Global Beer Packaging Equipment Market

Market Size in USD Billion

CAGR :

%

USD

13.14 Billion

USD

18.69 Billion

2025

2033

USD

13.14 Billion

USD

18.69 Billion

2025

2033

| 2026 –2033 | |

| USD 13.14 Billion | |

| USD 18.69 Billion | |

|

|

|

|

What is the Global Beer Packaging Equipment Market Size and Growth Rate?

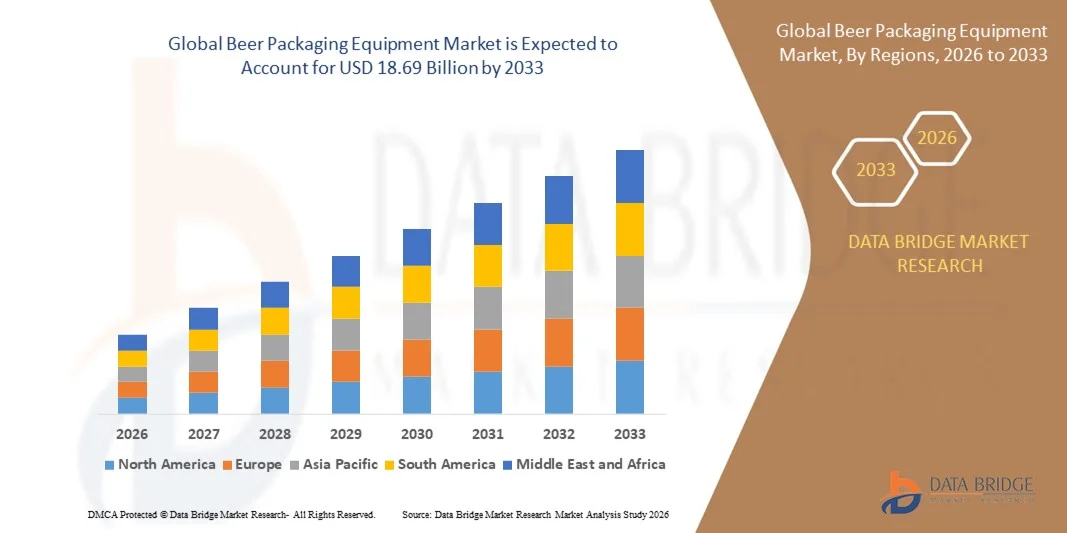

- The global beer packaging equipment market size was valued at USD 13.14 billion in 2025 and is expected to reach USD 18.69 billion by 2033, at a CAGR of 4.50% during the forecast period

- Increase in the innovative packaging increases product appeal acts as the major factor escalating the market growth, also rise in the demand for convenient and sustainable packaging for beverages and rise in the demand from beer all over the globe are the major factors among others propelling the growth of beer packaging equipment market

What are the Major Takeaways of Beer Packaging Equipment Market?

- Rise in the research and development activities and increase in the use of biodegradable and renewable raw materials will further create new opportunities for the beer packaging equipment market

- However, rise in the stringent environmental legislations is the major factor among others restraining the market growth, and will further challenge the growth of beer packaging equipment market

- Europe dominated the beer packaging equipment market with a 39.8% revenue share in 2025, driven by the strong presence of established breweries, high per-capita beer consumption, and early adoption of automated and sustainable packaging technologies across Germany, the U.K., France, Italy, and Spain

- North America is projected to register the fastest CAGR of 9.6% from 2026 to 2033, driven by rising craft beer production, growing can packaging adoption, and increasing automation across breweries in the U.S. and Canada

- The Filling segment dominated the market with a 41.6% share in 2025, as filling systems represent the most capital-intensive and technologically advanced stage of beer packaging

Report Scope and Beer Packaging Equipment Market Segmentation

|

Attributes |

Beer Packaging Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Beer Packaging Equipment Market?

Increasing Shift Toward High-Speed, Compact, and Digitally Integrated Beer Packaging Equipments

- The beer packaging equipment market is witnessing strong adoption of high-speed, space-efficient, and modular packaging lines designed to support rising production volumes and frequent SKU changeovers

- Manufacturers are introducing compact fillers, cappers, and labeling systems integrated with PLC- and PC-based control platforms for real-time monitoring and automation

- Growing demand for energy-efficient, low-footprint, and flexible equipment is driving adoption across craft breweries, contract packers, and large-scale commercial breweries

- For instance, companies such as Krones, KHS, Sidel, and Tetra Pak have launched advanced beer packaging systems with enhanced throughput, digital diagnostics, and remote maintenance capabilities

- Increasing focus on smart factories, Industry 4.0 integration, and predictive maintenance is accelerating the shift toward digitally connected beer packaging lines

- As beer producers prioritize efficiency, consistency, and operational flexibility, Beer Packaging Equipments will remain central to high-volume, automated brewing operations

What are the Key Drivers of Beer Packaging Equipment Market?

- Rising demand for high-speed, reliable, and automated packaging solutions to meet growing global beer consumption and export volumes

- For instance, in 2025, leading players such as Krones, SIG, and Barry-Wehmiller expanded their beer packaging portfolios with faster filling speeds, reduced changeover times, and improved hygiene standards

- Growing adoption of cans, returnable glass bottles, and sustainable packaging formats is boosting demand for advanced filling, sealing, and inspection equipment across the U.S., Europe, and Asia-Pacific

- Advancements in servo-driven systems, robotics, vision inspection, and digital control software have improved packaging accuracy, uptime, and operational efficiency

- Rising number of craft breweries and private-label beer brands is increasing demand for compact, scalable, and cost-effective packaging equipment

- Supported by continuous investments in brewery modernization, automation, and packaging innovation, the Beer Packaging Equipment market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Beer Packaging Equipment Market?

- High capital costs associated with fully automated, high-speed beer packaging lines limit adoption among small and mid-sized breweries

- For instance, during 2024–2025, rising steel prices, component shortages, and supply-chain disruptions increased equipment procurement and installation costs for brewery operators

- Complexity in integrating new packaging equipment with legacy brewery systems increases installation time and technical dependency

- Limited technical expertise and maintenance capabilities in emerging markets slow the adoption of advanced, digitally integrated packaging solutions

- Competition from refurbished equipment, manual or semi-automatic systems, and contract packaging services creates pricing pressure on equipment manufacturers

- To overcome these challenges, companies are focusing on modular designs, financing models, operator training, and digital service platforms to improve accessibility and adoption of Beer Packaging Equipments

How is the Beer Packaging Equipment Market Segmented?

The market is segmented on the basis of type, brewery type, and mode of operation.

- By Type

On the basis of type, the beer packaging equipment market is segmented into Milling, Brewhouse, Cooling, Fermentation, Filtration, and Filling. The Filling segment dominated the market with a 41.6% share in 2025, as filling systems represent the most capital-intensive and technologically advanced stage of beer packaging. High demand for automated bottle, can, and keg filling lines, combined with strict hygiene, speed, and accuracy requirements, continues to drive investment in this segment. Filling equipment is widely adopted by macrobreweries and large regional breweries due to its direct impact on throughput, product consistency, and shelf life.

The Fermentation segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing craft beer production, experimentation with specialty beer variants, and rising demand for precise temperature- and pressure-controlled fermentation systems. Growing emphasis on quality differentiation and batch consistency is accelerating adoption of advanced fermentation equipment across microbreweries and brew pubs globally.

- By Brewery Type

On the basis of brewery type, the beer packaging equipment market is segmented into Macrobrewery, Microbrewery, Brew Pubs, and Regional Breweries. The Macrobrewery segment dominated the market with a 48.2% share in 2025, supported by large-scale production volumes, global distribution networks, and continuous investments in high-speed, fully automated packaging lines. Macrobreweries prioritize efficiency, standardization, and cost optimization, leading to strong demand for advanced filling, labeling, and palletizing equipment.

The Microbrewery segment is projected to register the fastest CAGR from 2026 to 2033, driven by the rapid expansion of craft beer culture, premiumization trends, and rising consumer preference for locally brewed and specialty beers. Microbreweries increasingly invest in compact, modular, and flexible packaging equipment that supports smaller batch sizes, frequent product launches, and multi-format packaging. Government support for small breweries and growing urban consumption are further accelerating equipment adoption in this segment.

- By Mode of Operation

On the basis of mode of operation, the beer packaging equipment market is segmented into Manual, Semi-Automatic, and Automatic systems. The Automatic segment held the largest market share of 52.7% in 2025, driven by rising labor costs, increasing production scale, and strong focus on operational efficiency and quality consistency. Automatic beer packaging equipment offers high throughput, minimal human intervention, reduced product loss, and seamless integration with digital monitoring and control systems, making it the preferred choice for macro and regional breweries.

The Semi-Automatic segment is expected to grow at the fastest CAGR from 2026 to 2033, as it offers an optimal balance between affordability and performance. Small and mid-sized breweries, particularly microbreweries and brew pubs, are adopting semi-automatic systems to improve productivity while maintaining flexibility and lower capital expenditure. Growing demand for scalable, easy-to-operate packaging solutions is further driving growth of this segment globally.

Which Region Holds the Largest Share of the Beer Packaging Equipment Market?

- Europe dominated the beer packaging equipment market with a 39.8% revenue share in 2025, driven by the strong presence of established breweries, high per-capita beer consumption, and early adoption of automated and sustainable packaging technologies across Germany, the U.K., France, Italy, and Spain. Strict food safety regulations, emphasis on recyclable packaging, and continuous modernization of brewery infrastructure are fueling demand for advanced filling, labeling, and inspection equipment

- Leading European equipment manufacturers are introducing high-speed, energy-efficient, and digitally integrated beer packaging systems, strengthening the region’s technological leadership. Strong focus on Industry 4.0, smart factories, and predictive maintenance further supports long-term market expansion

- Dense concentration of global brewery groups, skilled workforce availability, and strong engineering ecosystems reinforce Europe’s dominance in the Beer Packaging Equipment market

Which Region Holds the Largest Share of the Beer Packaging Equipment Market?

- Europe dominated the beer packaging equipment market with a 39.8% revenue share in 2025, driven by the strong presence of established breweries, high per-capita beer consumption, and early adoption of automated and sustainable packaging technologies across Germany, the U.K., France, Italy, and Spain

- Strict food safety regulations, emphasis on recyclable packaging, and continuous modernization of brewery infrastructure are fueling demand for advanced filling, labeling, and inspection equipment. Leading European equipment manufacturers are introducing high-speed, energy-efficient, and digitally integrated beer packaging systems, strengthening the region’s technological leadership

- Strong focus on Industry 4.0, smart factories, and predictive maintenance further supports long-term market expansion. Dense concentration of global brewery groups, skilled workforce availability, and strong engineering ecosystems reinforce Europe’s dominance in the Beer Packaging Equipment market

Germany Beer Packaging Equipment Market Insight

Germany is the largest contributor in Europe, supported by its strong brewing heritage, large number of breweries, and leadership in high-precision packaging machinery manufacturing. Continuous upgrades in bottling and canning lines, rising demand for returnable glass systems, and strict hygiene standards drive equipment adoption. Presence of leading OEMs and export-oriented machinery suppliers further strengthens market growth.

U.K. Beer Packaging Equipment Market Insight

The U.K. contributes significantly due to rapid expansion of craft breweries, growing premium beer consumption, and increasing investments in flexible packaging solutions. Breweries are adopting compact and modular equipment to support small batch production and frequent product launches. Sustainability initiatives and recyclable packaging formats further boost demand.

North America Beer Packaging Equipment Market

North America is projected to register the fastest CAGR of 9.6% from 2026 to 2033, driven by rising craft beer production, growing can packaging adoption, and increasing automation across breweries in the U.S. and Canada. Breweries are investing heavily in high-speed, low-downtime packaging lines to improve efficiency, reduce labor dependency, and maintain product consistency. Expansion of contract brewing and private-label beer production further accelerates equipment demand.

U.S. Beer Packaging Equipment Market Insight

The U.S. is the largest contributor in North America, supported by a large base of craft and regional breweries, strong consumer demand for canned and flavored beers, and rapid adoption of automated packaging technologies. Increasing brewery expansions, modernization projects, and emphasis on operational efficiency drive strong demand for filling, sealing, and palletizing equipment.

Canada Beer Packaging Equipment Market Insight

Canada shows steady growth driven by rising craft brewery penetration, increasing exports, and growing preference for sustainable packaging formats. Breweries are investing in flexible and semi-automatic packaging solutions to support scalability. Government support for local manufacturing and food processing modernization further supports market adoption.

Asia-Pacific Beer Packaging Equipment Market

Asia-Pacific continues to show robust growth supported by rising beer consumption, expanding urban populations, and increasing brewery investments across China, India, Japan, and Southeast Asia. Growth of premium beer segments, international brewery expansions, and modernization of local brewing facilities are driving demand for advanced beer packaging equipment.

Which are the Top Companies in Beer Packaging Equipment Market?

The beer packaging equipment industry is primarily led by well-established companies, including:

- Amcor Plc (Switzerland)

- O-I Glass (U.S.)

- Crown Holdings, Inc. (U.S.)

- Ardagh Group S.A. (Luxembourg)

- Verallia SA (France)

- Tetra Pak Group (Switzerland)

- Ball Corporation (U.S.)

- Vidrala S.A. (Spain)

- Toyo Seikan Group Holdings, Ltd (Japan)

- CPMC Holdings Limited (China)

What are the Recent Developments in Global Beer Packaging Equipment Market?

- In July 2024, AGP-North America, a subsidiary of Ardagh Group, expanded its domestically produced glass portfolio by introducing a new range of craft beverage bottles, including 12 oz bottles in emerald, green, flint, and amber colors, manufactured in the U.S. using 100% recyclable glass; In addition, the company partnered with Stevens Point Brewery in March 2024 to supply glass beer bottles, reinforcing its commitment to sustainable and locally produced beer packaging solutions

- In May 2024, during the Time Out Festival in Barcelona, Diageo unveiled an innovative Baileys Irish Cream bottle containing 90% paper content, developed in collaboration with PA Consulting and PulPac using Dry Molded Fiber technology with a recyclable plastic lining, highlighting Diageo’s focus on testing consumer response and advancing sustainable packaging alternatives in the beverage industry

- In October 25, 2023, Ball Corporation announced the installation of a Cycle Reverse Vending Machine at Red Rocks Amphitheatre to incentivize recycling by rewarding consumers for returning used beverage containers, demonstrating the company’s ongoing efforts to promote circular economy practices and sustainability within the beer packaging ecosystem

- In November 2023, Ardagh Group S.A. launched new Boston Round beverage bottles through its BuyOurBottles platform, offering a classic and versatile packaging option suitable for beer and other beverages, thereby strengthening its portfolio of accessible and customizable packaging solutions for breweries and beverage producers

- In December 2023, Amcor plc introduced “WIPE,” a technology-driven innovation that utilizes advanced digital tools to assess and enhance the quality and durability of beer packaging materials such as cans and bottles, reinforcing Amcor’s position as a trusted partner focused on packaging integrity and performance excellence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Beer Packaging Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Beer Packaging Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Beer Packaging Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.