dominant share due to its well-established biomedical research institutions, increasing demand for automated solutions in diagnostics and drug discovery, and strong presence of leading market players such as Thermo Fisher Scientific and Bruker

- The favorable government funding for life sciences research and a surge in AI-based microscopy system adoption in pathology and diagnostics further bolster market leadership

- In addition, the growing focus on personalized medicine and increasing integration of automated digital pathology platforms in clinical workflows continue to fuel market growth in the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Automated Microscopy Market”

- Asia-Pacific is expected to witness the fastest growth rate in the automated microscopy market due to expanding research activities, growing investments in biotech startups, and increasing demand for high-throughput screening systems

- China, India, and Japan are emerging as major markets with rapidly evolving pharmaceutical industries and rising interest in precision diagnostics and molecular biology research

- Japan, with its strong focus on innovation in imaging technologies and presence of top-tier academic institutions, remains a significant contributor to market expansion

- China and India are seeing increased public and private funding in life sciences, along with a growing pool of skilled researchers, which is driving adoption of automated microscopy in academic labs, diagnostic centers, and CROs. Government initiatives to modernize healthcare infrastructure also support market growth across the region

Automated Microscopy Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Olympus Corporation (Japan)

- Leica Microsystems (Germany)

- ZEISS Group (Germany)

- Nikon Instruments Inc. (Japan)

- Bruker (U.S.)

- KEYENCE CORPORATION (Japan)

- Cytiva (U.S.)

- Agilent Technologies (U.S.)

- Meiji Techno America (Japan)

- CrestOptics (Italy)

- Revvity Discovery Limited (U.K.)

- PerkinElmer (U.S.)

- Danaher Corporation (U.S.)

- Oxford Instruments (U.K.)

- HighTechSystem Co.,Ltd. (Japan)

- SciMed (U.S.)

- RP Photonics AG (Germany)

- Motic (China)

- TESCAN GROUP, a.s. (Czech Republic)

Latest Developments in Global Automated Microscopy Market

- In March 2025, Thermo Fisher Scientific announced the launch of its EVOS M7000X, an advanced automated imaging platform designed to support high-content screening and multi-well plate imaging. The system integrates deep learning algorithms for real-time image analysis and is aimed at accelerating workflows in cell biology and drug discovery

- In December 2024, Leica Microsystems launched a collaboration with Microsoft Azure AI to integrate automated microscopy data with cloud-based AI analysis. This partnership enables scalable, remote processing of microscopy data, aiming to reduce diagnostic time in digital pathology by up to 50%

- In October 2024, during the Society for Neuroscience (SfN) Annual Meeting, ZEISS introduced its next-gen Celldiscoverer 8 system with AI-powered autofocus and adaptive illumination, enhancing live-cell imaging efficiency for neuroscience and microbiology researchers

- In September 2024, Nikon Instruments Inc. expanded its NIS-Elements software suite with AI-powered automated detection of mitosis and apoptosis, helping to streamline cancer research through automated quantification of cellular events across time-lapse microscopy datasets.

- In October 2024, Zomedica Corp. declared the release of the Ear Cytology Quick Scan protocol, a latest feature of the TRUVIEW microscope equipped with the TRUprep automated slide preparation system. This innovative feature streamlines the slide preparation and scanning of ear cytology cases, helping veterinary professionals to diagnose and treat companion animals faster and more efficiently

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.