Global Barium Carbonate Market

Market Size in USD Million

CAGR :

%

USD

696.08 Million

USD

1,216.71 Million

2025

2033

USD

696.08 Million

USD

1,216.71 Million

2025

2033

| 2026 –2033 | |

| USD 696.08 Million | |

| USD 1,216.71 Million | |

|

|

|

|

Barium Carbonate Market Size

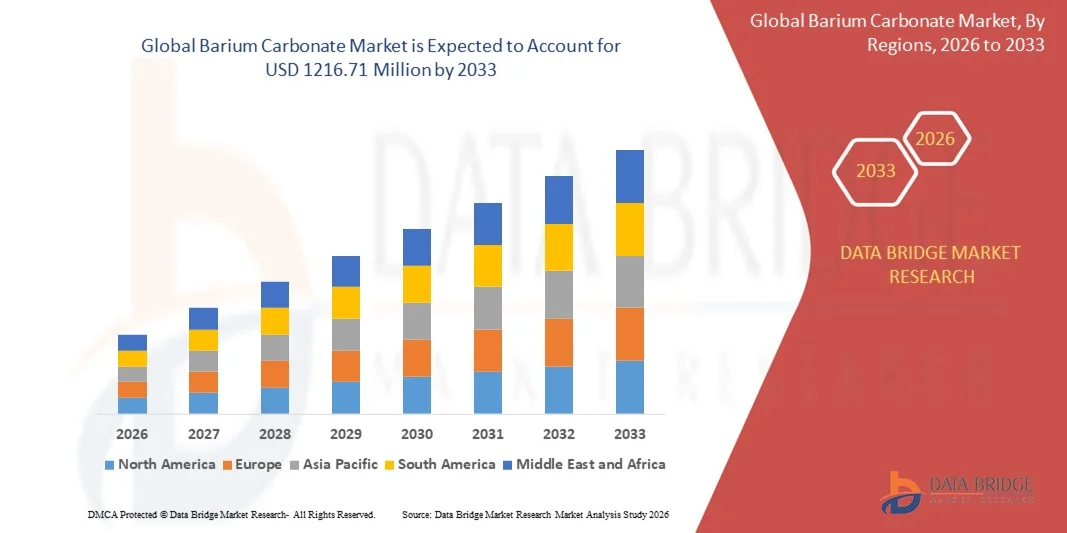

- The global barium carbonate market size was valued at USD 696.08 million in 2025 and is expected to reach USD 1216.71 million by 2033, at a CAGR of 7.23% during the forecast period

- The market growth is largely fueled by rising demand from the ceramics, bricks, and tiles industry, where barium carbonate is widely used to prevent efflorescence and improve product durability. Rapid urbanization, infrastructure expansion, and increased residential and commercial construction activities are driving consistent consumption across emerging and developed economies

- Furthermore, growing applications in specialty glass, chemical compounds, and electro-ceramic materials are strengthening market momentum. These converging factors, supported by expanding industrial manufacturing and material performance requirements, are accelerating barium carbonate adoption and contributing significantly to overall market growth

Barium Carbonate Market Analysis

- Barium carbonate, used as a key raw material in ceramics, glass, and chemical processing, plays a critical role in enhancing material quality, structural stability, and surface finish across construction and industrial applications. Its effectiveness in controlling soluble salts and improving end-product performance makes it essential in large-scale manufacturing environments

- The increasing demand for barium carbonate is primarily driven by growth in construction materials production, expanding ceramics manufacturing capacity, and rising use in advanced materials such as electro-ceramics and specialty glass, reinforcing its importance within the global industrial chemicals landscape

- Asia-Pacific dominated the barium carbonate market with a share of 45.06% in 2025, due to strong demand from bricks and tiles manufacturing, expanding ceramics production, and rapid growth in construction activities

- North America is expected to be the fastest growing region in the barium carbonate market during the forecast period due to demand from construction materials, specialty glass, and electro-ceramic applications

- Granular segment dominated the market with a market share of 42.36% in 2025, due to its widespread use in bricks and tiles manufacturing where controlled reactivity and uniform mixing are critical. Granular barium carbonate is preferred for its ease of handling, reduced dust generation, and suitability for large-scale production processes. Its effectiveness in preventing efflorescence and improving the durability and surface quality of construction materials further supports strong demand from the building and ceramics industry

Report Scope and Barium Carbonate Market Segmentation

|

Attributes |

Barium Carbonate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Barium Carbonate Market Trends

Increasing Use of Barium Carbonate in Advanced Ceramics

- A major trend in the barium carbonate market is the increasing use of the material in advanced ceramics, driven by the need for improved electrical, thermal, and structural properties in high-performance applications. Manufacturers are increasingly adopting barium carbonate as a precursor material to enhance consistency, purity, and functional reliability in ceramic formulations used across industrial and electronic applications

- For instance, Solvay has supplied technical-grade barium compounds that are widely utilized in advanced ceramic and electro-ceramic material production, supporting applications that require controlled chemical behavior and stable performance. Such usage highlights the role of barium carbonate in enabling precision manufacturing within high-value ceramic segments

- The growing adoption of electro-ceramic materials in electronics and energy-related applications is further reinforcing this trend, as barium carbonate is used in the production of dielectric and functional ceramic components. This is expanding its relevance beyond traditional construction-related uses into technologically advanced material systems

- Advanced ceramics manufacturers are increasingly focusing on material uniformity and performance optimization, where barium carbonate helps improve sintering behavior and end-product quality. This trend is strengthening demand from specialized ceramic producers that require consistent raw material inputs

- Rising investments in high-performance ceramics for electronics, automotive components, and industrial equipment are accelerating the integration of barium carbonate into advanced material supply chains. This shift is positioning the market toward higher-value applications with stricter quality requirements

- The continued evolution of advanced ceramics manufacturing is reinforcing barium carbonate’s role as a critical input material, supporting long-term market growth and diversification across emerging high-tech end-use sectors

Barium Carbonate Market Dynamics

Driver

Growing Demand from Bricks, Tiles, and Construction Materials Manufacturing

- The growing demand from bricks, tiles, and construction materials manufacturing is a primary driver of the barium carbonate market, as the compound is widely used to control efflorescence and improve surface quality in clay-based products. Rapid urbanization and expanding infrastructure development are sustaining high consumption volumes across residential and commercial construction projects

- For instance, Indian ceramic tile manufacturers such as Kajaria Ceramics and Somany Ceramics extensively utilize barium carbonate in tile production to enhance durability and prevent surface defects. This consistent industrial usage underscores the material’s importance within large-scale construction material manufacturing

- The expansion of housing projects and commercial buildings across emerging economies is increasing demand for quality-controlled bricks and tiles, directly supporting higher barium carbonate consumption. Construction-focused government initiatives are further reinforcing this demand trend

- Large-scale production environments favor barium carbonate due to its effectiveness, ease of integration, and reliable performance during firing processes. This makes it a preferred additive for manufacturers focused on maintaining uniform quality across high-volume outputs

- The sustained growth of the global construction sector continues to strengthen this driver, positioning bricks and tiles manufacturing as a stable and long-term demand base for the barium carbonate market

Restraint/Challenge

Volatility in Raw Material Prices and Energy Costs

- The barium carbonate market faces significant challenges from volatility in raw material prices and rising energy costs, which directly impact production economics and profit margins. Barium carbonate manufacturing is energy-intensive, making producers vulnerable to fluctuations in electricity and fuel prices

- For instance, Vishnu Chemicals has highlighted the sensitivity of barium carbonate production costs to power pricing, prompting the company to secure long-term renewable energy contracts to manage cost volatility. Such measures reflect the broader industry challenge of maintaining cost stability under fluctuating energy conditions

- Variations in raw material availability and pricing further complicate production planning, particularly for manufacturers operating at large scale. These fluctuations can affect supply consistency and pricing strategies across regional markets

- Energy cost pressures also influence competitiveness between domestic and international producers, especially in regions with differing energy regulations and infrastructure costs. This can create pricing imbalances and margin pressures for manufacturers

- The combined impact of raw material and energy cost volatility continues to constrain market stability, pushing producers to focus on efficiency improvements, alternative energy sourcing, and long-term cost management strategies to sustain operations and competitiveness

Barium Carbonate Market Scope

The market is segmented on the basis of product, form, and application.

- By Product

On the basis of product, the Barium Carbonate market is segmented into crystal type and powder type. The powder type segment dominated the market with the largest revenue share in 2025, driven by its wide usage across ceramics, specialty glass, and chemical processing industries. Powder barium carbonate offers better dispersion, higher reactivity, and easier blending with other raw materials, which makes it suitable for large-scale industrial applications. Manufacturers prefer powder form due to consistent quality, simplified handling, and compatibility with automated production systems. Its strong demand from bricks, tiles, and glaze applications further supports segment dominance. Stable supply chains and cost efficiency also reinforce its leading position in the overall market.

The crystal type segment is anticipated to witness the fastest growth from 2026 to 2033, supported by rising demand from high-purity chemical and electro-ceramic applications. Crystal barium carbonate is valued for controlled particle structure and higher purity levels, which are essential for advanced material formulations. Increasing use in specialty chemicals and electronic-grade ceramics is accelerating adoption. Growth in research-driven applications and precision manufacturing environments further enhances its expansion outlook.

- By Form

On the basis of form, the Barium Carbonate market is segmented into granular, powder, ultra-fine, and others. The granular form segment accounted for the largest market revenue share 0f 42.36% in 2025, driven by its widespread use in bricks and tiles manufacturing where controlled reactivity and uniform mixing are critical. Granular barium carbonate is preferred for its ease of handling, reduced dust generation, and suitability for large-scale production processes. Its effectiveness in preventing efflorescence and improving the durability and surface quality of construction materials further supports strong demand from the building and ceramics industry.

The ultra-fine segment is expected to register the fastest growth rate during the forecast period, driven by increasing use in electro-ceramic materials and high-performance glass applications. Ultra-fine barium carbonate enables enhanced material uniformity, improved sintering behavior, and superior end-product performance. Rising investments in advanced ceramics and electronic components are supporting this trend. Demand from applications requiring precise particle size control is accelerating market penetration.

- By Application

On the basis of application, the Barium Carbonate market is segmented into specialty glass, chemical compounds, bricks and tiles, glazes, electro-ceramic materials, and frits and enamels. The bricks and tiles segment dominated the market in 2025, supported by extensive use of barium carbonate as an efflorescence control agent in clay-based products. Its ability to react with soluble salts improves durability and surface quality of construction materials. Rapid urbanization and infrastructure development across emerging economies continue to sustain high consumption. Large-scale production volumes and consistent demand from the construction sector reinforce segment leadership.

The electro-ceramic materials segment is projected to witness the fastest growth from 2026 to 2033, driven by expanding applications in electronic components and advanced functional ceramics. Barium carbonate serves as a key precursor in dielectric and piezoelectric material manufacturing. Growth in consumer electronics, electric vehicles, and energy storage technologies is increasing demand. Technological advancements and rising focus on high-performance ceramic materials are further accelerating segment growth.

Barium Carbonate Market Regional Analysis

- Asia-Pacific dominated the barium carbonate market with the largest revenue share of 45.06% in 2025, driven by strong demand from bricks and tiles manufacturing, expanding ceramics production, and rapid growth in construction activities

- The region’s cost-efficient manufacturing base, high availability of raw materials, and large-scale production capacity are supporting increased consumption across industrial and construction applications

- Rapid urbanization, infrastructure development, and supportive government initiatives across developing economies are accelerating the use of barium carbonate in ceramics, glass, and chemical processing

China Barium Carbonate Market Insight

China held the largest share in the Asia-Pacific barium carbonate market in 2025, supported by its dominance in ceramics, bricks and tiles, and specialty glass manufacturing. The country’s extensive chemical production infrastructure, large domestic demand, and strong export capabilities are key growth drivers. Continuous investments in construction materials and industrial ceramics are further strengthening market expansion.

India Barium Carbonate Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid infrastructure development, rising ceramic tile production, and expanding construction activities. Government initiatives promoting housing and industrial growth are increasing demand for barium carbonate in bricks and tiles applications. In addition, growth in specialty glass and chemical manufacturing is contributing to accelerating market momentum.

Europe Barium Carbonate Market Insight

The Europe barium carbonate market is growing steadily, supported by strong demand from specialty glass, advanced ceramics, and chemical manufacturing industries. The region emphasizes product quality, regulatory compliance, and efficient material performance, particularly in construction and industrial applications. Increasing adoption of advanced ceramic materials is further supporting market growth.

Germany Barium Carbonate Market Insight

Germany’s barium carbonate market is driven by its strong chemical industry base, advanced manufacturing capabilities, and focus on high-performance materials. The country’s well-established industrial infrastructure and emphasis on precision ceramics and specialty glass applications support consistent demand. Strong R&D activity also contributes to innovation in material usage.

U.K. Barium Carbonate Market Insight

The U.K. market benefits from steady demand in specialty glass, ceramics, and chemical processing applications. Growing investments in construction renovation, infrastructure maintenance, and advanced materials manufacturing are supporting consumption. Increased focus on quality-controlled and application-specific chemicals is sustaining market relevance.

North America Barium Carbonate Market Insight

North America is projected to grow at a steady CAGR from 2026 to 2033, driven by demand from construction materials, specialty glass, and electro-ceramic applications. Ongoing investments in infrastructure modernization and advanced manufacturing are boosting usage. The region’s focus on consistent material performance and regulatory compliance further supports market expansion.

U.S. Barium Carbonate Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by strong demand from bricks and tiles, specialty glass, and industrial chemical applications. A well-established construction sector, advanced manufacturing base, and focus on high-quality materials are key growth factors. Presence of major end-use industries and stable supply chains further reinforce the U.S.'s leading position in the region.

Barium Carbonate Market Share

The barium carbonate industry is primarily led by well-established companies, including:

- Ashland (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Honeywell International Inc. (U.S.)

- Shaanxi Ankang Jianghua Group Co., Ltd. (China)

- Chemical Products Corporation (U.S.)

- Dow (U.S.)

- Akzo Nobel N.V. (Netherlands)

- BASF SE (Germany)

- Barium & Chemicals, Inc. (U.S.)

- China Nafine Group International Co., Ltd. (China)

- Merck KGaA (Germany)

- Solvay (Belgium)

Latest Developments in Global Barium Carbonate Market

- In May 2025, Vishnu Chemicals highlighted that its 20-year solar power contract signed in 2023 has reduced electricity costs for barium carbonate production by nearly 25–30%, significantly improving operational efficiency. This cost reduction strengthens the company’s pricing flexibility and margin resilience, enabling it to remain competitive amid volatile energy prices while supporting long-term sustainable manufacturing practices in the barium carbonate market

- In July 2023, Solvay implemented advanced process optimization and emission-control technologies across its specialty chemical operations in Europe to meet tightening environmental regulations. These investments enhanced production efficiency, product consistency, and regulatory compliance, indirectly raising quality benchmarks in the barium carbonate market and influencing downstream customers to prioritize environmentally compliant suppliers

- In October 2022, the Indian Finance Ministry, acting on recommendations from the Directorate General of Trade Remedies, removed anti-dumping duties on barium carbonate imports from China. This policy shift increased competitive pressure on domestic producers such as Vishnu Chemicals, led to price rationalization in the local market, and improved supply availability for end-use industries including ceramics and construction materials

- In March 2021, Shandong Xinke Environmental Chemistry Co Ltd expanded its barium carbonate production capacity to address growing demand from bricks, tiles, and specialty ceramics manufacturers. This expansion reinforced China’s role as a major global supplier, improved regional supply stability, and supported the rapid growth of construction and ceramics industries across Asia-Pacific

- In November 2020, Solvay completed the divestment of its technical-grade barium and strontium business in Germany, Spain, and Mexico to Latour Capital, including the formation of a joint venture with Chemical Products Corporation (CPC). This strategic move allowed Solvay to streamline its portfolio while strengthening CPC’s footprint in technical-grade barium chemicals, reshaping competitive dynamics and consolidating expertise within the global barium carbonate value chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Barium Carbonate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Barium Carbonate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Barium Carbonate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.