Global Brewing Materials Market

Market Size in USD Billion

CAGR :

%

USD

38.30 Billion

USD

67.30 Billion

2025

2033

USD

38.30 Billion

USD

67.30 Billion

2025

2033

| 2026 –2033 | |

| USD 38.30 Billion | |

| USD 67.30 Billion | |

|

|

|

|

Brewing Materials Market Size

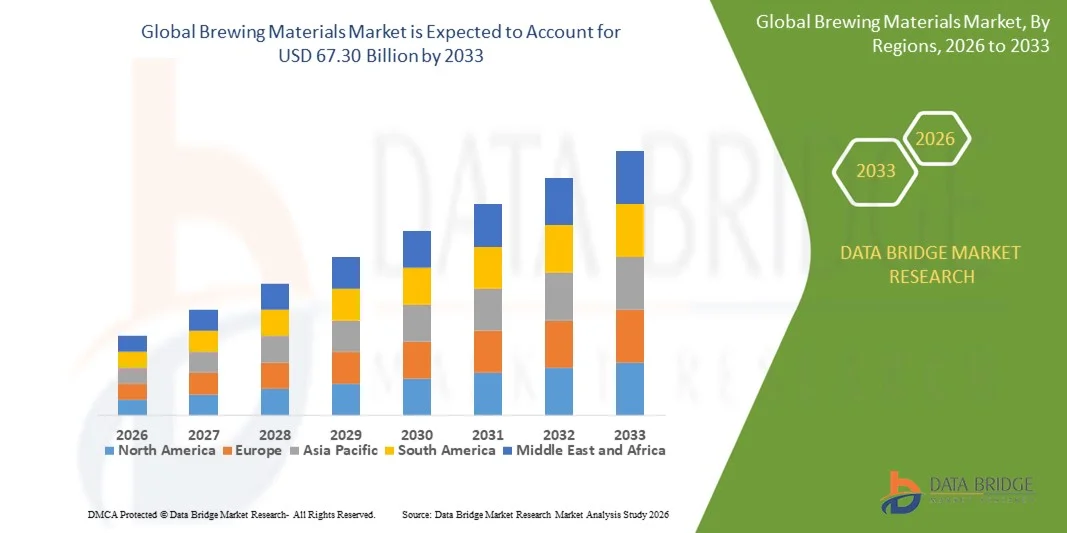

- The global brewing materials market size was valued at USD 38.30 billion in 2025 and is expected to reach USD 67.30 billion by 2033, at a CAGR of 7.30% during the forecast period

- The market growth is largely fuelled by rising global beer consumption, expansion of craft breweries, and increasing demand for premium and specialty brews

- Growing investments in brewery infrastructure and continuous innovation in ingredients such as malt, hops, and yeast are further supporting market expansion

Brewing Materials Market Analysis

- The brewing materials market is driven by strong demand from both commercial breweries and emerging microbreweries seeking consistent quality and differentiated flavors

- Increasing consumer preference for craft, organic, and flavored beers is encouraging brewers to adopt high-quality and sustainable brewing inputs, positively influencing overall market growth

- North America dominated the global brewing materials market with the largest revenue share of 38.5% in 2025, driven by the growing demand for craft and specialty beers, as well as the increasing number of breweries and brewpubs across the U.S. and Canada

- Asia-Pacific region is expected to witness the highest growth rate in the global brewing materials market, driven by rising beer consumption, expanding craft beer culture, modernization of brewing infrastructure, and increased adoption of high-quality brewing ingredients in countries such as China, Japan, and India

- The Grains segment held the largest market revenue share in 2025, driven by their essential role in fermentation and flavor development in beer production. Grains provide the base sugars required for yeast activity and contribute significantly to the color, body, and aroma of the final product, making them a key choice for both macro and craft breweries. In addition, the increasing adoption of high-quality barley and wheat varieties has further strengthened the demand for grains in brewing. The segment benefits from steady supply chains and the ability to support large-scale production efficiently

Report Scope and Brewing Materials Market Segmentation

|

Attributes |

Brewing Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Brewing Materials Market Trends

Rising Demand For Craft And Premium Beverages

- The increasing global preference for craft, premium, and specialty beers is significantly shaping the brewing materials market, as consumers seek distinctive flavors, higher quality, and authentic brewing experiences. Brewing materials such as specialty malts, aroma hops, and advanced yeast strains are gaining traction due to their ability to enhance taste, aroma, and consistency. This trend is strengthening adoption across large breweries and microbreweries, encouraging continuous innovation in ingredient sourcing and processing

- Growing interest in artisanal and locally produced beverages has accelerated demand for high-quality brewing inputs across beer, cider, and emerging fermented drinks. Craft brewers are increasingly experimenting with unique malt profiles, hop varieties, and fermentation techniques, driving demand for diverse and premium brewing materials. This has also led to closer collaboration between ingredient suppliers and brewers to develop customized solutions

- Premiumization trends are influencing purchasing decisions, with breweries emphasizing ingredient transparency, origin authenticity, and sustainability. These factors help brewers differentiate products in competitive markets and build strong brand identity, while also supporting the use of traceable and responsibly sourced brewing materials. Marketing strategies increasingly highlight ingredient quality to appeal to discerning consumers

- For instance, in 2024, Heineken in the Netherlands and BrewDog in the U.K. expanded their premium and craft beer portfolios by incorporating specialty malts and aroma hop varieties. These product launches targeted consumers seeking unique flavor profiles and higher-quality brews, with distribution across on-trade and off-trade channels. The focus on ingredient quality contributed to higher consumer engagement and brand loyalty

- While demand for premium brewing materials is rising, sustained market growth depends on consistent supply, cost management, and maintaining quality across large-scale production. Suppliers are focusing on improving yield efficiency, expanding sourcing networks, and investing in R&D to balance performance, cost, and flavor innovation

Brewing Materials Market Dynamics

Driver

Growing Expansion Of Craft And Microbreweries

- The rapid growth of craft and microbreweries worldwide is a major driver for the brewing materials market. Independent brewers rely heavily on high-quality malts, hops, yeast, and adjuncts to differentiate their products, fueling demand for specialized brewing ingredients. This trend is also encouraging ingredient suppliers to diversify product offerings and support small-scale brewers

- Expanding applications across beer, flavored alcoholic beverages, and low- and non-alcoholic brews are contributing to market growth. Brewing materials play a critical role in enhancing taste, mouthfeel, and stability, enabling brewers to meet evolving consumer preferences for variety and quality. The rising popularity of experimental and seasonal brews further supports this driver

- Breweries are actively investing in product innovation and capacity expansion, supported by strong consumer demand and favorable regulatory environments in several regions. These developments encourage partnerships between breweries and raw material suppliers to ensure reliable supply, consistent quality, and innovation in brewing techniques

- For instance, in 2023, Anheuser-Busch InBev in Belgium and Carlsberg Group in Denmark reported increased procurement of specialty malts and advanced yeast strains to support new product launches. This expansion aligned with growing demand for craft-style and premium beers, enhancing product differentiation and market competitiveness

- Although craft brewery expansion supports market growth, continued momentum depends on raw material availability, price stability, and technical support for brewers. Investments in sustainable agriculture, supplier integration, and brewing technology will be essential to sustain long-term demand for brewing materials

Restraint/Challenge

Volatility In Raw Material Prices And Supply Constraints

- Fluctuating prices of key raw materials such as barley, hops, and yeast present a major challenge for the brewing materials market. Climate variability, crop yield fluctuations, and rising input costs can impact pricing stability and profit margins for both suppliers and brewers. These uncertainties make long-term procurement planning more complex

- Supply constraints and dependency on agricultural output create challenges in meeting consistent quality and volume requirements. Smaller breweries are particularly vulnerable to supply disruptions, which can affect production schedules and product consistency. Limited availability of specialty hops and malts further intensifies competition among buyers

- Logistics and storage challenges also affect market growth, as brewing materials often require controlled storage conditions to preserve quality. Transportation delays, rising freight costs, and infrastructure limitations can increase operational expenses and impact timely delivery to breweries

- For instance, in 2024, breweries in the U.S. and Germany reported supply pressure on specialty hop varieties due to adverse weather conditions and increased global demand. Craft brewers and ingredient distributors faced higher costs and longer lead times, prompting some producers to reformulate recipes or limit seasonal offerings

- Addressing these challenges will require improved agricultural practices, diversified sourcing strategies, and stronger supplier-brewer collaborations. Investment in climate-resilient crops, inventory management, and supply chain optimization will be critical to ensure stable growth of the global brewing materials market

Brewing Materials Market Scope

The market is segmented on the basis of source, function, form, brewery size, and end users.

- By Source

On the basis of source, the brewing materials market is segmented into Malt Extract, Grains, Yeasts, and Beer Additives. The Grains segment held the largest market revenue share in 2025, driven by their essential role in fermentation and flavor development in beer production. Grains provide the base sugars required for yeast activity and contribute significantly to the color, body, and aroma of the final product, making them a key choice for both macro and craft breweries. In addition, the increasing adoption of high-quality barley and wheat varieties has further strengthened the demand for grains in brewing. The segment benefits from steady supply chains and the ability to support large-scale production efficiently

The Yeasts segment is expected to witness the fastest growth rate from 2026 to 2033, driven by innovations in yeast strains that enhance fermentation efficiency and impart unique flavor profiles. Yeasts are particularly valued for their ability to influence beer aroma and taste, making them a preferred component for craft brewers seeking differentiation and high-quality specialty beers. The growing trend of experimental and specialty beers, including sour, fruit-infused, and seasonal variants, is further fueling the adoption of diverse yeast strains

- By Function

On the basis of function, the market is segmented into Fragrance, Preservatives, Flavours, Proteins, and Others. The Flavours segment held the largest share in 2025 due to the increasing demand for unique and diverse beer profiles among consumers, which encourages breweries to incorporate a variety of natural and synthetic flavoring agents. Brewers are focusing on creating innovative flavors to attract younger demographics and global consumers seeking distinctive taste experiences. Flavor enhancers also help in balancing bitterness and aroma, contributing to a consistent and appealing final product. Growing consumer preference for flavored and craft beers supports sustained growth in this segment

The Proteins segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising need for beer clarity, foam stability, and improved mouthfeel, which are critical quality parameters for both commercial and craft beer production. Proteins help improve the overall sensory profile and shelf life of beer, making them indispensable for premium and craft brewers. The adoption of protein additives is increasing, especially among breweries aiming to enhance product quality without compromising taste or stability. Technological advancements in protein extraction and formulation further support market growth

- By Form

On the basis of form, the brewing materials market is segmented into Dry and Liquid. The Dry segment dominated the market in 2025 owing to its longer shelf life, ease of transport, and consistent quality, making it a practical choice for large-scale brewing operations. Dry materials are cost-effective, allow precise measurement, and reduce the risk of microbial contamination, which is crucial for maintaining product safety and quality. The segment also supports automated and high-capacity production lines, ensuring efficiency and minimal downtime

The Liquid segment is anticipated to grow rapidly from 2026 to 2033, fueled by the growing preference for ready-to-use formulations that simplify the brewing process and reduce preparation time, particularly among small and craft breweries. Liquid materials offer better solubility and faster incorporation into brewing processes, enhancing operational efficiency. Breweries are increasingly adopting liquid extracts and concentrates to maintain consistent quality while experimenting with new flavors and recipes. The convenience and reduced handling requirements make this segment attractive for emerging microbreweries

- By Brewery Size

On the basis of brewery size, the market is segmented into Macro Brewery and Craft Brewery. The Macro Brewery segment held the largest market share in 2025, driven by the scale of production, standardized recipes, and established distribution networks that require consistent and high-volume raw materials. Large breweries leverage economies of scale, ensuring cost-effective sourcing and supply chain efficiency. They also have the capacity to invest in high-quality raw materials to meet consumer expectations across global markets. Consistent product quality and mass production capabilities make this segment a key revenue contributor

The Craft Brewery segment is expected to witness the fastest growth rate during 2026–2033 due to the rising popularity of craft beers, experimentation with new flavors, and the increasing number of small-scale breweries entering the market. Craft breweries focus on innovation, premium ingredients, and unique brewing techniques to differentiate their products. The growing consumer preference for artisanal and locally brewed beers fuels the demand for high-quality brewing materials. Flexible production capabilities and direct-to-consumer sales models also encourage rapid adoption of specialty materials

- By End Users

On the basis of end users, the market is segmented into Microbreweries, Brewpubs, Contract Brewery, Craft Brewers, and Others. The Craft Brewers segment dominated in 2025, fueled by the growing consumer demand for artisanal and specialty beers that offer unique taste experiences. Craft brewers prioritize premium ingredients and innovative formulations to stand out in competitive markets. Their focus on small-batch production allows experimentation with flavors, yeasts, and brewing techniques, driving the need for specialized raw materials. Increasing brand awareness and consumer willingness to pay a premium for high-quality craft beers support sustained growth

The Microbreweries segment is expected to witness the fastest growth rate from 2026 to 2033, supported by the increasing number of small-scale brewing setups, innovation in product offerings, and rising interest in locally produced beers. Microbreweries often serve niche markets and cater to local tastes, requiring flexible and diverse brewing materials. They benefit from simplified processes and ready-to-use formulations, enabling them to maintain quality while experimenting with new beer styles. Government initiatives supporting small breweries in various regions further enhance the growth potential of this segment

Brewing Materials Market Regional Analysis

- North America dominated the global brewing materials market with the largest revenue share of 38.5% in 2025, driven by the growing demand for craft and specialty beers, as well as the increasing number of breweries and brewpubs across the U.S. and Canada

- Consumers and brewers in the region highly value high-quality raw materials, consistent supply, and innovative ingredients that enhance flavor, aroma, and beer quality

- This widespread adoption is further supported by strong disposable incomes, a well-established beer culture, and the preference for premium and craft beers, establishing North America as a key revenue contributor

U.S. Brewing Materials Market Insight

The U.S. brewing materials market captured the largest revenue share in 2025 within North America, fueled by the rapid growth of craft breweries and the rising trend of specialty beers. Brewers are increasingly focusing on premium ingredients such as high-quality grains, specialty yeasts, and natural flavoring agents to differentiate their products. The growing interest in small-batch and artisanal beers, combined with rising consumer demand for unique flavor profiles, further drives the adoption of diverse brewing materials. In addition, the expansion of home brewing and DIY beer kits contributes to market growth.

Europe Brewing Materials Market Insight

The Europe brewing materials market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing demand for craft beers and innovative brewing techniques across countries such as Germany, the U.K., and Belgium. Stringent quality standards and sustainability-focused brewing practices are encouraging the use of high-quality raw materials. The growing preference for flavored and specialty beers, along with the expansion of microbreweries and brewpubs, supports the market. Brewers are also investing in natural additives and specialty yeasts to cater to evolving consumer tastes.

U.K. Brewing Materials Market Insight

The U.K. brewing materials market is expected to witness strong growth from 2026 to 2033, driven by rising craft beer consumption and the increasing number of small and medium-sized breweries. Brewers are prioritizing ingredients that enhance flavor, aroma, and visual appeal, while also focusing on sustainable and locally sourced raw materials. Consumer demand for innovative beer styles and premium products encourages breweries to adopt advanced brewing materials. Moreover, the U.K.’s robust retail and distribution networks facilitate the wider availability of specialty brewing ingredients.

Germany Brewing Materials Market Insight

The Germany brewing materials market is expected to witness steady growth from 2026 to 2033, fueled by the country’s strong beer culture, high-quality brewing standards, and demand for specialty and craft beers. Brewers in Germany focus on traditional grains, malt extracts, and specific yeast strains to maintain product authenticity and consistency. The emphasis on quality and innovation promotes the use of advanced brewing materials, while sustainable practices in sourcing and production align with consumer preferences. Integration of modern brewing technologies further drives efficiency and adoption.

Asia-Pacific Brewing Materials Market Insight

The Asia-Pacific brewing materials market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and growing interest in craft and specialty beers in countries such as China, Japan, and India. The expansion of microbreweries, brewpubs, and contract breweries is supporting increased consumption of high-quality raw materials. Government initiatives promoting local production, digital brewing solutions, and modernization of brewing infrastructure further boost market growth. The growing beer culture and experimentation with flavors among younger consumers are accelerating adoption.

Japan Brewing Materials Market Insight

The Japan brewing materials market is expected to witness rapid growth from 2026 to 2033 due to increasing consumer preference for premium beers and innovative flavors. The country’s technologically advanced brewing industry emphasizes quality ingredients, including specialized yeasts, malt extracts, and flavoring agents. The growing popularity of craft beer and small-scale breweries, along with the aging population seeking easier-to-consume premium beverages, further propels the demand. Integration of brewing materials with modern techniques and focus on consistent taste profiles supports market expansion.

China Brewing Materials Market Insight

The China brewing materials market accounted for the largest market revenue share in Asia Pacific in 2025, driven by rapid urbanization, rising middle-class incomes, and increasing beer consumption. The country is witnessing a surge in craft beer, microbreweries, and brewpubs, which is fueling demand for diverse and high-quality brewing ingredients. Government support for local breweries, coupled with the availability of cost-effective raw materials and domestic manufacturers, is boosting adoption. The growing beer culture, coupled with experimentation with flavors and specialty ingredients, is further propelling market growth.

Brewing Materials Market Share

The Brewing Materials industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- Angel Yeast (China)

- BOORTMALT (Belgium)

- Malteurop (France)

- Rahr Corporation (U.S.)

- Lallemand Inc. (Canada)

- Viking Malt (Finland)

- Lesaffre (France)

- Maltexco S.A. (Belgium)

- Simpsons Malt (U.K.)

- PUREMALT PRODUCTS LTD (U.K.)

- IREKS GmbH (Germany)

- Leiber GmbH (Germany)

- Imperial Malts Ltd. (U.K.)

- Holland Malt (Netherlands)

- Imperial Yeast (U.S.)

- Mahalaxmi Malt Products Private Limited (India)

- PMV Maltings Pvt. Ltd. (India)

- Cereal and Malt (India)

- Cereal Food Manufacturing Company (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Brewing Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Brewing Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Brewing Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.