Global Clean Labelling Market

Market Size in USD Billion

CAGR :

%

USD

53.67 Billion

USD

90.51 Billion

2024

2032

USD

53.67 Billion

USD

90.51 Billion

2024

2032

| 2025 –2032 | |

| USD 53.67 Billion | |

| USD 90.51 Billion | |

|

|

|

|

Clean Labelling Market Size

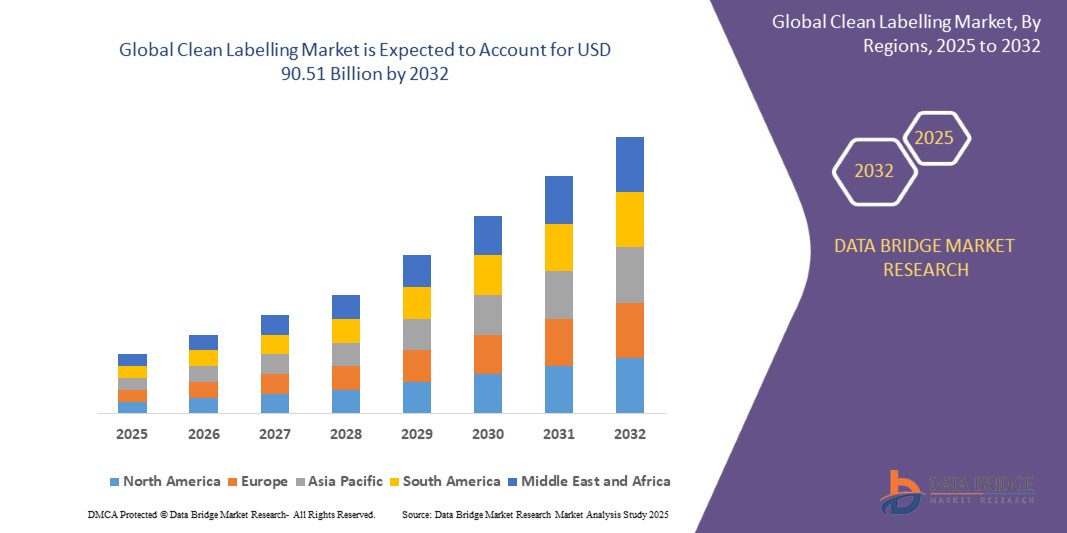

- The global clean labelling market size was valued at USD 53.67 billion in 2024 and is expected to reach USD 90.51 billion by 2032, at a CAGR of 6.75% during the forecast period

- The growth is fueled by increasing consumer demand for transparency in food labels, preference for natural and organic ingredients, and rising awareness of health risks associated with artificial additives.

- Food manufacturers are reformulating products using clean label ingredients, driven by regulatory support and the willingness of consumers to pay premium prices for healthier options.

- Technological advancements in sourcing and processing natural ingredients, such as plant-based alternatives and minimally processed additives, support broadening product portfolios across various food and beverage segments.

Clean Labelling Market Analysis

- Clean labelling involves products made with simple and recognizable ingredients that are natural, organic, and ethically sourced, minimizing artificial additives and preservatives.

- The market comprises a variety of natural ingredient types including natural colours, natural flavours, fruit and vegetable extracts, starches and sweeteners, and flours, each employed to meet clean label standards in food formulations.

- Ingredient forms include dry powders and liquid extracts to suit diverse manufacturing processes and applications across bakery, beverages, dairy products, prepared meals, and snacks.

- A key driver is the rise of health-conscious consumers globally seeking authentic, wholesome food experiences and transparency on ingredient sourcing and labeling.

- Challenges include higher costs of clean label ingredients compared to synthetic alternatives and complexities in maintaining product shelf-life and sensory properties without artificial preservatives.

Report Scope and Clean Labelling Market Segmentation

|

Attributes |

Clean Labelling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Clean Labelling Market Trends

Rising Consumer Demand for Transparency and Natural Ingredients

- Increased global awareness of health and wellness is driving the clean label movement, with consumers seeking products free from artificial additives and preservatives.

- Growth in plant-based and organic food product launches encourages the adoption of natural clean label ingredients.

- Advancements in natural ingredient extraction and processing technologies improve functional benefits and sensory qualities of clean label alternatives.

- E-commerce and digital transparency tools boost consumer access to information, accelerating demand for simpler, recognizable ingredient lists.

Clean Labelling Market Dynamics

Driver

Growing Health Consciousness and Regulatory Support

- The growing global focus on health and wellness has led to an increased demand for food and beverage products with simple, natural, and transparent ingredient lists. Consumers are actively seeking clean label products that provide assurance of safety, quality, and authenticity.

- Government agencies across the U.S., Europe, and Asia-Pacific are setting progressively stricter regulations around food labeling, artificial additives, and claims related to naturalness and organic content. The push for clearer ingredient disclosures has prompted manufacturers to invest in reformulating products to meet clean label standards.

- The rise of plant-based diets, organic produce, and allergen-free food options is propelling expansion in clean label ingredient sourcing, supported by improvements in agricultural practices and supply chain transparency.

- Retailers and e-commerce platforms are responding with dedicated clean label shelves, featured categories, and digital information tools, helping consumers make informed decisions and fueling overall market growth.

- Technological advances such as high-pressure processing, cold pasteurization, and natural preservation methods are enabling manufacturers to maintain product freshness, taste, and shelf life without reliance on synthetic chemicals.

Restraint/Challenge

Higher Costs and Technical Challenges in Product Formulation

- Clean label food ingredients, especially certified organic or plant-based options, are often more expensive due to supply limitations, specialized cultivation, and processing requirements. This leads to higher overall costs for manufacturers and can result in premium product pricing that may restrict broader market penetration.

- Reformulating products to eliminate artificial preservatives, colorants, and flavor enhancers poses significant technical challenges, including ensuring comparable shelf life, maintaining desired sensory profiles, and meeting food safety requirements.

- Some natural alternatives have variable performance or lack the same functional benefits as synthetic additives, requiring extensive R&D investments and ingredient testing before commercial launch.

- Global supply chain fluctuations, such as crop failures or regulatory changes, can cause availability issues for key clean label ingredients, leading to product shortages or reformulation delays.

Clean Labelling Market Scope

The market is segmented on the basis of ingredient type, form, and application.

- By Ingredient Type

On the basis of ingredient type, the clean labelling market is segmented into natural colours, natural flavours, fruit & vegetable ingredients, starch & sweeteners, flours, malts, and others. The natural colours and natural flavours segments dominate the largest market revenue share in 2024, driven by increased consumer preference for recognizable and plant-based ingredients that enhance product appeal and transparency. Natural colours sourced from fruits, vegetables, and botanical extracts are widely adopted in the beverage, bakery, and snack sectors due to regulatory encouragement and consumer demand for additive-free foods.

Fruit & vegetable ingredients—including purees, concentrates, and powders—are gaining traction for their nutritional benefits and suitability in clean label product formulations. Starches, sweeteners, and flours, especially those derived from non-GMO and organic sources, are increasingly favored for their functional properties and compatibility with natural product claims. Malts and other minimally processed ingredients support the trend toward wholesome, authentic foods.

- By Form

On the basis of form, the market is divided into dry and liquid. The dry form segment holds the largest market share in 2024, attributed to its ease of storage, handling, and versatility across various food manufacturing processes including bakery, cereals, and snacks. Dry ingredients are preferred in large-scale production for their stability and cost-effectiveness. The liquid form is rapidly expanding, particularly in beverage and dairy applications where natural extracts and concentrates provide enhanced sensory appeal and clean label benefits. Technological advancements in liquid extraction methods are supporting superior flavor profiles and streamlined manufacturing.

- By Application

On the basis of application, the clean labelling market is segmented into beverages, bakery, dairy & frozen desserts, prepared foods/ready meals, cereals & snacks, and others. The bakery segment dominated the market in 2024, supported by sustained demand for additive-free breads, cakes, and pastries with simple ingredient lists. Beverages—including juices, teas, and plant-based drinks—are projected to register the fastest CAGR from 2025 to 2032, driven by a surge in clean label product launches and consumer seeking transparency in ready-to-drink products.

Clean Labelling Market Regional Analysis

- Asia-Pacific dominates the global clean labelling market, accounting for an estimated 38–40% of total revenue share in 2024. This leading position is driven by expanding healthcare infrastructure, rising awareness of hygiene, and a flourishing textile manufacturing sector across major countries such as China, India, Japan, and South Korea.

- Consumers and institutional buyers in Asia-Pacific are increasingly adopting clean labelling for medical uniforms, sportswear, bedding, and daily apparel, largely in response to heightened concerns about infection control and odor prevention—particularly in densely populated urban centers throughout the region.

- The growth of the Asia-Pacific market is further supported by government regulations on hospital hygiene, strong demand from the apparel and home textile sectors, and the availability of low-cost labor and raw materials. The region’s robust export-driven textile industry and rising adoption of sustainable, antimicrobial finishes also contribute significantly to its market dominance.

- China leads regional production, leveraging high efficiency and innovation in antimicrobial agents. India’s large population, growing healthcare investment, and expanding export potential further boost the region’s market growth.

U.S. Clean Labelling Market Insight

The U.S. leads the North American clean labelling market in 2024, supported by high consumer health awareness, strict FDA regulations against artificial additives, and proactive reformulation initiatives by major food manufacturers. Robust demand spans the beverage, bakery, dairy, and prepared foods sectors, propelled by shoppers seeking simple, transparently sourced ingredients. The market benefits from strong retail and e-commerce infrastructure, facilitating broad access to clean label products. Leading companies continue to innovate with plant-based, organic, and allergen-friendly ingredient portfolios, and invest in certification and digital transparency tools to strengthen consumer trust.

Europe Clean Labelling Market Insight

Europe’s clean labelling market is experiencing robust growth, driven by rigorous EU regulations on ingredient disclosure and the widespread consumer preference for natural, organic, and sustainable food. Key applications include bakery, beverages, dairy, and prepared meals. EU-funded research and strong certification frameworks encourage innovation in clean label ingredients. Countries such as Germany, France, and the U.K. are leading contributors, with food producers developing high-quality, authentic products for domestic consumption and exports. Growing adoption of minimally processed, plant-based ingredients and adherence to clean label standards support continued market progress.

U.K. Clean Labelling Market Insight

The U.K. clean labelling market is poised for steady expansion amid heightened consumer and regulatory focus on food transparency, naturalness, and sustainability. Major retailers and manufacturers are actively reformulating offerings to eliminate artificial additives while promoting products with simple and recognizable ingredients. Clean label claims around allergen-free, plant-based, and ethical sourcing are shaping market dynamics, especially in the bakery, snack, and prepared meal segments. Rising demand for external certifications and ingredient traceability is reshaping both product launches and consumer purchasing patterns.

Germany Clean Labelling Market Insight

Germany’s clean labelling market continues to grow, fueled by a health-conscious population, stringent food safety regulations, and emphasis on quality in food manufacturing. The country’s leadership in natural ingredient extraction and functional foods is driving broad adoption of clean label ingredients within bakery, dairy, and snack categories. Strong support for sustainability and minimal processing, paired with consumer demand for organic and non-GMO products, further supports market expansion.

Asia-Pacific Clean Labelling Market Insight

Asia-Pacific holds the largest revenue share and fastest growth in the global clean labelling market in 2024, powered by rising disposable incomes, rapid urbanization, and increasing health consciousness. China, India, Japan, and South Korea anchor regional growth with booming demand for natural, transparent ingredients in beverages, bakery, dairy, and ready meals. Government initiatives promoting food safety and anti-adulteration reinforce the uptake of clean label standards. Expanding middle-class populations and thriving food industries drive innovation and adoption of clean label product portfolios.

India Clean Labelling Market Insight

India is projected to register a substantial CAGR, fueled by burgeoning health awareness, government promotion of organic agri-food products, and urban middle-class expansion. Increasing attention to food adulteration and allergen concerns is prompting regulation and reformulation in traditional and packaged foods. Domestic and multinational brands are investing in natural colors, organic sweeteners, and plant-based alternatives, targeting rising demand for transparency and authenticity in food labelling.

China Clean Labelling Market Insight

China leads Asia-Pacific in revenue share, driven by its vast food manufacturing base and evolving consumer preferences for safer, natural foods. Regulatory campaigns against artificial additives and strong government support for ingredient transparency support continued clean label market expansion. Wide application of clean label ingredients spans beverages, bakery, ready meals, and snacks, with both domestic and export-focused manufacturers investing in innovative natural formulations and certifications.

Clean Labelling Market Share

The clean labelling industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- ADM (U.S.)

- BENEO GmbH (Germany)

- Chr. Hansen Holding A/S (Denmark)

- Corbion NV (Netherlands)

- Ingredion Incorporated (U.S.)

- Kerry Group plc (Ireland)

- Sensient Technologies Corporation (U.S.)

- Tate & Lyle PLC (U.K.)

- International Flavors & Fragrances Inc. (U.S.)

- DSM-Firmenich (Netherlands)

- Symrise (Germany)

- Puratos (Belgium)

- Ajinomoto Co., Inc. (Japan)

- Roquette Frères (France)

Latest Developments in Global Clean Labelling Market

- In 2025 Chr. Hansen introduced a new line of natural flavor extracts derived from botanical sources for bakery and beverage applications.

- In 2024 Cargill launched clean label starch and sweetener solutions enhancing texture and shelf life without artificial additives.

- In 2024 Kerry Group unveiled plant-based protein ingredients formulated for clean label prepared meals and snacks.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.