Global Beef Extract Market

Market Size in USD Billion

CAGR :

%

USD

1.95 Billion

USD

3.36 Billion

2025

2033

USD

1.95 Billion

USD

3.36 Billion

2025

2033

| 2026 –2033 | |

| USD 1.95 Billion | |

| USD 3.36 Billion | |

|

|

|

|

Beef Extract Market Size

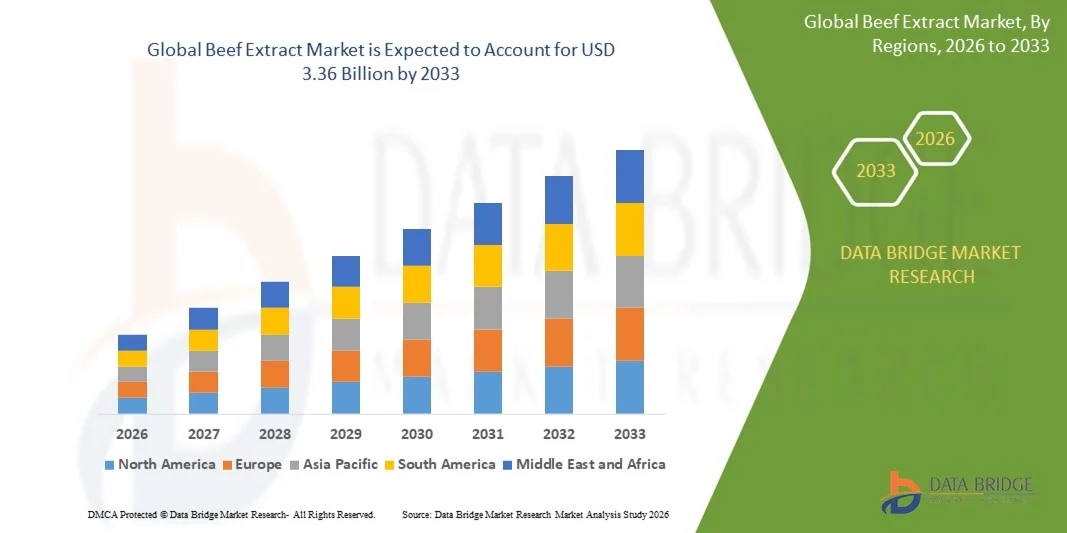

- The global beef extract market size was valued at USD 1.95 billion in 2025 and is expected to reach USD 3.36 billion by 2033, at a CAGR of 7.00% during the forecast period

- The market growth is largely fuelled by the rising demand for convenient and ready-to-eat food products, growing awareness of nutritional benefits, and increasing use of beef extract in soups, sauces, and processed foods

- Expanding foodservice and packaged food industries, particularly in North America and Europe, are further driving market adoption

Beef Extract Market Analysis

- Growing preference for natural, high-protein, and clean-label food ingredients is positively influencing the beef extract market

- Increasing consumer inclination towards processed foods, ready meals, and culinary convenience products is supporting market expansion

- North America dominated the beef extract market with the largest revenue share of 38.50% in 2025, driven by the increasing demand for natural flavor enhancers and clean-label food products

- Asia-Pacific region is expected to witness the highest growth rate in the global beef extract market, driven by increasing adoption in processed foods, rapid growth of the hospitality sector, rising consumer awareness of natural flavor enhancers, and expansion of retail and e-commerce channels

- The powder segment held the largest market revenue share in 2025, driven by its ease of use, long shelf life, and wide applicability across soups, sauces, snacks, and ready-to-eat meals. Powdered beef extract allows for precise formulation, consistent flavor, and convenient storage, making it a preferred choice for food manufacturers and commercial kitchens

Report Scope and Beef Extract Market Segmentation

|

Attributes |

Beef Extract Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Beef Extract Market Trends

Rise of Natural Flavor Enhancers in Food and Beverage

- The growing incorporation of beef extract as a natural flavor enhancer is transforming the food and beverage industry by providing rich, savory taste profiles without artificial additives. The use of beef extract allows manufacturers to meet consumer demand for clean-label, high-quality products, improving overall flavor experience. Its adoption also supports product differentiation in a competitive market and enhances the perceived nutritional value of foods

- Increasing adoption of beef extract in ready-to-eat meals, processed foods, soups, sauces, and snacks is accelerating market growth. These applications are particularly relevant in regions with rising consumer preference for convenient, flavorful, and nutritious food products, helping boost product appeal and sales. Manufacturers are also leveraging beef extract to create premium offerings that cater to gourmet and health-conscious segments

- The versatility and stability of modern beef extract formulations make them suitable for use in various cooking, processing, and preservation applications. Easy integration into multiple food matrices supports product innovation, consistent taste, and extended shelf life. In addition, beef extract can enhance sensory attributes such as umami, aroma, and mouthfeel, further increasing product acceptance

- For instance, in 2023, several food manufacturers in North America reported improved consumer acceptance and repeat purchases after incorporating beef extract into soups and instant meals, enhancing brand value and market competitiveness. These successes highlight the potential for beef extract to drive revenue growth across multiple food categories while meeting consumer demands for natural ingredients

- While beef extract adoption is increasing, long-term impact depends on sustainable sourcing, cost-effective production, and compliance with food safety regulations. Manufacturers must focus on high-quality raw material sourcing and scalable processing techniques to fully capitalize on market opportunities. The emphasis on traceability and ethical sourcing is also becoming a key factor influencing brand reputation and consumer trust

Beef Extract Market Dynamics

Driver

Rising Demand for Natural and Clean-Label Flavoring Solutions

- Increasing consumer preference for natural, additive-free, and clean-label products is driving the demand for beef extract as a natural flavoring solution. Manufacturers are increasingly prioritizing beef extract over artificial flavor enhancers to meet evolving taste and health expectations. This trend also encourages innovation in product formulation and supports the launch of new flavor-enhanced food items

- The expansion of the processed and convenience food sector, including ready-to-eat meals, snacks, and sauces, is fueling the adoption of beef extract. Its ability to provide savory taste while maintaining nutritional value supports innovation and product differentiation. Furthermore, foodservice and quick-service restaurants are increasingly incorporating beef extract to enhance menu offerings and customer satisfaction

- Government regulations and food safety standards promoting the use of natural ingredients further encourage the adoption of beef extract in food processing. Certification programs and labeling initiatives reinforce trust among consumers, boosting market acceptance. Companies adhering to such guidelines also gain a competitive edge by demonstrating compliance with quality and safety standards

- For instance, in 2022, multiple European and North American food companies launched new product lines using beef extract, increasing consumer engagement and driving market growth across the processed foods segment. These launches demonstrate the ingredient's versatility across different cuisines and product formats, further solidifying its market position

- While consumer demand and regulatory support are driving growth, challenges remain in sourcing high-quality beef raw materials, ensuring cost-effective processing, and maintaining consistent flavor profiles. Investment in R&D to improve extract stability and flavor retention is increasingly important for long-term success

Restraint/Challenge

High Production Cost and Limited Availability of Premium Beef Extract

- The premium cost of high-quality beef extract, particularly those derived from natural and traceable sources, restricts adoption among small-scale food manufacturers and cost-sensitive product lines. Price-sensitive markets may prefer cheaper synthetic flavorings, limiting market penetration. In addition, fluctuating livestock prices can further impact production costs, creating financial unpredictability for manufacturers

- Limited availability of consistent, high-quality raw materials can disrupt production schedules and affect flavor consistency. Sourcing challenges, especially in regions with restricted livestock supply or regulatory constraints, pose operational difficulties. Manufacturers may need to establish long-term supplier agreements or explore alternative processing methods to ensure uninterrupted supply

- Technical complexities in processing beef extract to maintain flavor, aroma, and shelf stability may restrict usage, requiring specialized expertise and quality control measures. Improper formulation can reduce taste efficacy and consumer acceptance. Advances in extraction technology and formulation research are critical to overcoming these limitations and expanding market applications

- For instance, in 2023, several Asian and African food producers experienced delays in launching beef extract-based products due to raw material shortages and high costs, impacting revenue growth and market expansion. These delays highlight the importance of supply chain resilience and the need for efficient procurement strategies to sustain market momentum

- While processing technologies and supply chains are evolving, addressing cost, sourcing, and technical challenges is essential. Market players must focus on sustainable, scalable, and cost-efficient production methods to maximize long-term market potential. Partnerships with technology providers and investment in innovative extraction techniques can further strengthen market competitiveness

Beef Extract Market Scope

The market is segmented on the basis of form, end-use, application, and distribution channel.

- By Form

On the basis of form, the beef extract market is segmented into powder, oil, liquid, granules, capsules, paste, and others. The powder segment held the largest market revenue share in 2025, driven by its ease of use, long shelf life, and wide applicability across soups, sauces, snacks, and ready-to-eat meals. Powdered beef extract allows for precise formulation, consistent flavor, and convenient storage, making it a preferred choice for food manufacturers and commercial kitchens.

The liquid segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its versatility in industrial and commercial applications, easy integration into cooking and processing, and superior flavor extraction. Liquid beef extract is particularly popular for instant soups, sauces, and ready-to-eat meals, offering fast solubility and enhanced taste performance.

- By End-Use

On the basis of end-use, the beef extract market is segmented into the food & beverage industry and lab testing. The food & beverage industry segment dominated the market in 2025, owing to the rising demand for natural flavor enhancers in processed foods, snacks, and ready-to-eat meals. This segment benefits from the growing trend of clean-label, additive-free products and consumer preference for savory, high-quality flavors.

The lab testing segment is expected to witness notable growth from 2026 to 2033, fueled by increasing research on food formulations, quality control, and flavor profiling. Food manufacturers and research institutions increasingly use beef extract for experimental applications, sensory analysis, and product development studies.

- By Application

On the basis of application, the beef extract market is segmented into industrial and commercial. The industrial segment held the largest market share in 2025, supported by large-scale food processing, flavor manufacturing, and ready-to-eat meal production. Industrial users benefit from consistent flavor quality, scalability, and compatibility with multiple product lines.

The commercial segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the adoption of beef extract in restaurants, catering services, and specialty food outlets. Commercial kitchens leverage beef extract for its convenience, rich taste, and time-efficient preparation, enhancing the quality of their menu offerings.

- By Distribution Channel

On the basis of distribution channel, the beef extract market is segmented into B2B, B2C, hypermarket/supermarket, grocery stores, retail stores, online, and others. The B2B segment dominated the market in 2025, fueled by bulk purchases by food manufacturers, processors, and institutional buyers. This channel ensures steady supply, consistent quality, and cost efficiency for large-scale operations.

The online segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing e-commerce adoption, convenience in bulk and small-quantity purchases, and the ability to reach global customers. Online platforms provide access to various beef extract forms, competitive pricing, and direct-to-consumer delivery, expanding market reach.

Beef Extract Market Regional Analysis

- North America dominated the beef extract market with the largest revenue share of 38.50% in 2025, driven by the increasing demand for natural flavor enhancers and clean-label food products

- Consumers in the region highly value the rich, savory taste, ease of use in food preparation, and ability to enhance the flavor profile of processed and ready-to-eat foods

- This widespread adoption is further supported by high disposable incomes, growing consumer preference for convenient and flavorful meals, and the expanding processed food sector, establishing beef extract as a favored ingredient across food and beverage applications

U.S. Beef Extract Market Insight

The U.S. beef extract market captured the largest revenue share in 2025 within North America, fueled by the rising adoption of natural flavoring solutions in processed foods, soups, sauces, and ready-to-eat meals. Consumers are increasingly prioritizing additive-free, clean-label products, driving manufacturers to incorporate high-quality beef extract. The growing demand for convenience foods, combined with increasing awareness of nutritional quality and flavor enhancement, further propels the beef extract industry. Moreover, the expanding food processing infrastructure and advanced manufacturing capabilities are significantly contributing to market growth.

Europe Beef Extract Market Insight

The Europe beef extract market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by the rising demand for natural ingredients and stringent food safety regulations. Increasing urbanization, busy lifestyles, and higher consumption of processed foods are fostering adoption of beef extract. European consumers are also drawn to the clean-label trend and the desire for authentic, rich flavors in home-cooked and commercial food products. The region is experiencing significant growth across industrial food production and commercial kitchens, with beef extract being incorporated into soups, sauces, and ready meals.

U.K. Beef Extract Market Insight

The U.K. beef extract market is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing focus on natural flavor solutions and the rise in processed food consumption. Health-conscious consumers are seeking additive-free alternatives, which encourages both manufacturers and food service providers to adopt beef extract. In addition, the country’s robust food manufacturing and retail infrastructure supports product innovation and faster market penetration. The growing preference for ready-to-eat meals and convenience foods further fuels the adoption of beef extract in commercial kitchens and packaged food products.

Germany Beef Extract Market Insight

The Germany beef extract market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising consumer awareness of natural and clean-label ingredients and a strong processed food industry. Germany’s well-established food processing infrastructure, combined with a focus on quality and flavor, promotes the incorporation of beef extract in soups, sauces, and meal bases. The integration of beef extract into convenience foods and industrial applications is also increasing, with manufacturers prioritizing sustainable sourcing and consistent flavor profiles to meet local consumer expectations.

Asia-Pacific Beef Extract Market Insight

The Asia-Pacific beef extract market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and a growing preference for processed and ready-to-eat meals in countries such as China, Japan, and India. The region's expanding food and beverage sector, coupled with government initiatives supporting food manufacturing and safety standards, is encouraging the adoption of beef extract. Furthermore, APAC’s emergence as a manufacturing hub for flavoring ingredients ensures improved affordability and availability, expanding the market to a wider consumer and industrial base.

Japan Beef Extract Market Insight

The Japan beef extract market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high demand for natural, high-quality ingredients and the increasing consumption of processed and convenience foods. Japanese consumers emphasize clean-label and flavor-rich products, driving manufacturers to adopt beef extract in commercial and packaged food segments. The integration of beef extract with soups, sauces, and ready-to-eat meals is gaining momentum, supported by advanced food processing technologies and efficient supply chains.

China Beef Extract Market Insight

The China beef extract market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rapid urbanization, and increasing processed food consumption. China represents one of the largest markets for natural flavoring solutions, and beef extract is becoming increasingly popular in both commercial kitchens and packaged food products. The growth of modern food processing facilities, availability of cost-effective ingredients, and domestic manufacturing capabilities are key factors driving the adoption of beef extract across food and beverage applications.

Beef Extract Market Share

The Beef Extract industry is primarily led by well-established companies, including:

- APC, Inc (U.S.)

- Givaudan (Switzerland)

- BRF Global (Brazil)

- Carnad A/S (Denmark)

- NEOGEN CORPORATION (U.S.)

- Ohly (Germany)

- Meioh Bussan Co., Ltd (Japan)

- HACO AG (Switzerland)

- Kanegrade Ltd. (U.K.)

- Inthaco Co., Ltd (Japan)

- Nikken Foods Co., Ltd (Japan)

- Colin Ingrédients (France)

- ARIAKE JAPAN Co., Ltd. (Japan)

- Merck KGaA (Germany)

- JBS GLOBAL (Brazil)

- Maverick Biosciences (U.S.)

- IDF (France)

Latest Developments in Global Beef Extract Market

- In August 2025, Nestlé (Switzerland) launched a new line of organic beef extracts, aimed at meeting the rising consumer demand for natural and clean-label ingredients. This development enhances the company’s sustainability credentials and positions it as a key player in the organic segment. The new product line is expected to strengthen brand loyalty, attract health-conscious consumers, and potentially increase market share in the premium beef extract sector

- In September 2025, Unilever (U.K.) entered a strategic partnership with a local beef supplier to improve traceability in its beef extract sourcing. This initiative focuses on supply chain transparency and ethical sourcing, addressing growing consumer concerns about food origin. The move is likely to enhance brand reputation, appeal to environmentally conscious buyers, and provide a competitive advantage in the market

- In July 2025, Kraft Heinz (U.S.) expanded its portfolio through the acquisition of a company specializing in plant-based beef extracts. This development allows Kraft Heinz to tap into the growing plant-based and health-focused food segment, diversify its offerings, and cater to evolving dietary preferences. The acquisition is expected to boost market presence, attract a broader consumer base, and support long-term revenue growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Beef Extract Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Beef Extract Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Beef Extract Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.