Global Catenary Infrastructure Inspection Market

Market Size in USD Billion

CAGR :

%

USD

3.65 Billion

USD

6.76 Billion

2024

2032

USD

3.65 Billion

USD

6.76 Billion

2024

2032

| 2025 –2032 | |

| USD 3.65 Billion | |

| USD 6.76 Billion | |

|

|

|

|

Catenary Infrastructure Inspection Market Size

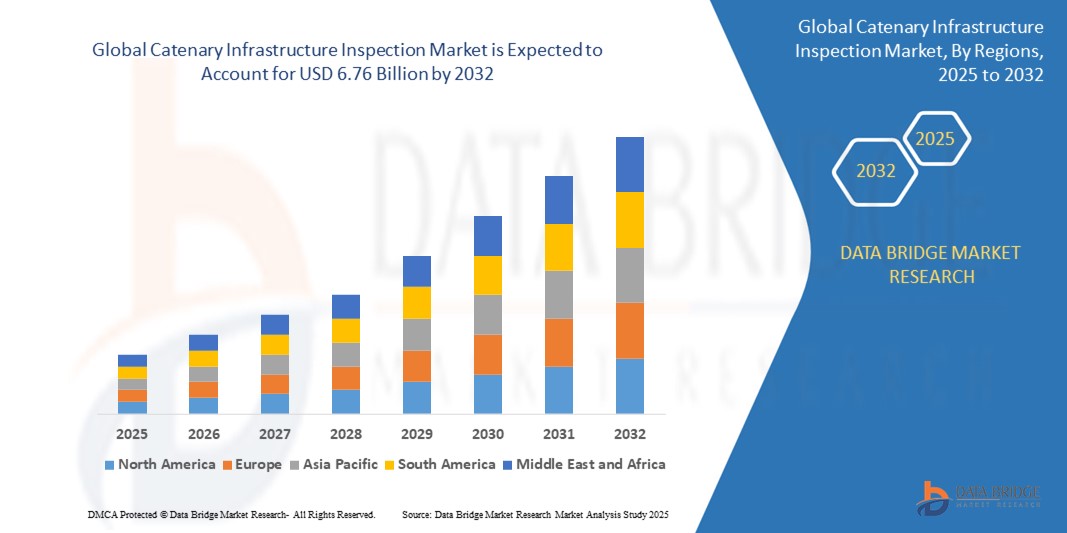

- The global catenary infrastructure inspection market size was valued at USD 3.65 billion in 2024 and is expected to reach USD 6.76 billion by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is primarily driven by the increasing electrification of railway systems, growing emphasis on rail safety, and advancements in inspection technologies such as drones, AI, and IoT

- Rising investments in high-speed rail networks and the need for reliable and efficient rail infrastructure are further propelling the adoption of advanced catenary inspection solutions globally

Catenary Infrastructure Inspection Market Analysis

- Catenary infrastructure inspection involves the thorough assessment of overhead wires and associated components in electrified railway systems to ensure safety, reliability, and operational efficiency. These inspections are critical for maintaining the integrity of rail networks

- The demand for catenary infrastructure inspection is fueled by the global expansion of electrified rail networks, stringent safety regulations, and the integration of advanced technologies such as UAVs, sensors, and data analytics for proactive maintenance

- North America dominated the catenary infrastructure inspection market with the largest revenue share of 35.2% in 2024, driven by significant investments in commuter and freight rail systems, a strong presence of key industry players, and advanced technological adoption in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, high-speed rail projects, and increasing infrastructure investments in countries such as China, India, and Japan

- The hardware segment dominated the largest market revenue share of 62.5% in 2024, driven by the critical role of specialized equipment such as drones, cameras, sensors, and robotic systems in conducting precise inspections of overhead electrical lines and associated infrastructure.

Report Scope and Catenary Infrastructure Inspection Market Segmentation

|

Attributes |

Catenary Infrastructure Inspection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Catenary Infrastructure Inspection Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global catenary infrastructure inspection market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies facilitate advanced data processing, enabling comprehensive analysis of catenary system conditions, operational efficiency, and predictive maintenance requirements

- AI-driven inspection solutions support proactive maintenance by identifying potential faults in overhead wires, supports, and components before they cause system failures or service disruptions

- For instances, companies are developing AI platforms that analyze inspection data from drones and sensors to predict wear patterns or optimize maintenance schedules based on real-time environmental and operational conditions

- This trend enhances the efficiency and reliability of catenary inspection systems, making them increasingly valuable for railway authorities and operators

- AI algorithms can process extensive datasets, including visual imagery, electrical performance metrics, and mechanical stress indicators, to detect anomalies and improve inspection accuracy

Catenary Infrastructure Inspection Market Dynamics

Driver

“Rising Demand for Electrified Railways and Enhanced Safety Standards”

- Growing global demand for electrified railway systems, driven by the need for sustainable and efficient transportation, is a key driver for the catenary infrastructure inspection market

- Inspection systems ensure the safety and reliability of catenary infrastructure through features such as real-time fault detection, predictive maintenance, and compliance with safety regulations

- Government mandates, particularly in regions such as Europe with stringent railway safety standards, are accelerating the adoption of advanced inspection technologies

- The expansion of IoT and 5G technologies supports faster data transmission and real-time monitoring, enabling more sophisticated inspection processes for catenary systems

- Railway operators are increasingly adopting integrated inspection solutions as standard to meet regulatory requirements and enhance operational efficiency

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The high initial investment required for deploying advanced inspection hardware, software, and integration into existing railway systems poses a significant barrier, particularly in emerging markets

- Retrofitting older railway infrastructure with modern inspection technologies can be complex and expensive

- Data security and privacy concerns are a major challenge, as inspection systems collect and transmit sensitive operational and infrastructure data, raising risks of cyberattacks or unauthorized access

- The varying regulatory frameworks across countries regarding data handling and privacy compliance create operational complexities for global solution providers

- These challenges may slow market growth in cost-sensitive regions or areas with heightened data privacy awareness

Catenary Infrastructure Inspection market Scope

The market is segmented on the basis of solution, inspection process, and end-user.

- By Solution

On the basis of solution, the global catenary infrastructure inspection market is segmented into hardware and services. The hardware segment dominated the largest market revenue share of 62.5% in 2024, driven by the critical role of specialized equipment such as drones, cameras, sensors, and robotic systems in conducting precise inspections of overhead electrical lines and associated infrastructure. These tools ensure reliable and accurate assessments, supporting safety and operational efficiency.

The services segment is anticipated to witness the fastest growth rate of 9.2% from 2025 to 2032, fueled by increasing demand for predictive maintenance, data analytics, and consulting services. The integration of AI and IoT in service offerings enhances real-time monitoring and proactive issue resolution, driving adoption across rail networks.

- By Inspection Process

On the basis of inspection process, the global catenary infrastructure inspection market is segmented into visual inspection, mechanical inspection, electrical inspection, and other inspection processes. The visual inspection segment is expected to hold the largest market revenue share of 38.5% in 2024, owing to its widespread use as a primary method for identifying visible defects in catenary systems, supported by advancements in drone and camera technologies.

The electrical inspection segment is expected to witness the fastest growth rate of 10.1% from 2025 to 2032, driven by the growing need to ensure the reliability and safety of electrified rail systems. Advancements in sensor technologies and automation enable precise detection of electrical faults, minimizing downtime and enhancing system performance.

- By End-User

On the basis of end-user, the global catenary infrastructure inspection market is segmented into railway authorities, contractors and inspection firms, train operators, and other end-users. The railway authorities segment is expected to hold the largest market revenue share of 45.5% in 2024, driven by stringent safety regulations and significant investments in rail infrastructure maintenance to ensure operational reliability and passenger safety.

The train operators segment is anticipated to witness the fastest growth rate of 11.2% from 2025 to 2032, fueled by the increasing adoption of advanced inspection technologies such as drones and sensor-based tools to enhance operational efficiency and minimize disruptions. The focus on proactive maintenance and real-time monitoring supports sustained growth in this segment.

Catenary Infrastructure Inspection Market Regional Analysis

- North America dominated the catenary infrastructure inspection market with the largest revenue share of 35.2% in 2024, driven by significant investments in commuter and freight rail systems, a strong presence of key industry players, and advanced technological adoption in the U.S. and Canada

- Consumers and railway operators prioritize inspection technologies for enhancing system longevity, reducing downtime, and ensuring compliance with stringent safety regulations, particularly in regions with extensive electrified rail networks

- Growth is supported by advancements in inspection technologies, including drones, LiDAR, and AI-based analytics, alongside rising adoption in both railway authorities and contractor segments

U.S. Catenary Infrastructure Inspection Market Insight

The U.S. catenary infrastructure inspection market captured the largest revenue share of 72.2% in 2024 within North America, fueled by strong demand from railway authorities and growing awareness of predictive maintenance benefits. The trend towards infrastructure modernization and increasing regulatory focus on rail safety standards further boost market expansion. The integration of advanced inspection technologies, such as drones and thermal imaging, by railway operators complements contractor-driven services, creating a robust ecosystem for both hardware and services.

Europe Catenary Infrastructure Inspection Market Insight

The Europe catenary infrastructure inspection market is expected to witness significant growth, supported by regulatory emphasis on rail safety and operational efficiency. Railway operators and contractors seek advanced inspection solutions that enhance system reliability while ensuring compliance with safety standards. The growth is prominent in both new rail projects and retrofit initiatives, with countries such as Germany and France showing significant uptake due to rising environmental concerns and extensive electrified rail networks.

U.K. Catenary Infrastructure Inspection Market Insight

The U.K. market for catenary infrastructure inspection is expected to witness rapid growth, driven by demand for enhanced rail safety and operational efficiency in urban and inter-city settings. Increased investment in high-speed rail and growing awareness of predictive maintenance benefits encourage adoption. Evolving rail safety regulations influence technology choices, balancing inspection thoroughness with compliance, particularly for visual and electrical inspection processes.

Germany Catenary Infrastructure Inspection Market Insight

Germany is expected to witness rapid growth in the catenary infrastructure inspection market, attributed to its advanced railway manufacturing sector and high focus on system reliability and energy efficiency. German railway operators prefer technologically advanced inspection solutions, such as robotic systems and AI-driven analytics that reduce maintenance costs and enhance safety. The integration of these technologies in both new and existing rail systems supports sustained market growth.

Asia-Pacific Catenary Infrastructure Inspection Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the global catenary infrastructure inspection market, driven by expanding railway networks and rising investments in electrification projects in countries such as China, India, and Japan. Increasing awareness of safety, reliability, and operational efficiency is boosting demand for advanced inspection solutions. Government initiatives promoting sustainable rail systems and infrastructure modernization further encourage the adoption of cutting-edge inspection technologies.

Japan Catenary Infrastructure Inspection Market Insight

Japan’s catenary infrastructure inspection market is expected to witness the fastest growth rate due to strong consumer and operator preference for high-quality, technologically advanced inspection solutions that enhance rail safety and efficiency. The presence of major railway operators and the integration of inspection technologies in both OEM and contractor-driven projects accelerate market penetration. Rising interest in predictive maintenance and automation also contributes to growth.

China Catenary Infrastructure Inspection Market Insight

China holds the largest share of the Asia-Pacific catenary infrastructure inspection market, propelled by rapid urbanization, rising rail network expansion, and increasing demand for safety and reliability solutions. The country’s growing investment in high-speed rail and focus on sustainable mobility support the adoption of advanced inspection technologies. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility for hardware and services.

Catenary Infrastructure Inspection Market Share

The catenary infrastructure inspection industry is primarily led by well-established companies, including:

- Hitachi Ltd. (Japan)

- Siemens AG (Germany)

- General Electric Company (U.S.)

- Schneider Electric SE (France)

- ABB Ltd. (Switzerland)

- Toshiba Corporation (Japan)

- Alstom SA (France)

- Wabtec Corporation (U.S.)

- Knorr-Bremse AG (Germany)

- Bombardier Inc. (Canada)

- Fuji Electric Co. Ltd. (Japan)

- Stadler Rail AG (Switzerland)

- Meidensha Corporation (Japan)

- Harsco Corporation (U.S.)

- Bentley Systems Inc. (U.S.)

- Vossloh AG (Germany)

What are the Recent Developments in Global Catenary Infrastructure Inspection Market?

- In March 2025, China completed successful on-track trials of its first domestically developed hydrogen-powered overhead contact line maintenance vehicle, marking a major advancement in sustainable rail infrastructure. This innovative vehicle, powered by hydrogen fuel cells, is designed to perform inspection and maintenance tasks while significantly reducing CO₂ emissions. It reflects China’s broader commitment to green transportation and the integration of clean energy technologies into railway operations. The development also supports the country’s long-term hydrogen strategy, which emphasizes renewable energy adoption and carbon neutrality goals

- In May 2024, Alstom advanced its "HealthHub" platform, a web-based solution designed to optimize predictive maintenance across railway systems. By analyzing real-time data from trains, signaling, and infrastructure—including catenary systems—HealthHub uses sophisticated algorithms to detect anomalies, anticipate failures, and improve asset availability and reliability. The platform processes over 200 parameters every 30 seconds from trains in service, enabling operators to act proactively rather than reactively. This innovation supports Alstom’s broader mission to deliver smarter, more sustainable rail operations through digital transformation

- In August 2022, Intel Corporation, in collaboration with its global ecosystem of partners, introduced a Pantograph Catenary Monitoring System (PCMS)—a fully automated solution for predictive maintenance in rail networks. The system combines 3D laser triangulation, AI, machine learning, and advanced edge computing to detect and measure damage to pantographs and catenary components with high precision. By identifying issues such as deformed bows, cracked graphite plates, or loose dropper wires in real time, PCMS helps reduce unscheduled maintenance, enhance fleet availability, and improve safety for maintenance personnel

- In March 2022, TESMEC launched a new generation of multi-purpose catenary maintenance vehicles featuring AI-powered diagnostic systems, signaling a major advancement in intelligent railway infrastructure solutions. These vehicles integrate machine learning, real-time analytics, and automated inspection tools to detect faults in overhead contact lines with exceptional accuracy and efficiency. Designed for both installation and maintenance, they offer modular configurations, including diesel-electric and full-electric traction, along with crane systems, elevated work platforms, and cloud-based diagnostics. This innovation underscores TESMEC’s dedication to predictive maintenance and sustainable rail operations

- In October 2021, Socofer introduced a lightweight catenary maintenance vehicle aimed at reducing energy consumption and enhancing operational efficiency. This innovation aligns with the industry’s increasing emphasis on eco-friendly and energy-efficient solutions for railway infrastructure, particularly in the inspection and maintenance of overhead contact lines. By optimizing weight and integrating modern traction systems, the vehicle supports sustainable rail operations while maintaining high performance and safety standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.