Global Cold Chain Packaging Market

Market Size in USD Billion

CAGR :

%

USD

35.45 Billion

USD

135.53 Billion

2025

2033

USD

35.45 Billion

USD

135.53 Billion

2025

2033

| 2026 –2033 | |

| USD 35.45 Billion | |

| USD 135.53 Billion | |

|

|

|

|

Cold Chain Packaging Market Size

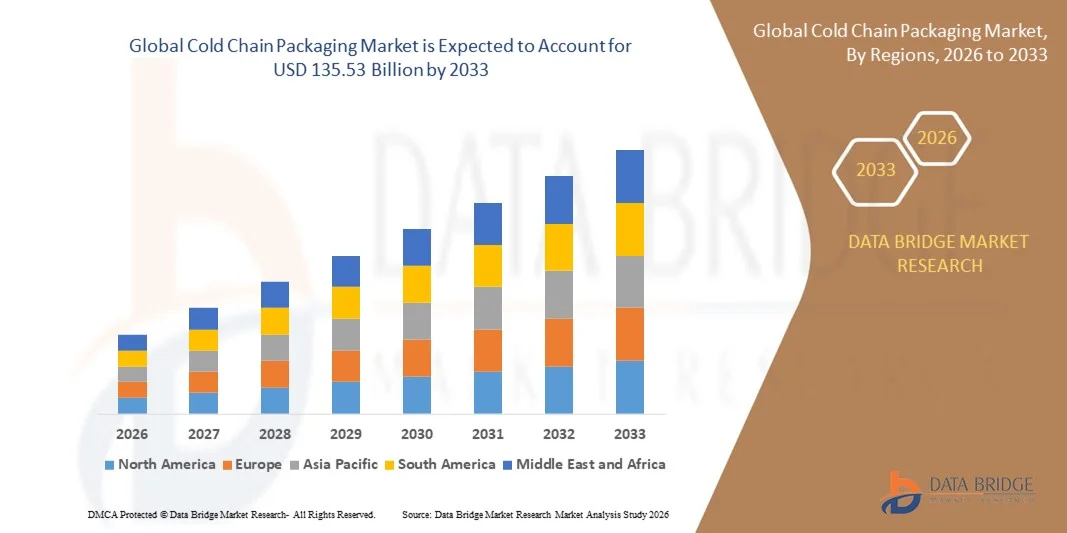

- The global cold chain packaging market size was valued at USD 35.45 billion in 2025 and is expected to reach USD 135.53 billion by 2033, at a CAGR of 18.25% during the forecast period

- The market growth is largely fueled by the rising demand for temperature-controlled logistics and advancements in cold chain technologies, leading to improved storage, transport, and monitoring of perishable food, dairy, and pharmaceutical products

- Furthermore, increasing regulatory requirements for product safety, growing consumer awareness about freshness and quality, and the need for efficient supply chains are establishing cold chain packaging as a critical solution across industries. These converging factors are accelerating the adoption of insulated containers, refrigerants, and temperature monitoring systems, thereby significantly boosting the industry’s growth

Cold Chain Packaging Market Analysis

- Cold chain packaging, providing temperature-controlled storage and transportation for perishable and sensitive products, is becoming an essential component of modern supply chains across food, dairy, and pharmaceutical sectors due to its ability to maintain product integrity and compliance with safety standards

- The escalating demand for cold chain packaging is primarily fueled by global urbanization, rising consumption of perishable products, growth in pharmaceutical logistics, and the increasing focus on sustainability and efficiency in supply chain operations

- North America dominated the cold chain packaging market with a share of 33.60% in 2025, due to increasing demand for temperature-sensitive food, dairy, and pharmaceutical products, as well as advanced logistics infrastructure

- Asia-Pacific is expected to be the fastest growing region in the cold chain packaging market during the forecast period due to rapid urbanization, rising disposable incomes, and growing demand for perishable food, vaccines, and dairy products in countries such as China, India, and Japan

- Insulated containers segment dominated the market with a market share of 41.79% in 2025, due to their ability to maintain consistent temperatures during storage and transportation. Businesses prefer insulated containers for preserving product quality over long distances, their compatibility with various packaging formats, and integration with temperature-sensitive logistics systems. Growing demand from food and pharmaceutical sectors for reliable temperature-controlled solutions further supports their dominance. Advanced designs with enhanced durability and lightweight materials improve operational efficiency and strengthen market leadership

Report Scope and Cold Chain Packaging Market Segmentation

|

Attributes |

Cold Chain Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cold Chain Packaging Market Trends

Rising Adoption of Sustainable Cold Chain Packaging

- A significant trend in the cold chain packaging market is the growing adoption of sustainable and eco-friendly packaging solutions, driven by increasing regulatory pressure to reduce carbon emissions and rising consumer preference for environmentally responsible products. Companies are developing insulated containers, refrigerants, and thermal liners that maintain temperature integrity while minimizing environmental impact, shaping a shift toward greener logistics and distribution practices

- For instance, Ranpak introduced its RecyCold climaliner solution, a thermal liner made from paper, ensuring temperature-sensitive products remain within their ideal range for up to 48 hours while being fully recyclable. Such innovations are reinforcing the role of sustainable solutions in modern cold chain logistics

- The adoption of recyclable and biodegradable materials in cold chain packaging is rising across food, dairy, and pharmaceutical sectors. Businesses are increasingly integrating these solutions to reduce packaging waste and comply with stringent environmental standards, positioning sustainable cold chain packaging as a market differentiator

- The pharmaceutical sector is leveraging sustainable packaging to maintain temperature-sensitive products such as vaccines and biologics while meeting global environmental guidelines. Companies such as Cold Chain Technologies are expanding their portfolios with eco-friendly thermal packaging solutions, driving industry-wide adoption

- The food and dairy industries are also embracing green cold chain solutions, incorporating insulated containers and temperature monitoring systems that lower carbon footprints. This trend is accelerating investment in research and development for advanced, sustainable packaging materials

- Global logistics providers are increasingly prioritizing environmentally responsible packaging for temperature-controlled shipments to improve brand reputation and meet consumer expectations. The rising adoption of sustainable cold chain solutions is positioning the market for long-term growth and innovation

Cold Chain Packaging Market Dynamics

Driver

Rising Demand for Temperature-Controlled Logistics

- The rising global demand for temperature-controlled logistics is driving the adoption of cold chain packaging solutions across food, dairy, and pharmaceutical industries. Businesses require insulated containers, refrigerants, and monitoring systems to preserve product quality, prevent spoilage, and comply with regulatory standards

- For instance, Peli BioThermal launched its Crēdo™ Cargo bulk shipper to simplify the global transportation of temperature-sensitive products, enhancing operational efficiency and reliability. Such solutions are critical for ensuring product integrity in long-distance supply chains

- Increasing pharmaceutical production and vaccine distribution is further boosting the need for reliable cold chain packaging solutions. Companies such as Cryopak provide advanced thermal packaging to support safe and compliant transport of biologics and medicines

- E-commerce expansion and growing demand for fresh and perishable foods are also propelling investments in cold chain logistics. Businesses are deploying smart packaging systems to monitor temperature in real-time, improving efficiency and reducing waste

- The growing integration of IoT-enabled sensors and temperature monitoring systems enhances visibility and control over shipments. These technologies are strengthening the overall market demand by offering precise, reliable solutions for maintaining product integrity during transit

Restraint/Challenge

High Infrastructure and Setup Costs

- The cold chain packaging market faces challenges due to the high initial investment and infrastructure costs required for temperature-controlled storage, transport, and monitoring systems. Setting up insulated container networks, advanced refrigerants, and monitoring devices demands significant capital expenditure and skilled personnel

- For instance, companies such as Mettcover Global invested in a new warehouse in Pennsylvania, U.S., to store and distribute thermal covers and data loggers. While this expansion improves service, it also reflects the substantial setup costs and operational commitments needed to support cold chain operations

- Maintaining ultra-low temperature environments for pharmaceuticals and perishable foods adds to operational expenses, making cost efficiency a critical concern for businesses. Investments in specialized equipment, energy-intensive storage units, and regulatory compliance further elevate expenditure

- Scaling cold chain infrastructure across regions, especially in emerging markets, remains challenging due to fragmented supply chains and logistical complexities. These factors collectively restrain market growth despite rising demand for temperature-sensitive product logistics

- In addition, the cold chain packaging market faces challenges from fluctuations in raw material costs and energy prices, which can impact profitability and increase overall operational expenditure for companies managing large-scale temperature-controlled supply chains

Cold Chain Packaging Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the cold chain packaging market is segmented into refrigerants, insulated containers, and temperature monitoring systems. The insulated containers segment dominated the market with the largest share of 41.79% in 2025, driven by their ability to maintain consistent temperatures during storage and transportation. Businesses prefer insulated containers for preserving product quality over long distances, their compatibility with various packaging formats, and integration with temperature-sensitive logistics systems. Growing demand from food and pharmaceutical sectors for reliable temperature-controlled solutions further supports their dominance. Advanced designs with enhanced durability and lightweight materials improve operational efficiency and strengthen market leadership.

The refrigerants segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising adoption in temperature-sensitive logistics. For instance, companies such as Cryopak are expanding refrigerant solutions for longer transit durations with lower environmental impact. Refrigerants complement insulated containers and temperature monitoring systems, ensuring continuous temperature control. Demand from pharmaceutical shipments and perishable food transport drives this growth, supported by eco-friendly and scalable refrigerant solutions.

- By Application

On the basis of application, the cold chain packaging market is segmented into food, dairy, and pharmaceutical. The food segment dominated the market in 2025, driven by rising perishable food consumption and the need for extended shelf life. Cold chain packaging preserves freshness and nutritional quality across supply chains and supports ready-to-eat meals, frozen foods, and fresh produce delivery. Advanced packaging solutions ensure compliance with safety standards and reduce spoilage losses, strengthening market leadership.

The pharmaceutical segment is expected to witness the fastest growth from 2026 to 2033, driven by the transportation of temperature-sensitive medicines, vaccines, and biologics. For instance, Cold Chain Technologies provides specialized packaging for vaccine distribution maintaining ultra-low temperatures. Regulatory requirements and the growth of biologics, clinical trials, and global vaccine programs further boost adoption. Real-time temperature monitoring and reliable thermal protection accelerate market expansion.

Cold Chain Packaging Market Regional Analysis

- North America dominated the cold chain packaging market with the largest revenue share of 33.60% in 2025, driven by increasing demand for temperature-sensitive food, dairy, and pharmaceutical products, as well as advanced logistics infrastructure

- Consumers and businesses in the region highly value reliable temperature control, efficient delivery, and regulatory compliance offered by cold chain packaging solutions such as insulated containers, refrigerants, and temperature monitoring systems

- This widespread adoption is further supported by well-established supply chains, advanced cold storage facilities, and rising awareness of product quality preservation, establishing cold chain packaging as a critical solution across food, dairy, and pharmaceutical sectors

U.S. Cold Chain Packaging Market Insight

The U.S. cold chain packaging market captured the largest revenue share in 2025 within North America, fueled by rising demand for perishable food, vaccines, and biologics. Businesses increasingly prioritize advanced insulated containers, refrigerants, and temperature monitoring systems to maintain product integrity during storage and transport. The growth is driven by the expansion of e-commerce food delivery services, pharmaceutical distribution, and robust logistics networks. In addition, regulatory compliance for temperature-sensitive products and the adoption of innovative packaging solutions, such as real-time monitoring systems, are further propelling the market.

Europe Cold Chain Packaging Market Insight

The Europe cold chain packaging market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent food safety and pharmaceutical regulations and growing demand for fresh and temperature-sensitive products. Increasing urbanization and technological adoption in logistics are fostering the use of cold chain packaging solutions. European businesses are focusing on reducing spoilage, maintaining product quality, and adopting eco-friendly refrigerants and insulated containers. The region is witnessing growth across food retail, dairy, and pharmaceutical sectors, supported by both new construction and modernized storage facilities.

U.K. Cold Chain Packaging Market Insight

The U.K. cold chain packaging market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for temperature-controlled delivery of pharmaceuticals, dairy, and perishable foods. Businesses are adopting advanced insulated containers and real-time monitoring systems to comply with regulations and ensure product safety. The U.K.’s robust logistics and retail infrastructure, combined with increasing consumer awareness regarding freshness and quality, is expected to continue driving market expansion.

Germany Cold Chain Packaging Market Insight

The Germany cold chain packaging market is expected to expand at a considerable CAGR during the forecast period, fueled by strong industrial infrastructure, increasing food and pharmaceutical exports, and focus on sustainability. Companies are adopting insulated containers, refrigerants, and monitoring solutions to ensure safe transport and storage of temperature-sensitive products. The integration of eco-friendly refrigerants and innovative packaging systems is gaining traction, particularly in pharmaceutical and dairy supply chains, aligning with local regulatory standards and consumer expectations.

Asia-Pacific Cold Chain Packaging Market Insight

The Asia-Pacific cold chain packaging market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and growing demand for perishable food, vaccines, and dairy products in countries such as China, India, and Japan. The region’s expanding cold storage infrastructure, government initiatives promoting food safety, and increasing adoption of insulated containers and temperature monitoring systems are key drivers. APAC’s role as a manufacturing hub for cold chain solutions is also improving affordability and accessibility, fueling widespread adoption.

Japan Cold Chain Packaging Market Insight

The Japan cold chain packaging market is gaining momentum due to rising demand for high-quality food and pharmaceutical products, rapid urbanization, and an aging population requiring reliable temperature-controlled solutions. Businesses are increasingly integrating insulated containers, refrigerants, and monitoring systems to maintain product integrity. Government regulations and consumer focus on freshness and safety are supporting growth, while the integration of smart logistics technologies enhances efficiency across supply chains.

China Cold Chain Packaging Market Insight

The China cold chain packaging market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising middle-class consumption, and increasing demand for perishable foods, vaccines, and biologics. The government’s push for cold chain infrastructure development, combined with the presence of domestic manufacturers offering affordable solutions, is driving adoption. Businesses are leveraging insulated containers, refrigerants, and temperature monitoring systems to ensure safe storage and transport, supporting market growth across food, dairy, and pharmaceutical sectors.

Cold Chain Packaging Market Share

The cold chain packaging industry is primarily led by well-established companies, including:

- Cascades Inc (Canada)

- Intelsius (U.K.)

- Cold Chain Technologies (U.S.)

- Cryopak (U.S.)

- Sonoco Thermosafe (U.S.)

- SOFRIGAM (France)

- Softbox Systems Ltd (U.K.)

- Pelican Products, Inc. (U.S.)

- CSafe (U.S.)

- TOWER Cold Chain Solutions (U.S.)

- Sealed Air Corporation (U.S.)

- Nordic Cold Chain Solutions (Sweden)

- Inmark LLC (U.S.)

- Envirotainer AB (Sweden)

- DGP Intelsius LLC (U.K.)

- Emballages Cre-O-Pack Intl (France)

- TemperPack Technologies, Inc (U.S.)

Latest Developments in Global Cold Chain Packaging Market

- In October 2023, Cold Chain Technologies announced the acquisition of Exeltainer, SL, an international provider of isothermal packaging solutions for the pharmaceutical industry with manufacturing facilities in Spain and Brazil. This strategic move strengthens Cold Chain Technologies’ global presence and expands its portfolio of sustainable and high-performance cold chain packaging solutions. The acquisition is expected to enhance the company’s ability to serve life sciences clients, improve supply chain efficiency, and support growing demand for temperature-controlled pharmaceutical logistics worldwide

- In October 2023, Exeltainer, a global provider of life sciences thermal packaging solutions, became part of Cold Chain Technologies through its acquisition. This integration is poised to accelerate innovation in sustainable cold chain packaging, combining Exeltainer’s isothermal expertise with Cold Chain Technologies’ established product portfolio. The expansion supports the company’s objective to deliver efficient, eco-friendly temperature-controlled solutions to pharmaceutical and biotech clients, meeting rising market expectations for sustainability and reliability

- In April 2023, Mettcover Global inaugurated a new warehouse in Pennsylvania, U.S., strategically positioned to store and distribute thermal covers and data loggers across the country. This development enhances the company’s operational efficiency and distribution capabilities, enabling faster and more reliable delivery of cold chain packaging solutions. The warehouse supports increasing demand from the U.S. food, dairy, and pharmaceutical sectors, while reinforcing the company’s commitment to expanding its domestic supply chain network

- In March 2023, Ranpak introduced the RecyCold climaliner solution, a thermal liner made from paper for cold chain packaging applications. This innovation allows products to remain within their optimal temperature range for up to 48 hours while promoting sustainability and recyclability. The launch addresses the growing market demand for eco-friendly and efficient packaging solutions, offering businesses a way to maintain product quality and reduce environmental impact in temperature-sensitive supply chains

- In February 2023, Peli BioThermal launched the Crēdo™ Cargo bulk shipper, a new cargo shipping solution designed to simplify global logistics challenges. This release enhances the company’s ability to provide reliable, scalable, and temperature-controlled transport for pharmaceuticals and other sensitive products. By streamlining international cold chain logistics, the Crēdo™ Cargo shipper supports faster, safer, and more efficient product delivery, addressing the increasing global demand for temperature-sensitive supply chain solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cold Chain Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cold Chain Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cold Chain Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.