Global Bar And Prep Faucets Market

Market Size in USD Billion

CAGR :

%

USD

5.05 Billion

USD

9.63 Billion

2025

2033

USD

5.05 Billion

USD

9.63 Billion

2025

2033

| 2026 –2033 | |

| USD 5.05 Billion | |

| USD 9.63 Billion | |

|

|

|

|

Bar and Prep Faucets Market Size

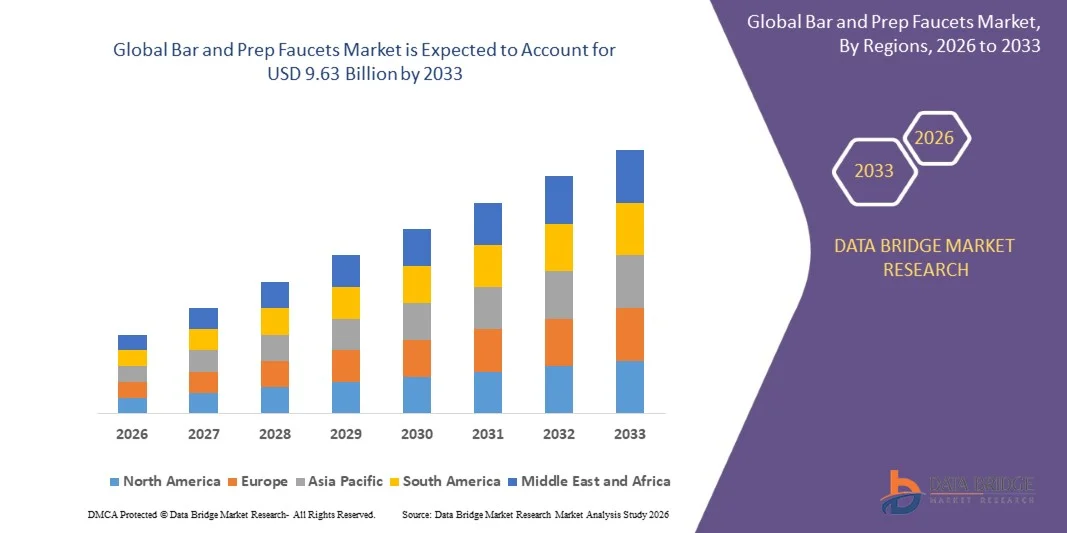

- The global bar and prep faucets market size was valued at USD 5.05 billion in 2025 and is expected to reach USD 9.63 billion by 2033, at a CAGR of 8.41% during the forecast period

- The market growth is largely fueled by increasing investments in residential renovation and kitchen remodeling projects, along with rising adoption of modular kitchens and dedicated food preparation spaces in urban households

- Furthermore, growing demand from the hospitality and foodservice sectors for efficient, durable, and aesthetically appealing fixtures is accelerating the uptake of bar and prep faucets, thereby significantly supporting overall market expansion

Bar and Prep Faucets Market Analysis

- Bar and prep faucets, designed to support specialized kitchen tasks such as food preparation and beverage handling, have become essential fixtures in modern residential kitchens and commercial foodservice environments due to their convenience, space efficiency, and functional design

- The increasing demand for bar and prep faucets is primarily driven by changing consumer lifestyles, preference for premium and task-specific kitchen fixtures, and the steady expansion of restaurants, cafés, and hotels seeking optimized workflow and enhanced hygiene standards

- North America dominated bar and prep faucets market with a share of around 40% in 2025, due to strong demand for premium kitchen fixtures and the rising trend of home renovation and remodeling projects

- Asia-Pacific is expected to be the fastest growing region in the bar and prep faucets market during the forecast period due to rapid urbanization, rising disposable incomes, and expanding residential construction in emerging economies

- Single hole segment dominated the market with a market share of 45.5% in 2025, due to its compact design, ease of installation, and compatibility with modern bar and prep sink layouts. Consumers prefer single hole faucets as they require minimal countertop space and support a clean, minimalist aesthetic in residential kitchens and home bars. Their wide availability across price ranges and styles further strengthens adoption. In addition, single hole bar and prep faucets integrate easily with pull-down or swivel spouts, enhancing functionality for food preparation and beverage handling

Report Scope and Bar and Prep Faucets Market Segmentation

|

Attributes |

Bar and Prep Faucets Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bar and Prep Faucets Market Trends

“Growing Adoption of Specialized and Task-Specific Kitchen Faucets”

- A key trend in the bar and prep faucets market is the rising adoption of specialized faucets designed for specific kitchen tasks, driven by changing kitchen layouts and evolving consumer preferences for functional efficiency. Modern residential kitchens increasingly incorporate dedicated prep sinks and beverage stations, creating demand for compact and purpose-built bar and prep faucets. This trend is strengthening the role of these faucets as essential components in premium and modular kitchen designs

- For instance, Kohler Co. offers dedicated bar and prep faucet collections tailored for secondary sinks, supporting food preparation and beverage handling in residential kitchens. These products enhance workflow efficiency and support multi-tasking in modern kitchen environments

- Hospitality and foodservice establishments are increasingly adopting bar and prep faucets to streamline operations and improve hygiene standards in beverage counters and food prep areas. This adoption supports faster service delivery and better space utilization in commercial kitchens

- Manufacturers are focusing on design versatility, offering bar and prep faucets in multiple finishes and configurations to align with contemporary interior aesthetics. This emphasis on visual appeal is encouraging consumers to invest in specialized fixtures rather than standard kitchen faucets

- The trend is also supported by rising awareness of ergonomic kitchen design, where task-specific fixtures reduce congestion around main sinks. This is reinforcing long-term demand for bar and prep faucets across residential and commercial applications

- The continued shift toward customized and premium kitchen solutions is positioning specialized bar and prep faucets as integral elements of modern kitchen infrastructure, supporting sustained market growth

Bar and Prep Faucets Market Dynamics

Driver

“Rising Residential Renovation and Modular Kitchen Installations”

- The increasing volume of residential renovation projects and adoption of modular kitchens is a major driver for the bar and prep faucets market. Homeowners are investing in upgraded kitchen layouts that emphasize efficiency, aesthetics, and multi-functional work zones, directly increasing demand for dedicated prep fixtures

- For instance, Moen Incorporated has expanded its range of bar and prep faucets to cater to homeowners upgrading kitchens with secondary sinks and beverage stations. These offerings support the growing trend of kitchen customization in renovation projects

- Urban housing developments and premium apartments are increasingly designed with modular kitchens that integrate compact prep sinks. This structural shift is directly contributing to higher installation rates of bar and prep faucets

- The driver is further reinforced by rising disposable incomes and growing interest in premium home improvement products. Consumers are willing to invest in durable and stylish faucets that enhance both functionality and visual appeal

- Overall, the strong momentum in home renovation and modular kitchen adoption is creating a stable demand base for bar and prep faucets and supporting long-term market expansion

Restraint/Challenge

“High Cost of Premium Bar and Prep Faucet Products”

- The bar and prep faucets market faces challenges due to the relatively high cost of premium products, which can limit adoption among price-sensitive consumers. Advanced materials, refined finishes, and precision engineering contribute to higher manufacturing and retail prices

- For instance, premium bar and prep faucets offered by brands such as Hansgrohe are positioned at higher price points due to superior build quality and design standards. While these products appeal to upscale buyers, cost remains a barrier for broader market penetration

- Installation costs associated with secondary sinks and specialized plumbing further increase the overall expense for consumers. This can discourage adoption in budget-conscious residential projects

- Manufacturers also face pressure to balance product quality with affordability, especially in competitive markets where lower-priced alternatives are available. This challenge impacts pricing strategies and profit margins

- The persistence of high product and installation costs continues to act as a restraint, requiring manufacturers to focus on cost optimization and value-based offerings to expand adoption across wider consumer segments

Bar and Prep Faucets Market Scope

The market is segmented on the basis of mount, sales channel, and end-use.

- By Mount

On the basis of mount, the Bar and Prep Faucets market is segmented into single hole, wall-mounted, and others. The single hole segment dominated the market with the largest revenue share of 45.5% in 2025, driven by its compact design, ease of installation, and compatibility with modern bar and prep sink layouts. Consumers prefer single hole faucets as they require minimal countertop space and support a clean, minimalist aesthetic in residential kitchens and home bars. Their wide availability across price ranges and styles further strengthens adoption. In addition, single hole bar and prep faucets integrate easily with pull-down or swivel spouts, enhancing functionality for food preparation and beverage handling.

The wall-mounted segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising adoption in premium residential projects and commercial foodservice environments. Wall-mounted faucets offer better countertop hygiene, easier cleaning, and space optimization, which is highly valued in bars, cafés, and compact prep areas. Growing design preferences for industrial and contemporary interiors, along with increased renovation activities, are supporting faster uptake of wall-mounted bar and prep faucets.

- By Sales Channel

On the basis of sales channel, the Bar and Prep Faucets market is segmented into wholesalers/distributors, supermarkets/hypermarkets, convenience stores, online retailers, specialty stores, and other sales channels. Wholesalers and distributors accounted for the largest market revenue share in 2025, driven by their strong presence in the professional plumbing and commercial installation ecosystem. Contractors, builders, and hospitality buyers rely on this channel for bulk purchasing, consistent supply, and access to established faucet brands. The availability of technical support, warranties, and competitive pricing further reinforces dominance of this segment.

The online retailers segment is expected to register the fastest growth rate during the forecast period, supported by increasing consumer preference for digital purchasing and home renovation platforms. Online channels provide wide product comparisons, customer reviews, and access to premium and customized bar and prep faucet designs. The convenience of home delivery, frequent promotional offers, and growing penetration of e-commerce in home improvement categories are accelerating growth of this segment.

- By End-Use

On the basis of end-use, the Bar and Prep Faucets market is segmented into residential and commercial applications. The residential segment dominated the market in 2025, driven by rising investments in kitchen remodeling, home bars, and compact food preparation spaces. Homeowners increasingly adopt dedicated bar and prep faucets to improve workflow efficiency and enhance kitchen aesthetics. Growing interest in premium fixtures, coupled with rising disposable income and urban housing developments, continues to support strong residential demand.

The commercial segment is projected to witness the fastest growth from 2026 to 2033, fueled by expansion of restaurants, cafés, hotels, and catering services. Commercial establishments require durable, high-performance bar and prep faucets to support frequent usage and hygiene standards. Increasing focus on efficient kitchen layouts, faster service delivery, and regulatory compliance in foodservice operations is accelerating adoption of bar and prep faucets across the commercial sector.

Bar and Prep Faucets Market Regional Analysis

- North America dominated the bar and prep faucets market with the largest revenue share of around 40% in 2025, driven by strong demand for premium kitchen fixtures and the rising trend of home renovation and remodeling projects

- Consumers in the region highly value functionality, durability, and aesthetic appeal in bar and prep faucets, particularly designs that complement modern kitchens and home bar setups

- This widespread adoption is further supported by high disposable incomes, a mature housing market, and strong penetration of organized retail and professional installation services, positioning bar and prep faucets as essential fixtures across residential and commercial spaces

U.S. Bar and Prep Faucets Market Insight

The U.S. bar and prep faucets market captured the largest revenue share within North America in 2025, supported by extensive residential remodeling activity and growing preference for dedicated prep and beverage stations in kitchens. Consumers increasingly prioritize convenience and efficiency, driving demand for faucets with swivel spouts, pull-down features, and premium finishes. The strong presence of leading faucet manufacturers, coupled with widespread availability through wholesalers and home improvement retailers, continues to fuel market expansion across residential and foodservice applications.

Europe Bar and Prep Faucets Market Insight

The Europe bar and prep faucets market is projected to expand at a steady CAGR during the forecast period, primarily driven by increasing urban housing developments and a growing focus on space-efficient kitchen designs. Rising renovation of older housing stock and demand for modern, water-efficient fixtures are supporting adoption across residential and commercial segments. European consumers also emphasize quality, sustainability, and design consistency, encouraging uptake of durable and aesthetically refined bar and prep faucets.

U.K. Bar and Prep Faucets Market Insight

The U.K. bar and prep faucets market is anticipated to grow at a notable CAGR over the forecast period, supported by increasing popularity of open-plan kitchens and compact living spaces. Homeowners and hospitality operators are investing in specialized prep faucets to improve workflow efficiency and visual appeal. Strong retail distribution networks and growing interest in premium kitchen fittings are expected to continue stimulating market growth.

Germany Bar and Prep Faucets Market Insight

The Germany bar and prep faucets market is expected to expand at a considerable CAGR, driven by strong demand for high-quality, precision-engineered kitchen fixtures. German consumers prioritize durability, functionality, and water efficiency, which supports adoption of well-designed bar and prep faucets in both residential and commercial kitchens. The country’s robust construction and renovation activity, combined with emphasis on premium materials and engineering standards, further contributes to market growth.

Asia-Pacific Bar and Prep Faucets Market Insight

The Asia-Pacific bar and prep faucets market is poised to grow at the fastest CAGR from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and expanding residential construction in emerging economies. Increasing adoption of modular kitchens and western-style kitchen layouts is accelerating demand for specialized faucets. The region’s expanding hospitality and foodservice sectors are also contributing significantly to market growth.

Japan Bar and Prep Faucets Market Insight

The Japan bar and prep faucets market is gaining momentum due to compact housing designs and strong emphasis on efficient kitchen layouts. Japanese consumers favor space-saving, ergonomically designed faucets that enhance convenience in limited kitchen areas. Growth is further supported by ongoing residential renovations and demand from cafés and small foodservice establishments requiring reliable and hygienic prep solutions.

China Bar and Prep Faucets Market Insight

The China bar and prep faucets market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urban development, a growing middle-class population, and increasing adoption of modern kitchen infrastructure. Rising investments in residential housing, hotels, and restaurants are boosting demand for functional and cost-effective bar and prep faucets. The presence of strong domestic manufacturers and expanding distribution networks continues to improve product accessibility, supporting sustained market expansion in China.

Bar and Prep Faucets Market Share

The bar and prep faucets industry is primarily led by well-established companies, including:

- Moen Incorporated (U.S.)

- Franke Kitchen Systems, LLC (Switzerland)

- Delta Faucet Company (U.S.)

- Gerber Plumbing Fixtures LLC (U.S.)

- GROHE America, Inc. (Germany)

- Jaquar (India)

- Kohler Co. (U.S.)

- Colston Bath (India)

- PROFLO (U.S.)

- TOTO Ltd. (Japan)

- LIXIL Group Corporation (Japan)

- Fortune Brands Home & Security, Inc. (U.S.)

- Paini (Italy)

- Hansgrohe (Germany)

- Roca Sanitario, S.A. (Spain)

- CERA Sanitaryware Limited (India)

- Villeroy & Boch AG (Germany)

- VitrA (Turkey)

Latest Developments in Global Bar and Prep Faucets Market

- In March 2025, Delta Faucet formed a strategic partnership with a large hospitality group to deploy standardized bar and prep faucet solutions across multiple hotel and foodservice properties. This collaboration supports consistent product adoption in high-volume commercial settings, improving operational efficiency and maintenance uniformity. The partnership is expected to drive steady long-term demand while reinforcing Delta’s leadership in the commercial bar and prep faucets segment

- In February 2025, Delta Faucet Company’s acquisition of Newport Brass significantly enhanced its footprint in the premium bar and prep faucets market by incorporating a well-established luxury brand into its portfolio. This development allows Delta to address rising demand for high-end, customizable faucet designs in upscale residential kitchens, boutique hotels, and premium foodservice environments. The acquisition also strengthens design innovation, material quality, and brand positioning in the luxury fixtures segment

- In November 2024, Moen’s acquisition of BrassLine Components improved vertical integration and supply chain resilience for its faucet manufacturing operations. By securing access to high-quality internal components, Moen can enhance durability, performance consistency, and innovation in its bar and prep faucet offerings. This development strengthens Moen’s competitive position, particularly in premium and performance-focused residential and commercial applications

- In June 2024, Kohler launched the Aura Bar series, expanding its specialized bar and prep faucet portfolio with products designed for modern kitchens and professional foodservice use. The launch addresses increasing consumer demand for dedicated prep and beverage faucets that offer precise water control, refined aesthetics, and long-term reliability. This product expansion supports market growth by encouraging replacement of standard faucets with task-specific solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.