Global Automotive Buffers Market

Market Size in USD Billion

CAGR :

%

USD

4.51 Billion

USD

7.69 Billion

2025

2033

USD

4.51 Billion

USD

7.69 Billion

2025

2033

| 2026 –2033 | |

| USD 4.51 Billion | |

| USD 7.69 Billion | |

|

|

|

|

Automotive Buffers Market Size

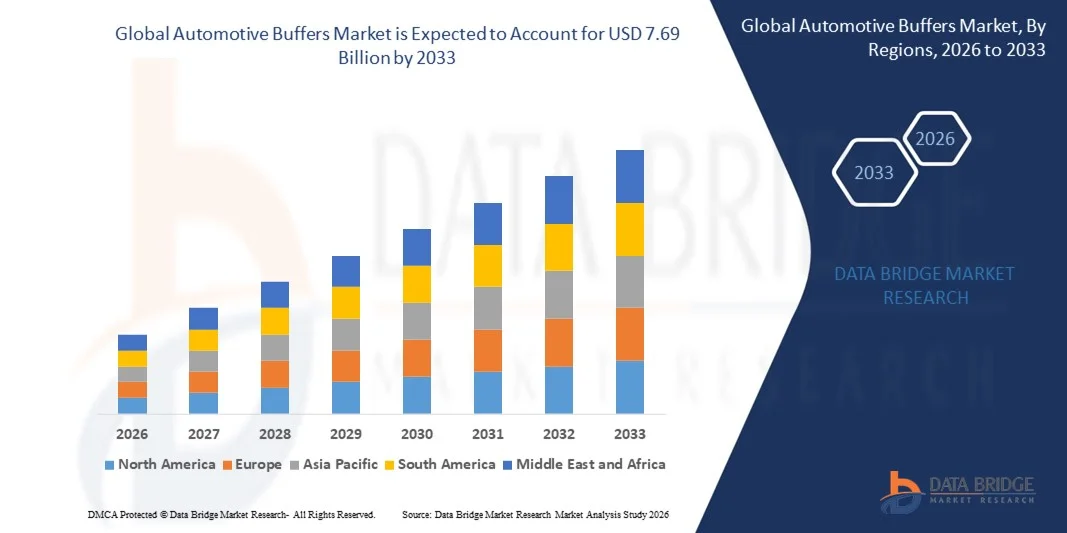

- The global automotive buffers market size was valued at USD 4.51 billion in 2025 and is expected to reach USD 7.69 billion by 2033, at a CAGR of 6.90% during the forecast period

- The market growth is largely fuelled by increasing vehicle production and rising demand for vibration, noise, and impact reduction components to enhance vehicle durability and passenger comfort

- Growing focus on vehicle safety, ride quality, and component longevity is supporting the adoption of high-performance automotive buffers across passenger and commercial vehicles

Automotive Buffers Market Analysis

- The market is characterised by steady demand driven by automotive manufacturing activity, aftermarket replacement needs, and continuous improvements in suspension and chassis systems

- Technological innovation, coupled with the emphasis on comfort, safety, and noise reduction, is shaping product development and long-term growth prospects for the automotive buffers market

- North America dominated the global automotive buffers market with the largest revenue share of 38.75% in 2025, driven by increasing vehicle ownership, a strong presence of automotive workshops, and growing demand for professional detailing solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive buffers market, driven by increasing urbanization, growing automotive production, rising disposable incomes, expanding middle-class population, and rising interest in vehicle aesthetics and professional detailing services

- The 10–15 inch segment accounted for the largest market revenue share in 2025 driven by its balanced performance, ease of handling, and suitability for a wide range of passenger vehicles. Buffers in this size range are widely preferred by both professionals and DIY users for routine waxing and polishing applications. Their moderate size allows precise control and consistent results on varied surfaces

Report Scope and Automotive Buffers Market Segmentation

|

Attributes |

Automotive Buffers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Buffers Market Trends

Rising Demand for Vehicle Comfort, Safety, and Noise Reduction

- The growing focus on improving ride comfort, safety, and durability is significantly shaping the automotive buffers market, as vehicle manufacturers increasingly prioritize components that reduce vibration, noise, and impact stress. Automotive buffers are gaining traction due to their ability to enhance suspension performance, protect critical components, and improve overall driving comfort across passenger and commercial vehicles

- Increasing consumer expectations for smoother rides and quieter cabins have accelerated the adoption of advanced automotive buffers in modern vehicle designs. Automakers are integrating high-performance buffer materials to meet regulatory standards and deliver enhanced driving experiences, supporting consistent demand across OEM and aftermarket channels

- Comfort and safety trends are influencing design and material selection, with manufacturers emphasizing durability, lightweight construction, and resistance to wear and extreme conditions. These factors are helping automotive brands differentiate vehicle performance while supporting long-term reliability and reduced maintenance requirements

- For instance, in 2024, automotive manufacturers in Germany and Japan expanded the use of advanced rubber and polyurethane buffers in suspension and chassis systems to improve ride quality and reduce noise levels. These enhancements were introduced across new passenger vehicle models and light commercial vehicles, strengthening customer satisfaction and brand positioning

- While demand for automotive buffers continues to rise, sustained market growth depends on material innovation, cost efficiency, and maintaining performance under diverse operating conditions. Manufacturers are focusing on R&D, automation, and scalable production to balance cost, quality, and durability

Automotive Buffers Market Dynamics

Driver

Growing Emphasis on Vehicle Comfort and Safety Standards

- Rising demand for enhanced ride comfort and vehicle safety is a major driver for the automotive buffers market. Automakers are increasingly adopting advanced buffer systems to minimize vibration and impact forces, improve suspension efficiency, and meet evolving safety and quality standards

- Expanding applications across passenger cars, commercial vehicles, and electric vehicles are supporting market growth. Automotive buffers play a critical role in protecting suspension components, improving handling, and extending component lifespan, aligning with manufacturer goals for durability and performance

- OEMs and component suppliers are actively promoting advanced buffer technologies through product innovation, lightweight materials, and improved elastomer formulations. These efforts are reinforced by growing consumer awareness of comfort and safety features and the need to comply with stringent automotive regulations

- For instance, in 2023, leading automotive manufacturers in the U.S. and South Korea increased the adoption of advanced buffer systems in new vehicle platforms to enhance ride stability and reduce noise and vibration levels. These improvements contributed to better driving performance and higher customer satisfaction ratings

- Although rising comfort and safety requirements support market expansion, long-term growth relies on continuous material development, supply chain efficiency, and cost optimization to meet global vehicle production demands

Restraint/Challenge

Raw Material Price Volatility and Cost Pressure

- Fluctuating prices of raw materials such as rubber, elastomers, and polymers present a key challenge for the automotive buffers market, impacting production costs and profit margins. Dependence on petrochemical-based materials further exposes manufacturers to price instability and supply disruptions

- Cost sensitivity among automotive manufacturers, particularly in price-competitive vehicle segments, can limit the adoption of high-performance buffer solutions. This creates pressure on suppliers to balance performance improvements with cost-effective manufacturing processes

- Supply chain disruptions and compliance with environmental regulations also affect market growth, as manufacturers must adhere to emission standards and sustainability requirements. These factors can increase operational complexity and investment needs across production facilities

- For instance, in 2024, automotive component suppliers in India and Mexico reported margin pressures due to rising rubber prices and higher compliance costs related to environmental regulations. These challenges influenced pricing strategies and slowed adoption of premium buffer materials in cost-sensitive vehicle models

- Addressing these challenges will require material innovation, diversified sourcing strategies, and improved manufacturing efficiency. In addition, investment in sustainable materials and process optimization will be critical for supporting long-term growth in the global automotive buffers market

Automotive Buffers Market Scope

The market is segmented on the basis of product size, distribution channel, technology, application, vehicle type, and end use

- By Product Size

On the basis of product size, the global automotive buffers market is segmented into Less Than 10 Inch, 10–15 Inch, 15–20 Inch, and More Than 20 Inch. The 10–15 inch segment accounted for the largest market revenue share in 2025 driven by its balanced performance, ease of handling, and suitability for a wide range of passenger vehicles. Buffers in this size range are widely preferred by both professionals and DIY users for routine waxing and polishing applications. Their moderate size allows precise control and consistent results on varied surfaces.

The Less Than 10 Inch segment is expected to experience the highest growth rate from 2026 to 2033 is preferred for detailed work and smaller vehicle parts, while the The segment is expected to grow as manufacturers focus on ergonomic designs for professional users.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Online and Offline. The Offline segment dominated the market revenue share in 2025 supported by strong presence of automotive accessory stores, authorized dealers, and hands-on product evaluation before purchase. Many consumers prefer offline channels for immediate availability and after-sales support. Offline sales are also driven by trusted brand recognition and professional recommendations in workshops.

The Online segment is anticipated to register the fastest growth rate during the forecast period owing to expanding e-commerce platforms, wider product variety, competitive pricing, and increasing consumer preference for doorstep delivery. Online channels also provide access to customer reviews and detailed product comparisons, further boosting their adoption.

- By Technology

Based on technology, the automotive buffers market is segmented into Cord Type and Cordless. The Cord Type segment held the largest market share in 2025 driven by consistent power supply, higher torque output, and suitability for prolonged usage in professional workshops and detailing centers. Corded buffers are valued for their reliability and uninterrupted operation during large-scale polishing projects.

The Cordless segment is expected to grow at a faster pace from 2026 to 2033 due to advancements in battery technology, improved portability, and growing demand for flexible and convenient tools. Cordless buffers are increasingly used in DIY applications and on-site vehicle detailing where mobility and ease of use are important. Manufacturers are focusing on longer battery life and faster charging solutions to meet rising demand.

- By Application

On the basis of application, the market is segmented into Waxing and Polishing. The Polishing segment accounted for the largest revenue share in 2025 as polishing is a critical step in vehicle surface restoration, scratch removal, and paint correction across both personal and commercial vehicles. Polishing buffers help achieve smooth finishes and enhance the gloss of vehicle surfaces.

The Waxing segment is expected to experience the highest growth rate from 2026 to 2033 driven by increasing consumer awareness regarding vehicle aesthetics, paint protection, and regular maintenance practices. Waxing buffers help in protective coating application, preserving the vehicle’s exterior and prolonging paint life. Both applications are witnessing innovation with dual-action buffers for combined polishing and waxing functionality.

- By Vehicle Type

Based on vehicle type, the market is segmented into Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Electric Vehicles. The Passenger Cars segment dominated the market in 2025 supported by high vehicle ownership, frequent detailing activities, and growing interest in personal vehicle appearance and maintenance. Light and heavy commercial vehicles require robust buffers for larger surfaces, contributing to market growth.

The Electric Vehicles segment is expected to experience the highest growth rate from 2026 to 2033 due to the rising adoption of EVs globally and increasing emphasis on specialized maintenance and surface care solutions. EVs often have delicate paint finishes, which drives demand for advanced polishing and waxing equipment. Growing EV sales in North America, Europe, and Asia-Pacific further fuel the segment’s expansion.

- By End Use

On the basis of end use, the automotive buffers market is segmented into Authorized Dealers, Independent Dealers, and Do-It-Yourself (DIY). The Independent Dealers segment held the largest market share in 2025 driven by the widespread presence of local workshops and detailing centers offering cost-effective and customized services. Independent dealers cater to small fleets, individual vehicle owners, and niche detailing services.

The Do-It-Yourself (DIY) segment is expected to experience the highest growth rate from 2026 to 2033 owing to increasing availability of user-friendly buffer machines, growing online tutorials, and rising consumer inclination toward self-maintenance of vehicles. DIY users seek convenience, affordability, and multifunctional buffers to maintain vehicle aesthetics at home. Manufacturers are introducing ergonomic designs and safety features to attract this segment.

Automotive Buffers Market Regional Analysis

- North America dominated the global automotive buffers market with the largest revenue share of 38.75% in 2025, driven by increasing vehicle ownership, a strong presence of automotive workshops, and growing demand for professional detailing solutions

- Consumers in the region highly value high-quality buffers that provide efficiency, durability, and superior surface finishing for both personal and commercial vehicles

- This widespread adoption is further supported by rising disposable incomes, technologically advanced tools, and a preference for time-saving, professional-grade equipment, establishing automotive buffers as a key solution for vehicle maintenance and aesthetics

U.S. Automotive Buffers Market Insight

The U.S. automotive buffers market captured the largest revenue share in 2025 within North America, fueled by a robust automotive industry and increasing interest in vehicle detailing and customization. Consumers are prioritizing high-performance buffer machines for polishing, waxing, and paint protection. The growing trend of DIY vehicle maintenance, combined with strong demand from professional detailing workshops, further propels the market. Moreover, the adoption of cordless and dual-action buffers, along with advanced features such as variable speed controls, is significantly contributing to the market’s expansion.

Europe Automotive Buffers Market Insight

The Europe automotive buffers market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising demand for premium vehicle care products and increasing awareness regarding surface protection. The region’s automotive service industry, combined with high standards for vehicle aesthetics, is fostering the adoption of professional-grade buffers. European consumers are also drawn to innovative, energy-efficient, and eco-friendly tools. The market is witnessing strong growth across passenger cars, commercial fleets, and luxury vehicles, with buffers being incorporated in both workshops and personal use.

U.K. Automotive Buffers Market Insight

The U.K. automotive buffers market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising interest in home-based car maintenance and professional detailing services. Consumers and workshops are increasingly adopting cordless and ergonomically designed buffers for ease of use and efficiency. Concerns regarding vehicle resale value and paint protection are encouraging adoption. The U.K.’s strong automotive aftermarket, coupled with increasing e-commerce sales of automotive accessories, is expected to continue driving market growth.

Germany Automotive Buffers Market Insight

The Germany automotive buffers market is expected to witness the fastest growth rate from 2026 to 2033, fueled by growing awareness of vehicle care, high standards for surface finishing, and demand for technologically advanced solutions. Germany’s strong automotive culture, coupled with the presence of professional detailing centers, promotes the adoption of high-performance buffers. Integration of buffers in workshops and service centers, along with eco-friendly and energy-efficient designs, aligns with local consumer preferences and sustainability goals.

Asia-Pacific Automotive Buffers Market Insight

The Asia-Pacific automotive buffers market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing vehicle production, rising disposable incomes, and expanding automotive service sectors in countries such as China, Japan, and India. The region’s growing interest in vehicle aesthetics and DIY maintenance is boosting buffer adoption. Furthermore, APAC’s role as a manufacturing hub for automotive tools ensures affordability and accessibility, expanding the consumer base for professional and home-use buffer machines.

Japan Automotive Buffers Market Insight

The Japan automotive buffers market is expected to witness significant growth from 2026 to 2033 due to the country’s high standards for vehicle maintenance, technological adoption, and increasing number of vehicle owners focusing on aesthetics. Japanese consumers favor compact, efficient, and easy-to-use buffers suitable for both residential and commercial applications. Integration with smart features such as variable speed control and ergonomic design is fueling adoption. The aging population is also likely to increase demand for user-friendly buffers that simplify vehicle care.

China Automotive Buffers Market Insight

The China automotive buffers market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid vehicle ownership growth, expanding middle-class population, and increasing interest in vehicle care. China is one of the largest markets for automotive accessories, and buffers are becoming increasingly popular across passenger cars, commercial vehicles, and fleet maintenance. The push for premium vehicle maintenance, availability of affordable high-performance buffer machines, and strong domestic manufacturing capabilities are key factors propelling the market in China.

Automotive Buffers Market Share

The Automotive Buffers industry is primarily led by well-established companies, including:

• DEWALT (U.S.)

• PORTER-CABLE (U.S.)

• Milwaukee Tool (U.S.)

• Griot's Garage (U.S.)

• Meguiar's (U.S.)

• RYOBI Limited (Japan)

• Makita U.S.A., Inc. (U.S.)

• BLACK+DECKER Inc (U.S.)

• 3M (U.S.)

• Ingersoll Rand (U.S.)

• Robert Bosch Tool Corporation (Germany)

• TRIESTE a. s. (Czech Republic)

• Turtle Wax, Inc. (U.S.)

• Tetrosyl Express Limited (U.K.)

• Simoniz USA (U.S.)

• Altro Limited (U.K.)

• Auto Magic (U.S.)

• Dow (U.S.)

• Gur Sarab Automotives (India)

• TRINITY AUTO ENGINEERING PVT. LTD. (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.