Global Clean Label Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

53.67 Billion

USD

90.51 Billion

2024

2032

USD

53.67 Billion

USD

90.51 Billion

2024

2032

| 2025 –2032 | |

| USD 53.67 Billion | |

| USD 90.51 Billion | |

|

|

|

|

Clean Label Ingredients Market Size

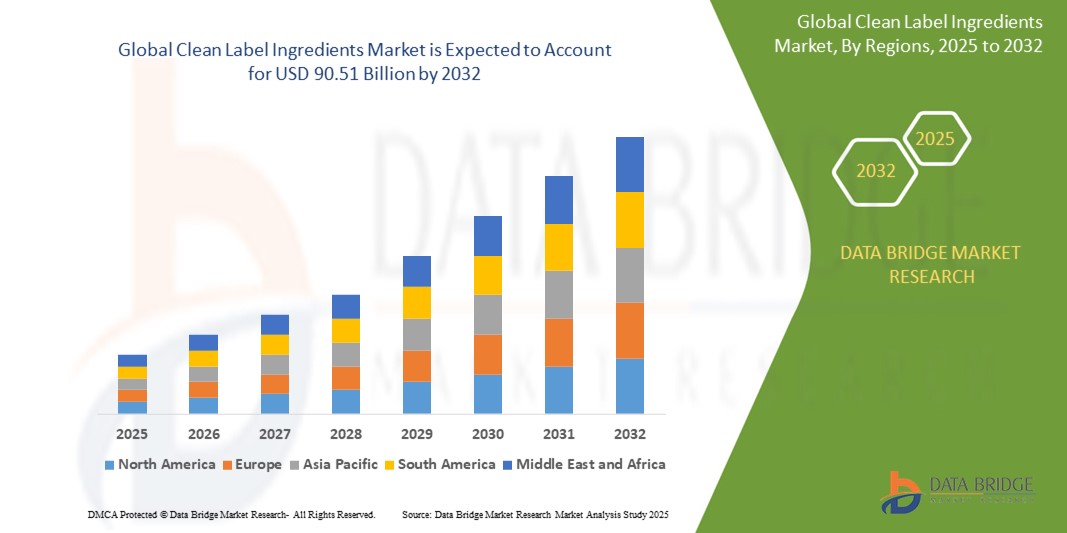

- The global clean label ingredients market size was valued at USD 53.67 billion in 2024 and is expected to reach USD 90.51 billion by 2032, at a CAGR of 6.75% during the forecast period

- This growth is driven by factors such as the rising consumer demand for transparency in food labeling, growing health consciousness, increasing preference for natural and organic ingredients, and regulatory support for clean label standards across the food and beverage industry

Clean Label Ingredients Market Analysis

- Powdered clean label ingredients are gaining strong market traction due to their compatibility with a wide range of food applications

- Their ease of use and ability to maintain product consistency make them a preferred choice for clean label product development

- Asia Pacific is expected to dominate the clean label ingredients market due to with 15.05 % share due to rapid economic growth and rising consumer awareness about health and wellness

- North America is expected to be the fastest growing region in the clean label ingredients market during the forecast period with market share of 40.05% due to increasing consumer demand for transparency and natural ingredients

- The natural flavours segment is expected to dominate the clean label ingredients market with the largest share of 19.11% in 2025 due to increasing consumer preference for authentic taste experiences combined with a growing demand for products made with recognizable, minimally processed ingredients that align with clean label principles

Report Scope and Clean Label Ingredients Market Segmentation

|

Attributes |

Clean Label Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Clean Label Ingredients Market Trends

“Rising Popularity of Powdered Clean Label Ingredients”

- Powdered clean label ingredients are becoming increasingly popular due to their ease of integration in various food products

- Their stable shelf life and simple storage needs make them ideal for both small and large-scale food manufacturers

- Powdered fruit and vegetable extracts are widely used in snacks and beverages to enhance nutrition naturally

- These powders maintain product consistency while allowing clean label claims without compromising taste or texture

- The rising demand for transparency and simplicity in food is pushing more brands to adopt powdered clean label solutions

- In conclusion, the consistent rise in the use of powdered clean label ingredients highlights their central role in shaping product innovation and consumer trust in today’s food market

Clean Label Ingredients Market Dynamics

Driver

“Growing Consumer Demand for Natural and Transparent Ingredients”

- Increasing consumer awareness about health and wellness is boosting demand for natural and transparent food ingredients, with many seeking products labeled with recognizable and trusted components, for instance, plant-based snacks and beverages

- This shift is pushing food and beverage manufacturers to reformulate products using natural additives, preservatives, and flavorings as alternatives to artificial or synthetic ones, which consumers often avoid due to health concerns

- For Instance, the clean label movement aligns with broader lifestyle choices such as organic diets, veganism, and allergen-free preferences, encouraging brands to use whole food ingredients like natural fibers and plant extracts, such as, oat fiber in bakery products

- Beyond ingredients, this demand influences supply chain transparency, packaging, and marketing strategies, with brands such as Amy’s Kitchen gaining loyalty by emphasizing clean label formulations

- Real-time such as include companies reformulating popular items like beverages and snacks to replace artificial flavors with natural fruit extracts to meet consumer expectations

- In conclusion, the rising consumer focus on natural and transparent ingredients is driving innovation and strengthening brand trust in the clean label ingredients market

Opportunity

“Expansion into Plant-Based and Functional Food Markets”

- The growing adoption of plant-based diets for health, ethical, and environmental reasons is increasing demand for natural, plant-derived clean label ingredients like plant proteins and botanical extracts

- Functional foods offering health benefits beyond nutrition, such as digestive support and immunity boosting, create opportunities for clean label ingredients to be incorporated, for instance, natural probiotics and antioxidant-rich extracts

- Manufacturers can develop products that satisfy both clean label and functional food requirements, appealing to consumers seeking transparent and beneficial food options

- This expanding market segment encourages innovation in ingredient formulations, allowing companies to differentiate products and often command premium prices

- Collaboration between food science and nutrition experts is fostering ongoing improvements and growth in clean label ingredients within plant-based and functional food sectors

- In conclusion, the integration of clean label ingredients into plant-based and functional foods offers a promising avenue for market expansion and innovation

Restraint/Challenge

“Complexity in Sourcing Consistent Quality Natural Ingredients”

- Sourcing natural ingredients with consistent quality and safety is a major challenge due to variability from factors like growing conditions, harvest times, and processing methods affecting taste, texture, and shelf life

- Natural ingredients are more prone to contamination and degradation, necessitating stringent quality control and testing throughout complex supply chains involving multiple growers and processors

- Ensuring reliable delivery and traceability can lead to higher costs and longer lead times compared to synthetic alternatives, complicating production planning for manufacturers

- Regulatory compliance and labeling standards differ across regions, creating additional hurdles for companies operating in multiple markets and limiting scalability of clean label ingredients

- To overcome these challenges, manufacturers must build strong supplier relationships, implement advanced quality assurance, and enhance supply chain transparency for sustained market growth

- In conclusion, while demand for clean label ingredients is increasing, addressing sourcing complexities remains critical for the market’s long-term success

Clean Label Ingredients Market Scope

The market is segmented on the basis of application, foam, and type.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

|

By Foam |

|

|

By Type |

|

In 2025, the natural flavours segment is projected to dominate the market with a largest share in type segment

The natural flavours segment is expected to dominate the clean label ingredients market with the largest share of 19.11% in 2025 due to increasing consumer preference for authentic taste experiences combined with a growing demand for products made with recognizable, minimally processed ingredients that align with clean label principles.

The prepared food/ready meals and processed foods segment is expected to account for the largest share during the forecast period in application segment

In 2025, the prepared food/ready meals and processed foods segment is expected to dominate the market with the largest market share of 39.08% due to rising consumer demand for convenient and time-saving meal options that maintain clean label standards by using natural and easily recognizable ingredients.

Clean Label Ingredients Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Clean Label Ingredients Market”

- Asia Pacific dominates the clean label ingredients market with 15.05 % share due to rapid economic growth and rising consumer awareness about health and wellness

- Increasing demand for natural and organic food products in countries like China and India drives market expansion across the region

- Consumers in Asia Pacific are shifting towards plant-based diets and products free from artificial additives and preservatives

- Government regulations in the region are becoming stricter, encouraging the use of clean label ingredients and transparent labeling

- The combination of a growing middle class and changing lifestyles supports strong market growth in the region

“North America is Projected to Register the Highest CAGR in the Clean Label Ingredients Market”

- North America is the fastest-growing region in the clean label ingredients market with market share of 40.05% due to increasing consumer demand for transparency and natural ingredients

- The U.S. sees a strong shift towards clean label dairy products, with consumers favoring less-processed foods with naturally occurring nutrients

- Significant investments are being made in processing infrastructure to support the production of clean label and lactose-reduced dairy products

- Health-conscious consumers prefer products with clean label claims, boosting demand for natural additives and preservatives

- Ongoing innovation and growing consumer preference are expected to sustain rapid growth in the North American clean label ingredients market

Clean Label Ingredients Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cargill, Incorporated (U.S.)

- ADM (U.S.)

- Corbion NV (Netherlands)

- Kerry Group plc. (Ireland)

- Ingredion (U.S.)

- Tate & Lyle (U.K.)

- Sensient Technologies Corporation (U.S.)

- International Flavors & Fragrances Inc. (Israel)

- Chr Hasen A/S (Denmark)

- DuPont (U.S.)

- Koninklijke DSM N.V. (Netherlands)

- Daikin America, Inc. (U.S.)

- Fluoryx Labs (U.S.)

- Wilshire Technologies (U.S.)

- Tokyo Chemical Industry (India) Pvt. Ltd. (India)

- Givaudan (Switzerland)

- Firmenich (Switzerland)

- Symrise (Germany)

- Takasago International Corporation (Japan)

- Mane (France)

Latest Developments in Global Clean Label Ingredients Market

- In December 2023, Ingredion launched Ingredion NOVATION, a new line of clean label ingredients, catering to food and beverage manufacturers. This move aligns with the growing demand in the clean label ingredients market

- In June 2022, DuPont Nutrition & Biosciences launched DuPont Danisco Clean Label Solutions, contributing to the expanding clean label ingredients market for food and beverage manufacturers seeking consumer-centric products

- In April 2022, Ingredion launched two functional native rice starches designed to enhance color and flavor release, catering to the clean label ingredients market by allowing natural flavors and colors to shine through even in white products

- In September 2021, DSM launched DelvoGuard cultures, addressing clean-label solutions for dairy producers and extending the shelf life of products such as yogurt, fresh cheese, and sour cream, contributing to the growth of the clean label ingredients market

- In June 2021, Cargill Incorporated presented SimPure rice flour at the SupplySide West trade show, positioning itself in the clean label ingredients market. SimPure functions as a clean-label bulking agent, aligning with the company's strategy to diversify its product portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Clean Label Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Clean Label Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Clean Label Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.