Global Automotive Tensioner Market

Market Size in USD Billion

CAGR :

%

USD

1.59 Billion

USD

2.18 Billion

2021

2029

USD

1.59 Billion

USD

2.18 Billion

2021

2029

| 2022 –2029 | |

| USD 1.59 Billion | |

| USD 2.18 Billion | |

|

|

|

|

Automotive Tensioner Market Analysis and Size

Automotive tensioner are one of the most important part of the vehicles. In recent years, there has been a rise in demand for lightweight cars to improve vehicle fuel economy throughout the world are expected to considerably boost demand for automotive tensioners, which is expected to drive the global market. Furthermore, rising concern regarding global warming and other environmental issues, as well as development of fuel-saving technology, are some major factor which are likely to drive demand for automobile tensioners. Therefore, rising demand for lighter and more compact automobile tensioner is one of the major factor which is expected to drive the growth of the global automotive tensioner market during the forecast period of 2022-2029.

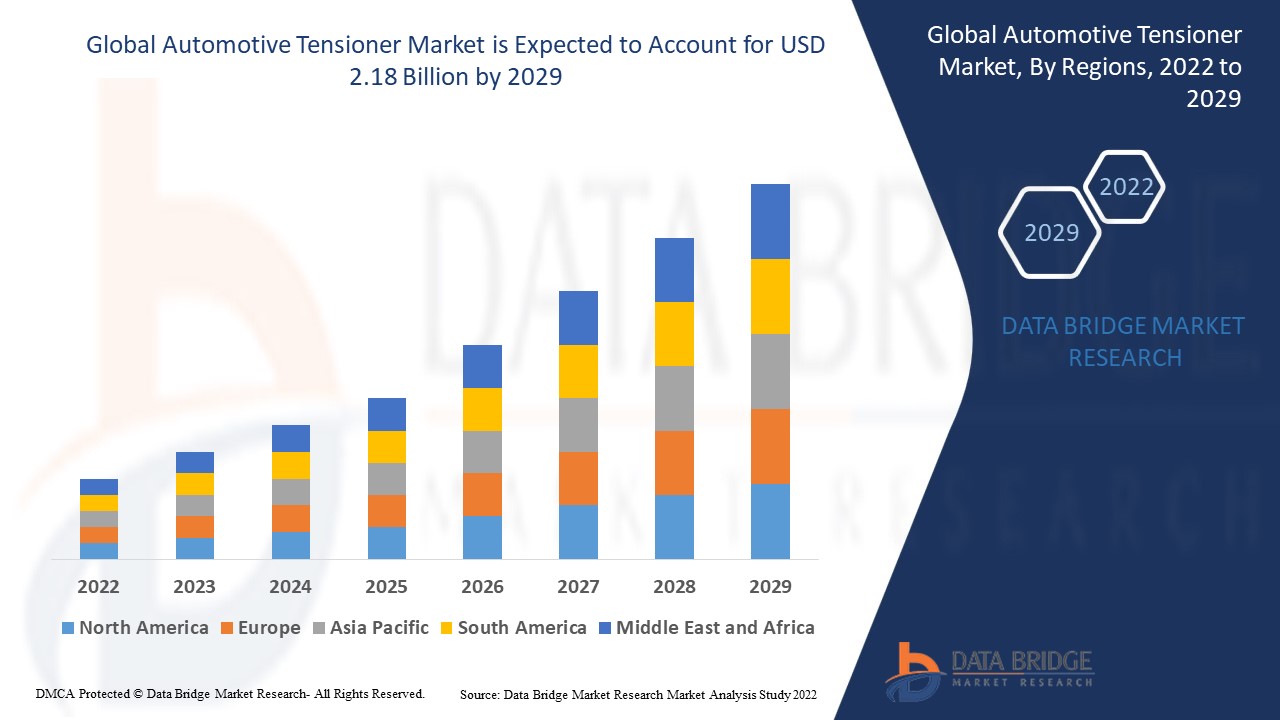

Data Bridge Market Research analyses that the automotive tensioner market was valued at USD 1.59 billion in 2021 and is expected to reach USD 2.18 billion by 2029, registering a CAGR of 4.05% during the forecast period of 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Timing Chain Automotive Tensioner, Timing Belt Automotive Tensioner, Auxiliaries Drive Belt Automotive Tensioner) Vehicle Type (Passenger Car (PC), 2-Wheeler, Commercial Vehicle)Drive Type (Chain Drive, Belt Drive, Auxiliary Drive), System (Dual Arm Tensioner System, Conventional Belt Tensioner System, Automatic Belt Tensioner System), Type of Tensioner (Hydraulically Operated System, Damping Structure), Sales Channel (OEM, Aftermarket |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Continental AG (Germany), ABA Automotive (U.S.), ALT America Inc. (U.S.), Litens Automotive Group (Canada), GMB Corporation (Japan), Dayco IP Holdings, LLC (U.S.), NTN Corporation (Japan), Gates Corporation (U.S.), Muhr und Bender KG (Germany), KMC Automobile Transmission (Taiwan), Pricol Limited (India), Zhejiang Renchi Auto Parts Co., Ltd. (China), Taizhou GEDLBT Machinery Manufacturing Co. Ltd. (China), Gambo Industry Co. Ltd. (China), Guangzhou Kafu Engeering Machinery Parts Co. Ltd. (China), Capitol Stampings Corp. (U.S.) |

|

Market Opportunities |

|

Market Definition

Automotive tensioner is a device that applies force to create tension on the chain or belt which is used in the automotive drive. This device always maintains the timing chain or belts' proper tension and transfers the crankshaft rotation to the camshaft and accessory drive belts. It is extensively used in automotive engines to decrease noise from the timing belt and enhance engine durability.

Automotive Tensioner Market Dynamics

Drivers

- Development of automotive sector

Growing production of vehicles both in emerging and developed economies is one of the major factors recognised to the growth of the automotive tensioner market globally. For instance, according to the International Organization of Motor Vehicle production, the total number of vehicles produced in 2016 was 95 million units, which augmented to 97 million units in 2017, globally. Therefore, growing number of vehicles on road is leading the demand for automotive tensioner which are anticipated to increase the market growth rate during the forecast period of 2022-2029.

- Growing demand for light weight vehicle

Increase in demand for light weight vehicles in order to upsurge fuel-efficiency of the vehicle, is expected to increase the automotive tensioner market across the globe. Also, Rise in manufacture and sale of passenger vehicles is likely to significantly boost the demand for automotive tensioner across the globe, which is anticipated to drive the growth of the automotive tensioner market across the globe.

- Increasing demand for eco-friendly devices

The rolling inclination of consumers towards the eco-friendly vehicles on the back of the rising awareness regarding environmental pollution which is expected to drive the growth of the market during above mentioned period. These components are fuel-efficient which reduce fuel consumption and emissions. The increasing demand for performance and improvement in fuel economy are expected to drive the growth rate of the automotive tensioner market.

Furthermore, the growing vehicle demand, increasing adoption of timing chains to rise use of hydraulic tensioners and oil pressure, escalating urban population, rise in demand for light weight vehicles ,increase in concern regarding global warming and other environmental issues are some other factors which is flourishing the growth of the automotive tensioner market in the forecast period of 2022 to 2029. .

Opportunities

- Growing awareness regarding environmental issues

Rise in concern regarding global warming and other environmental issues to reduce fuel consumption are expected to increase the demand for more compact and lighter automotive tensioners. Many countries have endorsed rules and regulations to decrease emissions and fuel consumption. So, numerous vehicle manufacturers have been manufacturing low fuel consumption technologies to help create ways to save energy and reduce CO2 emissions. This will create immense opportunities for the growth of the global automotive tensioner market.

Furthermore, the rise in vehicle production and sales along with large usage of belt-in-oil engine timing belts are expected to provide lucrative opportunities for the growth of the automotive tensioner market in upcoming years.

Restraints/ Challenges

- Increasing chances of error

In mechanical tensioner pulleys, the augmented chance of mistake in mechanical tensioner pulleys is acting as market restraint for the growth of the automotive tensioner market in the forecast period of 2022-2029.

Moreover, failures in tensioner can result in the belt to break or jump teeth. This is expected to be a factor which is restraining the growth of the automotive tensioner market over the forecast period.

This automotive tensioner market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the automotive tensioner market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Automotive Tensioner Market

The outbreak of COVID-19 pandemic has continued to impact the growth of the automotive and many other sector across the globe. This pandemic has hampered a majority of businesses overall the globe due to imposed lockdown, which caused the people to stay at home. The imposed lockdown led to a decrease in the sales of vehicle, consequently, contracting the global automotive tensioner market. However, the global automotive tensioner market is anticipated to expand from 2021 due to economic measures and the government has taken some steps to recover financial losses which has caused due to shutdown of business activities during the COVID-19 pandemic.

Global Automotive Tensioner Market Scope

The automotive tensioner market is segmented on the basis of type, vehicle type, drive type, system, type of tensioner and sales channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Timing Chain Automotive Tensioner

- Timing Belt Automotive Tensioner

- Auxiliaries Drive Belt Automotive Tensioner

Vehicle Type

- Passenger Car (PC)

- 2-Wheeler

- Commercial Vehicle

Drive Type

- Chain Drive

- Belt Drive

- Auxiliary Drive

System

- Dual Arm Tensioner System

- Conventional Belt Tensioner System

- Automatic Belt Tensioner System

Type of Tensioner

- Hydraulically Operated System

- Damping Structure

Sales Channel

- OEM

- Aftermarket

Automotive Tensioner Market Regional Analysis/Insights

The automotive tensioner market is analysed and market size insights and trends are provided by country, type, vehicle type, drive type, system, type of tensioner and sales channel as referenced above.

The countries covered in the automotive tensioner market report are U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Switzerland, Netherlands, Russia, Turkey, Belgium, Rest of Europe, Japan, China, South Korea, India, Australia & New Zealand, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, South Africa, Israel, U.A.E., Saudi Arabia, Egypt, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

Asia-Pacific dominates the automotive tensioner market in terms of market share and revenue growth. This is due to the rise in vehicle generation production in developing countries such as India and China.

Europe is expected to fastest growing region during the forecast period of 2022-2029 due to the enactment of stringent rules about vehicle emission norms and considerable presence of automotive industries in this region

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Automotive Tensioner Market Share Analysis

The automotive tensioner market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to automotive tensioner market.

Some of the major players operating in the automotive tensioner market are:

- Continental AG (Germany)

- ABA Automotive (U.S.)

- ALT America Inc. (U.S.)

- Litens Automotive Group (Canada)

- GMB Corporation (Japan)

- Dayco IP Holdings, LLC (U.S.)

- NTN Corporation (Japan)

- Gates Corporation (U.S.)

- Muhr und Bender KG (Germany)

- KMC Automobile Transmission (Taiwan)

- Pricol Limited (India)

- Zhejiang Renchi Auto Parts Co., Ltd. (China)

- Taizhou GEDLBT Machinery Manufacturing Co. Ltd. (China)

- Gambo Industry Co. Ltd. (China)

- Guangzhou Kafu Engeering Machinery Parts Co. Ltd. (China)

- Capitol Stampings Corp. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AUTOMOTIVE TENSIONER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AUTOMOTIVE TENSIONER MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AUTOMOTIVE TENSIONER MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 COUNTRY WISE_ VEHICLE PRODUCTION

5.2 DEMAND FOR COMFORT AND LUXURY

5.3 TECHNOLOGICAL ADVANCEMENTS

5.4 FOCUS ON LIGHT WEIGHTING

5.5 SHIFT TOWARDS AUTONOMOUS VEHICLES

5.6 URBANIZATION AND RIDE-SHARING TRENDS

5.7 REGIONAL GROWTH OPPORTUNITIES

5.8 SUSTAINABILITY INITIATIVES

5.9 ECONOMIC FACTORS

5.9.1 INTEREST RATES

5.9.2 DISPOSABLE INCOMES

5.9.3 INFLATION

5.9.4 GDP

5.9.5 EXCHANGE RATES

5.9.6 UNEMPLOYMENT RATES

5.1 POLITICAL FACTORS

5.11 SOCIAL FACTORS

5.11.1 CHANGING CONSUMER TRENDS

5.11.2 POPULATION GROWTH

5.11.3 DEMOGRAPHIC SHIFTS

5.12 GEOPOLITICAL FACTORS

5.13 EV BIKE DOMINANCE IN THE MARKET (EXISTING PRODUCTS)

FIGURE 1 PERCENTAGE OF COUNTRY WISE SHARE OF EV BIKE FROM TOTAL EV BIKE SALES

EV Bike Model 2023 Sales

NOTE: THE ABOVE DATA WILL BE COVERED FOR ALL THE COUNTRIES WHICH ARE COVERED IN THE REPORT.

5.14 NEW LAUNCHES OF EV BIKE

FIGURE 2 PERCENTAGE OF COUNTRY WISE SHARE OF NEW LAUNCHES EV BIKE FROM TOTAL EV BIKE EXPECTED SALES

EV Bike Model Expected Launch

NOTE: THE ABOVE DATA WILL BE COVERED FOR ALL THE COUNTRIES WHICH ARE COVERED IN THE REPORT. THE FORECASTED SALES WILL BE PROVIDED FOR THE CONSECUTIVE YEAR OF THE EXPECTED LAUNCH.

5.15 EV BIKE R&D MARKET

5.16 TECHNOLOGICAL TRENDS

FIGURE 3 TECHNOLOGICAL DEVELOPMENT

EV Bike Model Hybrid System

5.17 SUPPLY CHAIN ANALYSIS

5.18 TRADE ANALYSIS: IMPORT & EXPORT SCENARIO

5.19 CASE STUDY ANALYSIS

5.2 COMPANY COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

5.21 PRICING ANALYSIS

5.22 CONSUMER BUYING BEHAVIOUR

FIGURE 4 CONSUMER BUYING BEHAVIOUR

Parameters Model 1

Fuel Efficiency

Interior Design

Exterior Design

Safety

Price

Brand Image

High Quality

Driving Comfort

Customer Service

Sound System

NOTE: THE ABOVE DATA WILL BE COVERED FOR ALL THE COUNTRIES WHICH ARE COVERED IN THE REPORT. ALSO, THE PARAMETERS CAN CHANGE ONCE WE PROCEED WITH THE RESEARCH.

5.23 CONSUMER PURCHASE DECISION PROCESS

5.24 KEY STARTEGIC INITIATIVES

6 GLOBAL AUTOMOTIVE TENSIONER MARKET, BY TYPE

6.1 OVERVIEW

6.2 DAMPING STRUCTURE

6.3 HYDRAULICALLY OPERATED SYSTEM

7 GLOBAL AUTOMOTIVE TENSIONER MARKET, BY TENSIONER TYPE

7.1 OVERVIEW

7.2 FIXED TENSIONER

7.3 AUTOMATIC TENSIONER

8 GLOBAL AUTOMOTIVE TENSIONER MARKET, BY SYSTEM TYPE

8.1 OVERVIEW

8.2 DUAL ARM TENSIONER SYSTEM

8.3 CONVENTIONAL BELT TENSIONER

8.4 AUTOMATIC BELT TENSIONER SYSTEM

9 GLOBAL AUTOMOTIVE TENSIONER MARKET, BY VEHICLE TYPE

9.1 OVERVIEW

9.2 PASSENGER CARS

9.2.1 PASSENGER CARS, BY TYPE

9.2.1.1. SEDAN

9.2.1.2. SUV

9.2.1.3. COUPE

9.2.1.4. SPORTS CAR

9.2.1.5. CONVERTIBLE

9.2.1.6. MUV

9.2.1.7. HATCHBACK

9.2.1.8. OTHERS

9.3 COMMERCIAL VEHICLES

9.3.1 COMMERCIAL VEHICLES, BY TYPE

9.3.1.1. LIGHT COMMERCIAL VEHICLES (LCV)

9.3.1.2. VANS

9.3.1.2.1. PASSENGER VANS

9.3.1.3. CARGO VANS

9.3.1.4. PICKUP TRUCKS

9.3.1.5. MINI BUS

9.3.1.6. COACHES

9.3.1.7. OTHERS

9.3.1.8. HEAVY COMMERCIAL VEHICLES (HCV)

9.3.1.8.1. BUSES

9.3.1.8.2. TRUCKS

9.3.1.8.2.1 TOW TRUCKS

9.3.1.8.2.2 DUMP TRUCKS

9.3.1.8.2.3 OTHERS

9.4 ELECTRIC VEHICLES

9.4.1 BATTERY ELECTRIC VEHICLES (BEVS)

9.4.2 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

9.4.3 HYBRID ELECTRIC VEHICLES (HEVS)

10 GLOBAL AUTOMOTIVE TENSIONER MARKET, BY REGION

GLOBAL AUTOMOTIVE TENSIONER MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

10.2 EUROPE

10.2.1 GERMANY

10.2.2 FRANCE

10.2.3 U.K.

10.2.4 ITALY

10.2.5 SPAIN

10.2.6 RUSSIA

10.2.7 TURKEY

10.2.8 BELGIUM

10.2.9 NETHERLANDS

10.2.10 SWITZERLAND

10.2.11 REST OF EUROPE

10.3 ASIA PACIFIC

10.3.1 JAPAN

10.3.2 CHINA

10.3.3 SOUTH KOREA

10.3.4 INDIA

10.3.5 AUSTRALIA

10.3.6 SINGAPORE

10.3.7 THAILAND

10.3.8 MALAYSIA

10.3.9 INDONESIA

10.3.10 PHILIPPINES

10.3.11 REST OF ASIA PACIFIC

10.4 SOUTH AMERICA

10.4.1 BRAZIL

10.4.2 ARGENTINA

10.4.3 REST OF SOUTH AMERICA

10.5 MIDDLE EAST AND AFRICA

10.5.1 SOUTH AFRICA

10.5.2 EGYPT

10.5.3 SAUDI ARABIA

10.5.4 U.A.E

10.5.5 ISRAEL

10.5.6 REST OF MIDDLE EAST AND AFRICA

11 GLOBAL AUTOMOTIVE TENSIONER MARKET,COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.5 MERGERS & ACQUISITIONS

11.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

11.7 EXPANSIONS

11.8 REGULATORY CHANGES

11.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12 GLOBAL AUTOMOTIVE TENSIONER MARKET, SWOT AND DBMR ANALYSIS

13 GLOBAL AUTOMOTIVE TENSIONER MARKET, COMPANY PROFILE

13.1 NTN CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 DAYCO INCORPORATED

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 NTN CORPORATION

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 GATES CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 GMB CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 LITENS AUTOMOTIVE GROUP

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 CR PRODUCT LIMITED

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 KMC AUTOMOTIVE TRANSMISSION CO., LTD

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 MUHR AND BENDER KG

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 ZHEJIANG RENCHI AUTO PARTS CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 ALT AMERICA INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 AISIN SEIKI CO. LTD.

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 INA SCHAEFFLER

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 NSK

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 BORGWARNER

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 GATES

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 FEDERALMOGUL

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 NTN

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 CONTINENTAL

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 MOOG

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

13.21 AISIN SEIKI

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 PRODUCT PORTFOLIO

13.21.4 RECENT DEVELOPMENTS

13.22 DUNLOP

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 PRODUCT PORTFOLIO

13.22.4 RECENT DEVELOPMENTS

13.23 DAYCO

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 PRODUCT PORTFOLIO

13.23.4 RECENT DEVELOPMENTS

13.24 TRELLEBORG

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 PRODUCT PORTFOLIO

13.24.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

17 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.