Global Ceramics Market

Market Size in USD Billion

CAGR :

%

USD

85.88 Billion

USD

144.49 Billion

2024

2032

USD

85.88 Billion

USD

144.49 Billion

2024

2032

| 2025 –2032 | |

| USD 85.88 Billion | |

| USD 144.49 Billion | |

|

|

|

|

Ceramics Market Size

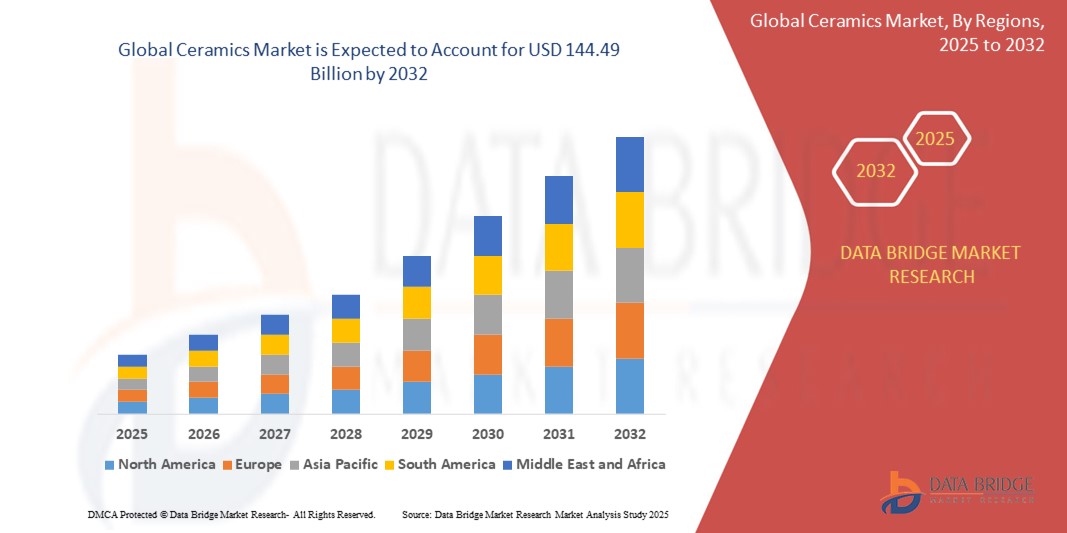

- The global ceramics market size was valued at USD 85.88 billion in 2024 and is expected to reach USD 144.49 billion by 2032, at a CAGR of 6.72% during the forecast period

- The market growth is primarily driven by increasing demand for ceramics in construction, infrastructure development, and advancements in manufacturing technologies, particularly in advanced ceramics for industrial and medical applications

- Rising consumer preference for aesthetically pleasing, durable, and sustainable materials in residential and commercial construction is positioning ceramics as a preferred choice, further accelerating market expansion

Ceramics Market Analysis

- Ceramics, encompassing both traditional and advanced materials, are critical components in various industries due to their durability, heat resistance, and versatility in applications ranging from construction to medical devices

- The growing demand for ceramics is fueled by rapid urbanization, increasing infrastructure investments, and the rising adoption of advanced ceramics in high-performance industrial and medical applications

- Asia-Pacific dominated the ceramics market with the largest revenue share of 45.12% in 2024, driven by robust construction activities, a strong manufacturing base, and the presence of key industry players, particularly in China, India, and Japan

- North America is expected to be the fastest-growing region during the forecast period due to increasing investments in sustainable construction and advancements in ceramic technologies for industrial and medical applications

- The traditional ceramics segment dominated the largest market revenue share of 56.0% in 2024, driven by its extensive use in manufacturing tiles, sanitary ware, and refractories for construction and household applications. Traditional ceramics, primarily composed of clay, silica, and feldspar, benefit from widespread adoption in residential and commercial construction due to their cost-effectiveness and aesthetic appeal

Report Scope and Ceramics Market Segmentation

|

Attributes |

Ceramics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ceramics Market Trends

“Increasing Integration of Advanced Manufacturing Technologies”

- The global ceramics market is experiencing a significant trend toward the integration of advanced manufacturing technologies, such as 3D printing, nanotechnology, and inkjet technology, in ceramic production

- These technologies enable precise shaping, enhanced material properties, and cost-effective production of complex ceramic components, improving efficiency and product quality

- Advanced ceramics, enhanced by these technologies, offer superior properties such as high-temperature resistance, corrosion resistance, and improved fracture toughness, making them ideal for demanding applications in industries such as electronics, medical, and aerospace

- For instances, 3D printing is increasingly used to produce intricate ceramic components for dental implants and medical devices, while nanotechnology enhances the strength and durability of ceramic tiles and coatings

- This trend is boosting the appeal of ceramics for both traditional and advanced applications, driving innovation and expanding market opportunities

- These technologies allow for the customization of ceramic products, enabling manufacturers to meet specific end-user requirements, such as tailored designs for construction or specialized components for industrial applications

Ceramics Market Dynamics

Driver

“Rising Demand for Sustainable and Durable Materials”

- The growing demand for sustainable, durable, and aesthetically appealing materials in construction, automotive, and medical sectors is a key driver for the global ceramics market

- Ceramics, particularly advanced ceramics, offer properties such as high strength, chemical inertness, and resistance to wear and corrosion, making them ideal for applications such as tiles, sanitary ware, and bioimplants

- Government initiatives, especially in Asia-Pacific, promoting infrastructure development and affordable housing, such as India’s Housing for All initiative, are increasing the demand for ceramic tiles, bricks, and sanitary ware

- The proliferation of smart ceramics in electronics, driven by the rollout of 5G technology, and the increasing use of ceramics in renewable energy applications, such as solar panels, further support market growth

- Manufacturers are increasingly incorporating ceramics as standard materials in construction and industrial applications to meet consumer expectations for eco-friendly and long-lasting products

Restraint/Challenge

“High Production Costs and Environmental Regulations”

- The high initial costs associated with raw materials, advanced manufacturing processes, and specialized equipment for producing ceramics, particularly advanced ceramics, pose a significant barrier to market growth

- The production of ceramics, especially advanced ceramics such as alumina and zirconia, requires energy-intensive processes, increasing operational costs and limiting adoption in cost-sensitive markets

- Environmental concerns and stringent regulations regarding emissions and waste from ceramic manufacturing, particularly in regions such as Europe and North America, present challenges for manufacturers

- Compliance with varying environmental standards across countries complicates operations for global manufacturers, requiring significant investment in sustainable practices

- These factors can deter smaller manufacturers and limit market expansion in regions with high regulatory oversight or cost sensitivity

Ceramics market Scope

The market is segmented on the basis of product, application, and end-use.

- By Product

On the basis of product, the global ceramics market is segmented into traditional and advanced ceramics. The traditional ceramics segment dominated the largest market revenue share of 56.0% in 2024, driven by its extensive use in manufacturing tiles, sanitary ware, and refractories for construction and household applications. Traditional ceramics, primarily composed of clay, silica, and feldspar, benefit from widespread adoption in residential and commercial construction due to their cost-effectiveness and aesthetic appeal.

The advanced ceramics segment is expected to witness the fastest growth rate of 7.5% from 2025 to 2032, fueled by increasing demand in high-tech industries such as electronics, automotive, and healthcare. Advanced ceramics, including materials such as alumina, zirconia, and silicon carbide, offer superior properties such as high-temperature resistance, electrical insulation, and biocompatibility, driving their adoption in specialized applications such as medical implants and electronic components.

- By Application

On the basis of application, the global ceramics market is segmented into sanitary ware, abrasives, bricks and pipes, tiles, pottery, and others. The tiles segment dominated the market with a revenue share of 48.0% in 2024, attributed to the global surge in construction activities and the growing demand for aesthetically appealing, durable, and cost-effective tiles for residential and commercial spaces. Ceramic tiles are favored for their tensile strength, water resistance, and design versatility.

The sanitary ware segment is anticipated to experience the fastest growth rate of 6.8% from 2025 to 2032. Rising urbanization, increasing living standards, and government initiatives promoting sanitation, particularly in emerging economies such as India and China, are driving demand for ceramic-based sanitary ware such as washbasins, toilet bowls, and bathtubs, which offer durability, easy maintenance, and a glossy finish.

- By End-Use

On the basis of end-use, the global ceramics market is segmented into building and construction, industrial, medical, and others. The building and construction segment held the largest market revenue share of 40.0% in 2024, driven by the extensive use of ceramics in tiles, bricks, pipes, and sanitary ware for residential, commercial, and infrastructural projects. Rapid urbanization and infrastructure development, particularly in Asia-Pacific, are key growth drivers.

The medical segment is expected to witness the fastest growth rate of 6.1% from 2025 to 2032. The increasing adoption of advanced ceramics in medical applications, such as dental implants, prosthetics, and medical devices, is driven by their biocompatibility, wear resistance, and non-corrosive properties. The expansion of the healthcare industry, especially in North America, further supports this segment’s growth.

Ceramics Market Regional Analysis

- Asia-Pacific dominated the ceramics market with the largest revenue share of 45.12% in 2024, driven by robust construction activities, a strong manufacturing base, and the presence of key industry players, particularly in China, India, and Japan

- Consumers and industries prioritize ceramics for their durability, thermal resistance, and aesthetic versatility, particularly in regions with expanding infrastructure and healthcare sectors

- Growth is fueled by advancements in ceramic technology, including advanced ceramics for industrial and medical applications, alongside increasing adoption in both traditional and innovative end-use segments

Japan Ceramics Market Insight

Japan’s ceramics market is experiencing significant growth, driven by strong demand for advanced ceramics in industrial and medical applications, as well as traditional ceramics in construction and pottery. The presence of major manufacturers and a focus on high-quality, technologically advanced ceramics for electronics and automotive sectors accelerates market penetration. Rising interest in aesthetic and functional ceramics for residential projects also contributes to growth.

China Ceramics Market Insight

China holds the largest share of the Asia-Pacific ceramics market, propelled by rapid urbanization, increasing construction activities, and growing demand for ceramics in industrial and medical applications. The country’s expanding middle class and focus on sustainable infrastructure support the adoption of both traditional ceramics (tiles, sanitary ware) and advanced ceramics. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

North America Ceramics Market Insight

The North America ceramics market is expected to witness the fastest growth rate globally, driven by strong demand in construction, medical, and industrial sectors, particularly in the U.S. and Canada. The region benefits from increasing adoption of advanced ceramics in high-performance applications, such as aerospace, biomedical devices, and electronics, alongside a robust construction industry. Regulatory support for sustainable materials and energy-efficient solutions, coupled with growing consumer awareness of ceramic benefits in durability and aesthetics, fuels market expansion. Both OEM and aftermarket segments contribute to a diverse product ecosystem.

U.S. Ceramics Market Insight

The U.S. ceramics market is expected to witness significant growth fueled by strong demand in construction, medical, and industrial applications. Increasing adoption of advanced ceramics for high-performance uses, such as aerospace and biomedical devices, alongside rising construction activities, fuels market expansion. Regulatory support for sustainable materials and energy-efficient solutions further boosts demand for ceramics in both OEM and aftermarket segments.

Europe Ceramics Market Insight

The European ceramics market is experiencing steady growth, supported by a focus on sustainable building materials and advanced industrial applications. Consumers and industries prioritize ceramics for their energy efficiency, durability, and aesthetic appeal in construction and manufacturing. Countries such as Germany and Italy show significant uptake due to their established ceramic manufacturing sectors and increasing demand for sanitary ware and tiles in urban development projects.

U.K. Ceramics Market Insight

The U.K. ceramics market is growing steadily, driven by demand for high-quality tiles, sanitary ware, and advanced ceramics in construction and medical applications. Increasing consumer awareness of sustainable materials and aesthetic preferences in residential and commercial projects encourages adoption. Evolving regulations promoting energy-efficient construction further influence the use of ceramics, balancing performance with environmental compliance.

Germany Ceramics Market Insight

Germany is a key player in the European ceramics market, with strong growth driven by its advanced manufacturing sector and high demand for ceramics in construction, automotive, and medical industries. German industries favor technologically advanced ceramics for their durability, thermal resistance, and energy efficiency. The integration of ceramics in premium construction projects and industrial applications supports sustained market growth.

Ceramics Market Share

The ceramics industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- 3M (U.S.)

- Solvay (Belgium)

- Kajaria Ceramics Limited (India)

- AGC Inc. (Japan)

- Halocarbon, LLC (U.S.)

- The Chemours Company (U.S.)

- Rogers Corporation (U.S.)

- LINTEC Corporation (Japan)

- Nitto Denko Corporation (Japan)

- KYOCERA Corporation (Japan)

- CeramTec GmbH (U.S.)

- CoorsTek Inc. (U.S.)

- Saint-Gobain (U.S.)

- Morgan Advanced Materials (UK)

- McDanel Ceramics (U.S.)

- Momentive Performance Materials (U.S.)

- RAK Ceramics (UAE)

- Mohawk Industries, Inc. (U.S.)

What are the Recent Developments in Global Ceramics Market?

- In September 2024, Austria-based Lithoz unveiled the CeraMax Vario V900, a cutting-edge ceramic 3D printer boasting the largest build volume in its category. Designed for manufacturing large, high-density ceramic parts, it utilizes Laser-Induced Slipcasting (LIS) technology to process both oxide and dark ceramics such as silicon carbide. This innovation enables simplified debinding and thick-walled component production, making it ideal for demanding applications in aerospace, medical, and research sectors. The printer’s compatibility with water-based suspensions and low binder content ensures precision and efficiency, setting a new benchmark in ceramic additive manufacturing

- In November 2023, KaMin and CADAM announced a global price increase of up to 9% on their kaolin products, effective January 1, 2024, or as contracts allow. This adjustment reflects ongoing inflationary pressures across their operations, including rising mining costs, energy rates in the US and Brazil, and labor market challenges. Despite efforts to offset these costs through continuous improvement initiatives, the companies stated that passing on the increase was necessary to maintain service quality and continued investment in their performance minerals business

- In October 2023, CeramTec marked a major milestone by initiating construction on a new extension building at its Marktredwitz facility in Germany. This expansion responds to the rising global demand for ceramic components used in joint replacements and reinforces CeramTec’s dedication to advancing medical technology. The company plans to invest approximately €75 million over four years, creating over 100 new jobs and enhancing its production capacity for high-performance ceramics. The new facility will also incorporate sustainable technologies, including photovoltaic systems and energy-efficient ventilation, underscoring CeramTec’s commitment to innovation and environmental responsibility

- In October 2022, Lithoz GmbH, an Austria-based leader in ceramic 3D printing, acquired CerAMing GmbH, a German startup known for its patented Layer-wise Slurry Disposition (LSD) printing process. CerAMing, a spin-off from the German Federal Institute for Materials Research and Testing (BAM), brought complementary technology to Lithoz’s portfolio, bridging the gap between its existing LCM and LIS processes. This strategic move expanded Lithoz’s capabilities across a broader range of ceramic additive manufacturing applications, reinforcing its global leadership and enabling more versatile, high-quality production solutions

- In May 2022, CeramTec GmbH introduced AlN HP, a high-performance ceramic substrate made from aluminum nitride, at the PCIM Europe trade fair in Nuremberg. This advanced material offers over 40% greater flexural strength compared to previous AlN substrates, reaching up to 450 MPa, while maintaining excellent thermal conductivity of 170 W/mK. Designed for demanding applications such as power converters in rail vehicles and renewable energy systems, AlN HP supports miniaturization and extreme thermal cycling, making it ideal for next-generation power electronics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ceramics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ceramics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ceramics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.