Global Cloud Security Market

Market Size in USD Billion

CAGR :

%

USD

12.30 Billion

USD

24.30 Billion

2024

2032

USD

12.30 Billion

USD

24.30 Billion

2024

2032

| 2025 –2032 | |

| USD 12.30 Billion | |

| USD 24.30 Billion | |

|

|

|

|

Cloud Security Market Size

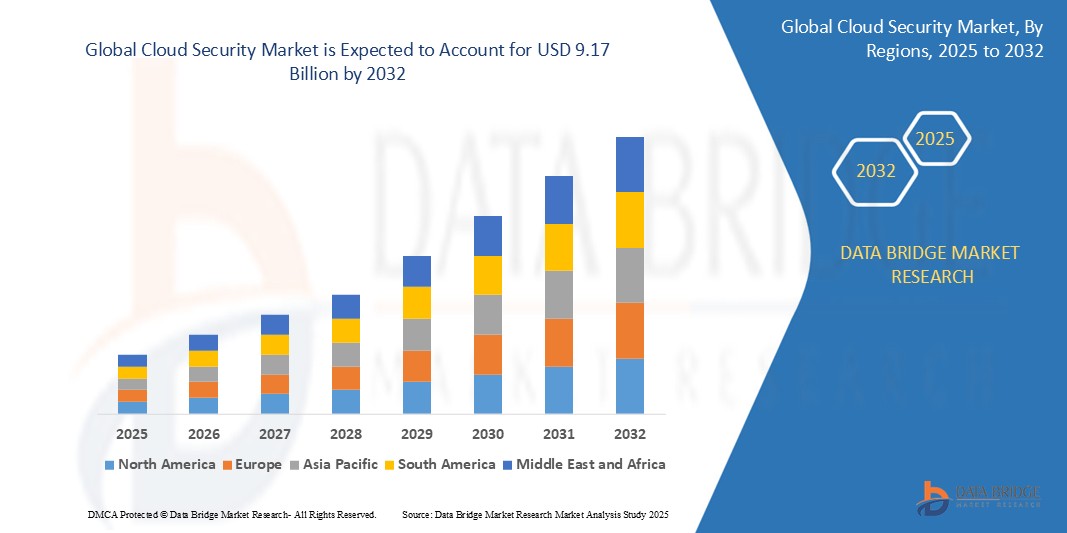

- The global cloud security market size was valued at USD 2.57 billion in 2024 and is expected to reach USD 9.17 billion by 2032, at a CAGR of 17.20% during the forecast period

- This growth is driven by factors such as the increasing adoption of cloud computing services, the rise in cyber threats targeting cloud environments, stringent regulatory compliance requirements, the shift towards remote and hybrid work models, and the integration of advanced technologies such as AI and machine learning into cloud security solutions

Cloud Security Market Analysis

- The cloud security refers to the set of measures and technologies designed to protect data, applications, and infrastructure stored and operated in cloud environments. It encompasses safeguards against unauthorized access, data breaches, and other threats, ensuring the confidentiality, integrity, and availability of cloud resources

- Effective cloud security involves encryption, identity and access management, regular audits, and adherence to best practices

- North America is expected to dominate the cloud security market with 34.5% due to advanced technological infrastructure, with widespread adoption of cloud technologies across various sectors, including BFSI, healthcare, and government

- Asia-Pacific is expected to be the fastest growing region in the cloud security market during the forecast period due to rise in cyberattacks and data breaches in the region has heightened awareness about the importance of cloud security

- Private cloud segment is expected to dominate the market with a market share of 47.6% due to its organizations operating mission-critical applications and workloads to ensure the most effective reliability and speed

Report Scope and Cloud Security Market Segmentation

|

Attributes |

Cloud Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Cloud Security Market Trends

“Reliance on Cloud-Based Services”

- The growing reliance on cloud-based services is creating a robust demand for cloud security solutions. As organizations migrate their IT infrastructures to the cloud, ensuring the protection of data, applications, and networks from cyber threats becomes paramount. This is contributing to the increasing adoption of cloud security services such as identity and access management (IAM), encryption, firewalls, and threat intelligence

- A significant trend in cloud security is the adoption of zero-trust architectures. This security model assumes that every user, device, or network trying to access company resources is untrusted and requires verification. Organizations are increasingly incorporating zero-trust principles into their cloud security strategies to mitigate the risk of breaches

- AI and machine learning are transforming cloud security by automating threat detection, identifying vulnerabilities, and predicting potential cyber-attacks. These technologies are enhancing the effectiveness and speed of security operations in dynamic cloud environments, making them crucial for cloud security strategies

- With the increase in containerization and microservices, there is a growing need for cloud-native security tools that integrate with DevOps processes. Solutions that protect cloud-native applications and data in real time are gaining traction, driving the demand for innovative security services

- Regulatory compliance, such as GDPR and CCPA, continues to drive demand for robust cloud security solutions to ensure that businesses meet legal requirements and protect customer data. Cloud service providers are enhancing their security offerings to help clients maintain compliance

Cloud Security Market Dynamics

Driver

“Rise in Cyber Threats Targeting Cloud Environments”

- The rise in cyber threats targeting cloud environments is a key driver of the global cloud security market. As more businesses move their operations to the cloud, they become vulnerable to cyber-attacks, such as data breaches, ransomware, and DDoS attacks

- For Instance, in 2023, there was a notable increase in cyber-attacks targeting cloud infrastructures, leading to substantial financial losses. As a result, the demand for comprehensive cloud security solutions has surged

- Cloud computing adoption continues to grow rapidly across various sectors, including finance, healthcare, and government. With organizations shifting to cloud-based systems to reduce costs, improve scalability, and enhance operational flexibility, the need for robust security solutions to protect sensitive data and applications has become critical.

- The shift to remote and hybrid work models, accelerated by the COVID-19 pandemic, has significantly increased the risk to cloud-based resources. With employees accessing cloud systems from multiple devices and locations, cloud security has become crucial to safeguard corporate data.

- The increasing number of data privacy regulations, such as GDPR in Europe and CCPA in California, is pushing businesses to adopt advanced cloud security solutions to meet compliance standards. Companies must ensure their cloud infrastructure complies with these regulations to avoid heavy fines and reputational damage

- As businesses undergo digital transformation and migrate legacy systems to the cloud, they require more advanced security solutions to mitigate risks associated with cloud environments. This widespread digital shift is driving the market growth of cloud security solutions

Opportunity

“Expansion of Cloud Security for SMEs”

- Small and medium-sized enterprises (SMEs) represent an untapped market for cloud security services. While large enterprises have already invested heavily in cloud security solutions, SMEs are beginning to recognize the need for protection in cloud environments. As cloud services become more affordable and accessible for SMEs, the demand for cost-effective and scalable cloud security solutions is expected to rise.

- Many organizations are opting for managed cloud security services as they may lack the internal resources to build robust security infrastructures. Managed service providers (MSPs) are seeing a growing demand for these solutions, which offer 24/7 monitoring, threat detection, and incident response

- The growing trend of multi-cloud and hybrid cloud strategies creates an opportunity for cloud security vendors to provide solutions that secure multiple cloud environments. This shift towards hybrid infrastructures is opening new avenues for the development of integrated security solutions that ensure seamless protection across diverse cloud environments.

- The integration of AI and automation into cloud security presents vast opportunities. AI-driven threat intelligence platforms and automated security orchestration tools can help businesses enhance their security posture by detecting threats faster and responding proactively. This technology is especially valuable in managing the scale and complexity of modern cloud environments.

- Venture capital and investments in cloud security startups are fueling innovation in the space. New companies are emerging with innovative approaches to cloud security, such as leveraging blockchain for secure data sharing or using machine learning to enhance threat detection. These innovations offer exciting opportunities for market players to expand their portfolios.

Restraint/Challenge

“Complexity of Securing Multi-Cloud Environments”

- One of the major challenges in cloud security is the complexity of securing multi-cloud environments. Organizations often use multiple cloud providers (AWS, Azure, Google Cloud, etc.) for different business needs, which can create security gaps if not properly managed. Securing these diverse cloud platforms requires advanced skills and resources, which many businesses struggle to maintain.

- Data privacy remains a major challenge in the cloud security market. Organizations must ensure that their cloud providers comply with various regulations such as GDPR, HIPAA, and CCPA. Ensuring consistent data privacy and protection across multiple jurisdictions is complex and requires constant vigilance. The inability to meet compliance requirements can lead to severe financial penalties and reputational damage.

- As cloud technologies evolve, so do the methods used by cybercriminals. The increasing sophistication of cyber-attacks, including advanced persistent threats (APTs), ransomware, and insider threats, presents a significant challenge. Cloud environments are especially vulnerable to these attacks, as they often involve complex interdependencies across various services and applications

- While cloud security solutions are essential, their implementation can be expensive, particularly for SMEs. The cost of acquiring and integrating advanced security tools, as well as maintaining a dedicated security team, can be prohibitive for smaller organizations, limiting their ability to adequately protect their cloud assets

Cloud Security Market Scope

The market is segmented on the basis of service type, security type, service model, development type, security model, and vertical type.

|

Segmentation |

Sub-Segmentation |

|

By Service Type |

|

|

By Security Type |

|

|

By Service model |

|

|

By Development Type |

|

|

By Security Model |

|

|

By Vertical Type |

|

In 2025, the private cloud is projected to dominate the market with a largest share in deployment type segment

The private cloud segment is expected to dominate the Cloud Security market with the largest share of 47.6% in 2025 due to organizations operating mission-critical applications and workloads to ensure the most effective reliability and speed. Many businesses see private cloud deployment as a milestone toward digital transformation. The migration of conventional on-premises infrastructure to an exclusive cloud setting allows enterprises to gain the benefits of the cloud while preserving a high level of control.

The large enterprises is expected to account for the largest share during the forecast period in security model segment

In 2025, the large enterprises segment is expected to dominate the market with the largest market share of 75% due to the utilization of cloud-native security solutions that are customized to the dynamic and adaptable nature of cloud environments. As enterprises continue to transfer their activities to the cloud, there will be an increasing need for security measures that interact smoothly with cloud architectures.

Cloud Security Market Regional Analysis

“North America Holds the Largest Share in the Cloud Security Market”

- North America holds the largest share of the global cloud security market, accounting for 34.5%

- The region boasts advanced technological infrastructure, with widespread adoption of cloud technologies across various sectors, including BFSI, healthcare, and government

- Major cloud service providers and cybersecurity firms are headquartered in North America, driving innovation and setting industry standards

- Stringent data protection regulations, such as GDPR and CCPA, have prompted organizations to invest heavily in cloud security solutions to ensure compliance

- The increasing frequency and sophistication of cyberattacks in the region underscore the critical need for robust cloud security measures

“Asia-Pacific is Projected to Register the Highest CAGR in the Cloud Security Market”

- Countries such as India, China, and Japan are undergoing significant digital transformations, leading to increased reliance on cloud-based services

- The rise in cyberattacks and data breaches in the region has heightened awareness about the importance of cloud security

- Policies such as India's 'Digital India' campaign and China's focus on cybersecurity are driving investments in cloud security infrastructure

- The burgeoning startup ecosystem in countries such as India is contributing to the demand for scalable and cost-effective cloud security solutions

- The Asia-Pacific region is expected to witness the fastest growth in the cloud security market

Cloud Security Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Amazon Web Services, Inc. (U.S.)

- Microsoft (U.S.)

- Check Point Software Technologies Ltd.(U.S.)

- Google (U.S.,)

- Palo Alto Networks. (U.S.)

- McAfee, LLC. (U.S.)

- IBM (U.S.)

- Zscaler, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Fortinet, Inc. (U.S.)

- Sophos Ltd. (U.K.)

- Foreseeti (Sweden)

- Broadcom. (U.S.)

- Trend Micro Incorporated. (Japan)

- Tenable,Inc. (U.S.)

- Forcepoint (U.S.)

- Imperva. (U.S.)

- Proofpoint. (U.S.)

- Cloudflare, Inc (U.S.)

- Aqua Security Software Ltd. (Israel)

- Qualys,Inc. (U.S.)

- Konverge (U.S.)

- Bitglass,Inc. (U.S.)

- SiteLock (U.S.)

Latest Developments in Global Cloud Security Market

- In February 2024, Check Point Software Technologies launched a novel Infinity AI Copilot platform. It helps IT teams enhance cloud technologies' efficiency by leveraging AI technology.

- In October 2023, Palo Alto Networks acquired Dig Security, a cloud data security startup company, for USD 400 million. With this acquisition, the company aims to integrate Dig’s data security posture management (DSPM) technology into its Prisma Cloud platform.

- In September 2023, Check Point Software Technologies acquired Atmosec, a provider of SaaS Security solutions. With this acquisition, the company aims to enhance its SaaS security offering to support SaaS applications.

- In May 2023, Cisco Systems, Inc. announced its plans to acquire Lightspin Technologies Ltd., a cloud security software company. This acquisition will help Cisco to provide end-to-end cloud security by incorporating cloud security posture management (CSPM) into cloud-native resources.

- In July 2021, Microsoft Corporation acquired CloudKnox Security. This acquisition will help Microsoft offer cloud entitlement management and unified privileged access.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.