Global Composites Market

Market Size in USD Billion

CAGR :

%

USD

110.85 Billion

USD

205.17 Billion

2024

2032

USD

110.85 Billion

USD

205.17 Billion

2024

2032

| 2025 –2032 | |

| USD 110.85 Billion | |

| USD 205.17 Billion | |

|

|

|

|

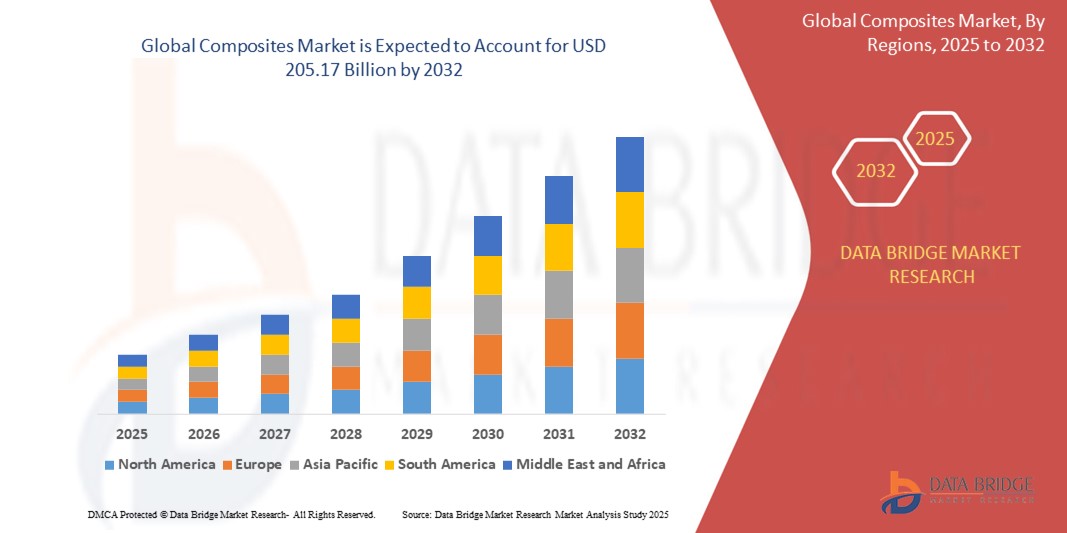

What is the Global Composites Market Size and Growth Rate?

- The global composites market size was valued at USD 110.85 billion in 2024 and is expected to reach USD 205.17 billion by 2032, at a CAGR of 8.00% during the forecast period

- In the aerospace industry, global composites play a pivotal role in revolutionizing aircraft manufacturing alongside traditional materials such as aluminum alloys. Composites, including carbon fiber-reinforced polymers (CFRP) and fiberglass-reinforced polymers (FRP), are extensively used in aircraft structures, including fuselages, wings, and tail sections, due to their exceptional strength-to-weight ratio and resistance to corrosion and fatigue. This enables the development of lightweight yet robust aircraft, enhancing fuel efficiency and overall performance

- For instance, NASA's award of a USD 800,000 Phase II STTR contract to AnalySwift LLC in July 2023 underscores the aerospace industry's reliance on advanced composites. The development of the Design Tool for Advanced Tailorable Composites (DATC) aims to enhance design capabilities, reflecting the industry's ongoing pursuit of innovative materials to improve aircraft performance, efficiency, and sustainability

What are the Major Takeaways of Composites Market?

- Composites offer advantages such as durability, corrosion resistance, and design flexibility, making them ideal for various infrastructure components such as bridges, buildings, pipelines, and roadways. Composites enable faster construction processes and lower maintenance costs, contributing to overall project efficiency and longevity

- As governments worldwide prioritize infrastructure upgrades and expansions, the demand for composites in these projects is expected to continue rising, fueling growth in the global composites market

- North America dominated the composites market with the largest revenue share of 38.7% in 2024, driven by strong demand from aerospace, automotive, defense, and renewable energy sectors

- Asia-Pacific composites market is poised to grow at the fastest CAGR of 22% from 2025 to 2032, driven by rapid urbanization, expanding infrastructure, and increasing demand from transportation, construction, and renewable energy sectors

- The Glass Fiber Composites segment dominated the composites market with the largest revenue share of 58.7% in 2024, owing to their cost-effectiveness, corrosion resistance, and versatility across automotive, construction, and marine applications

Report Scope and Composites Market Segmentation

|

Attributes |

Composites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Composites Market?

“Rising Adoption of Lightweight and Sustainable Composite Materials”

- A prominent and accelerating trend in the global composites market is the growing preference for lightweight, high-strength, and sustainable composite materials designed to improve product performance, reduce environmental impact, and support energy efficiency across industries. Modern composites are increasingly replacing traditional metals in sectors such as automotive, aerospace, and construction

- For instance, companies such as Hexcel Corporation and Toray Industries have introduced next-generation carbon fiber composites with enhanced durability, lower weight, and improved recyclability, addressing both performance and sustainability goals

- The emphasis on reducing fuel consumption and CO₂ emissions is driving demand for composites in electric vehicles, aircraft, and renewable energy applications, where lightweight structures play a critical role in improving energy efficiency

- Technological advancements such as thermoplastic composites, bio-based resins, and automated manufacturing processes are transforming the market, offering faster production, reduced costs, and eco-friendly alternatives

- This shift towards lightweight, sustainable, and high-performance composites is reshaping industry expectations, fueling demand across automotive, aerospace, marine, wind energy, and infrastructure sectors worldwide

What are the Key Drivers of Composites Market?

- The rising need for fuel-efficient vehicles, renewable energy infrastructure, and high-performance materials across critical industries are major drivers propelling the Composites market. Growing environmental regulations and emission reduction targets are accelerating the adoption of advanced composites globally

- For instance, in March 2024, SGL Carbon launched innovative carbon fiber composite solutions tailored for hydrogen storage and lightweight mobility, reflecting the market’s focus on green technologies

- Expanding use of composites in electric vehicles, wind turbine blades, and aerospace components is contributing significantly to market growth, offering weight reduction, corrosion resistance, and extended service life

- The increasing demand for durable, weather-resistant, and cost-effective construction materials is further supporting composites adoption in bridges, building facades, and infrastructure projects

- Moreover, manufacturers are investing in automation, sustainable raw materials, and recyclable composites to meet evolving industry requirements and global sustainability commitments

Which Factor is challenging the Growth of the Composites Market?

- Despite the market's growth potential, high production costs and complex manufacturing processes remain key challenges limiting the widespread adoption of composites, especially in cost-sensitive applications or emerging economies

- Limited recycling infrastructure and end-of-life disposal concerns for certain composite materials, particularly thermoset-based products, can hinder sustainability efforts and regulatory compliance

- For instance, industries in developing regions often rely on conventional materials such as steel or aluminum due to lower upfront costs, delaying the large-scale adoption of advanced composites

- In addition, technical limitations such as brittleness in some composites, performance variability, and design complexities can pose challenges for product development and structural applications

- Addressing these obstacles requires continuous innovation in material science, scalable recycling technologies, and cost reduction strategies to ensure composites become more accessible, sustainable, and competitive across industries

How is the Composites Market Segmented?

The market is segmented on the basis of fiber type, product, resin type, manufacturing process and end-use industry.

- By Fiber Type

On the basis of fiber type, the composites market is segmented into Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites, and Others. The Glass Fiber Composites segment dominated the Composites market with the largest revenue share of 58.7% in 2024, owing to their cost-effectiveness, corrosion resistance, and versatility across automotive, construction, and marine applications. Glass fiber composites offer excellent strength-to-weight ratios, making them a preferred choice for structural and lightweight components.

The Carbon Fiber Composites segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand for high-performance, lightweight materials in aerospace, defense, and electric vehicle applications. Carbon fiber composites are known for their superior strength, stiffness, and weight reduction capabilities, making them ideal for advanced engineering applications.

- By Product

On the basis of product, the composites market is segmented into Carbon and Glass. The Glass segment held the largest revenue share of 60.4% in 2024, supported by its widespread use in wind energy, automotive, and construction sectors due to affordability, durability, and ease of processing. Glass composites offer a reliable, lightweight alternative to metals in structural and insulation applications.

The Carbon segment is expected to experience the fastest growth rate from 2025 to 2032, attributed to increasing use in aerospace, defense, and sports equipment sectors where high strength, low weight, and superior performance are critical. The ongoing electrification of vehicles and demand for fuel efficiency are further accelerating carbon composites adoption.

- By Resin Type

On the basis of resin type, the composites market is segmented into Thermoset Composites and Thermoplastic Composites. The Thermoset Composites segment dominated the market with the largest revenue share of 67.9% in 2024, due to their superior structural performance, heat resistance, and widespread application in automotive, aerospace, and construction industries. Thermoset composites are favored for their rigidity, durability, and cost-effectiveness in large-volume production.

The Thermoplastic Composites segment is projected to witness the fastest growth rate from 2025 to 2032, driven by growing demand for lightweight, recyclable materials with excellent impact resistance and faster processing times. Thermoplastic composites are gaining traction in automotive, consumer goods, and medical device applications due to their reprocessability and design flexibility.

- By Manufacturing Process

On the basis of manufacturing process, the composites market is segmented into Lay-Up Process, Filament Winding Process, Injection Molding Process, Pultrusion Process, Compression Molding Process, Resin Transfer Molding (RTM) Process, and Others. The Lay-Up Process segment dominated the market with the largest revenue share of 33.2% in 2024, supported by its cost-effectiveness, design flexibility, and suitability for producing large, low-volume composite structures used in marine, wind energy, and construction industries.

The Injection Molding Process segment is expected to witness the fastest growth from 2025 to 2032, owing to its high production efficiency, suitability for mass production, and growing use in automotive and consumer goods applications. Injection molding offers precision, repeatability, and lower labor costs, driving its increasing adoption in composite manufacturing.

- By End-Use Industry

On the basis of end-use industry, the composites market is segmented into Transportation, Aerospace and Defense, Wind Energy, Construction and Infrastructure, Pipe and Tank, Marine, Electrical and Electronics, and Others. The Transportation segment accounted for the largest revenue share of 37.5% in 2024, fueled by rising demand for lightweight, fuel-efficient vehicles, growing adoption of electric mobility, and stringent emission regulations driving the replacement of traditional materials with composites.

The Aerospace and Defense segment is projected to record the fastest growth rate from 2025 to 2032, supported by increasing aircraft production, demand for fuel efficiency, and performance-driven composite solutions offering weight reduction, high strength, and design flexibility. The expansion of space exploration and defense modernization programs is further boosting composite adoption in this sector.

Which Region Holds the Largest Share of the Composites Market?

- North America dominated the composites market with the largest revenue share of 38.7% in 2024, driven by strong demand from aerospace, automotive, defense, and renewable energy sectors

- The region's well-established manufacturing infrastructure, coupled with advancements in lightweight materials and increasing adoption of electric vehicles, is boosting the use of composites

- High investments in aerospace, wind energy, and infrastructure projects, along with consumer preference for fuel-efficient and sustainable solutions, are accelerating composites adoption in North America

U.S. Composites Market Insight

The U.S. composites market captured the largest revenue share in North America in 2024, supported by the country's leadership in aerospace, defense, and automotive industries. Demand for lightweight, durable, and high-strength materials is rapidly growing across various applications, including aircraft, EVs, and wind turbines. Government initiatives promoting energy efficiency and sustainability, along with increasing investment in wind energy and infrastructure projects, are propelling market expansion. The U.S. is also witnessing technological advancements in carbon fiber and glass fiber composites to meet evolving industrial needs.

Europe Composites Market Insight

The Europe composites market is projected to witness stable growth, driven by stringent environmental regulations, the rising focus on electric mobility, and the renewable energy transition. Increasing use of composites in automotive lightweighting, aerospace innovation, and wind turbine production is boosting market demand. European manufacturers are investing heavily in sustainable, recyclable composite materials, aligning with the region's ambitious climate goals. The market is further supported by significant adoption across automotive, marine, and infrastructure sectors.

Germany Composites Market Insight

The Germany composites market is expected to grow at a considerable CAGR, fueled by the country’s robust automotive and aerospace industries and emphasis on advanced materials. Germany's strong focus on research, sustainability, and innovation is driving demand for lightweight composites, particularly in electric vehicles and renewable energy sectors. The integration of composites in vehicle structures, aircraft components, and wind energy applications is becoming increasingly prevalent, supporting the market's expansion.

U.K. Composites Market Insight

The U.K. composites market is anticipated to expand steadily, supported by the country's push for decarbonization, advanced aerospace programs, and rising demand for lightweight materials. Growing investments in electric vehicle manufacturing and renewable energy projects, coupled with government support for innovation, are encouraging wider adoption of composites. The integration of high-performance composites into automotive and defense applications is a key factor driving market growth.

Which Region is the Fastest Growing Region in the Composites Market?

Asia-Pacific composites market is poised to grow at the fastest CAGR of 22% from 2025 to 2032, driven by rapid urbanization, expanding infrastructure, and increasing demand from transportation, construction, and renewable energy sectors. Countries such as China, India, and Japan are witnessing heightened adoption of composites, supported by government initiatives promoting sustainable mobility, wind energy, and industrial growth. Furthermore, APAC's position as a manufacturing hub for automotive, aerospace, and composite components is making advanced materials more affordable and accessible, fueling market growth.

China Composites Market Insight

The China composites market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by the country's leadership in electric vehicle production, wind energy capacity, and large-scale construction projects. With strong domestic manufacturing, technological advancements, and government policies promoting lightweight materials and renewable energy, composites are gaining traction in automotive, aerospace, and infrastructure applications. China's growing demand for sustainable and high-performance materials is expected to further accelerate market expansion.

Japan Composites Market Insight

The Japan composites market is experiencing significant growth, driven by advancements in automotive, aerospace, and electronics industries. Japan's reputation for technological innovation, combined with the need for lightweight, durable materials, is fostering the integration of composites in transportation and renewable energy applications. The focus on electric vehicle production, high-speed rail, and wind energy projects, alongside the country's commitment to sustainability, is propelling the composites market forward.

Which are the Top Companies in Composites Market?

The composites industry is primarily led by well-established companies, including:

- Dow (U.S.)

- Halocarbon, LLC (U.S.)

- Freudenberg SE (Germany)

- The Chemours Company (U.S.)

- Metalubgroup (Israel)

- Huntsman International LLC (U.S.)

- Bostik (France)

- H.B. Fuller Company (U.S.)

- Sika AG (Switzerland)

- Cardolite Corporation (U.S.)

- DAIKIN (Japan)

- Kukdo Chemical Co., Ltd. (South Korea)

- BASF SE (Germany)

- Covestro AG (Germany)

- LANXESS (Germany)

- Dupont (U.S.)

- SOLVAY (Belgium)

- Wanhua (China)

- Arkema (France)

- Hexion (U.S.)

- Woodbridge (Canada)

What are the Recent Developments in Global Composites Market?

- In June 2024, Plastics processor Ensinger invested in expanding its production capacity for its composites division, with a high-performance double belt press set to begin operations in Rottenburg-Ergenzingen. This initiative will significantly enhance the efficient production of thermoplastic composite materials, strengthening Ensinger's foothold in the composites market

- In April 2024, Aurora Flight Sciences, a Boeing Company, expanded its manufacturing facility in Bridgeport, West Virginia, adding nearly 50,000 square feet to support the growing demand for high-quality composite components and assemblies across existing programs and new aerospace projects. This expansion reinforces Aurora's commitment to meeting increased global aerospace demands

- In March 2024, Toray Advanced Composites introduced its latest product, Toray Cetex TC915 PA+, designed for use in sporting goods, high-performance industrial applications, automotive structures, energy, Urban Air Mobility (UAM), and Unmanned Aerial Systems (UAS). This product launch strengthens Toray’s diversified composites portfolio and market competitiveness

- In February 2024, Owens Corning acquired Masonite for USD 3.9 billion, enhancing its presence in the building materials and glass reinforcement segments of its Composites division. This acquisition positions Owens Corning as a stronger player in the global composites market

- In July 2023, Toray Advanced Composites announced an expansion of its Morgan Hill, California, plant operations, with the addition of 74,000 square feet (6,800 square meters) to the campus. This development underscores Toray's efforts to meet the rising demand for advanced composite materials

- In June 2023, Solvay and Spirit AeroSystems entered into a strategic collaboration to advance composite development for sustainable aircraft technologies through joint research with a broad network of industry, academic, and supply-chain partners. This partnership accelerates innovation in eco-friendly aerospace materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Composites Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Composites Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Composites Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.