Global Automotive Ecall Market

Market Size in USD Billion

CAGR :

%

USD

3.27 Billion

USD

7.15 Billion

2024

2032

USD

3.27 Billion

USD

7.15 Billion

2024

2032

| 2025 –2032 | |

| USD 3.27 Billion | |

| USD 7.15 Billion | |

|

|

|

|

Automotive eCall Market Size

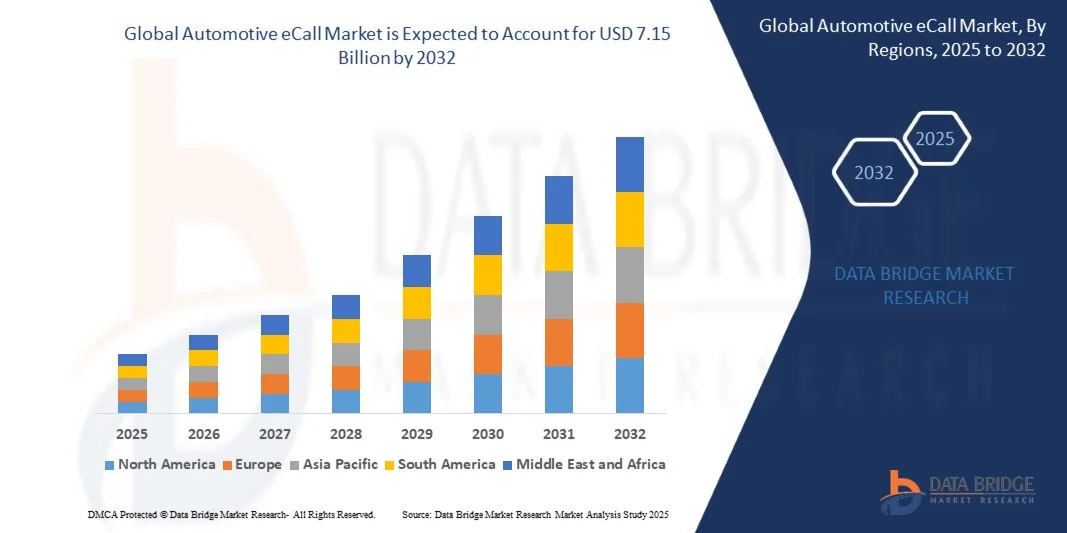

- The global automotive eCall market size was valued at USD 3.27 billion in 2024 and is expected to reach USD 7.15 billion by 2032, at a CAGR of 10.28% during the forecast period

- The market growth is largely fueled by the increasing integration of advanced telematics and vehicle connectivity technologies, leading to enhanced safety standards and improved emergency response mechanisms across the automotive sector. Growing regulatory mandates in regions such as Europe requiring eCall systems in all new vehicles have further accelerated adoption, making automatic emergency communication a standard safety feature in modern vehicles

- Furthermore, rising consumer awareness regarding road safety and the increasing demand for real-time vehicle monitoring and connected safety solutions are driving the expansion of the eCall market. These factors, combined with the proliferation of connected and autonomous vehicles, are fostering widespread implementation of eCall systems across passenger and commercial vehicle segments

Automotive eCall Market Analysis

- The automotive eCall system, designed to automatically notify emergency services in the event of a collision, is becoming a crucial component of modern vehicle safety architecture. Its ability to transmit real-time crash data and location information significantly reduces emergency response times, saving lives and enhancing overall road safety

- The growing emphasis on vehicle telematics, digital transformation in the automotive industry, and government-backed safety initiatives are key factors driving market growth. As automakers increasingly prioritize compliance with global safety regulations and integrate advanced connectivity solutions, the automotive eCall market is poised for sustained expansion worldwide

- Europe dominated the automotive eCall market with a share of 40.3% in 2024, due to stringent safety regulations and the mandatory implementation of eCall systems in all new vehicles as per EU legislation

- Asia-Pacific is expected to be the fastest growing region in the automotive eCall market during the forecast period due to rapid vehicle production, urbanization, and the rising focus on road safety across emerging economies

- Passenger cars segment dominated the market with a market share of 73.3% in 2024, due to the higher installation rate of eCall systems in private and premium vehicles. Automakers are increasingly incorporating eCall as a standard feature to meet safety regulations and enhance the value proposition of their models. The rising consumer preference for advanced in-vehicle safety and telematics systems also drives the segment’s dominance

Report Scope and Automotive eCall Market Segmentation

|

Attributes |

Automotive eCall Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive eCall Market Trends

“Integration of eCall with Advanced Telematics”

- The global automotive eCall market is witnessing strong growth as the system becomes increasingly integrated with advanced telematics and vehicle connectivity platforms. The evolution of smart vehicle communication technologies is transforming eCall from a standalone emergency solution into a connected safety and performance management system that enhances driver assistance and post-accident response capabilities

- For instance, Bosch and Continental AG have developed integrated telematics control units (TCUs) that combine eCall services with real-time vehicle health monitoring and predictive maintenance alerts. These developments highlight how manufacturers are embedding eCall into broader connected car ecosystems to improve safety, operational efficiency, and user experience

- The incorporation of cloud-based telematics networks enables automatic transmission of vital vehicle and location data to emergency centers during critical incidents. This speeds up response time and also enhances collaboration between emergency teams, insurers, and automotive service providers through data sharing

- The increasing adoption of AI and IoT-based telematics infrastructure is paving the way for intelligent eCall systems capable of analyzing crash severity, detecting driver conditions, and automatically notifying emergency services without manual intervention. Such integration supports the growing trend of autonomous and semi-autonomous vehicle technologies

- Regulatory support, particularly across Europe and Asia-Pacific, is accelerating the standardization of eCall systems in new vehicles, alongside other vehicle-to-everything (V2X) features. Automakers are focusing on delivering next-generation telematics platforms that ensure connectivity, safety, and compliance in a single architecture

- As connected mobility advances, the convergence between telematics, emergency communication, and data-driven vehicle functions will define the future of eCall systems. This trend positions eCall as a central feature of intelligent transportation networks that prioritize proactive safety and seamless emergency response capabilities

Automotive eCall Market Dynamics

Driver

“Rising Safety Regulations in Automotive Sector”

- The growing emphasis on passenger safety and government-led mandates for connected emergency assistance systems are driving the expansion of the automotive eCall market. Regulatory frameworks requiring automatic emergency communication features are compelling automakers to integrate standardized eCall units into vehicle designs

- For instance, the European Union has mandated eCall installation in all new passenger vehicles since 2018, prompting major automakers such as BMW and Volkswagen to incorporate compliant modules across their production lines globally. Similar initiatives in Japan, South Korea, and India are reinforcing regulatory alignment toward connected safety mandates

- The increasing number of vehicular accidents and the need for real-time crash response have made automated calling systems essential components in reducing fatalities. eCall ensures faster coordination with emergency centers, enabling first responders to reach accident sites promptly and effectively minimize the impact of injuries

- The expansion of connected vehicle infrastructure and telecom advancements such as 4G LTE and 5G are providing the reliability needed for continuous and accurate emergency data transmission. These technological enhancements support higher accuracy in location data and network stability even in remote regions

- As governments and regulatory agencies strengthen focus on road safety, the enforcement of eCall-compatible systems across commercial and private vehicles is expected to grow. This sustained compliance-driven momentum will continue to underpin the global adoption of eCall systems within the automotive industry

Restraint/Challenge

“High Installation Cost and Network Dependence”

- The high cost associated with integrating eCall systems and telematics architecture remains a major barrier, particularly for mid-range and low-cost vehicle segments. The requirement for high-performance sensors, dedicated control units, and connectivity modules increases the total manufacturing expense of eCall-enabled vehicles

- For instance, smaller automotive OEMs and tier-2 suppliers often face cost constraints in adopting advanced telematics hardware due to the upfront capital needed for compliance and testing. These financial barriers limit large-scale integration, especially in price-sensitive markets where consumers prioritize affordability over value-added features

- Network dependency and inconsistent telecommunications infrastructure also pose challenges to uninterrupted eCall functionality. In regions with weak mobile coverage or poor GPS signal reliability, the accuracy and timeliness of emergency data transmission can be adversely affected, compromising system effectiveness

- Complex integration processes involving coordination between automotive, telecom, and emergency service providers further lengthen implementation timelines. The lack of uniform data protocols across countries complicates interoperability and maintenance for global OEMs

- Ongoing efforts to lower component costs, expand cellular network coverage, and standardize communication frameworks will be essential to overcoming these challenges. Increasing collaboration between automakers and telecom providers will help optimize operational efficiency, ensuring eCall adoption becomes more accessible and reliable across all vehicle categories worldwide

Automotive eCall Market Scope

The market is segmented on the basis of propulsion type, trigger type, and vehicle type.

• By Propulsion Type

On the basis of propulsion type, the automotive eCall market is segmented into ICE and Electric Motor. The ICE segment dominated the market with the largest revenue share of 73.3% in 2024, driven by the high penetration of conventional vehicles globally, particularly in developing regions. Most existing vehicle fleets are powered by internal combustion engines, and automakers are increasingly integrating eCall systems into these models to comply with safety mandates. The availability of robust infrastructure and lower vehicle cost further strengthen the dominance of ICE vehicles equipped with eCall solutions.

The Electric Motor segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the accelerating adoption of electric vehicles and supportive government regulations promoting connected safety features. Electric vehicle manufacturers are prioritizing advanced communication and safety systems such as eCall to enhance customer confidence and align with sustainability goals. The growing EV infrastructure, along with the increasing focus on integrating telematics and real-time emergency response systems, contributes significantly to the expansion of this segment.

• By Trigger Type

On the basis of trigger type, the automotive eCall market is segmented into Manually Initiated eCall (MIeC) and Automatically Initiated eCall (AIeC). The Automatically Initiated eCall (AIeC) segment dominated the market with the largest revenue share of 66.8% in 2024, driven by stringent safety regulations in regions such as Europe mandating automated emergency call systems in all new vehicles. AIeC systems offer faster response times and minimize human error by automatically contacting emergency services in the event of a crash, which significantly enhances occupant safety. OEMs are increasingly integrating AIeC systems to comply with regulatory standards and improve vehicle safety ratings.

The Manually Initiated eCall (MIeC) segment is projected to witness the fastest growth during the forecast period, supported by rising adoption in entry-level and mid-range vehicles. MIeC systems allow occupants to manually trigger emergency calls, offering flexibility and cost-effectiveness compared to automated systems. Growing consumer awareness regarding road safety and increasing integration of MIeC in fleet and commercial vehicles are expected to accelerate the segment’s growth over the coming years.

• By Vehicle Type

On the basis of vehicle type, the automotive eCall market is segmented into Passenger Cars and Commercial Vehicles. The Passenger Cars segment dominated the market in 2024 with the largest revenue share of 73.3%, attributed to the higher installation rate of eCall systems in private and premium vehicles. Automakers are increasingly incorporating eCall as a standard feature to meet safety regulations and enhance the value proposition of their models. The rising consumer preference for advanced in-vehicle safety and telematics systems also drives the segment’s dominance.

The Commercial Vehicles segment is anticipated to record the fastest growth from 2025 to 2032, supported by the growing need for real-time monitoring and safety assurance in logistics and fleet operations. Commercial operators are adopting eCall systems to ensure driver safety, optimize emergency response times, and comply with transportation safety standards. The rapid expansion of connected fleet management and the integration of telematics-based emergency solutions further boost this segment’s growth trajectory.

Automotive eCall Market Regional Analysis

- Europe dominated the automotive eCall market with the largest revenue share of 40.3% in 2024, driven by stringent safety regulations and the mandatory implementation of eCall systems in all new vehicles as per EU legislation

- The region’s advanced automotive industry, strong focus on vehicle safety standards, and growing integration of connected car technologies have significantly contributed to market expansion

- The rising adoption of telematics and intelligent transport systems is further supporting the widespread use of eCall solutions across passenger and commercial vehicles, positioning Europe as the leading region in this market

U.K. Automotive eCall Market Insight

The U.K. automotive eCall market is projected to grow steadily during the forecast period, fueled by increasing government emphasis on road safety and the integration of advanced emergency response systems in new vehicles. The expanding connected vehicle ecosystem and consumer demand for enhanced in-car safety features are key drivers supporting the market. Moreover, local automakers are focusing on incorporating eCall technology to meet EU-aligned safety standards and improve post-accident emergency response efficiency.

Germany Automotive eCall Market Insight

The Germany automotive eCall market captured the largest share within Europe in 2024, supported by the country’s leading automotive manufacturing base and focus on innovation in vehicular safety technology. The strong presence of OEMs such as BMW, Mercedes-Benz, and Volkswagen, which have implemented eCall systems across their vehicle lines, drives growth. Furthermore, Germany’s high vehicle ownership rate and government-backed initiatives promoting smart mobility and connected safety systems are propelling the eCall market forward.

North America Automotive eCall Market Insight

The North America automotive eCall market is expanding steadily, supported by increasing awareness of vehicle safety and the growing penetration of connected car technologies. The region’s robust automotive infrastructure and rising consumer interest in advanced driver assistance systems (ADAS) contribute to the adoption of eCall services. Automakers in the U.S. and Canada are also focusing on integrating emergency call systems in both passenger and commercial vehicles to enhance driver safety and compliance with evolving safety standards.

U.S. Automotive eCall Market Insight

The U.S. automotive eCall market held the largest share within North America in 2024, driven by increasing adoption of telematics-based emergency services and strong support from connected car policies. The integration of AI-powered vehicle communication systems and partnerships between automakers and telecom providers are enhancing the efficiency of eCall operations. The country’s growing demand for smart and safe mobility solutions continues to reinforce the adoption of eCall systems across vehicle categories.

Asia-Pacific Automotive eCall Market Insight

The Asia-Pacific automotive eCall market is projected to grow at the fastest CAGR from 2025 to 2032, supported by rapid vehicle production, urbanization, and the rising focus on road safety across emerging economies. Countries such as China, Japan, and India are increasingly adopting connected vehicle technologies, and regulatory authorities are emphasizing the inclusion of emergency communication systems in new vehicles. The development of 5G networks and advancements in telematics infrastructure further accelerate regional growth.

China Automotive eCall Market Insight

The China automotive eCall market accounted for the largest share within Asia-Pacific in 2024, driven by a growing number of connected vehicles and expanding smart city projects. The country’s strong automotive manufacturing base and government policies promoting vehicle safety technologies are fueling adoption. The integration of eCall systems in both domestic and international brands, supported by AI-enabled telematics and IoT platforms, continues to strengthen China’s market position.

Automotive eCall Market Share

The automotive eCall industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- Telit (U.K.)

- Thales Group (France)

- STMicroelectronics (Switzerland)

- u-blox (Switzerland)

- Texas Instruments Incorporated. (U.S.)

- Valeo (France)

- Infineon Technologies AG (Germany)

- Visteon Corporation (U.S.)

Latest Developments in Global Automotive eCall Market

- In March 2025, Telit Cinterion launched two new modules—the LE310 LTE Cat.1 bis and the SL871K2 GNSS—targeted toward compact, low-power IoT applications such as asset tracking, telematics, and wearables. This launch is expected to strengthen the company’s position in the connected automotive ecosystem by providing enhanced connectivity and location-tracking capabilities essential for efficient eCall operations. The LE310’s compact size and global LTE coverage make it ideal for integration into next-generation telematics and emergency communication devices, while the SL871K2’s multi-constellation support enhances accuracy and reliability in emergency location detection, boosting adoption across vehicle safety solutions

- In January 2025, Infineon Technologies AG initiated the construction of a new semiconductor backend production facility in Samut Prakan, Thailand, to expand its power module manufacturing capacity. This strategic investment supports the growing demand for automotive-grade semiconductors critical for connected safety systems such as eCall. By enhancing production efficiency, supply chain resilience, and capacity for high-quality power modules, Infineon is expected to play a key role in meeting the increasing electronic and telematics integration needs in modern vehicles, thereby reinforcing the growth of the global eCall market

- In December 2023, Applus and Rohde & Schwarz integrated eCall test services within electromagnetic compatibility (EMC) environments, improving the testing and validation standards for automotive emergency communication systems. This development enhances the precision and reliability of eCall performance testing under various conditions, ensuring better compliance with international automotive safety regulations. The integration strengthens industry confidence in eCall technologies and promotes faster adoption by OEMs seeking certified, high-quality safety communication systems

- In August 2023, FIH Mobile Limited, a subsidiary of Hon Hai Technology Group, became the first automotive supplier in Taiwan to obtain eCall certification after successfully passing TÜV Rheinland’s stringent testing process. This achievement signifies a major milestone for Taiwan’s automotive electronics sector, as it enables FIH to contribute to global eCall module supply chains. The certification underscores growing regional capabilities in producing advanced, compliant vehicle safety components, fostering greater competitiveness and technological advancement in the eCall market

- In April 2022, Robert Bosch GmbH expanded its eCall services by integrating them into eDriving’s Mentor app, in collaboration with U.S.-based firms Sfara and eDriving. This move marked a significant advancement in making emergency assistance accessible via smartphones, extending eCall functionalities to vehicles without built-in hardware. By leveraging collision detection and mobile connectivity, Bosch’s initiative broadened the scope of eCall applications across fleet and personal vehicles, accelerating market adoption of mobile-based emergency response systems worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.