Global Carbon Capture Utilization And Storage Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

4.21 Billion

2025

2033

USD

1.20 Billion

USD

4.21 Billion

2025

2033

| 2026 –2033 | |

| USD 1.20 Billion | |

| USD 4.21 Billion | |

|

|

|

|

Carbon Capture, Utilization, and Storage Market Size

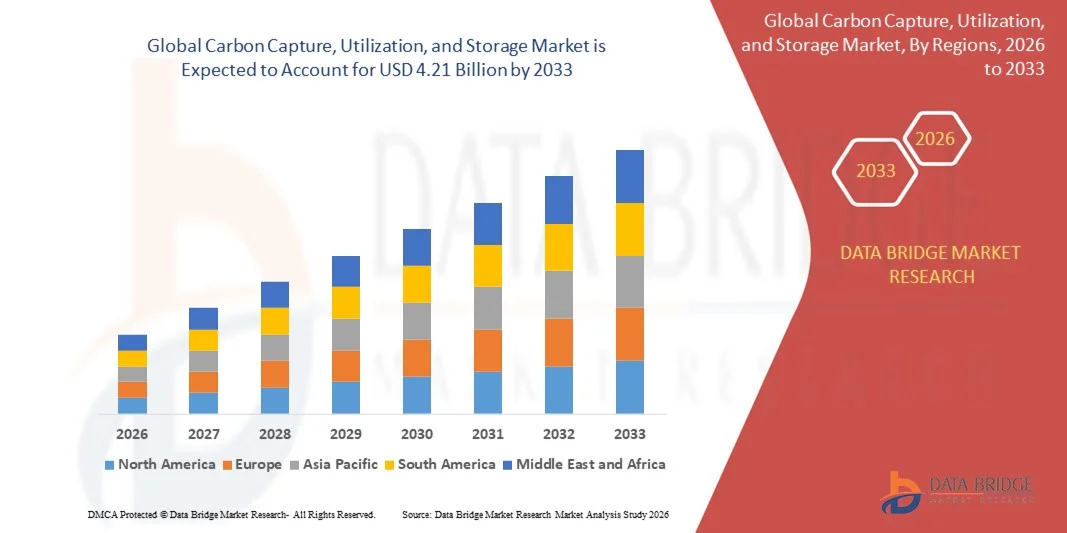

- The global carbon capture, utilization, and storage market size was valued at USD 1.20 billion in 2025 and is expected to reach USD 4.21 billion by 2033, at a CAGR of 16.95% during the forecast period

- The market growth is largely fueled by increasing global initiatives to reduce carbon emissions and achieve net-zero targets, driving adoption of advanced carbon capture and storage technologies across power generation, industrial, and chemical sectors

- Furthermore, rising governmental incentives and regulatory frameworks aimed at promoting sustainable practices, for instance, Shell’s large-scale carbon capture projects, are accelerating investments in carbon capture, utilization, and storage solutions, thereby significantly boosting market expansion

Carbon Capture, Utilization, and Storage Market Analysis

- Carbon capture, utilization, and storage technologies, which involve capturing carbon dioxide emissions from industrial processes and storing or converting them for productive uses, are becoming essential in mitigating climate change and supporting sustainable industrial growth

- The escalating demand for these solutions is primarily fueled by increasing industrialization, growing environmental awareness among governments and corporations, and the need to comply with stringent emission reduction targets

- North America dominated the carbon capture, utilization, and storage market with a share of 44.5% in 2025, due to extensive industrialization, the presence of stringent emission regulations, and substantial investments in carbon capture projects

- Asia-Pacific is expected to be the fastest growing region in the carbon capture, utilization, and storage market during the forecast period due to rapid industrialization, urbanization, and the need for emission reductions in countries such as China, Japan, and India

- Capture segment dominated the market with a market share of 51.7% in 2025, due to its critical role in the overall CCUS value chain and the need to directly remove CO₂ from emission sources. Companies are increasingly prioritizing capture solutions as the first step toward achieving carbon neutrality targets, and technological advancements have made capture systems more energy-efficient and scalable across industries. The segment also benefits from supportive policies and subsidies aimed at reducing industrial greenhouse gas emissions

Report Scope and Carbon Capture, Utilization, and Storage Market Segmentation

|

Attributes |

Carbon Capture, Utilization, and Storage Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Carbon Capture, Utilization, and Storage Market Trends

Rising Adoption of Large-Scale Carbon Capture and Storage Projects

- A significant trend in the carbon capture, utilization, and storage market is the increasing deployment of large-scale carbon capture and storage projects across power generation, oil and gas, and industrial sectors, driven by the urgent need to mitigate greenhouse gas emissions and achieve net-zero targets. These projects are positioning carbon capture, utilization, and storage solutions as critical technologies for sustainable industrial operations

- For instance, Royal Dutch Shell and Mitsubishi Heavy Industries are implementing major carbon capture initiatives that capture and store millions of tons of carbon dioxide annually, reinforcing the importance of carbon capture, utilization, and storage technologies in reducing industrial carbon footprints

- The adoption of carbon capture technologies in enhanced oil recovery operations is growing as captured CO2 is increasingly utilized to improve extraction efficiency while lowering environmental impact. This is strengthening the role of carbon capture solutions in both economic and ecological strategies

- Industrial sectors such as cement, steel, and chemical manufacturing are integrating carbon capture systems to comply with tightening emission regulations and sustainability targets. These measures are accelerating the adoption of carbon capture, utilization, and storage technologies as essential tools for industrial decarbonization

- Emerging research and innovation in carbon utilization, including conversion into chemicals, fuels, and building materials, are expanding the potential applications of captured carbon. This is creating pathways for industries to transform waste emissions into valuable resources, enhancing economic feasibility

- The market is witnessing robust growth in government-backed pilot programs and public-private partnerships aimed at scaling carbon capture solutions. This rising focus on collaborative efforts is reinforcing the market’s trajectory toward widespread adoption and technological advancement

Carbon Capture, Utilization, and Storage Market Dynamics

Driver

Increasing Governmental Support and Regulatory Incentives

- The growing emphasis on reducing carbon emissions and achieving climate goals is driving strong governmental support and regulatory incentives for carbon capture, utilization, and storage adoption. These initiatives provide financial support, tax benefits, and policy frameworks that encourage companies to invest in carbon capture, utilization, and storage projects

- For instance, the European Union and U.S. Department of Energy fund large-scale CCS projects that facilitate deployment of advanced carbon capture technologies, promoting sustainability in heavy industries and energy production

- Stringent emission reduction regulations across Europe, North America, and Asia-Pacific are compelling industries to adopt carbon capture solutions to remain compliant and avoid penalties. These mandates are driving consistent demand for carbon capture, utilization, and storage systems

- Rising environmental awareness among corporations and investors is incentivizing the adoption of carbon capture, utilization, and storage technologies to enhance ESG performance and strengthen corporate sustainability profiles. This is positioning carbon capture solutions as strategic investments for long-term resilience

- Increasing collaboration between technology providers, industrial operators, and governments is accelerating deployment of innovative carbon capture, utilization, and storage technologies. These partnerships are fostering knowledge sharing, reducing project risks, and supporting the commercialization of advanced carbon capture solutions

Restraint/Challenge

High Capital Expenditure and Operational Costs

- The carbon capture, utilization, and storage market faces challenges due to the substantial capital investment and operational expenses associated with installing and maintaining carbon capture, utilization, and storage infrastructure. High upfront costs and energy requirements for capture, transport, and storage processes can limit widespread adoption

- For instance, companies such as Linde and Hitachi face significant expenditures when deploying carbon capture units at industrial sites, which can affect project feasibility and return on investment

- The complexity of integrating carbon capture, utilization, and storage systems into existing industrial processes further elevates operational costs, requiring specialized equipment, skilled labor, and continuous monitoring to ensure safety and efficiency

- Uncertainties in carbon pricing and long-term storage liabilities contribute to financial risk for operators, making project planning and investment more challenging

- The market continues to confront constraints in balancing economic viability with environmental impact, as cost-intensive carbon capture, utilization, and storage solutions must demonstrate measurable benefits to attract investment and support scaling efforts

Carbon Capture, Utilization, and Storage Market Scope

The market is segmented on the basis of technology, application, and service.

- By Technology

On the basis of technology, the CCUS market is segmented into pre-combustion, post-combustion, and oxy-fuel combustion. The post-combustion segment dominated the market with the largest revenue share in 2025, driven by its compatibility with existing power plants and industrial facilities without requiring major infrastructural changes. Industries favor post-combustion technology due to its ability to capture CO₂ from flue gases with relative ease, providing a cost-effective solution for emission reduction. The market sees strong adoption because post-combustion systems can be retrofitted to both coal- and gas-fired plants, and ongoing innovations have enhanced their efficiency and lowered operational costs.

The pre-combustion segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising implementation in large-scale industrial and hydrogen production facilities. Pre-combustion technology enables the separation of CO₂ before combustion, improving the efficiency of energy generation and providing higher purity CO₂ streams for utilization or storage. Its adoption is supported by increasing interest in integrated energy solutions and hydrogen economy initiatives, especially in regions focusing on low-carbon industrial transformation.

- By Application

On the basis of application, the CCUS market is segmented into oil and gas, chemical processing, power generation, and others. The power generation segment dominated the market with the largest revenue share in 2025, driven by the high volume of CO₂ emissions from coal- and gas-fired plants. Governments and regulatory bodies are increasingly encouraging carbon capture adoption in power generation to meet stringent emission reduction targets and national decarbonization plans. The segment benefits from ongoing investments in retrofitting existing plants with capture technology and from the integration with renewable energy systems to achieve hybrid low-carbon operations.

The oil and gas segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by enhanced oil recovery (EOR) projects and growing investments in sustainable hydrocarbon extraction. For instance, major players such as Shell are actively deploying CCUS technologies to reduce operational emissions while improving oil recovery efficiency. The increasing focus on reducing methane and CO₂ emissions across upstream and downstream processes also supports the adoption of CCUS solutions in this sector.

- By Service

On the basis of service, the CCUS market is segmented into capture, transportation, utilization, and storage. The capture segment dominated the market with the largest revenue share of 51.7% in 2025, driven by its critical role in the overall CCUS value chain and the need to directly remove CO₂ from emission sources. Companies are increasingly prioritizing capture solutions as the first step toward achieving carbon neutrality targets, and technological advancements have made capture systems more energy-efficient and scalable across industries. The segment also benefits from supportive policies and subsidies aimed at reducing industrial greenhouse gas emissions.

The storage segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing development of geological storage sites and offshore sequestration projects. For instance, ExxonMobil has been investing in large-scale storage infrastructure to ensure long-term CO₂ containment. Rising awareness of the permanence and safety of storage options, along with favorable regulatory frameworks, drives market adoption across oil, gas, and industrial sectors seeking durable solutions for carbon management.

Carbon Capture, Utilization, and Storage Market Regional Analysis

- North America dominated the carbon capture, utilization, and storage market with the largest revenue share of 44.5% in 2025, driven by extensive industrialization, the presence of stringent emission regulations, and substantial investments in carbon capture projects

- Companies and governments in the region are increasingly focusing on reducing carbon footprints, encouraging the deployment of CCUS technologies across power generation, oil and gas, and chemical industries

- This widespread adoption is further supported by advanced infrastructure, strong R&D capabilities, and favorable policy frameworks, establishing CCUS as a critical solution for achieving emission reduction targets

U.S. Carbon Capture, Utilization, and Storage Market Insight

The U.S. carbon capture, utilization, and storage market captured the largest revenue share in 2025 within North America, fueled by stringent emission reduction policies, significant federal funding, and industrial decarbonization efforts. For instance, Occidental Petroleum is investing heavily in carbon capture projects in Texas, aiming to enhance oil recovery while storing millions of tons of CO₂ annually. The increasing deployment of large-scale carbon capture plants, alongside supportive tax credits and regulatory frameworks, is accelerating market growth, and the integration of carbon capture with hydrogen production and renewable energy projects is creating new avenues for expansion.

Europe Carbon Capture, Utilization, and Storage Market Insight

The Europe carbon capture, utilization, and storage market is projected to expand at a substantial CAGR throughout the forecast period, driven by strong climate policies, carbon pricing mechanisms, and the European Union’s ambitious net-zero targets. For instance, Shell’s Quest CCS project demonstrates growing investment in large-scale carbon capture and storage infrastructure. The demand for low-carbon industrial processes, the push for decarbonized energy sectors, and the deployment of carbon storage hubs in countries such as Norway and the Netherlands are fostering market adoption, while collaborations between governments and private companies are enabling knowledge sharing and cost reduction to support growth.

U.K. Carbon Capture, Utilization, and Storage Market Insight

The U.K. carbon capture, utilization, and storage market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government initiatives supporting carbon capture clusters and industrial decarbonization. For instance, Drax Group is advancing carbon capture solutions at its biomass power plants, contributing to negative emissions goals. The rising adoption of carbon capture technologies in power generation, cement, and chemical industries, along with supportive policies such as contracts for difference for carbon capture projects, is encouraging investments, and the U.K.’s focus on achieving net-zero emissions by 2050 is expected to continue stimulating market growth.

Germany Carbon Capture, Utilization, and Storage Market Insight

The Germany carbon capture, utilization, and storage market is expected to expand at a considerable CAGR during the forecast period, fueled by strong regulatory frameworks and growing awareness of industrial decarbonization. For instance, RWE is exploring CCS technologies for coal-fired power plants and industrial facilities to meet Germany’s climate targets. The country’s emphasis on renewable energy integration, technological advancements, and public-private partnerships is promoting adoption across multiple sectors, while Germany’s focus on sustainable and efficient carbon management solutions aligns with local industrial and environmental objectives.

Asia-Pacific Carbon Capture, Utilization, and Storage Market Insight

The Asia-Pacific carbon capture, utilization, and storage market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid industrialization, urbanization, and the need for emission reductions in countries such as China, Japan, and India. For instance, Sinopec is advancing large-scale CCS projects in China to curb industrial CO₂ emissions and support government climate policies. The region’s focus on building carbon-neutral industrial hubs, government incentives, strategic investments, and technological advancements is boosting adoption, and Asia-Pacific is emerging as a key market due to industrial demand, innovation, and supportive policy measures.

Japan Carbon Capture, Utilization, and Storage Market Insight

The Japan carbon capture, utilization, and storage market is gaining momentum due to government-led emission reduction targets, technological innovation, and industrial decarbonization initiatives. For instance, Mitsubishi Heavy Industries is investing in advanced carbon capture solutions for power generation and hydrogen production projects. The integration of CCS with industrial clusters and renewable energy infrastructure, along with strong R&D capabilities and regulatory support, is fostering adoption, and Japan’s focus on sustainable energy solutions and reducing fossil fuel dependency continues to drive market expansion.

China Carbon Capture, Utilization, and Storage Market Insight

The China carbon capture, utilization, and storage market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising industrial emissions, government support for low-carbon technologies, and extensive urbanization. For instance, China Huaneng Group is deploying CCS projects at power plants and industrial facilities to achieve carbon neutrality. The country is advancing large-scale carbon storage hubs, CO₂ transport networks, and domestic-international collaborations to enhance capacity and reduce costs, while policy support, industrial scale, and technological investments are key factors propelling market growth across residential, commercial, and industrial sectors.

Carbon Capture, Utilization, and Storage Market Share

The carbon capture, utilization, and storage industry is primarily led by well-established companies, including:

- Royal Dutch Shell (Netherlands)

- Aker Solutions (Norway)

- MITSUBISHI HEAVY INDUSTRIES, LTD (Japan)

- Linde plc (Ireland)

- Hitachi, Ltd (Japan)

- Exxon Mobil Corporation (U.S.)

- JGC HOLDINGS CORPORATION (Japan)

- Honeywell International, Inc (U.S.)

- Halliburton (U.S.)

- Schlumberger Limited (U.K.)

Latest Developments in Global Carbon Capture, Utilization, and Storage Market

- In April 2025, Shell took Final Investment Decision (FID) on two major carbon capture and storage (CCS) projects in Canada: the Polaris CCS project at its Scotford Energy and Chemicals Park, designed to capture 650,000 tons (716,502.35 tons) of CO₂ annually, and the Atlas Carbon Storage Hub, developed in partnership with ATCO EnPower, which will provide permanent underground storage for captured CO₂. These initiatives significantly expand Shell’s CCS portfolio, reinforcing the company’s leadership in the North American market while promoting industrial decarbonization and increasing the availability of large-scale CO₂ storage infrastructure

- In April 2025, Shell, along with partners Equinor and TotalEnergies, announced a USD 714 million investment to expand the Northern Lights CCS project, increasing its CO₂ storage capacity from 1.5 to 5 million tons (1.65 to 5.5 million tons) per year. Enabled by a long-term agreement with Stockholm Exergi and supported by EU and Norwegian funding, this expansion strengthens Europe’s carbon capture infrastructure, facilitates cross-border CO₂ transport, and enhances the market for secure offshore storage, positioning the region as a leader in decarbonization technologies

- In April 2025, Calpine and Exxon Mobil signed a CO₂ transportation and storage agreement under which Exxon Mobil will store up to 2 million tons (2.2 million tons) of CO₂ per year from Calpine’s Baytown Energy Center. The project will support the production of ~500 MW of low-carbon electricity, enough to power over 500,000 homes, boosting U.S. energy security and competitiveness while accelerating the adoption of carbon capture solutions in the power generation sector and demonstrating the market’s capability to integrate CCS with large-scale industrial applications

- In March 2025, Occidental Petroleum announced the expansion of its CO₂ capture capacity at its Texas operations to more than 3 million tons annually, integrating advanced capture technologies for enhanced oil recovery and industrial emissions mitigation. This development strengthens Occidental’s position in the North American CCS market, accelerates large-scale deployment of carbon capture projects, and demonstrates the scalability of CCS solutions for commercial and industrial sectors

- In February 2025, Mitsubishi Heavy Industries (MHI) launched a collaborative CCS pilot program in Japan with JERA and local utilities, targeting 100,000 tons of CO₂ capture per year from power plants, with plans to scale up for commercial deployment. This initiative underscores the growing adoption of CCS technology in Asia-Pacific, supports Japan’s national decarbonization goals, and enhances market confidence in integrating carbon capture with existing energy infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Carbon Capture Utilization And Storage Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Carbon Capture Utilization And Storage Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Carbon Capture Utilization And Storage Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.