Global Clinical Laboratory Tests Market

Market Size in USD Billion

CAGR :

%

USD

206,645.00 Billion

USD

399,819.07 Billion

2021

2029

USD

206,645.00 Billion

USD

399,819.07 Billion

2021

2029

| 2022 –2029 | |

| USD 206,645.00 Billion | |

| USD 399,819.07 Billion | |

|

|

|

|

Clinical Laboratory Tests Market Analysis and Size

According to World Health Organization data, more than 17 million people die each year from cardiovascular disorders caused by a variety of unhealthy behaviours, high blood pressure, and high cholesterol levels. Liver cirrhosis, hepatitis, liver cancer, bone disease, bile duct obstruction, and autoimmune disorders are all part of the liver panel segment. Hepatitis had the highest share in 2019, while liver cirrhosis was expected to be the fastest-growing segment over the forecast period due to rising lifestyle disorders and tobacco and alcohol consumption.

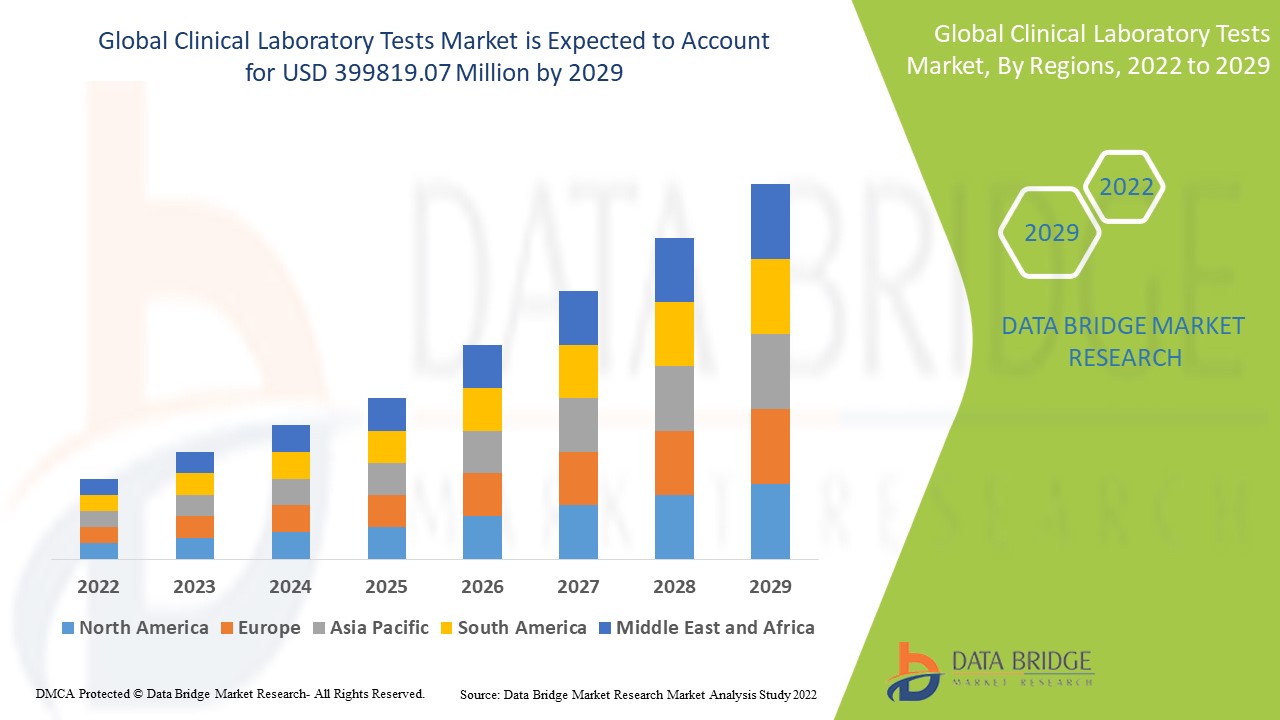

Data Bridge Market Research analyses that the clinical laboratory tests market which was USD 206,645.00 million in 2021, is expected to reach USD 399819.07 million by 2029, at a CAGR of 8.6% during the forecast period 2022 to 2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Clinical Laboratory Tests Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type of Test, Clinical (Complete Comprehensive Test or Complete Body Test), CBC (Complete Body Count), Basic Metabolic Panel (BMP), HGB/HCT), Tests, HbA1c Tests, BUN Creatinine Tests, Electrolytes Tests, Renal Panel Tests, Lipid Panel Tests, Routine, Speciality), Application (Parasitology, Haematology, Virology, Toxicology, Immunology/Serology, Histopathology and Urinalysis, End Users (Hospital Based Laboratories, Clinics Based Laboratories, Central/Independent Laboratories, Physician Office-Based Laboratories and Other - Retail Clinic) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South AUmerica. |

|

Market Players Covered |

Abbott (U.S.), ARUP Laboratories (U.S.), OPKO Health, Inc. (U.S.), ioscientia Healthcare GmbH (Germany), Charles River Laboratories (U.S.), NeoGenomics Laboratories (U.S.), Genoptix, Inc. (U.S.), Healthscope (Australia), The Laboratory Glassware Co. (U.S.), Laboratory Corporation of America® Holdings (U.S.), Fresenius Medical Care AG & Co. KGaA (Germany), QIAGEN (Germany), Quest Diagnostics Incorporated (U.S.), Siemens Healthcare Private Limited (Germany), Tulip Diagnostics (P) Ltd. (India), Sonic Healthcare Limited (Australia), Merck KGaA (Germany) |

|

Market Opportunities |

|

Market Definition

Clinical laboratory test results are used in diagnostic decision making as part of clinical medicine. Clinical laboratory tests are classified into three types. The US Food and Drug Administration (FDA) determines the testing categories of tests that have been cleared for clinical use using a scoring system that considers the complexity of the testing, the stability of calibrators, controls, pre-analytical steps required, and the need for result interpretation. The test samples are analysed by a technician or your doctor to see if your results are within the normal range. Clinical laboratories are medical services that offer a wide range of research techniques to help doctors with diagnosis, therapeutic interventions, and patient supervision. These labs are run by medical technologists (clinical laboratory physicists), who are qualified to conduct experiments on collections of biological samples obtained from their patients. The vast majority of clinical labs are housed within or near medical facilities, making them accessible to both doctors and patients. Clinical laboratory classifications show that these facilities can include high-quality laboratory experiments required to meet clinical and public health demands.

Global Clinical Laboratory Tests Market Dynamics

Drivers

- Growing geriatric population will bolster the growth rate

The growing geriatric population is expected to drive the overall clinical laboratory test market. According to the World Population Prospects: the 2019 Revision data, approximately one in every eleven people in the world were over the age of 65 in 2019, and by 2050, it is estimated that approximately one in every six people will be over the age of 65. Clinical laboratory tests are being used more and more to diagnose age-related diseases.

Furthermore, the rising rate of insufficient exercise, unhealthy food consumption, and the resulting rise in cases of obesity are expected to increase the prevalence of various chronic diseases. The growing awareness of the importance of regular body profiling among healthcare professionals and patients around the world is drive up demand for clinical laboratory tests.

- Rising prevalence of target diseases

The market is expected to benefit from the rising prevalence of target diseases such as cardiovascular disease and diabetes during the forecast period. Cardiovascular diseases are the leading cause of death worldwide. Demand for point-of-care lipid testing is expected to be driven by unmet medical needs related to cardiovascular diseases and increased patient awareness. The World Health Organization predicts that cardiovascular diseases will be the leading cause of death and morbidity in 2021. In the last three decades, 17.7 million people have died from cardiovascular diseases, accounting for 31% of all fatalities worldwide.

The rising prevalence of lifestyle-related diseases such as obesity, the global smoking trend, and an unhealthy diet are among the factors contributing to the global rise in the incidence of renal and lipid-related disorders. Furthermore, as the global prevalence of diabetes rises, so does the number of patients who require clinical laboratory tests.

Opportunities

- Innovative solutions in clinical laboratory tests

Innovative solutions for improving efficiency and eliminating errors are expected to be a major rendering driver in this industry. Integrated workflow management systems, database management tools, and patient test records are becoming increasingly important in the healthcare industry, with organisations processing 100 to 150 billion samples per year. The implementation and development of data management and informatics solutions to support smooth operations are expected to drive market growth.

Restraints/Challenges

- Stringent governmental guidelines will restrict the growth rate

The stringent governmental guidelines and regulations on laboratory research are the main factors limiting the market growth. The maintenance of quality of clinical laboratory products is governed by country specific regulatory bodies. These bodies ensure protection from risks caused by flaws in design, technology, packaging, and manufacturing of the equipment or peripherals.

- Ambiguous regulatory framework

The healthcare industry relies heavily on regulatory frameworks established by organisations such as the FDA and EMA in the United States. There are no specific regulatory requirements for the diagnostic business in emerging markets such as China and India. Laboratory-designed tests (LDTs) are tests developed in-house clinical laboratories that provide accurate and timely results. LDT risks could reduce profit margins and cause delays in the marketing of newly designed tests. This factor is impeding the global clinical laboratory tests market's growth.

This clinical laboratory tests market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the clinical laboratory tests market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent developments

- In April 2022, Quest Diagnostics, based in Secaucus, New Jersey, has announced a number of organisational changes and senior leadership appointments to better support the company's two-point business strategy of accelerating growth and driving operational excellence.

- In April 2022, Abbott has updated its digital health app with its chronic pain neurostimulation devices, making it easier for clinicians to monitor how well patients respond to treatment. While using Abbott's Proclaim device range for spinal cord stimulation (SCS) or dorsal root ganglion (DRG) therapy, the Neurosphere myPath app measures and reports patient-perceived pain relief and general well-being.

Global Clinical Laboratory Tests Market Scope

The clinical laboratory tests market is segmented on the basis of test type, application and end users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Test Type

- Clinical

- Complete Comprehensive Test or Complete Body Test

- Complete Body Count (CBC)

- Basic Metabolic Panel (BMP)

- HGB/HCT

- HbA1c Tests

- BUN Creatinine Tests

- Electrolytes Tests

- Renal Panel Tests

- Lipid Panel Tests

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Routine

- Speciality

Application

- Parasitology

- Haematology

- Virology

- Toxicology

- Immunology/Serology

- Histopathology

- Urinalysis

End Users

- Hospital Based Laboratories

- Clinics Based Laboratories

- Central/Independent Laboratories

- Physician Office-Based Laboratories

- Retail Clinic

- Other

Clinical Laboratory Tests Market Regional Analysis/Insights

The clinical laboratory tests market is analysed and market size insights and trends are provided by country, test type, application and end users as referenced above.

The countries covered in the clinical laboratory tests market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the clinical laboratory tests market owing to the pervasiveness of numerous pharmaceuticals as well as for biotechnology companies in the region. Additionally, rising advancement in technology can be the driver of region market whereas the geriatric population is also increasing which increase the demand for diagnostic techniques.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 due to the growing research and development sector and rising investment towards the healthcare sector.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The clinical laboratory tests market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for clinical laboratory tests market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the clinical laboratory tests market. The data is available for historic period 2010-2020.

Competitive Landscape and Clinical Laboratory Tests Market Share Analysis

The clinical laboratory tests market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to clinical laboratory tests market.

Some of the major players operating in the clinical laboratory tests market are:

- Abbott (U.S.)

- ARUP Laboratories (U.S.)

- OPKO Health, Inc. (U.S.)

- Bioscientia Healthcare GmbH (Germany)

- Charles River Laboratories (U.S.)

- NeoGenomics Laboratories (U.S.)

- Genoptix, Inc. (U.S.)

- Healthscope (Australia)

- The Laboratory Glassware Co. (U.S.)

- Laboratory Corporation of America® Holdings (U.S.)

- Fresenius Medical Care AG & Co. KGaA (Germany)

- QIAGEN (Germany)

- Quest Diagnostics Incorporated (U.S.)

- Siemens Healthcare Private Limited (Germany)

- Tulip Diagnostics (P) Ltd. (India)

- Sonic Healthcare Limited (Australia)

- Merck KGaA (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CLINICAL LABORATORY TESTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CLINICAL LABORATORY TESTS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VOLUME

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CLINICAL LABORATORY TESTS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTLE ANALYSIS

5.2 PORTER’S FIVE FORCES

6 REGULATORY SCENARIO

7 INDUSTRY INSIGHTS

8 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

8.1 PRICE IMPACT

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC DECISION FOR MANUFACTURERS

8.5 CONCLUSION

9 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY TEST

9.1 OVERVIEW

9.2 CLINICAL

9.3 COMPLETE COMPREHENSIVE TEST OR COMPLETE BODY TEST

9.4 COMPLETE BODY COUNT (CBC)

9.5 BASIC METABOLIC PANEL (BMP)

9.6 HGB/HCT

9.7 HBA1C TESTS

9.8 BUN CREATININE TESTS

9.9 ELECTROLYTES TESTS

9.1 RENAL PANEL TESTS

9.11 LIPID PANEL TESTS

9.12 HEPATITIS

9.13 BILE DUCT OBSTRUCTION

9.14 LIVER PANNEL TESTS

9.14.1 HEPATITIS

9.14.2 BILE DUCT OBSTRUCTION

9.14.3 LIVER CIRRHOSIS

9.14.4 LIVER CANCER

9.14.5 BONE DISEASE

9.14.6 AUTOIMMUNE DISORDERS

9.14.7 OTHERS

9.15 BONE DISEASE TEST

9.16 AUTOIMMUNE DISORDERS TEST

9.17 OTHERS

10 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY TYPE

10.1 OVERVIEW

10.2 ROUTINE

10.3 SPECIALTY

11 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY APPLICATIONS

11.1 OVERVIEW

11.2 PARASITOLOGY

11.3 HEMATOLOGY

11.4 VIROLOGY

11.5 TOXICOLOGY

11.6 IMMUNOLOGY/SEROLOGY

11.7 URINALYSIS

11.8 OTHERS

12 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY SPECIALTY

12.1 ORGAN FUNCTION TESTS

12.1.1 KIDNEY

12.1.1.1. CREATININE

12.1.1.2. UREA

12.1.1.3. URIC ACID

12.1.1.4. OTHERS

12.1.2 LIVER

12.1.2.1. AST

12.1.2.2. ALT

12.1.2.3. AST & ALT

12.1.2.4. LDH

12.1.2.5. BILIRUBIN

12.1.2.6. OTHERS

12.1.3 PANCREAS

12.1.3.1. AMYLASE

12.1.3.2. LIPASE

12.1.4 CARDIOVASCULAR

12.1.4.1. TOTAL CHOLESTEROL

12.1.4.2. TRIGLYCERIDES

12.1.4.3. HDL-CHOLESTEROL

12.1.4.4. LDL-CHOLESTEROL

12.1.5 OTHERS

12.2 HORMONE LEVEL TESTS

12.2.1 CORTISOL

12.2.2 TESTOSTERONE

12.2.3 FOLLICLE-STIMULATING HORMONE

12.2.4 LUTEINIZING HORMONE (LH)

12.2.5 ESTRADIOL

12.2.6 PROGESTERONE

12.2.7 PROLACTIN

12.2.8 OTHERS

12.3 SCREENING TESTS

12.3.1 COMPLETE BLOOD COUNT

12.3.1.1. HAEMOGLOBIN

12.3.1.2. RBC & HEMATOCRIT (HCT)

12.3.1.3. WBC (WHITE BLOOD CELLS, LEUKOCYTES)

12.3.1.4. PLATELET

12.3.1.5. OTHERS

12.3.2 PAP SMEAR

12.3.3 URINALYSIS

12.3.4 HGB/HCT TESTING

12.3.5 OTHERS

12.4 INFECTIOUS DISEASE TESTS

12.4.1 FLU PANEL TEST

12.4.2 MONONUCLEOSIS

12.4.3 OTHERS

12.5 SEXUALLY TRANSMITTED INFECTION TESTS

12.5.1 CHLAMYDIA

12.5.2 GONORRHEA

12.5.3 HIV

12.5.4 OTHERS

12.6 CANCER TESTS

12.6.1 LIVER CANCER

12.6.1.1. CA 125

12.6.1.2. PSA,

12.6.1.3. AFP

12.6.1.4. CEA

12.6.1.5. OTHERS

12.6.2 PROSTATE CANCER

12.6.3 OVARIAN CANCER

12.6.4 OTHERS

12.7 AUTOIMMUNE TESTS

12.8 OTHERS

13 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY END USERS

13.1 OVERVIEW

13.2 INDEPENDENT & REFERENCE LABORATORIES

13.3 HOSPITAL-BASED LABORATORIES

13.4 CLINIC-BASED LABORATORIES

13.5 CENTRAL/INDEPENDENT LABORATORIES

13.6 PHYSICIAN OFFICE-BASED LABORATORIES

13.7 OTHERS

14 GLOBAL CLINICAL LABORATORY TESTS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY GEOGRAPHY

GLOBAL CLINICAL LABORATORY TESTS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 FRANCE

15.2.3 U.K.

15.2.4 HUNGARY

15.2.5 LITHUANIA

15.2.6 AUSTRIA

15.2.7 IRELAND

15.2.8 NORWAY

15.2.9 POLAND

15.2.10 ITALY

15.2.11 SPAIN

15.2.12 RUSSIA

15.2.13 TURKEY

15.2.14 NETHERLANDS

15.2.15 SWITZERLAND

15.2.16 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 SINGAPORE

15.3.6 THAILAND

15.3.7 INDONESIA

15.3.8 MALAYSIA

15.3.9 PHILIPPINES

15.3.10 AUSTRALIA

15.3.11 NEW ZEALAND

15.3.12 VIETNAM

15.3.13 TAIWAN

15.3.14 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 PERU

15.4.4 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 SAUDI ARABIA

15.5.3 UAE

15.5.4 EGYPT

15.5.5 KUWAIT

15.5.6 ISRAEL

15.5.7 REST OF MIDDLE EAST AND AFRICA

15.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL CLINICAL LABORATORY TESTS MARKET, SWOT AND DBMR ANALYSIS

17 GLOBAL CLINICAL LABORATORY TESTS MARKET, COMPANY PROFILE

17.1 ABBOTT

17.1.1 COMPANY OVERVIEW

17.1.2 GEOGRAPHIC PRESENCE

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 ARUP LABORATORIES

17.2.1 COMPANY OVERVIEW

17.2.2 GEOGRAPHIC PRESENCE

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 OPKO HEALTH, INC.

17.3.1 COMPANY OVERVIEW

17.3.2 GEOGRAPHIC PRESENCE

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 BIOSCIENTIA HEALTHCARE GMBH

17.4.1 COMPANY OVERVIEW

17.4.2 GEOGRAPHIC PRESENCE

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 CHARLES RIVER LABORATORIES

17.5.1 COMPANY OVERVIEW

17.5.2 GEOGRAPHIC PRESENCE

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 NEOGENOMICS LABORATORIES

17.6.1 COMPANY OVERVIEW

17.6.2 GEOGRAPHIC PRESENCE

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 GENOPTIX, INC.

17.7.1 COMPANY OVERVIEW

17.7.2 GEOGRAPHIC PRESENCE

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 HEALTHSCOPE

17.8.1 COMPANY OVERVIEW

17.8.2 GEOGRAPHIC PRESENCE

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 THE LABORATORY GLASSWARE CO.

17.9.1 COMPANY OVERVIEW

17.9.2 GEOGRAPHIC PRESENCE

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 LABORATORY CORPORATION OF AMERICA® HOLDINGS

17.10.1 COMPANY OVERVIEW

17.10.2 GEOGRAPHIC PRESENCE

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 FRESENIUS MEDICAL CARE AG & CO. KGAA

17.11.1 COMPANY OVERVIEW

17.11.2 GEOGRAPHIC PRESENCE

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 QIAGEN

17.12.1 COMPANY OVERVIEW

17.12.2 GEOGRAPHIC PRESENCE

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 QUEST DIAGNOSTICS INCORPORATED

17.13.1 COMPANY OVERVIEW

17.13.2 GEOGRAPHIC PRESENCE

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 SIEMENS HEALTHCARE PRIVATE LIMITED

17.14.1 COMPANY OVERVIEW

17.14.2 GEOGRAPHIC PRESENCE

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 TULIP DIAGNOSTICS (P) LTD.

17.15.1 COMPANY OVERVIEW

17.15.2 GEOGRAPHIC PRESENCE

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 SONIC HEALTHCARE LIMITED

17.16.1 COMPANY OVERVIEW

17.16.2 GEOGRAPHIC PRESENCE

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 MERCK KGAA

17.17.1 COMPANY OVERVIEW

17.17.2 GEOGRAPHIC PRESENCE

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 LABCORP

17.18.1 COMPANY OVERVIEW

17.18.2 GEOGRAPHIC PRESENCE

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 SPECTRA LABORATORIES

17.19.1 COMPANY OVERVIEW

17.19.2 GEOGRAPHIC PRESENCE

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 DAVITA HEALTHCARE PARTNERS

17.20.1 COMPANY OVERVIEW

17.20.2 GEOGRAPHIC PRESENCE

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 ACM MEDICAL LABORATORY

17.21.1 COMPANY OVERVIEW

17.21.2 GEOGRAPHIC PRESENCE

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 CEREBA HEALTHCARE

17.22.1 COMPANY OVERVIEW

17.22.2 GEOGRAPHIC PRESENCE

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

18 RELATED REPORTS

19 CONCLUSION

20 QUESTIONNAIRE

21 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.