Global Clinical Oncology Next Generation Sequencing Market

Market Size in USD Million

CAGR :

%

USD

592.56 Million

USD

1,825.30 Million

2021

2029

USD

592.56 Million

USD

1,825.30 Million

2021

2029

| 2022 –2029 | |

| USD 592.56 Million | |

| USD 1,825.30 Million | |

|

|

|

|

Market Analysis and Size

According to the American Cancer Society, 1.7 million additional cancer cases and 0.6 million cancer deaths occurred in the United States in 2019. Lung, prostate, bladder, and female breast cancer are the four most common cancers worldwide, accounting for 43% of all new cancer cases. As a result, demand for clinical oncology next-generation sequencing is predicted to rise as cancer incidence rates rise globally. Clinical oncology next-generation sequencing companies are increasingly investing in workflow automation to improve accuracy and lower sample-to-sample variability.

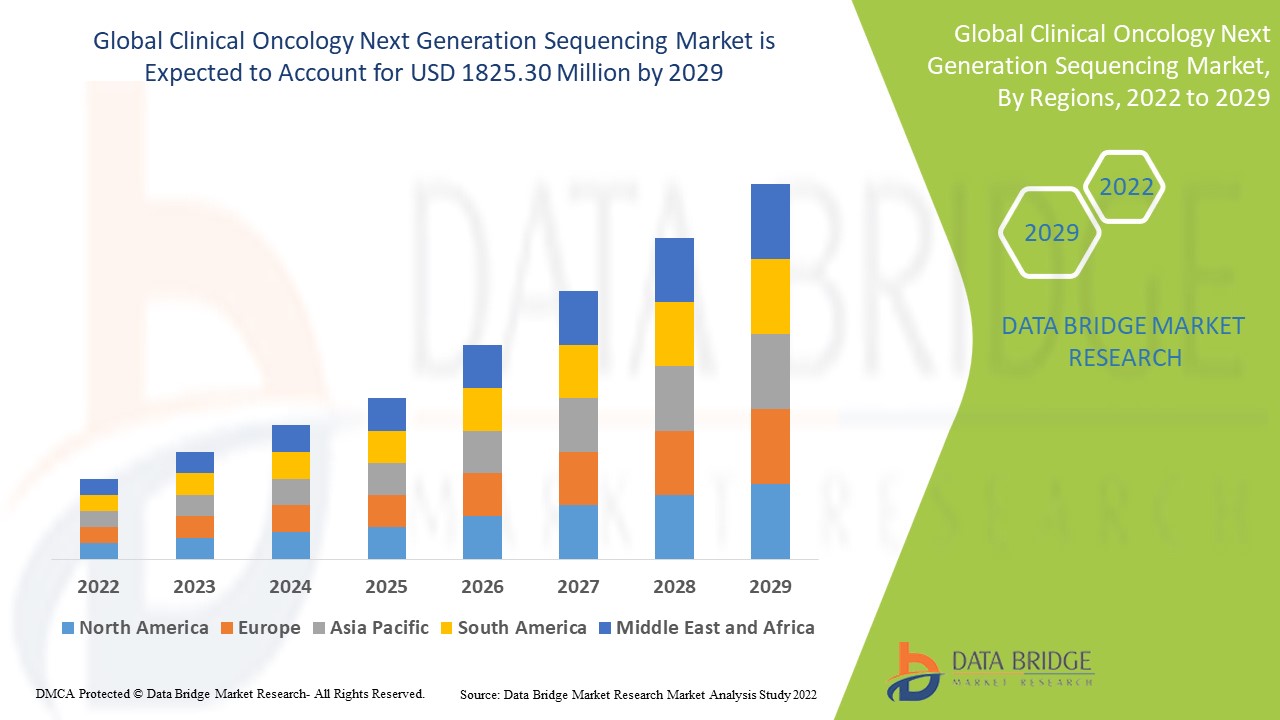

Data Bridge Market Research analyses that the clinical oncology next generation sequencing market which was USD 592.56 million in 2021, would rocket up to USD 1825.30 million by 2029, and is expected to undergo a CAGR of 15.1% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Technology (Whole Genome Sequencing, Whole Exome Sequencing, Targeted Sequencing & Resequencing), Workflow (NGS Pre-Sequencing, NGS Sequencing, NGS Data Analysis), Application (Screening, Companion Diagnostics, Others), End User (Hospitals, Clinics, Laboratories, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), Agilent Technologies Inc. (U.S.), Myriad Genetics Inc. (U.S.), BGI (China), Perkin Elmer Inc. (U.S.), Foundation Medicine Inc. (U.S.), PacBio (U.S.), Oxford Nanopore Technologies plc. (U.K.), Paradigm Diagnostics Inc. (U.S.), Caris Life Sciences (Japan), Partek, Incorporated (U.S.), Eurofins Scientific (Luxembourg), Qiagen (Germany) |

|

Market Opportunities |

|

Market Definition

Next-generation sequencing is a DNA or RNA technique that permits several reactions to be carried out simultaneously. This is one of the most important applications of next-generation sequencing in oncology. In recent years, NGS has changed cancer genetics by providing researchers greater access to genomic and transcriptome data. Next-generation tumour and germline DNA sequencing is used in oncology screening for therapeutic application.

Clinical Oncology Next Generation Sequencing Market Dynamics

Drivers

- Increase in cancer cases

The clinical oncology next-generation sequencing market is projected to be significantly impacted by personalized medicine and oncology improvements. Rising cancer prevalence, high acceptance of sequencing-based diagnostics platforms among practicing oncologists, decrease in the cost of genetic sequencing, and increased government R&D funding are some of the reasons expected to boost market growth. On the other hand, high adoption of this technique over single-gene testing and higher adoption of clinical oncology next-generation sequencing technology and platforms in academia projects will fuel a slew of new opportunities, propelling the clinical oncology next generation sequencing market forward from 2022 to 2029.

- New technological Innovatives

According to the World Health Organization's (WHO) International Agency for Research on Cancer (IARC), cancer was the top cause of death worldwide in 2020, with over 10 million fatalities. In addition, 19.3 million additional cases were reported globally. New creative technologies, such as next generation sequencing, are being used to address this worldwide burden and lower mortality rates. As a result, the clinical oncology next generation market is growing at a faster rate.

- Reduction in the cost of NGS platforms

The factor aiding the market's growth is the reduction in the cost of NGS platforms. Clinical oncology next-generation sequencing approaches provide a high percentage of reads as well as low cost per read. Leading players are introducing low-cost sequencing approaches. Similarly, the worldwide clinical oncology next generation sequencing market will expand over the forecast period as more people use next generation sequencing for liquid biopsy.

Opportunities

Rapidly increasing cancer cases have become a major issue all over the world. The sickness not only kills people but also has a negative influence on countries' economies. As a result, the government and a variety of other healthcare organisations are taking steps to combat cancer's global burden. Research institutes are receiving large sums of money in order to find viable treatments and drugs. New studies are being launched to comprehensively examine the human genome.

Restraints/Challenges

High cost coupled with technology is a major restraint to the growth of the clinical oncology next generation sequencing market in the above mentioned forecast period. High costs connected with the installation of sequencing platforms, poor outsourced service efficiency, and limited availability of sequencing platforms in specific regional markets are all expected to restraint the overall development of the clinical oncology next-generation sequencing market.

This clinical oncology next generation sequencing market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the clinical oncology next generation sequencing market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Clinical Oncology Next Generation Sequencing Market

The COVID-19 epidemic hugely influenced the world as a whole, causing economic collapse and death. It has resulted in a worldwide pandemic that is extremely transmissible. With the advancement of technology, next-generation sequencing is becoming increasingly important in a variety of fields. From manufacturing PPE kits to inventing test kits to detect the virus and vaccines to prevent transmission, a number of pharmaceutical businesses and agencies have contributed to reducing the infection's impact. To combat the virus, businesses have strengthened their R&D and production workforce due to the increasing benefit of determining and finding the genetic sequence of a virus, which helps scientists to comprehend the virus's entire mutation, the overall influence on the next generation sequencing industry and market is expected to be beneficial.

Recent Development

- In January 2022, Agendia, Inc., a global pioneer in breast cancer precision medicine, announced a multi-year collaboration with Illumina to co-develop in vitro diagnostic (IVD) assays for oncology testing.

- In October 2021, Roche introduced the AVENIO tumour tissue CGP kit to make tailored cancer research more accessible.

Global Clinical Oncology Next Generation Sequencing Market Scope

The clinical oncology next generation sequencing market is segmented on the basis of technology, workflow, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Whole Genome Sequencing

- Whole Exome Sequencing

- Targeted Sequencing and Resequencing Centrifuges

Workflow

- Pre-Sequencing

- Sequencing

- Data Analysis

Application

- Screening

- Sporadic Cancer

- Inherited Cancer

- Companion Diagnostics

- Other Diagnostics

End-user

- Hospitals

- Clinics

- Laboratories

Clinical Oncology Next Generation Sequencing Market Regional Analysis/Insights

The clinical oncology next generation sequencing market is analysed and market size insights and trends are provided by country, technology, workflow, application and end-user as referenced above.

The countries covered in the clinical oncology next generation sequencing market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the clinical oncology next generation sequencing market due to the initiatives the governments have taken up for these technologies in the countries of this region.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 due to the increasing automation in this region's pre-sequencing protocols.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Clinical Oncology Next Generation Sequencing Market Share Analysis

The clinical oncology next generation sequencing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to clinical oncology next generation sequencing market.

Some of the major players operating in the clinical oncology next generation sequencing market are:

- Illumina, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Agilent Technologies Inc. (U.S.)

- Myriad Genetics Inc. (U.S.)

- BGI (China)

- Perkin Elmer Inc. (U.S.)

- Foundation Medicine Inc. (U.S.)

- PacBio (U.S.)

- Oxford Nanopore Technologies plc. (U.K.)

- Paradigm Diagnostics Inc. (U.S.)

- Caris Life Sciences (Japan)

- Partek, Incorporated (U.S.)

- Eurofins Scientific (Luxembourg)

- Qiagen (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY TECHNOLOGY

16.1 OVERVIEW

16.2 NEXT GENERATION SEQUENCING

16.3 WHOLE GENOME SEQUENCING

16.4 WHOLE EXOME SEQUENCING

16.5 TARGETED SEQUENCING & RESEQUENCING

16.6 OMICS

17 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY PRODUCT AND SERVICES

17.1 OVERVIEW

17.2 INSTRUMENTS

17.2.1 BY PRODUCT

17.2.1.1. WORKSTATION/PLATFORM

17.2.1.2. NEXT GENERATION SEQUENCERS

17.2.1.2.1. AUTMATED

17.2.1.2.2. SEMIAUTOMATED

17.2.1.3. OTHERS

17.2.2 BY TYPE

17.2.2.1. HIGH SEQUENCING

17.2.2.2. LOW SEQUENCING

17.2.3 BY MODALITY

17.2.3.1. STANDALONE

17.2.3.2. PORTABLES

17.2.3.3. BENCHTOP

17.3 CONSUMABLES

17.3.1 DNA FRAGMENTATION, END REPAIR, A-TAILING AND SIZE SELECTION

17.3.1.1. REAGENTS AND KITS

17.3.1.1.1. FAST HYBRIDIZATION AND WASH KIT

17.3.1.1.2. STANDARD HYBRIDIZATION AND WASH KIT

17.3.1.1.3. UNIVERSAL BLOCKER

17.3.1.1.4. METHYLATION DETECTION SYSTEM

17.3.1.1.5. OTHERS

17.3.1.2. OTHERS

17.3.2 LIBRARY PREPARATION

17.3.2.1. WHOLE GENOME KITS

17.3.2.1.1. 12 SAMPLE

17.3.2.1.1.1 WITH PREPARATION BEADS

17.3.2.1.1.2 WITHOUT PREPARATION BEADS

17.3.2.1.2. 24 SAMPLE

17.3.2.1.2.1 WITH PREPARATION BEADS

17.3.2.1.2.2 WITHOUT PREPARATION BEADS

17.3.2.1.3. 96 SAMPLE

17.3.2.1.3.1 WITH PREPARATION BEADS

17.3.2.1.3.2 WITHOUT PREPARATION BEADS

17.3.2.2. OTHERS

17.3.3 EXOME GENOMIC KITS

17.3.3.1. 12 SAMPLE

17.3.3.1.1. WITH PREPARATION BEADS

17.3.3.1.2. WITHOUT PREPARATION BEADS

17.3.3.2. 24 SAMPLE

17.3.3.2.1. WITH PREPARATION BEADS

17.3.3.2.2. WITHOUT PREPARATION BEADS

17.3.3.3. 96 SAMPLE

17.3.3.3.1. WITH PREPARATION BEADS

17.3.3.3.2. WITHOUT PREPARATION BEADS

17.3.3.3.3. OTHERS

17.3.4 TARGET ENRICHMENT

17.3.4.1. BY TARGETED REGION

17.3.4.1.1. 60 MB

17.3.4.1.2. 51 MB

17.3.4.1.3. 39 MB

17.3.4.1.4. OTHERS

17.3.4.2. BY PROBE TYPE

17.3.4.2.1. BIOTINYLATED CRNA BAITS

17.3.4.2.2. BIOTINYLATED DNA BAIT

17.3.4.2.3. OTHERS

17.3.4.3. OTHERS

17.4 SERVICES

17.4.1 SEQUENCING SERVICES

17.4.1.1. RNA SEQUENCING

17.4.1.2. WHOLE EXOME SEQUENCING

17.4.1.3. WHOLE GENOME SEQUENCING

17.4.1.4. TARGETED SEQUENCING

17.4.1.5. CHIP SEQUENCING

17.4.1.6. DE NOVO SEQUENCING

17.4.1.7. METHYL SEQUENCING

17.4.1.8. OTHERS

17.4.2 DATA MANAGEMENT SERVICES

17.4.2.1. NGS DATA ANALYSIS SERVICES

17.4.2.2. NGS DATA ANALYSIS SOFTWARE & WORKBENCHES

17.4.2.2.1. LIBRARIES FOR GENOMICS SCREENING

17.4.2.2.2. CRISPR-CAS9 SCREENING LIBRARIES

17.4.2.2.2.1 POOLED SGRNA

17.4.2.2.2.2 ARRAYED CRRNA

17.4.2.2.3. CRISPR ACTIVATION CRRNA LIBRARIES

17.4.2.2.3.1 GENE FAMILIES

17.4.2.2.3.2 DRUGGABLE

17.4.2.2.3.3 WHOLE HUMAN GENOME

17.4.2.2.4. RNAI SCREENING LIBRARIES

17.4.2.2.4.1 SIRNA

17.4.2.2.4.2 SHRNA

17.4.2.2.4.3 MICRORNA

17.4.2.2.5. CDNA AND ORF LIBRARIES

17.4.2.2.5.1 CCSB HUMAN ORFEOME

17.4.2.2.5.2 ORFEOME COLLABORATION

17.4.2.2.5.3 MAMMALIAN GENE COLLECTION

17.4.2.2.6. OTHERS

17.4.2.3. OMICS SERVICES

17.4.2.4. OTHERS

18 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY SEQUENCING TYPE

18.1 OVERVIEW

18.2 SINGLE-READ SEQUENCING

18.3 PAIRED-END SEQUENCING

19 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY METHODS OF SEQUENCING

19.1 OVERVIEW

19.2 LOW THROUGHPUT

19.3 MEDIUM THROUGHPUT

19.4 HIGH THROUGHPUT

20 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY APPLICATION

20.1 OVERVIEW

20.2 PRECISION MEDICINE FOR CANCER

20.3 LIQUID BIOPSY

20.4 MINIMAL RESIDUAL DISEASE (MRD) MONITORING

20.5 CANCER IMMUNOTHERAPY

20.6 OTHERS

21 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY CANCER TYPE

21.1 OVERVIEW

21.2 BREAST CANCER

21.3 LUNG CANCER

21.4 COLORECTAL CANCER

21.5 PROSTATE CANCER

21.6 LEUKEMIA

21.7 LYMPHOMA

21.8 MELANOMA

21.9 OTHERS

22 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY END USER

22.1 OVERVIEW

22.2 HOSPITALS

22.2.1 PUBLIC

22.2.2 PRIVATE

22.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

22.3.1 SMALL

22.3.2 MEDIUM

22.3.3 LARGE

22.4 ACADEMIC & RESEARCH INSTITUTES

22.5 CLINICAL LABORATORIES

22.6 GOVERNMENT INSTITUTES

22.7 FORENSIC LABORATORIES

22.8 CONTRACT RESEARCH ORGANIZATIONS (CROS)

22.9 OTHERS

23 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY DISTRUBUTION CHANNEL

23.1 OVERVIEW

23.2 DIRECT TENDERS

23.3 RETAIL SALES

23.4 OTHERS

24 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY REGION

24.1 GLOBAL MEDICAL CARTS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.2 NORTH AMERICA

24.2.1 U.S.

24.2.2 CANADA

24.2.3 MEXICO

24.3 EUROPE

24.3.1 GERMANY

24.3.2 FRANCE

24.3.3 U.K.

24.3.4 ITALY

24.3.5 SPAIN

24.3.6 RUSSIA

24.3.7 TURKEY

24.3.8 BELGIUM

24.3.9 NETHERLANDS

24.3.10 SWITZERLAND

24.3.11 REST OF EUROPE

24.4 ASIA-PACIFIC

24.4.1 JAPAN

24.4.2 CHINA

24.4.3 SOUTH KOREA

24.4.4 INDIA

24.4.5 AUSTRALIA

24.4.6 SINGAPORE

24.4.7 THAILAND

24.4.8 MALAYSIA

24.4.9 INDONESIA

24.4.10 PHILIPPINES

24.4.11 REST OF ASIA-PACIFIC

24.5 SOUTH AMERICA

24.5.1 BRAZIL

24.5.2 ARGENTINA

24.5.3 REST OF SOUTH AMERICA

24.6 MIDDLE EAST AND AFRICA

24.6.1 SOUTH AFRICA

24.6.2 SAUDI ARABIA

24.6.3 UAE

24.6.4 EGYPT

24.6.5 ISRAEL

24.6.6 REST OF MIDDLE EAST AND AFRICA

24.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS & PARTNERSHIP

25.8 REGULATORY CHANGES

26 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, SWOT AND DBMR ANALYSIS

27 GLOBAL CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, COMPANY PROFILE

27.1 ACT GENOMICS

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 RESOLUTION BIOSCIENCE, INC. (AGILENT TECHNOLOGIES, INC.)

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 ILLUMINA, INC.

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 BD

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 BERRY GENOMICS

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 BIO-RAD LABORATORIES, INC.

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 DNASTAR

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 EUROFINS GENOMICS

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 QIAGEN

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 CARIS LIFE SCIENCES

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 F. HOFFMANN-LA ROCHE LTD

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 THERMO FISHER SCIENTIFIC INC

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 MYRIAD GENETICS, INC

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 BGI

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 REVVITY

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

27.16 FOUNDATION MEDICINE, INC.,

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPMENTS

27.17 PACBIO

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPMENTS

27.18 OXFORD NANOPORE TECHNOLOGIES PLC.

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPMENTS

27.19 GRAPHPAD SOFTWARE, LLC,

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPMENTS

27.2 MACROGEN, INC.

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPMENTS

27.21 AZENTA LIFE SCIENCES

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPMENTS

27.22 TAKARA BIO INC.

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPMENTS

27.23 NOVOGENE CO, LTD.

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.23.5 RECENT DEVELOPMENTS

27.24 STANDARD BIOTOOLS INC.

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPMENTS

27.25 CREATIVE BIOLABS

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPMENTS

27.26 ZYMO RESEARCH CORPORATION

27.26.1 COMPANY OVERVIEW

27.26.2 REVENUE ANALYSIS

27.26.3 GEOGRAPHIC PRESENCE

27.26.4 PRODUCT PORTFOLIO

27.26.5 RECENT DEVELOPMENTS

27.27 VERACYTE, INC

27.27.1 COMPANY OVERVIEW

27.27.2 REVENUE ANALYSIS

27.27.3 GEOGRAPHIC PRESENCE

27.27.4 PRODUCT PORTFOLIO

27.27.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

28 RELATED REPORTS

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.