Global Automotive Gas Charged Shock Absorbers Market

Market Size in USD Billion

CAGR :

%

USD

41.72 Billion

USD

65.75 Billion

2025

2033

USD

41.72 Billion

USD

65.75 Billion

2025

2033

| 2026 –2033 | |

| USD 41.72 Billion | |

| USD 65.75 Billion | |

|

|

|

|

Automotive Gas Charged Shock Absorbers Market Size

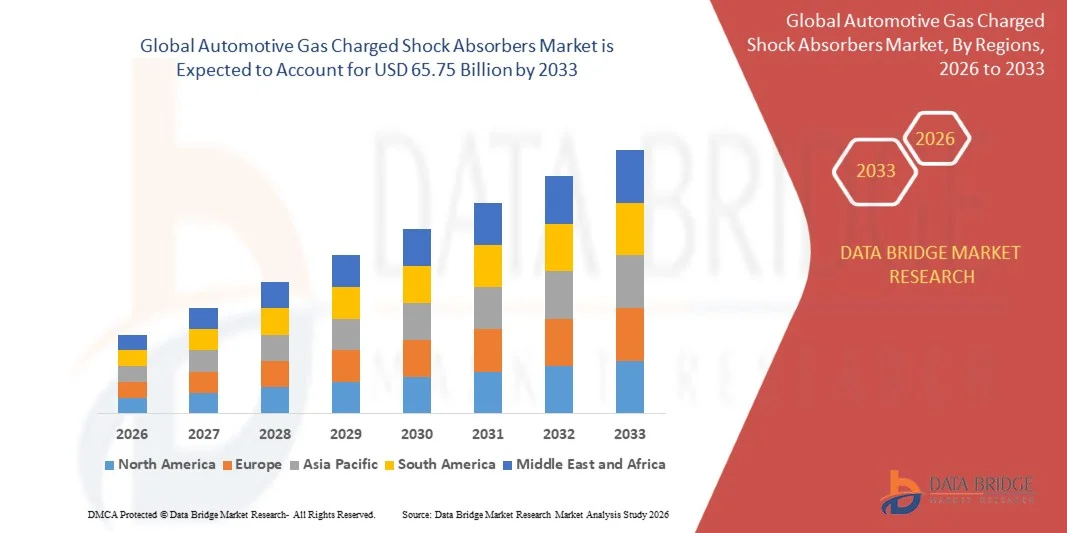

- The global automotive gas charged shock absorbers market size was valued at USD 41.72 billion in 2025 and is expected to reach USD 65.75 billion by 2033, at a CAGR of 5.85% during the forecast period

- The market growth is largely driven by the rising production of passenger and commercial vehicles, along with continuous advancements in suspension technologies focused on improving ride comfort, handling stability, and vehicle safety

- Furthermore, increasing consumer preference for smoother driving experiences, better load management, and durable suspension systems is accelerating the adoption of gas charged shock absorbers across OEM and aftermarket channels, thereby supporting steady market expansion

Automotive Gas Charged Shock Absorbers Market Analysis

- Automotive gas charged shock absorbers, designed to control vehicle vibrations and enhance ride quality, have become essential suspension components across passenger and commercial vehicles due to their superior damping performance and improved driving stability

- The growing demand for these shock absorbers is primarily fueled by rising vehicle ownership, increasing focus on comfort and safety standards, and the expanding use of advanced suspension systems in modern vehicles

- North America dominated the automotive gas charged shock absorbers market with a share of over 40% in 2025, due to high vehicle ownership rates, strong demand for ride comfort, and widespread adoption of advanced suspension systems

- Asia-Pacific is expected to be the fastest growing region in the automotive gas charged shock absorbers market during the forecast period due to rising vehicle production, rapid urbanization, and expanding middle-class populations. Increasing demand for passenger vehicles, improving road infrastructure, and growing awareness of vehicle comfort contribute to strong market growth

- Twin tube segment dominated the market with a market share of 65.5% in 2025, due to its cost effectiveness, wide availability, and extensive use in mass-market passenger vehicles. Twin tube shock absorbers are preferred by OEMs due to their simpler design, balanced ride comfort, and suitability for varied road conditions. Their ability to deliver adequate damping performance at a lower production cost supports large-scale adoption across mid-range and economy vehicles. Strong penetration in emerging markets, supported by high vehicle production volumes, further reinforces the dominance of twin tube shock absorbers

Report Scope and Automotive Gas Charged Shock Absorbers Market Segmentation

|

Attributes |

Automotive Gas Charged Shock Absorbers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Gas Charged Shock Absorbers Market Trends

“Adoption of Advanced Suspension Systems”

- A prominent trend in the automotive gas charged shock absorbers market is the increasing adoption of advanced suspension systems aimed at improving ride comfort, vehicle handling, and overall driving stability. Automakers are integrating gas charged shock absorbers into modern vehicle platforms to meet rising consumer expectations for smoother performance across varied road conditions

- For instance, ZF Friedrichshafen AG supplies advanced gas charged shock absorber solutions that are widely used in passenger cars and commercial vehicles to enhance damping performance and driving control. These solutions support improved vehicle dynamics and align with OEM requirements for safety and comfort optimization

- The growing popularity of sport utility vehicles and premium passenger vehicles is accelerating demand for suspension systems that deliver consistent performance under higher loads. Gas charged shock absorbers are increasingly preferred due to their ability to reduce vibration and maintain stability during high-speed or uneven driving conditions

- Technological advancements in suspension design are enabling manufacturers to offer shock absorbers with better heat dissipation and longer service life. This trend supports improved durability and reliability, particularly in vehicles designed for extended usage

- The integration of advanced suspension systems is also gaining traction in electric and hybrid vehicles where balanced weight distribution and noise reduction are critical. This is reinforcing the role of gas charged shock absorbers as essential components in next-generation vehicle architectures

- Overall, the growing emphasis on driving comfort, vehicle performance, and technological refinement is positioning advanced gas charged shock absorbers as a standard feature across evolving automotive platforms

Automotive Gas Charged Shock Absorbers Market Dynamics

Driver

“Rising Vehicle Production and Comfort Demand”

- The increasing global production of passenger and commercial vehicles is a key driver supporting the growth of the automotive gas charged shock absorbers market. Automakers are prioritizing suspension systems that enhance comfort, stability, and safety to remain competitive in a crowded automotive landscape

- For instance, KYB Corporation supplies gas charged shock absorbers to multiple global OEMs, supporting large-scale vehicle manufacturing programs focused on improved ride quality. These components play a critical role in meeting consumer expectations for smoother and more controlled driving experiences

- Rising consumer awareness regarding vehicle comfort and handling is encouraging manufacturers to integrate higher-quality suspension components even in mid-range vehicle segments. This shift is expanding the adoption of gas charged shock absorbers beyond premium vehicles

- The growth of urban mobility and increasing daily vehicle usage are also driving demand for suspension systems that minimize wear and enhance long-term driving comfort. Gas charged shock absorbers support this need by offering consistent damping performance over extended periods

- As vehicle production expands across emerging and developed markets, the emphasis on comfort-oriented design is reinforcing the importance of gas charged shock absorbers in modern automotive manufacturing

Restraint/Challenge

“High Cost of Advanced Shock Absorbers”

- The automotive gas charged shock absorbers market faces challenges related to the high cost associated with advanced suspension technologies. Manufacturing gas charged shock absorbers with superior damping performance requires precision engineering, high-quality materials, and advanced production processes

- For instance, Hitachi, Ltd. develops high-performance suspension components that involve complex design and manufacturing techniques to ensure durability and efficiency. These factors contribute to elevated production costs, which can limit adoption in cost-sensitive vehicle segments

- Price sensitivity in emerging markets poses an additional challenge, as automakers often seek cost-effective components to maintain competitive vehicle pricing. This can restrict the penetration of premium shock absorber solutions

- Fluctuations in raw material prices and increasing labor costs further impact overall cost structures within the suspension component supply chain. Manufacturers face pressure to balance performance enhancements with affordability

- These cost-related constraints continue to challenge widespread adoption, particularly in entry-level vehicles, prompting manufacturers to focus on process optimization and scalable production strategies to sustain market growth

Automotive Gas Charged Shock Absorbers Market Scope

The market is segmented on the basis of type, sales channel, and vehicle type.

• By Type

On the basis of type, the automotive gas charged shock absorbers market is segmented into mono-tube and twin tube. The twin tube segment dominated the market with the largest revenue share of 65.5% in 2025, driven by its cost effectiveness, wide availability, and extensive use in mass-market passenger vehicles. Twin tube shock absorbers are preferred by OEMs due to their simpler design, balanced ride comfort, and suitability for varied road conditions. Their ability to deliver adequate damping performance at a lower production cost supports large-scale adoption across mid-range and economy vehicles. Strong penetration in emerging markets, supported by high vehicle production volumes, further reinforces the dominance of twin tube shock absorbers.

The mono-tube segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by rising demand for high-performance suspension systems. Mono-tube shock absorbers offer superior heat dissipation, improved handling, and consistent damping performance under extreme driving conditions. Increasing adoption in premium passenger vehicles, sports utility vehicles, and performance-oriented models supports rapid growth. Growing consumer preference for enhanced driving stability and comfort, along with advancements in suspension technologies, accelerates demand for mono-tube designs.

• By Sales Channel

On the basis of sales channel, the automotive gas charged shock absorbers market is segmented into OEMs and aftermarket. The OEM segment dominated the market in 2025, supported by high global vehicle production and strong integration of gas charged shock absorbers during factory assembly. Automakers prioritize optimized suspension systems to meet ride comfort, safety, and regulatory standards, driving consistent OEM demand. Long-term supply contracts between manufacturers and component suppliers ensure volume stability. Increasing focus on vehicle performance and durability further strengthens OEM dominance.

The aftermarket segment is expected to register the fastest growth from 2026 to 2033, driven by rising vehicle parc and increasing replacement cycles. Wear and tear of suspension components over time generates sustained demand for replacement shock absorbers. Growing consumer awareness regarding vehicle maintenance and ride quality supports aftermarket expansion. Improved availability of performance-oriented and vehicle-specific products also contributes to accelerated growth across independent repair and service networks.

• By Vehicle Type

On the basis of vehicle type, the automotive gas charged shock absorbers market is segmented into passenger vehicles and commercial vehicles. The passenger vehicle segment accounted for the largest market revenue share in 2025, driven by high production volumes and widespread use of gas charged shock absorbers across sedans, hatchbacks, and sport utility vehicles. Rising consumer demand for improved ride comfort, noise reduction, and handling stability supports adoption. Continuous upgrades in suspension systems by automakers further reinforce dominance within this segment.

The commercial vehicle segment is projected to witness the fastest growth rate from 2026 to 2033, driven by increasing logistics activity and infrastructure development. Heavy-duty usage conditions require durable suspension systems capable of handling high loads and long operating cycles. Expanding freight transportation, construction activity, and fleet modernization initiatives support demand for advanced gas charged shock absorbers. Improved focus on driver comfort and vehicle stability also accelerates adoption across commercial fleets.

Automotive Gas Charged Shock Absorbers Market Regional Analysis

- North America dominated the automotive gas charged shock absorbers market with the largest revenue share of over 40% in 2025, driven by high vehicle ownership rates, strong demand for ride comfort, and widespread adoption of advanced suspension systems

- Consumers in the region emphasize driving stability, safety, and durability, encouraging OEMs and aftermarket players to integrate gas charged shock absorbers across passenger and commercial vehicles

- This strong adoption is further supported by a well-established automotive manufacturing base, high disposable incomes, and frequent vehicle replacement cycles, positioning gas charged shock absorbers as a standard suspension component across vehicle categories

U.S. Automotive Gas Charged Shock Absorbers Market Insight

The U.S. automotive gas charged shock absorbers market accounted for the largest revenue share within North America in 2025, supported by high production of passenger vehicles and light trucks. Growing preference for enhanced ride quality, coupled with strong aftermarket demand due to vehicle aging, drives market expansion. The presence of major automotive OEMs, along with increasing sales of SUVs and pickup trucks, further accelerates adoption of gas charged shock absorbers across both factory-fitted and replacement segments.

Europe Automotive Gas Charged Shock Absorbers Market Insight

The Europe automotive gas charged shock absorbers market is expected to grow at a steady CAGR during the forecast period, driven by strict vehicle safety and performance standards. Automakers in the region focus on suspension efficiency to improve handling, comfort, and emission-related vehicle optimization. Rising demand for premium and performance vehicles, along with strong penetration of technologically advanced suspension systems, supports consistent market growth across Europe.

U.K. Automotive Gas Charged Shock Absorbers Market Insight

The U.K. automotive gas charged shock absorbers market is projected to expand at a notable CAGR, driven by increasing demand for vehicle comfort and handling performance. Growth in passenger vehicle sales, along with a strong aftermarket supported by high vehicle usage, fuels demand. The rising popularity of SUVs and crossovers, combined with consumer focus on driving stability, continues to support market expansion.

Germany Automotive Gas Charged Shock Absorbers Market Insight

The Germany automotive gas charged shock absorbers market is anticipated to register a considerable CAGR over the forecast period, supported by the country’s strong automotive engineering and manufacturing ecosystem. Germany’s emphasis on vehicle performance, safety, and innovation drives the adoption of advanced suspension technologies. High production of premium and performance vehicles further boosts demand for gas charged shock absorbers across OEM and aftermarket channels.

Asia-Pacific Automotive Gas Charged Shock Absorbers Market Insight

The Asia-Pacific automotive gas charged shock absorbers market is expected to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising vehicle production, rapid urbanization, and expanding middle-class populations. Increasing demand for passenger vehicles, improving road infrastructure, and growing awareness of vehicle comfort contribute to strong market growth. The region’s role as a global automotive manufacturing hub further supports large-scale adoption of gas charged shock absorbers.

Japan Automotive Gas Charged Shock Absorbers Market Insight

The Japan automotive gas charged shock absorbers market is witnessing steady growth due to the country’s focus on vehicle reliability, comfort, and advanced engineering. Japanese automakers emphasize refined suspension systems to enhance driving experience and safety. High penetration of technologically advanced vehicles, combined with consistent replacement demand, supports sustained market growth.

China Automotive Gas Charged Shock Absorbers Market Insight

The China automotive gas charged shock absorbers market held the largest revenue share in Asia Pacific in 2025, driven by massive vehicle production volumes and rapid expansion of the passenger vehicle segment. Rising disposable incomes, growing demand for improved ride quality, and strong domestic manufacturing capabilities fuel adoption. Continuous growth in commercial vehicles and expanding aftermarket networks further strengthen China’s position in the regional market.

Automotive Gas Charged Shock Absorbers Market Share

The automotive gas charged shock absorbers industry is primarily led by well-established companies, including:

- Motherson (India)

- ANAND Group (India)

- ITT Inc. (U.S.)

- Hitachi, Ltd. (Japan)

- ZF Friedrichshafen AG (Germany)

- thyssenkrupp AG (Germany)

- SHOWA Corporation (Japan)

- KYB Corporation (Japan)

- Arnott Inc. (U.S.)

- ZHEJIANG SENSEN AUTO PARTS CO., LTD. (China)

- ACDelco (U.S.)

Latest Developments in Global Automotive Gas Charged Shock Absorbers Market

- In September 2024, Hitachi Astemo announced the expansion of its advanced suspension component portfolio with a strong focus on next-generation gas charged shock absorbers, aimed at improving damping efficiency, durability, and ride comfort. This initiative strengthens the company’s competitive positioning by enabling it to meet rising OEM demand for high-performance suspension systems across passenger vehicles and electrified platforms. The development supports overall market growth by accelerating technological innovation and encouraging wider adoption of advanced gas charged shock absorbers

- In June 2024, Continental AG disclosed strategic investments in smart and adaptive suspension technologies integrated with gas charged shock absorbers to enhance vehicle stability and comfort. By combining sensor-based control systems with traditional shock absorber designs, the company is addressing growing demand for intelligent suspension solutions. This move positively impacts the market by driving value-added product offerings and supporting the transition toward electronically controlled suspension systems

- In March 2023, Tenneco Inc. launched a specialized range of gas charged shock absorbers tailored for electric vehicles, focusing on improved noise reduction, load management, and energy efficiency. These products are designed to accommodate the heavier battery systems and unique driving dynamics of electric vehicles. This development expands the application scope of gas charged shock absorbers and supports market growth in line with the rapid adoption of electric mobility

- In February 2023, ZF Friedrichshafen AG completed the acquisition of WABCO Holdings Inc. to strengthen its commercial vehicle technology portfolio, including braking, control, and chassis systems. The acquisition enables ZF to offer more integrated suspension and control solutions, enhancing performance and safety in commercial vehicles. This strategic consolidation reinforces ZF’s market position and contributes to increased demand for advanced gas charged shock absorbers in heavy-duty applications

- In January 2023, KYB Corporation announced a USD 100 million investment to expand its manufacturing facility in Laurens, South Carolina, with the objective of boosting production capacity for gas charged shock absorbers. The expansion improves supply chain efficiency and supports rising demand from North American OEMs and aftermarket customers. This investment contributes to market growth by ensuring consistent product availability and supporting regional manufacturing capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Gas Charged Shock Absorbers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Gas Charged Shock Absorbers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Gas Charged Shock Absorbers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.