Global Cat Food And Snacks Market

Market Size in USD Billion

CAGR :

%

USD

29.96 Billion

USD

41.64 Billion

2025

2033

USD

29.96 Billion

USD

41.64 Billion

2025

2033

| 2026 –2033 | |

| USD 29.96 Billion | |

| USD 41.64 Billion | |

|

|

|

|

Cat Food and Snacks Market Size

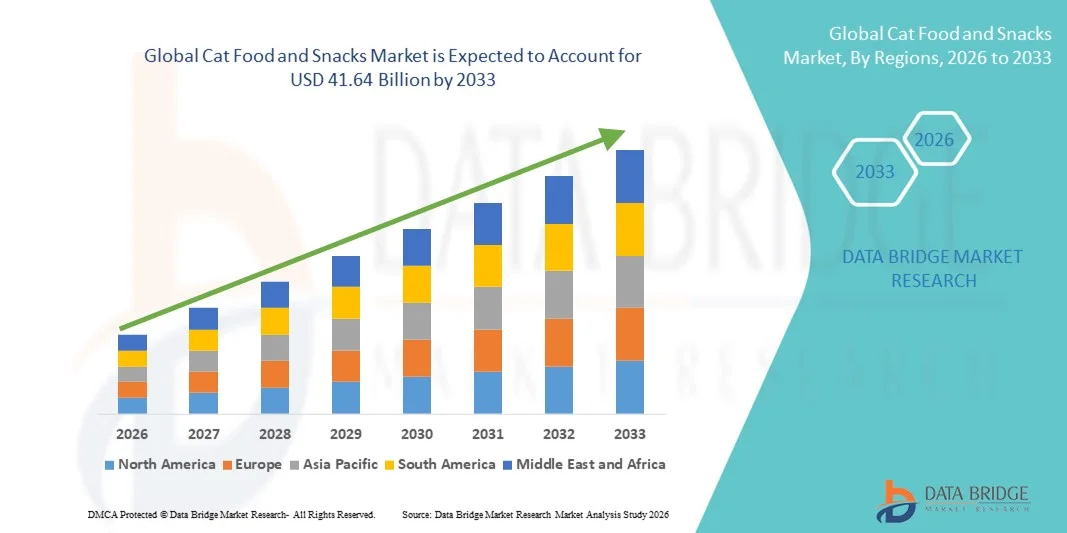

- The global cat food and snacks market size was valued at USD 29.96 billion in 2025 and is expected to reach USD 41.64 billion by 2033, at a CAGR of 4.20% during the forecast period

- The market growth is largely fuelled by the rising global cat population and increasing consumer spending on premium and functional pet food products

- Increasing pet humanization trends and growing demand for nutritious, natural, and specialized cat food formulations such as grain-free and organic variants are further supporting market expansion

Cat Food and Snacks Market Analysis

- The market is witnessing steady growth driven by increasing awareness regarding feline nutrition, health, and wellness, encouraging owners to invest in high-quality and functional food and snack products

- Manufacturers are focusing on product innovation, premiumization, and sustainable packaging, while expanding distribution networks and introducing specialized offerings to meet evolving consumer preferences and strengthen market presence

- North America dominated the cat food and snacks market with the largest revenue share in 2025, driven by a high pet ownership rate, increasing disposable incomes, and growing awareness of pet health and nutrition

- Asia-Pacific region is expected to witness the highest growth rate in the global cat food and snacks market, driven by urbanization, rising middle-class population, and increasing trend of pet humanization

- The Dry Cat Food segment held the largest market revenue share in 2025, driven by its long shelf life, convenience, and wide availability across retail and online channels. Dry cat food is particularly popular among busy pet owners seeking cost-effective and nutritionally balanced options for daily feeding

Report Scope and Cat Food and Snacks Market Segmentation

|

Attributes |

Cat Food and Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cat Food and Snacks Market Trends

Rising Demand for Premium and Functional Products

- The growing focus on high-quality, nutritious, and specialty cat food products is significantly shaping the cat food and snacks market, as pet owners increasingly prefer products that support health, wellness, and convenience. Premium formulations are gaining traction due to their ability to enhance palatability, nutritional value, and overall pet well-being, strengthening adoption across dry, wet, and snack segments, and encouraging manufacturers to innovate with new product lines that cater to evolving consumer preferences

- Increasing awareness around pet health, immunity, and life-stage nutrition has accelerated the demand for functional cat food and treats. Health-conscious consumers are actively seeking products enriched with vitamins, minerals, probiotics, and natural ingredients, prompting brands to focus on transparency, ingredient quality, and sustainability in sourcing and production processes. Collaborations between pet food manufacturers and nutrition experts are also on the rise to improve product functionality and appeal

- Premiumization and convenience trends are influencing purchasing decisions, with manufacturers emphasizing high-quality ingredients, eco-friendly packaging, and transparency in labeling. These factors are helping brands differentiate in a competitive market, build consumer trust, and strengthen loyalty, while also driving the adoption of specialized product lines for weight management, dental care, and age-specific nutrition

- For instance, in 2024, Nestlé Purina in the U.S. and Royal Canin in France expanded their product portfolios with new functional and gourmet cat food and snacks. These launches addressed rising consumer demand for health-focused, high-quality offerings, with distribution across retail, specialty pet stores, and online channels. The products were marketed as nutritious and safe choices, enhancing brand trust and repeat purchases among pet owners

- While demand for premium and functional products is growing, sustained market expansion depends on continuous R&D, cost-effective production, and maintaining nutritional quality and palatability. Manufacturers are focusing on improving scalability, supply chain reliability, and developing innovative solutions that balance cost, quality, and sustainability for broader adoption

Cat Food and Snacks Market Dynamics

Driver

Rising Preference for Premium and Functional Products

- Growing consumer awareness of pet health and wellness is a major driver for the cat food and snacks market. Pet owners are increasingly seeking high-quality, nutrient-rich, and specialty products to support their pets’ overall health, driving innovation and diversification in product offerings

- Expanding applications in dry food, wet food, treats, and supplements are influencing market growth. Functional cat food products enhance digestion, immunity, dental health, and coat quality, enabling manufacturers to meet consumer expectations for healthy and premium offerings. The growing trend of pet humanization further reinforces this adoption

- Pet food manufacturers are actively promoting premium and functional product lines through innovation, marketing campaigns, and expert collaborations. These efforts are supported by the increasing consumer preference for natural, functional, and specialty nutrition, while encouraging partnerships between ingredient suppliers and brands to improve product quality and sustainability

- For instance, in 2023, Hill’s Pet Nutrition in the U.S. and Mars Petcare in Germany expanded their product lines with new functional cat food and snacks. This expansion followed higher demand for weight management, urinary health, and digestive care products, driving repeat purchases and product differentiation. Both companies also emphasized ingredient transparency and nutritional benefits to strengthen consumer trust and brand loyalty

- Although premiumization trends support growth, wider adoption depends on cost optimization, ingredient availability, and scalable production processes. Investment in supply chain efficiency, sustainable sourcing, and advanced formulation technology is critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Cost And Ingredient Sourcing Constraints

- The relatively higher cost of premium and functional cat food compared to standard products remains a key challenge, limiting adoption among price-sensitive consumers. Higher raw material costs, specialized ingredients, and complex processing methods contribute to elevated pricing

- Limited awareness of functional benefits and nutritional differences remains uneven, particularly in emerging markets where premium pet food demand is still developing. This restricts adoption across certain regions and product categories

- Supply chain and production challenges also impact market growth, as premium ingredients require certified sourcing and strict quality standards. Logistical complexities and perishable nature of wet foods increase operational costs. Companies must invest in cold storage, proper handling, and efficient distribution to maintain product integrity

- For instance, in 2024, distributors in India and Southeast Asia supplying premium cat food brands such as Royal Canin and Hill’s Pet Nutrition reported slower uptake due to higher prices and limited awareness of functional benefits. Packaging requirements and cold chain logistics were additional barriers, affecting product visibility and sales

- Overcoming these challenges will require cost-efficient production, expanded distribution networks, and focused educational initiatives for consumers. Collaboration with retailers, veterinarians, and nutrition experts can help unlock the long-term growth potential of the global cat food and snacks market. Developing cost-competitive, high-quality, and functional formulations will be essential for widespread adoption

Cat Food and Snacks Market Scope

The market is segmented on the basis of product, ingredients, sales channel, and pricing.

- By Product

On the basis of product, the cat food and snacks market is segmented into Dry Cat Food, Wet Cat Food, Veterinary Diet, Treats/Snacks, and Organic Products. The Dry Cat Food segment held the largest market revenue share in 2025, driven by its long shelf life, convenience, and wide availability across retail and online channels. Dry cat food is particularly popular among busy pet owners seeking cost-effective and nutritionally balanced options for daily feeding.

The Treats/Snacks segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising consumer interest in functional and reward-based pet products. Treats and snacks often provide added health benefits, enrichment, and bonding opportunities between pets and owners, making them a preferred choice for enhancing pet care routines.

- By Ingredients

On the basis of ingredients, the cat food and snacks market is segmented into Animal-derived, Plant-derived, Cereal, Cereal By-products, and Other Ingredient Types. The Animal-derived segment held the largest market share in 2025, supported by increasing demand for protein-rich diets that cater to cats’ natural carnivorous needs. Animal-derived ingredients are considered essential for maintaining muscle development, energy levels, and overall health in domestic cats.

The Plant-derived segment is expected to register the fastest growth from 2026 to 2033, driven by the rising adoption of natural, organic, and functional ingredients among health-conscious pet owners. Plant-based additives, fibers, and supplements are increasingly incorporated into cat food formulations for improved digestion, immunity, and wellness.

- By Sales Channel

On the basis of sales channel, the market is segmented into Specialized Pet Shop, Internet Sales, Hypermarkets/Supermarkets, and Other Sales Channels. Hypermarkets/Supermarkets dominated the market in 2025 due to their wide product range, competitive pricing, and easy accessibility for consumers. These outlets offer convenience, bundled promotions, and loyalty programs, encouraging repeat purchases of cat food and snacks.

The Internet Sales segment is projected to witness the fastest growth from 2026 to 2033, fueled by the increasing preference for e-commerce platforms, subscription-based delivery models, and home convenience. Online channels provide extensive product variety, competitive pricing, and direct-to-door delivery, attracting tech-savvy and busy pet owners.

- By Pricing

On the basis of pricing, the cat food and snacks market is segmented into Economy Segment, Premium Segment, and Super-premium Segment. The Premium Segment held the largest market revenue share in 2025, driven by consumers’ willingness to pay more for high-quality, nutritionally balanced, and specialty formulations that enhance feline health. Premium products often emphasize added functional benefits, such as hairball control, urinary health, and weight management.

The Super-premium Segment is expected to register the fastest growth rate from 2026 to 2033, supported by rising demand for natural, organic, and specialty ingredients. Super-premium cat food and snacks cater to pet owners seeking customized nutrition, ethically sourced ingredients, and enhanced wellness benefits, making it a key growth driver in the market.

Cat Food and Snacks Market Regional Analysis

- North America dominated the cat food and snacks market with the largest revenue share in 2025, driven by a high pet ownership rate, increasing disposable incomes, and growing awareness of pet health and nutrition

- Consumers in the region increasingly prioritize premium, nutritious, and functional cat food products, with a focus on convenience, high-quality ingredients, and dietary benefits

- The widespread adoption is further supported by strong retail infrastructure, online penetration, and a rising trend of humanization of pets, establishing North America as a leading market for cat food and snacks

U.S. Cat Food and Snacks Market Insight

The U.S. cat food and snacks market captured the largest revenue share in 2025 within North America, fueled by rising pet ownership and increasing consumer spending on pet wellness. Consumers are prioritizing high-quality, nutrient-rich products, including veterinary diets and organic options. The growing preference for subscription-based and online purchasing, combined with demand for functional treats and snacks, further propels the market. Moreover, marketing initiatives highlighting ingredient transparency and health benefits are significantly contributing to market expansion.

Europe Cat Food and Snacks Market Insight

The Europe cat food and snacks market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by growing awareness about pet nutrition, stringent pet food regulations, and increasing urbanization. Consumers are seeking premium, natural, and sustainable products, while demand for specialized diets and functional treats is rising. The region is experiencing growth across retail and e-commerce channels, with products being incorporated into both multi-pet households and premium pet care segments.

U.K. Cat Food and Snacks Market Insight

The U.K. cat food and snacks market is expected to witness strong growth from 2026 to 2033, driven by the rising trend of pet humanization and demand for high-quality, functional, and convenient products. Health-conscious pet owners are encouraging the adoption of specialized diets, organic products, and nutrient-rich snacks. In addition, robust online retail and e-commerce penetration is expected to support market expansion.

Germany Cat Food and Snacks Market Insight

The Germany cat food and snacks market is expected to witness significant growth from 2026 to 2033, fueled by increasing awareness of pet health, advanced retail infrastructure, and a preference for premium and sustainable pet food. Consumers are increasingly adopting specialized diets and functional products, while innovative product launches and marketing campaigns focusing on nutrition and quality are driving adoption. The integration of online and offline sales channels further supports market growth.

Asia-Pacific Cat Food and Snacks Market Insight

The Asia-Pacific cat food and snacks market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing pet adoption, rising disposable incomes, and growing awareness about pet nutrition in countries such as China, Japan, and India. The region’s emerging middle class and urbanization are accelerating demand for premium, functional, and organic cat food products. Government regulations supporting pet food safety and a growing e-commerce infrastructure are also expanding market accessibility.

Japan Cat Food and Snacks Market Insight

The Japan cat food and snacks market is expected to witness strong growth from 2026 to 2033 due to high pet ownership, a tech-savvy population, and demand for premium and functional products. Consumers increasingly focus on specialized diets, nutrient-rich snacks, and organic options. The integration of online retail and subscription services, along with innovative product launches, is likely to enhance market growth.

China Cat Food and Snacks Market Insight

The China cat food and snacks market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising pet adoption, and increasing consumer awareness of pet nutrition. Premiumization, functional food options, and online retail adoption are key factors driving market growth. Domestic manufacturers and international brands are expanding product portfolios to capture the growing demand for nutritious and convenient cat food products across residential and commercial channel.

Cat Food and Snacks Market Share

The Cat Food and Snacks industry is primarily led by well-established companies, including:

- Mars Incorporated (U.S.)

- ADM Animal Nutrition (U.S.)

- Nestlé India Ltd. (India)

- J.M. Smucker Co (U.S.)

- Colgate-Palmolive Company (India) Limited (India)

- The J.M. Smucker Company (U.S.)

- SCHELL & KAMPETER, INC. (U.S.)

- General Mills, Inc. (U.S.)

- SpectrumBrands (U.S.)

- Blue Buffalo Co., Ltd. (U.S.)

- Beaphar (Netherlands)

- WellPet (U.S.)

- Harringtons Pet Food (U.K.)

- PetGuard (U.S.)

- Canidae (U.S.)

Latest Developments in Global Cat Food and Snacks Market

- In October 2023, Cult Food Science (Canada) launched a new line of vegan cat treats under its Noochies sub-brand, featuring the patented nutritional yeast ingredient Bmmune. The freeze-dried treats provide a protein-rich, high-fiber alternative with essential B vitamins, closely mimicking the amino acid profile of traditional meat. This product innovation is expected to cater to the growing demand for plant-based pet foods, strengthen brand positioning in the alternative protein segment, and appeal to health-conscious pet owners

- In March 2023, Temptations (U.S.) expanded its product portfolio by introducing Temptations Dry Cat Food, combining dry kibble with crunchy and creamy pockets across multiple flavors. Formulated with high-quality protein and 35 essential nutrients, the line supports healthy muscle development in cats. This launch aims to capture a larger share of the cat food market, diversify offerings, and enhance customer loyalty

- In February 2023, Nestlé Purina PetCare (U.S.) announced the acquisition of the Red Collar Pet Foods factory in Miami, Oklahoma, marking its 22nd facility in North America. This strategic expansion enhances Purina’s production capabilities, enabling more efficient in-house manufacturing of dog and cat treats. The move is expected to strengthen Purina’s market presence, support innovation, and meet the rising demand for premium pet products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.