Global Cataracts Market

Market Size in USD Billion

CAGR :

%

USD

5.59 Billion

USD

8.92 Billion

2024

2032

USD

5.59 Billion

USD

8.92 Billion

2024

2032

| 2025 –2032 | |

| USD 5.59 Billion | |

| USD 8.92 Billion | |

|

|

|

|

Cataracts Market Size

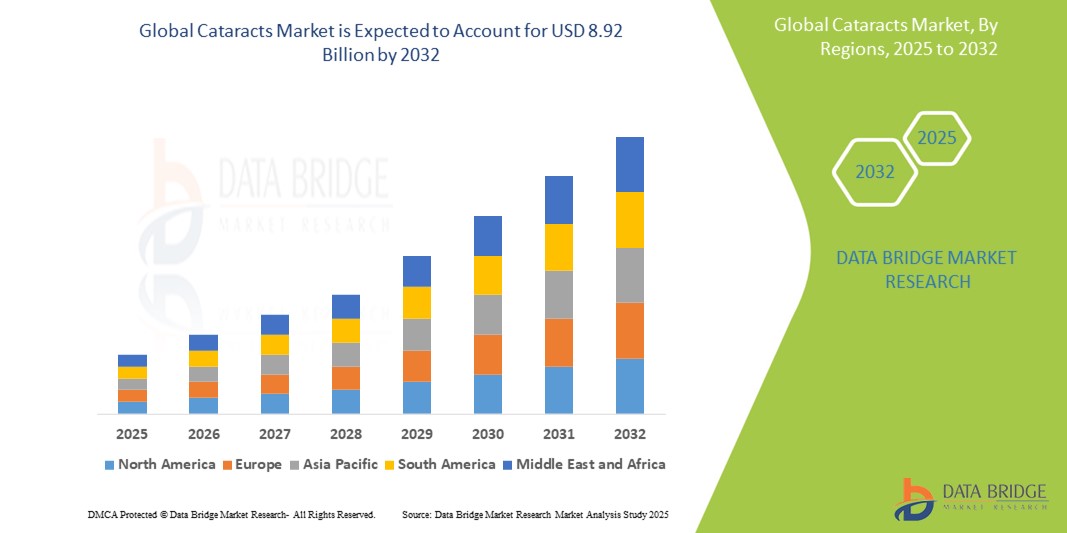

- The global cataracts market size was valued at USD 5.59 billion in 2024 and is expected to reach USD 8.92 billion by 2032, at a CAGR of 6.0% during the forecast period

- The increasing prevalence of cataracts among the elderly is a major driver, especially in countries with expanding geriatric demographics such as Japan, Germany, and the U.S.

- Furthermore, the innovations such as femtosecond laser-assisted cataract surgery (FLACS) and premium intraocular lenses (IOLs) are transforming patient outcomes and driving demand

Cataracts Market Analysis

- Cataract surgeries are becoming increasingly essential in modern ophthalmic care due to their proven ability to restore vision, enhance quality of life, and reduce the risk of falls and related complications, especially in the elderly

- The surging demand for cataract treatment is driven by a combination of factors including the rising incidence of age-related eye disorders, technological advancements in intraocular lenses (IOLs), and improved access to surgical care across both developed and developing regions

- North America dominated the cataracts market with the largest revenue share of 39.15% in 2024, to the region’s advanced healthcare infrastructure, early adoption of cutting-edge cataract surgical technologies, and favorable reimbursement policies. The U.S., in particular, continues to witness high surgical volumes, fueled by increased awareness, a growing elderly population, and the availability of premium intraocular lenses (IOLs)

- Asia-Pacific is expected to be the fastest growing region with a CAGR of 9.2% in the cataracts market during the forecast period due to increasing urbanization, rising healthcare expenditure, expanding access to ophthalmic care, and government-supported initiatives to eliminate preventable blindness

- The surgery segment dominated the cataracts market with a market share of 38.5% in 2024, owing to its status as the primary and most effective treatment option for cataracts

Report Scope and Cataracts Market Segmentation

|

Attributes |

Cataracts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cataracts Market Trends

“Enhanced Outcomes Through AI, Robotics, and Personalized Care”

- A growing trend in the global cataracts market is the integration of artificial intelligence (AI) and robotics into cataract diagnostics, surgical planning, and post-operative care. These technologies are enhancing precision, efficiency, and patient-specific outcomes

- For instance, Alcon’s Vivity and PanOptix IOLs are part of a new wave of premium lenses that provide extended depth of focus, supported by AI-driven customization in lens selection based on patient lifestyle and vision requirements

- Robotic-assisted cataract surgeries, powered by platforms such as the Catalys Precision Laser System (Johnson & Johnson Vision) and LenSx (Alcon), are gaining traction in developed markets. These systems use real-time imaging and laser precision to improve surgical outcomes

- AI-powered diagnostic platforms, such as those offered by Topcon and Zeiss, can analyze retinal scans to detect early-stage cataracts and other ocular conditions, facilitating early diagnosis and intervention

- In addition, the trend toward outpatient and ambulatory surgical centers (ASCs), equipped with advanced imaging, femtosecond lasers, and AI integration, is revolutionizing how cataract surgeries are delivered—minimizing hospital stay times and reducing healthcare costs

- This move toward personalized cataract care, supported by real-time data, digital diagnostics, and robotic precision, is reshaping both patient expectations and ophthalmology standards globally

Cataracts Market Dynamics

Driver

“Rising Global Burden of Vision Impairment and Advancements in Cataract Surgery”

- The increasing global burden of vision impairment due to age-related cataracts is a major driver for the market. According to the World Health Organization (WHO), cataracts remain the leading cause of blindness globally, affecting over 65 million people

- With aging populations in regions such as North America, Europe, and Asia-Pacific, the demand for effective and rapid cataract treatment is rising. For instance, India's National Program for Control of Blindness (NPCB) is scaling up free cataract surgeries to reduce avoidable blindness

- Key companies such as Alcon, Johnson & Johnson Vision, and Bausch + Lomb are launching next-gen IOLs that not only restore vision but also reduce dependence on glasses—driving the premium IOL segment forward

- The shift from traditional extracapsular surgery to phacoemulsification and femtosecond laser-assisted cataract surgery (FLACS) has enhanced surgical precision, minimized healing time, and reduced complications

- Moreover, the expansion of cataract surgery in emerging markets—via mobile eye units, public-private partnerships, and teleophthalmology—is unlocking major growth potential, particularly across Latin America and Sub-Saharan Africa

Restraint/Challenge

“High Cost of Advanced Cataract Procedures and Limited Access in Rural Areas”

- While cataract surgery is widely recognized as cost-effective, the high upfront cost of premium IOLs and advanced surgical equipment poses a barrier to adoption, particularly in low- and middle-income countries

- Access remains a major challenge in rural and underserved regions, where the lack of trained ophthalmologists and infrastructure results in treatment backlogs. For instance, despite India performing over 6 million cataract surgeries annually, rural areas still face long waiting times and accessibility issues

- Advanced procedures such as FLACS and toric/multifocal IOL implants are often not covered under standard public insurance or government schemes, limiting their reach to high-income patients or private care settings

- Leading companies such as Zeiss and Rayner are focusing on scaling down premium lens prices and expanding surgical platforms into Tier 2 and Tier 3 cities globally to address this imbalance

- Another challenge is the post-operative care and follow-up, which may not be accessible for elderly or low-income patients, impacting long-term outcomes despite successful surgeries

Cataracts Market Scope

The market is segmented on the basis of type, diagnosis, treatment, end user and distribution channel.

- By Type

On the basis of type, the cataracts market is segmented into nuclear cataract, cortical cataract, posterior subcapsular cataract, congenital cataracts, and others. The nuclear cataract segment dominated in 2024, accounting for 38.4% of the market, driven by its high prevalence in the aging population and the frequency of associated surgical interventions

The posterior subcapsular cataracts segment is anticipated to witness the fastest growth rate of 21.7% from 2025 to 2032, owing to its rapid progression and increasing diagnosis among diabetic and steroid-using patients.

- By Diagnosis

On the basis of diagnosis, the cataracts market is segmented into visual acuity test, slit-lamp examination, retinal exam, and others. The slit-lamp examination held the largest market revenue share in 2024 driven by the due to its critical role in detecting and assessing cataracts in early and advanced stages.

The retinal exam segment is expected to witness the fastest CAGR from 2025 to 2032, driven by supported by technological advancements in retinal imaging and its growing use in detecting coexisting ocular conditions that may influence surgical planning.

- By Treatment

On the basis of treatment, the cataracts market is segmented into surgery. The surgery segment held the largest market revenue share of 38.5% in 2024, as it remains the only effective and definitive treatment for cataracts. The widespread adoption of advanced surgical techniques such as phacoemulsification and femtosecond laser-assisted surgery continues to drive this segment's dominance and growth potential.

- By End-Users

On the basis of end-users, the cataracts market is segmented into hospitals, homecare, specialty clinics, and others. The hospitals segment accounted for the largest market revenue share in 2024, driven by the availability of skilled ophthalmologists, advanced surgical infrastructure, and high patient inflow for cataract surgeries.

The specialty clinics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by their focus on outpatient cataract procedures, shorter waiting times, and personalized care.

- By Distribution Channel

On the basis of distribution channel, the cataracts market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment accounted for the largest market revenue share in 2024, supported by direct procurement of post-surgical medications and follow-up treatments.

The hospital pharmacy segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing digitalization in healthcare access and the growing demand for doorstep delivery of ophthalmic drugs.

Cataracts Market Regional Analysis

- North America dominated the cataracts market with the largest revenue share of 39.15% in 2024, driven by a high prevalence of age-related cataracts and widespread access to advanced surgical procedures such as phacoemulsification and femtosecond laser-assisted cataract surgery.

- Favorable reimbursement policies, growing awareness about ocular health, and the presence of key players offering innovative intraocular lenses (IOLs) continue to support strong market growth.

- In addition, the rising geriatric population and high healthcare expenditure in the region are accelerating the demand for timely diagnosis and surgical treatment of cataracts

U.S. Cataracts Market Insight

The U.S. cataracts market captured the largest revenue share of 80.5% in 2024 within North America, due to the increasing burden of cataract cases among the aging population and the rapid adoption of premium IOLs. Continued advancements in minimally invasive surgical technologies and strong presence of ophthalmic centers specializing in cataract care are major growth drivers. Moreover, the rising demand for outpatient cataract surgeries and growing acceptance of elective lens replacement procedures is further contributing to market expansion.

Europe Cataracts Market Insight

The Europe cataracts market is projected to expand at a substantial CAGR throughout the forecast period, supported by increasing demand for improved visual outcomes and growing government initiatives for cataract screening programs. Aging demographics, particularly in countries such as Germany, France, and Italy, and the availability of public health systems providing subsidized surgical treatment are enhancing market penetration. In addition, a shift towards premium lens implants is gaining momentum in private healthcare settings.

U.K. Cataracts Market Insight

The U.K. cataracts market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased NHS funding for cataract surgeries and growing awareness of early diagnosis. The expansion of private ophthalmology clinics, adoption of laser-assisted cataract surgeries, and rising demand for monofocal and multifocal IOLs are also boosting growth. The market benefits from efforts to reduce surgical wait times through mobile surgical units and community-based diagnostic pathways.

Germany Cataracts Market Insight

The Germany cataracts market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong healthcare infrastructure and early adoption of advanced technologies in eye care. High awareness about cataract symptoms and the availability of skilled ophthalmic surgeons have increased the uptake of surgical treatments. Moreover, increased use of toric and presbyopia-correcting lenses is improving patient satisfaction and reinforcing market trends in both public and private settings.

Asia-Pacific Cataracts Market Insight

The Asia-Pacific cataracts market is poised to grow at the fastest CAGR of 9.2% during the forecast period of 2025 to 2032, driven by rapid population aging, expanding healthcare access, and government initiatives for blindness prevention. Countries such as India and China are scaling up cataract surgery outreach programs and public-private partnerships to reduce cataract-related visual impairment. The increasing affordability of surgical consumables and IOLs is also improving surgical volume across rural and urban areas.

Japan Cataracts Market Insight

The Japan cataracts market is gaining momentum due to the country’s large elderly population and high incidence of cataract-induced vision loss. The market benefits from early diagnosis, well-established reimbursement systems, and technological innovation in ophthalmic surgery. Demand is also rising for customizable IOLs, especially among patients seeking refractive correction. Increasing patient preference for day-care surgeries and enhanced recovery protocols is further supporting market growth.

China Cataracts Market Insight

The China cataracts market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by strong government programs such as the National Cataract Elimination Project. Rapid urbanization, a growing middle class, and expansion of private eye hospitals are driving surgical volumes. In addition, improved insurance coverage and domestic manufacturing of affordable IOLs and surgical devices are strengthening local market development. The push for vision health awareness and access in rural areas continues to shape future growth.

Cataracts Market Share

The cataracts industry is primarily led by well-established companies, including:

- Alcon Management S. A. (Switzerland)

- AbbVie Inc. (U.S.)

- Bausch Health Companies Inc. (Canada)

- Merck & Co. Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Amorphex Therapeutics Holdings Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

- Bayer AG (Germany)

- Novartis AG (Switzerland)

- AstraZeneca (U.K.)

- Amgen Inc. (U.S.)

- Carl Zeiss AG (Germany)

- HumanOptics Holding AG (Germany)

- STAAR SURGICAL (U.S.)

What are the Recent Developments in Global Cataracts Market?

- In February 2024, Johnson & Johnson MedTech, a prominent leader in eye health, introduced the TECNIS PureSee presbyopia-correcting intraocular lens (IOL) across the EMEA region. Featuring a purely refractive design, the TECNIS PureSee IOL delivers seamless, high-quality vision with outstanding contrast sensitivity and low-light performance. It offers visual clarity comparable to monofocal lenses while addressing presbyopia, setting a new benchmark in advanced lens technology

- In September 2024, Alcon, a global leader in eye care committed to enhancing vision, unveiled new innovations at the European Society of Cataract and Refractive Surgeons (ESCRS) Annual Meeting in Barcelona. Among the highlights was the launch of the SMARTCataract DX digital planning solution—powered by the ARGOS Biometer and upcoming Alcon diagnostic tools—aimed at optimizing clinical workflows and improving procedural efficiency for ophthalmic practices

- In September 2024, Johnson & Johnson, a global leader in eye health, has announced the expanded U.S. rollout of its latest innovation in presbyopia-correcting intraocular lenses (PC-IOL), the TECNIS Odyssey. This next-generation full-range IOL provides patients with seamless, continuous vision across all distances—from far to near and everything in between significantly reducing dependence on glasses

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CATARACT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CATARACT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CATARACT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 EPIDEMIOLOGY

11.1 INCIDENCE OF ALL BY GENDER

11.2 TREATMENT RATE

11.3 MORTALITY RATE

11.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

11.5 PATIENT TREATMENT SUCCESS RATES

12 REGULATORY COMPLIANCE

12.1 REGULATORY AUTHORITIES

12.2 REGULATORY CLASSIFICATIONS

12.2.1 CLASS I

12.2.2 CLASS II

12.2.3 CLASS III

12.3 REGULATORY SUBMISSIONS

12.4 INTERNATIONAL HARMONIZATION

12.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

12.6 REGULATORY CHALLENGES AND STRATEGIES

13 PIPELINE ANALYSIS

13.1 CLINICAL TRIALS AND PHASE ANALYSIS

13.2 DRUG THERAPY PIPELINE

13.3 PHASE III CANDIDATES

13.4 PHASE II CANDIDATES

13.5 PHASE I CANDIDATES

13.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL ANALYSIS CATARACT MARKET

Company Name Product Name

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE FOR CATARACT MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved but Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE FOR CATARACT MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE FOR CATARACT MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR CATARACT MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

14 REIMBURSEMENT FRAMEWORK

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

17 GLOBAL CATARACT MARKET, BY TYPE

17.1 OVERVIEW

17.2 DIAGNOSIS

17.2.1 VISUAL ACUITY TEST

17.2.2 SLIT-LAMP EXAMINATION

17.2.3 RETINAL EXAM

17.2.4 TONOMETRY TEST

17.2.5 OTHERS

17.3 TREATMENT

17.3.1 NUCLEAR SCLEROTIC CATARACTS, BY TREATMENT PRODUCTS

17.3.1.1. INTRAOCULAR LENS (IOL)

17.3.1.1.1. MONOFOCAL IOL

17.3.1.1.1.1 HYDROPHILLIC MONOFOCAL LENS

17.3.1.1.1.2 HYDROPHOBIC MONOFOCAL LENS

17.3.1.1.2. TORIC IOL

17.3.1.1.3. MULTIFOCAL IOL

17.3.1.1.4. MONOVISION

17.3.1.1.5. OTHERS

17.3.1.2. OPHTHALMIC VISCOELASTIC DEVICE

17.3.1.2.1. COHESIVE OVD

17.3.1.2.2. DISPERSIVE OVD

17.3.1.3. FEMTOSECOND LASER EQUIPMENT, BY BRAND

17.3.1.3.1. INTRALASE

17.3.1.3.2. VISUMAX

17.3.1.3.3. FEMTO LDV

17.3.1.3.4. FEMTEC

17.3.1.3.5. OTHERS

17.3.1.4. OTHERS

17.3.2 CORTICAL CATARACTS, BY TREATMENT PRODUCTS

17.3.2.1. INTRAOCULAR LENS (IOL)

17.3.2.1.1. MONOFOCAL IOL

17.3.2.1.1.1 HYDROPHILLIC MONOFOCAL LENS

17.3.2.1.1.2 HYDROPHOBIC MONOFOCAL LENS

17.3.2.1.2. TORIC IOL

17.3.2.1.3. MULTIFOCAL IOL

17.3.2.1.4. MONOVISION

17.3.2.1.5. OTHERS

17.3.2.2. OPHTHALMIC VISCOELASTIC DEVICE

17.3.2.2.1. COHESIVE OVD

17.3.2.2.2. DISPERSIVE OVD

17.3.2.3. FEMTOSECOND LASER EQUIPMENT, BY BRAND

17.3.2.3.1. INTRALASE

17.3.2.3.2. VISUMAX

17.3.2.3.3. FEMTO LDV

17.3.2.3.4. FEMTEC

17.3.2.3.5. OTHERS

17.3.2.4. OTHERS

17.3.3 POSTERIOR SUBCAPSULAR CATARACTS, BY TREATMENT PRODUCTS

17.3.3.1. INTRAOCULAR LENS (IOL)

17.3.3.1.1. MONOFOCAL IOL

17.3.3.1.1.1 HYDROPHILLIC MONOFOCAL LENS

17.3.3.1.1.2 HYDROPHOBIC MONOFOCAL LENS

17.3.3.1.2. TORIC IOL

17.3.3.1.3. MULTIFOCAL IOL

17.3.3.1.4. MONOVISION

17.3.3.1.5. OTHERS

17.3.3.2. OPHTHALMIC VISCOELASTIC DEVICE

17.3.3.2.1. COHESIVE OVD

17.3.3.2.2. DISPERSIVE OVD

17.3.3.3. FEMTOSECOND LASER EQUIPMENT, BY BRAND

17.3.3.3.1. INTRALASE

17.3.3.3.2. VISUMAX

17.3.3.3.3. FEMTO LDV

17.3.3.3.4. FEMTEC

17.3.3.3.5. OTHERS

17.3.4 MEDICATIONS

17.3.4.1. MYDRIATICS

17.3.4.1.1. PHENYLEPHRINE OPHTHALMIC

17.3.4.1.2. TROPICAMIDE

17.3.4.1.3. OTHERS

17.3.4.2. NONSTEROIDAL ANTI-INFLAMMATORY OPHTHALMICS

17.3.4.2.1. NEPAFENAC OPHTHALMIC

17.3.4.2.2. BROMFENAC OPHTHALMIC

17.3.4.2.3. OTHERS

17.3.4.3. COMBINATION OPHTHALMICS

17.3.4.3.1. KETOROLAC/PHENYLEPHRINE OPHTHALMIC

17.3.4.3.2. OTHERS

17.3.4.4. CORTICOSTEROIDS

17.3.4.4.1. PREDNISOLONE ACETATE 1%

17.3.4.4.2. DEXAMETHASONE OPHTHALMIC

17.3.4.4.3. DIFLUPREDNATE OPHTHALMIC

17.3.4.4.4. LOTEPREDNOL OPHTHALMIC

17.3.4.4.5. OTHERS

17.3.4.5. ANTIBIOTICS

17.3.4.5.1. CIPROFLOXACIN OPHTHALMIC

17.3.4.5.2. MOXIFLOXACIN OPHTHALMIC

17.3.4.5.3. BESIFLOXACIN OPHTHALMIC

17.3.4.5.4. LEVOFLOXACIN OPHTHALMIC

17.3.4.5.5. ERYTHROMYCIN OPHTHALMIC

17.3.4.5.6. OTHERS

17.3.5 SURGERY

17.3.5.1. INCISION SURGERY

17.3.5.1.1. SMALL

17.3.5.1.2. LARGE

17.3.5.2. PHACOEMULSIFICATION

17.3.5.3. EXTRACAPSULAR CATARACT EXTRACTION

17.3.5.4. FEMTOSECOND LASER SURGERY

17.3.5.5. OTHERS

18 GLOBAL CATARACT MARKET, BY GENDER

18.1 OVERVIEW

18.2 MALE

18.2.1 PEDIATRIC

18.2.2 ADULT

18.2.3 GERIATRIC

18.3 FEMALE

18.3.1 PEDIATRIC

18.3.2 ADULT

18.3.3 GERIATRIC

19 GLOBAL CATARACT MARKET, BY END USER

19.1 OVERVIEW

19.2 HOSPITALS

19.2.1 BY TYPE

19.2.1.1. PRIVATE

19.2.1.2. PUBLIC

19.2.2 BY LEVEL

19.2.2.1. TIER 1

19.2.2.2. TIER 2

19.2.2.3. TIER 3

19.3 OPHTHALMIC CLINICS

19.4 AMBULATORY SURGICAL CENTERS

19.5 ACADEMIC AND RESEARCH INSTITUTES

19.6 OTHERS

20 GLOBAL CATARACT MARKET, BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 DIRECT TENDER

20.3 RETAIL SALES

20.3.1 ONLINE SALES

20.3.2 OFFLINE SALES

20.4 OTHERS

21 GLOBAL CATARACT MARKET, BY GEOGRAPHY

GLOBAL CATARACT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

21.1 NORTH AMERICA

21.1.1 U.S.

21.1.2 CANADA

21.1.3 MEXICO

21.2 EUROPE

21.2.1 GERMANY

21.2.2 FRANCE

21.2.3 U.K.

21.2.4 HUNGARY

21.2.5 LITHUANIA

21.2.6 AUSTRIA

21.2.7 IRELAND

21.2.8 NORWAY

21.2.9 POLAND

21.2.10 ITALY

21.2.11 SPAIN

21.2.12 RUSSIA

21.2.13 TURKEY

21.2.14 NETHERLANDS

21.2.15 SWITZERLAND

21.2.16 REST OF EUROPE

21.3 ASIA-PACIFIC

21.3.1 JAPAN

21.3.2 CHINA

21.3.3 SOUTH KOREA

21.3.4 INDIA

21.3.5 AUSTRALIA

21.3.6 SINGAPORE

21.3.7 THAILAND

21.3.8 MALAYSIA

21.3.9 INDONESIA

21.3.10 PHILIPPINES

21.3.11 VIETNAM

21.3.12 REST OF ASIA-PACIFIC

21.4 SOUTH AMERICA

21.4.1 BRAZIL

21.4.2 ARGENTINA

21.4.3 PERU

21.4.4 REST OF SOUTH AMERICA

21.5 MIDDLE EAST AND AFRICA

21.5.1 SOUTH AFRICA

21.5.2 GLOBAL

21.5.3 UAE

21.5.4 EGYPT

21.5.5 KUWAIT

21.5.6 ISRAEL

21.5.7 REST OF MIDDLE EAST AND AFRICA

21.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

22 GLOBAL CATARACT MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

22.5 MERGERS & ACQUISITIONS

22.6 NEW PRODUCT DEVELOPMENT & APPROVALS

22.7 EXPANSIONS

22.8 REGULATORY CHANGES

22.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 GLOBAL CATARACT MARKET, SWOT AND DBMR ANALYSIS

24 GLOBAL CATARACT MARKET, COMPANY PROFILE

24.1 JOHNSON & JOHNSON, INC.

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHIC PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 BAUSCH & LOMB INCORPORATED.

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHIC PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 OCULENTIS MEDICAL PVT. LTD

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHIC PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 NIDEK CO., LTD

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHIC PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.5 CARL ZEISS MEDITECH AG

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHIC PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 ABBOTT

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHIC PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 ESSILOR

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHIC PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 ALCON INC

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHIC PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 STAAR SURGICAL

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHIC PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 OMNI LENS PVT. LTD.

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 GEOGRAPHIC PRESENCE

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 HOYA MEDICAL SINGAPORE PTE. LTD

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 GEOGRAPHIC PRESENCE

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPMENTS

24.12 LENSAR

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHIC PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

24.13 AAREN LABS INC.

24.13.1 COMPANY OVERVIEW

24.13.2 REVENUE ANALYSIS

24.13.3 GEOGRAPHIC PRESENCE

24.13.4 PRODUCT PORTFOLIO

24.13.5 RECENT DEVELOPMENTS

24.14 AKKOLENS CLINICAL BV

24.14.1 COMPANY OVERVIEW

24.14.2 REVENUE ANALYSIS

24.14.3 GEOGRAPHIC PRESENCE

24.14.4 PRODUCT PORTFOLIO

24.14.5 RECENT DEVELOPMENTS

24.15 ALSANZA MEDIZINTECHNIK UND PHARMA GMBH.

24.15.1 COMPANY OVERVIEW

24.15.2 REVENUE ANALYSIS

24.15.3 GEOGRAPHIC PRESENCE

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENTS

24.16 1STQ DEUTSCHLAND GMBH

24.16.1 COMPANY OVERVIEW

24.16.2 REVENUE ANALYSIS

24.16.3 GEOGRAPHIC PRESENCE

24.16.4 PRODUCT PORTFOLIO

24.16.5 RECENT DEVELOPMENTS

24.17 BVI

24.17.1 COMPANY OVERVIEW

24.17.2 REVENUE ANALYSIS

24.17.3 GEOGRAPHIC PRESENCE

24.17.4 PRODUCT PORTFOLIO

24.17.5 RECENT DEVELOPMENTS

24.18 RAYNER GROUP

24.18.1 COMPANY OVERVIEW

24.18.2 REVENUE ANALYSIS

24.18.3 GEOGRAPHIC PRESENCE

24.18.4 PRODUCT PORTFOLIO

24.18.5 RECENT DEVELOPMENTS

24.19 HUMANOPTICS HOLDING AG

24.19.1 COMPANY OVERVIEW

24.19.2 REVENUE ANALYSIS

24.19.3 GEOGRAPHIC PRESENCE

24.19.4 PRODUCT PORTFOLIO

24.19.5 RECENT DEVELOPMENTS

24.2 TOPCON HEALTHCARE SOLUTIONS

24.20.1 COMPANY OVERVIEW

24.20.2 REVENUE ANALYSIS

24.20.3 GEOGRAPHIC PRESENCE

24.20.4 PRODUCT PORTFOLIO

24.20.5 RECENT DEVELOPMENTS

24.21 PRECISION LENS

24.21.1 COMPANY OVERVIEW

24.21.2 REVENUE ANALYSIS

24.21.3 GEOGRAPHIC PRESENCE

24.21.4 PRODUCT PORTFOLIO

24.21.5 RECENT DEVELOPMENTS

24.22 AUROLABS

24.22.1 COMPANY OVERVIEW

24.22.2 REVENUE ANALYSIS

24.22.3 GEOGRAPHIC PRESENCE

24.22.4 PRODUCT PORTFOLIO

24.22.5 RECENT DEVELOPMENTS

24.23 ZEIMER OPHTHALMIC SYSTEMS

24.23.1 COMPANY OVERVIEW

24.23.2 REVENUE ANALYSIS

24.23.3 GEOGRAPHIC PRESENCE

24.23.4 PRODUCT PORTFOLIO

24.23.5 RECENT DEVELOPMENTS

24.24 HANITA LENSES

24.24.1 COMPANY OVERVIEW

24.24.2 REVENUE ANALYSIS

24.24.3 GEOGRAPHIC PRESENCE

24.24.4 PRODUCT PORTFOLIO

24.24.5 RECENT DEVELOPMENTS

24.25 EYEKON MEDICAL INC

24.25.1 COMPANY OVERVIEW

24.25.2 REVENUE ANALYSIS

24.25.3 GEOGRAPHIC PRESENCE

24.25.4 PRODUCT PORTFOLIO

24.25.5 RECENT DEVELOPMENTS

24.26 APOLLO OPTICAL SYSTEMS

24.26.1 COMPANY OVERVIEW

24.26.2 REVENUE ANALYSIS

24.26.3 GEOGRAPHIC PRESENCE

24.26.4 PRODUCT PORTFOLIO

24.26.5 RECENT DEVELOPMENTS

24.27 RXSIGHT

24.27.1 COMPANY OVERVIEW

24.27.2 REVENUE ANALYSIS

24.27.3 GEOGRAPHIC PRESENCE

24.27.4 PRODUCT PORTFOLIO

24.27.5 RECENT DEVELOPMENTS

24.28 CARE GROUP

24.28.1 COMPANY OVERVIEW

24.28.2 REVENUE ANALYSIS

24.28.3 GEOGRAPHIC PRESENCE

24.28.4 PRODUCT PORTFOLIO

24.28.5 RECENT DEVELOPMENTS

24.29 HAAG STREIT HOLDING

24.29.1 COMPANY OVERVIEW

24.29.2 REVENUE ANALYSIS

24.29.3 GEOGRAPHIC PRESENCE

24.29.4 PRODUCT PORTFOLIO

24.29.5 RECENT DEVELOPMENTS

24.3 VALEANT PHARMACEUTICALS

24.30.1 COMPANY OVERVIEW

24.30.2 REVENUE ANALYSIS

24.30.3 GEOGRAPHIC PRESENCE

24.30.4 PRODUCT PORTFOLIO

24.30.5 RECENT DEVELOPMENTS

24.31 GLAUKOS CORPORATION

24.31.1 COMPANY OVERVIEW

24.31.2 REVENUE ANALYSIS

24.31.3 GEOGRAPHIC PRESENCE

24.31.4 PRODUCT PORTFOLIO

24.31.5 RECENT DEVELOPMENTS

24.32 ELLEX

24.32.1 COMPANY OVERVIEW

24.32.2 REVENUE ANALYSIS

24.32.3 GEOGRAPHIC PRESENCE

24.32.4 PRODUCT PORTFOLIO

24.32.5 RECENT DEVELOPMENTS

24.33 NOVARTIS AG

24.33.1 COMPANY OVERVIEW

24.33.2 REVENUE ANALYSIS

24.33.3 GEOGRAPHIC PRESENCE

24.33.4 PRODUCT PORTFOLIO

24.33.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.