Global Cellulose Market

Market Size in USD Billion

CAGR :

%

USD

48.78 Billion

USD

102.08 Billion

2024

2032

USD

48.78 Billion

USD

102.08 Billion

2024

2032

| 2025 –2032 | |

| USD 48.78 Billion | |

| USD 102.08 Billion | |

|

|

|

|

Cellulose Market Size

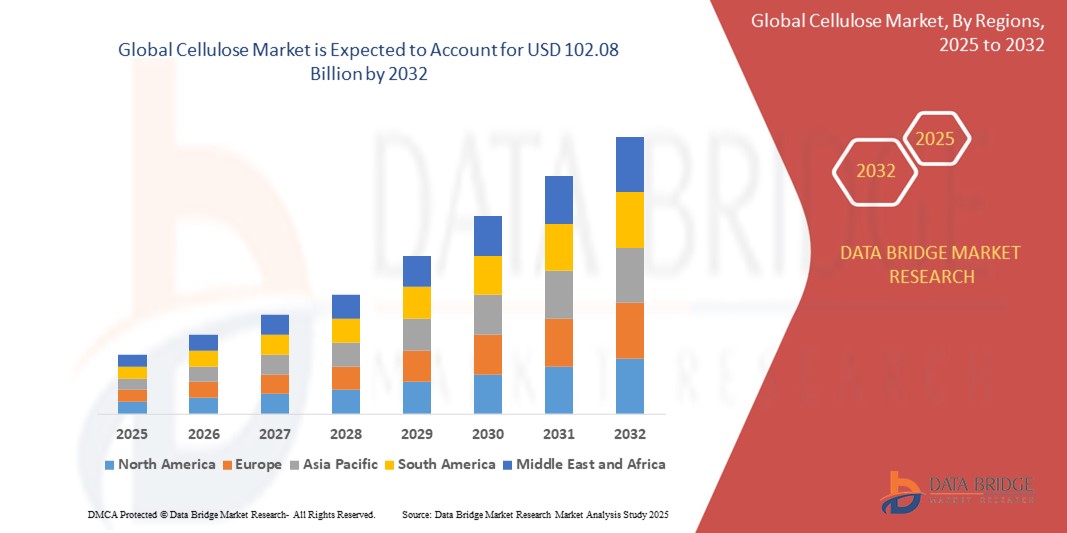

- The global cellulose market size was valued at USD 48.78 billion in 2024 and is expected to reach USD 102.08 billion by 2032, at a CAGR of 9.67% during the forecast period

- The market growth is largely fueled by the rising shift toward sustainable materials and increasing emphasis on bio-based alternatives across various industries, including packaging, pharmaceuticals, textiles, and food processing

- Furthermore, growing environmental concerns, stringent regulations on synthetic polymers, and advancements in cellulose extraction and modification techniques are positioning cellulose as a key material in the transition toward circular and low-carbon economies. These converging factors are accelerating the adoption of cellulose-based products, thereby significantly boosting the industry's growth

Cellulose Market Analysis

- Cellulose is a natural polymer derived from plant sources and is widely used in various forms—such as microcrystalline cellulose, cellulose ethers, and esters—for applications in pharmaceuticals, food, cosmetics, paper, and textiles. It is valued for its biodegradability, renewability, and versatility in functional performance

- The escalating demand for cellulose is primarily driven by increasing environmental regulations, the rising need for biodegradable packaging and personal care products, and growing consumer awareness of sustainable and clean-label ingredients across global markets

- Asia-Pacific dominated the cellulose market with a share of 38.7% in 2024, due to robust industrial growth, expanding paper and textile manufacturing, and abundant availability of raw materials such as wood and agricultural waste

- Europe is expected to be the fastest growing region in the cellulose market during the forecast period due to stringent environmental regulations, strong consumer preference for sustainable products, and advancements in cellulose processing technologies

- Modified segment dominated the market with a market share of 66.9% in 2024, due to its superior performance in specialized applications such as pharmaceuticals, construction, and personal care products. Modified cellulose types such as methylcellulose, carboxymethylcellulose, and hydroxypropyl cellulose are valued for their enhanced solubility, thickening, stabilizing, and film-forming properties. Their chemical versatility enables broader use across industries requiring customized functional attributes

Report Scope and Cellulose Market Segmentation

|

Attributes |

Cellulose Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cellulose Market Trends

“Increasing Demand for Natural and Sustainable Materials”

- Growing emphasis on sustainability and environmental concerns is driving demand for cellulose as a renewable, biodegradable alternative to synthetic materials across various industries

- For instance, companies such as Asahi Kasei are innovating with cellulose-based fibers and bioplastics to replace petroleum-derived products in packaging and textiles, reflecting increasing industrial adoption

- Technological advancements enable production of high-purity cellulose with tailored properties for applications in pharmaceuticals, cosmetics, and food additives, expanding market potential

- Rising consumer preference for natural products in personal care and hygiene sectors is fueling the development of cellulose-based ingredients that offer biocompatibility and enhanced sensory experiences

- The integration of cellulose into composite materials for automotive and construction applications is growing, driven by the need for lightweight, strong, and eco-friendly components

- Increasing R&D focus on nanocellulose and microfibrillated cellulose products is creating new possibilities in electronics, paper coatings, and specialty films due to their superior mechanical and barrier properties

Cellulose Market Dynamics

Driver

“Rising Demand in End-Use Industries”

- Expanding use of cellulose in packaging, textiles, personal care, and pharmaceuticals is significantly propelling market growth as these industries seek sustainable raw materials with functional benefits

- For instance, international packaging firms such as WestRock are incorporating cellulose-based barrier coatings and films into their product portfolios to meet growing demand for biodegradable solutions

- The surge in eco-conscious consumerism is encouraging manufacturers to replace plastics and synthetic fibers with cellulose products that reduce ecological footprints and improve recyclability

- Regulatory pressures and bans on single-use plastics in many countries are accelerating the shift towards cellulose-based packaging materials, benefiting market expansion

- Growth in emerging economies with increasing industrialization and disposable incomes is boosting cellulose demand due to rising consumption of packaged goods and personal care products

Restraint/Challenge

“Limited Availability of Raw Materials”

- Variability in raw material supply, such as wood pulp and agricultural residues, impacts cellulose production capacity, posing a significant challenge to consistent market growth

- For instance, pulp producers such as Stora Enso face raw material shortages during adverse climate conditions, which affects the supply chain and leads to pricing volatility in the cellulose market

- Land-use competition between forestry for cellulose and other industries, including timber and food production, limits the sustainable sourcing and scalability of cellulose raw materials

- High processing costs for extracting and refining cellulose from biomass, particularly in developing nanocellulose products, restrict broader commercial adoption due to economic constraints

- Environmental concerns related to deforestation and unsustainable harvesting practices necessitate strict regulatory compliance, which can increase operational costs and supply chain complexity

Cellulose Market Scope

The market is segmented on the basis of source, modification, manufacturing process, purity, and application.

• By Source

On the basis of source, the cellulose market is segmented into natural, fruits, and treewood. The treewood segment dominated the largest market revenue share in 2024, driven by its high cellulose content, widespread availability, and established role as the primary raw material in industrial-scale cellulose production. Treewood-derived cellulose is extensively used across paper, textile, and chemical industries due to its consistent quality and efficient extraction process. Its dominance is further reinforced by the mature supply chains and processing infrastructure in place globally.

The fruits segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for organic and biodegradable cellulose in food and cosmetic applications. Cellulose extracted from fruit sources is often favored in clean-label products, aligning with growing consumer preference for natural and plant-based ingredients. In addition, innovations in extraction technology and increasing agricultural waste valorization efforts are driving the viability and cost-effectiveness of fruit-based cellulose.

• By Modification

On the basis of modification, the cellulose market is segmented into unmodified and modified. The modified segment held the largest market revenue share of 66.9% in 2024, owing to its superior performance in specialized applications such as pharmaceuticals, construction, and personal care products. Modified cellulose types such as methylcellulose, carboxymethylcellulose, and hydroxypropyl cellulose are valued for their enhanced solubility, thickening, stabilizing, and film-forming properties. Their chemical versatility enables broader use across industries requiring customized functional attributes.

The unmodified segment is expected to register the fastest CAGR from 2025 to 2032, supported by the rising shift toward minimally processed, eco-friendly ingredients. Unmodified cellulose is gaining traction in packaging, paper, and food applications where natural integrity and sustainability are prioritized. Its low environmental footprint and regulatory acceptance in clean-label formulations position it for strong future demand.

• By Manufacturing Process

On the basis of manufacturing process, the cellulose market is segmented into viscose, cellulose, and ethers. The viscose process dominated the market in 2024 due to its longstanding use in textile production and its efficiency in converting raw cellulose into semi-synthetic fibers such as rayon. Viscose-based cellulose products remain widely used in the fashion industry for their affordability, biodegradability, and cotton-such as texture.

The ethers process is expected to witness the fastest growth from 2025 to 2032, driven by increasing utilization in pharmaceutical and food industries. Cellulose ethers offer functional benefits such as water retention, emulsification, and controlled drug release. The growing demand for advanced drug delivery systems and processed foods is accelerating the adoption of cellulose ethers in both developed and emerging markets.

• By Purity

On the basis of purity, the cellulose market is segmented into above 95%, 85%–95%, and below 85%. The above 95% purity segment captured the largest revenue share in 2024, owing to its critical role in pharmaceutical and food-grade applications where high-quality cellulose is essential for safety, consistency, and performance. This segment is also favored for producing high-grade films, coatings, and microcrystalline cellulose used in tablets and dietary supplements.

The 85%–95% purity segment is projected to witness the highest growth during 2025–2032, supported by its expanding use in paper manufacturing, personal care, and construction industries. This purity range offers a balance between cost and performance, making it suitable for industrial-scale applications where extremely high purity is not necessary but functional integrity must be maintained.

• By Application

On the basis of application, the cellulose market is segmented into food, pharmaceuticals, paper, cosmetics, and textiles. The paper segment held the largest market share in 2024, as cellulose remains a fundamental raw material in the global paper and pulp industry. Its structural properties, renewability, and low cost make it indispensable for the production of writing paper, packaging, and specialty paper products.

The cosmetics segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by surging demand for sustainable, plant-based, and biodegradable ingredients in personal care formulations. Cellulose derivatives are increasingly used as thickeners, binders, and film formers in skincare and haircare products. As consumer awareness of environmental and ingredient transparency grows, the appeal of cellulose-based cosmetic ingredients is expected to rise significantly.

Cellulose Market Regional Analysis

- Asia-Pacific dominated the cellulose market with the largest revenue share of 38.7% in 2024, driven by robust industrial growth, expanding paper and textile manufacturing, and abundant availability of raw materials such as wood and agricultural waste

- Regional demand is further propelled by the rising consumption of cellulose in food and pharmaceutical sectors, particularly in developing economies such as China and India, where industrialization and urbanization are accelerating rapidly

- The presence of cost-effective manufacturing infrastructure and increasing foreign investments in chemical processing industries also support the dominance of Asia-Pacific in the global cellulose market

China Cellulose Market Insight

China accounted for the largest revenue share within Asia-Pacific in 2024, owing to its robust cellulose production capacity and diverse industrial applications. The country’s expanding middle class, urbanization, and push for sustainable solutions are boosting demand for cellulose in food, packaging, and healthcare industries. China’s dominance is further supported by domestic manufacturing of cellulose-based textiles and government initiatives promoting eco-friendly materials in both export and domestic sectors.

India Cellulose Market Insight

India is emerging as a key growth market in the region, fueled by expanding applications of cellulose in textiles, personal care, and pharmaceuticals. The country’s growing population and increasing demand for cost-effective, biodegradable solutions are creating strong tailwinds for cellulose adoption. Moreover, the availability of agricultural residues and government focus on promoting bio-economy initiatives are positioning India as both a major consumer and supplier of cellulose materials.

Europe Cellulose Market Insight

Europe is projected to grow at the fastest CAGR in the cellulose market during the forecast period, primarily driven by stringent environmental regulations, strong consumer preference for sustainable products, and advancements in cellulose processing technologies. The region is witnessing increasing use of cellulose and its derivatives in packaging, pharmaceuticals, and cosmetics, as industries move toward bio-based alternatives to reduce plastic use and carbon footprint. With widespread support for circular economy models and innovations in biodegradable and recyclable materials, cellulose is becoming integral to many EU sustainability strategies. Public and private sector investments in R&D are also accelerating the adoption of cellulose in high-performance and functional applications.

Germany Cellulose Market Insight

Germany represents a key market within Europe, underpinned by its strong industrial base and environmental policy leadership. The country’s well-established pulp and paper industry, combined with ongoing innovation in cellulose-based chemicals and composites, supports its growing demand. Regulatory support for sustainable practices and increasing use of cellulose in pharmaceuticals and packaging are also driving market expansion.

France Cellulose Market Insight

France is witnessing steady growth in the cellulose market, particularly in the cosmetics, food, and specialty paper segments. The nation’s strong emphasis on clean-label, natural, and biodegradable products aligns well with the use of cellulose in personal care and food processing. Continued government efforts to reduce plastic usage and enhance material recyclability are further promoting cellulose-based alternatives across industries.

Cellulose Market Share

The cellulose industry is primarily led by well-established companies, including:

- Ashland (U.S.)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Dow (U.S.)

- CP Kelco (U.S.)

- Akzo Nobel N.V. (Netherlands)

- LOTTE Chemical CORPORATION (South Korea)

- China RuiTai International Holdings Co., Ltd. (China)

- DKS Co. Ltd. (South Korea)

- Daicel Corporation (Japan)

- Fenchem (China)

- J. RettenmaierandSöhne GmbH + Co.Kg (Germany)

- Lotte Fine Chemical (South Korea)

- Reliance Cellulose Products Ltd. (India)

- SE Tylose GmbH and Co. Kg (Germany)

- Shandong Head Co., Ltd. (China)

- Shin-Etsu Chemical Co. Ltd. (Japan)

- MAZRUI INTERNATIONAL (U.A.E.)

- Zhejiang Kehong Chemical Co. Ltd. (China)

- Rayonier Inc. (U.S.)

- Tembec Inc. (Canada)

- Borregaard (Norway)

Latest Developments in Global Cellulose Market

- In June 2025, Ence, a leading player in sustainable cellulose and renewable energy, unveiled a new range of cellulose-based packaging specifically designed to replace traditional plastic in the food sector. Backed by a €12 million investment, this launch marks a major step toward reducing plastic dependency and advancing the circular economy. By targeting the high-volume food packaging industry, Ence is addressing increasing environmental concerns and also expanding its market reach. The initiative is expected to drive growth in the bio-based packaging segment and reinforce Ence’s competitive edge in the rapidly evolving sustainable materials landscape

- In May 2024, Spanish biomaterials innovator Polybion announced the global commercial availability of its cultivated cellulose material, Celium. Touted as more than a leather substitute, Celium introduces a novel class of materials with unique structural and performance properties. This breakthrough is poised to reshape the biomaterials market by offering sustainable, scalable, and animal-free alternatives for use in fashion, interior design, and lifestyle products. Polybion’s global expansion opens new market avenues and also elevates cellulose’s status as a high-value material in premium consumer goods, supporting the shift toward cruelty-free and climate-resilient solutions

- In February 2024, Birla Cellulose introduced its patented innovation, Birla Viscose – Intellicolor, at the Bharat Tex event, aimed at transforming the textile industry’s dyeing process. This next-generation product integrates coloration during fiber production, reducing the need for conventional reactive dyeing, which is resource-intensive and environmentally taxing. Intellicolor has the potential to lower water and chemical usage significantly, thereby aligning with global sustainability goals. Its launch positions Birla Cellulose as a pioneer in eco-conscious textile innovation, appealing to brands and manufacturers seeking cleaner production practices and boosting the market for sustainable textile fibers

- In February 2023, Asahi Kasei completed its second production facility for Ceolus microcrystalline cellulose (MCC) at Mizushima Works in Japan. This expansion was driven by surging global demand for MCC, particularly in the pharmaceutical industry, where it is widely used as an excipient in tablet formulations. With this new plant, Asahi Kasei is poised to enhance supply reliability, meet growing regulatory standards, and strengthen its leadership in the pharmaceutical-grade cellulose segment. The facility is expected to play a critical role in addressing the increasing complexity of drug formulations and supporting innovation in oral dosage forms

- In January 2020, Anhui Guozhen Group and Chemtex formed a joint venture to construct China’s first commercial-scale cellulosic ethanol plant in Fuyang, Anhui province, with an annual capacity of 50 kilotons. Powered by Clariant’s Sunliquid® technology, the facility is designed to convert agricultural residues into renewable fuel, representing a significant milestone in Asia’s transition to sustainable energy sources. This development is expected to catalyze the growth of the cellulosic biofuels market in China by demonstrating the commercial viability of advanced biofuels. It also aligns with national goals to reduce greenhouse gas emissions, optimize agricultural waste usage, and foster energy independence through cleaner alternatives.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cellulose Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cellulose Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cellulose Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.