Global Banana Essence Market

Market Size in USD Billion

CAGR :

%

USD

1.15 Billion

USD

1.91 Billion

2025

2033

USD

1.15 Billion

USD

1.91 Billion

2025

2033

| 2026 –2033 | |

| USD 1.15 Billion | |

| USD 1.91 Billion | |

|

|

|

|

Banana Essence Market Size

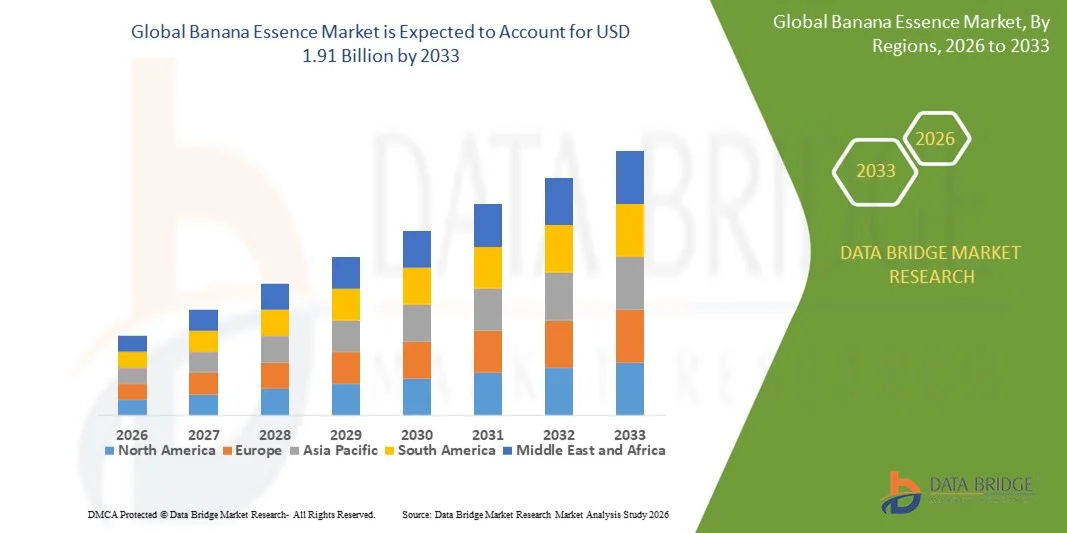

- The global banana essence market size was valued at USD 1.15 billion in 2025 and is expected to reach USD 1.91 billion by 2033, at a CAGR of 6.6% during the forecast period

- The market growth is largely fueled by the rising demand for flavored food and beverage products, bakery items, and confectionery, driving manufacturers to adopt banana essence for authentic taste and aroma

- Furthermore, increasing consumer preference for natural, clean-label, and premium ingredients is establishing banana essence as a preferred flavoring solution across beverages, desserts, and processed foods. These converging factors are accelerating the adoption of banana essence, thereby significantly boosting the industry’s growth

Banana Essence Market Analysis

- Banana essence is a concentrated flavoring ingredient derived from natural or synthetic sources, used to impart the characteristic taste and aroma of bananas in food, beverages, confectionery, bakery, and cosmetic products. It is available in liquid and powder forms, catering to industrial and retail applications

- The escalating demand for banana essence is primarily fueled by the growth of the global food and beverage industry, increasing consumer inclination toward flavored and indulgent products, and the rising preference for natural and clean-label ingredients in both developed and emerging markets

- North America dominated the banana essence market with a share of around 40% in 2025, due to rising demand in beverages, bakery, and confectionery industries, as well as increasing consumer preference for natural flavors

- Asia-Pacific is expected to be the fastest growing region in the banana essence market during the forecast period due to increasing urbanization, rising disposable incomes, and rapid expansion of the food and beverage industry in countries such as China, Japan, and India

- Liquid segment dominated the market with a market share of 62.5% in 2025, due to its ease of use in beverages, confectionery, and bakery products. Manufacturers often prefer liquid banana essence for its uniform flavor distribution and faster solubility in various formulations. The segment also benefits from widespread adoption in industrial-scale production where consistency and efficiency are crucial. The convenience of incorporating liquid essence into automated mixing processes further supports its dominance

Report Scope and Banana Essence Market Segmentation

|

Attributes |

Banana Essence Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Banana Essence Market Trends

Rising Demand for Natural and Clean-Label Flavors

- A prominent trend in the banana essence market is the increasing preference for natural and clean-label flavoring agents across beverages, bakery, and confectionery products, driven by consumer demand for transparency and healthier alternatives. This trend is encouraging manufacturers to reformulate products and replace synthetic flavors with natural banana extracts that align with clean-label standards

- For instance, Firmenich and Givaudan supply high-quality natural banana flavor compounds to leading food and beverage brands, supporting clean-label initiatives and enhancing product appeal. Such offerings are enabling companies to meet regulatory requirements while satisfying evolving taste preferences

- The market is witnessing growing integration of banana essence in dairy-based products, smoothies, and flavored yogurts, as consumers seek fruit-forward experiences. This is positioning banana essence as a versatile flavoring ingredient capable of enhancing sensory appeal across multiple categories

- In the confectionery sector, banana essence is increasingly used in chocolates, candies, and baked treats to provide authentic tropical notes, complementing other natural flavors. This adoption is fostering product innovation and expanding the functional applications of banana essence

- The rising influence of health-conscious consumers is encouraging the replacement of synthetic fruit flavors with natural banana essence, enhancing perceived product value and supporting brand differentiation. This consumer-driven focus is shaping formulation strategies and flavor development pipelines

- The trend toward organic and sustainable sourcing of banana flavor compounds is strengthening the market’s focus on environmentally responsible practices and traceability in supply chains. This is elevating the importance of ethically produced banana essence in meeting both regulatory and consumer expectations

Banana Essence Market Dynamics

Driver

Growing Adoption in Beverages, Bakery, and Confectionery Products

- The increasing use of banana essence across beverages, baked goods, and confectionery products is fueling market growth, driven by consumer preference for fruit-flavored options and novel taste experiences. Banana essence enhances product aroma, taste, and overall sensory appeal, making it an essential ingredient in flavor formulation

- For instance, Kerry Group supplies natural banana flavorings to major beverage and snack companies, enabling brands to create distinctive taste profiles that resonate with consumers. Such partnerships support innovation while meeting rising demand for fruit-flavored products

- Rising demand for tropical-flavored beverages, smoothies, and desserts is positioning banana essence as a key component in product differentiation strategies. Its versatility allows integration into both traditional and emerging culinary offerings, expanding application opportunities

- The bakery sector is leveraging banana essence in muffins, cakes, and pastries to deliver authentic fruity aromas, enhancing consumer experience and repeat purchase likelihood. This growing adoption underscores the ingredient’s role in product enhancement and flavor standardization

- Manufacturers are increasingly incorporating banana essence in confectionery items such as candies, chocolates, and frozen desserts to meet consumer expectations for natural fruit flavoring. This widespread utilization is driving consistent market demand and innovation

Restraint/Challenge

Fluctuating Raw Material Prices and Supply Constraints

- The banana essence market faces challenges due to the volatility of raw material prices and constraints in sourcing high-quality banana extracts, which can disrupt production schedules and impact profit margins. Such fluctuations are influenced by climatic conditions, crop yields, and global supply chain dynamics

- For instance, companies such as Mane and Symrise encounter periodic raw material shortages that affect production planning and pricing strategies. These supply uncertainties require manufacturers to adopt risk management practices and diversify sourcing

- The reliance on sustainable and traceable banana sources adds complexity to procurement and may increase costs for flavor manufacturers. Ensuring consistent quality and compliance with food safety standards further intensifies these operational challenges

- Transportation disruptions and logistical issues in banana-producing regions can lead to delays in essence delivery, impacting timely product launches and supply commitments

- The market continues to navigate the balance between maintaining product affordability and ensuring consistent availability of high-quality banana essence. These challenges emphasize the need for strategic sourcing, supplier partnerships, and inventory management to sustain market growth

Banana Essence Market Scope

The market is segmented on the basis of form, nature, end-use, and distribution channel.

- By Form

On the basis of form, the banana essence market is segmented into liquid and powder. The liquid segment dominated the largest market revenue share of 62.5% in 2025, driven by its ease of use in beverages, confectionery, and bakery products. Manufacturers often prefer liquid banana essence for its uniform flavor distribution and faster solubility in various formulations. The segment also benefits from widespread adoption in industrial-scale production where consistency and efficiency are crucial. The convenience of incorporating liquid essence into automated mixing processes further supports its dominance. Moreover, liquid banana essence is compatible with multiple preservation and packaging methods, enhancing its shelf-life and appeal to large-scale producers.

The powder segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand in ready-to-mix health products, bakery desserts, and confectionery. Powdered essence offers longer shelf-life, easier transport, and flexibility in dosage, making it ideal for both small-scale artisanal and large-scale industrial applications. The growing trend of on-the-go beverages and powdered mixes is boosting its adoption across emerging markets. Its convenience for blending with dry ingredients and minimal storage requirements further drives market growth.

- By Nature

On the basis of nature, the banana essence market is segmented into natural and synthetic. The natural segment dominated the largest market revenue share in 2025, supported by increasing consumer preference for clean-label and organic products. Health-conscious consumers and manufacturers of premium food and beverage products often prioritize natural essence for authentic flavor and safety assurance. The segment also benefits from regulatory support and certifications for natural ingredients, which strengthen consumer trust and brand loyalty. In addition, natural banana essence is widely used in high-end bakery, confectionery, and cosmetic formulations, where product authenticity and aroma intensity are critical. The market growth is reinforced by the expanding organic and natural product segments globally.

The synthetic segment is expected to witness the fastest CAGR from 2026 to 2033, driven by cost-effectiveness and consistent flavor quality. Synthetic banana essence provides manufacturers with a reliable, standardized alternative to natural extracts, especially for mass-produced beverages, confectionery, and ice cream. Its ease of availability and scalability makes it suitable for industrial applications where uniform taste is essential. Companies such as Firmenich and Givaudan actively supply synthetic banana flavoring to meet growing industrial demand. The segment is further supported by ongoing innovation in chemical flavor synthesis, enhancing taste authenticity and stability.

- By End-Use

On the basis of end-use, the banana essence market is segmented into health products, pharmaceuticals, beverages, ice cream, fruit jams and jellies, confectionery, bakery desserts, and cosmetics. The beverages segment dominated the largest market revenue share in 2025, driven by rising consumption of flavored drinks, smoothies, and energy beverages. Manufacturers often prefer banana essence for its rich aroma, ease of blending, and ability to enhance sensory appeal without altering nutritional composition. The segment also benefits from growing urbanization and changing consumer lifestyles, which encourage flavored ready-to-drink options. Its versatility in both alcoholic and non-alcoholic beverages contributes to sustained demand. In addition, beverage companies focus on product differentiation through flavor innovation, which strengthens the market for banana essence.

The bakery desserts segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for flavored cakes, pastries, and desserts. Companies such as Nestlé and General Mills are incorporating banana essence in bakery applications to enhance taste and aroma. The segment growth is supported by rising bakery outlets, café culture, and home baking trends in emerging markets. Banana essence provides consistent flavor and complements other natural ingredients, improving product appeal. Its ease of mixing in powdered or liquid form allows manufacturers flexibility in recipe development, further driving adoption.

- By Distribution Channel

On the basis of distribution channel, the banana essence market is segmented into business to business (B2B) and business to consumer (B2C). The B2B segment dominated the largest market revenue share in 2025, driven by large-scale adoption in food and beverage manufacturing, bakery, and confectionery industries. Manufacturers and wholesalers often prefer bulk supplies through B2B channels for cost efficiency, consistent quality, and reliable delivery. The segment also benefits from strategic partnerships between essence producers and industrial clients, ensuring long-term contracts and steady demand. Furthermore, B2B transactions allow companies to tailor formulations and packaging according to client requirements, strengthening business relationships and reducing procurement complexities. In addition, the expansion of food processing units in emerging economies continues to support the dominance of B2B distribution.

The B2C segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing consumer awareness and home-based baking trends. E-commerce platforms and retail stores are making banana essence easily accessible to individual consumers for beverages, desserts, and DIY confectionery. Companies such as McCormick and LorAnn are actively promoting consumer packs for home use, enhancing convenience and brand visibility. Rising interest in flavored homemade products, social media-driven cooking trends, and giftable food items further accelerate adoption in the B2C segment. Its growth is also supported by innovations in small-sized, easy-to-use packaging that caters specifically to home users.

Banana Essence Market Regional Analysis

- North America dominated the banana essence market with the largest revenue share of around 40% in 2025, driven by rising demand in beverages, bakery, and confectionery industries, as well as increasing consumer preference for natural flavors

- Consumers in the region highly value authentic taste, consistency, and clean-label ingredients, which encourages manufacturers to incorporate banana essence in a variety of food and beverage products

- This widespread adoption is further supported by high disposable incomes, strong food processing infrastructure, and the growing popularity of flavored health products and desserts, establishing banana essence as a favored ingredient across industrial and retail applications

U.S. Banana Essence Market Insight

The U.S. banana essence market captured the largest revenue share in 2025 within North America, fueled by the expanding beverage industry and the rise of flavored bakery and confectionery products. Consumers increasingly prefer natural and clean-label flavoring solutions, boosting demand for high-quality banana essence. The growing trend of protein shakes, smoothies, and ready-to-drink beverages also supports market growth. Moreover, manufacturers are leveraging flavor innovation to differentiate products, while e-commerce and retail availability make banana essence more accessible to both B2B and B2C buyers.

Europe Banana Essence Market Insight

The Europe banana essence market is projected to expand at a substantial CAGR during the forecast period, driven by high consumer demand for bakery desserts, confectionery, and flavored beverages. Stringent food safety regulations and quality standards encourage the use of authentic and certified banana essence. The increase in urbanization and rising disposable incomes are fostering product adoption across multiple segments, including ice cream, fruit jams, and dairy-based beverages. European consumers are particularly drawn to natural flavors that provide authentic taste experiences, supporting both industrial and artisanal applications.

U.K. Banana Essence Market Insight

The U.K. banana essence market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the rising popularity of flavored bakery desserts, beverages, and confectionery products. Growing consumer awareness of natural ingredients and home-baking trends is encouraging the adoption of banana essence in small-scale and retail applications. In addition, the expansion of e-commerce platforms and robust distribution networks enables manufacturers to reach consumers efficiently. The trend toward innovative flavor profiles and premium desserts is expected to continue driving market growth.

Germany Banana Essence Market Insight

The Germany banana essence market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong food processing industry and emphasis on high-quality, natural flavors. Germany’s well-developed manufacturing and retail infrastructure supports the large-scale adoption of banana essence across bakery, confectionery, and beverage sectors. Consumers show increasing interest in health-oriented and artisanal food products, which boosts demand for authentic banana flavoring. Integration of banana essence in innovative desserts, ice creams, and beverages is also a key factor contributing to market growth.

Asia-Pacific Banana Essence Market Insight

The Asia-Pacific banana essence market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and rapid expansion of the food and beverage industry in countries such as China, Japan, and India. The region's growing inclination towards flavored beverages, bakery products, and confectionery is driving adoption. In addition, APAC’s emergence as a major production hub for flavoring ingredients makes banana essence more affordable and accessible to manufacturers. The rising preference for natural flavors and innovative dessert products is further propelling market growth.

Japan Banana Essence Market Insight

The Japan banana essence market is gaining momentum due to the country’s strong consumer preference for high-quality, natural flavors and rising demand for bakery, confectionery, and beverage products. Japanese consumers increasingly value authentic taste and aroma, which encourages manufacturers to incorporate banana essence in desserts, beverages, and ice creams. The trend of convenience foods and ready-to-drink flavored beverages further supports market growth. Moreover, an aging population is likely to boost demand for flavored health products and easy-to-consume desserts, creating additional opportunities for banana essence manufacturers.

China Banana Essence Market Insight

The China banana essence market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rapid urbanization, and growing food and beverage industry. China stands as one of the largest markets for flavored bakery products, beverages, and confectionery items, with banana essence gaining popularity across industrial and retail segments. The push toward innovative and flavored ready-to-eat products, coupled with domestic production of flavoring agents and competitive pricing, is driving market adoption. Strong e-commerce channels and growing demand for natural flavors further contribute to the market’s growth in China.

Banana Essence Market Share

The banana essence industry is primarily led by well-established companies, including:

- Treatt Plc. (U.K.)

- Shaanxi Fuheng (FH) Biotechnology Co., Ltd. (China)

- Shenzhen Tangzheng Biotechnology Co., Ltd. (China)

- Magical Flavour Co., Ltd. (India)

- Stand Around Creations (U.S.)

- Xi’an Flavour Spring Biotech Co., Ltd. (China)

- S‑Amden & Company (U.S.)

- Marc Flavours (India)

- Asian Flavours & Fragrances (India)

- Flavour Producers (India)

- Penta Manufacturing (U.S.)

- Grünewald International (Germany)

- Northwest Naturals (U.S.)

- P&J Trading Premium Fragrance Oils (U.S.)

- SKINFOOD (South Korea)

- Lotioncrafter LLC (U.S.)

- FruitSmart (U.S.)

- Essence Global Limited (U.K.)

- Döhler (Germany)

- Foodie Flavours Ltd (India)

Latest Developments in Global Banana Essence Market

- In January 2025, Givaudan secured a major supply contract with a leading global beverage company to provide banana-flavored ingredients for its ready-to-drink product lines. This development strengthened Givaudan’s presence in the high-demand beverage segment, enabling the company to capture a larger share of the banana essence market. The deal highlights the increasing reliance of global beverage manufacturers on high-quality, consistent flavoring solutions to enhance product appeal and maintain brand differentiation. It also drives overall market growth by signaling strong industrial demand for banana essence in large-scale production

- In 2025, Robertet completed the acquisition of Sambavanam Natural Products to broaden its capabilities in banana extract and tropical fruit flavor production. This acquisition enhanced Robertet’s portfolio of natural flavor offerings and reinforced its position as a key player in the banana essence market. By combining resources and expertise, Robertet can meet the increasing demand for high-quality, authentic flavors across bakery, confectionery, and beverage applications. The acquisition also supports market expansion by enabling the company to deliver more innovative and scalable solutions to manufacturers worldwide

- In December 2024, Symrise launched a new banana flavor encapsulation technology designed for dairy, confectionery, and snack applications. This innovation improved flavor stability, enabling products to retain authentic banana taste over longer shelf life. The launch addresses growing consumer demand for clean-label and natural flavoring options, providing manufacturers with reliable solutions for premium and processed products. By enhancing the versatility of banana essence in multiple applications, this development strengthens Symrise’s market position and expands adoption across the food and beverage sector

- In August 2024, McCormick & Company partnered with Flavorchem to co-develop banana flavor profiles specifically for plant-based dairy alternatives. This partnership allows both companies to accelerate product innovation and respond to the rising demand for tropical flavors in plant-based beverages and desserts. By combining expertise in flavor formulation and application, the collaboration enhances product differentiation for manufacturers while supporting the growth of the banana essence market in the fast-expanding plant-based segment. It also promotes the use of authentic banana flavors in health-conscious and vegan-friendly products

- In March 2025, Givaudan announced a strategic collaboration with Flavorchem Corporation to co-create banana-flavored ingredients for plant-based beverages and snack products. This initiative expands Givaudan’s product pipeline and addresses the growing consumer preference for natural, clean-label ingredients. The collaboration strengthens the company’s competitive positioning in the banana essence market while enabling faster commercialization of innovative flavor solutions. It also highlights the rising importance of banana essence in emerging food categories, supporting sustained market growth and diversification across different applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Banana Essence Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Banana Essence Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Banana Essence Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.