Global Automation Testing Market

Market Size in USD Billion

CAGR :

%

USD

33.50 Billion

USD

125.56 Billion

2025

2033

USD

33.50 Billion

USD

125.56 Billion

2025

2033

| 2026 –2033 | |

| USD 33.50 Billion | |

| USD 125.56 Billion | |

|

|

|

|

Automation Testing Market Size

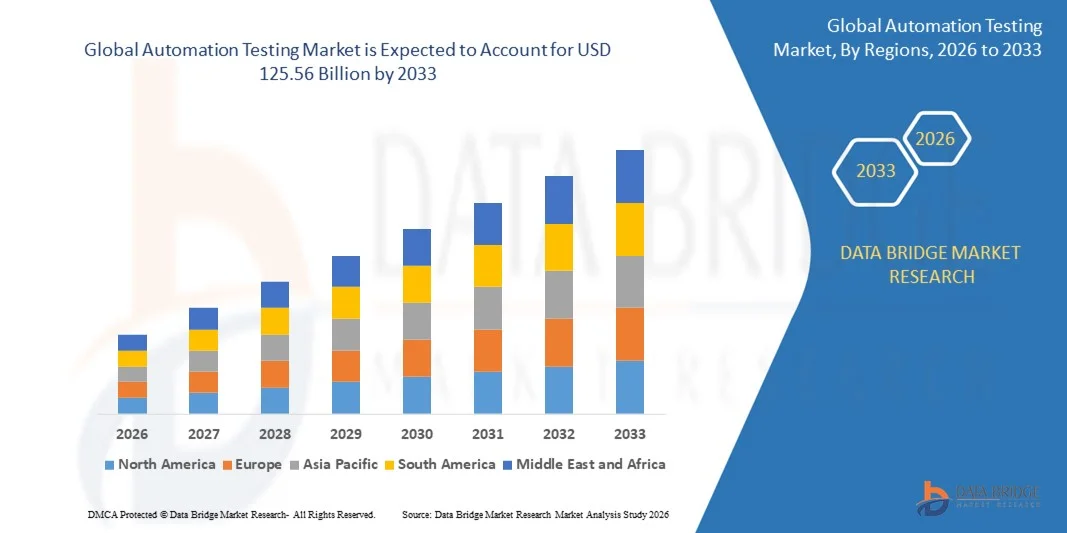

- The global automation testing market size was valued at USD 33.50 billion in 2025 and is expected to reach USD 125.56 billion by 2033, at a CAGR of 17.60% during the forecast period

- The market growth is largely fuelled by the rising demand for faster software releases, increased adoption of agile and DevOps methodologies, and the need for cost-efficient, reliable, and scalable testing solutions

- Growing emphasis on improving software quality, reducing human error, and ensuring compliance with industry standards is further driving the adoption of automation testing tools

Automation Testing Market Analysis

- The market is witnessing increased investments in AI-powered and intelligent automation testing tools that enhance test coverage, optimize test cycles, and reduce overall time-to-market

- Enterprises across industries, including BFSI, healthcare, IT & telecom, and retail, are rapidly integrating automation testing solutions to achieve operational efficiency, minimize defects, and accelerate digital transformation initiatives

- North America dominated the automation testing market with the largest revenue share of 36.25% in 2025, driven by the widespread adoption of agile and DevOps practices, increased digital transformation initiatives, and growing demand for faster software release cycles

- Asia-Pacific region is expected to witness the highest growth rate in the global automation testing market, driven by expanding IT services, rising smartphone and internet penetration, and government initiatives supporting digitalization and smart infrastructure development

- The testing types segment held the largest market revenue share in 2025, driven by the growing adoption of functional, performance, and security testing across complex software applications. Testing type solutions provide comprehensive coverage for web, mobile, and enterprise platforms, enabling faster defect identification, higher reliability, and improved software quality

Report Scope and Automation Testing Market Segmentation

|

Attributes |

Automation Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automation Testing Market Trends

Rise of Intelligent and Continuous Testing Solutions

- The growing adoption of intelligent automation testing is transforming the software quality assurance landscape by enabling faster, more accurate, and repeatable testing across complex applications. AI and ML-driven tools allow real-time defect detection and predictive analytics, improving software reliability and accelerating release cycles. Organizations are increasingly leveraging predictive insights to optimize test coverage, reduce errors, and proactively manage potential risks, enhancing overall product quality

- The increasing demand for continuous integration and continuous delivery (CI/CD) in agile and DevOps environments is driving the adoption of automated testing frameworks. These solutions support rapid testing, reduce manual intervention, and enhance collaboration among development and QA teams. Continuous testing allows teams to identify and fix defects earlier, maintain software stability, and accelerate release cycles across multiple environments

- The affordability and scalability of cloud-based automation testing platforms are making them attractive for enterprises of all sizes. Organizations benefit from flexible test environments, reduced infrastructure costs, and faster time-to-market, which ultimately improves operational efficiency. Cloud-based testing also enables global teams to collaborate seamlessly, conduct parallel testing, and scale resources on demand for complex projects

- For instance, in 2023, Infosys implemented AI-powered automation testing solutions across its banking and retail clients in the U.S. and Europe, resulting in faster defect detection, improved software quality, and reduced deployment delays. Similarly, Capgemini deployed intelligent test automation for a European telecom operator, enhancing test coverage, reducing manual errors, and accelerating release timelines. These deployments also enhanced team productivity, reduced reliance on manual testers, and provided actionable analytics for continuous improvement

- While automation testing adoption is growing, sustained impact depends on continuous innovation, integration with emerging technologies, and workforce upskilling. Providers must focus on tool interoperability, AI enhancements, and training programs to fully capitalize on market growth. Strategic investment in R&D, certification programs, and ecosystem partnerships will also support long-term adoption and industry advancement

Automation Testing Market Dynamics

Driver

Rising Complexity of Software Applications and Demand for Faster Releases

- The increasing complexity of enterprise applications and multi-platform software is pushing organizations to adopt automation testing as a key solution for ensuring quality and performance. Manual testing is no longer sufficient to handle large-scale, integrated systems. Automation enables efficient regression testing, cross-platform compatibility checks, and consistency across releases, reducing operational risk

- Businesses are increasingly adopting agile and DevOps methodologies, which emphasize continuous testing and faster release cycles. Automation testing enables frequent regression testing, early bug detection, and more reliable software delivery. This approach also supports rapid iteration, promotes faster feedback loops, and aligns testing with real-time development changes for enhanced product stability

- Advancements in AI, ML, and cloud-based testing tools are improving test accuracy, scalability, and efficiency, encouraging enterprises to invest in automation solutions. These innovations reduce human error, optimize testing costs, and support rapid deployment. Enhanced predictive capabilities also allow organizations to anticipate failures, optimize test suites, and maintain high software quality standards

- For instance, in 2022, a major European banking firm implemented AI-driven test automation across its mobile and web platforms, resulting in a 40% reduction in testing time and higher release reliability. In 2023, Cognizant deployed a cloud-based automation testing solution for a global e-commerce client, enabling parallel testing across multiple regions, reducing release time by 35%, and improving defect detection. These initiatives helped standardize testing practices and improve customer satisfaction

- While growing demand and technological progress are fueling the market, organizations must address challenges related to tool selection, integration with legacy systems, and workforce skills to maximize adoption and long-term benefits. Continuous investment in upskilling, infrastructure modernization, and strategic tool selection is crucial to achieve sustainable automation testing advantages

Restraint/Challenge

High Implementation Costs and Integration Complexity

- The initial investment required for implementing comprehensive automation testing solutions, including AI-powered tools, test frameworks, and skilled personnel, can be prohibitive for small and mid-sized enterprises. This cost factor limits widespread adoption. High licensing fees, infrastructure setup costs, and ongoing maintenance expenses can make automation testing less accessible to smaller organizations

- Integrating automation testing into existing IT infrastructure and legacy systems often presents technical challenges. Complex application architectures, heterogeneous environments, and multiple development platforms can complicate tool implementation and management. Integration issues can lead to inconsistent results, prolonged deployment cycles, and higher operational overhead if not carefully managed

- Limited availability of skilled automation testers and AI specialists can slow deployment and reduce the efficiency of testing programs. Organizations often face training and recruitment challenges to maintain highly skilled QA teams. Workforce gaps can hinder adoption of advanced tools, delay implementation, and increase dependency on external consultants, impacting cost and timelines

- For instance, in 2023, SMEs in Southeast Asia, including software startups in Singapore and Indonesia, reported delays in adopting automated testing due to high tool costs and lack of skilled testers, affecting product release timelines and quality assurance. Similarly, a mid-sized IT firm in Germany faced integration challenges with legacy ERP systems, which delayed automation testing implementation and impacted delivery schedules. These delays also affected customer satisfaction, limited competitiveness in fast-paced markets, and slowed internal digital transformation initiatives

- While the market continues to evolve with innovative solutions, addressing cost, integration, and skill gaps is critical. Vendors and enterprises must focus on scalable, user-friendly solutions, training programs, and cloud-based options to unlock full market potential. Strategic partnerships, modular implementation, and flexible pricing models can also mitigate barriers and accelerate adoption across industries

Automation Testing Market Scope

The market is segmented on the basis of component, endpoint interface, organization size and vertical.

- By Component

On the basis of component, the automation testing market is segmented into testing types and services. The testing types segment held the largest market revenue share in 2025, driven by the growing adoption of functional, performance, and security testing across complex software applications. Testing type solutions provide comprehensive coverage for web, mobile, and enterprise platforms, enabling faster defect identification, higher reliability, and improved software quality.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for outsourced automation testing, consulting, and managed services. Service providers offer expertise in AI/ML-driven testing, CI/CD integration, and test management, helping organizations reduce operational burden, optimize costs, and accelerate software delivery cycles.

- By Endpoint Interface

On the basis of endpoint interface, the market is segmented into mobile, web, desktop, and embedded software. The web segment held the largest market revenue share in 2025, fueled by the widespread adoption of cloud-based applications and enterprise portals that require rigorous automated testing. Web testing ensures cross-browser compatibility, functionality, and security across online platforms, supporting seamless user experiences.

The mobile segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the proliferation of smartphones, tablets, and mobile applications. Automated mobile testing enables rapid deployment, real-time defect detection, and consistent performance across devices and operating systems, making it critical for modern digital ecosystems.

- By Organization Size

On the basis of organization size, the market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. Large enterprises held the largest market revenue share in 2025, owing to their complex IT infrastructure, multi-platform software, and high-volume application requirements that necessitate automation testing. Large organizations leverage enterprise-grade tools to enhance test coverage, ensure regulatory compliance, and improve release reliability.

The SME segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing availability of cost-effective, cloud-based, and AI-powered automation testing solutions. SMEs are adopting automated testing to accelerate digital transformation, reduce manual testing costs, and remain competitive in fast-moving markets.

- By Vertical

On the basis of vertical, the market is segmented into banking, financial services, insurance, automotive, defense and aerospace, healthcare and life sciences, retail, telecom and IT, manufacturing, logistics and transportation, energy and utilities, media and entertainment, government and public sector, and others. The banking, financial services, and insurance (BFSI) segment held the largest market revenue share in 2025, driven by stringent regulatory compliance, high transaction volumes, and the need for secure, error-free applications.

The healthcare and life sciences segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the adoption of digital health platforms, telemedicine, and medical software. Automation testing in this vertical ensures data integrity, system reliability, and regulatory compliance, supporting patient safety and operational efficiency.

Automation Testing Market Regional Analysis

- North America dominated the automation testing market with the largest revenue share of 36.25% in 2025, driven by the widespread adoption of agile and DevOps practices, increased digital transformation initiatives, and growing demand for faster software release cycles

- Enterprises in the region highly value intelligent, AI-driven automation testing solutions that enhance software quality, reduce manual intervention, and enable continuous testing across complex applications

- This widespread adoption is further supported by the presence of major IT service providers, high technology penetration, and growing investment in cloud-based testing platforms, establishing automation testing as a critical component of enterprise software development

U.S. Automation Testing Market Insight

The U.S. automation testing market captured the largest revenue share in 2025 within North America, fueled by the increasing complexity of enterprise applications and the strong emphasis on CI/CD and DevOps methodologies. Organizations are prioritizing the implementation of AI and ML-based testing tools to improve software reliability and accelerate release cycles. Furthermore, the integration of cloud-based testing platforms and demand for predictive analytics is significantly contributing to market growth.

Europe Automation Testing Market Insight

The Europe automation testing market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing software modernization initiatives and stringent quality compliance standards. The demand for efficient testing of web and mobile applications, coupled with growing digital transformation across banking, healthcare, and manufacturing sectors, is fostering automation testing adoption. European enterprises are also focusing on test optimization, reduced time-to-market, and high-quality software delivery.

U.K. Automation Testing Market Insight

The U.K. automation testing market is expected to witness the fastest growth rate from 2026 to 2033, driven by digital transformation in financial services, IT, and retail industries. Businesses are increasingly adopting AI-powered testing frameworks to reduce manual efforts and ensure high-quality application performance. In addition, regulatory compliance requirements and the growing emphasis on security and reliability are further stimulating market expansion.

Germany Automation Testing Market Insight

The Germany automation testing market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the adoption of Industry 4.0 practices, technological advancements in embedded software, and increasing demand for automated testing in automotive and manufacturing sectors. Germany’s robust IT infrastructure, emphasis on innovation, and focus on digitalization are promoting market adoption. Enterprises are increasingly integrating intelligent testing solutions into their development pipelines to enhance efficiency and software quality.

Asia-Pacific Automation Testing Market Insight

The Asia-Pacific automation testing market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid digitalization, growing IT outsourcing activities, and increasing adoption of cloud and mobile-based applications in countries such as India, China, and Japan. Government initiatives promoting smart cities and digital infrastructure, coupled with the availability of cost-effective automation solutions, are accelerating adoption. The region is also emerging as a hub for AI-driven testing solution development and deployment.

Japan Automation Testing Market Insight

The Japan automation testing market is expected to witness significant growth from 2026 to 2033 due to the increasing focus on high-quality software delivery, demand for advanced mobile and web applications, and adoption of AI-based testing solutions. Japanese enterprises are leveraging intelligent automation to enhance software reliability, reduce testing time, and optimize costs. In addition, rising demand for connected devices and IoT applications is further propelling market growth.

China Automation Testing Market Insight

The China automation testing market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid IT infrastructure growth, high software development activity, and strong adoption of AI and cloud-based testing solutions. China is witnessing increased adoption of automated testing across industries such as finance, telecom, and manufacturing, driven by the need for faster release cycles, enhanced software quality, and digital transformation initiatives. The growing domestic automation testing ecosystem is also supporting widespread market adoption.

Automation Testing Market Share

The Automation Testing industry is primarily led by well-established companies, including:

- Verizon (U.S.)

- IBM (U.S.)

- Aemulus Corporation Sdn. Bhd. (Malaysia)

- Chroma ATE Inc. (Taiwan)

- AEROFLEX (U.S.)

- Astronics Corporation (U.S.)

- ADVANTEST CORPORATION (Japan)

- Cohu, Inc (U.S.)

- Teradyne Inc. (U.S.)

- Star Infomatic Pvt. Ltd. (India)

- TESEC, Inc (Japan)

- ROOS INSTRUMENTS, INC. (U.S.)

- Marvin Test Solutions, Inc. (U.S.)

- Danaher (U.S.)

- Capgemini (France)

- Wipro (India)

- Accenture (Ireland)

- TATA Consultancy Services Limited (India)

- The Qt Company (Finland)

- Worksoft, Inc. (U.S.)

Latest Developments in Global Automation Testing Market

- In March 2024, Sauce Labs announced a strategic partnership with GitHub Actions to optimize continuous testing workflows for developers. The collaboration enables tests to be triggered directly from GitHub repositories using Sauce Labs’ cloud infrastructure, allowing teams to automate web and mobile testing efficiently. This integration improves CI/CD pipeline efficiency, accelerates development cycles, and enhances overall software quality, strengthening market adoption of cloud-based testing solutions

- In February 2024, Micro Focus launched UFT One 17.5, the latest version of its automation testing platform. This release introduces scriptless automation for simplified testing, AI-driven test maintenance for adaptive updates, and enhanced reporting for deeper workflow insights. The platform helps organizations improve testing accuracy, accelerate release cycles, and maintain high-quality software, reinforcing Micro Focus’s position in enterprise automation

- In January 2024, Eggplant unveiled Eggplant AI 2.0, an upgraded intelligent automation testing platform. The new version leverages machine learning for autonomous test creation and predictive analytics to anticipate testing outcomes. These features enable faster, more reliable testing processes, reduce manual intervention, and contribute to higher software quality, driving broader market adoption of AI-powered automation tools

- In June 2023, ESCRIBA AG entered a strategic partnership with Software AG to deliver advanced end-to-end digital solutions. This collaboration provides tools to optimize processes and promote digital transformation across industries, enhancing operational efficiency. By leveraging Software AG’s platform, ESCRIBA AG strengthens its market presence and supports businesses in adopting comprehensive automation strategies

- In May 2023, UiPath partnered with Peraton to offer its business automation platform as a managed service for high-security U.S. government and defense environments. The initiative enables secure cloud or on-premises deployment of AI-powered automation, improving operational efficiency, compliance, and workflow automation. This move expands UiPath’s footprint in sensitive sectors and reinforces the adoption of enterprise automation solutions

- In April 2023, Emerson acquired NI for USD 8.2 billion to enhance its automation and testing capabilities. The acquisition integrates NI’s advanced testing and measurement solutions, enabling Emerson to expand into high-growth sectors such as transportation, electric vehicles, semiconductors, and aerospace. This strategic move strengthens Emerson’s market position and supports long-term growth in industries requiring sophisticated automation solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.