Global Automotive Noise Vibration And Harshness Materials Market

Market Size in USD Billion

CAGR :

%

USD

14.05 Billion

USD

22.31 Billion

2025

2033

USD

14.05 Billion

USD

22.31 Billion

2025

2033

| 2026 –2033 | |

| USD 14.05 Billion | |

| USD 22.31 Billion | |

|

|

|

|

What is the Global Automotive Noise Vibration and Harshness Materials Market Size and Growth Rate?

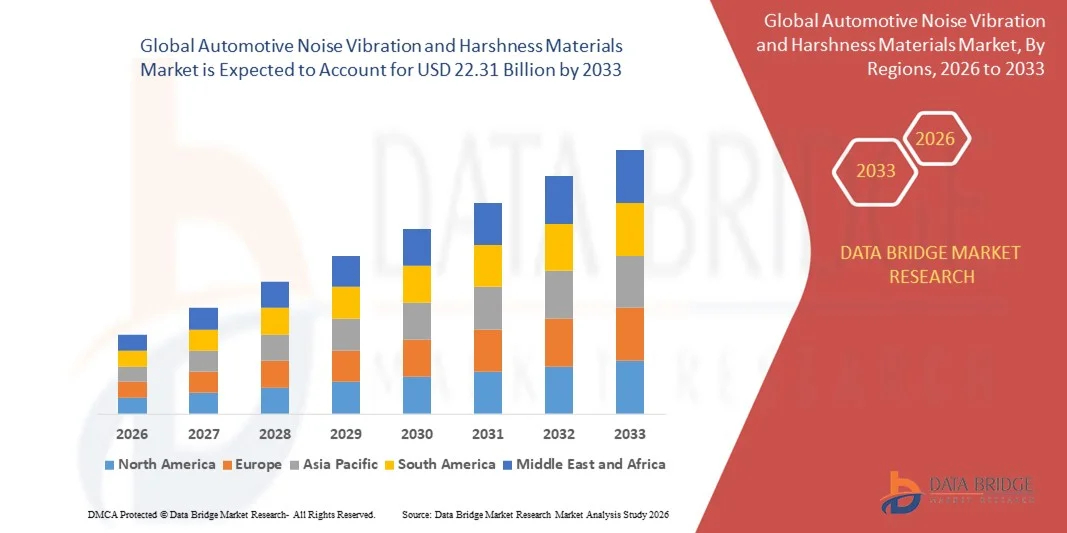

- The global automotive noise vibration and harshness materials market size was valued at USD 14.05 billion in 2025 and is expected to reach USD 22.31 billion by 2033, at a CAGR of5.95% during the forecast period

- Rise in the consumption of plastics in automotive production is the vital factor escalating the market growth, also rise in the technological advancements associated with NVH materials, continuous change in lifestyle, increase in middle class income coupled with supporting financial schemes for purchasing cars are the major factors among others driving the automotive noise vibration and harshness materials market

What are the Major Takeaways of Automotive Noise Vibration and Harshness Materials Market?

- Rise in the research and development activities and increase in the demand from emerging economies will further create new opportunities for the automotive noise vibration and harshness materials market

- However, rise in the cost of research and development acts as the major factor among others acting as a restraint, and will further challenge the growth of automotive noise vibration and harshness materials market

- Asia-Pacific dominated the automotive noise vibration and harshness materials market with an estimated 44.2% revenue share in 2025, driven by high vehicle production volumes, rapid expansion of automotive manufacturing hubs, and strong demand for passenger and commercial vehicles across China, Japan, India, South Korea, and Southeast Asia

- North America is expected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by rising EV adoption, increasing demand for premium vehicles, and strict noise and vibration regulations across the U.S. and Canada

- The Rubber dominated the market with an estimated 41.6% share in 2025, owing to its excellent vibration damping, flexibility, durability, and wide usage in engine mounts, bushings, seals, and underbody components

Report Scope and Automotive Noise Vibration and Harshness Materials Market Segmentation

|

Attributes |

Automotive Noise Vibration and Harshness Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Automotive Noise Vibration and Harshness Materials Market?

Increasing Shift Toward Lightweight, High-Performance, and Sustainable NVH Materials

- The automotive noise vibration and harshness (NVH) materials market is witnessing a growing shift toward lightweight, high-damping materials to improve vehicle comfort, fuel efficiency, and overall acoustic performance

- Manufacturers are increasingly adopting advanced polymers, multilayer composites, and foam-based solutions that offer superior sound absorption and vibration isolation while reducing vehicle weight

- Rising electrification of vehicles is driving demand for specialized NVH materials to manage new noise sources such as electric motors, power electronics, and high-frequency vibrations

- For instance, leading companies such as BASF, Dow, Covestro, and Sumitomo Riko are developing next-generation NVH materials with enhanced thermal stability, durability, and recyclability

- Growing focus on sustainability is accelerating the use of recyclable, bio-based, and low-emission NVH materials across global automotive platforms

- As vehicle architectures evolve toward EVs and connected mobility, advanced NVH materials will remain critical for enhancing cabin comfort and acoustic refinement

What are the Key Drivers of Automotive Noise Vibration and Harshness Materials Market?

- Rising consumer demand for quieter, smoother, and more comfortable driving experiences across passenger and commercial vehicles

- For instance, in 2024–2025, major OEMs increased the use of polyurethane foams, rubber-based insulators, and composite dampers to meet stricter noise and vibration standards

- Rapid growth in electric and hybrid vehicles is increasing the need for innovative NVH solutions to address high-frequency and structure-borne noise

- Advancements in material science, including high-damping elastomers and lightweight thermoplastics, are improving performance and cost efficiency

- Expanding global vehicle production, particularly in Asia-Pacific and Europe, is boosting large-scale adoption of NVH materials

- Supported by stringent regulatory norms and continuous automotive R&D investments, the Automotive NVH Materials market is expected to grow steadily

Which Factor is Challenging the Growth of the Automotive Noise Vibration and Harshness Materials Market?

- High costs associated with advanced NVH materials and multi-layer acoustic systems can limit adoption, especially in low-cost vehicle segments

- For instance, during 2024–2025, volatility in raw material prices such as polymers and specialty rubbers increased production costs for NVH material suppliers

- Design complexity and integration challenges in compact vehicle platforms require precise engineering and customization

- Balancing lightweight requirements with long-term durability and acoustic performance remains a technical challenge

- Competition from alternative noise control solutions, including active noise cancellation technologies, adds pressure on traditional NVH material demand

- To overcome these challenges, manufacturers are focusing on material optimization, cost-efficient formulations, and integration-friendly NVH solutions to sustain market growth

How is the Automotive Noise Vibration and Harshness Materials Market Segmented?

The market is segmented on the basis of material, NVH treatment, and vehicle.

- By Material

On the basis of material, the automotive noise vibration and harshness materials market is segmented into Rubber, Polypropylene, Polyurethane, Polyamide, and Polyvinyl Chloride (PVC). Rubber dominated the market with an estimated 41.6% share in 2025, owing to its excellent vibration damping, flexibility, durability, and wide usage in engine mounts, bushings, seals, and underbody components. Rubber-based NVH materials are extensively adopted across passenger and commercial vehicles due to their cost-effectiveness and proven performance in reducing structure-borne noise.

Polyurethane is expected to register the fastest CAGR from 2026 to 2033, driven by rising demand for lightweight, high-performance acoustic foams used in dashboards, headliners, door panels, and floor insulation. Growing electrification of vehicles, combined with OEM focus on weight reduction and interior comfort, is accelerating adoption of advanced polyurethane and polymer-based NVH materials across global automotive platforms.

- By NVH Treatment

Based on NVH treatment, the market is segmented into Absorber, Insulator, Absorber & Insulator, and Damper. The Absorber & Insulator segment dominated the market with a 38.9% share in 2025, as it offers dual functionality by simultaneously reducing airborne noise and blocking vibration transmission. These combined solutions are widely used in vehicle cabins, engine compartments, and firewall applications to meet increasingly stringent noise regulations and consumer comfort expectations.

The Damper segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for vibration control in electric vehicles, battery packs, power electronics, and lightweight body structures. Increasing use of constrained layer damping and viscoelastic materials to manage resonance and structural vibrations is further supporting growth. As vehicle architectures become more complex and lightweight, advanced damping solutions are gaining importance across passenger and commercial vehicles.

- By Vehicle

On the basis of vehicle, the automotive NVH materials market is segmented into Passenger Cars, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). Passenger Cars dominated the market with a 56.4% share in 2025, supported by high global production volumes, strong consumer demand for enhanced cabin comfort, and increasing adoption of premium NVH solutions in mid-range and luxury vehicles. OEMs extensively use NVH materials in passenger cars to reduce engine, road, and wind noise while improving ride quality.

The Light Commercial Vehicles segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rapid expansion of e-commerce, logistics, and urban transportation. Increasing electrification of LCV fleets and stricter noise regulations are pushing manufacturers to integrate advanced NVH materials to improve driver comfort and vehicle refinement, supporting sustained segment growth.

Which Region Holds the Largest Share of the Automotive Noise Vibration and Harshness Materials Market?

- Asia-Pacific dominated the automotive noise vibration and harshness materials market with an estimated 44.2% revenue share in 2025, driven by high vehicle production volumes, rapid expansion of automotive manufacturing hubs, and strong demand for passenger and commercial vehicles across China, Japan, India, South Korea, and Southeast Asia. Increasing focus on cabin comfort, noise reduction regulations, and lightweight material adoption is accelerating NVH material usage across ICE and electric vehicles

- Presence of large OEMs, tier-1 suppliers, and cost-efficient raw material availability strengthens regional dominance

- Rising EV adoption, urbanization, and growing middle-class vehicle demand further reinforce Asia-Pacific’s market leadership

China Automotive Noise Vibration and Harshness Materials Market Insight

China is the largest contributor in Asia-Pacific, supported by the world’s highest automotive production, strong EV manufacturing capacity, and extensive use of NVH materials in passenger cars and commercial vehicles. Government regulations on noise pollution and rapid adoption of lightweight polymer-based NVH solutions are driving market growth. Strong domestic supplier networks and competitive pricing further support large-scale deployment.

Japan Automotive Noise Vibration and Harshness Materials Market Insight

Japan shows steady growth due to its focus on vehicle refinement, high-quality manufacturing, and advanced material innovation. Leading automakers emphasize superior cabin acoustics, vibration control, and durability, driving demand for premium NVH materials. Growth in hybrid and electric vehicles further strengthens long-term market adoption.

India Automotive Noise Vibration and Harshness Materials Market Insight

India is emerging as a key growth market, driven by expanding passenger car production, rising demand for comfort-oriented vehicles, and increasing localization of automotive components. Government initiatives such as “Make in India,” growth in EV manufacturing, and expanding commercial vehicle fleets are accelerating NVH material adoption.

South Korea Automotive Noise Vibration and Harshness Materials Market Insight

South Korea contributes significantly due to strong automotive exports, advanced material technologies, and growing EV production. OEM focus on ride comfort, noise reduction, and lightweight vehicle platforms is boosting demand for high-performance NVH materials across passenger and electric vehicles.

North America Automotive Noise Vibration and Harshness Materials Market

North America is expected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by rising EV adoption, increasing demand for premium vehicles, and strict noise and vibration regulations across the U.S. and Canada. OEMs are increasingly integrating advanced rubber, polyurethane, and composite NVH materials to improve cabin comfort and vehicle refinement. Strong R&D investments, advanced manufacturing capabilities, and demand for lightweight solutions support accelerated growth

U.S. Automotive Noise Vibration and Harshness Materials Market Insight

The U.S. leads North America, supported by high demand for SUVs, electric vehicles, and premium passenger cars. Increasing focus on noise reduction in EVs, battery systems, and lightweight vehicle platforms is driving adoption of advanced NVH materials. Presence of major OEMs and tier suppliers further fuels market growth.

Canada Automotive Noise Vibration and Harshness Materials Market Insight

Canada contributes steadily through strong automotive assembly operations, rising EV investments, and increasing demand for comfort-enhancing vehicle components. Adoption of NVH materials is supported by regulatory standards, advanced manufacturing, and growing emphasis on vehicle quality and sustainability.

Which are the Top Companies in Automotive Noise Vibration and Harshness Materials Market?

The automotive noise vibration and harshness materials industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- 3M (U.S.)

- Dow (U.S.)

- Exxon Mobil Corporation (U.S.)

- Huntsman Corporation (U.S.)

- Solvay (Belgium)

- Nitto Denko Corporation (Japan)

- NVH Korea (South Korea)

- Celanese Corporation (U.S.)

- Henkel Corporation (Germany)

- Sumitomo Riko Company Limited (Japan)

- Borgers SE & Co. KGaA (Germany)

- Covestro AG (Germany)

What are the Recent Developments in Global Automotive Noise Vibration and Harshness Materials Market?

- In October 2023, 3M introduced a new portfolio of lightweight, high-performance materials designed to manage noise, vibration, and harshness in electric vehicles. These solutions emphasize effective sound damping and vibration control while reducing overall vehicle weight, aligning with sustainability goals and enhanced driving comfort, thereby supporting next-generation EV design requirements

- In September 2023, BASF launched an innovative range of environmentally friendly NVH materials derived from renewable resources. These materials deliver improved sound absorption while lowering environmental impact, helping automotive manufacturers achieve carbon reduction targets and advance sustainable vehicle production

- In August 2023, DuPont unveiled advanced NVH solutions featuring a newly developed sound-dampening polymer engineered for durability and high performance under extreme automotive operating conditions. This development enhances cabin comfort and reliability, reinforcing DuPont’s focus on premium vehicle experience

- In December 2022, Vibracoustic developed a battery isolation pack system for body-on-chassis electric vehicles, including light commercial vehicles, large SUVs, and off-road vehicles. The solution uses elastomer-damped mounts to mitigate torsional forces and improve NVH performance, ensuring battery safety and long-term vehicle durability

- In October 2020, Halco collaborated with 3M to develop efficient NVH reduction solutions for electric vehicles by integrating high-performance adhesive tapes into fastening systems. This approach simplifies assembly, improves material compatibility, and supports high-volume manufacturing, enhancing overall production efficiency

- In June 2020, Nissan announced a breakthrough NVH application using lightweight acoustic meta-materials that significantly reduce cabin noise while improving energy efficiency. Weighing only 25% of conventional rubber mats, the innovation delivers equal sound insulation, supporting vehicle lightweighting and improved driving comfort

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Noise Vibration And Harshness Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Noise Vibration And Harshness Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Noise Vibration And Harshness Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.