Global Bouillon Market

Market Size in USD Billion

CAGR :

%

USD

10.71 Billion

USD

13.67 Billion

2025

2033

USD

10.71 Billion

USD

13.67 Billion

2025

2033

| 2026 –2033 | |

| USD 10.71 Billion | |

| USD 13.67 Billion | |

|

|

|

|

What is the Global Bouillon Market Size and Growth Rate?

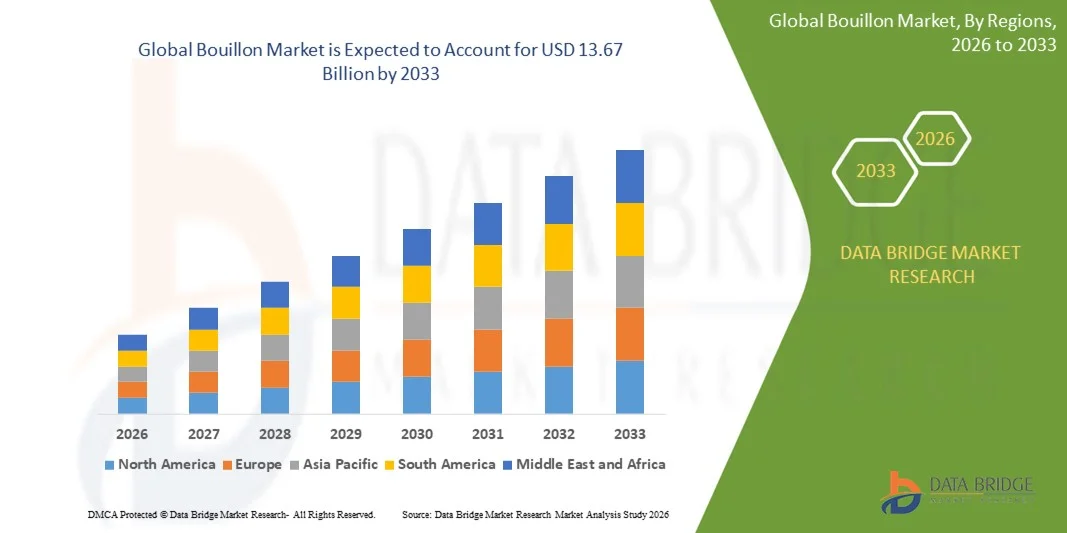

- The global bouillon market size was valued at USD 10.71 billion in 2025 and is expected to reach USD 13.67 billion by 2033, at a CAGR of3.10% during the forecast period

- Rise in the demand for soups & packaged food products is a vital factor escalating the market growth, also rise in the awareness regarding health benefits of bouillon products, rise in the inclination towards healthy eating habits among people and changing lifestyle of people and inclination towards consumption of easy to make and healthy food products are the major factors among others driving the bouillon market

What are the Major Takeaways of Bouillon Market?

- Rise in the research and development activities and increase in the technological advancements and modernization in the production techniques will further create new opportunities for the bouillon market

- However, rise in the presence of harmful flavouring agent acts as the major factors among others acting as restraints, and will further challenge the bouillon market

- Europe dominated the bouillon market with an estimated 43.23% revenue share in 2025, driven by strong consumption of packaged and convenience foods, long-established culinary traditions, and high penetration of soups, stocks, and seasoning products across households and foodservice outlets

- Asia-Pacific is projected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by rising urbanization, growing disposable incomes, expansion of modern retail, and increasing adoption of convenience and processed food across China, India, Japan, South Korea, and Southeast Asia

- The Vegetable bouillon segment dominated the market with an estimated 34.6% share in 2025, driven by rising demand for plant-based, vegan, and clean-label food products

Report Scope and Bouillon Market Segmentation

|

Attributes |

Bouillon Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Bouillon Market?

Increasing Shift Toward Clean-Label, Plant-Based, and Convenient Bouillon Products

- The bouillon market is witnessing a strong shift toward clean-label, low-sodium, and plant-based formulations, driven by rising consumer focus on health, transparency, and natural ingredients

- Manufacturers are introducing organic, vegan, and additive-free bouillon cubes, powders, and liquids to cater to flexitarian, vegetarian, and health-conscious consumers

- Growing preference for convenient cooking solutions is boosting demand for ready-to-use bouillon formats across households, foodservice, and quick-service restaurants

- For instance, leading brands such as Nestlé, Unilever, and McCormick have expanded their bouillon portfolios with reduced-salt and natural ingredient variants

- Rising use of bouillon as a flavor enhancer in soups, sauces, snacks, and ready meals is accelerating market penetration

- As global cooking habits evolve toward faster yet healthier meal preparation, bouillon products will remain essential pantry staples worldwide

What are the Key Drivers of Bouillon Market?

- Rising demand for convenient and time-saving cooking ingredients among urban consumers and working populations

- For instance, in recent years, companies such as Kraft Heinz, Hormel Foods, and Goya Foods have strengthened distribution of bouillon cubes and powders across retail and online channels

- Increasing consumption of processed and packaged foods is driving the use of bouillon as a base ingredient in food manufacturing

- Growing popularity of international cuisines is expanding bouillon usage in diverse culinary applications

- Expansion of foodservice outlets, cloud kitchens, and quick-service restaurants is boosting bulk demand

- Supported by population growth, urbanization, and evolving dietary habits, the bouillon market is expected to register steady long-term growth

Which Factor is Challenging the Growth of the Bouillon Market?

- Rising concerns over high sodium content in conventional bouillon products limit adoption among health-conscious consumers

- For instance, during 2023–2025, increased regulatory scrutiny on salt intake and labeling norms pressured manufacturers to reformulate products

- Volatility in raw material prices, including spices, vegetables, and meat extracts, impacts production costs

- Growing competition from homemade stocks, fresh broths, and alternative seasoning products affects market differentiation

- Limited penetration in price-sensitive and rural markets restricts volume growth

- To overcome these challenges, companies are focusing on low-sodium formulations, clean-label innovation, premiumization, and wider distribution, supporting sustained adoption of bouillon products globally

How is the Bouillon Market Segmented?

The market is segmented on the basis of product type, form, and distribution channel.

- By Product Type

On the basis of product type, the bouillon market is segmented into Vegetable, Fish, Meat, Poultry, Beef, and Others. The Vegetable bouillon segment dominated the market with an estimated 34.6% share in 2025, driven by rising demand for plant-based, vegan, and clean-label food products. Increasing health awareness, lower fat content, and suitability for vegetarian and flexitarian diets have strengthened adoption across households and foodservice applications. Vegetable bouillons are widely used in soups, sauces, ready meals, and snacks due to their versatility and cost-effectiveness.

The Meat-based bouillon segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by strong consumer preference for rich umami flavors, growing meat consumption in emerging economies, and rising use in quick-service restaurants and processed food manufacturing. Expansion of premium meat extracts and authentic regional flavors is further accelerating growth.

- By Form

On the basis of form, the market is segmented into Cubes, Liquid, Powder, Granules, and Others. The Cubes segment dominated the market with a 46.2% share in 2025, owing to ease of storage, longer shelf life, precise portion control, and widespread availability across retail channels. Bouillon cubes are highly popular among households and small foodservice operators due to their affordability and convenience.

The Liquid bouillon segment is projected to register the fastest CAGR from 2026 to 2033, driven by demand for premium, clean-label, and ready-to-use cooking solutions. Liquid formats offer superior flavor dispersion, reduced processing, and appeal to gourmet cooking and professional kitchens. Growing adoption in urban markets and online retail is further supporting rapid expansion.

- By Distribution Channel

On the basis of distribution channel, the bouillon market is segmented into Supermarket/Hypermarket, Independent Grocery Stores, Online Retail, and Other Retail Formats. The Supermarket/Hypermarket segment dominated the market with a 41.8% share in 2025, supported by wide product assortment, strong brand visibility, competitive pricing, and high consumer footfall. These channels remain the primary purchasing point for packaged food products globally.

The Online retail segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising e-commerce adoption, convenience of home delivery, availability of niche and premium products, and expanding digital grocery platforms. Increased smartphone penetration and changing shopping behavior are accelerating online sales of bouillon products worldwide.

Which Region Holds the Largest Share of the Bouillon Market?

- Europe dominated the bouillon market with an estimated 43.23% revenue share in 2025, driven by strong consumption of packaged and convenience foods, long-established culinary traditions, and high penetration of soups, stocks, and seasoning products across households and foodservice outlets. Countries such as Germany, France, the U.K., Italy, and Spain exhibit strong demand for vegetable, meat, and premium bouillon variants

- Leading manufacturers in Europe are focusing on clean-label formulations, reduced sodium content, organic ingredients, and sustainable packaging, strengthening the region’s competitive positioning. Continuous innovation in plant-based and gourmet bouillon products further supports market expansion

- High consumer awareness regarding nutrition, strong retail infrastructure, and widespread availability across supermarkets and specialty stores reinforce Europe’s market leadership

France Bouillon Market Insight

France is a major contributor in Europe, supported by increasing demand for gourmet and convenience food, strong presence of retail chains, and rising adoption of high-quality bouillon products in households and foodservice sectors. Premium product launches and sustainable packaging initiatives drive market growth.

Germany Bouillon Market Insight

Germany shows steady growth due to high consumer awareness of health-oriented and organic bouillon options, combined with strong distribution networks and innovative product offerings. The growing trend of home cooking and meal kits further supports adoption.

Italy Bouillon Market Insight

Italy contributes significantly with rising culinary tourism, strong preference for authentic flavors, and increasing penetration of processed and ready-to-use bouillons in both retail and foodservice. Local manufacturers and artisanal brands strengthen the market.

U.K. Bouillon Market Insight

The U.K. market benefits from convenience-driven consumption, strong retail presence, and increasing demand for premium, low-sodium, and organic bouillons. Supermarkets and e-commerce channels are expanding product availability, enhancing adoption.

Asia-Pacific Bouillon Market

Asia-Pacific is projected to register the fastest CAGR of 11.36% from 2026 to 2033, driven by rising urbanization, growing disposable incomes, expansion of modern retail, and increasing adoption of convenience and processed food across China, India, Japan, South Korea, and Southeast Asia. High demand for instant soups, meal bases, and ready-to-cook products accelerates market growth. Local manufacturing capabilities, evolving taste preferences, and expanding e-commerce platforms further support rapid adoption.

China Bouillon Market Insight

China leads Asia-Pacific with growing processed food consumption, expanding urban households, and rising preference for ready-to-cook solutions. Innovation in flavors and packaging drives domestic and export growth.

India Bouillon Market Insight

India is emerging as a key growth hub, driven by rising urban population, busy lifestyles, and growing retail penetration of instant and convenient cooking products. Flavor diversification and premium offerings are enhancing market penetration.

Japan Bouillon Market Insight

Japan exhibits steady growth with high adoption of gourmet and convenience bouillons, supported by a strong retail network and evolving culinary trends. Consumers increasingly prefer healthy and organic options.

South Korea Bouillon Market Insight

South Korea contributes significantly due to rising demand for instant meal bases, premium bouillon products, and modern retail expansion. Innovation in packaging and product differentiation further accelerates market adoption.

Which are the Top Companies in Bouillon Market?

The bouillon industry is primarily led by well-established companies, including:

- Nestlé (Switzerland)

- International Dehydrated Foods, Inc. (U.S.)

- Unilever (U.K.)

- McCormick & Company, Inc. (U.S.)

- The Kraft Heinz Company (U.S.)

- Hormel Foods Corporation (U.S.)

- Southern Mills, Inc. (U.S.)

- Goya Foods, Inc. (U.S.)

- Proliver (Turkey)

What are the Recent Developments in Global Bouillon Market?

- In September 2024, Better Than Bouillon announced the launch of a new Organic Beef Pho Base from its Culinary Collection, made with roasted beef, beef stock, ginger, and anise, enabling consumers to prepare a rich and flavorful pho broth, and enhancing the brand’s organic product portfolio

- In February 2024, Watson’s Seasoning Blends, a premium seasoning provider from the U.S., launched new vegan bouillon flavors, including Vegan Beef Bouillon and Vegan Chicken Bouillon, to expand its product portfolio and cater to the growing demand for plant-based food products, strengthening its position in the vegan segment

- In December 2023, Unilever announced the expansion of product innovation beyond ingredient restrictions, promoting healthier foods with positive nutrition standards based on a study conducted at its Unilever Foods Innovation Center in the Netherlands, reinforcing its commitment to health-oriented product development

- In October 2023, Hormel Foods Corporation launched HERB-OX Cold Water Dissolve Beef and Chicken Bouillon, the first products of their kind that dissolve in cold water for convenient preparation of soups, gravies, and stews, providing enhanced convenience and flavor, and boosting product differentiation

- In August 2022, Veggiebel, a bouillon manufacturer from Belgium, launched organic and vegan bouillon cubes under its V-Cubes line, available in flavors such as Chicken, Beef, Fish, and Pad Thai made from 100% natural spices, strengthening the brand’s presence in the organic and plant-based market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bouillon Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bouillon Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bouillon Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.