Global Automotive Anti Lock Braking System Market

Market Size in USD Billion

CAGR :

%

USD

54.10 Billion

USD

101.63 Billion

2024

2032

USD

54.10 Billion

USD

101.63 Billion

2024

2032

| 2025 –2032 | |

| USD 54.10 Billion | |

| USD 101.63 Billion | |

|

|

|

|

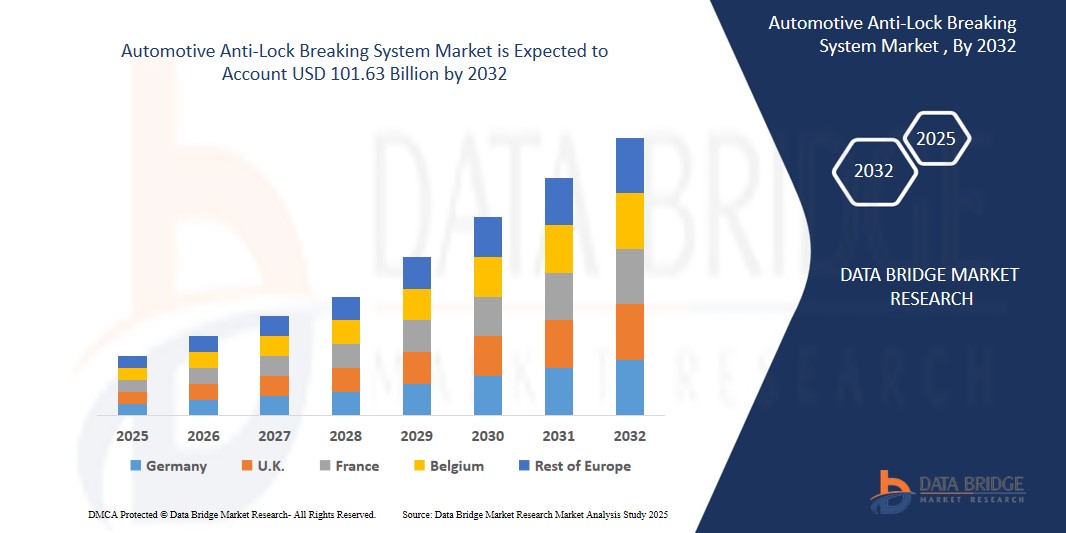

Automotive Anti-Lock Breaking System Market Size

- The global Automotive anti-Lock breaking system market size was valued at USD 54.10 billion in 2024 and is expected to reach USD 101.63 billion by 2032, at a CAGR of 8.2% during the forecast period

- This growth is driven by stringent government regulations mandating ABS installation, increasing consumer demand for vehicle safety features, and the rising adoption of advanced driver assistance systems (ADAS).

Automotive Anti-Lock Breaking System Market Analysis

- Automotive Anti-Lock Braking Systems are advanced safety technologies that prevent wheel lock-up during braking, enhancing vehicle control and reducing stopping distances on various road surfaces.

- The market is propelled by growing road safety awareness, advancements in sensor and IoT technologies, and the integration of ABS with electronic stability control (ESC) and autonomous emergency braking (AEB).

- North America holds a significant market share due to stringent safety regulations, high vehicle production, and the presence of key players like Robert Bosch GmbH and Continental AG.

- Asia-Pacific is expected to register the fastest growth, fueled by increasing vehicle production, rising disposable incomes, and government mandates for ABS in countries like China, India, and Japan.

- The passenger car segment is projected to account for a significant market share of approximately 56.21% in 2025, driven by widespread ABS adoption in passenger vehicles to enhance safety and comply with regulations.

Report Scope and Automotive Anti-Lock Breaking System Market Segmentation

|

Attributes |

Automotive anti-Lock breaking system Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Anti-Lock Breaking System Market Trends

“Advancements in Sensor and IoT-Enabled ABS Technologies”

- The adoption of advanced sensors, such as wheel speed sensors, and IoT-enabled ABS systems is a key trend, offering precise braking control and integration with other safety systems.

- Integration of cloud-based platforms enables real-time data analytics, predictive maintenance, and remote diagnostics for ABS systems.

- For instance, in November 2022, Continental AG launched a fully integrated 2-channel ABS for motorcycles, reducing costs and installation space while enhancing safety for the Indian market.

- These innovations are accelerating ABS adoption across passenger cars, commercial vehicles, and two-wheelers.

Automotive Anti-Lock Breaking System Market Dynamics

Driver

“Stringent Government Regulations and Rising Road Safety Awareness”

- Increasing global road accident rates, with over 1.3 million fatalities annually as per WHO, drive demand for ABS to enhance vehicle safety.

- Government mandates, such as the U.S. NHTSA requiring ABS in all new heavy vehicles and India’s mandate for ABS in two-wheelers since 2019, propel market growth.

- For instance, a 2024 NHTSA report highlighted a 30% reduction in heavy vehicle accidents due to ABS adoption, underscoring its critical role.

- Growing consumer awareness of safety features further accelerates market expansion.

Opportunity

“Integration with Autonomous Driving and ADAS Technologies”

- The integration of ABS with ADAS, ESC, and autonomous emergency braking systems offers enhanced safety, scalability, and compatibility with autonomous vehicles.

- These technologies enable cost-effective solutions, supporting growth in passenger cars, commercial vehicles, and two-wheeler segments.

- For instance, in March 2024, Continental AG introduced a next-generation ABS with enhanced pedestrian recognition capabilities using radar technology, targeting autonomous vehicle applications.

- The rising demand for smart safety solutions presents significant growth opportunities.

Restraint/Challenge

“High Installation Costs and Availability of Counterfeit Parts”

- Implementing advanced ABS systems, such as IoT-enabled ECUs and sensors, involves high installation and maintenance costs, posing challenges for cost-sensitive markets.

- The availability of counterfeit ABS parts at lower costs hinders market growth, particularly in developing regions.

- For instance, a 2024 industry report noted a 40% increase in counterfeit ABS components in Asia-Pacific, impacting consumer trust and market expansion.

- Cybersecurity risks in IoT-based ABS systems further complicate adoption.

Automotive Anti-Lock Breaking System Market Scope

The market is segmented based on type, component, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Component |

|

|

By Application |

|

|

By End User |

|

In 2025, the passenger car segment is projected to dominate the application segment

The passenger car segment is expected to hold a market share of approximately 56.21% in 2025, driven by stringent safety regulations and increasing consumer demand for advanced safety features in passenger vehicles.

The OEMs segment is expected to account for the largest share during the forecast period in the end-user market

In 2025, the OEMs segment is projected to account for a significant market share approximately 62.93%, driven by the mandatory integration of ABS in new vehicle models to comply with global safety standards.

“North America Holds the Largest Share in the Automotive anti-Lock breaking system Market”

- North America dominates the market due to stringent safety regulations, high vehicle production, and the presence of leading vendors like WABCO Holdings Inc. and Robert Bosch GmbH.

- The U.S. holds a significant share, driven by robust R&D investments, high demand for ABS in passenger and commercial vehicles, and government mandates for safety features.

- The region benefits from advancements in sensor technologies and integration with ADAS.

“Asia-Pacific is Projected to Register the Highest CAGR in the Automotive anti-Lock breaking system Market”

- Asia-Pacific’s growth is driven by rapid vehicle production, increasing disposable incomes, and government mandates for ABS in countries like China, India, and Japan.

- India is projected to exhibit the highest CAGR due to its growing automotive industry and mandatory ABS regulations for two-wheelers and passenger cars.

- The region’s focus on road safety and smart city initiatives further accelerates market growth.

Automotive Anti-Lock Breaking System Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- ZF Friedrichshafen AG (Germany)

- Aisin Seiki Co., Ltd. (Japan)

- Denso Corporation (Japan)

- Hitachi Automotive Systems, Ltd. (Japan)

- Mando Corporation (South Korea)

- WABCO Holdings Inc. (U.S.)

- Brembo S.p.A. (Italy)

- Haldex AB (Sweden)

Latest Developments in Global Automotive Anti-Lock Breaking System Market

- In July 2023, Itelma LLC a Russian automotive technology company, launched the country’s first dedicated production facility for Anti-Lock Braking Systems (ABS) and Electronic Stability Control (ESC) systems for passenger cars in July 2023. Located in Moscow, the facility aims to reduce Russia’s reliance on imported automotive safety systems amid global supply chain disruptions. The production line focuses on four-channel ABS systems integrated with ESC, designed to meet European safety standards (ECE R13-H). Itelma’s initiative includes partnerships with local OEMs like AvtoVAZ to equip models such as the Lada Vesta with domestically produced ABS units. The company projects an annual output of 500,000 units by 2026, targeting both domestic and CIS markets. This development strengthens Russia.

- In November 2023, ZF Friedrichshafen AG a global leader in automotive technologies, introduced a groundbreaking brake-by-wire system for software-defined vehicles in November 2023. Unlike traditional hydraulic systems, this fully electromechanical solution eliminates hydraulic components, reducing weight and improving response times. The system enhances ABS integration by enabling seamless coordination with advanced driver assistance systems (ADAS) and autonomous driving technologies. Designed for next-generation electric and autonomous vehicles, the brake-by-wire system offers precise braking control and supports over-the-air updates for continuous performance optimization. ZF showcased the technology at the 2023 Munich Motor Show, demonstrating its application in a prototype electric SUV. The company plans to begin mass production by late 2025, targeting premium OEMs like BMW and Tesla.

- In January 2024, Bosch announced advancements in ABS for electric vehicles, improving regenerative braking efficiency and vehicle range.

- In March 2024, Continental AG introduced a next-generation ABS with pedestrian recognition capabilities, leveraging radar technology for enhanced safety.

- In April 2024, Mando Corporation a South Korean automotive supplier, announced a strategic partnership with a leading Chinese OEM, BYD, in April 2024 to deploy cost-effective ABS solutions for electric and hybrid vehicles in the Asia-Pacific market. The collaboration focuses on developing a lightweight, three-channel ABS system optimized for compact EVs and hybrids, reducing production costs by 12% compared to traditional four-channel systems. The ABS incorporates Mando’s proprietary ECU software, which enhances braking performance on slippery surfaces and supports integration with regenerative braking systems. The partnership includes a supply agreement to equip BYD’s Han EV and Qin Plus models with Mando’s ABS by mid-2025. Mando also plans to leverage this collaboration to expand its presence in Southeast Asia, targeting markets like Thailand and Indonesia, where EV adoption is accelerating. This move strengthens Mando’s position in the cost-sensitive EV market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.