Global Automotive Push Rods Market

Market Size in USD Billion

CAGR :

%

USD

21.71 Billion

USD

102.46 Billion

2025

2033

USD

21.71 Billion

USD

102.46 Billion

2025

2033

| 2026 –2033 | |

| USD 21.71 Billion | |

| USD 102.46 Billion | |

|

|

|

|

What is the Global Automotive Push Rods Market Size and Growth Rate?

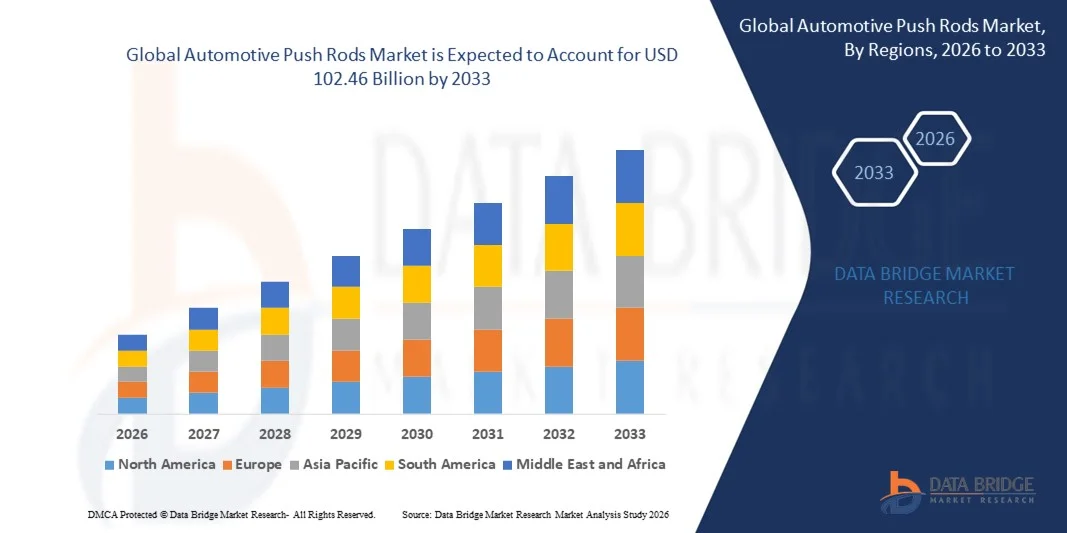

- The global automotive push rods market size was valued at USD 21.71 billion in 2025 and is expected to reach USD 102.46 billion by 2033, at a CAGR of 21.40% during the forecast period

- Increasing adoption of hybrid engine to improve upon the fuel efficiency, easy deployment of push rods as compared to other engines, increasing growth of the logistics sector along with e-commerce industry, growing urbanization and increasing levels of disposable income of the middle-class population, imposition of stringent rules and regulations by the government regrading fuel emission are some of the major as well as important factors which will likely to augment the growth of the automotive push rods market

What are the Major Takeaways of Automotive Push Rods Market?

- Increasing production of new vehicles according to the BS-6 standard along with integration of overhead camshaft (OHC) engines in their vehicles for better fuel efficiency which will further contribute by generating massive opportunities that will lead to the growth of the automotive push rods market in the above mentioned projected timeframe

- Increasing demand of the electric vehicles along with stringent emission norms which will likely to act as market restraints factor for the growth of the automotive push rods in the above mentioned projected timeframe. Several governments of various countries are promoting electro mobility vehicles such as metro, electric buses and other which will become the biggest and foremost challenge for the growth of the market

- North America dominated the automotive push rods market with a 36.78% revenue share in 2025, driven by strong automotive production, high demand for performance vehicles, and widespread adoption of advanced valve-train components across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.36% from 2026 to 2033, driven by expanding automotive manufacturing in China, India, Japan, and South Korea

- The Passenger Car segment dominated the market with a 46.8% share in 2025, driven by high global production volumes, increasing demand for fuel-efficient engines, and steady adoption of advanced push rod systems in compact, mid-size, and utility vehicles

Report Scope and Automotive Push Rods Market Segmentation

|

Attributes |

Automotive Push Rods Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Automotive Push Rods Market?

Rising Demand for High-Strength, Lightweight, and Multi-Functional Automotive Push Rods

- The automotive push rods market is experiencing strong growth driven by increasing demand for lightweight, heat-resistant, and high-durability push rods, designed to support modern high-performance and turbocharged engines

- Manufacturers are developing multi-functional push rods using advanced materials such as chromoly steel, titanium alloys, and carbon composites to enhance engine efficiency, reduce friction, and improve fuel economy

- Automotive OEMs and aftermarket suppliers are prioritizing precision-engineered, corrosion-resistant, and vibration-optimized push rods to meet evolving emission standards and engine downsizing trends

- For instance, companies such as COMP Cams, Schaeffler, Melling, and S&S Cycle have expanded their portfolios of performance push rods for use in high-RPM engines, off-road vehicles, and next-generation passenger cars

- Growing emphasis on engine efficiency, thermal stability, and long-service life is accelerating adoption of advanced push rod technologies globally

- As automakers continue shifting toward high-output, durable, and low-maintenance valve-train components, Automotive Push Rods are expected to remain essential for performance and efficiency improvements across internal combustion engines

What are the Key Drivers of Automotive Push Rods Market?

- Increasing demand for high-performance, fuel-efficient, and lightweight engine components is supporting global adoption of advanced push rods

- For instance, in 2025, COMP Cams, Manton Pushrods, and Smith Bros. Pushrods expanded their product lines with precision-engineered push rods designed for racing engines, commercial vehicles, and modern emission-compliant systems

- Rising global production of commercial vehicles, passenger cars, and off-road vehicles in the U.S., Europe, and Asia-Pacific is boosting market expansion

- Advancements in metalworking, heat-treatment, CNC machining, and material strengthening have improved load-bearing capacity, stiffness, and wear resistance of push rods

- Growing preference for durable, cost-effective, and easily serviceable valve-train components—especially in heavy-duty engines—continues to enhance market growth

- With ongoing R&D investments, material innovations, and strategic OEM-aftermarket partnerships, the Automotive Push Rods market is expected to witness sustained growth in the coming years

Which Factor is Challenging the Growth of the Automotive Push Rods Market?

- High costs associated with premium materials, advanced machining, and precision heat-treatment increase overall manufacturing expenses for performance push rods

- For instance, during 2024–2025, fluctuations in steel, titanium, and alloy prices impacted production costs for several push rod manufacturers

- Strict quality standards for engine performance, durability, and emissions compliance increase technical complexity and regulatory burden

- Limited awareness in developing regions about performance-grade valve-train components restricts widespread adoption outside OEM channels

- Growing competition from overhead camshaft (OHC) engine designs, which eliminate the need for push rods, poses structural challenges for long-term market penetration

- To address these constraints, companies are focusing on cost-efficient material sourcing, precision automation, expanded aftermarket distribution, and engine-specific product customization to strengthen global market adoption

How is the Automotive Push Rods Market Segmented?

The market is segmented on the basis of vehicle type, design, material type, distribution channel, and sales channel.

- By Vehicle Type

The Automotive Push Rods market is segmented into Two Wheelers, Passenger Cars, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). The Passenger Car segment dominated the market with a 46.8% share in 2025, driven by high global production volumes, increasing demand for fuel-efficient engines, and steady adoption of advanced push rod systems in compact, mid-size, and utility vehicles. Push rods used in passenger cars are engineered for superior stiffness, heat resistance, and extended service life, aligning with tightening emission norms and growing consumer preference for low-maintenance powertrains.

The Heavy Commercial Vehicles segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for heavy-duty engines, increased logistics activity, and expanding construction and mining operations across Asia-Pacific and Latin America. Durable, high-load-bearing push rods remain essential for commercial fleets, ensuring smooth valve operation, engine longevity, and reliable performance under harsh operating conditions.

- By Design

The market is segmented into Tapered Push Rods and Straight Push Rods. The Tapered Push Rods segment dominated the market with a 57.3% share in 2025, attributable to their enhanced rigidity, reduced flex, and superior load distribution, which make them ideal for high-performance and high-RPM engines. Their ability to minimize valve-train deflection, improve horsepower output, and withstand thermal stress has increased their adoption in racing applications, premium motorcycles, and performance-enhanced passenger cars.

The Straight Push Rods segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand in cost-sensitive markets, commercial vehicles, and standard passenger cars where reliability, affordability, and ease of replacement are key priorities. Straight push rods continue to be preferred in traditional engine architectures due to simple manufacturing, widespread availability, and compatibility with a broad range of engine configurations.

- By Material Type

The market is segmented into Steel, Aluminium, and Alloy. The Steel segment dominated the market with a 52.6% share in 2025, driven by its superior tensile strength, durability, high temperature resistance, and cost-effectiveness. Steel push rods are commonly used in heavy-duty engines, commercial vehicles, and performance automotive applications where stability and longevity are essential. Their compatibility with advanced heat treatment and precision machining methods further strengthens adoption across OEM and aftermarket channels.

The Alloy segment is projected to grow at the fastest CAGR from 2026 to 2033, boosted by increasing demand for lightweight, corrosion-resistant, and high-rigidity materials. Alloy push rods—often made from chromoly or titanium blends—enhance engine efficiency, reduce reciprocating mass, and support high-RPM performance, especially in sports cars, racing engines, and premium motorcycles. This shift toward lightweight metals aligns with global fuel-efficiency targets, emission reduction goals, and evolving performance engineering trends.

- By Distribution Channel

The market is segmented into Online and Offline channels. The Offline segment dominated the market with a 63.4% revenue share in 2025, supported by strong distribution networks, extensive presence of automotive parts retailers, and consumer preference for physical inspection and immediate product availability. Workshops, authorized service centers, and automotive dealers continue to rely on offline procurement to ensure timely repairs, component quality verification, and professional installation of push rods across various vehicle categories.

The Online segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising e-commerce penetration, increasing adoption of digital aftermarket platforms, and growth of direct-to-consumer sales models. Online channels offer broader product variety, transparent pricing, doorstep delivery, and compatibility-based filtering features, making them increasingly attractive for DIY vehicle owners, small garages, and motorsport enthusiasts seeking specialized or performance-grade push rods.

- By Sales Channel

The market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket. The OEM segment dominated the market with a 58.9% share in 2025, driven by large-scale manufacturing of passenger cars, LCVs, and HCVs, along with OEM requirements for precision-engineered, high-durability push rods that meet strict performance, safety, and emission standards. OEM-supplied push rods ensure consistent quality, compatibility with vehicle-specific valve-train systems, and longer replacement intervals, supporting strong dominance across global automotive production hubs.

The Aftermarket segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by rising vehicle aging, growing engine rebuild activities, increasing demand for performance-grade push rods, and expanding small-garage repair networks. Consumers increasingly prefer aftermarket push rods for cost savings, customization options, and wider availability of specialized designs optimized for racing, off-road use, or high-mileage engines.

Which Region Holds the Largest Share of the Automotive Push Rods Market?

- North America dominated the automotive push rods market with a 36.78% revenue share in 2025, driven by strong automotive production, high demand for performance vehicles, and widespread adoption of advanced valve-train components across the U.S. and Canada. Increasing consumer interest in engine efficiency, emission compliance, and high-durability components significantly contributes to market growth across passenger cars, pickup trucks, and commercial fleets

- Leading manufacturers are expanding their presence in push rod design through innovations in metallurgy, heat treatment, and lightweight alloy development to enhance rigidity, reduce flex, and support high-RPM engine performance. Strict regulatory norms for fuel efficiency and vehicle reliability further strengthen the region’s market leadership

- High disposable incomes, strong aftermarket activity, and rapid adoption of high-performance engine parts continue to fuel regional expansion

U.S. Automotive Push Rods Market Insight

The U.S. is the largest contributor in North America, supported by strong vehicle production, growing preference for high-output engines, and rising demand for premium aftermarket upgrades. Manufacturers are increasingly investing in precision-engineered push rods, advanced steel alloys, and performance-grade components designed for muscle cars, trucks, drag racing, and motorsports applications. Robust distribution networks, strong DIY automotive culture, and expanding commercial fleet maintenance activities continue to drive market growth across OEM and aftermarket channels.

Canada Automotive Push Rods Market Insight

Canada plays a significant role in regional growth, driven by increasing demand for durable engine components in passenger cars, SUVs, and heavy-duty vehicles. The country’s colder climate and growing logistics sector create higher replacement frequency for engine parts, strengthening aftermarket demand. Automotive suppliers and performance tuning workshops are expanding push rod offerings, including strengthened steel rods and lightweight alloy variants. Rising interest in vehicle customization and improved engine longevity continues to support market development.

Asia-Pacific Automotive Push Rods Market Insight

Asia-Pacific is projected to register the fastest CAGR of 10.36% from 2026 to 2033, driven by expanding automotive manufacturing in China, India, Japan, and South Korea. Rising vehicle ownership, rapid urbanization, and strong demand for fuel-efficient engines accelerate adoption of high-quality push rods. Growth in small-engine motorcycles, compact cars, and light commercial vehicles is boosting market penetration across developing economies. Increasing investments in automotive R&D, materials engineering, and component export activities further strengthen regional growth.

China Automotive Push Rods Market Insight

China is the largest contributor within Asia-Pacific, supported by vast automotive production capacity and high demand for engine components in compact cars, motorcycles, and commercial vehicles. Manufacturers are investing in high-strength alloys, advanced machining technologies, and lightweight design improvements to support both domestic and international markets. Expanding aftermarket services, growing vehicle modification culture, and rising engine efficiency standards contribute to strong market performance.

Japan Automotive Push Rods Market Insight

Japan exhibits steady growth, driven by strong demand for precision-engineered valve-train components in hybrid vehicles, compact cars, and high-performance engines. Automotive OEMs in Japan emphasize superior durability, low weight, and engine optimization, encouraging adoption of premium alloy push rods. Continuous innovation in material science and strict quality standards support consistent market expansion across both OEM and performance segments.

India Automotive Push Rods Market Insight

India is emerging as a high-growth market, supported by rising motorcycle production, increasing sales of compact cars, and expanding commercial transport fleets. Demand for cost-effective yet durable push rods is increasing across both OEM and aftermarket sectors. Growing awareness of engine maintenance, increasing vehicle lifespan, and the rapid rise of organized automotive service networks continue to enhance market penetration.

South Korea Automotive Push Rods Market Insight

South Korea contributes notably due to strong vehicle manufacturing capabilities and high demand for fuel-efficient, technologically advanced engines. Push rods are increasingly used in small-engine passenger cars, high-performance vehicles, and export-oriented automobile production. The influence of motorsport culture, premium vehicle upgrades, and material innovation—such as chromoly steel and titanium alloys—continues to strengthen the market outlook.

Which are the Top Companies in Automotive Push Rods Market?

The automotive push rods industry is primarily led by well-established companies, including:

- COMP Cams (U.S.)

- Schaeffler Technologies AG & Co. KG (Germany)

- EDELBROCK, LLC. (U.S.)

- S&S Cycle (U.S.)

- Melling (U.S.)

- Manton Pushrods (U.S.)

- OE Pushrods (U.S.)

- Smith Bros. Pushrods (U.S.)

- Elgin Industries (U.S.)

- Hubei Junvoch Industrial & Trade Co., Ltd (China)

- Rane Holdings Limited (India)

- Wuxi Xizhou Machinery Co., Ltd. (China)

- STAR FASTENERS PVT. LTD. (India)

- Lunati (U.S.)

- ROSSIGNOL GROUP (France)

- G. M. Exports India (India)

- GPP-India (India)

- Garuda Impex (India)

What are the Recent Developments in Global Automotive Push Rods Market?

- In June 2025, Setco Automotive Limited, one of India’s leading MHCV clutch manufacturers and a premium supplier of commercial vehicle components, announced the introduction of its new Load Cushion and Torque Rod Bush as part of its expansion into suspension solutions for the MHCV segment, highlighting the company’s strategic move to strengthen its product diversification

- In October 2023, Vedanta Aluminium, India’s largest aluminium producer, unveiled an advanced portfolio of wire rods including the T4, AL59, and the 8xxx series, marking a significant enhancement in product innovation for the global power and transmission industry, reinforcing the company’s commitment to high-performance aluminium solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.