Global Bicycle Components Market

Market Size in USD Billion

CAGR :

%

USD

15.31 Billion

USD

25.34 Billion

2024

2032

USD

15.31 Billion

USD

25.34 Billion

2024

2032

| 2025 –2032 | |

| USD 15.31 Billion | |

| USD 25.34 Billion | |

|

|

|

|

Bicycle Components Market Size

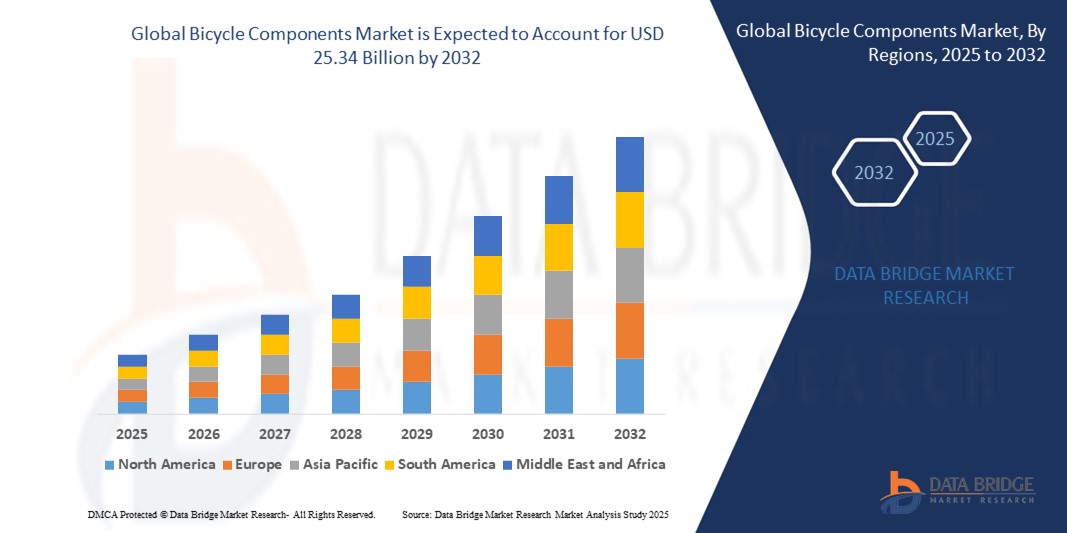

- The global bicycle components market size was valued at USD 15.31 billion in 2024 and is expected to reach USD 25.34 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fuelled by the increasing adoption of bicycles for commuting and fitness, rising environmental awareness, growing popularity of electric bikes, and government initiatives promoting cycling infrastructure

- In addition, the surge in recreational cycling, competitive biking events, and rising consumer preference for customized, high-performance components are further accelerating global market expansion

Bicycle Components Market Analysis

- The rising trend of eco-friendly transportation is pushing consumers toward bicycles, especially in urban centers, which in turn is boosting demand for reliable and high-performance components

- Electric and hybrid bicycles are creating new revenue opportunities for component manufacturers, particularly in the drivetrain, braking, and battery-assisted systems segments

- Asia-Pacific dominated the bicycle components market with the largest revenue share of 42.3% in 2024, driven by rising urbanization, expanding cycling infrastructure, and growing demand for both recreational and electric bikes across countries such as China, Japan, and India

- North America region is expected to witness the highest growth rate in the global bicycle components market, driven by government initiatives promoting green mobility, the rising trend of bike commuting, and increasing consumer investment in performance-enhancing components and smart cycling technologies

- The derailleurs segment dominated the market with the largest market revenue share in 2024, driven by increasing demand for smooth gear shifting in both road and mountain bikes. Cyclists across segments prioritize high-performance derailleurs due to their impact on ride efficiency, control, and adaptability across various terrains. In addition, product innovations with electronic shifting and lightweight materials are further fueling this segment’s growth

Report Scope and Bicycle Components Market Segmentation

|

Attributes |

Bicycle Components Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Electric Bicycle Segment Across Urban Areas |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Bicycle Components Market Trends

Rising Demand for Lightweight and High-Performance Bicycle Components

- The global shift toward performance-oriented and lightweight bicycles is driving manufacturers to develop advanced materials and aerodynamic designs. Riders—from professionals to daily commuters—are seeking efficiency, speed, and agility, which has amplified the demand for carbon fiber, titanium, and high-grade aluminum components across multiple segments including drivetrains, wheels, and frames

- Increasing participation in cycling sports, coupled with the growing popularity of recreational biking, is accelerating innovation in gear systems, braking mechanisms, and suspension technologies. These trends are particularly strong in North America and Europe, where consumer preferences favor precision engineering and premium-quality parts

- Urban mobility initiatives and e-bike adoption are also influencing component upgrades, with a focus on seamless gear shifting, motor-assisted pedaling, and compact drivetrains. For instance, Shimano and SRAM have expanded their electric-compatible product lines to meet rising demand in cities promoting cycling infrastructure

- In 2024, several high-performance brands launched modular component kits for mountain and gravel bikes, allowing riders to customize setups based on terrain. This trend supports a do-it-yourself culture and drives aftermarket revenue through accessory upgrades and replacements

- While demand for high-performance components continues to grow, price sensitivity in developing regions remains a hurdle. However, strategic collaborations and localization of production are expected to enhance product affordability and availability without compromising quality

Bicycle Components Market Dynamics

Driver

Growing Popularity of Cycling as a Sustainable and Health-Conscious Mobility Choice

• The global bicycle components market is benefitting from a strong consumer shift toward health, fitness, and sustainable transportation. Bicycles are increasingly viewed as eco-friendly alternatives to cars, particularly in urban settings with rising concerns over emissions and traffic congestion. Governments are actively supporting cycling through infrastructure investments, subsidies, and awareness campaigns

• Health-conscious lifestyles post-pandemic have encouraged both young and older demographics to adopt cycling for fitness and mental well-being. As a result, the demand for efficient, durable, and ergonomic bicycle components has significantly increased across recreational and commuting segments

• Technological advancements have also made premium bicycle components more accessible. From electronic shifting systems to integrated sensor-based diagnostics, the market is witnessing higher consumer engagement, especially among enthusiasts seeking performance optimization and longer component life

• For instance, in 2023, the Netherlands witnessed a 15% increase in demand for gear hubs and disc brakes as urban cyclists upgraded their bikes for daily use. This reflects a broader trend across Europe where enhanced riding comfort and safety are influencing purchase decisions

• Despite growing momentum, the market still faces challenges in standardization, component compatibility, and servicing. However, strong consumer awareness, coupled with policy and retail support, is expected to ensure continued expansion of the market across developed and emerging economies

Restraint/Challenge

Fluctuating Raw Material Prices and Supply Chain Disruptions Impacting Cost and Availability

• The bicycle components market is vulnerable to cost fluctuations in key raw materials such as aluminum, carbon fiber, and rubber. These materials are crucial for drivetrains, frames, and braking systems, and their price volatility directly impacts the pricing of finished components, making it difficult for manufacturers to maintain profit margins

• Global supply chain disruptions, exacerbated by geopolitical tensions and post-pandemic recovery hurdles, have led to delays in component shipments and inventory shortages. This has been particularly challenging for small and mid-sized manufacturers dependent on imported parts or centralized sourcing hubs

• Component availability issues have also hindered aftermarket services and slowed bicycle assembly in some regions. Inconsistencies in lead times, coupled with rising freight costs, are affecting both production timelines and consumer satisfaction

• For instance, during 2023, multiple bicycle brands in Southeast Asia and Latin America reported delays in receiving gear cassettes and hydraulic brake sets due to supplier backlogs in East Asia, impacting new product launches and maintenance services

• Addressing this challenge will require diversification of suppliers, greater investment in local manufacturing hubs, and the adoption of digital supply chain tools. Such measures will improve resiliency and ensure timely delivery of high-demand components in both OEM and aftermarket segments

Bicycle Components Market Scope

The market is segmented on the basis of component type, sales channel, and bicycle type.

- By Component Type

On the basis of component type, the bicycle components market is segmented into derailleurs, road group sets, suspensions, wheel sets, brakes, caliper type, gears, and others. The derailleurs segment dominated the market with the largest market revenue share in 2024, driven by increasing demand for smooth gear shifting in both road and mountain bikes. Cyclists across segments prioritize high-performance derailleurs due to their impact on ride efficiency, control, and adaptability across various terrains. In addition, product innovations with electronic shifting and lightweight materials are further fueling this segment’s growth.

The suspensions segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising popularity of mountain biking and off-road cycling. Suspensions enhance rider comfort and safety by absorbing shocks on rough surfaces, making them crucial for performance and endurance cycling. The adoption of adjustable and air-sprung suspension systems is also increasing among professional cyclists and adventure riders, contributing to the rapid expansion of this segment.

- By Sales Channel

On the basis of sales channel, the bicycle components market is segmented into specialty bicycle retailers, discount stores, department stores, full-line sporting goods stores, outdoor specialty stores, and other sales channels. The specialty bicycle retailers segment held the largest market revenue share in 2024, supported by the availability of high-end components, personalized service, and strong customer trust. These retailers cater specifically to cycling enthusiasts and offer expert guidance and product customization options that appeal to both professionals and hobbyists.

The online and outdoor specialty stores segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the convenience of online shopping and increasing brand collaborations with e-commerce platforms. These channels provide access to a wider range of components and competitive pricing, making them particularly attractive to price-sensitive consumers and tech-savvy buyers who prefer researching and purchasing products digitally.

- By Bicycle Type

On the basis of bicycle type, the market is segmented into mountain bike, road/700C, hybrid/cross, road, comfort, youth, cruiser, recumbent/tandem, electric, and folding. The road/700C segment dominated the market in 2024 owing to its widespread usage among urban commuters, competitive cyclists, and recreational riders. This category benefits from demand for speed, lightweight construction, and efficient drivetrains, especially in developed regions with extensive cycling infrastructure.

The electric bicycle segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the global surge in e-bike adoption for commuting, fitness, and sustainable mobility. Components designed for e-bikes, such as motor-compatible gear systems and heavy-duty brakes, are experiencing strong demand. As cities encourage greener transport options, electric bicycles are becoming mainstream, boosting growth across their component supply chain.

Bicycle Components Market Regional Analysis

• Asia-Pacific dominated the bicycle components market with the largest revenue share of 42.3% in 2024, driven by rising urbanization, expanding cycling infrastructure, and growing demand for both recreational and electric bikes across countries such as China, Japan, and India

• Consumers in the region are increasingly embracing cycling as a sustainable and healthy mode of transport, boosting the demand for reliable and performance-oriented components such as derailleurs, suspensions, and disc brakes

• This regional dominance is further supported by the presence of large-scale component manufacturers, favorable government policies, and the rapid expansion of e-bike production and exports, strengthening Asia-Pacific’s leadership in the global market

China Bicycle Components Market Insight

The China bicycle components market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by robust domestic manufacturing capabilities, rising fitness awareness, and growing investment in smart city mobility programs. The surge in electric bike usage, supported by favorable government incentives and wide-scale adoption of bike-sharing schemes, is significantly increasing demand for high-quality gears, braking systems, and lightweight frames. Moreover, China's expanding middle class and increased interest in premium cycling accessories are driving continued innovation and market growth

Japan Bicycle Components Market Insight

The Japan bicycle components market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s dense urban infrastructure, cycling culture, and technological advancement. Japanese consumers prioritize safety, compactness, and precision, leading to high demand for advanced components such as hub gears, torque sensors, and integrated lighting systems. The presence of renowned component manufacturers and a strong focus on innovation in e-bike and folding bike designs are contributing to the country’s sustained market performance

North America Bicycle Components Market Insight

The North America bicycle components market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising environmental concerns, the popularity of cycling for fitness, and expanding urban cycling infrastructure. The region's consumers are increasingly investing in advanced gear systems, ergonomic components, and electric bike upgrades. Government initiatives promoting non-motorized transport and the growing trend of eco-conscious commuting are further strengthening the demand for durable and performance-driven components across the U.S. and Canada

U.S. Bicycle Components Market Insight

The U.S. bicycle components market is expected to witness the fastest growth rate from 2025 to 2032, propelled by the increasing integration of cycling into urban planning and a growing fitness-oriented consumer base. The rising popularity of premium and electric bicycles is boosting the need for reliable suspension systems, high-efficiency gear sets, and long-lasting braking mechanisms. Moreover, strong retail channels and supportive cycling policies across several states are facilitating market expansion

Europe Bicycle Components Market Insight

The Europe bicycle components market is expected to witness the fastest growth rate from 2025 to 2032, backed by a strong cycling heritage, well-developed infrastructure, and active government support for green mobility. Urban bike lanes, public bike-sharing schemes, and health-conscious commuting are driving the adoption of performance-centric bicycle parts across major economies. European consumers are particularly drawn to components that offer enhanced safety, energy efficiency, and durability, especially in electric and hybrid bikes used for daily transport

Germany Bicycle Components Market Insight

The Germany bicycle components market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s leadership in engineering and green transportation. Germany’s consumers emphasize quality, reliability, and environmental sustainability, leading to increased adoption of lightweight materials, disc brakes, and smart shifting technologies. The rise of e-bikes and the government’s investment in cycle-friendly infrastructure are also creating strong momentum for component manufacturers

U.K. Bicycle Components Market Insight

The U.K. bicycle components market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the growing popularity of cycling for fitness and commuting, alongside supportive government incentives such as the Cycle to Work scheme. Consumers are increasingly upgrading to premium gear systems, wheelsets, and braking components to enhance riding comfort and performance. As e-bike usage rises and urban congestion remains a challenge, demand for advanced, low-maintenance bicycle components is expected to grow significantly across the U.K.

Bicycle Components Market Share

The Bicycle Components industry is primarily led by well-established companies, including:

- Dorel Industries (Canada)

- Accell Group (Netherlands)

- SHIMANO INC. (Japan)

- SRAM LLC. (U.S.)

- Hero Cycles Ltd (India)

- Campagnolo S.r.l. (Italy)

- MERIDA BIKES. (Taiwan)

- Specialized Bicycle Components, Inc. (U.S.)

- Rohloff AG (Germany)

- Giant Bicycles (Taiwan)

- Currie Technologies (U.S.)

- OMAX Corporation (U.S.)

- Trek Bicycle Corporation (U.S.)

- Marin Bikes (U.S.)

- Atlas Cycles (Haryana) Ltd. (India)

Latest Developments in Global Bicycle Components Market

- In April 2022, Hero Motors and Yamaha Motor Co. Japan formed a joint venture named HYM Drive Systems to manufacture electric drive units for bicycles. The initiative is set to enhance the technological control and performance of e-bikes. With production expected to begin soon, this collaboration is likely to strengthen innovation in the electric bicycle segment and expand the reach of high-performance, tech-integrated cycling solutions

- In March 2022, Propella launched the 9S Pro, a new lightweight urban electric bike equipped with improved components, higher power, and greater speed capabilities. This development highlights Propella’s focus on advancing e-bike performance and rider experience. The launch is expected to boost competitiveness in the urban mobility space and attract consumers seeking efficient and tech-driven commuting solutions

- In March 2022, Bosch introduced a new smart system for bicycles that incorporates magneto ignition technology originally used in automobiles. This innovation enables seamless connectivity and enhanced control for cyclists. The move reflects Bosch's commitment to transforming traditional cycling through technological integration, potentially setting new standards in smart mobility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.