Global Combine Harvester Market

Market Size in USD Billion

CAGR :

%

USD

15.36 Billion

USD

20.70 Billion

2025

2033

USD

15.36 Billion

USD

20.70 Billion

2025

2033

| 2026 –2033 | |

| USD 15.36 Billion | |

| USD 20.70 Billion | |

|

|

|

|

Combine Harvester Market Size

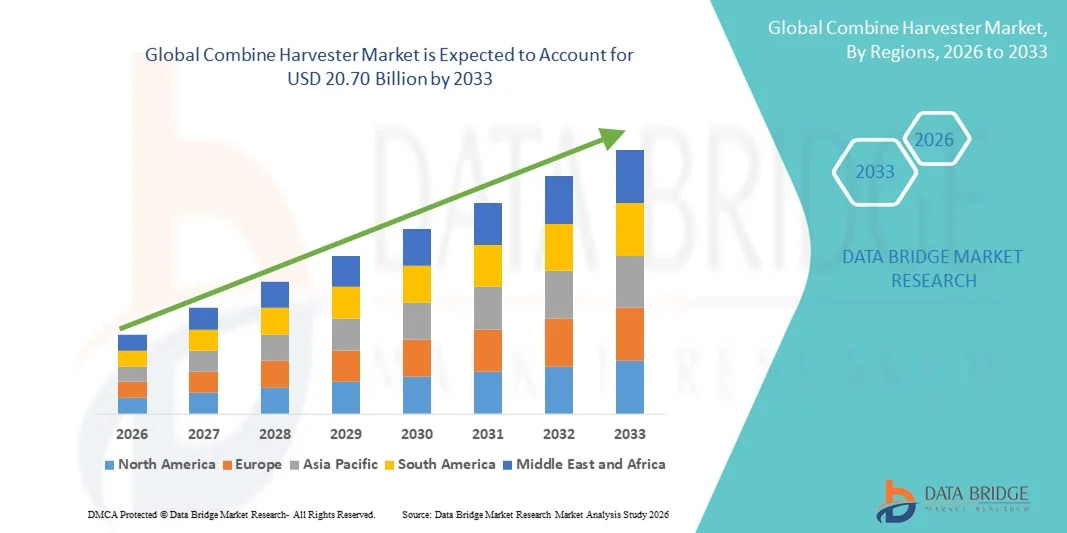

- The global combine harvester market size was valued at USD 15.36 billion in 2025 and is expected to reach USD 20.70 billion by 2033, at a CAGR of 3.80% during the forecast period

- The market growth is largely fuelled by increasing global demand for food production, rising adoption of mechanized farming practices, and the need to improve harvesting efficiency and reduce labor costs

- Growing investments in advanced agricultural machinery and government initiatives to support modern farming are also contributing to market expansion

Combine Harvester Market Analysis

- The combine harvester market is witnessing steady growth due to technological advancements such as GPS-enabled systems, automation, and improved grain handling capabilities

- Increasing adoption of combine harvesters in emerging economies, along with rising crop yields and the need for efficient post-harvest operations, is positively impacting market demand

- North America dominated the global combine harvester market with the largest revenue share of 32.45% in 2025, driven by widespread adoption of mechanized farming, advanced agricultural infrastructure, and increased awareness of productivity-enhancing equipment

- Asia-Pacific region is expected to witness the highest growth rate in the global combine harvester market, driven by expanding agricultural activities, supportive government policies, and rising investments in mechanization. Countries such as China and India are investing in modern equipment to boost productivity and reduce post-harvest losses

- The Large Size Combine Harvester segment held the largest market revenue share in 2025, driven by its high harvesting capacity, ability to cover larger fields efficiently, and suitability for commercial and industrial-scale farming operations. Large size harvesters help reduce harvesting time and labor requirements, making them a preferred choice for major crop producers

Report Scope and Combine Harvester Market Segmentation

|

Attributes |

Combine Harvester Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Combine Harvester Market Trends

Rising Adoption of Mechanized and Precision Farming

- The growing focus on mechanization and precision agriculture is significantly shaping the combine harvester market, as farmers increasingly prefer equipment that enhances efficiency, reduces labor dependency, and improves harvesting speed. Advanced combine harvesters are gaining traction due to their ability to handle multiple crop types, reduce post-harvest losses, and improve productivity, encouraging manufacturers to innovate with higher-capacity and technologically advanced models

- Increasing awareness around operational efficiency, labor shortages, and the need for higher crop yields has accelerated the adoption of modern combine harvesters in wheat, rice, corn, and other staple crops. Farmers are actively seeking equipment with integrated automation, GPS, and IoT-enabled monitoring systems, prompting manufacturers to develop smart and precision solutions that enhance performance and reduce operational costs

- Technological trends such as autonomous harvesting, GPS guidance, and sensor-based yield monitoring are influencing purchasing decisions, with manufacturers emphasizing reliability, fuel efficiency, and multi-functionality. These factors help differentiate products in a competitive market and build farmer confidence, while also driving partnerships between equipment suppliers and agri-tech firms

- For instance, in 2024, Deere & Company in the U.S. and CNH Industrial in Italy introduced new combine harvester models equipped with precision farming technologies and higher-capacity threshing systems. These launches were aimed at addressing farmer demand for efficiency, accuracy, and reduced crop loss, with distribution across global retail, dealer, and online channels

- While demand for combine harvesters is growing, sustained market expansion depends on continuous R&D, cost-effective manufacturing, and maintaining high operational performance. Manufacturers are also focusing on improving service networks, spare parts availability, and after-sales support to ensure reliable adoption and customer satisfaction

Combine Harvester Market Dynamics

Driver

Growing Demand for Mechanized Farming and Higher Crop Productivity

- Rising need for mechanized solutions in large-scale farming is a major driver for the combine harvester market. Farmers are increasingly replacing traditional harvesting methods with advanced machinery to improve efficiency, reduce labor costs, and meet growing food demand

- Expanding applications in wheat, rice, corn, and other crops are influencing market growth. Modern combine harvesters help enhance harvesting speed, reduce post-harvest losses, and improve yield, enabling farmers to meet increasing global food requirements

- Equipment manufacturers are actively promoting combine harvesters through technological upgrades, dealer networks, and financing solutions. These efforts are supported by government initiatives to modernize agriculture and mechanize farms, encouraging wider adoption of advanced harvesting machinery

- For instance, in 2023, AGCO in the U.S. and Kubota in Japan reported increased sales of combine harvesters integrated with GPS and IoT-based monitoring systems. The expansion followed higher farmer demand for automation, precision agriculture, and fuel-efficient solutions, strengthening brand presence and market share

- Although rising mechanization and precision farming trends support growth, wider adoption depends on equipment cost, availability of skilled operators, and access to financing. Investment in manufacturing efficiency, after-sales support, and innovative technology will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Initial Cost and Maintenance Requirements

- The relatively high purchase cost of modern combine harvesters compared to traditional equipment remains a key challenge, limiting adoption among small-scale farmers. High maintenance costs, fuel consumption, and need for technical expertise further impact affordability and utilization

- Awareness and training gaps, particularly in developing countries, restrict adoption of technologically advanced harvesters. Limited understanding of precision farming benefits and proper operation hinders effective usage, slowing market growth in certain regions

- Supply chain and service network limitations also affect market expansion, as combine harvesters require reliable dealer support, spare parts availability, and regular maintenance. Logistical challenges and technical complexity increase operational costs for farmers

- For instance, in 2024, farmers in parts of Southeast Asia and Africa reported slower adoption of high-capacity combine harvesters due to high upfront costs, maintenance complexity, and limited access to service centers. These barriers also influenced financing decisions and slowed market penetration

- Overcoming these challenges will require cost-efficient manufacturing, expanded service networks, training programs for operators, and financing solutions for small and medium-scale farmers. Collaboration between manufacturers, governments, and financial institutions will be essential to unlock the long-term growth potential of the global combine harvester market

Combine Harvester Market Scope

The market is segmented on the basis of cutting width, type of movement, and power source

- By Cutting Width

On the basis of cutting width, the global combine harvester market is segmented into Small Size Combine Harvester and Large Size Combine Harvester. The Large Size Combine Harvester segment held the largest market revenue share in 2025, driven by its high harvesting capacity, ability to cover larger fields efficiently, and suitability for commercial and industrial-scale farming operations. Large size harvesters help reduce harvesting time and labor requirements, making them a preferred choice for major crop producers.

The Small Size Combine Harvester segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its maneuverability, lower cost, and suitability for small to medium-sized farms. Small size harvesters are particularly popular in regions with fragmented land holdings and limited field space, offering efficient harvesting while being easier to operate and maintain.

- By Type of Movement

On the basis of type of movement, the global combine harvester market is segmented into Wheel Type Combine Harvester and Crawler Type Combine Harvester. The Wheel Type Combine Harvester segment held the largest market revenue share in 2025, due to its faster operation, better speed on roads, and easier maintenance compared to crawler types, making it widely adopted in developed and flat-terrain regions.

The Crawler Type Combine Harvester segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its superior stability, ability to operate on uneven or muddy terrain, and suitability for paddy fields. Crawler harvesters are increasingly preferred in regions with challenging field conditions where wheel-type harvesters face limitations.

- By Power Source

On the basis of power source, the global combine harvester market is segmented into Tractor Pulled/PTO Powered Combine Harvester and Self-Propelled Combine Harvester. The Self-Propelled Combine Harvester segment held the largest market revenue share in 2025, driven by its high efficiency, integrated engine system, and ability to perform all harvesting functions independently, making it ideal for large-scale commercial farms.

The Tractor Pulled/PTO Powered Combine Harvester segment is expected to witness the fastest growth rate from 2026 to 2033, owing to its lower cost, ease of attachment to existing tractors, and suitability for small to medium-sized farms. This segment is gaining popularity among farmers seeking cost-effective mechanization solutions without investing in fully self-propelled machines.

Combine Harvester Market Regional Analysis

- North America dominated the global combine harvester market with the largest revenue share of 32.45% in 2025, driven by widespread adoption of mechanized farming, advanced agricultural infrastructure, and increased awareness of productivity-enhancing equipment

- Farmers in the region highly value the efficiency, reliability, and multi-crop harvesting capabilities offered by modern combine harvesters, which help reduce labor costs and post-harvest losses

- This widespread adoption is further supported by high investment in precision agriculture technologies, strong government initiatives promoting mechanization, and growing demand for large-scale commercial farming, establishing combine harvesters as essential equipment for modern agriculture

U.S. Combine Harvester Market Insight

The U.S. combine harvester market captured the largest revenue share in 2025 within North America, fueled by large-scale farming practices and the need to increase crop yields efficiently. Farmers are increasingly prioritizing high-capacity and self-propelled harvesters to optimize operations. The demand for advanced features, such as GPS-enabled guidance, automated threshing, and telematics systems, further propels the market. Moreover, government subsidies and financing schemes for modern agricultural machinery are significantly supporting market expansion.

Europe Combine Harvester Market Insight

The Europe combine harvester market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising mechanization in agriculture and stringent regulations promoting efficient harvesting practices. The increase in large-scale and commercial farms, coupled with the demand for precision farming, is fostering adoption. European farmers are also drawn to energy-efficient and low-emission harvesters, promoting sustainable agricultural operations. The region is witnessing significant growth across cereal crops, corn, and oilseed harvesting applications.

U.K. Combine Harvester Market Insight

The U.K. combine harvester market is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing focus on modernizing farms, enhancing crop yield, and reducing manual labor. Concerns regarding labor shortages and crop wastage are encouraging farmers to invest in self-propelled and high-capacity combine harvesters. The U.K.’s adoption of precision agriculture technologies, alongside strong agricultural support programs, is expected to continue stimulating market growth.

Germany Combine Harvester Market Insight

The Germany combine harvester market is expected to witness the fastest growth rate from 2026 to 2033, fueled by technological advancements, high awareness of sustainable farming, and demand for efficient harvesting solutions. Germany’s well-developed agricultural infrastructure, combined with emphasis on mechanization and innovation, promotes the adoption of modern harvesters, particularly in large-scale cereal and corn farms. Integration with farm management systems and telematics solutions is increasingly prevalent, supporting operational efficiency and data-driven farming.

Asia-Pacific Combine Harvester Market Insight

The Asia-Pacific combine harvester market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising urbanization, increasing farm mechanization, and growing crop production in countries such as China, India, and Japan. Government initiatives promoting agricultural modernization and subsidies for mechanized equipment are encouraging adoption. In addition, as APAC emerges as a manufacturing hub for agricultural machinery, the affordability and accessibility of combine harvesters are expanding to a wider farmer base.

Japan Combine Harvester Market Insight

The Japan combine harvester market is expected to witness the fastest growth rate from 2026 to 2033 due to advanced farming practices, high-tech adoption, and increasing demand for labor-efficient solutions. Japanese farmers emphasize precision, reliability, and compact designs suitable for smaller and fragmented fields. Integration with IoT-enabled farm management systems and GPS-guided harvesting is fueling growth. Moreover, Japan’s aging farmer population is likely to drive demand for user-friendly and efficient combine harvesters.

China Combine Harvester Market Insight

The China combine harvester market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid mechanization, large-scale farmland, and growing demand for efficient harvesting. China is one of the largest markets for agricultural machinery, and combine harvesters are becoming increasingly popular across wheat, rice, corn, and soybean farms. Government policies promoting farm modernization, alongside strong domestic manufacturing capabilities, are key factors propelling the market.

Combine Harvester Market Share

The Combine Harvester industry is primarily led by well-established companies, including:

• Tractors and Farm Equipment Limited (India)

• Preet Group (India)

• Kartar Agro Industries Private Limited (India)

• Agco Corporation (U.S.)

• Mahindra & Mahindra Ltd (India)

• Claas Kgaa Mbh (Germany)

• Deere & Company (U.S.)

• Sdf S.P.A (Italy)

• Iseki & Co., Ltd (Japan)

• Kubota Agricultural Machinery India Pvt Ltd (India)

• KS GROUP (India)

• HIND AGRO Industries (India)

• YANMAR HOLDINGS Co., Ltd (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.