Global Cell Expansion Market

Market Size in USD Billion

CAGR :

%

USD

23.42 Billion

USD

92.17 Billion

2025

2033

USD

23.42 Billion

USD

92.17 Billion

2025

2033

| 2026 –2033 | |

| USD 23.42 Billion | |

| USD 92.17 Billion | |

|

|

|

|

Cell Expansion Market Size

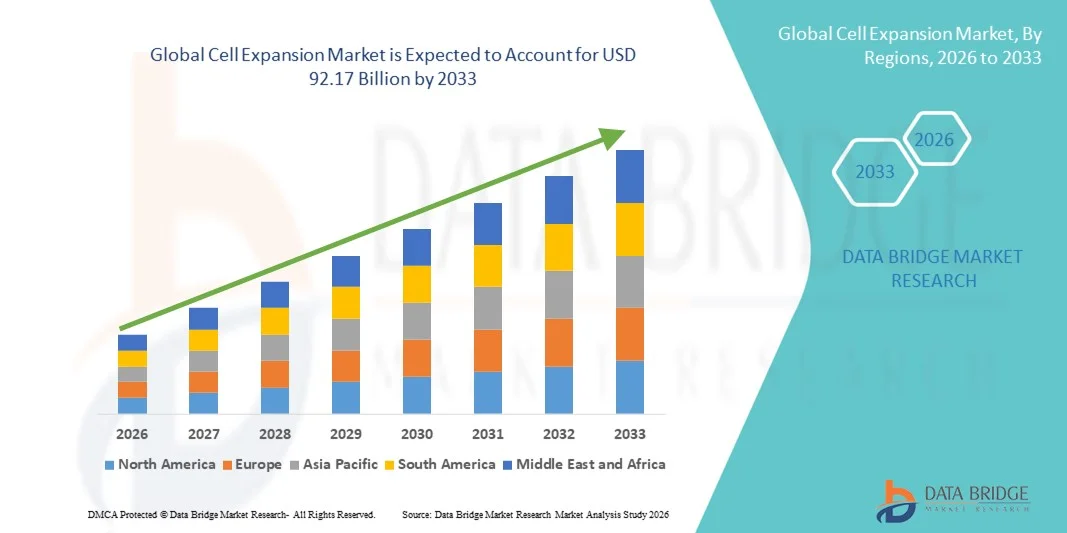

- The global cell expansion market size was valued at USD 23.42 billion in 2025 and is expected to reach USD 92.17 billion by 2033, at a CAGR of 18.68% during the forecast period

- The market growth is largely driven by increasing adoption of advanced cell culture technologies and rising investments in regenerative medicine, cell therapy, and personalized medicine, which are fueling demand for scalable and automated cell expansion solutions

- Furthermore, growing research initiatives, coupled with the need for high-quality, reproducible cell production in both academic and industrial settings, are positioning cell expansion systems as a critical component in modern biomanufacturing processes. These converging factors are accelerating the deployment of cell expansion technologies, thereby significantly boosting the industry's growth

Cell Expansion Market Analysis

- Cell expansion systems, enabling the scalable growth of various cell types for research, therapeutic, and industrial applications, are becoming essential components of modern biomanufacturing and regenerative medicine workflows due to their ability to ensure high-quality, reproducible, and controlled cell production

- The rising demand for cell expansion technologies is primarily driven by the growth of cell and gene therapies, increasing research in regenerative medicine, and the need for automated, scalable solutions that reduce manual handling and contamination risks

- North America dominated the cell expansion market with the largest revenue share of 45.3% in 2025, characterized by advanced biopharmaceutical infrastructure, high R&D investments, and a strong presence of key industry players, with the U.S. witnessing significant adoption of automated and closed-system expansion platforms in both academic and commercial settings

- Asia-Pacific is expected to be the fastest growing region in the cell expansion market during the forecast period due to increasing biopharmaceutical investments, expansion of contract development and manufacturing organizations (CDMOs), and growing adoption of advanced cell culture technologies in emerging economies such as China and India

- Instruments segment dominated the cell expansion market with a market share of 44.3% in 2025, driven by their critical role in providing precise control, scalability, and reproducibility required for both research and clinical applications

Report Scope and Cell Expansion Market Segmentation

|

Attributes |

Cell Expansion Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Cell Expansion Market Trends

Advancements Through Automated and Closed-System Platforms

- A significant and accelerating trend in the global cell expansion market is the adoption of automated and closed-system platforms that ensure scalable, reproducible, and contamination-free cell growth, enhancing efficiency in both research and clinical applications

- For instance, the CliniMACS Prodigy system offers fully automated cell processing, allowing researchers to perform cell expansion, selection, and differentiation within a single enclosed platform, reducing manual handling and improving standardization

- Integration of sensors and digital monitoring in cell expansion platforms enables real-time tracking of cell health, growth kinetics, and environmental conditions, facilitating better process control and reproducibility

- The seamless combination of automation, monitoring, and closed-system design allows for high-throughput cell production while maintaining compliance with good manufacturing practices (GMP), which is critical for therapeutic applications

- This trend towards more automated, monitored, and contamination-resistant systems is reshaping expectations for biomanufacturing, prompting companies such as Terumo BCT to develop advanced cell expansion solutions with integrated process analytics and workflow automation

- The demand for intelligent, high-throughput, and standardized cell expansion platforms is growing rapidly across both academic and commercial sectors, as stakeholders increasingly prioritize scalability, quality, and regulatory compliance

- Cloud-based data management and remote monitoring features are becoming increasingly integrated, allowing real-time process tracking and analytics, which improves operational efficiency and decision-making

Cell Expansion Market Dynamics

Driver

Increasing Demand From Regenerative Medicine and Cell Therapy

- The growing prevalence of chronic diseases and the expanding pipeline of cell and gene therapies is a major driver for the rising demand for cell expansion technologies

- For instance, in March 2025, Miltenyi Biotec launched a new version of its automated expansion system designed specifically for CAR-T cell therapy production, supporting high-quality and scalable cell yields

- As regenerative medicine and immunotherapy applications expand, reliable cell expansion systems are crucial for ensuring reproducibility, viability, and potency of therapeutic cells

- In addition, the increasing investment in personalized medicine and advanced research initiatives is propelling the adoption of automated and high-throughput cell expansion platforms across both clinical and research settings

- The need for consistent, GMP-compliant cell production workflows and reduction of manual errors is further reinforcing the importance of cell expansion technologies in therapeutic development pipelines

- Rising collaborations between biotech companies and academic institutions are accelerating the integration of advanced cell expansion systems into R&D programs, boosting market demand

- Growing government and private funding for cell therapy research, particularly in North America and Europe, is fueling investments in state-of-the-art cell expansion technologies, supporting market growth

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The relatively high initial cost of automated and closed-system cell expansion platforms compared to traditional manual methods can limit adoption, particularly among small academic labs or emerging biotech firms

- For instance, specialized bioreactors and automated systems from companies such as Sartorius require significant capital investment, which can be a barrier for budget-constrained institutions

- Strict regulatory requirements for cell-based therapies, including GMP compliance, process validation, and documentation, pose additional challenges for the deployment of advanced cell expansion systems

- Addressing these challenges requires not only financial investment but also robust training, standard operating procedures, and compliance strategies to ensure regulatory adherence

- Overcoming cost and regulatory hurdles through modular, scalable systems, leasing options, and streamlined validation processes will be critical for broadening market adoption and sustaining growth

- Limited technical expertise in handling sophisticated automated systems may slow adoption in smaller labs or emerging regions, requiring specialized training programs

- Potential variability in cell quality and reproducibility when transitioning from manual to automated systems can pose challenges, necessitating extensive process optimization and validation

Cell Expansion Market Scope

The market is segmented on the basis of product, cell type, application, and end use.

- By Product

On the basis of product, the cell expansion market is segmented into instruments, consumables, and disposables. The instruments segment dominated the market with the largest market revenue share of 44.3% in 2025, driven by the critical role instruments play in providing precise control over cell culture conditions, scalability, and reproducibility. Instruments such as automated bioreactors, closed-system expansion platforms, and incubators are essential for both research and therapeutic production. Their adoption is further fueled by the increasing demand for GMP-compliant cell manufacturing processes and the growth of cell therapy pipelines. Academic and industrial labs prioritize high-quality instruments to ensure consistent cell yields, viability, and potency. Leading companies are investing in instrument innovation to provide multifunctional, automated, and integrated solutions.

The consumables segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for single-use flasks, media, and reagents. Consumables enable flexibility in scaling up cell expansion processes without the need for large capital investment, making them attractive for small and medium-sized labs. The growing adoption of disposable products reduces contamination risk and simplifies workflow management. Consumables also support diverse applications, from research to clinical cell therapies, ensuring reproducibility and compliance. Rising outsourcing of cell expansion to contract development and manufacturing organizations (CDMOs) further contributes to the growth of consumables.

- By Cell Type

On the basis of cell type, the market is segmented into human cells and animal stem cells. The human cells segment led the market in 2025, owing to the widespread use of human-derived cells in regenerative medicine, immunotherapy, and personalized medicine. Human cells are in high demand for clinical applications such as CAR-T therapy, stem cell therapy, and organoid research. Research institutions and biotech companies prioritize human cells to develop therapies targeting chronic diseases and cancer. The need for high-quality, reproducible cell expansion technologies is particularly strong in human cell applications. Companies focus on developing systems optimized for human cells, ensuring viability, potency, and scalability. Human cells also dominate due to regulatory support for clinical applications and the growing pipeline of therapeutic programs.

The animal stem cells segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing research in disease modeling, veterinary applications, and preclinical studies. Animal stem cells provide an essential platform for studying disease mechanisms, testing drugs, and developing translational therapies. Rising investments in stem cell research and regenerative medicine are fueling demand. The availability of specialized media, instruments, and expansion systems for animal stem cells is enhancing adoption in laboratories. Collaborations between biotech firms and research institutions also accelerate the use of animal stem cells for experimental and preclinical purposes.

- By Application

On the basis of application, the market is segmented into regenerative medicine, cancer, and cell-based research. The regenerative medicine segment dominated the market in 2025, fueled by the increasing prevalence of chronic diseases and the growing demand for personalized cell therapies. Regenerative medicine applications require high-quality, scalable, and GMP-compliant cell expansion systems to ensure therapeutic efficacy. Companies are developing advanced automated solutions to meet the stringent quality standards for regenerative therapies. The segment also benefits from rising government and private funding for stem cell and tissue engineering research. High adoption rates in hospitals, clinical labs, and biotech companies further reinforce its dominance.

The cell-based research segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by rising academic research initiatives, drug discovery programs, and preclinical studies. Cell-based research relies on scalable and reliable cell expansion platforms to support experiments across multiple cell lines. The growing trend of high-throughput screening and organoid research fuels demand for flexible, automated expansion systems. Companies are introducing modular platforms to cater to diverse research applications, enhancing adoption. Increasing collaborations between academia and industry further contribute to segment growth.

- By End Use

On the basis of end use, the market is segmented into hospitals, biotech and pharma companies, academic and research institutes, and others. The biotech and pharma companies segment dominated the market in 2025, driven by their extensive use of cell expansion systems for R&D, therapeutic development, and commercial-scale production. These companies require high-throughput, automated, and GMP-compliant systems to ensure consistent cell quality and scalability for clinical applications. Rising investment in cell and gene therapies is reinforcing the demand. Strategic collaborations, licensing agreements, and expansion of CDMOs further boost adoption. The segment also benefits from advanced process analytics and automation integration in large-scale cell production workflows.

The academic and research institutes segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing government and private funding for cell-based research. Academic labs increasingly adopt automated and modular expansion systems to enhance reproducibility, reduce manual handling, and accelerate research timelines. The growing focus on translational research, stem cell studies, and preclinical testing is driving demand. Affordable and flexible platforms are particularly attractive for educational and research institutions. Collaborations with industry partners also support adoption and infrastructure development in academia.

Cell Expansion Market Regional Analysis

- North America dominated the cell expansion market with the largest revenue share of 45.3% in 2025, characterized by advanced biopharmaceutical infrastructure, high R&D investments, and a strong presence of key industry players

- Institutions and companies in the region prioritize high-quality, scalable, and GMP-compliant cell expansion systems to support regenerative medicine, immunotherapy, and personalized medicine applications

- This widespread adoption is further supported by strong government and private funding, a technologically skilled workforce, and collaborations between academic and industrial organizations, establishing North America as a key hub for both research and commercial-scale cell production

U.S. Cell Expansion Market Insight

The U.S. cell expansion market captured the largest revenue share of 42% in 2025 within North America, fueled by the rapid adoption of advanced automated and closed-system cell expansion platforms. Research institutions and biotech companies are prioritizing scalable, high-quality, and GMP-compliant systems to support regenerative medicine, immunotherapy, and cell-based research. The growing demand for personalized therapies, coupled with strong government and private funding, is further propelling market growth. Moreover, collaborations between academic organizations and biopharma companies are accelerating the deployment of innovative cell expansion solutions. The preference for automated, high-throughput platforms enhances efficiency, reproducibility, and regulatory compliance in both R&D and clinical applications.

Europe Cell Expansion Market Insight

The Europe cell expansion market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investment in cell and gene therapy research and stringent regulatory standards for clinical-grade cell production. Rising urbanization, expanding biotech infrastructure, and growing demand for scalable and automated cell culture systems are fostering market adoption. European institutions are emphasizing high-quality, reproducible cell expansion workflows for therapeutic applications. Countries such as Germany, France, and Switzerland are witnessing strong growth in hospitals, academic labs, and biotech companies using advanced instruments and consumables. The focus on innovation, quality, and compliance is supporting broad adoption across research and commercial-scale manufacturing.

U.K. Cell Expansion Market Insight

The U.K. cell expansion market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing regenerative medicine initiatives and the growing number of clinical trials involving cell therapies. Academic and industrial labs are adopting automated and modular expansion systems to improve reproducibility, reduce manual handling, and accelerate research outcomes. Regulatory frameworks promoting safe and high-quality cell-based products further encourage adoption. The U.K.’s strong biotech ecosystem, along with its active collaborations between research institutions and pharma companies, is expected to stimulate market growth. Rising government funding and venture capital investments in cell therapy development are additional growth enablers.

Germany Cell Expansion Market Insight

The Germany cell expansion market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s emphasis on biotechnology innovation and high-quality manufacturing standards. Germany’s well-established biopharma infrastructure and research capabilities promote the adoption of advanced cell expansion instruments, consumables, and automated systems. Hospitals, academic institutes, and contract manufacturing organizations are increasingly using scalable and GMP-compliant platforms. The integration of digital monitoring, process analytics, and closed-system designs enhances reproducibility and regulatory compliance. Growing collaborations between German biotech firms and global partners further accelerate market growth.

Asia-Pacific Cell Expansion Market Insight

The Asia-Pacific cell expansion market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by rising investments in biotechnology, increasing R&D activities, and expanding manufacturing capabilities in countries such as China, Japan, and India. The region’s growing focus on regenerative medicine, immunotherapy, and cell-based research is driving adoption of automated and modular expansion systems. Government initiatives promoting biotech innovation and funding for clinical trials are supporting market expansion. The availability of cost-effective instruments, consumables, and disposables enhances accessibility for academic and commercial users. Rapid urbanization and increasing skilled workforce also contribute to higher adoption rates across APAC.

Japan Cell Expansion Market Insight

The Japan cell expansion market is gaining momentum due to the country’s advanced biotechnology infrastructure, high R&D investment, and focus on regenerative medicine. Japanese institutions are adopting automated, closed-system platforms to improve scalability, reproducibility, and safety in therapeutic and research applications. The integration of process analytics, monitoring sensors, and high-throughput systems is enhancing efficiency. Japan’s regulatory environment encourages clinical-grade cell production, supporting market growth. Growing demand for personalized therapies and cell-based research is driving the adoption of instruments, consumables, and disposables across hospitals, biotech firms, and academic labs.

India Cell Expansion Market Insight

The India cell expansion market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding biotech industry, increasing academic research, and rising investments in regenerative medicine and cell therapy. India is emerging as a hub for cost-effective cell expansion solutions, including instruments, consumables, and disposables. Growing adoption in hospitals, biotech companies, and academic institutions is boosting market growth. Government initiatives supporting biotechnology research, smart lab infrastructure development, and collaborations with global firms are key drivers. The availability of affordable and scalable cell expansion platforms enhances accessibility, further propelling market expansion across the country.

Cell Expansion Market Share

The Cell Expansion industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Sartorius AG (Germany)

- Merck KGaA (Germany)

- Danaher (U.S.)

- Lonza Group AG (Switzerland)

- Corning Incorporated (U.S.)

- BD (U.S.)

- Terumo BCT, Inc. (Japan)

- Miltenyi Biotec GmbH (Germany)

- Eppendorf AG (Germany)

- STEMCELL Technologies Inc. (Canada)

- Takara Bio Inc. (Japan)

- Bio Techne Corporation (U.S.)

- HiMedia Laboratories Pvt. Ltd. (India)

- CellGenix GmbH (Germany)

- PBS Biotech, Inc. (U.S.)

- PromoCell GmbH (Germany)

- WuXi AppTec Co., Ltd. (China)

- FUJIFILM Irvine Scientific, Inc. (U.S.)

- Esco Healthcare (Singapore)

What are the Recent Developments in Global Cell Expansion Market?

- In August 2025, Cytiva and Culture Biosciences strengthened their strategic collaboration, with Cytiva agreeing to globally commercialize Culture’s Stratyx™ 250 bioreactor platform and work jointly on additional bioreactor formats, enabling seamless scale‑up from benchtop to production scales

- In April 2025, Culture Biosciences launched the Stratyx™ 250 mobile bioreactor, a cloud‑connected, automated system enabling remote real‑time monitoring and optimization of cell culture processes, reducing development time and improving scale‑up success for both adherent and suspension cell lines, marking a significant step forward in cell expansion technology

- In March 2025, Cytiva expanded its Xcellerex X‑Platform bioreactor portfolio, adding 500 L and 2 000 L single‑use bioreactors to support scalable bioprocessing from early clinical research to commercial manufacturing and meet growing demand for advanced therapeutics

- In June 2024, WuXi Biologics boosted its manufacturing capabilities with three 5 000 L single‑use bioreactors at its Hangzhou facility, significantly increasing capacity and enhancing flexibility, scalability, and contamination control in large‑scale cell culture and biologics production

- In April 2023, Cytiva launched its X‑platform bioreactors to simplify and enhance single‑use upstream bioprocessing operations, offering improved automation, ergonomic design, and scalability for monoclonal antibody, viral vector, and cell therapy production workflows

- https://www.prnewswire.com/news-releases/culture-biosciences-unveils-stratyx-250-the-first-cloud-integrated-mobile-bioreactor-for-cell-culture-process-development-302415306.html

- https://www.cytivalifesciences.com/en/us/news-center/cytiva-broaden-xcellerex-platform-to-include-500l-and-2-000l-bioreactors-1000

- https://www.genengnews.com/topics/bioprocessing/cytiva-expands-collaboration-with-culture-biosciences/?

- https://www.europeanpharmaceuticalreview.com/news/229968/wuxi-facility-boosts-bioprocessing-capacity-with-new-bioreactors/?

- https://www.biopharmaboardroom.com/news/17/340/cytivas-x-platform-bioreactors-boost-process-efficiency-paving-the-way-for-future-biomanufacturing-breakthroughs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.