Global Automated Pest Monitoring System Market

Market Size in USD Million

CAGR :

%

USD

436.60 Million

USD

808.11 Million

2025

2033

USD

436.60 Million

USD

808.11 Million

2025

2033

| 2026 –2033 | |

| USD 436.60 Million | |

| USD 808.11 Million | |

|

|

|

|

Automated Pest Monitoring System Market Size

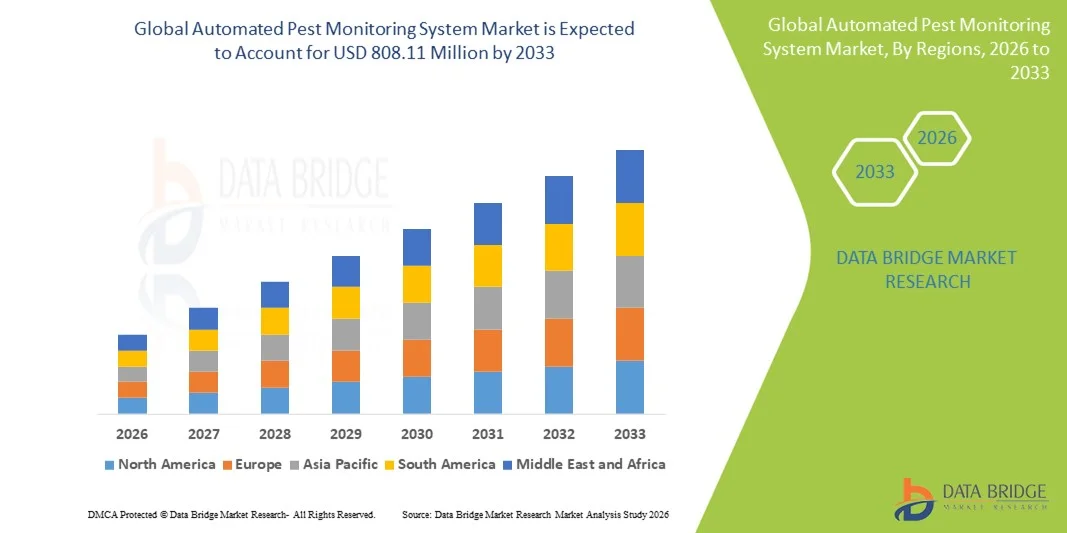

- The global automated pest monitoring system market size was valued at USD 436.60 million in 2025 and is expected to reach USD 808.11 million by 2033, at a CAGR of 8.0% during the forecast period

- The market growth is largely fueled by the increasing adoption of precision agriculture technologies and IoT-enabled farming solutions, driving the integration of automated pest monitoring systems across farms of all sizes

- Furthermore, rising demand for data-driven crop management, sustainable pest control, and reduced pesticide usage is establishing automated pest monitoring systems as essential tools for modern agriculture. These converging factors are accelerating the uptake of smart pest monitoring solutions, thereby significantly boosting the industry’s growth

Automated Pest Monitoring System Market Analysis

- Automated pest monitoring systems, offering real-time detection and predictive analytics for pest activity, are becoming vital components of modern agricultural operations due to their ability to optimize crop protection, improve yield, and reduce labor requirements

- The escalating demand for these systems is primarily fueled by the adoption of IoT sensors, AI-based analytics, and cloud-based platforms, growing awareness of sustainable farming practices, and the need for timely, precise pest management interventions

- North America dominated the automated pest monitoring system market with a share of around 40% in 2025, due to the adoption of advanced precision agriculture technologies and increased awareness of sustainable farming practices

- Asia-Pacific is expected to be the fastest growing region in the automated pest monitoring system market during the forecast period due to rising adoption of smart farming solutions, rapid urbanization, and government initiatives promoting digital agriculture in countries such as China, Japan, and India

- Hardware segment dominated the market with a market share of 47% in 2025, due to its role in real-time pest detection, data collection, and environmental monitoring. Advanced sensors, cameras, and IoT-enabled traps provide high accuracy and efficiency, making hardware critical for modern pest management. For instance, Pessl Instruments strengthened demand with durable devices that operate in varied field conditions. Integration with software platforms allows actionable insights and easier management, increasing adoption across farm sizes. The emphasis on precision agriculture further boosts hardware adoption, ensuring reliable pest monitoring and timely intervention

Report Scope and Automated Pest Monitoring System Market Segmentation

|

Attributes |

Automated Pest Monitoring System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automated Pest Monitoring System Market Trends

Rising Adoption of IoT-Enabled Precision Agriculture

- A significant trend in the automated pest monitoring system market is the increasing adoption of IoT-enabled solutions in precision agriculture, driven by the need for timely pest detection and optimized crop protection. This adoption is enhancing farm productivity and reducing losses by enabling data-driven decision-making for pest management

- For instance, companies such as Arable and Semios Technologies provide IoT-based pest monitoring devices that collect real-time field data, allowing farmers to identify infestation patterns early and implement targeted interventions. Such systems help reduce pesticide use and improve overall crop health while ensuring environmental sustainability

- The integration of automated monitoring systems with smart farm management platforms is growing rapidly, where sensors detect pest activity and transmit alerts for immediate action. This is positioning automated pest monitoring as a key enabler for intelligent and proactive agricultural practices

- Precision agriculture solutions are increasingly being combined with machine learning and AI-based predictive analytics to forecast pest outbreaks based on environmental conditions and historical data. This trend is driving innovation in automated monitoring technologies that provide actionable insights and minimize human dependency

- Agricultural research institutions and government-supported programs are promoting the deployment of automated pest monitoring systems to enhance sustainable farming practices. These initiatives are expanding awareness and adoption, creating a favorable market environment for commercial solutions

- The market is witnessing strong growth in integrated pest management approaches, where automated monitoring systems are paired with biological control measures and targeted interventions. This combination reinforces the transition toward more efficient, environmentally responsible, and data-driven pest management practices

Automated Pest Monitoring System Market Dynamics

Driver

Growing Demand for Data-Driven Pest Management

- The rising need for precision and efficiency in crop protection is driving demand for automated pest monitoring systems that deliver real-time data on pest activity and infestation levels. These systems help reduce crop losses, optimize pesticide use, and support sustainable agricultural practices

- For instance, companies such as Trapview offer smart pest monitoring traps that automatically identify pest species and provide real-time analytics through cloud-based platforms. This enables farmers to implement timely control measures and improve overall yield management

- The increasing awareness among farmers regarding environmental impact and the benefits of precision pest control is fueling investments in automated monitoring solutions. This ensures minimal chemical usage while maintaining crop quality and safety

- Integration with farm management software and decision support systems allows for predictive analytics and actionable insights, enhancing operational efficiency and reducing manual monitoring efforts

- The expansion of precision agriculture across developed and developing regions is supporting the adoption of automated pest monitoring systems. The growing need for sustainable farming practices continues to strengthen this driver and incentivizes technology deployment

Restraint/Challenge

High Initial Investment and Technology Integration Costs

- The automated pest monitoring system market faces challenges due to the high upfront costs of IoT-enabled devices, sensors, and software platforms, which may limit adoption among small and mid-sized farms. Integrating these systems with existing farm operations also requires technical expertise and additional resources

- For instance, Semios Technologies deploys advanced automated traps with cloud connectivity and predictive analytics, but the initial investment in devices and subscription-based data services can be significant for individual farmers

- The complexity of installing, calibrating, and maintaining automated monitoring systems adds to the overall cost, which can be a barrier for cost-sensitive agricultural enterprises

- Farmers may also encounter challenges in integrating data from multiple sensors and platforms to make comprehensive pest management decisions. This requires software interoperability and training, which increases operational expenditure

- The market continues to experience constraints from limited awareness in certain regions and resistance to adopting advanced technologies due to perceived cost and complexity. These factors collectively affect adoption rates and market penetration despite the clear benefits of automated pest monitoring systems

Automated Pest Monitoring System Market Scope

The market is segmented on the basis of offerings, end-user industry, and farm size.

- By Offerings

On the basis of offerings, the automated pest monitoring system market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest share of 47% in 2025, driven by its role in real-time pest detection, data collection, and environmental monitoring. Advanced sensors, cameras, and IoT-enabled traps provide high accuracy and efficiency, making hardware critical for modern pest management. For instance, Pessl Instruments strengthened demand with durable devices that operate in varied field conditions. Integration with software platforms allows actionable insights and easier management, increasing adoption across farm sizes. The emphasis on precision agriculture further boosts hardware adoption, ensuring reliable pest monitoring and timely intervention.

The software segment is expected to witness the fastest growth from 2026 to 2033, fueled by AI-based predictive analytics and real-time alerts. For instance, Agro-optronics’ platforms enable proactive pest management through historical and environmental data analysis. Cloud-based accessibility, mobile integration, and subscription-based models increase adoption among cost-conscious farmers. The ability to consolidate sensor data and provide actionable insights drives software demand, enhancing operational efficiency and crop protection.

- By End User Industry

On the basis of end-user industry, the market is segmented into agricultural industry, forestry industry, and others. The agricultural industry dominated in 2025, driven by the need to prevent crop losses and optimize pesticide use. For instance, Arable Technologies provides systems that monitor both pest activity and environmental conditions, improving yield and quality. Real-time data and reporting enhance decision-making, encouraging widespread adoption.

The forestry industry is expected to witness the fastest growth from 2026 to 2033, driven by monitoring pests in large, remote areas to prevent ecological damage. For instance, Teralytic offers long-range sensor networks for early infestation detection. Integration with drones and satellite data enables proactive intervention, boosting adoption in forest management.

- By Farm Size

On the basis of farm size, the market is segmented into small, mid-sized, and large farms. Large farms dominated in 2025, driven by extensive operations and higher pest risk. For instance, John Deere’s precision farming solutions integrate sensors with farm management platforms to improve efficiency. Scalable and high-capacity systems covering multiple fields make large farms the leading adopters.

The mid-sized farms segment is expected to witness the fastest growth from 2026 to 2033, fueled by affordable, modular, and subscription-based solutions. For instance, AgriWebb allows mid-sized farms to implement automated monitoring with limited investment. Real-time alerts and predictive analytics enhance responsiveness and productivity, driving adoption.

Automated Pest Monitoring System Market Regional Analysis

- North America dominated the automated pest monitoring system market with the largest revenue share of around 40% in 2025, driven by the adoption of advanced precision agriculture technologies and increased awareness of sustainable farming practices

- Farmers in the region prioritize real-time pest monitoring, data-driven crop management, and the reduction of pesticide use offered by automated systems

- This widespread adoption is further supported by high technology penetration, government support for smart farming initiatives, and the growing demand for optimized crop yields, establishing automated pest monitoring systems as a preferred solution across large-scale agricultural operations

U.S. Automated Pest Monitoring System Market Insight

The U.S. automated pest monitoring system market captured the largest revenue share in 2025 within North America, fueled by the adoption of IoT-enabled sensors and smart farming platforms. Farmers increasingly seek systems that provide predictive pest analytics, remote monitoring, and efficient pesticide management. The growing preference for precision agriculture, combined with integration of cloud-based platforms and mobile apps for real-time alerts, further propels the market. Moreover, government subsidies and initiatives promoting digital agriculture are significantly contributing to market expansion.

Europe Automated Pest Monitoring System Market Insight

The Europe automated pest monitoring system market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent agricultural regulations and the rising need for sustainable pest management. Increasing awareness of crop protection, coupled with the adoption of IoT and cloud-based farming solutions, is fostering market growth. European farmers are also drawn to systems that improve yield efficiency while minimizing environmental impact. The region is experiencing strong growth across both large-scale and mid-sized farms, with automated monitoring increasingly incorporated into modern agricultural practices.

U.K. Automated Pest Monitoring System Market Insight

The U.K. automated pest monitoring system market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the adoption of precision agriculture and the need to reduce pesticide usage. Rising concerns regarding crop losses due to pests are encouraging both small and large farms to invest in automated monitoring solutions. The U.K.’s emphasis on smart farming technologies, alongside strong government support for sustainable agriculture, is expected to continue stimulating market growth.

Germany Automated Pest Monitoring System Market Insight

The Germany automated pest monitoring system market is expected to expand at a considerable CAGR during the forecast period, fueled by the adoption of advanced IoT-based monitoring and environmentally friendly pest control methods. Germany’s well-developed agricultural infrastructure, combined with focus on innovation and sustainability, promotes adoption across commercial farms. Integration with farm management platforms and predictive analytics tools is becoming increasingly prevalent, supporting efficient and data-driven crop protection strategies.

Asia-Pacific Automated Pest Monitoring System Market Insight

The Asia-Pacific automated pest monitoring system market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising adoption of smart farming solutions, rapid urbanization, and government initiatives promoting digital agriculture in countries such as China, Japan, and India. Increasing awareness of sustainable farming and crop protection, along with improved affordability and accessibility of automated systems, is driving market adoption.

Japan Automated Pest Monitoring System Market Insight

The Japan automated pest monitoring system market is gaining momentum due to high technology adoption in agriculture, increasing farm mechanization, and demand for precision crop management. Farmers prioritize systems that integrate IoT sensors, predictive analytics, and mobile-based alerts to monitor pest activity effectively. In addition, Japan’s aging farming population is likely to spur demand for automated and user-friendly solutions that reduce labor dependency while improving yield outcomes.

China Automated Pest Monitoring System Market Insight

The China automated pest monitoring system market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a large agricultural base, and increasing adoption of smart farming technologies. China is a leading market for IoT-enabled agricultural solutions, and automated pest monitoring systems are widely used in both crop and horticultural sectors. Government programs supporting digital agriculture, along with domestic manufacturers providing cost-effective solutions, are key factors propelling the market in China.

Automated Pest Monitoring System Market Share

The automated pest monitoring system industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- Syngenta Crop Protection AG (Switzerland)

- Anticimex (Sweden)

- Valent BioSciences LLC (U.S.)

- DTN (U.S.)

- DunavNET (Serbia)

- EFOS d.o.o. (Slovenia)

- FAUNAPHOTONICS (Hungary)

- Mouser Electronics, Inc. (U.S.)

- Semios (Canada)

- ServicePro (U.S.)

- SNAPTRAP (U.S.)

- Spensa Technologies Inc. (U.S.)

- Russell IPM Ltd (U.K.)

- TRAPVIEW HQ (Slovenia)

Latest Developments in Global Automated Pest Monitoring System Market

- In October 2025, Trapview Group entered into a strategic partnership with Doktar to integrate its AI-powered pest monitoring and forecasting technology into Doktar’s digital agronomy platform. This collaboration is expected to significantly enhance real-time pest data insights by combining automated pest detection with comprehensive field analytics, enabling farmers to reduce pesticide usage while improving crop health through smarter, data-driven interventions. The integrated solution will deliver localized pest alerts and predictive forecasts, strengthening both companies’ positions in the precision agriculture ecosystem and accelerating adoption of advanced pest management tools globally

- In September 2025, Syngenta AG expanded its digital agriculture capabilities through a multi-year partnership with Planet Labs to integrate high-resolution satellite imagery into its Cropwise platform. This alliance will give growers access to near-daily satellite data that supports early pest infestation detection and broader crop health insights, enabling more precise and proactive pest management decisions. The partnership strengthens Syngenta’s digital offerings and accelerates the adoption of AI-enhanced remote sensing tools in precision agriculture worldwide

- In August 2025, BASF SE unveiled a new digital pest monitoring platform leveraging artificial intelligence for real-time data analytics in pest management. This launch is expected to enhance BASF’s competitive edge by providing growers with more precise, data-driven pest control insights that improve intervention timing and reduce crop damage. By integrating AI into pest monitoring workflows, BASF is addressing the growing demand for smarter agricultural decision-making tools and strengthening its presence in the automated pest monitoring segment

- In July 2025, FarmSense announced plans to demo the latest version of its real-time insect monitoring technology at the 2025 Almond Conference. This development highlights FarmSense’s continued innovation in real-time pest detection, with improvements in GPS accuracy, multi-species monitoring, and user dashboard capabilities boosting usability for growers. The enhanced FlightSensor platform is expected to improve decision-making and intervention timing for integrated pest management programs, reinforcing FarmSense’s competitive edge in providing scalable, automated pest monitoring solutions

- In July 2025, Rentokil Initial plc expanded its operations in the Asia-Pacific region by acquiring a local pest control company. This acquisition is part of Rentokil’s strategy to enhance its service capabilities and market presence in emerging markets. By integrating local expertise with its global resources, Rentokil aims to provide tailored pest management solutions that meet the specific needs of regional customers while strengthening its overall market position

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.