Global Carbon Steel Market

Market Size in USD Billion

CAGR :

%

USD

2.19 Billion

USD

3.04 Billion

2024

2032

USD

2.19 Billion

USD

3.04 Billion

2024

2032

| 2025 –2032 | |

| USD 2.19 Billion | |

| USD 3.04 Billion | |

|

|

|

|

Carbon Steel Market Size

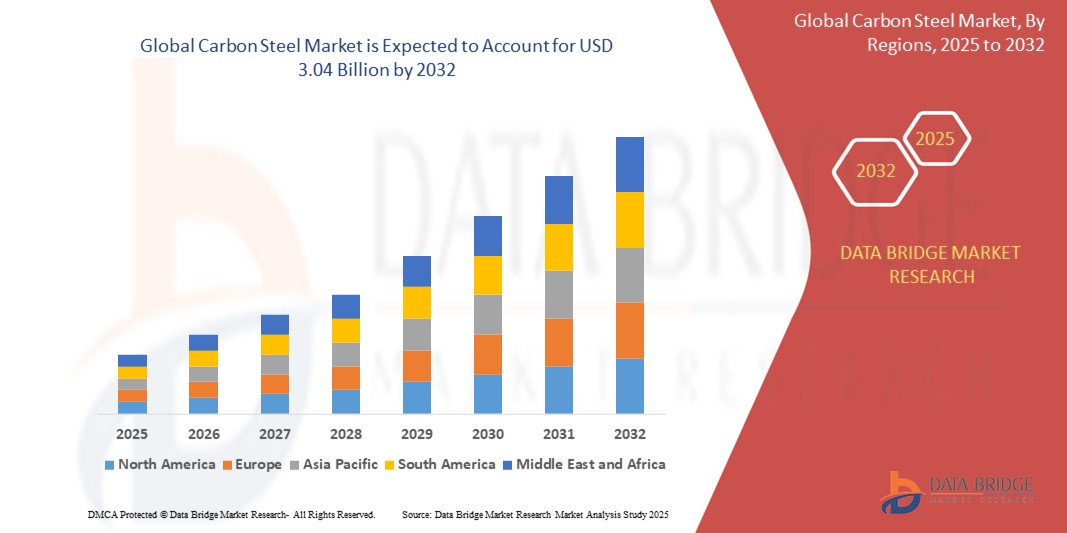

- The global carbon steel market size was valued at USD 2.19 billion in 2024 and is expected to reach USD 3.04 billion by 2032, at a CAGR of 4.2% during the forecast period

- The market growth is driven by increasing demand from construction, automotive, and energy sectors, coupled with advancements in steel production technologies and infrastructure development globally

- Rising urbanization, industrialization, and the need for durable, cost-effective materials in emerging economies are further propelling the adoption of carbon steel, establishing it as a critical material across multiple industries

Carbon Steel Market Analysis

- Carbon steel, known for its strength, versatility, and affordability, is a fundamental material in industries such as construction, automotive, shipbuilding, and oil and gas, due to its wide range of applications and adaptability to various treatments and shapes

- The growing demand for carbon steel is fueled by rapid infrastructure development, increasing automotive production, and the expansion of the energy sector, particularly in oil and gas pipelines and renewable energy projects

- Asia-Pacific dominated the carbon steel market with the largest revenue share of 45.8% in 2024, driven by robust industrial growth, large-scale construction projects, and the presence of major steel producers in countries such as China, India, and Japan

- North America is expected to be the fastest-growing region during the forecast period, propelled by rising investments in infrastructure modernization, automotive innovation, and energy sector advancements, particularly in the U.S. and Canada

- The low carbon steel segment held the largest market revenue share of 48.5% in 2024, driven by its widespread use in construction, automotive, and manufacturing due to its affordability, versatility, and ease of fabrication

Report Scope and Carbon Steel Market Segmentation

|

Attributes |

Carbon Steel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Carbon Steel Market Trends

“Increasing Integration of Advanced Manufacturing Technologies and Automation”

- The global carbon steel market is experiencing a notable trend toward the integration of advanced manufacturing technologies, such as automation, IoT, and Industry 4.0 solutions

- These technologies enable enhanced precision in steel production, improved quality control, and optimized manufacturing processes, resulting in higher efficiency and reduced waste

- Smart manufacturing systems powered by IoT allow real-time monitoring of production parameters, ensuring consistent quality across different carbon steel types

- For instances, companies are adopting automated rolling mills and AI-driven quality assurance systems to produce high-quality flat, long, and tabular steel products tailored to specific applications such as construction hardware or structural components

- This trend is increasing the appeal of carbon steel products for end-users in industries such as construction, automotive, and shipbuilding, where precision and reliability are critical

- Advanced analytics are also being used to predict material performance under various treatments enabling manufacturers to meet stringent industry standards

Carbon Steel Market Dynamics

Driver

“Growing Demand for Infrastructure Development and Industrial Applications”

- The rising global demand for infrastructure development, particularly in emerging economies, is a major driver for the carbon steel market

- Carbon steel, especially low and medium carbon steel, is widely used in construction for structural components, pipes, and tubes due to its strength, durability, and cost-effectiveness

- The automotive industry’s increasing reliance on high carbon steel for lightweight, high-strength components to improve fuel efficiency and meet emission standards further fuels market growth

- Government initiatives, particularly in the Asia Pacific region, for large-scale infrastructure projects, such as bridges, railways, and urban development, are boosting the demand for long steel and flat steel products

- The expansion of the oil and gas energy sector, particularly in North America, is driving the use of tabular steel for pipelines and other critical applications

- Advancements in production processes, such as the Basic Oxygen Furnace and Electric Arc Furnace, are enabling manufacturers to meet the growing demand for high-quality carbon steel products across diverse applications

Restraint/Challenge

“High Production Costs and Environmental Concerns”

- The significant capital investment required for advanced production facilities, such as Basic Oxygen Furnaces or Electric Arc Furnaces, poses a barrier to entry for smaller manufacturers, particularly in developing markets

- The integration of advanced treatments (e.g., galvanizing or annealing) and compliance with environmental regulations increase production costs, impacting affordability for some end-users

- Environmental concerns related to carbon emissions and energy-intensive steel production processes are a major challenge. The industry faces pressure to adopt sustainable practices, such as recycling steel or using cleaner energy sources, which can be costly to implement

- Stringent environmental regulations in regions such as North America and Europe regarding emissions and waste management add complexity to manufacturing operations, particularly for high and ultra-high carbon steel production

- These factors can limit market expansion, especially in regions with high cost sensitivity or where environmental awareness is a significant concern

Carbon Steel market Scope

The market is segmented on the basis of type, end-user, product, shape, treatment, process, and application.

- By Type

On the basis of type, the global carbon steel market is segmented into low carbon steel, medium carbon steel, high carbon steel, and ultra-high carbon steel. The low carbon steel segment held the largest market revenue share of 48.5% in 2024, driven by its widespread use in construction, automotive, and manufacturing due to its affordability, versatility, and ease of fabrication. Its high ductility and weldability make it ideal for structural applications.

The high carbon steel segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for durable and high-strength materials in tools, automotive components, and industrial machinery. Advancements in heat treatment technologies are further enhancing its adoption.

- By End-User

On the basis of end-user, the global carbon steel market is segmented into shipbuilding, construction, automotive, oil and gas energy, and others. The construction segment dominated the market with a revenue share of 40.2% in 2024, owing to the extensive use of carbon steel in infrastructure projects, residential buildings, and commercial structures, particularly in the Asia Pacific region.

The automotive segment is anticipated to experience the fastest growth rate of 16.8% from 2025 to 2032, driven by increasing demand for lightweight, high-strength carbon steel in vehicle manufacturing to improve fuel efficiency and meet stringent emission standards.

- By Product

On the basis of product, the global carbon steel market is segmented into carbon steel, alloy steel, and stainless steel. The carbon steel segment held the largest market revenue share of 55.7% in 2024, attributed to its cost-effectiveness and widespread application across industries such as construction, automotive, and oil and gas.

The alloy steel segment is projected to grow at the fastest rate from 2025 to 2032, driven by its enhanced mechanical properties, such as improved strength and corrosion resistance, making it suitable for demanding applications in energy and industrial sectors.

- By Shape

On the basis of shape, the global carbon steel market is segmented into long steel, tabular steel, and flat steel. The flat steel segment accounted for the largest market revenue share of 50.3% in 2024, driven by its extensive use in automotive body panels, appliances, and construction materials due to its versatility and ease of processing.

The long steel segment is expected to witness significant growth from 2025 to 2032, fueled by rising demand for rebar, beams, and rods in infrastructure development, particularly in emerging economies.

- By Treatment

On the basis of treatment, the global carbon steel market is segmented into cold rolled, hot rolled, galvanized, and annealed. The hot rolled segment dominated with a revenue share of 45.6% in 2024, owing to its cost-effectiveness and suitability for structural applications in construction and heavy industries.

The galvanized segment is anticipated to experience the fastest growth from 2025 to 2032, driven by increasing demand for corrosion-resistant steel in automotive, construction, and infrastructure projects, especially in regions prone to harsh environmental conditions.

- By Process

On the basis of process, the global carbon steel market is segmented into basic oxygen furnace (BOF) and electric arc furnace (EAF). The basic oxygen furnace segment held the largest market revenue share of 60.8% in 2024, due to its high production efficiency and ability to produce large volumes of carbon steel for industrial applications.

The electric arc furnace segment is expected to grow at a robust rate from 2025 to 2032, driven by its sustainability advantages, such as the use of recycled scrap metal, and increasing adoption in North America and Europe due to environmental regulations.

- By Application

On the basis of application, the global carbon steel market is segmented into tools, pipes and tubes, construction hardware, and structural. The structural segment accounted for the largest market revenue share of 42.7% in 2024, driven by the extensive use of carbon steel in beams, columns, and other structural components in construction and infrastructure projects.

The pipes and tubes segment is projected to witness the fastest growth from 2025 to 2032, fueled by rising demand in the oil and gas industry for pipelines and in construction for plumbing and HVAC systems, particularly in the Asia Pacific region.

Carbon Steel Market Regional Analysis

- Asia-Pacific dominated the carbon steel market with the largest revenue share of 45.8% in 2024, driven by robust industrial growth, large-scale construction projects, and the presence of major steel producers in countries such as China, India, and Japan

- Consumers and industries prioritize carbon steel for its strength, durability, and cost-effectiveness, particularly in applications requiring structural integrity and corrosion resistance

- Growth is supported by advancements in steel production technologies, such as electric arc furnaces and basic oxygen furnaces, alongside increasing adoption in both industrial and infrastructural projects

U.S. Carbon Steel Market Insight

The U.S. carbon steel market is expected to witness significant growth, fueled by strong demand from the construction, automotive, and energy sectors. The trend toward infrastructure modernization and increasing regulations promoting sustainable materials boost market expansion. The growing use of high-strength, low-carbon steel in automotive manufacturing and aftermarket applications further enhances market growth.

Europe Carbon Steel Market Insight

The Europe carbon steel market is witnessing steady growth, supported by regulatory emphasis on sustainable construction and energy-efficient manufacturing. Industries seek carbon steel for its versatility in applications such as construction hardware and structural components. Growth is notable in both new infrastructure projects and industrial retrofitting, with countries such as Germany and France showing significant demand due to environmental concerns and industrial advancements.

U.K. Carbon Steel Market Insight

The U.K. market for carbon steel is experiencing notable growth, driven by demand for durable materials in construction and automotive applications. Increased focus on infrastructure development and rising awareness of low-carbon steel benefits encourage adoption. Evolving regulations promoting energy efficiency and material recyclability influence consumer choices, balancing performance with compliance.

Germany Carbon Steel Market Insight

Germany is witnessing significant growth in the carbon steel market, attributed to its advanced manufacturing sector and high consumer focus on energy-efficient and durable materials. German industries prefer high-quality carbon steel, such as medium and high-carbon variants, for automotive and construction applications. The integration of advanced steel treatments such as galvanizing and annealing in premium products supports sustained market growth.

Asia-Pacific Carbon Steel Market Insight

The Asia-Pacific region dominates the global carbon steel market, driven by expanding industrial production and rising infrastructure investments in countries such as China, India, and Japan. Increasing demand for low-carbon and high-carbon steel in construction, automotive, and shipbuilding sectors boosts market growth. Government initiatives promoting sustainable manufacturing and energy efficiency further encourage the use of advanced carbon steel products.

Japan Carbon Steel Market Insight

Japan’s carbon steel market is experiencing robust growth due to strong consumer preference for high-quality, technologically advanced steel products that enhance structural integrity and durability. The presence of major automotive and shipbuilding industries accelerates market penetration. Rising interest in customized steel solutions for infrastructure and industrial applications also contributes to growth.

China Carbon Steel Market Insight

China holds the largest share of the Asia-Pacific carbon steel market, propelled by rapid urbanization, rising industrial output, and increasing demand for cost-effective, durable materials. The country’s growing construction and automotive sectors, along with a focus on sustainable manufacturing, support the adoption of advanced carbon steel products. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Carbon Steel Market Share

The carbon steel industry is primarily led by well-established companies, including:

- NACHI-FUJIKOSHI CORP. (Japan)

- Daido Steel Co., Ltd. (Japan)

- voestalpine High Performance Metals GmbH (Austria)

- Sandvik AB (Sweden)

- Kennametal Inc. (U.S.)

- Hudson Tool Steel (U.S.)

- ERASTEEL (France)

- ArcelorMittal (Luxembourg)

- Shandong Baosteel Industry Co., Ltd. (China)

- POSCO (South Korea)

- NIPPON STEEL CORPORATION (Japan)

- JFE Steel Corporation (Japan)

- Tata Steel (India)

- United States Steel Corporation (U.S.)

- Angang Steel Company Limited (China)

- Gerdau S/A (Brazil)

- Maanshan Iron & Steel Company Limited (China)

What are the Recent Developments in Global Carbon Steel Market?

- In May 2025, EMSTEEL, one of the UAE’s largest steel and building materials manufacturers, unveiled its inaugural Green Finance Framework to accelerate its transition toward a low-carbon economy. The framework enables EMSTEEL and its subsidiaries to issue green financial instruments—such as bonds, loans, and commercial papers—to fund eligible projects in low-carbon steel and cement production, renewable energy installations, and energy efficiency technologies. Developed in line with global green finance standards, the initiative received a strong endorsement from Moody’s Ratings with a Sustainability Quality Score of SQS2. It reflects EMSTEEL’s broader ESG strategy and commitment to achieving net-zero emissions by 2050

- In May 2025, Cleveland-Cliffs Inc. announced the successful completion of a hydrogen injection trial at its Middletown Works blast furnace, marking a historic milestone as the first-ever use of hydrogen gas as an iron-reducing agent in a blast furnace in the Americas. During the trial, hydrogen was injected into all 20 tuyeres of the #3 blast furnace, replacing a portion of the traditional coke and significantly reducing CO₂ emissions by releasing water vapor instead. This breakthrough demonstrates Cleveland-Cliffs’ commitment to decarbonizing steel production while maintaining product quality and operational efficiency

- In January 2025, JFE Steel Corporation announced it would begin supplying its JGreeX™ green steel to JFE Shoji Pipe & Fitting Corporation (JKK)—marking the first time a Japanese steel distributor has offered JGreeX™ in the steel pipe sector. This milestone enables small-lot shipments and faster deliveries, expanding access to sustainable steel solutions across construction and infrastructure markets. JFE Steel uses a mass-balance approach to allocate emission reductions to specific JGreeX™ products, supporting efforts to decarbonize supply chains and reduce greenhouse gas emissions throughout the lifecycle of buildings and industrial systems

- In January 2025, Volvo Construction Equipment (Volvo CE) began using low-carbon emission steel in the serial production of all its articulated haulers manufactured in Braås, Sweden. This milestone marks a significant step in decarbonizing heavy machinery manufacturing, as steel accounts for over 50% of the machines’ total carbon footprint. By integrating recycled, low-emission steel into its production process, Volvo CE aims to reduce lifecycle emissions and support its broader goal of achieving net-zero greenhouse gas emissions by 2040. The move also reflects a growing industry shift toward sustainable materials and circular manufacturing practices

- In October 2024, JSW Group and POSCO Group of Korea signed a landmark Memorandum of Understanding (MoU) to jointly develop an integrated steel plant in India with an initial capacity of 5 million tonnes per annum. This strategic collaboration aims to bolster India’s steel production infrastructure while also exploring synergies in battery materials—particularly for electric vehicles—and renewable energy. The partnership combines JSW’s robust manufacturing and project execution capabilities with POSCO’s technological expertise, laying the groundwork for sustainable industrial growth and innovation across multiple sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Carbon Steel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Carbon Steel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Carbon Steel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.