Global Cloud Storage Market

Market Size in USD Million

CAGR :

%

USD

650.91 Million

USD

3,735.64 Million

2024

2032

USD

650.91 Million

USD

3,735.64 Million

2024

2032

| 2025 –2032 | |

| USD 650.91 Million | |

| USD 3,735.64 Million | |

|

|

|

|

Cloud Storage Market Size

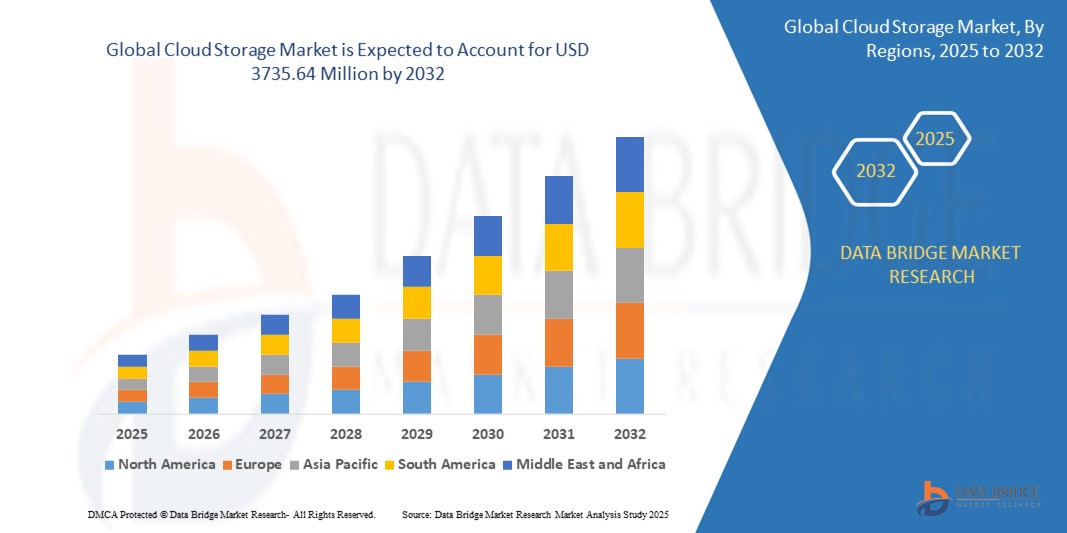

- The global cloud storage market size was valued at USD 650.91 million in 2024 and is expected to reach USD 3735.64 million by 2032, at a CAGR of 24.41% during the forecast period

- The market growth is primarily driven by the increasing adoption of cloud-based solutions, the proliferation of data-driven technologies, and the growing need for scalable and cost-effective storage solutions across industries

- Rising demand for secure, flexible, and accessible data storage, coupled with advancements in AI, machine learning, and big data analytics, is positioning cloud storage as a critical component of modern digital infrastructure, significantly boosting industry expansion

Cloud Storage Market Analysis

- Cloud storage solutions, enabling scalable and remote data storage accessible via the internet, are increasingly integral to enterprise IT strategies and digital transformation initiatives due to their cost efficiency, flexibility, and seamless integration with modern applications

- The growing demand for cloud storage is fueled by the rise in data generation, increasing adoption of hybrid and multi-cloud strategies, and the need for enhanced data security and disaster recovery capabilities

- North America dominated the cloud storage market with the largest revenue share of 42.5% in 2024, driven by early adoption of cloud technologies, high investment in digital infrastructure, and the presence of major industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid digitalization, increasing internet penetration, and rising investments in cloud infrastructure in countries such as China, India, and Japan

- The object storage segment dominated the largest market revenue share of 42.5% in 2024, driven by its scalability, cost-effectiveness, and suitability for unstructured data such as multimedia, backups, and archival storage. Its compatibility with big data analytics and AI workloads further boosts its adoption

Report Scope and Cloud Storage Market Segmentation

|

Attributes |

Cloud Storage Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Cloud Storage Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global cloud storage market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into data usage patterns, storage optimization, and predictive resource allocation

- AI-powered cloud storage solutions facilitate proactive management, identifying potential storage bottlenecks or security risks before they escalate into significant issue

- For instances, several providers are developing AI-driven platforms that analyze data access patterns to optimize storage allocation or offer personalized pricing models based on usage trends

- This trend enhances the value proposition of cloud storage systems, making them more appealing to both enterprises and individual users

- AI algorithms can analyze vast datasets, including access frequency, data types, and user behavior, to improve storage efficiency and enhance security measures

Cloud Storage Market Dynamics

Driver

“Rising Demand for Scalable and Flexible Data Storage Solutions”

- The increasing demand for scalable, flexible, and cost-effective data storage solutions is a major driver for the global cloud storage market

- Cloud storage systems enhance accessibility by providing features such as real-time data access, seamless collaboration tools, and automated backups

- Government initiatives promoting digital transformation, particularly in regions such as North America, which dominates the market, are contributing to the widespread adoption of cloud storage

- The proliferation of IoT and the advancement of 5G technology are further enabling the expansion of cloud storage applications, offering faster data transfer and lower latency for real-time services

- Enterprises are increasingly adopting cloud storage as a standard or optional component to meet data management needs and enhance operational efficiency

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The substantial initial investment required for cloud storage infrastructure, including hardware, software, and integration, can be a significant barrier to adoption, particularly for small and medium enterprises (SMEs) in emerging markets

- Migrating existing data to cloud storage platforms can be complex and costly

- In addition, data security and privacy concerns pose a major challenge. Cloud storage systems collect and store vast amounts of sensitive data, raising concerns about potential breaches, unauthorized access, and compliance with stringent data protection regulations

- The fragmented regulatory landscape across different countries regarding data storage, usage, and compliance further complicates operations for global service providers

- These factors can deter potential adopters and limit market expansion, particularly in regions such as Asia-Pacific, the fastest-growing market, where cost sensitivity and data privacy awareness are significant considerations

Cloud Storage market Scope

The market is segmented on the basis of type, component type, deployment, enterprise services, application, and end user

- By Type

On the basis of type, the market is segmented into object storage, file storage, and block storage. The object storage segment dominated the largest market revenue share of 42.5% in 2024, driven by its scalability, cost-effectiveness, and suitability for unstructured data such as multimedia, backups, and archival storage. Its compatibility with big data analytics and AI workloads further boosts its adoption.

The block storage segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by its high performance and low latency, making it ideal for mission-critical applications such as databases and enterprise resource planning systems. The increasing demand for real-time data processing and high-speed storage solutions accelerates its growth.

- By Component Type

On the basis of component type, the market is segmented into solutions and services. The solutions segment dominated the market with a revenue share of 65.5% in 2024, driven by the widespread adoption of cloud storage platforms that provide scalable, secure, and efficient data management capabilities. Enterprises increasingly rely on these solutions for data backup, disaster recovery, and collaboration.

The services segment is expected to witness the fastest growth rate of 18.2% from 2025 to 2032, propelled by the rising demand for managed services, consulting, and integration to optimize cloud storage deployment. As businesses seek tailored solutions to address complex storage needs, service providers play a critical role in driving adoption.

- By Deployment

On the basis of deployment, the market is segmented into private, public, and hybrid. The public cloud segment held the largest market revenue share of 58.5% in 2024, attributed to its cost-efficiency, scalability, and ease of access for businesses of all sizes. Major providers such as AWS, Microsoft Azure, and Google Cloud drive its dominance.

The hybrid cloud segment is projected to grow at the fastest rate from 2025 to 2032, driven by its ability to combine the flexibility of public clouds with the security and control of private clouds. Enterprises increasingly adopt hybrid models to balance sensitive data storage with cost-effective scalability, particularly in regulated industries.

- By Enterprise Services

On the basis of enterprise size, the market is segmented into SMEs and large enterprises. The large enterprises segment accounted for the largest revenue share of 62.5% in 2024, driven by their substantial investments in cloud infrastructure to support complex operations, data analytics, and digital transformation initiatives.

The SMEs segment is expected to register the fastest growth rate of 20.1% from 2025 to 2032, fueled by the affordability and accessibility of cloud storage solutions. SMEs are increasingly adopting cloud storage to enhance operational efficiency, reduce IT costs, and compete with larger players.

- By Application

On the basis of application, the market is segmented into front end and back end. The back-end application segment held the largest market revenue share of 60.5% in 2024, driven by its critical role in data storage, backup, and disaster recovery for enterprise systems, ensuring business continuity and data security.

The front-end application segment is anticipated to witness the fastest growth from 2025 to 2032, propelled by the increasing demand for user-friendly, cloud-based applications such as collaboration tools, content management systems, and customer-facing platforms. The integration of AI and real-time analytics further enhances front-end application adoption.

- By End User

On the basis of end user, the market is segmented into BFSI, retail and consumer goods, healthcare and life sciences, media and entertainment, IT and telecommunication, manufacturing, government and public sector, energy and utilities, and others. The BFSI segment dominated the market with a revenue share of 28.5% in 2024, driven by the sector’s need for secure, scalable storage solutions to manage sensitive financial data and comply with regulatory requirements.

The healthcare and life sciences segment is expected to experience the fastest growth rate from 2025 to 2032, fueled by the increasing adoption of cloud storage for managing electronic health records, medical imaging, and research data. The sector’s focus on data security, interoperability, and real-time access drives demand for advanced cloud solutions.

Cloud Storage Market Regional Analysis

- North America dominated the cloud storage market with the largest revenue share of 42.5% in 2024, driven by early adoption of cloud technologies, high investment in digital infrastructure, and the presence of major industry players

- Enterprises prioritize cloud storage for scalability, data security, and cost efficiency, particularly in regions with advanced digital ecosystems and diverse business needs

- Growth is fueled by advancements in storage technologies, including object, file, and block storage, alongside increasing demand for hybrid and multi-cloud deployments in both SMEs and large enterprises

U.S. Cloud Storage Market Insight

The U.S. cloud storage market captured the largest revenue share of 81% in 2024 within North America, fueled by strong demand for cloud solutions in industries such as BFSI, IT, and healthcare. The trend toward digital transformation, coupled with growing awareness of data security and compliance requirements, boosts market expansion. The adoption of hybrid cloud models and increasing investments in AI-driven storage solutions complement both enterprise and consumer segments.

Europe Cloud Storage Market Insight

The Europe cloud storage market is expected to witness significant growth, supported by stringent data privacy regulations such as GDPR and increasing demand for secure and scalable storage solutions. Enterprises seek cloud storage for enhanced data accessibility and operational efficiency. The growth is prominent in both public and hybrid cloud deployments, with countries such as Germany and France showing significant adoption due to digitalization initiatives and robust IT infrastructure.

U.K. Cloud Storage Market Insight

The U.K. market for cloud storage is expected to witness rapid growth, driven by demand for flexible and secure data storage in urban business hubs. Increased focus on digital transformation and rising awareness of cloud-based backup and disaster recovery solutions encourage adoption. Evolving regulations around data sovereignty and cybersecurity influence enterprise choices, balancing performance with compliance.

Germany Cloud Storage Market Insight

Germany is expected to witness rapid growth in the cloud storage market, attributed to its advanced technological ecosystem and high enterprise focus on data efficiency and security. German businesses prefer cloud solutions that offer seamless integration with existing IT systems and contribute to operational cost savings. The integration of cloud storage in industries such as manufacturing and automotive supports sustained market growth.

Asia-Pacific Cloud Storage Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid digitalization, expanding IT infrastructure, and rising adoption of cloud solutions in countries such as China, India, and Japan. Increasing awareness of data scalability, security, and cost benefits boosts demand across BFSI, retail, and IT sectors. Government initiatives promoting digital economies and smart cities further encourage the use of advanced cloud storage solutions.

Japan Cloud Storage Market Insight

Japan’s cloud storage market is expected to witness rapid growth due to strong consumer preference for high-quality, secure cloud solutions that enhance operational efficiency and data management. The presence of major technology providers and integration of cloud storage in enterprise IT systems accelerate market penetration. Rising interest in hybrid cloud deployments and AI-driven analytics also contributes to growth.

China Cloud Storage Market Insight

China holds the largest share of the Asia-Pacific cloud storage market, propelled by rapid urbanization, increasing internet penetration, and growing demand for scalable data storage solutions. The country’s expanding digital economy and focus on smart technologies support the adoption of cloud storage across industries such as retail, manufacturing, and government. Strong domestic cloud providers and competitive pricing enhance market accessibility.

Cloud Storage Market Share

The cloud storage industry is primarily led by well-established companies, including:

- Microsoft (U.S.)

- IBM (U.S.)

- Oracle (U.S.)

- MongoDB, Inc. (U.S.)

- Rohde & Schwarz (Germany)

- Hewlett-Packard (U.S.)

- Dell (U.S.)

- Atlantic (U.S.

- VMware (U.S.)

- Cisco Systems, Inc. (U.S.)

- DataDirect Networks (U.S.)

- Swisslog Holding AG (Switzerland)

- Mecalux, S.A. (Spain)

- KNAPP AG (Austria)

- Dematic (U.S.)

- Verizon Terremark (U.S.)

What are the Recent Developments in Global Cloud Storage Market?

- In October 2023, BT and Google Cloud announced a strategic partnership to advance cybersecurity innovation. As part of this collaboration, BT became a managed services delivery partner for Google’s Autonomic Security Operations (ASO), leveraging Google Chronicle to enhance threat detection and response capabilities. The partnership integrates Google Cloud’s AI-driven security analytics with BT’s expertise in managed security services, providing enterprise clients with advanced cybersecurity solutions

- In September 2023, Amazon Web Services (AWS) introduced a new feature for Amazon FSx for Windows File Server, enabling users to adjust IOPS levels independently from storage capacity. This enhancement provides greater flexibility, allowing organizations to optimize performance based on workload demands. The update supports higher IOPS configurations, improving file system responsiveness while maintaining cost efficiency. Users can now fine-tune throughput and latency without modifying storage allocation

- In September 2023, Alibaba Cloud and Astra Tech signed a Memorandum of Understanding (MoU) to integrate Alibaba Cloud’s Enterprise Mobile Application Studio (EMAS) mobile testing solution into Botim, which is evolving into an ultra-app. This collaboration aims to enhance user experience by improving app performance, reliability, and seamless functionality. EMAS will support VoIP calls and video quality, offering 24/7 risk detection for app crashes, compatibility issues, and performance concerns. The partnership builds on Botim’s existing use of Alibaba Cloud’s services, including Elastic Compute Service (ECS), storage, networking, and databases

- In August 2023, Google Cloud introduced Parallelstore, a parallel file system designed to optimize AI/ML and High-Performance Computing (HPC) workloads. This solution prevents GPU resource waste by ensuring continuous data availability, eliminating delays caused by storage I/O bottlenecks. Built on Intel DAOS architecture, Parallelstore offers up to 6.3x read throughput performance compared to competitive Lustre Scratch offerings. It enables equal storage access across compute nodes, ensuring high-speed data retrieval for AI model training and HPC applications

- In March 2023, IBM and Wasabi Technologies announced a strategic collaboration to enable enterprises to run applications across any environment—on-premises, in the cloud, or at the edge—while ensuring real-time access to critical business data and analytics with cost-effectiveness. The Boston Red Sox became the first organization to leverage the joint power of IBM Cloud Satellite® and Wasabi hot cloud storage, enhancing data accessibility, security, and operational efficiency. This partnership aims to drive innovation across hybrid cloud environments, supporting flexible and scalable data management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CLOUD STORAGE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CLOUD STORAGE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CLOUD STORAGE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SOFTWARE DEFINED STORAGE

5.1.1 CONTAINER-BASED SOFTWARE

5.1.2 VIRTUALIZED SOFTWARE

5.1.3 HYPER-CONVERGED INFRASTRUCTURE (HCI) SOFTWARE

5.1.4 OTHERS

5.2 PENETRATION & GROWTH PERSPECTIVE MAPPING

5.3 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.4 COMPETITOR KEY PRICING STRATEGIES

5.5 COMPANY COMPARATIVE ANALYSIS

5.6 TECHNOLOGICAL TRENDS

5.7 PATENT ANALYSIS

6 GLOBAL CLOUD STORAGE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 CLOUD STORAGE GATEWAY

6.2.2 PRIMARY STORAGE

6.2.3 BACKUP STORAGE

6.2.4 DATA ARCHIVING

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 TRIANING AND CONSULTING

6.3.3 CLOUD INTEGRATION AND MIGRATION

6.3.4 SUPPORT AND MAINTENANCE

7 GLOBAL CLOUD STORAGE MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 PRIVATE

7.3 PUBLIC

7.4 HYBRID

8 GLOBAL CLOUD STORAGE MARKET, BY ENTERPRISE SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISE

8.2.1 PRIVATE

8.2.2 PUBLIC

8.2.3 HYBRID

8.3 SMALL & MEDIUM ENTERPRISE

8.3.1 PRIVATE

8.3.2 PUBLIC

8.3.3 HYBRID

9 GLOBAL CLOUD STORAGE MARKET, BY ARCHITECTURE TYPE

9.1 OVERVIEW

9.2 DATA STORAGE LAYER

9.3 DATA MANAGEMENT LAYER

9.4 DATA SERVICE LAYER

9.5 USER ACCESS LAYER

10 GLOBAL CLOUD STORAGE MARKET, BY PRICING MODEL

10.1 OVERVIEW

10.2 FREE/AD BASED

10.3 SUBSCRIPTION BASED

11 GLOBAL CLOUD STORAGE MARKET, BY STORAGE CLASS

11.1 OVERVIEW

11.2 STANDARD STORAGE

11.3 NEARLINE STORAGE

11.4 COLDLINE STORAGE

11.5 ARCHIVE STORAGE

12 GLOBAL CLOUD STORAGE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BUSINESS CONTINUITY

12.2.1 BACKUP & RECOVERY

12.2.2 DATA ARCHIVING

12.2.3 OTHERS

12.3 DATA MANAGEMENT

12.3.1 BIG DATA ANALYTICS

12.3.2 DATABASE STORAGE MANAGEMENT

12.3.3 OTHERS

12.4 APPLICATION MANAGEMENT

12.4.1 CONTENT DELIVERY

12.4.2 DISTRIBUTION

12.4.3 OTHERS

12.5 OTHERS

13 GLOBAL CLOUD STORAGE MARKET, BY END USER

13.1 OVERVIEW

13.2 BANKING, FINANCIAL SERVICES & INSURANCE

13.2.1 BY OFFERING

13.2.1.1. SOLUTIONS

13.2.1.2. SERVICES

13.3 RETAIL AND CONSUMER GOODS

13.3.1 BY OFFERING

13.3.1.1. SOLUTIONS

13.3.1.2. SERVICES

13.4 TELECOMMUNICATION

13.4.1 BY OFFERING

13.4.1.1. SOLUTIONS

13.4.1.2. SERVICES

13.5 PERSONAL USAGE

13.5.1 BY OFFERING

13.5.1.1. SOLUTIONS

13.5.1.2. SERVICES

13.6 MEDIA & ENTERTAINMENT

13.6.1 BY OFFERING

13.6.1.1. SOLUTIONS

13.6.1.2. SERVICES

13.7 HEALTHCARE & LIFE SCIENCE

13.7.1 BY OFFERING

13.7.1.1. SOLUTIONS

13.7.1.2. SERVICES

13.8 GOVERNMENT AND PUBLIC SECTOR

13.8.1 BY OFFERING

13.8.1.1. SOLUTIONS

13.8.1.2. SERVICES

13.9 TRAVEL AND HOSPITALITY

13.9.1 BY OFFERING

13.9.1.1. SOLUTIONS

13.9.1.2. SERVICES

13.1 EDUCATION

13.10.1 BY OFFERING

13.10.1.1. SOLUTIONS

13.10.1.2. SERVICES

13.11 OTHERS

14 GLOBAL CLOUD STORAGE MARKET, BY REGION

14.1 GLOBAL CLOUD STORAGE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 FRANCE

14.2.3 U.K.

14.2.4 ITALY

14.2.5 SPAIN

14.2.6 RUSSIA

14.2.7 TURKEY

14.2.8 BELGIUM

14.2.9 NETHERLANDS

14.2.10 SWITZERLAND

14.2.11 NORWAY

14.2.12 FINLAND

14.2.13 DENMARK

14.2.14 SWEDAN

14.2.15 POLAND

14.2.16 REST OF EUROPE

14.3 ASIA PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 AUSTRALIA

14.3.6 NEW ZEALAND

14.3.7 SINGAPORE

14.3.8 THAILAND

14.3.9 MALAYSIA

14.3.10 INDONESIA

14.3.11 PHILIPPINES

14.3.12 TAIWAN

14.3.13 VIETNAM

14.3.14 REST OF ASIA PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 EGYPT

14.5.3 SAUDI ARABIA

14.5.4 U.A.E

14.5.5 ISRAEL

14.5.6 REST OF MIDDLE EAST AND AFRICA

14.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 GLOBAL CLOUD STORAGE MARKET,COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.2 COMPANY SHARE ANALYSIS: EUROPE

15.3 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15.4 MERGERS & ACQUISITIONS

15.5 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.6 EXPANSIONS

15.7 REGULATORY CHANGES

15.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL CLOUD STORAGE MARKET , SWOT & DBMR ANALYSIS

17 GLOBAL CLOUD STORAGE MARKET, COMPANY PROFILE

17.1 AMAZON WEB SERVICES, INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 ALIBABA CLOUD

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 DELL INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 DROPBOX

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 IDRIVE

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 IDRIVE

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 MEGA

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 BOX

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 PCLOUD

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.1 EGNYTE, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 TENCENT CLOUD

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 FUJITSU

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 NETAPP

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 GOOGLE INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 HITACHI VANATRA

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 SCALITY

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHIC PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENTS

17.17 CITRIX

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHIC PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENTS

17.18 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 GEOGRAPHIC PRESENCE

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENTS

17.19 HUAWEI

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 GEOGRAPHIC PRESENCE

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENTS

17.2 IBM CORPORATION

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 GEOGRAPHIC PRESENCE

17.20.4 PRODUCT PORTFOLIO

17.20.5 RECENT DEVELOPMENTS

17.21 MICROSOFT CORPORATION

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 GEOGRAPHIC PRESENCE

17.21.4 PRODUCT PORTFOLIO

17.21.5 RECENT DEVELOPMENTS

17.22 ORACLE CORPORATION

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 GEOGRAPHIC PRESENCE

17.22.4 PRODUCT PORTFOLIO

17.22.5 RECENT DEVELOPMENTS

17.23 VMWARE, INC

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 GEOGRAPHIC PRESENCE

17.23.4 PRODUCT PORTFOLIO

17.23.5 RECENT DEVELOPMENTS

17.24 STONEFLY

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 GEOGRAPHIC PRESENCE

17.24.4 PRODUCT PORTFOLIO

17.24.5 RECENT DEVELOPMENTS

17.25 RACKSPACE US, INC.

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 GEOGRAPHIC PRESENCE

17.25.4 PRODUCT PORTFOLIO

17.25.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 CONCLUSION

19 QUESTIONNAIRE

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.