Global Bone Grafts And Substitutes Market

Market Size in USD Billion

CAGR :

%

USD

3.67 Billion

USD

5.41 Billion

2025

2033

USD

3.67 Billion

USD

5.41 Billion

2025

2033

| 2026 –2033 | |

| USD 3.67 Billion | |

| USD 5.41 Billion | |

|

|

|

|

Bone Grafts and Substitutes Market Size

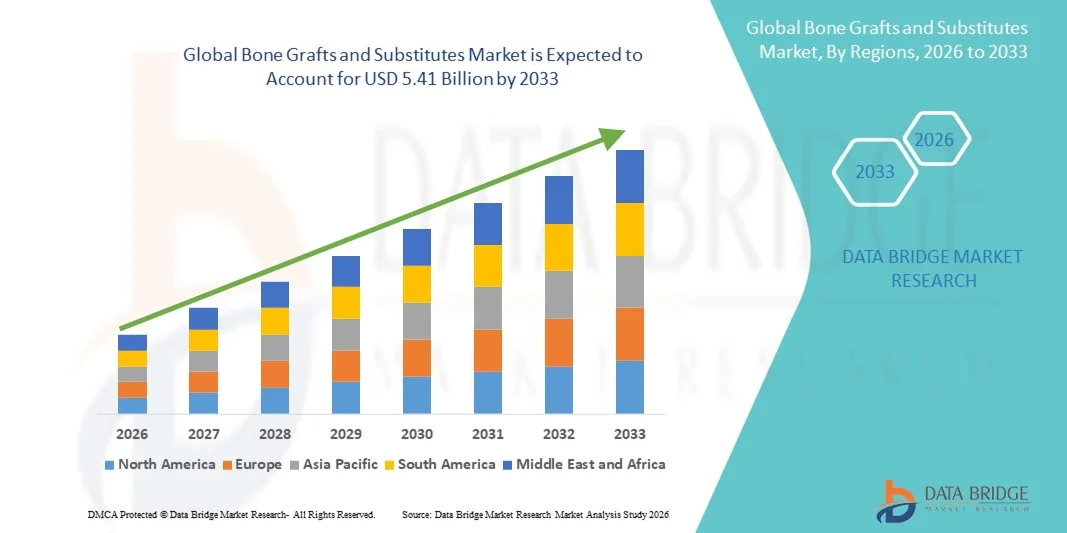

- The global bone grafts and substitutes market size was valued at USD 3.67 billion in 2025 and is expected to reach USD 5.41 billion by 2033, at a CAGR of4.99% during the forecast period

- The market growth is largely fueled by the increasing prevalence of orthopedic disorders, rising number of surgical procedures, and technological advancements in bone graft materials, leading to improved patient outcomes in both orthopedic and dental applications

- Furthermore, rising consumer demand for biocompatible, effective, and easy-to-use bone grafting solutions is establishing bone grafts and substitutes as the preferred choice for bone repair and regeneration. These converging factors are accelerating the uptake of Bone Grafts and Substitutes solutions, thereby significantly boosting the industry's growth

Bone Grafts and Substitutes Market Analysis

- Bone grafts and substitutes, including autografts, allografts, xenografts, and synthetic bone substitutes, are increasingly essential in orthopedic, dental, and spinal surgeries due to their ability to enhance bone regeneration, accelerate healing, and reduce post-surgical complications

- The market growth is primarily driven by rising incidence of orthopedic disorders, increasing demand for minimally invasive surgical procedures, technological advancements in biomaterials, and growing geriatric population requiring bone repair and reconstruction

- North America dominated the bone grafts and substitutes market with an estimated revenue share of 39.5% in 2025, attributed to advanced healthcare infrastructure, high adoption of innovative grafting materials, and a strong presence of leading market players in the U.S.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by expanding healthcare access, increasing orthopedic surgical procedures, rising awareness about advanced bone grafting solutions, and strong growth potential in countries such as China and India

- The Bone Grafts segment dominated the largest market revenue share of 58.4% in 2025, driven by the long-established clinical efficacy, high compatibility, and widespread adoption in orthopedic, dental, and spinal surgeries

Report Scope and Bone Grafts and Substitutes Market Segmentation

|

Attributes |

Bone Grafts and Substitutes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Medtronic (Ireland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Bone Grafts and Substitutes Market Trends

Growing Preference for Advanced Bone Grafts and Substitutes

- A significant and accelerating trend in the global bone grafts and substitutes market is the increasing adoption of advanced, synthetic, and bioactive bone graft materials over traditional autografts and allografts. These materials are gaining preference due to their reduced donor site complications, faster healing times, and improved osteoconductive and osteoinductive properties

- For instance, in 2024, Medtronic launched its Actifuse bone graft substitute across multiple hospitals in Europe and North America, highlighting its enhanced handling properties and clinical outcomes compared to conventional grafts

- Manufacturers are increasingly focusing on developing composite materials, including ceramics, polymers, and bioactive glasses, to enhance bone regeneration and integration in orthopedic and dental applications

- The rising prevalence of orthopedic disorders, spinal injuries, trauma, and dental defects is further accelerating the demand for efficient and reliable bone graft substitutes

- In addition, growing awareness among surgeons about patient safety, reduced surgical time, and predictable clinical results is driving the adoption of synthetic and alloplastic bone graft substitutes

- Consequently, key players are investing in research and development to offer next-generation bone graft materials that are resorbable, infection-resistant, and compatible with minimally invasive surgical techniques

Bone Grafts and Substitutes Market Dynamics

Driver

Rising Incidence of Orthopedic Disorders and Aging Population

- The increasing prevalence of orthopedic conditions such as osteoporosis, spinal disorders, fractures, and bone defects among the aging population is a major driver for the Bone Grafts and Substitutes market

- For instance, in 2025, Stryker reported a notable increase in demand for its demineralized bone matrix (DBM) products in the United States, especially for spinal fusion and orthopedic reconstructive procedures, due to higher orthopedic case volumes

- Growing surgical interventions, including spinal fusion, dental implants, and trauma reconstruction, are encouraging hospitals and surgical centers to adopt bone graft substitutes as safer and more convenient alternatives to autografts

- Advancements in material science and regenerative medicine are enabling manufacturers to develop graft substitutes that promote faster healing, reduce infection risks, and improve patient outcomes

- Furthermore, the increasing number of joint replacement surgeries and dental procedures in emerging markets is creating new growth opportunities for bone graft manufacturers

- These factors collectively are expected to significantly drive market expansion during the forecast period

Restraint/Challenge

High Costs and Regulatory Complexities

- The high cost of advanced bone graft substitutes compared to traditional grafts remains a key restraint, particularly in price-sensitive regions and smaller healthcare facilities

- For instance, in early 2025, several hospitals in Latin America deferred large-scale adoption of synthetic bone graft products due to budget limitations and reimbursement challenges

- Regulatory approvals for novel bone graft substitutes can be lengthy and complex, delaying product launches and increasing compliance costs for manufacturers

- There is also a need for extensive clinical trials to demonstrate safety, efficacy, and long-term outcomes, which can be time-consuming and resource-intensive

- In addition, surgeon familiarity and preference for conventional grafts in certain regions may slow the adoption of newer substitutes

- Overcoming these challenges through cost optimization, streamlined regulatory processes, and surgeon education programs will be vital for sustained growth in the Bone Grafts and Substitutes market

Bone Grafts and Substitutes Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the Bone Grafts and Substitutes market is segmented into Bone Grafts and Bone Graft Substitutes. The Bone Grafts segment dominated the largest market revenue share of 58.4% in 2025, driven by the long-established clinical efficacy, high compatibility, and widespread adoption in orthopedic, dental, and spinal surgeries. Bone grafts are preferred due to their osteoconductive, osteoinductive, and osteogenic properties, making them ideal for a variety of reconstructive procedures. Hospitals and specialty clinics often prioritize bone grafts for critical surgeries, supported by robust clinical evidence and regulatory approvals. The segment’s leadership is further strengthened by ongoing research improving graft performance, such as enhanced integration and reduced immunogenicity. Global acceptance in emerging markets such as Asia-Pacific also bolsters revenue share. Surgeons’ familiarity and long-standing trust in autografts and allografts contribute to sustained demand, complemented by insurance coverage in developed regions.

The Bone Graft Substitutes segment is expected to witness the fastest CAGR of 19.3% from 2026 to 2033, fueled by increasing demand for synthetic and composite alternatives to reduce donor-site morbidity and overcome limitations of autografts. Innovations in hydroxyapatite, tricalcium phosphate, and bioactive glass-based substitutes are expanding clinical applications. Growth is also supported by rising adoption in minimally invasive procedures and expanding use in dental and spinal fusion surgeries. Cost-effectiveness, availability, and customization options drive adoption in emerging regions. Increasing collaborations between biomaterial companies and hospitals for localized production further accelerate growth. The focus on advanced biomaterials with enhanced osteointegration and reduced infection risk supports rapid adoption. Government incentives for domestic manufacturing in regions like India and China also contribute to market expansion.

- By Application

On the basis of application, the market is segmented into Craniomaxillofacial, Dental, Foot and Ankle, Joint Reconstruction, Long Bone, and Spinal Fusion. The Spinal Fusion segment held the largest revenue share of 35.7% in 2025, owing to the high prevalence of spinal disorders, rising orthopedic surgeries, and the critical need for structural support and bone healing in fusion procedures. The segment’s dominance is driven by the growing aging population, incidence of degenerative spinal conditions, and technological advancements in minimally invasive spinal fusion techniques. The adoption of autografts, allografts, and synthetic substitutes in spinal surgeries ensures strong revenue generation. Surgeons’ preference for clinically validated materials, combined with favorable reimbursement policies in North America and Europe, further supports market leadership. Additionally, the rising prevalence of obesity and lifestyle-related spinal issues drives procedure volumes, increasing graft demand.

The Dental application segment is expected to witness the fastest CAGR of 20.1% from 2026 to 2033, fueled by the growing number of dental implant procedures, rising oral health awareness, and increasing use of bone substitutes in alveolar ridge augmentation. Adoption is particularly strong in emerging markets due to the rise in cosmetic dentistry and affordability of synthetic graft materials. Technological advancements such as CAD/CAM-guided graft placement enhance precision and outcomes, driving growth. Increasing collaborations between dental clinics and biomaterial suppliers ensure consistent supply and usage. Awareness campaigns promoting oral rehabilitation and regenerative procedures also support rapid market expansion.

- By End User

On the basis of end user, the market is segmented into Hospitals, Specialty Clinics, and Others. The Hospitals segment dominated the largest market revenue share of 62.5% in 2025, driven by the high volume of complex orthopedic, dental, and spinal surgeries performed in hospitals. Hospitals invest in advanced graft materials to improve patient outcomes and comply with stringent regulatory standards. Large hospital chains in North America and Europe adopt high-quality bone grafts and substitutes due to the demand for superior surgical outcomes and adherence to clinical protocols. Access to advanced surgical infrastructure, trained surgeons, and high patient footfall ensures sustained revenue dominance. Hospitals also benefit from bulk procurement agreements with suppliers, ensuring cost efficiencies and steady supply chains.

The Specialty Clinics segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, owing to the rise of outpatient orthopedic, dental, and cosmetic surgery centers. Increasing patient preference for minimally invasive procedures, reduced hospital stays, and cost-effective solutions drives adoption. Clinics in Asia-Pacific and Latin America are rapidly integrating synthetic substitutes to meet patient demand. Strategic collaborations with suppliers and local production units enable timely availability. Technological adoption, such as portable graft storage systems and simplified surgical kits, further supports growth. Rising awareness of regenerative and reconstructive procedures ensures continued expansion.

Bone Grafts and Substitutes Market Regional Analysis

- North America dominated the bone grafts and substitutes market with an estimated revenue share of 39.5% in 2025

- Attributed to advanced healthcare infrastructure, high adoption of innovative grafting materials, and a strong presence of leading market players in the U.S.

- The market growth is further supported by increasing orthopedic procedures, rising demand for minimally invasive surgeries, and continuous investments in R&D for next-generation bone graft solutions

U.S. Bone Grafts and Substitutes Market Insight

The U.S. bone grafts and substitutes market captured the largest revenue share within North America in 2025, driven by the high adoption of autografts, allografts, and synthetic grafting materials in orthopedic surgeries. The country’s well-established healthcare infrastructure, combined with a strong presence of major market players and ongoing clinical innovations, continues to propel market expansion.

Europe Bone Grafts and Substitutes Market Insight

The Europe bone grafts and substitutes market is projected to grow steadily throughout the forecast period, fueled by increasing prevalence of musculoskeletal disorders, rising geriatric population, and the adoption of advanced grafting techniques. Countries such as Germany, France, and the U.K. are witnessing rising demand for both autografts and allografts across orthopedic and spinal surgeries.

U.K. Bone Grafts and Substitutes Market Insight

The U.K. bone grafts and substitutes market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing number of orthopedic surgeries and growing awareness of innovative bone grafting solutions. Furthermore, government initiatives to improve surgical outcomes and adoption of minimally invasive procedures are supporting market growth.

Germany Bone Grafts and Substitutes Market Insight

Germany bone grafts and substitutes market is expected to expand at a significant CAGR, supported by a well-developed healthcare system, rising orthopedic surgical volumes, and growing adoption of synthetic and bioactive bone grafts. Increasing focus on research and development in regenerative medicine also drives market growth.

Asia-Pacific Bone Grafts and Substitutes Market Insight

The Asia-Pacific bone grafts and substitutes market is expected to be the fastest-growing region during the forecast period, driven by expanding healthcare access, increasing orthopedic surgical procedures, rising awareness about advanced bone grafting solutions, and strong growth potential in countries such as China and India. The rapid development of hospital infrastructure and growing medical tourism in the region further accelerates market adoption.

China Bone Grafts and Substitutes Market Insight

China bone grafts and substitutes market accounted for a significant share of the Asia-Pacific market in 2025, supported by the expanding middle class, rising healthcare expenditure, and increasing number of orthopedic surgeries. The availability of innovative graft materials, along with strong domestic manufacturing capabilities, is further propelling the market.

India Bone Grafts and Substitutes Market Insight

India bone grafts and substitutes market is witnessing rapid growth due to rising orthopedic surgical volumes, increasing awareness of advanced bone grafting materials, and government initiatives to improve surgical care. The market is expected to grow robustly with the expansion of private healthcare facilities and increasing investments in medical technologies.

Bone Grafts and Substitutes Market Share

The Bone Grafts and Substitutes industry is primarily led by well-established companies, including:

• Medtronic (Ireland)

• Stryker (U.S.)

• Zimmer Biomet (U.S.)

• NuVasive (U.S.)

• Orthofix (U.S.)

• Johnson & Johnson (U.S.)

• Globus Medical (U.S.)

• RTI Surgical (U.S.)

• Geistlich Pharma (Switzerland)

• Baxter International (U.S.)

• Smith & Nephew (U.K.)

• BioHorizons (U.S.)

• Cam Bioceramics (Italy)

• IsoTis OrthoBiologics (Switzerland)

• B. Braun Melsungen (Germany)

• AlloSource (U.S.)

• Wright Medical Group (U.S.)

• Amedica Corporation (U.S.)

• Orthopaedic Implants Ltd (U.K.)

Latest Developments in Global Bone Grafts and Substitutes Market

- In April 2023, ZimVie Inc. — a leading life sciences company specializing in dental and spine solutions — introduced two new biomaterials, RegenerOss Bone Graft Plug and RegenerOss CC Allograft Particulate, expanding its bone graft product portfolio to improve surgical outcomes in orthopedic and dental applications. Both products are designed to enhance handling, support bone regeneration, and offer longer shelf life, reinforcing ZimVie’s commitment to advanced regenerative solutions in key therapeutic areas

- In June 2023, BONESUPPORT, a Sweden‑based medical technology company, launched CERAMENT G, an antibiotic‑eluting bone graft substitute with enhanced usability, reduced environmental impact, and extended shelf life. The new iteration of CERAMENT is 28 % smaller and includes surface‑sterile components, optimizing surgical workflows and increasing efficiency for surgical teams in treating bone injuries and orthopedic conditions

- In January 2023, Nobel Biocare introduced creos syntogain, a biomimetic bone graft alternative developed in collaboration with Mimetis Biomaterials S.L., aimed at advancing dental reconstruction procedures. This collaboration underscores increasing focus on regenerative dental graft solutions that mimic natural bone architecture for improved clinical performance

- In January 2024, Stryker Corporation announced FDA approval of Reef DBM Putty Plus with Antibiotic, a new bone graft substitute incorporating antibiotic technology to reduce the risk of postoperative infections during grafting procedures. This approval represents a significant regulatory milestone for Stryker’s biologics portfolio in the U.S. market

- In March 2024, Medtronic plc and Orthofix Medical Inc. entered into a strategic partnership to expand their combined offerings in the bone graft substitutes market, merging Medtronic’s orthopedic expertise with Orthofix’s biologics portfolio to deliver comprehensive spinal and orthopedic graft solutions to healthcare providers

- In May 2024, Smith & Nephew completed the acquisition of Osiris Therapeutics, a regenerative medicine company with a strong portfolio of bone graft substitutes and cell therapies, strengthening Smith & Nephew’s presence in advanced biologic solutions for bone regeneration

- In February 2025, SCTIMST (Sree Chitra Tirunal Institute for Medical Sciences & Technology) launched two drug‑eluting bone graft products, CASPRO and BONYX, developed by its Biomedical Technology Wing and commercialized via Onyx Medicals in India, highlighting innovation in graft materials tailored to enhance healing and therapeutic performance in orthopedic applications

- In March 2025, Elute received FDA clearance for BonVie+, a synthetic resorbable bone void filler designed for controlled resorption and replacement by new bone, marking a significant product authorization that expands clinicians’ options for bone repair and remodeling procedures

- In June 2025, Xtant Medical announced the launch of Osteofactor Pro, a next‑generation bone graft substitute engineered to support bone healing in spinal and orthopedic surgeries, reflecting industry trends toward advanced graft materials with enhanced biological performance in complex procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.