Global Business Process As A Service Bpaas Market

Market Size in USD Billion

CAGR :

%

USD

66.13 Billion

USD

172.10 Billion

2024

2032

USD

66.13 Billion

USD

172.10 Billion

2024

2032

| 2025 –2032 | |

| USD 66.13 Billion | |

| USD 172.10 Billion | |

|

|

|

|

Business Process as a Service (BPaaS) Market Size

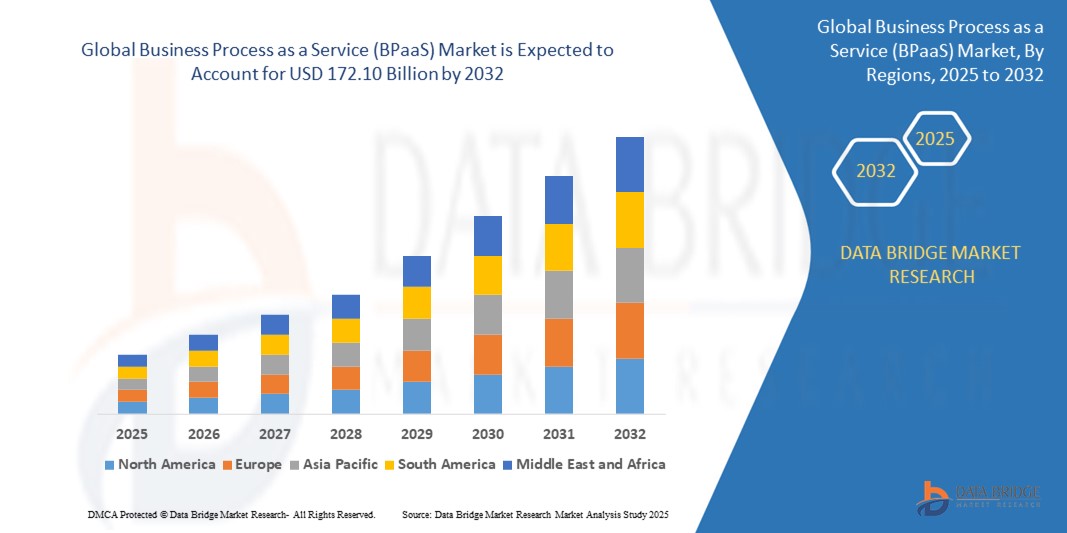

- The global business process as a service (BPaaS) market size was valued at USD 66.13 billion in 2024 and is expected to reach USD 172.10 billion by 2032, at a CAGR of 12.7% during the forecast period

- The market growth is largely fueled by the increasing shift of enterprises toward cloud-based infrastructure and digital transformation strategies, enabling streamlined operations, cost efficiency, and scalability across various business functions

- Furthermore, rising demand for automation, AI-driven insights, and flexible service delivery models is positioning BPaaS as a preferred solution for organizations seeking to modernize processes and enhance operational agility, thereby significantly boosting the industry's growth

Business Process as a Service (BPaaS) Market Analysis

- Business process as a service (BPaaS) is defined as the delivery of cloud-sourced and multitenancy-built business process outsourcing (BPO) services. Services are often automated, and there is no publicly dedicated labor pool per client when human process actors are needed. The pricing models are commercial words based on usage or on subscription. The BPaaS model as a cloud service is accessed through Internet-based technologies

- The escalating demand for BPaaS is primarily fueled by the growing adoption of digital transformation initiatives, increased reliance on cloud infrastructure, and the rising need for agile, data-driven, and outcome-focused business process solutions

- North America dominated the business process as a service (BPaaS) market with a share of 44.4% in 2024, due to early cloud adoption, mature IT infrastructure, and growing demand for cost-effective business process outsourcing across key industries such as BFSI, healthcare, and IT

- Asia-Pacific is expected to be the fastest growing region in the business process as a service (BPaaS) market during the forecast period due to rapid urbanization, growing SME sector, and increasing cloud adoption in countries such as China, India, and Japan

- Finance and accounting segment dominated the market with a market share of 25.9% in 2024, due to the demand for standardized, regulatory-compliant financial operations that improve accuracy and reduce overhead. Automated invoicing, tax calculation, and reporting services are critical for large enterprises aiming to streamline audits and ensure financial transparency

Report Scope and Business Process as a Service (BPaaS) Market Segmentation

|

Attributes |

Business Process as a Service (BPaaS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Business Process as a Service (BPaaS) Market Trends

“Rising Digital Transformation Initiatives”

- A significant and accelerating trend in the global BPaaS market is the widespread implementation of digital transformation strategies by enterprises aiming to modernize operations, enhance agility, and reduce operational costs through cloud-based business process outsourcing solutions

- For instance, in May 2024, DXC Technology introduced DXC Fast RISE with SAP, aimed at helping enterprises accelerate their S/4HANA implementation projects, streamlining workflows and enabling faster digital outcomes

- Organizations are increasingly integrating BPaaS with technologies such as AI, analytics, and RPA to optimize critical business functions such as HR, finance, and customer support. For instance, solutions from companies such as IBM and Oracle offer intelligent automation capabilities that improve decision-making and operational efficiency

- The shift toward outcome-based models and pay-per-use pricing structures is gaining traction as companies focus on value-driven results. SPS’s launch of an outcome-based BPaaS model in January 2024 reflects this trend, offering greater financial flexibility and operational transparency

- The integration of BPaaS with broader cloud ecosystems and enterprise software platforms is enabling centralized management of business processes, allowing seamless connectivity across departments and real-time visibility into performance metrics

- This trend is redefining how organizations approach scalability, innovation, and compliance, encouraging providers to develop more modular, intelligent, and adaptive BPaaS offerings that align with evolving enterprise needs

Business Process as a Service (BPaaS) Market Dynamics

Driver

“Rising Data Security Concerns Rising Due to External Hacks”

- Growing concerns over data breaches, ransomware attacks, and regulatory non-compliance are driving demand for BPaaS solutions with robust security architectures and compliance frameworks

- For instance, major providers such as Accenture and Capgemini are enhancing their BPaaS offerings with advanced cybersecurity features and encryption standards to meet enterprise and industry-specific requirements

- As organizations increasingly move sensitive processes such as payroll, finance, and procurement to cloud platforms, the need for secure access controls, threat detection, and real-time monitoring becomes critical

- BPaaS enables centralized oversight and auditing capabilities, which help businesses maintain data integrity, reduce risk exposure, and comply with regulations such as GDPR, HIPAA, and PCI-DSS

- The increasing complexity of cyber threats, combined with stricter international regulations, is making data security a top priority for businesses adopting BPaaS, thereby reinforcing its value proposition as a secure and compliant service model

Restraint/Challenge

“Lack of IT Skills and Knowledge in Underdeveloped Nations”

- A significant barrier to BPaaS adoption in underdeveloped and emerging economies is the limited availability of skilled IT professionals and digital literacy among enterprises

- For instance, many SMEs in parts of Africa and Southeast Asia face delays in BPaaS implementation due to insufficient IT infrastructure and a shortage of professionals trained in cloud process management

- The complexity of integrating BPaaS platforms with legacy systems, along with the need for cloud architecture understanding, often hampers deployment efforts in regions lacking technical expertise

- Smaller organizations in these regions may also struggle with vendor selection, process customization, and post-implementation support due to inadequate in-house IT capabilities. As a result, enterprises are hesitant to transition to BPaaS models, fearing implementation delays, service disruptions, or long-term dependencies on third-party providers

- To overcome this challenge, BPaaS vendors need to invest in local partnerships, training programs, and simplified onboarding solutions that cater to the needs of digitally less-mature markets and help bridge the skill gap

Business Process as a Service (BPaaS) Market Scope

The market is segmented on the basis of solution, deployment model, business process, organization size, application, cloud delivery model, and end-user.

• By Solution

On the basis of solution, the Business Process as a Service (BPaaS) market is segmented into platform and services. The services segment accounted for the largest revenue share in 2024, owing to the growing enterprise need to outsource non-core but essential business processes for better efficiency, scalability, and cost control. Service providers offer end-to-end capabilities such as automation, compliance support, and domain-specific customization, which appeal strongly to organizations undergoing digital transformation.

The platform segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for centralized, configurable environments that support multiple business functions with integrated analytics and process automation. Organizations are adopting BPaaS platforms to standardize workflows, enhance real-time decision-making, and ensure seamless integration across departments and systems.

• By Deployment Model

On the basis of deployment model, the market is segmented into public cloud, private cloud, and hybrid. The public cloud segment dominated the market in 2024 due to its lower upfront costs, ease of deployment, and scalability, making it ideal for enterprises looking for flexibility without extensive infrastructure investments. Public cloud BPaaS offerings are often bundled with value-added services such as real-time updates, automated scaling, and continuous security monitoring.

The hybrid deployment model is projected to grow at the fastest rate from 2025 to 2032, driven by organizations seeking to balance control over sensitive business data with the agility and cost-efficiency of public cloud. Hybrid models allow companies to run mission-critical operations in private environments while leveraging public cloud for dynamic workloads.

• By Business Process

On the basis of business process, the Business Process as a Service (BPaaS) market is segmented into finance and accounting, human resource (HR & payroll), sales and marketing, customer service and support (customer experience), operations, analytics, procurement and supply chain management, and others. The finance and accounting segment held the highest market share of 25.9% in 2024 due to the demand for standardized, regulatory-compliant financial operations that improve accuracy and reduce overhead. Automated invoicing, tax calculation, and reporting services are critical for large enterprises aiming to streamline audits and ensure financial transparency.

Customer service and support (customer experience) is anticipated to be the fastest-growing segment, as companies increasingly prioritize personalized, omnichannel support powered by AI and real-time analytics. BPaaS solutions for customer service help enterprises improve response time, satisfaction scores, and retention through integrated CRM tools and virtual assistants.

• By Organization Size

On the basis of organization size, the Business Process as a Service (BPaaS) market is segmented into large enterprises and small and medium-sized enterprises (SMEs). Large enterprises dominated the market in 2024 due to their complex operational structures and greater adoption of process outsourcing to reduce cost and optimize workflows. These organizations typically invest in scalable BPaaS models to modernize legacy systems and align with global business operations.

The SME segment is projected to expand at the highest CAGR, supported by the growing availability of affordable, modular BPaaS solutions tailored for smaller operations. SMEs benefit from on-demand process services that eliminate the need for dedicated IT teams and allow focus on core business development.

• By Application

On the basis of application, the Business Process as a Service (BPaaS) market is categorized into supportive, managerial, operational, and connected market area. Operational applications led the market in 2024, reflecting the strong need for outsourcing daily business functions such as payroll processing, customer onboarding, and transaction handling to specialized providers. These processes are typically high-volume and benefit most from automation and scalability.

The connected market area segment is expected to register the fastest growth through 2032 due to the rising convergence of BPaaS with IoT, AI, and real-time data environments, particularly in logistics, manufacturing, and smart retail. This integration enables continuous process optimization, predictive maintenance, and advanced customer insights.

• By Cloud Delivery Model

On the basis of cloud delivery model, the Business Process as a Service (BPaaS) market is segmented into SaaS-based, PaaS-based, and IaaS-based business process services. SaaS BP services accounted for the largest share in 2024 due to their plug-and-play nature, low maintenance requirements, and rapid implementation across a wide range of business functions. SaaS offerings are particularly favored for tasks such as HR onboarding, invoice generation, and CRM integration.

IaaS BP services are expected to exhibit the fastest growth rate during the forecast period, as enterprises seek more control over infrastructure to support custom workflows and compliance-sensitive operations. IaaS provides flexible and scalable resources, ideal for businesses needing to scale infrastructure alongside process automation efforts.

• By End-User

On the basis of end-user, the Business Process as a Service (BPaaS) market is segmented into banking, financial services, and insurance (BFSI), government, IT and telecommunication, manufacturing, healthcare, retail and e-commerce, media and entertainment, and others. The BFSI segment dominated the BPaaS market in 2024 due to its heavy reliance on secure, compliant, and scalable back-office operations such as claims processing, loan approvals, and regulatory reporting.

The healthcare segment is expected to grow at the highest CAGR, driven by the surge in digital health records, telemedicine, and regulatory documentation. BPaaS solutions assist healthcare providers in streamlining billing, patient engagement, insurance claims, and compliance, enabling them to focus on patient outcomes while optimizing administrative efficiency.

Business Process as a Service (BPaaS) Market Regional Analysis

- North America dominated the business process as a service (BPaaS) market with the largest revenue share of 44.4% in 2024, driven by early cloud adoption, mature IT infrastructure, and growing demand for cost-effective business process outsourcing across key industries such as BFSI, healthcare, and IT

- The region benefits from a strong ecosystem of cloud service providers and the rapid adoption of digital transformation strategies by both large enterprises and SMEs

- Increasing focus on improving customer experience, automation of core functions, and integration of AI and analytics into business workflows continues to reinforce BPaaS demand across verticals

U.S. Business Process as a Service (BPaaS) Market Insight

The U.S. Business Process as a Service (BPaaS) market captured the largest revenue share of 72.7% in 2024 within North America, primarily driven by robust digital infrastructure, a tech-savvy business environment, and widespread enterprise demand for scalable cloud-based process solutions. The market is witnessing strong growth across HR, finance, and customer support functions, as companies seek agility and efficiency through AI-integrated BPaaS platforms. In addition, stringent compliance requirements and the shift to remote and hybrid work models have further propelled adoption across sectors such as banking, insurance, and healthcare.

Europe Business Process as a Service (BPaaS) Market Insight

The Europe BPaaS market is projected to grow at a significant CAGR during the forecast period, supported by increasing regulatory requirements, rising demand for operational flexibility, and growing investment in cloud-based digital transformation. European enterprises are adopting BPaaS to optimize workflows and reduce operating costs while maintaining compliance with data protection standards such as GDPR. The market is gaining traction in industries such as manufacturing, retail, and government, where digitization and automation of legacy systems are a key priority.

U.K. Business Process as a Service (BPaaS) Market Insight

The U.K. BPaaS market is expected to expand at a notable CAGR, fueled by the country’s advanced service economy, growing focus on enterprise automation, and increasing demand for outsourced HR and financial operations. Businesses in the U.K. are rapidly transitioning to cloud platforms to remain competitive in a post-Brexit economic landscape, with BPaaS helping to minimize overheads and boost efficiency. The country’s robust fintech and e-commerce sectors are major contributors to market growth.

Germany Business Process as a Service (BPaaS) Market Insight

The Germany BPaaS market is poised for steady expansion, driven by industrial digitalization, strong data privacy frameworks, and the need to modernize back-office operations across sectors such as automotive, manufacturing, and logistics. German enterprises are increasingly investing in BPaaS to automate procurement, supply chain management, and workforce processes. The country’s emphasis on structured digital transformation and regulatory compliance supports long-term adoption of BPaaS solutions.

Asia-Pacific Business Process as a Service (BPaaS) Market Insight

The Asia-Pacific BPaaS market is set to grow at the fastest CAGR of 12.5% from 2025 to 2032, fueled by rapid urbanization, growing SME sector, and increasing cloud adoption in countries such as China, India, and Japan. The region benefits from a growing tech-savvy population, favorable government initiatives, and expanding digital infrastructure. Enterprises across verticals are embracing BPaaS to manage costs, enhance scalability, and improve service delivery in a competitive business environment.

Japan Business Process as a Service (BPaaS) Market Insight

The Japan BPaaS market is gaining momentum, driven by the country’s focus on enterprise efficiency, demographic shifts, and growing demand for business automation. Japanese firms are adopting BPaaS for customer service, HR, and finance functions, particularly in response to a shrinking workforce and the need for productivity-enhancing technologies. The integration of AI and analytics with BPaaS is becoming a major trend, especially among large enterprises and government bodies.

China Business Process as a Service (BPaaS) Market Insight

The China BPaaS market held the largest share in Asia-Pacific in 2024, underpinned by robust government support for cloud technology, a massive digital economy, and strong presence of domestic cloud providers. Chinese enterprises across e-commerce, telecom, and financial sectors are leveraging BPaaS to streamline operations, improve compliance, and scale rapidly. The growing adoption of AI, big data, and intelligent automation technologies continues to elevate the demand for BPaaS platforms and services.

Business Process as a Service (BPaaS) Market Share

The business process as a service (BPaaS) industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Capgemini (France)

- Cognizant (U.S.)

- Oracle (U.S.)

- Wipro Limited (India)

- Accenture (Ireland)

- Tata Consultancy Services Limited (India)

- HCL Technologies Limited (India)

- NTT DATA, Inc. (U.S.)

- DXC Technology Company (U.S.)

- Open Text Corporation (Canada)

- FUJITSU (Japan)

- Genpact (U.S.)

- ADP, Inc. (U.S.)

- Alight (U.S.)

- UKG Inc. (U.S.)

- WNS (Holdings) Ltd. (India)

- Conduent, Inc. (U.S.)

- Expertel S.A "proceedit" (Luxembourg)

- TIBCO Software Inc. (U.S.)

- Entercoms (U.S.)

- Avaloq (Switzerland)

- Scheer PAS Deutschland GmbH (Germany)

- Ceridian HCM, Inc. (U.S.)

Latest Developments in Global Business Process as a Service (BPaaS) Market

- In May 2024, DXC Technology, a leading provider in the technology services sector, launched DXC Fast RISE with SAP—a new addition to its service portfolio. This solution is designed to accelerate the deployment of S/4HANA projects, helping clients streamline their digital transformation efforts more efficiently

- In January 2024, Zurich-based SPS, a prominent player in the BPaaS market, unveiled a new outcome-based BPaaS offering with a pay-per-use model. This service emphasizes domain expertise, skilled talent, and advanced technology, aiming to help clients transition from capital expenditure (CapEx) models to more flexible operational expenditure (OpEx) frameworks

- In May 2020, Wipro Limited announced launch of finance and accounting business-process-as-a-service in partnership with NetSuite. This F&A BPaaS is an end-to-end business process solution which helps to improve business agility, user experience and process efficiency. BPaaS empowers customers to manage and control their finance and accounting processes on a standardized platform. This has helped the company to enhance their product portfolio in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.