Global Capillary Blood Collection Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.47 Billion

USD

3.77 Billion

2025

2033

USD

2.47 Billion

USD

3.77 Billion

2025

2033

| 2026 –2033 | |

| USD 2.47 Billion | |

| USD 3.77 Billion | |

|

|

|

|

Capillary Blood Collection Devices Market Size

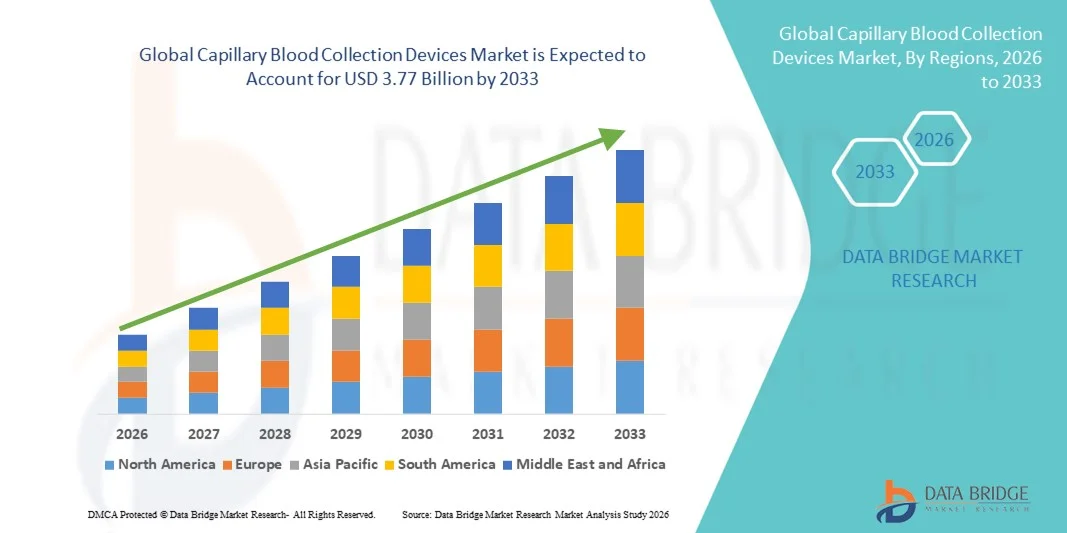

- The global capillary blood collection devices market size was valued at USD 2.47 billion in 2025 and is expected to reach USD 3.77 billion by 2033, at a CAGR of5.45% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases, increasing demand for point-of-care diagnostics, and growing adoption of home-based and outpatient testing solutions, leading to higher utilization of capillary blood collection devices across hospitals, diagnostic laboratories, and healthcare centers

- Furthermore, the need for minimally invasive, rapid, and patient-friendly blood sampling methods, combined with advancements in micro-collection technologies and automated sample handling systems, is establishing capillary blood collection devices as a preferred solution for accurate and convenient sample collection. These converging factors are accelerating the uptake of Capillary Blood Collection Devices solutions, thereby significantly boosting the industry's growth

Capillary Blood Collection Devices Market Analysis

- Capillary blood collection devices, including lancets, microtainers, and automated collection systems, are increasingly vital in modern diagnostic workflows due to their ability to enable minimally invasive, rapid, and accurate blood sampling across hospitals, clinics, laboratories, and home-based testing

- The escalating demand for capillary blood collection devices is primarily fueled by the growing prevalence of chronic diseases, increasing adoption of point-of-care testing, and the rising need for convenient, patient-friendly, and rapid blood sampling methods. Continuous technological advancements in micro-collection and automated sample handling systems are further driving market growth

- North America dominated the capillary blood collection devices market with the largest revenue share of approximately 39.5% in 2025, supported by advanced healthcare infrastructure, high adoption of point-of-care diagnostics, strong presence of key device manufacturers, and increasing demand for minimally invasive blood collection solutions, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the capillary blood collection devices market during the forecast period, driven by rising healthcare access, growing awareness of early diagnosis, expanding home healthcare services, and increasing adoption of modern diagnostic tools in countries such as China, India, and Japan

- The puncture segment dominated the largest market revenue share of 62.4% in 2025, owing to its minimally invasive nature and patient-friendly design

Report Scope and Capillary Blood Collection Devices Market Segmentation

|

Attributes |

Capillary Blood Collection Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Capillary Blood Collection Devices Market Trends

Rising Demand for Minimally Invasive and Efficient Sample Collection

- A key trend in the global capillary blood collection devices market is the increasing focus on minimally invasive, rapid, and patient-friendly blood sampling solutions. This is driven by the growing preference for point-of-care diagnostics, home-based testing, and preventive healthcare programs

- The trend is further supported by the rise of decentralized testing models, where patients can perform capillary blood sampling at home or in community clinics without visiting centralized laboratories

- Companies are innovating devices to improve sample accuracy, reduce discomfort, and allow easier integration with diagnostic assays for clinical, research, and home health applications

- For instance, micro-sampling devices that require only a few drops of blood are becoming increasingly popular, as they reduce pain and increase compliance among pediatric and geriatric patients

- Integration with automated sample processing systems is also expanding, allowing healthcare providers and laboratories to obtain faster results with minimal handling errors

- The trend toward single-use, sterile, and safety-engineered collection devices is being reinforced by rising regulatory emphasis on infection prevention and laboratory safety standards

Capillary Blood Collection Devices Market Dynamics

Driver

Growing Need for Efficient Diagnostics and Home Healthcare Solutions

- The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and anemia is driving the demand for accurate, rapid, and convenient blood collection methods

- Healthcare providers are adopting capillary blood collection devices for point-of-care testing to enable faster diagnosis, improved patient monitoring, and timely treatment interventions

- For instance, diabetic care programs extensively use finger-prick capillary devices to monitor glucose levels at home, which supports patient self-management and reduces hospital visits

- The rise of telemedicine and home healthcare services is further encouraging the adoption of self-collection kits and portable capillary blood devices

- Research and clinical trials also rely heavily on capillary blood collection for biomarker analysis, immunoassays, and pharmacokinetic studies, boosting market demand

- The increasing emphasis on personalized medicine and preventative healthcare is expanding the application of capillary blood collection devices beyond traditional laboratory settings

Restraint/Challenge

Sample Volume Limitations and Handling Errors

- A major challenge in the capillary blood collection devices market is the limitation in sample volume, which may restrict certain diagnostic applications that require larger blood quantities

- For instance, some laboratory assays for hematology, biochemistry, or molecular testing require venous blood, making capillary samples unsuitable for specific tests, thereby limiting market adoption

- Proper technique is crucial, as improper handling, underfilling, or contamination can compromise sample quality, leading to inaccurate test results

- The shortage of trained personnel in some healthcare settings to correctly collect capillary blood samples further exacerbates this challenge

- Device cost can also be a barrier in resource-limited regions, particularly for advanced safety-engineered or automated micro-sampling devices

- Overcoming these challenges through enhanced device design, better training programs, and user-friendly collection kits is vital for expanding the market and ensuring reliable diagnostic outcomes

Capillary Blood Collection Devices Market Scope

The market is segmented on the basis of product, modality, mode of administration, application, platform, material, procedure, age group, test type, technology, end user, and distribution channel.

- By Product

On the basis of product, the Capillary Blood Collection Devices market is segmented into blood sampling devices, capillary blood collection devices, rapid test cassettes, remote capillary blood collection devices, and wearable capillary blood collection devices. The blood sampling devices segment dominated the largest market revenue share of 35.4% in 2025, driven by the widespread adoption in clinical laboratories and hospitals for routine blood collection. The devices offer reliable sample quality, compatibility with multiple tests, and ease of handling, making them a preferred choice in both developed and emerging markets. Increasing prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and anemia, boosts demand for frequent blood testing. Advanced designs that minimize pain and sample contamination are encouraging higher adoption. Growing demand for minimally invasive procedures in hospitals and home care settings also supports segment dominance. The availability of diverse product variants and strong distribution networks further reinforces the segment’s market share. Regulatory approvals and standardization in quality contribute to trust and adoption in global markets.

The remote capillary blood collection devices segment is expected to witness the fastest CAGR of 11.2% from 2026 to 2033, driven by the rising demand for at-home testing solutions and telemedicine integration. The COVID-19 pandemic accelerated the need for remote and contactless sample collection, creating a permanent shift in patient behavior. These devices allow safe, reliable, and convenient collection of samples without visiting a healthcare facility. Integration with digital health platforms and real-time sample tracking further enhances adoption. Growing awareness of patient-centric care and home diagnostics is encouraging investments from manufacturers. Expansion of healthcare infrastructure in emerging economies supports penetration. Furthermore, advancements in wearable collection devices are enabling continuous monitoring for chronic conditions, adding to the segment’s growth.

- By Modality

On the basis of modality, the market is segmented into manual sampling and automated/autoinjection sampling. The manual sampling segment held the largest market revenue share of 38.1% in 2025, driven by its simplicity, low cost, and ease of use across hospitals, diagnostic laboratories, and research institutions globally. Manual devices are widely adopted in point-of-care testing, routine blood monitoring, and clinical trials. They benefit from well-established protocols and require minimal technical training, making them accessible in emerging markets. Hospitals and clinics often prefer manual devices for their reliability and ability to handle diverse sample types. Additionally, manual sampling devices have low maintenance requirements and are compatible with multiple testing workflows. Their availability in both disposable and reusable formats enhances operational flexibility. The global adoption is further reinforced by regulatory approvals and the ease of procurement. Manual sampling remains the standard choice in many regions due to cost-effectiveness and established trust. Growing awareness of minimally invasive procedures also supports segment dominance.

The automated/autoinjection sampling segment is expected to witness the fastest CAGR of 10.5% from 2026 to 2033, driven by increasing demand for high-throughput, low-contamination, and standardized blood collection. Automation improves sample consistency, reduces human error, and enables integration with laboratory information management systems (LIMS). Rising adoption in chronic disease management, pharmaceutical research, and clinical trials is a key growth driver. These devices allow for precise, repeatable sample volumes and faster processing times, enhancing efficiency in large-scale testing facilities. Integration with digital health platforms and remote monitoring systems is further accelerating adoption. Manufacturers are investing in automation to meet the growing need for reliable, error-free sample collection. The trend toward patient-centric and home-based care is encouraging development of compact automated devices. Innovations that reduce pain and improve collection accuracy are boosting acceptance in hospitals. Increasing awareness among healthcare providers of the advantages of automation over manual sampling also contributes to segment growth.

- By Mode of Administration

On the basis of mode of administration, the market is segmented into puncture and incision. The puncture segment dominated the largest market revenue share of 62.4% in 2025, owing to its minimally invasive nature and patient-friendly design. Puncture devices are widely used in hospitals, clinics, home care, and research laboratories for routine blood collection. The convenience, rapid sample collection, and reduced risk of complications make them the preferred choice for most age groups. Puncture methods are compatible with a variety of devices, including capillary collection tubes and rapid test cassettes, enhancing versatility. The segment benefits from robust regulatory approvals and the established safety profile of puncture devices. It also supports high-throughput sample collection, critical in large diagnostic labs. Puncture-based devices are widely promoted in preventive health programs and chronic disease monitoring. Their affordability and availability in disposable formats further reinforce market share. Strong training and adoption in point-of-care settings globally sustain segment dominance. Puncture devices remain central to both conventional and point-of-care procedures.

The incision segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, driven by its application in specialized diagnostics and therapeutic procedures. Innovations in incision devices are enhancing safety, minimizing patient discomfort, and enabling precise sample collection. Incision methods are increasingly used for tissue-based testing, surgical monitoring, and certain oncology-related assays. Technological advancements, such as micro-incision devices and minimally invasive sampling kits, contribute to segment growth. The segment benefits from rising demand in clinical research centers, tertiary hospitals, and specialized laboratories. Expansion of surgical and interventional diagnostic procedures globally further accelerates adoption. High precision and integration with laboratory automation are supporting wider usage. Healthcare providers are increasingly trained to utilize incision devices safely and efficiently. Emerging markets are witnessing higher adoption due to the introduction of low-cost, safe incision devices. Growing awareness of advanced diagnostics in chronic disease management and oncology also supports rapid growth.

- By Application

On the basis of application, the market is segmented into cardiovascular disease, infection and infectious disease, respiratory diseases, cancers, rheumatoid arthritis, and others. The cardiovascular disease segment held the largest market revenue share of 28.7% in 2025, driven by the high prevalence of heart disorders and the need for regular blood monitoring globally. Continuous monitoring, early detection, and preventive healthcare programs are key drivers. Hospitals and clinics rely heavily on capillary blood collection for cardiac biomarkers, cholesterol, and lipid panels. The segment benefits from widespread awareness campaigns and government health initiatives focused on cardiovascular care. Growing geriatric populations and rising incidence of chronic heart conditions are sustaining demand. Cardiovascular monitoring is integrated into both hospital-based and home-care testing workflows. Compatibility of devices with point-of-care diagnostics enhances segment adoption. Increasing reimbursement coverage and patient education also reinforce market share.

The infection and infectious disease segment is expected to witness the fastest CAGR of 11.5% from 2026 to 2033, fueled by the global need for rapid diagnostic testing for diseases such as COVID-19, influenza, dengue, and hepatitis. The segment is driven by the adoption of capillary collection devices for point-of-care, field testing, and outbreak response. The pandemic accelerated demand for reliable, decentralized testing solutions. Rising awareness of infectious disease monitoring in both developed and emerging markets supports segment growth. Devices are increasingly integrated with molecular diagnostic platforms, including PCR-based assays. Expansion of vaccination and disease surveillance programs is contributing to faster adoption. Portable and home-based collection devices further accelerate the trend. Integration with telemedicine and health apps enhances accessibility for patients. Manufacturers are focusing on producing faster, easy-to-use, and safe devices to capture the growing market demand.

- By Platform

On the basis of platform, the market is segmented into ELISA platform, PCR platform, lateral flow immunoassay platform, ELTABA platform, and others. The ELISA platform segment dominated the largest market revenue share of 33.2% in 2025, owing to its extensive use in clinical diagnostics and research for quantifying proteins, antibodies, and antigens. ELISA devices are widely adopted in hospitals, laboratories, and research centers due to their reliability, sensitivity, and established protocols. They are compatible with both manual and automated capillary blood collection systems. The platform benefits from strong regulatory approvals, ease of integration with laboratory workflows, and applicability across multiple therapeutic areas, including infectious diseases, oncology, and cardiovascular conditions. High throughput and scalability make ELISA platforms attractive for routine testing and research. Adoption is supported by a wide variety of commercially available ELISA kits tailored to specific diagnostic needs. The segment remains dominant due to widespread awareness and consistent global demand. Established partnerships between ELISA manufacturers and hospitals further reinforce the segment’s market share.

The PCR platform segment is expected to witness the fastest CAGR of 12.1% from 2026 to 2033, driven by the growing need for molecular diagnostics and infectious disease testing. PCR-based capillary blood testing has expanded significantly during the COVID-19 pandemic and continues to rise due to its accuracy, sensitivity, and ability to detect viral and bacterial pathogens. Adoption is growing in hospitals, reference labs, and field-based testing scenarios. The segment benefits from increasing prevalence of influenza, hepatitis, and other infectious diseases worldwide. Integration with automated sampling devices enhances throughput and reduces human error. Portable PCR platforms are also expanding use in point-of-care settings. Manufacturers are investing in rapid, low-cost PCR solutions suitable for capillary blood samples. The growth is further supported by government programs and funding for infectious disease diagnostics. High adoption in research and pharmaceutical studies also contributes to segment expansion.

- By Material

On the basis of material, the market is segmented into plastic, glass, stainless steel, and ceramic. The plastic segment held the largest market revenue share of 45.3% in 2025, driven by its cost-effectiveness, disposability, and compatibility with a wide range of tests. Plastic devices reduce the risk of contamination, are lightweight, and are easier to handle in high-volume laboratories. Plastic is commonly used for tubes, collection devices, and rapid test cassettes. The segment is further supported by the large-scale production and wide availability of plastic consumables globally. Hospitals, diagnostic centers, and home healthcare providers prefer plastic for routine testing due to safety, affordability, and ease of disposal. Standardization of plastic collection devices also ensures regulatory compliance across regions. High compatibility with ELISA, lateral flow, and PCR platforms strengthens adoption.

The glass segment is expected to witness the fastest CAGR of 9.7% from 2026 to 2033, owing to higher chemical resistance, thermal stability, and suitability for specialized laboratory assays. Glass is preferred for analytical tests requiring minimal interference or long-term sample storage. Increasing research and diagnostic applications in oncology, metabolic panels, and infectious disease testing are driving segment growth. Glass devices are often used in high-precision labs and clinical research institutes. Technological improvements in safety, such as break-resistant coatings, are expanding their usability.

- By Procedure

On the basis of procedure, the market is segmented into conventional and point-of-care testing. The conventional testing segment dominated the largest market revenue share of 56.8% in 2025, due to its well-established presence in hospitals, diagnostic laboratories, and research centers. Conventional procedures rely on centralized laboratories, standardized workflows, and trained personnel to ensure accuracy and reproducibility. The segment benefits from decades of adoption and global trust in results. Hospitals and large-scale labs favor conventional procedures for high-volume testing and multi-analyte assays.

The point-of-care testing segment is expected to register the fastest CAGR of 11.8% from 2026 to 2033, driven by growing demand for rapid, decentralized diagnostics. Devices designed for point-of-care testing enable immediate clinical decision-making in outpatient settings, home care, and emergency scenarios. The increasing prevalence of infectious diseases, chronic conditions, and remote healthcare solutions supports adoption. Portable and easy-to-use devices are critical in field-based applications and emerging markets. Integration with telemedicine and digital health platforms accelerates the trend. Government initiatives promoting accessible diagnostics and reimbursement support further encourage growth.

- By Age Group

On the basis of age group, the market is segmented into geriatrics, infant, pediatric, and adult. The adult segment held the largest market revenue share of 50.2% in 2025, owing to the high prevalence of chronic diseases, cardiovascular conditions, and regular health monitoring requirements. Adults account for the majority of diagnostic testing globally, supporting continuous demand for capillary blood collection devices. Hospitals, diagnostic centers, and home healthcare services extensively use adult-focused devices due to sample volume compatibility and standardized testing protocols.

The infant segment is expected to witness the fastest CAGR of 10.9% from 2026 to 2033, driven by rising newborn screening programs, neonatal care initiatives, and early disease detection requirements. Capillary blood collection is critical in infants for metabolic screening, bilirubin testing, and immunological assessments. Technological innovations in painless and low-volume sampling devices contribute to segment growth. Increasing focus on pediatric healthcare, government-funded screening programs, and higher awareness among parents further accelerates adoption. Portable and minimally invasive devices enhance ease of collection in hospitals and home care settings.

- By Test Type

On the basis of test type, the market is segmented into whole blood tests, dried blood spot tests, plasma/serum protein tests, liver panel/liver profile/liver function tests, comprehensive metabolic panel (CMP) tests, and others. The whole blood test segment dominated the largest market revenue share of 41.7% in 2025, owing to its broad applicability in routine diagnostic monitoring, clinical trials, and disease management. Whole blood tests are versatile for cardiovascular, infectious, metabolic, and hematological evaluations. Their adoption is reinforced by standardized collection protocols, ease of integration into laboratory workflows, and compatibility with multiple testing platforms including ELISA, PCR, and lateral flow immunoassays. Hospitals, diagnostic labs, and research centers prefer whole blood tests for their reliability and ability to provide immediate results. Additionally, the low-cost nature and minimal technical training required support high-volume use across both developed and emerging markets. Whole blood collection devices are often preferred for adult and geriatric populations due to adequate sample volume requirements. Manufacturers are continually innovating to enhance sample integrity and reduce contamination risk. Availability of automated sampling solutions further supports segment dominance. Standardization and regulatory approvals also reinforce trust and adoption globally.

The dried blood spot tests segment is expected to register the fastest CAGR of 12.2% from 2026 to 2033, driven by the rising popularity of home-based testing, newborn screening programs, and decentralized healthcare models. These tests allow small sample volumes to be collected easily, stored at room temperature, and transported without specialized equipment. The method is highly favored for neonatal metabolic disorder screening, infectious disease surveillance, and telemedicine-enabled diagnostics. Growth is fueled by increasing awareness among parents, government health initiatives, and technological advancements in sampling cards and storage media. Dried blood spot collection is minimally invasive, reducing patient discomfort, and allows repeated sampling for longitudinal studies. Its portability makes it suitable for field studies in remote or underserved areas. Integration with automated lab processing and high-sensitivity assays is driving adoption in clinical research. Emerging economies are also seeing higher uptake due to cost-effectiveness and logistics advantages. New device launches with improved accuracy and faster processing are accelerating segment growth.

- By Technology

On the basis of technology, the market is segmented into volumetric absorptive microsampling, capillary electrophoresis-based chemical analysis, and others. The volumetric absorptive microsampling segment held the largest market revenue share of 39.5% in 2025, owing to its precise sample volume control, minimal invasiveness, and seamless integration into diagnostic and research workflows. The technology reduces variability caused by user error, ensures reproducible results, and supports both centralized lab testing and decentralized sample collection. It is widely adopted in pharmacokinetic studies, chronic disease monitoring, and neonatal testing. Its ease of use in home care settings enhances patient compliance. Compatibility with multiple assay platforms including ELISA, PCR, and lateral flow immunoassays strengthens adoption. The segment is further supported by growing demand in personalized medicine, clinical trials, and regulatory acceptance globally. Continuous innovations in microsampling devices improve usability, safety, and sample stability, reinforcing market dominance. Manufacturers are focusing on compact, single-use designs to reduce contamination and cross-reactivity. Partnerships with diagnostic laboratories and telemedicine platforms further increase adoption.

The capillary electrophoresis-based chemical analysis segment is expected to witness the fastest CAGR of 11.4% from 2026 to 2033, driven by its high analytical sensitivity and specificity, making it ideal for specialized biochemical testing. It is widely used in metabolic profiling, enzyme activity measurement, and rare disease research. The technology is increasingly applied in both clinical and research laboratories requiring precise separation and quantification of analytes. Integration with automated sampling devices enhances throughput and reduces errors. Growing use in pharmaceutical research and clinical trials contributes to market expansion. Rising adoption in high-income countries and specialized centers is supporting segment growth. Innovations such as miniaturized capillary systems and improved detection methods are expanding the technology’s applicability. Increased demand for point-of-care biochemical assays also drives growth. Regulatory approvals and clinical validation studies further boost adoption.

- By End User

On the basis of end user, the market is segmented into laboratories and home care settings. The laboratories segment dominated the largest market revenue share of 61.3% in 2025, due to the growing number of diagnostic labs, hospital-based laboratories, and research institutions worldwide. Laboratory adoption is driven by the need for high-throughput processing, standardized workflows, and compatibility with multiple testing platforms. Hospitals and research centers rely on laboratories for routine monitoring, clinical trials, and disease surveillance. Established supply chains, technical support, and regulatory compliance further support laboratory preference. Laboratories often implement both manual and automated sampling solutions to optimize efficiency and accuracy.

The home care settings segment is expected to register the fastest CAGR of 12.5% from 2026 to 2033, fueled by the rising trend of at-home diagnostics, telemedicine, and self-monitoring of chronic diseases. Adoption is increasing due to devices designed for ease-of-use, portability, and safe handling by non-professional users. Government initiatives promoting decentralized healthcare, along with growing awareness of preventive diagnostics, support segment growth. Home care testing is particularly relevant in regions with limited hospital access, and it aligns with the shift toward personalized healthcare. Innovations in smartphone-integrated devices, mail-in sample kits, and low-volume microsampling enhance convenience.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment held the largest market revenue share of 53.8% in 2025, due to bulk hospital procurement, centralized purchasing systems, and long-term contracts with laboratories and diagnostic chains. Direct tendering ensures consistent supply, cost efficiency, and streamlined logistics for high-volume users. Hospitals, research institutes, and laboratories prefer direct tender arrangements to maintain inventory, ensure compliance, and negotiate better pricing.

The retail sales segment is expected to witness the fastest CAGR of 11.7% from 2026 to 2033, supported by the increasing availability of capillary blood collection devices through pharmacies, e-commerce platforms, and consumer health stores for home use. Rising health awareness, demand for home testing solutions, and subscription-based diagnostic services drive this growth. The segment benefits from marketing initiatives, product innovations, and government campaigns promoting at-home sample collection. Devices with user-friendly designs, low sample volume requirements, and integration with telemedicine platforms are particularly popular. Expansion of online retail and digital health marketplaces also accelerates adoption globally.

Capillary Blood Collection Devices Market Regional Analysis

- North America dominated the capillary blood collection devices market with the largest revenue share of approximately 39.5% in 2025

- Supported by advanced healthcare infrastructure, high adoption of point-of-care diagnostics, strong presence of key device manufacturers, and increasing demand for minimally invasive blood collection solutions

- The region benefits from a well-established healthcare network, rising prevalence of chronic diseases, and growing preference for rapid diagnostic testing

U.S. Capillary Blood Collection Devices Market Insight

The U.S. capillary blood collection devices market captured the largest share within North America in 2025, fueled by increasing volumes of outpatient diagnostics, adoption of minimally invasive collection techniques, and strong reimbursement frameworks. Healthcare providers favor capillary devices for convenience, patient comfort, and faster turnaround times. Integration with home healthcare kits and remote monitoring systems further supports market growth. Research laboratories and diagnostic centers are expanding use for screening and monitoring programs. Rising investment in digital health technologies and portable diagnostic tools accelerates adoption.

Europe Capillary Blood Collection Devices Market Insight

Europe is projected to expand at a steady CAGR during the forecast period, driven by government initiatives promoting early diagnosis, robust regulatory frameworks, and increasing demand for reliable, minimally invasive collection methods. Urbanization and the growing elderly population are fostering adoption across hospitals and clinics.

U.K. Capillary Blood Collection Devices Market Insight

The U.K. capillary blood collection devices market is anticipated to grow at a noteworthy CAGR from 2026 to 2033, driven by widespread adoption in outpatient clinics, blood collection centers, and home healthcare services. The trend toward patient-centric care, along with adoption of modern diagnostic workflows, supports growth. Partnerships with diagnostic labs and hospitals encourage technology integration.

Germany Capillary Blood Collection Devices Market Insight

Germany capillary blood collection devices market is expected to experience considerable growth, fueled by high healthcare standards, technological advancement, and strong demand in hospitals and research institutes. The adoption of capillary blood collection devices in preventive healthcare and chronic disease monitoring is rising. Eco-friendly and user-friendly designs further enhance acceptance. Integration into clinical trials and academic research centers also contributes to growth.

Asia Pacific Capillary Blood Collection Devices Market Insight

Asia-Pacific capillary blood collection devices market is poised to be the fastest-growing region with a CAGR during 2026–2033, driven by rising healthcare access, growing awareness of early diagnosis, expanding home healthcare services, and increasing adoption of modern diagnostic tools.

Japan Capillary Blood Collection Devices Market Insight

Japan’s capillary blood collection devices market is gaining momentum due to an aging population, high-tech healthcare ecosystem, and increasing demand for home-based diagnostics. Adoption in clinics, hospitals, and home healthcare settings is growing steadily. Integration with digital monitoring systems enhances convenience and patient compliance.

China Capillary Blood Collection Devices Market Insight

China capillary blood collection devices market accounted for the largest market share in Asia-Pacific in 2025, supported by rapid urbanization, expanding middle-class population, and rising adoption of point-of-care diagnostic tools. Government support for smart healthcare initiatives, rising awareness for early disease detection, and growth of private clinics are driving market expansion. Affordability and local manufacturing further support wider adoption across residential, commercial, and hospital applications.

Capillary Blood Collection Devices Market Share

The Capillary Blood Collection Devices industry is primarily led by well-established companies, including:

- BD (U.S.)

- Sarstedt AG & Co. KG (Germany)

- Terumo Corporation (Japan)

- Greiner Bio-One International GmbH (Austria)

- PerkinElmer, Inc. (U.S.)

- HemoCue AB (Sweden)

- MediLys Lab Instruments Pvt. Ltd. (India)

- Ortho Clinical Diagnostics (U.S.)

- Greiner Bio-One (Austria)

- HTL-Strefa S.A. (Poland)

- CAPITAL Biosciences (U.S.)

- Roche Diagnostics (Switzerland)

- NIPRO Corporation (Japan)

- Apexbio Technologies (China)

- Innovative MedTech Solutions (U.S.)

Latest Developments in Global Capillary Blood Collection Devices Market

- In September 2024, Becton, Dickinson and Company (BD) received 510(k) clearances from the U.S. Food and Drug Administration (FDA) for its new BD MiniDraw™ Capillary Blood Collection System, enabling minimally invasive fingertip blood collection that produces lab‑quality results for key tests such as lipid panels and hemoglobin/hematocrit. This device expands access to diagnostic testing beyond traditional venous draws and supports use in additional settings such as retail pharmacies and point‑of‑care locations

- In September 2024, Global Market Insights Inc reported that the global capillary blood collection devices market is set to grow significantly by 2032, driven by rising chronic disease prevalence and advancements in minimally invasive technologies that improve patient comfort and sample accuracy — reinforcing the ongoing market expansion toward easy and efficient diagnostics

- In December 2023, BD announced it received FDA 510(k) clearance for its MiniDraw™ Capillary Blood Collection System with SST tubes, broadening its product portfolio for capillary collection and supporting broader clinical use by enabling standard chemistry and serum separator protocols via fingertip sampling

- In October 2023, YourBio Health announced that its TAP Micro Select blood collection device received expanded CE marking certification in Europe, facilitating non‑invasive, virtually painless capillary blood collection across multiple applications including genetics and diagnostics, and expanding access in EU healthcare and retail markets

- In September 2024, producers in the capillary blood collection tubes segment introduced advanced safety‑cap tubes designed to reduce leakage and contamination, resulting in lower accidental exposure rates and improved sample sealing reliability — a key development for hospital and pediatric test environments

- In March 2025, Tasso, Inc. announced that it had sold over 1.5 million of its patient‑centric capillary blood collection devices, highlighting growing global acceptance of remote and minimally invasive sampling for clinical trials and decentralized diagnostics

- In February 2025, Trajan Group Holdings reported strong financial performance for its volumetric absorptive microsampling (VAMS) portfolio, confirming sustained demand for precise remote sampling technology that eliminates hematocrit bias, enabling reliable quantitative assays and supporting decentralized clinical research collection workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.