Global Automotive Integrated Hvac System Market

Market Size in USD Billion

CAGR :

%

USD

47.34 Billion

USD

77.76 Billion

2022

2030

USD

47.34 Billion

USD

77.76 Billion

2022

2030

| 2023 –2030 | |

| USD 47.34 Billion | |

| USD 77.76 Billion | |

|

|

|

|

Automotive Integrated Heating, Ventilation, and Air Conditioning (HVAC) System Market Analysis and Size

In last few years, increase in demand for safety and thermal comfort owing to the adoption of HVAC systems are likely to enhance the growth of the market. Besides, people travel in their personal vehicles for long distances for different needs, and consequently boost the need for HVAC. Factors such as climate change and global warming lead to increased global temperatures, which causes high demand for maintaining temperature of automobile. Several market players are involved in acquisitions and mergers to increase their market presence which is helping in the growth of the market.

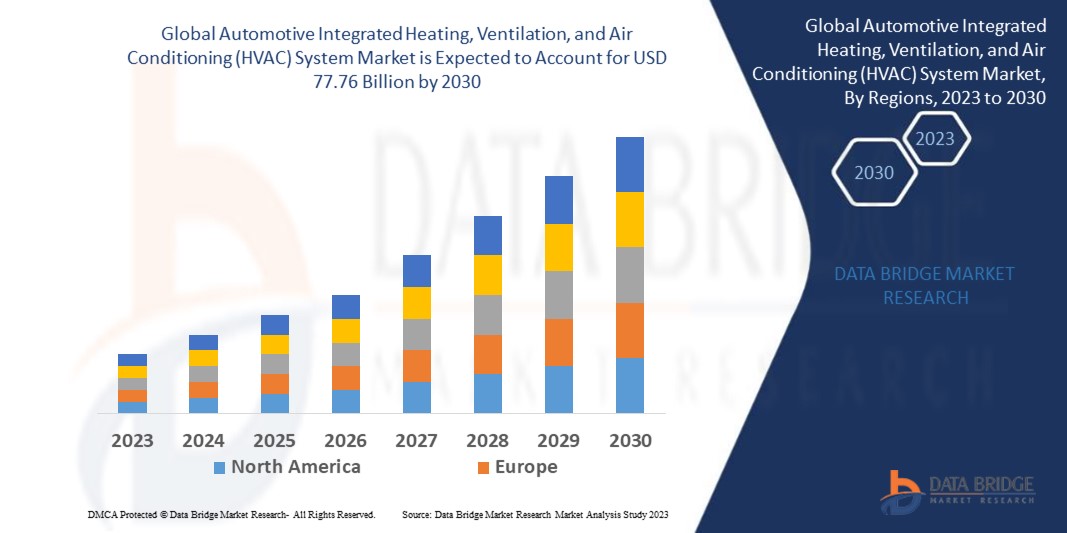

Data Bridge Market Research analyses that the automotive integrated heating, ventilation, and air conditioning (HVAC) system market is expected to reach USD 77.76 billion by 2030, which is USD 47.34 billion in 2022, at a CAGR of 6.40% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Automotive Integrated Heating, Ventilation, and Air Conditioning (HVAC) System Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015- 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Technology (Manual, Automatic), Vehicle Type (Passenger Vehicle, Commercial Vehicle, Electric Vehicle), Component (Compressor, Evaporator, Receiver, Condenser, Others), Distribution Channel (Original Equipment Manufacturer (OEMs), Aftermarket) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

DENSO CORPORATION (Japan), Johnson Electric Holdings Limited (China), Hanon Systems (South Korea), JAPAN CLIMATE SYSTEMS CORPORATION (Japan), MAHLE GmbH (Germany), MITSUBISHI HEAVY INDUSTRIES LTD. (Japan), OMEGA Environmental Technologies (U.S.), Trans/Air Manufacturing Corp. (U.S.), Kongsberg Automotive integrated (Switzerland), Imasen Electric Industrial Co. Ltd. (Japan), Eberspächer (Germany), Air International Thermal Systems (Thailand), Delphi Technologies (U.K.), Brose Fahrzeugteile GmbH and Co. (Germany), TOYOTA INDUSTRIES CORPORATION (Japan), Xiezhong International Holdings Limited (China), GENTHERM (U.S.), Keihin Corporation (Japan), Sensata Technologies Inc. (U.S.), SANDEN HOLDINGS CORPORATION (Japan), Calsonic Kansei Corporation (Japan), Valeo (France) |

|

Market Opportunities |

|

Market Definition

The automotive integrated heating, ventilation, and air conditioning (HVAC) system uses convection in the form of steam, air, water, and refrigerants in piping and ducts to convey heat energy to numerous parts of the system. The main purposes of an integrated heating, ventilation, and air conditioning (HVAC) system are to maintain good indoor air quality through suitable ventilation and offer thermal comfort. HVAC system facilitates proper climate control of the vehicle's hotness or coolness.

Automotive Integrated Heating, Ventilation, and Air Conditioning (HVAC) System Market Dynamics

Drivers

- Increasing demand of automotive integrated HVAC for safety proposes

Growing demand for comfort, safety and latest features among consumers has led to numerous technological developments in Integrated Heating, Ventilation, and Air Conditioning (HVAC) System. The Integrated Heating, Ventilation, and Air Conditioning (HVAC) system contributes to defrosting of windows, dehumidifying air and demisting windshields which improve safety and visibility of passengers. Therefore, increasing demand for safety and favourable conditions in the vehicle is expected to propel the market growth.

- Surging HVAC system installation in commercial vehicles

In last few years, commercial vehicles are experiencing sturdy growth in the integrated heating, ventilation, and air conditioning (HVAC) system market. The major factors which increase the demand for HVAC system are maintain air quality inside the truck cabin, need to improve the thermal comfort of the driver. Furthermore, increasing installation of integrated heating, ventilation, and air conditioning (HVAC) systems in buses and other public transport systems is expected to help increase the market's growth.

Opportunities

- Rising adoption of luxurious automobiles among consumers

Growing adoption of luxurious automobiles among consumers is a major factor that will generate lucrative global market opportunities. Numerous luxury vehicles integrated with automatic heating, ventilation, and air conditioning (HVAC) systems for instance power windows, and heated seats that increase comfort in the vehicle cabin. High comfort encouraged more consumers to adopt luxurious cars or vehicles. Hence, increasing need for comfort among consumers leads to surge the sales of luxury vehicles, which will expected to increase demand of the integrated heating, ventilation, and air conditioning (HVAC) system in the coming years.

- Increasing technological advancements and investments in integrated heating, ventilation, and air conditioning (HVAC) system market

Substantial investments and technological innovations in R & D activities are poised to increase the offering and technological capabilities of players. They are leading to the innovation of eco-friendly and energy-efficient systems HVAC units along with innovative designs to lower the weight and size of systems for improved vehicle performance and better adaptability. Reduction in system weight and size will support the growth of the market over the coming years.

Restraints/ Challenges

- Lack of awareness and high maintenance associated with automotive integrated heating, ventilation, and air conditioning system

Dearth of awareness regarding the usage and benefits of automotive integrated heating, ventilation, and air conditioning system among consumer or manufacturers is expected to obstruct the overall revenue generation of the market during the assessment period. Furthermore, this system's high maintenance price hinders the market's growth because it is expensive in nature and is not easily available in low-income countries.

This automotive integrated heating, ventilation, and air conditioning (HVAC) system market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the automotive integrated heating, ventilation, and air conditioning (HVAC) system market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In 2021, Marelli Corporation manufactured an Indoor Air Quality Purification System, which kills viruses and bacteria inside the vehicles. This system uses UV-C and UV-A light with a titanium dioxide filter to kills viruses and bacteria, including COVID-19, with around 99 percent effectiveness in 15 minutes.

- In 2021, Hanon System initiated its new establishments in Hungary. These facility provide around 22,464 square meters of manufacturing space and equipment including welding and bending, forming, brazing, assembly lines and testing for automotive heating, ventilation, and air conditioning (HVAC) (A/C) lines.

Automotive Integrated Heating, Ventilation, and Air Conditioning (HVAC) System Market Scope

The automotive integrated heating, ventilation, and air conditioning (HVAC) system market is segmented on the basis of technology, vehicle type, component and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Manual

- Automatic

Vehicle Type

- Passenger

- Commercial

- Light

- Heavy

- Electric

Component

- Compressor

- Heat Exchanging Equipment

- Expansion Device

- Receiver/Drier

Distribution Channel

- Original Equipment Manufacturer (OEMs)

- Aftermarket

Automotive Integrated Heating, Ventilation, and Air Conditioning (HVAC) System Market Regional Analysis/Insights

The automotive integrated heating, ventilation, and air conditioning (HVAC) system market is analysed and market size insights and trends are provided by country, technology, vehicle type, component and distribution channel as referenced above.

The countries covered in the automotive integrated heating, ventilation, and air conditioning (HVAC) system market report are U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Switzerland, Netherlands, Russia, Turkey, Belgium, Rest of Europe, Japan, China, South Korea, India, Australia and New Zealand, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, South Africa, Israel, U.A.E., Saudi Arabia, Egypt, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

Asia-Pacific dominates the automotive integrated heating, ventilation, and air conditioning (HVAC) system market in in terms of revenue. This is owing to the growing number of automobile manufacturers in this region.

North America is projected to be the fastest developing region during the forecast period of 2023-2030 due to improved macroeconomic and increase in production capacity of vehicles in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Automotive Integrated Heating, Ventilation, and Air Conditioning (HVAC) System Market Share Analysis

The automotive integrated heating, ventilation, and air conditioning (HVAC) system market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to automotive integrated heating, ventilation, and air conditioning (HVAC) system market.

Some of the major players operating in the automotive integrated heating, ventilation, and air conditioning (HVAC) system market are:

- DENSO CORPORATION (Japan)

- Johnson Electric Holdings Limited (China)

- Hanon Systems (South Korea)

- JAPAN CLIMATE SYSTEMS CORPORATION (Japan)

- MAHLE GmbH (Germany)

- MITSUBISHI HEAVY INDUSTRIES LTD. (Japan)

- OMEGA Environmental Technologies (U.S.)

- Trans/Air Manufacturing Corp. (U.S.)

- Kongsberg Automotive integrated (Switzerland)

- Imasen Electric Industrial Co. Ltd. (Japan)

- Eberspächer (Germany)

- Air International Thermal Systems (Thailand)

- Delphi Technologies (U.K.)

- Brose Fahrzeugteile GmbH and Co. (Germany)

- TOYOTA INDUSTRIES CORPORATION (Japan)

- Xiezhong International Holdings Limited (China)

- GENTHERM (U.S.)

- Keihin Corporation (Japan)

- Sensata Technologies Inc. (U.S.)

- SANDEN HOLDINGS CORPORATION (Japan)

- Calsonic Kansei Corporation (Japan)

- Valeo (France)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SENSORS

6.2.1 TEMPERATURE SENSOR

6.2.2 CURRENT SENSOR

6.2.3 GAS SENSOR

6.2.4 HUMIDITY SENSOR

6.2.5 OTHERS

6.3 CONDENSER

6.4 ORIFICE TUBE

6.5 EVAPORATOR

6.6 COMPRESSORS

6.6.1 ELECTRIC COMPRESSOR

6.6.2 CO2 COMPRESSORS

6.6.3 CARIABLE DISPLACEMENT TYPE COMPRESSORS

6.6.4 FIXED DISPLACEMENT TYPE COMPRESSORS

6.7 FILTERS

6.8 EXPANSION VALVE/DEVICE

6.9 RADIATOR

6.1 CHILLER

6.11 BLOWER

6.12 OTHERS

7 GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MANUAL

7.3 FULLY AUTOMATIC

8 GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET, BY PROPULSION TYPE

8.1 OVERVIEW

8.2 INTERNAL COMBUSTION ENGINE (ICE)

8.2.1 PETROL

8.2.2 DIESEL

8.2.3 CNG

8.3 ELECTRIC ENGINE

8.3.1 BATTERY ELECTRIC VEHICLES (BEVS)

8.3.2 HYBRID ELECTRIC VEHICLES (HEVS)

8.3.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

8.3.4 FUEL-CELL ELECTRIC VEHICLES (FCEVS)

8.4 HYBRID

9 GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET, BY VEHICLE TYPE

9.1 OVERVIEW

9.2 PASSENGER CARS

9.2.1 PASSENGER CARS, BY TYPE

9.2.1.1. HATCHBACK

9.2.1.2. SEDAN

9.2.1.3. SUV

9.2.1.4. MUV

9.2.1.5. COUPE

9.2.1.6. CONVERTIBLE

9.2.1.7. SPORTS CAR

9.2.1.8. OTHERS

9.3 COMMERCIAL VEHICLES

9.3.1 COMMERCIAL VEHICLES, BY TYPE

9.3.1.1. LIGHT COMMERCIAL VEHICLES (LCV)

9.3.1.1.1. BY TYPE

9.3.1.1.1.1 VANS

9.3.1.1.1.1.1. PASSENGER VANS

9.3.1.1.1.1.2. CARGO VANS

9.3.1.1.1.2 PICK UP TRUCKS

9.3.1.1.1.3 MINI BUS

9.3.1.1.1.4 COACHES

9.3.1.1.1.5 OTHERS

9.3.1.2. HEAVY COMMERCIAL VEHICLES (HCV)

9.3.1.2.1. BY TYPE

9.3.1.2.1.1 BUSES

9.3.1.2.1.2 TRUCKS

9.3.1.2.1.2.1. TOW TRUCKS

9.3.1.2.1.2.2. DUMP TRUCKS

9.3.1.2.1.2.3. CEMENT TRUCKS

10 GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OEM

10.3 AFTERMARKET

11 GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET, BY GEOGRAPHY

GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

11.2 EUROPE

11.2.1 GERMANY

11.2.2 FRANCE

11.2.3 U.K.

11.2.4 ITALY

11.2.5 SPAIN

11.2.6 RUSSIA

11.2.7 TURKEY

11.2.8 BELGIUM

11.2.9 NETHERLANDS

11.2.10 NORWAY

11.2.11 FINLAND

11.2.12 SWITZERLAND

11.2.13 DENMARK

11.2.14 SWEDEN

11.2.15 POLAND

11.2.16 REST OF EUROPE

11.3 ASIA PACIFIC

11.3.1 JAPAN

11.3.2 CHINA

11.3.3 SOUTH KOREA

11.3.4 INDIA

11.3.5 AUSTRALIA

11.3.6 NEW ZEALAND

11.3.7 SINGAPORE

11.3.8 THAILAND

11.3.9 MALAYSIA

11.3.10 INDONESIA

11.3.11 PHILIPPINES

11.3.12 TAIWAN

11.3.13 VIETNAM

11.3.14 REST OF ASIA PACIFIC

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 MIDDLE EAST AND AFRICA

11.5.1 SOUTH AFRICA

11.5.2 EGYPT

11.5.3 SAUDI ARABIA

11.5.4 U.A.E

11.5.5 OMAN

11.5.6 BAHRAIN

11.5.7 ISRAEL

11.5.8 KUWAIT

11.5.9 QATAR

11.5.10 REST OF MIDDLE EAST AND AFRICA

11.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

12 GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET,COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

12.7 EXPANSIONS

12.8 REGULATORY CHANGES

12.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET, SWOT & DBMR ANALYSIS

14 GLOBAL AUTOMOTIVE INTEGRATED HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET, COMPANY PROFILE

14.1 NXP SEMICONDUCTORS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 TEXAS INSTRUMENTS INCORPORATED

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 AIR INTERNATIONAL THERMAL SYSTEMS

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 DENSO CORPORATION.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 HANON SYSTEMS

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 AMETEK.INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 SANDEN CORPORATION

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 SNC FORMER PUBLIC COMPANY LIMITED

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 VALEO GROUP

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 MAHLE GMBH

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 JAPAN CLIMATE SYSTEMS CORPORATION

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 TRANS/AIR MANUFACTURING CORP.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 EBERSPÄCHER

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 SENSATA TECHNOLOGIES

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 KEIHIN CORPORATION

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 JOHNSON ELECTRIC HOLDINGS LIMITED

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 MARELLI CORPORATION (CALSONIC KANSEI CORPORATION)

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 GENTHERM

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 MODINE MANUFACTURING COMPANY

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 ELITE KL

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENT

14.22 ESTRA

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENT

14.23 PREH GMBH

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 PRODUCT PORTFOLIO

14.23.4 RECENT DEVELOPMENT

14.24 BEHR-HELLA THERMOCONTROL GMBH

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 PRODUCT PORTFOLIO

14.24.4 RECENT DEVELOPMENT

14.25 NAR GROUP LTD

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

15 CONCLUSION

16 QUESTIONNAIRE

17 RELATED REPORTS

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.