Global Automotive Paints And Coatings Market

Market Size in USD Billion

CAGR :

%

USD

18.94 Billion

USD

29.51 Billion

2025

2033

USD

18.94 Billion

USD

29.51 Billion

2025

2033

| 2026 –2033 | |

| USD 18.94 Billion | |

| USD 29.51 Billion | |

|

|

|

|

Automotive Paints and Coatings Market Size

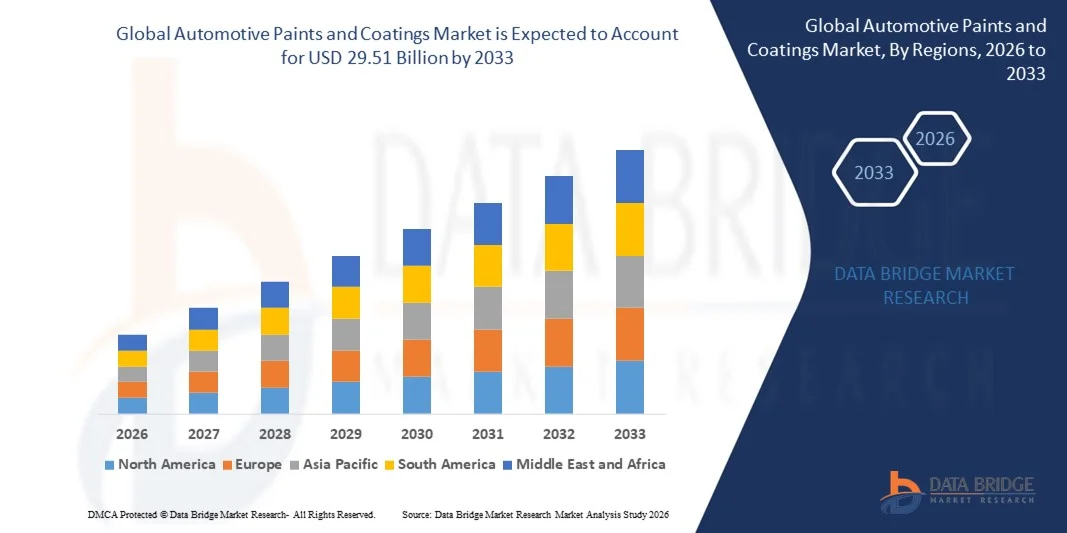

- The global automotive paints and coatings market size was valued at USD 18.94 billion in 2025 and is expected to reach USD 29.51 billion by 2033, at a CAGR of 5.70 during the forecast period

- The market growth is largely fueled by increasing automotive production globally, coupled with rising demand for premium finishes, durable coatings, and eco-friendly solutions such as waterborne and UV-cured paints. Technological advancements in coating formulations and application methods are further driving adoption across passenger and commercial vehicles

- Furthermore, growing consumer preference for customized vehicle colors, enhanced aesthetics, and corrosion-resistant finishes is pushing automakers and refinish providers to adopt advanced coating technologies. These converging factors are accelerating the uptake of automotive paints and coatings, thereby significantly boosting the industry’s growth

Automotive Paints and Coatings Market Analysis

- Automotive paints and coatings include a range of products such as primers, basecoats, electrocoats, and clear coats, applied to vehicle surfaces to enhance durability, appearance, and environmental resistance. These coatings are used in both OEM and aftermarket applications, offering protection against corrosion, UV exposure, and chemical damage

- The escalating demand for automotive paints and coatings is primarily fueled by stricter environmental regulations, the push for low-VOC and sustainable coatings, growing automotive production in emerging economies, and rising consumer expectations for premium finishes. Innovation in color trends, scratch resistance, and multi-functional coatings is further enhancing market adoption across global vehicle segments

- Asia-Pacific dominated the automotive paints and coatings market with a share of 51.5% in 2025, due to the rapid growth of automotive manufacturing, increasing demand for premium and durable coatings, and the presence of major automotive production hubs

- North America is expected to be the fastest growing region in the automotive paints and coatings market during the forecast period due to increasing demand for durable, eco-friendly, and technologically advanced coatings in passenger and commercial vehicles

- Passenger cars segment dominated the market with a market share of 52.5% in 2025, due to the high production volume of passenger vehicles globally and the increasing emphasis on aesthetic appeal and durability in consumer choices. Automakers prioritize advanced coating solutions for passenger cars to enhance corrosion resistance, color retention, and overall finish quality, boosting demand in this segment. The market also sees strong adoption due to the growing trend of personalization and premium coatings in passenger vehicles, which further enhances resale value and brand perception

Report Scope and Automotive Paints and Coatings Market Segmentation

|

Attributes |

Automotive Paints and Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Paints and Coatings Market Trends

Rising Adoption of Eco-Friendly and Low-VOC Coatings

- A significant trend in the automotive paints and coatings market is the increasing adoption of eco-friendly and low-VOC (volatile organic compounds) coatings, driven by the growing focus on sustainability and reducing environmental impact in vehicle manufacturing. This shift is prompting automakers and coating suppliers to innovate solutions that combine performance with environmental compliance

- For instance, PPG Industries and Axalta Coating Systems have launched low-VOC and waterborne coatings widely used in passenger cars and commercial vehicles. These coatings reduce emissions while maintaining color vibrancy and durability, aligning with global environmental initiatives

- The trend toward lightweight vehicles is influencing the formulation of coatings compatible with aluminum and composite materials, which require specialized adhesion and corrosion resistance. This is enabling broader integration of eco-friendly coatings without compromising finish quality or durability

- Automakers are increasingly adopting multifunctional coatings that provide both aesthetic appeal and protective performance, such as scratch resistance, UV protection, and anti-corrosion properties. This supports longer vehicle lifespans and enhances brand perception in premium segments

- The expansion of electric vehicles (EVs) is accelerating demand for coatings that withstand battery-related thermal conditions and reduce heat absorption. Coating manufacturers are tailoring formulations to meet these EV-specific requirements while adhering to sustainability standards

- The market is witnessing the rise of digital color-matching and automated application technologies that enhance efficiency and reduce waste. Such innovations are reinforcing the integration of eco-conscious solutions into high-volume production lines

Automotive Paints and Coatings Market Dynamics

Driver

Increasing Demand for Premium Finishes and Corrosion-Resistant Coatings

- The growing consumer preference for premium vehicle finishes with superior gloss, texture, and long-lasting protection is driving demand for advanced automotive coatings. These coatings enhance visual appeal while providing resistance to environmental factors, scratches, and chemical exposure

- For instance, BASF provides premium coatings for Mercedes-Benz and BMW vehicles that combine high durability with aesthetic excellence. These coatings contribute to vehicle longevity and elevate brand perception in luxury segments

- The rising emphasis on corrosion resistance, especially in regions with extreme weather conditions, is encouraging adoption of multi-layer coatings systems that protect metal surfaces from rust and degradation. This is critical for maintaining vehicle integrity and resale value

- Innovations in functional coatings, such as self-healing and anti-microbial finishes, are expanding applications in passenger vehicles and commercial fleets. This is driving the market toward coatings that provide both protective and functional benefits

- The increased penetration of SUVs and crossovers with exposed metal and aluminum panels is fueling demand for coatings that offer consistent adhesion, UV stability, and chemical resistance. Manufacturers are focusing on high-performance formulations to meet these segment-specific requirements

Restraint/Challenge

Compliance with Stringent Environmental and Safety Regulations

- The automotive paints and coatings market faces challenges due to strict environmental regulations governing VOC emissions, hazardous chemicals, and disposal practices. Manufacturers must ensure compliance without compromising coating performance or increasing costs

- For instance, Sherwin-Williams adheres to stringent EU and U.S. EPA guidelines for low-VOC and waterborne coatings, requiring investments in R&D and specialized production equipment. Regulatory compliance adds complexity to product development and supply chain management

- Varying regional standards in Asia-Pacific, Europe, and North America create additional hurdles for global coating suppliers who must maintain consistent quality while meeting local legal requirements. This affects formulation strategies and distribution efficiency

- The adoption of eco-friendly solvents and binders often involves higher production costs and longer curing times, impacting manufacturing throughput. Balancing sustainability objectives with economic feasibility remains a critical challenge

- The market also faces ongoing scrutiny related to occupational health and safety during coating application, storage, and transportation. This necessitates strict process controls, training, and safety protocols, influencing operational expenses and limiting flexibility

Automotive Paints and Coatings Market Scope

The market is segmented on the basis of vehicle type, coating type, technology type, texture, distribution channel, and raw material.

- By Vehicle Type

On the basis of vehicle type, the automotive paints and coatings market is segmented into passenger cars, heavy commercial vehicles, and light commercial vehicles. The passenger cars segment dominated the largest market revenue share of 52.5% in 2025, driven by the high production volume of passenger vehicles globally and the increasing emphasis on aesthetic appeal and durability in consumer choices. Automakers prioritize advanced coating solutions for passenger cars to enhance corrosion resistance, color retention, and overall finish quality, boosting demand in this segment. The market also sees strong adoption due to the growing trend of personalization and premium coatings in passenger vehicles, which further enhances resale value and brand perception.

The light commercial vehicles segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising e-commerce and logistics activities that drive fleet expansion. Demand for durable coatings that withstand heavy usage and varying climatic conditions is increasing, and manufacturers are integrating innovative technologies to meet these requirements. The growth is further supported by stricter emission and environmental regulations, encouraging the adoption of eco-friendly coating solutions in light commercial vehicles.

- By Coating Type

On the basis of coating type, the market is segmented into basecoat, primer, electrocoat, and clear coat. The clear coat segment held the largest market revenue share in 2025, driven by its essential role in providing a glossy finish, UV protection, and chemical resistance to automotive surfaces. Automotive manufacturers invest heavily in clear coat technologies to improve paint longevity and maintain vehicle aesthetics over extended periods, especially for premium and mid-range models. The segment also benefits from advancements in multifunctional clear coats that offer scratch resistance and self-healing properties, enhancing vehicle durability and appeal.

The basecoat segment is expected to witness the fastest growth from 2026 to 2033, propelled by increasing demand for vibrant color customization and enhanced aesthetic appeal in passenger and commercial vehicles. Basecoats provide a foundation for advanced coatings, allowing manufacturers to meet specific design and branding requirements. For instance, leading companies such as PPG Industries are developing high-performance basecoat solutions to offer superior coverage and color consistency, boosting adoption in new vehicle launches.

- By Technology Type

On the basis of technology type, the market is segmented into solvent-borne, waterborne, UV cured, and powder coatings. The waterborne segment dominated the largest revenue share in 2025, driven by stringent environmental regulations that restrict volatile organic compound (VOC) emissions from solvent-based coatings. Waterborne coatings are widely adopted for their eco-friendly properties, high corrosion resistance, and suitability for diverse vehicle surfaces, making them a preferred choice among OEMs. Manufacturers increasingly invest in waterborne technologies to meet sustainability goals and maintain compliance with global environmental standards.

The UV-cured segment is projected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for rapid-curing, energy-efficient coatings in high-volume automotive production. UV-curable paints reduce production cycle time and offer excellent hardness, chemical resistance, and gloss retention, appealing to both OEMs and specialty vehicle manufacturers. Companies such as BASF are advancing UV-curable solutions to cater to innovative automotive designs and high-efficiency production lines.

- By Texture

On the basis of texture, the automotive paints and coatings market is segmented into metallic, solid, and matte coatings. The metallic segment dominated the largest market revenue share in 2025, driven by the increasing consumer preference for premium finishes and visually striking designs. Metallic coatings enhance vehicle aesthetics by offering depth, shine, and dynamic visual effects under varying light conditions. The adoption is further supported by technological advancements that improve metallic particle dispersion, ensuring uniformity and scratch resistance.

The solid coating segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for cost-effective and durable finishes in commercial and fleet vehicles. Solid coatings offer reliable coverage, easy maintenance, and compatibility with waterborne and solvent-borne systems, making them versatile for a range of vehicle types. Manufacturers are also leveraging solid coatings for branding and color consistency across fleet vehicles.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into aftermarket and OEM. The OEM segment dominated the largest market revenue share in 2025, driven by the consistent demand from vehicle manufacturers for high-quality coatings during production. OEM coatings ensure uniform performance, compliance with warranty requirements, and alignment with brand aesthetics, strengthening their preference over aftermarket solutions. Investments in advanced coating technologies by automakers further bolster the OEM segment’s market share.

The aftermarket segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising vehicle parc and increasing vehicle refurbishment activities. Demand for touch-up paints, repair coatings, and protective solutions is growing as consumers seek to maintain vehicle appearance and resale value. Companies such as Sherwin-Williams are expanding their aftermarket product portfolios to meet diverse consumer and fleet requirements, driving segment adoption.

- By Raw Material

On the basis of raw material, the market is segmented into epoxy, acrylic, polyurethane, and other resins. The polyurethane segment dominated the largest market revenue share in 2025, driven by its superior chemical resistance, flexibility, and durability, which make it suitable for premium and high-performance vehicles. Polyurethane coatings are widely used for exterior applications, offering excellent adhesion, gloss retention, and resistance to weathering, corrosion, and UV exposure. Increasing adoption in passenger cars and commercial vehicles further strengthens the segment’s market position.

The acrylic segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for cost-effective, high-gloss, and color-retentive coatings in both OEM and aftermarket applications. Acrylic-based paints offer versatility across vehicle types and compatibility with waterborne and solvent-borne technologies, enhancing their adoption. Companies such as AkzoNobel are investing in advanced acrylic resin solutions to meet evolving consumer preferences and regulatory standards.

Automotive Paints and Coatings Market Regional Analysis

- Asia-Pacific dominated the automotive paints and coatings market with the largest revenue share of 51.5% in 2025, driven by the rapid growth of automotive manufacturing, increasing demand for premium and durable coatings, and the presence of major automotive production hubs

- The region’s cost-effective manufacturing landscape, rising investments in advanced coating technologies, and growing vehicle exports are accelerating market expansion

- Availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased adoption of automotive paints and coatings across passenger and commercial vehicles

China Automotive Paints and Coatings Market Insight

China held the largest share in the Asia-Pacific automotive paints and coatings market in 2025, owing to its position as the world’s largest automotive manufacturer and extensive OEM base. The country’s strong industrial infrastructure, government initiatives supporting automotive sector growth, and advanced R&D capabilities in coatings are major growth drivers. Demand is further bolstered by increasing focus on eco-friendly waterborne and UV-cured coatings in both domestic and export vehicles.

India Automotive Paints and Coatings Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising vehicle production, expansion of commercial fleets, and growing investments in modern automotive plants. Government programs promoting electric vehicles and sustainable manufacturing are strengthening the demand for advanced coatings. In addition, rising consumer preference for premium finishes and increasing exports of passenger and commercial vehicles are driving robust market expansion.

Europe Automotive Paints and Coatings Market Insight

The Europe automotive paints and coatings market is expanding steadily, supported by strict environmental regulations, strong focus on low-VOC and waterborne coatings, and high demand for durable and high-quality finishes. The region emphasizes sustainability, advanced formulations, and innovation, particularly in passenger cars and luxury vehicles. Increasing adoption of eco-friendly coatings and investments in R&D for smart and self-healing coatings are further enhancing market growth.

Germany Automotive Paints and Coatings Market Insight

Germany’s market is driven by its leadership in high-precision automotive manufacturing, advanced chemical industry, and export-oriented vehicle production. Well-established R&D networks and collaboration between automotive OEMs and coating manufacturers foster continuous innovation in premium and specialty coatings. Demand is particularly strong for high-performance coatings in luxury and commercial vehicles.

U.K. Automotive Paints and Coatings Market Insight

The U.K. market is supported by a mature automotive industry, strong focus on sustainable and low-VOC coatings, and increasing adoption of high-performance paints for premium vehicles. Efforts to strengthen domestic automotive supply chains post-Brexit, alongside investments in R&D and advanced coating solutions, are driving market growth.

North America Automotive Paints and Coatings Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for durable, eco-friendly, and technologically advanced coatings in passenger and commercial vehicles. Rising adoption of waterborne and UV-cured coatings, focus on sustainability, and growth of automotive manufacturing are supporting market expansion.

U.S. Automotive Paints and Coatings Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its strong automotive manufacturing base, R&D capabilities, and investment in advanced coating technologies. Focus on sustainability, regulatory compliance, and demand for premium finishes is encouraging adoption of high-performance coatings. Presence of key OEMs and coating manufacturers further solidifies the U.S.’s leading position in the region.

Automotive Paints and Coatings Market Share

The automotive paints and coatings industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- PPG Industries, Inc. (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Axalta Coating Systems (U.S.)

- The Sherwin-Williams Company (U.S.)

- Nippon Paint (India) Private Limited (India)

- RPM International Inc. (U.S.)

- PPG Asianpaints (India)

- DuPont (U.S.)

- Clariant (Switzerland)

- Solvay (Belgium)

- Cabot Corporation (U.S.)

- Covestro AG (Germany)

- Donglai Coating Technology (China)

- Eastman Chemical Company (U.S.)

- Kansai Paint Co., Ltd. (Japan)

- KCC CORPORATION (South Korea)

- Valspar (U.S.)

- Shanghai Kinlita Chemical Co., Ltd (China)

Latest Developments in Global Automotive Paints and Coatings Market

- In November 2025, BASF Coatings commissioned a new automotive OEM coatings production facility in Muenster, Germany, marking a significant expansion of its European manufacturing footprint. The advanced plant features high automation and sustainability-oriented processes, improving production efficiency, reducing energy consumption, and ensuring consistent product quality. This development strengthens BASF’s position in the OEM coatings segment, enabling faster fulfillment of high-volume coatings requirements and supporting the growing demand for premium vehicle finishes

- In January 2025, BASF Coatings entered a strategic partnership with BMW Group for the aftersales refinish market, extending the reach of its premium Glasurit and R‑M paint brands across more than 50 markets. The collaboration is expected to drive adoption of high-performance, sustainable refinish solutions within BMW’s dealer and bodyshop networks, enhancing process efficiency and reducing material usage. This initiative reinforces BASF’s market penetration and sustainability positioning in the global automotive coatings landscape

- In January 2025, Axalta introduced “Evergreen Sprint” as its 2025 Global Automotive Color of the Year, reflecting evolving automotive aesthetic trends and shaping coatings demand. This color trend release underscores Axalta’s focus on aligning with consumer preferences and influencing vehicle design, which is expected to increase uptake of advanced color formulations across OEMs and aftermarket refinishers, further strengthening the company’s market influence

- In October 2024, Troy Weaver, Senior Vice President, Global Refinish at Axalta, highlighted the company’s partnership with BMW Group, emphasizing that BMW’s selection of top-tier coatings demonstrates high expectations for quality, efficiency, and sustainability. This collaboration positions Axalta’s refinish solutions as key enablers of premium automotive servicing and reinforces its credibility in high-performance coatings

- In September 2024, Chris Titmarsh, Senior Vice President, Global Automotive Refinish Coatings at BASF, presented the company’s new portfolio at Automechanika 2024, showcasing innovations designed to enhance performance and sustainability in automotive coatings. The launch strengthens BASF’s competitive positioning in advanced refinish technologies and addresses rising market demand for eco-friendly and high-quality coating solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.