Global Baby Pacifier Market

Market Size in USD Million

CAGR :

%

USD

394.29 Million

USD

692.81 Million

2025

2033

USD

394.29 Million

USD

692.81 Million

2025

2033

| 2026 –2033 | |

| USD 394.29 Million | |

| USD 692.81 Million | |

|

|

|

|

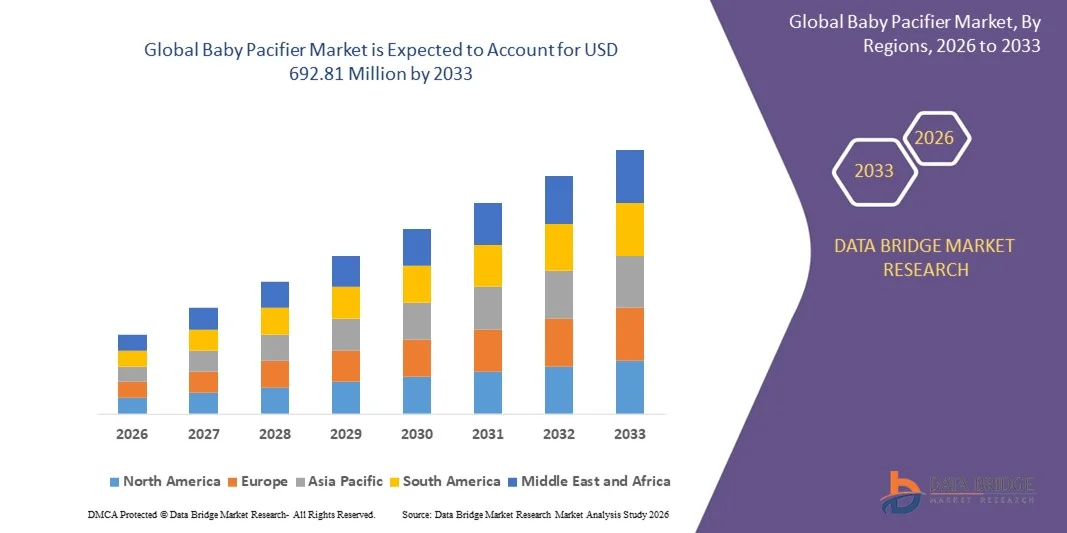

What is the Global Baby Pacifier Market Size and Growth Rate?

- The global baby pacifier market size was valued at USD 394.29 million in 2025 and is expected to reach USD 692.81 million by 2033, at a CAGR of7.3% during the forecast period

- The increase in the number of birth rates across the globe acts as one of the major factors driving the growth of the baby pacifier market

- The rise in the demand for the product helps keep babies quiet and provides comfort, and the surge in the women workforce seeking ways to take better care of their babies accelerates the market growth

What are the Major Takeaways of Baby Pacifier Market?

- The increase in demand for rubber and latex pacifiers because they are softer, natural, and flexible, and continuous evolution in their product offering further influences the market

- In addition, change in consumer preference, change in consumer preference, expansion of e-commerce and rise in disposable income positively affect the baby pacifier market. Furthermore, the usage of technology in pacifiers extends profitable opportunities to the market players

- North America dominated the Baby Pacifier market with a 42.32% revenue share in 2025, driven by high awareness of infant oral health, strong preference for premium and branded baby care products, and widespread adoption of BPA-free, orthodontic pacifiers across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 6.9% from 2026 to 2033, driven by high birth rates, rapid urbanization, increasing disposable incomes, and growing awareness of infant hygiene across China, India, Southeast Asia, and other emerging economies

- The Single-Piece Baby Pacifier segment dominated the market with an estimated 58.6% share in 2025, owing to its higher safety profile, seamless construction, and lower risk of choking or component detachment

Report Scope and Baby Pacifier Market Segmentation

|

Attributes |

Baby Pacifier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Baby Pacifier Market?

Increasing Shift Toward Orthodontic, BPA-Free, and Smart Baby Pacifiers

- The baby pacifier market is witnessing rising adoption of orthodontically designed, BPA-free, and silicone-based pacifiers that support healthy oral development and infant safety

- Manufacturers are introducing ergonomic shapes, lightweight designs, and age-specific pacifiers to reduce dental misalignment and improve soothing effectiveness

- Growing demand for premium, eco-friendly, and skin-safe materials is driving innovation in natural rubber, medical-grade silicone, and sustainable pacifier products

- For instance, companies such as Philips Avent, MAM Baby, Mayborn Group (Tommee Tippee), Natursutten, and The White Company are expanding portfolios with orthodontic and natural-material pacifiers

- Increasing awareness among parents regarding infant oral health, safety certifications, and comfort is accelerating demand for advanced pacifier designs

- As parenting preferences shift toward safe, functional, and premium baby care products, baby pacifiers will remain a core category within infant soothing solutions

What are the Key Drivers of Baby Pacifier Market?

- Rising demand for safe, non-toxic, and pediatrician-recommended baby products to ensure infant health and comfort

- For instance, in 2024–2025, leading brands launched BPA-free, latex-free, and orthodontic pacifiers to comply with stringent safety standards

- Growing birth rates in developing economies and increasing urbanization and nuclear family structures are boosting pacifier adoption across Asia-Pacific and Latin America

- Advancements in material science, design ergonomics, and hygiene-focused features such as sterilizable and self-cleaning pacifiers are strengthening product appeal

- Rising disposable income and preference for premium and branded baby care products are increasing market value

- Supported by expanding e-commerce penetration and strong retail distribution, the Baby Pacifier market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Baby Pacifier Market?

- Concerns over prolonged pacifier use and potential impact on dental development can limit adoption among certain parent groups

- For instance, during 2024–2025, increased awareness campaigns on pacifier weaning and oral health influenced cautious purchasing behavior

- Presence of stringent regulatory standards and product recalls raises compliance and manufacturing costs for vendors

- Growing preference for alternative soothing methods such as thumb sucking or parental-led calming techniques reduces reliance on pacifiers

- Price sensitivity in emerging markets restricts penetration of premium and smart pacifier products

- To overcome these challenges, manufacturers are focusing on educational marketing, orthodontic innovation, safety certifications, and affordable product variants to expand global adoption of baby pacifiers

How is the Baby Pacifier Market Segmented?

The market is segmented on the basis of type, size, and distribution channel.

- By Type

On the basis of type, the baby pacifier market is segmented into Single-Piece Baby Pacifiers and Multiple-Piece Baby Pacifiers. The Single-Piece Baby Pacifier segment dominated the market with an estimated 58.6% share in 2025, owing to its higher safety profile, seamless construction, and lower risk of choking or component detachment. Single-piece pacifiers are widely recommended by pediatricians and regulatory bodies, making them highly preferred among parents, hospitals, and neonatal care units. Their ease of cleaning, durability, and compliance with stringent safety standards further support dominance.

The Multiple-Piece Baby Pacifier segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for customizable designs, replaceable nipples, aesthetic appeal, and functional features such as orthodontic shapes and ventilated shields. Increasing premiumization and design innovation are accelerating adoption, particularly in developed markets.

- By Size

Based on size, the baby pacifier market is segmented into small, medium, and large categories, catering to different infant age groups. The Medium-size segment dominated the market with a 44.2% share in 2025, as it aligns with the most commonly used age group of infants aged 6–18 months. Medium-sized pacifiers offer balanced comfort, proper oral fit, and broad usability, making them the preferred choice for repeat purchases. Strong availability across retail channels and extensive product variety further reinforce this segment’s dominance.

The Small-size segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing focus on newborn and neonatal care, rising hospital births, and growing awareness of age-appropriate pacifier usage. Expanding demand for pacifiers designed specifically for infants below six months is supporting accelerated growth.

- By Distribution Channel

On the basis of distribution channel, the baby pacifier market is segmented into Offline Stores and Online Stores. The Offline Stores segment accounted for the largest share of 61.3% in 2025, supported by strong consumer preference for physical verification of baby products, immediate availability, and trust in pharmacies, supermarkets, and specialty baby stores. Personalized assistance, brand visibility, and bundled baby-care purchases further strengthen offline dominance.

The Online Stores segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rapid expansion of e-commerce platforms, rising digital adoption among parents, and availability of a wider product range with reviews and competitive pricing. Convenience, subscription models, and direct-to-consumer strategies are accelerating online market penetration.

Which Region Holds the Largest Share of the Baby Pacifier Market?

- North America dominated the baby pacifier market with a 42.32% revenue share in 2025, driven by high awareness of infant oral health, strong preference for premium and branded baby care products, and widespread adoption of BPA-free, orthodontic pacifiers across the U.S. and Canada. Well-established healthcare infrastructure, higher disposable incomes, and strong influence of pediatric recommendations continue to support market growth

- Leading companies in North America are introducing innovative pacifier designs, including orthodontic shapes, natural materials, and smart pacifiers with temperature and hygiene features, strengthening regional product differentiation

- High consumer trust in safety certifications, robust retail networks, and strong e-commerce penetration further reinforce North America’s market leadership

U.S. Baby Pacifier Market Insight

The U.S. is the largest contributor in North America, supported by high birth rates relative to developed economies, strong demand for premium baby products, and increasing parental focus on infant comfort and safety. Presence of major global brands, strong marketing influence, and rapid adoption of eco-friendly and orthodontic pacifiers drive sustained market growth.

Canada Baby Pacifier Market Insight

Canada contributes steadily, driven by rising demand for natural, silicone-based, and sustainable baby products. Strong healthcare guidance, government safety regulations, and growing preference for premium baby care items support market expansion.

Asia-Pacific Baby Pacifier Market

Asia-Pacific is projected to register the fastest CAGR of 6.9% from 2026 to 2033, driven by high birth rates, rapid urbanization, increasing disposable incomes, and growing awareness of infant hygiene across China, India, Southeast Asia, and other emerging economies. Expanding retail and e-commerce access is accelerating market penetration.

China Baby Pacifier Market Insight

China leads Asia-Pacific due to its large infant population, rising middle-class spending, and growing preference for branded and imported baby products. Increasing focus on child health and safety supports strong demand.

Japan Baby Pacifier Market Insight

Japan shows stable growth, supported by premium product demand, advanced safety standards, and high emphasis on infant well-being and quality baby care products.

India Baby Pacifier Market Insight

India is emerging as a high-growth market, driven by rising birth rates, increasing urban parents, expanding e-commerce platforms, and growing awareness of baby hygiene and comfort products.

South Korea Baby Pacifier Market Insight

South Korea contributes significantly due to strong demand for premium, design-focused baby products, high brand consciousness, and increasing spending on infant care, supporting steady market growth.

Which are the Top Companies in Baby Pacifier Market?

The baby pacifier industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- Baby Shusher (U.S.)

- Doddle & Co (U.S.)

- MAM Babyartikel GmbH (Austria)

- Mayborn Group Limited (U.K.)

- Natursutten (Denmark)

- Newell Brands (U.S.)

- The Natural Baby Company (U.S.)

- The White Company (U.K.)

- Trebco Specialty Products Inc (U.S.)

What are the Recent Developments in Global Baby Pacifier Market?

- In March 2024, Philips Avent introduced a new brand positioning campaign in North America titled Share the Care, designed to encourage families and communities to provide stronger support to mothers, aligning with the Daylight Saving Time transition as a symbolic reminder of shared responsibility, reinforcing the brand’s commitment to holistic parental support and awareness

- In February 2024, WubbaNub launched the Baby Bullseye range, an exclusive pacifier plush featuring Target’s Bull Terrier mascot, combining a pacifier with a plush toy made from 100% silicone and free from BPA, PVC, and phthalates, while remaining machine washable, strengthening product differentiation through safety, design, and brand collaboration

- In September 2022, Neste, Borealis, and MAM collaborated to introduce the MAM Original Pure pacifier made using renewably sourced polypropylene from Borealis’ Bornewables portfolio and Neste RE feedstock derived from waste and residues, advancing sustainability and circular economy practices in baby care products

- In March 2022, NUK launched its first sustainable baby care collection, NUK For Nature, featuring orthodontic pacifiers and feeding accessories designed to meet rising demand for eco-friendly products, supporting the shift toward environmentally responsible infant care solutions

- In September 2020, The Moms Co, an India-based mother and baby care brand, raised USD 8 million in Series B funding from domestic and global investors to expand its consumer reach to five million users, accelerating growth and strengthening its position in the direct-to-consumer baby care market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.