Global Composite Intermediate Bulk Containers Market

Market Size in USD Billion

CAGR :

%

USD

2.18 Billion

USD

2.90 Billion

2024

2032

USD

2.18 Billion

USD

2.90 Billion

2024

2032

| 2025 –2032 | |

| USD 2.18 Billion | |

| USD 2.90 Billion | |

|

|

|

|

Composite Intermediate Bulk Containers Market Size

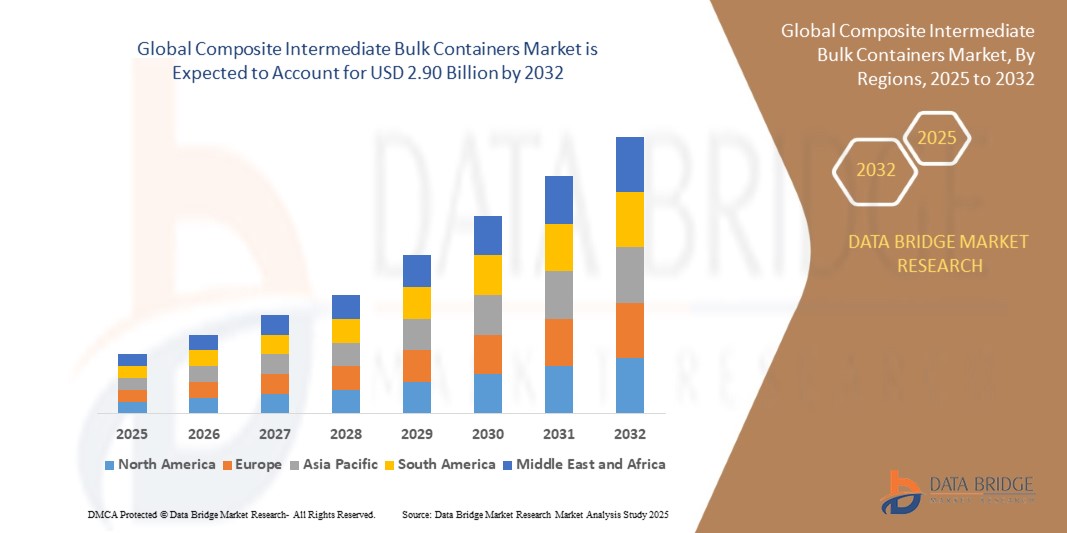

- The global composite intermediate bulk containers market size was valued at USD 2.18 billion in 2024 and is expected to reach USD 2.90 billion by 2032, at a CAGR of 3.60% during the forecast period

- The market growth is largely fuelled by the rising demand for cost-effective and durable bulk packaging solutions across industries such as chemicals, food & beverages, pharmaceuticals, and agriculture, driven by the need for safe storage, efficient transportation, and reduced product losses

- Increasing preference for reusable and eco-friendly bulk containers, supported by sustainability initiatives and government regulations, is further boosting the demand for composite intermediate bulk containers worldwide

Composite Intermediate Bulk Containers Market Analysis

- The increasing adoption of composite IBCs over traditional packaging formats is attributed to their lightweight structure, corrosion resistance, and reusability, offering significant cost savings for end users

- Technological advancements in material design, coupled with stringent regulations on product safety and handling, are further propelling market expansion

- Europe dominated the composite intermediate bulk containers market with the largest revenue share of 41.25% in 2024, driven by stringent environmental regulations, a well-established industrial sector, and the rising demand for sustainable bulk packaging solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global composite intermediate bulk containers market, driven by rising urbanization, expanding manufacturing hubs, and growing demand for cost-effective and sustainable bulk handling solutions

- The aseptic technology segment held the largest market revenue share in 2024, driven by its ability to maintain product sterility, extend shelf life, and meet stringent food safety and pharmaceutical regulations. Aseptic IBCs are widely adopted in the food & beverage and healthcare industries where product safety and hygiene are critical

Report Scope and Composite Intermediate Bulk Containers Market Segmentation

|

Attributes |

Composite Intermediate Bulk Containers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Composite Intermediate Bulk Containers Market Trends

Rising Demand For Sustainable Bulk Packaging Solutions

- The increasing focus on sustainability and circular economy practices is driving the adoption of composite intermediate bulk containers (IBCs) as reusable and eco-friendly packaging solutions. These containers help minimize single-use packaging waste and align with global environmental regulations, making them a preferred choice for industrial users

- Growing regulatory pressures in regions such as Europe and North America are accelerating the demand for recyclable and long-lasting bulk packaging systems. Composite IBCs, with their robust design and reusability, are helping companies meet packaging compliance requirements while reducing costs associated with waste disposal

- The rising need for cost-effective logistics solutions in chemicals, food & beverage, and pharmaceutical sectors is propelling the demand for composite IBCs. Their ability to optimize storage, transport efficiency, and safety is contributing to broader adoption across end-user industries

- For instance, in 2023, several chemical manufacturing companies in Germany transitioned to composite IBCs to comply with EU packaging directives, reducing their plastic waste footprint while improving operational efficiency in product handling and transportation

- While composite IBCs offer clear sustainability and cost benefits, the market growth depends on continuous innovation in materials, standardization of global packaging regulations, and wider adoption of closed-loop recycling programs by manufacturers and logistics providers

Composite Intermediate Bulk Containers Market Dynamics

Driver

Growing Demand From Chemical And Food & Beverage Industries

- Rapid industrialization and globalization have significantly increased the demand for safe, efficient, and cost-effective bulk packaging solutions. Composite IBCs meet these requirements by providing durability, chemical resistance, and compatibility with automated handling systems

- The food & beverage sector is particularly driving the adoption of composite IBCs due to strict hygiene standards and the need for contamination-free storage and transport. Their ability to safely carry liquids, semi-liquids, and hazardous materials makes them indispensable across industries

- Rising trade volumes and the growth of e-commerce logistics are further boosting the demand for intermediate bulk containers. Composite IBCs offer the dual advantage of lightweight design and high load-bearing capacity, reducing shipping costs and improving supply chain efficiency

- For instance, in 2022, the U.S. food processing sector witnessed a surge in the adoption of composite IBCs for transporting edible oils, dairy products, and liquid ingredients, driven by cost savings and stringent food safety regulations

- While industrial demand continues to rise, manufacturers are focusing on integrating smart tracking technologies, reusable designs, and improved safety features to strengthen their competitive position in the bulk packaging market

Restraint/Challenge

High Initial Investment And Limited Recycling Infrastructure In Developing Regions

- Despite long-term cost benefits, the initial purchase price of composite IBCs is higher than single-use packaging alternatives. This poses a barrier for small-scale manufacturers and businesses operating on tight capital budgets

- In developing regions, limited recycling infrastructure and lack of awareness about sustainable packaging practices hinder the large-scale adoption of composite IBCs. Many small enterprises continue to rely on low-cost traditional packaging despite higher operational inefficiencies

- The absence of standardized regulations and inadequate supply chain integration in certain markets creates additional challenges for manufacturers aiming to expand their customer base in cost-sensitive regions

- For instance, in 2023, packaging associations in Southeast Asia reported that over 60% of SMEs continued using conventional drums and barrels due to lower upfront costs, despite growing interest in sustainable alternatives such as composite IBCs

- Addressing these challenges requires coordinated efforts to develop cost-effective manufacturing methods, expand recycling networks, and introduce financial incentives or subsidies to encourage sustainable packaging adoption globally

Composite Intermediate Bulk Containers Market Scope

The market is segmented on the basis of technology, material, capacity, and end use.

• By Technology

On the basis of technology, the composite intermediate bulk containers market is segmented into aseptic technology and non-aseptic technology. The aseptic technology segment held the largest market revenue share in 2024, driven by its ability to maintain product sterility, extend shelf life, and meet stringent food safety and pharmaceutical regulations. Aseptic IBCs are widely adopted in the food & beverage and healthcare industries where product safety and hygiene are critical.

The non-aseptic technology segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand from the chemical and construction sectors where sterilization is less critical. These IBCs are valued for their cost-effectiveness and durability, making them suitable for transporting bulk industrial liquids and semi-solids.

• By Material

On the basis of material, the market is segmented into plastics, aluminum, carbon steel, and galvanized iron. The plastics segment accounted for the largest market share in 2024 due to its lightweight nature, corrosion resistance, and cost efficiency, which make it ideal for transporting food products, chemicals, and pharmaceuticals.

The aluminum segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for recyclable and sustainable packaging solutions in industries focusing on reducing their carbon footprint.

• By Capacity

On the basis of capacity, the market is segmented into 180 to 250 gallons, 250 to 300 gallons, 300 to 350 gallons, and above 350 gallons. The 250 to 300 gallons segment held the largest revenue share in 2024, driven by its suitability for a wide range of industrial and commercial applications requiring medium-capacity liquid transportation.

The above 350 gallons segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing demand for bulk packaging solutions in large-scale chemical manufacturing and food processing plants.

• By End Use

On the basis of end use, the market is segmented into industrial chemicals, paints, inks & dyes, food & beverage, building & construction, and pharmaceuticals. The industrial chemicals segment dominated the market in 2024, attributed to the extensive use of composite IBCs for the safe and efficient transport of hazardous and non-hazardous chemicals across global supply chains.

The food & beverage segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for hygienic, sustainable, and cost-effective bulk packaging solutions for edible liquids and semi-liquids.

Composite Intermediate Bulk Containers Market Regional Analysis

- Europe dominated the composite intermediate bulk containers market with the largest revenue share of 41.25% in 2024, driven by stringent environmental regulations, a well-established industrial sector, and the rising demand for sustainable bulk packaging solutions

- The region’s focus on industrial safety, supply chain efficiency, and sustainable logistics practices has accelerated the adoption of composite intermediate bulk containers across chemical, pharmaceutical, and food & beverage industries

- In addition, growing investments in eco-friendly materials and advanced manufacturing technologies are further strengthening Europe’s leadership position in the global market

Germany Composite Intermediate Bulk Containers Market Insight

The Germany composite intermediate bulk containers market accounted for the largest revenue share in Europe in 2024, supported by the country’s strong chemical and industrial manufacturing base, strict EU regulations on packaging safety, and rapid adoption of reusable, recyclable bulk container solutions.

U.K. Composite Intermediate Bulk Containers Market Insight

The U.K. composite intermediate bulk containers market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand from food processing, pharmaceutical, and construction industries. Increasing emphasis on cost efficiency and sustainable packaging solutions is further boosting the adoption of composite intermediate bulk containers across the country.

North America Composite Intermediate Bulk Containers Market Insight

The North America composite intermediate bulk containers market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the demand for safe, durable, and reusable bulk packaging solutions in industries such as chemicals, food & beverages, and pharmaceuticals. The region’s growing adoption of eco-friendly logistics solutions and emphasis on industrial safety are propelling market expansion.

U.S. Composite Intermediate Bulk Containers Market Insight

The U.S. composite intermediate bulk containers market is expected to witness the fastest growth rate from 2025 to 2032, attributed to advanced logistics infrastructure, stringent packaging safety standards, and increasing industrialization. Growing demand for efficient bulk handling solutions across chemical, pharmaceutical, and food processing industries further supports market growth in the country.

Asia-Pacific Composite Intermediate Bulk Containers Market Insight

The Asia-Pacific composite intermediate bulk containers market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and growing investments in manufacturing and logistics sectors across China, India, and Japan. The region’s cost-competitive production capabilities and rising demand for efficient packaging solutions are accelerating market growth.

China Composite Intermediate Bulk Containers Market Insight

The China composite intermediate bulk containers market captured the largest revenue share in Asia-Pacific in 2024, attributed to expanding chemical, food processing, and construction industries, as well as rising export activities requiring safe and reliable bulk packaging solutions.

Japan Composite Intermediate Bulk Containers Market Insight

The Japan composite intermediate bulk containers market is expected to witness the fastest growth rate from 2025 to 2032 due to advanced technological capabilities, strong industrial infrastructure, and rising demand for efficient, eco-friendly bulk packaging solutions in chemical, pharmaceutical, and food industries.

Composite Intermediate Bulk Containers Market Share

The Composite Intermediate Bulk Containers industry is primarily led by well-established companies, including:

- Grief Inc. (U.S.)

- Snyder Industries, Inc. (U.S.)

- Hoover Ferguson Group Inc. (U.S.)

- Mauser Group B.V. (Netherlands)

- WERIT Kunststoffwerke W. Schneider GmbH & Co. KG (Germany)

- Composite Containers LLC (U.S.)

- Pacific Container Systems (U.S.)

- Pyramid IBC Containers (India)

- Time Technolplast Ltd. (India)

Latest Developments in Global Composite Intermediate Bulk Containers Market

- In October 2023, CDF Corp launched a new Form-Fit IBC liner manufacturing line in Germany in collaboration with J Natzan Kunststoffverarbeitung GmbH & Co KG. The initiative, operational by the end of 2023, marks their second European expansion since 2013. The Lienen facility specializes in producing liners for liquid to highly viscous products, offering environmentally responsible bulk packaging solutions. This move aligns with market trends towards sustainable packaging, reflecting the growing importance of environmental stewardship in the industry

- In September 2023, Greif, a global leader in industrial packaging, opened a new IBC manufacturing facility in Dilovasi, Turkey, on September 27, 2023. Spanning 13,000 square meters, it offers high-quality packaging solutions for food, chemical, and lubricant industries. The expansion aims to strengthen global presence, provide exceptional customer service, and foster partnerships for sustainable solutions. Greif's portfolio includes innovative products such as GCUBE Shield and GCUBE Elektron, meeting specific customer requirements with customized valves and robust cages

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Composite Intermediate Bulk Containers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Composite Intermediate Bulk Containers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Composite Intermediate Bulk Containers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.