Global Computational Fluid Dynamics Market

Market Size in USD Billion

CAGR :

%

USD

6.80 Billion

USD

13.53 Billion

2025

2033

USD

6.80 Billion

USD

13.53 Billion

2025

2033

| 2026 –2033 | |

| USD 6.80 Billion | |

| USD 13.53 Billion | |

|

|

|

|

Computational Fluid Dynamics Market Size

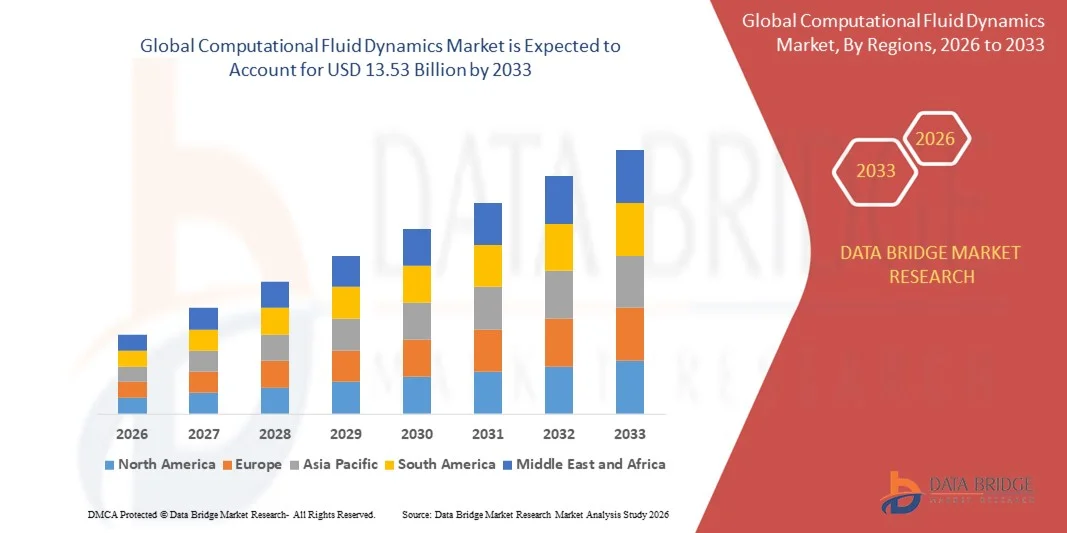

- The global computational fluid dynamics market size was valued at USD 6.80 billion in 2025 and is expected to reach USD 13.53 billion by 2033, at a CAGR of 8.98% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced simulation technologies and the increasing integration of computational fluid dynamics into product design and development processes across industries such as automotive, aerospace, energy, and industrial machinery

- Furthermore, rising demand for high-precision modeling, optimization of fluid flow, thermal management, and aerodynamics is establishing computational fluid dynamics as an essential tool for engineers and researchers. These converging factors are accelerating the uptake of computational fluid dynamics solutions, thereby significantly boosting the market’s growth

Computational Fluid Dynamics Market Analysis

- Computational fluid dynamics, offering high-fidelity simulations of fluid flow, heat transfer, and related phenomena, is increasingly vital in modern engineering and research applications across automotive, aerospace, energy, and industrial sectors due to its ability to reduce prototyping costs, enhance efficiency, and improve product performance

- The escalating demand for computational fluid dynamics solutions is primarily fueled by technological advancements in cloud computing, AI integration, and high-performance computing, growing industrial automation, and a rising preference for simulation-driven design and predictive analytics

- North America dominated the computational fluid dynamics market with a share of 35.5% in 2025, due to widespread adoption of advanced engineering simulation technologies, high investment in R&D, and strong presence of automotive and aerospace industries

- Asia-Pacific is expected to be the fastest growing region in the computational fluid dynamics market during the forecast period due to rapid industrialization, growing automotive and aerospace sectors, and increasing adoption of advanced engineering solutions in countries such as China, Japan, and India

- On- premises model segment dominated the market with a market share of 51.9% in 2025, due to organizations’ preference for complete control over sensitive simulation data and internal IT infrastructure. Enterprises in industries such as aerospace and automotive often prioritize on-premises deployment for its ability to handle complex and large-scale simulations without reliance on internet connectivity. The model also allows customization of hardware and software resources, enhancing performance and security for proprietary designs. In addition, on-premises solutions integrate seamlessly with legacy systems and existing computational resources, making them attractive to established companies. The reliability, predictability of costs, and the ability to comply with strict regulatory standards further reinforce its dominance

Report Scope and Computational Fluid Dynamics Market Segmentation

|

Attributes |

Computational Fluid Dynamics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Computational Fluid Dynamics Market Trends

Adoption of Cloud-Based and AI-Driven CFD Solutions

- A significant trend in the computational fluid dynamics market is the increasing adoption of cloud-based platforms and AI-driven simulation tools, driven by the rising need for faster, scalable, and more accurate analysis of fluid dynamics, thermal management, and aerodynamics across industries. This trend is transforming traditional simulation practices and allowing engineers to conduct complex analyses without relying solely on on-premises high-performance computing infrastructure

- For instance, Altair Inspire computational fluid dynamics offers cloud-enabled simulation that allows automotive and industrial engineers to run high-fidelity computational fluid dynamics models without extensive local hardware, improving accessibility and reducing time-to-insight. Such platforms are expanding computational fluid dynamics adoption among small and medium enterprises that previously faced computational constraints

- Siemens’ integration of AI into Simcenter STAR-CCM+ is enhancing solver efficiency and accuracy, automating tasks such as mesh generation and convergence optimization. This capability accelerates simulation workflows, enabling engineers to focus on design improvements rather than iterative solver tuning

- Ansys 2023 R1 emphasizes multi-GPU utilization and collaborative model-based systems engineering workflows, which allow engineering teams to simulate complex products in less time while maintaining high precision. The ability to integrate computational fluid dynamics into digital twin platforms further supports predictive maintenance and real-time performance optimization

- The increasing availability of cloud-based solutions is enabling global engineering teams to collaborate seamlessly on computational fluid dynamics projects, sharing models, results, and insights in real time. This enhances productivity and reduces design cycle times across automotive, aerospace, and energy sectors

- Industries such as renewable energy are leveraging cloud and AI-driven computational fluid dynamics tools to optimize wind turbine blade designs and energy efficiency, demonstrating how advanced simulation technologies are driving innovation, cost reduction, and performance enhancement across multiple domains

Computational Fluid Dynamics Market Dynamics

Driver

Rising Demand for Precise Simulations in Automotive and Aerospace

- The growing need for high-precision computational fluid dynamics simulations in automotive and aerospace industries is driving market growth, as manufacturers aim to optimize aerodynamics, thermal management, fuel efficiency, and overall vehicle performance. Computational fluid dynamics allows engineers to evaluate multiple design scenarios rapidly, reducing prototyping costs and improving product reliability

- For instance, Boeing employs computational fluid dynamics extensively for aerodynamic analysis of aircraft components, ensuring optimized airflow, reduced drag, and enhanced fuel efficiency. Such applications underscore the critical role of computational fluid dynamics in safety-critical and performance-sensitive engineering domains

- The automotive sector is increasingly integrating computational fluid dynamics into EV battery thermal management, combustion optimization, and airflow design to meet stringent regulatory standards and consumer expectations. Companies such as Tesla and General Motors leverage computational fluid dynamics to shorten development cycles and enhance vehicle efficiency

- Advancements in cloud-based simulation and high-performance computing have expanded computational fluid dynamics accessibility, allowing engineers to conduct precise simulations even for highly complex geometries. This trend is reinforcing computational fluid dynamics adoption across global manufacturing and research sectors

- The increasing focus on sustainability and energy-efficient product design further strengthens the reliance on computational fluid dynamics for predictive modeling and optimization, supporting faster innovation while minimizing environmental impact

Restraint/Challenge

High Computational Costs and Need for Skilled Engineers

- The computational fluid dynamics market faces challenges due to the high cost of software licenses, cloud computing resources, and the need for specialized hardware such as multi-GPU clusters. These factors create entry barriers for small and medium-sized enterprises and limit widespread adoption

- For instance, implementing high-fidelity simulations with Ansys Fluent or Siemens STAR-CCM+ requires significant computational power and also engineers trained in computational fluid dynamics principles, meshing strategies, and solver optimization. This combination of cost and skill requirement can slow market penetration

- Complex simulations often require extensive pre-processing, meshing, and post-processing steps, increasing project timelines and operational expenses. Maintaining accuracy and convergence in large-scale simulations demands experienced professionals, further elevating labor costs

- In addition, scaling computational fluid dynamics solutions across multiple teams or locations involves managing software licenses, data security, and IT infrastructure, which adds to operational challenges. Companies must balance cost, expertise, and technological investment to fully exploit computational fluid dynamics capabilities

- These challenges collectively restrict rapid adoption, particularly in regions or industries where technical expertise or financial resources are limited, emphasizing the need for accessible, user-friendly, and cost-effective computational fluid dynamics solutions

Computational Fluid Dynamics Market Scope

The market is segmented on the basis of deployment model and end-user.

- By Deployment Model

On the basis of deployment model, the computational fluid dynamics market is segmented into cloud-based and on-premises models. The on-premises model dominated the market with the largest revenue share of 51.9% in 2025, driven by organizations’ preference for complete control over sensitive simulation data and internal IT infrastructure. Enterprises in industries such as aerospace and automotive often prioritize on-premises deployment for its ability to handle complex and large-scale simulations without reliance on internet connectivity. The model also allows customization of hardware and software resources, enhancing performance and security for proprietary designs. In addition, on-premises solutions integrate seamlessly with legacy systems and existing computational resources, making them attractive to established companies. The reliability, predictability of costs, and the ability to comply with strict regulatory standards further reinforce its dominance.

The cloud-based model is anticipated to witness the fastest growth rate of 23.1% from 2026 to 2033, fueled by increasing adoption among small and medium enterprises and research institutions seeking flexible, scalable, and cost-effective computational fluid dynamics solutions. For instance, ANSYS Cloud offers simulation-as-a-service, enabling users to run complex computational fluid dynamics simulations without investing in high-performance computing infrastructure. The cloud model provides rapid deployment, collaborative workflows, and pay-as-you-go pricing, making it suitable for dynamic project requirements. Its growing integration with AI-driven simulation and high-performance computing further accelerates adoption. Ease of remote access and cross-geography collaboration enhances productivity, particularly for global engineering teams.

- By End User

On the basis of end user, the computational fluid dynamics market is segmented into automotive, aerospace and defense, electrical and electronics, industrial machinery, energy, material and chemical processing, and others. The automotive segment dominated the market with the largest revenue share in 2025, driven by the increasing need for vehicle aerodynamics optimization, fuel efficiency improvements, and electric vehicle thermal management. Automotive OEMs prioritize computational fluid dynamics for reducing design cycles, enhancing safety features, and complying with stringent emission regulations. The demand for lightweight components and high-performance engines further reinforces the segment’s dominance. computational fluid dynamics solutions enable predictive analysis of airflow, heat transfer, and combustion processes, allowing engineers to optimize designs before physical prototyping. In addition, collaborations between automotive companies and computational fluid dynamics software providers enhance innovation and deployment across global production facilities.

The aerospace and defense segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising investments in aircraft design, UAV development, and defense simulation projects. For instance, Siemens Simcenter STAR-CCM+ is widely adopted for simulating aerodynamics and propulsion systems in aerospace applications. The segment benefits from the need for precise modeling of high-speed airflow, thermal stresses, and structural dynamics to ensure safety and performance. Increasing adoption of unmanned aerial vehicles and advanced defense systems further drives demand. Computational fluid dynamics enables cost-effective testing of complex scenarios, reducing reliance on expensive wind tunnel experiments. Integration with AI and digital twin technology enhances predictive capabilities, making aerospace and defense a rapidly growing end-user segment.

Computational Fluid Dynamics Market Regional Analysis

- North America dominated the computational fluid dynamics market with the largest revenue share of 35.5% in 2025, driven by widespread adoption of advanced engineering simulation technologies, high investment in R&D, and strong presence of automotive and aerospace industries

- Organizations in the region prioritize computational fluid dynamics for optimizing product design, enhancing efficiency, and reducing prototyping costs. The integration of computational fluid dynamics with AI and high-performance computing further supports its adoption across automotive, aerospace, and energy sectors

- This strong adoption is further reinforced by advanced IT infrastructure, availability of skilled simulation engineers, and supportive regulatory frameworks, establishing computational fluid dynamics solutions as essential tools for product innovation and operational efficiency

U.S. Computational Fluid Dynamics Market Insight

The U.S. computational fluid dynamics market captured the largest revenue share in 2025 within North America, fueled by extensive adoption in automotive and aerospace design, energy systems, and industrial machinery. Leading manufacturers increasingly utilize computational fluid dynamics for aerodynamics, thermal management, and fluid flow optimization. The growth of cloud and on-premises computational fluid dynamics platforms allows companies to scale simulations efficiently while maintaining data security. Moreover, collaborations between software providers and industrial enterprises are accelerating innovation, enabling faster design iterations and predictive modeling capabilities. The integration of computational fluid dynamics with IoT and digital twin technologies further strengthens the market’s expansion.

Europe Computational Fluid Dynamics Market Insight

The Europe computational fluid dynamics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by advanced aerospace, automotive, and energy sectors emphasizing sustainability and efficiency. Increasing urbanization and government initiatives promoting research and innovation support the adoption of simulation technologies. European manufacturers are investing in computational fluid dynamics solutions to optimize energy consumption, improve safety standards, and reduce operational costs. The market growth is also encouraged by collaborations between academic institutions and industries, fostering development of specialized simulation tools. computational fluid dynamics is becoming a standard in both product development and performance testing across the region.

U.K. Computational Fluid Dynamics Market Insight

The U.K. computational fluid dynamics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by investments in aerospace, automotive, and energy sectors seeking precise simulation capabilities. The emphasis on digital transformation and adoption of Industry 4.0 technologies motivates companies to integrate computational fluid dynamics into design and manufacturing workflows. In addition, strong engineering talent, coupled with government incentives for innovation, encourages the use of cloud-based and on-premises computational fluid dynamics platforms. Demand for accurate thermal, aerodynamic, and fluid flow analysis in manufacturing and research applications further propels market growth.

Germany Computational Fluid Dynamics Market Insight

The Germany computational fluid dynamics market is expected to expand at a considerable CAGR during the forecast period, fueled by robust industrial and automotive sectors focused on efficiency and sustainability. German manufacturers prioritize computational fluid dynamics for optimizing fuel consumption, reducing emissions, and improving product safety. Well-established R&D infrastructure, strong technical expertise, and government support for advanced simulation technologies facilitate market adoption. Integration of computational fluid dynamics with digital twins and high-performance computing enhances predictive capabilities, making Germany a key hub for simulation-based innovation. The trend toward smart factories and eco-conscious design solutions further accelerates adoption.

Asia-Pacific Computational Fluid Dynamics Market Insight

The Asia-Pacific computational fluid dynamics market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid industrialization, growing automotive and aerospace sectors, and increasing adoption of advanced engineering solutions in countries such as China, Japan, and India. The region’s rising focus on manufacturing efficiency, energy optimization, and R&D investment promotes computational fluid dynamics integration across industries. Furthermore, the availability of cost-effective simulation software and cloud-based solutions expands access to SMEs and research institutions, fostering widespread adoption. Growing government initiatives to support high-tech manufacturing and smart industry development contribute to rapid market growth.

Japan Computational Fluid Dynamics Market Insight

The Japan computational fluid dynamics market is gaining momentum due to the country’s strong automotive, electronics, and aerospace industries, coupled with a high focus on R&D and technological innovation. Japanese manufacturers leverage computational fluid dynamics for thermal management, aerodynamics, and process optimization in production and design. Integration with AI and digital twin platforms enhances simulation accuracy and reduces development timelines. Moreover, Japan’s emphasis on precision engineering and energy-efficient designs drives continuous investment in both on-premises and cloud-based computational fluid dynamics solutions.

China Computational Fluid Dynamics Market Insight

The China computational fluid dynamics market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid industrialization, expansion of automotive and aerospace sectors, and government support for advanced engineering technologies. China’s growing middle-class industrial base and increasing focus on smart manufacturing promote computational fluid dynamics adoption across automotive, energy, and chemical processing industries. Availability of cost-effective software, skilled simulation talent, and strong domestic software providers further propels market growth. The push towards smart factories, digital twin integration, and energy-efficient design solutions establishes China as a key leader in the regional computational fluid dynamics market.

Computational Fluid Dynamics Market Share

The computational fluid dynamics industry is primarily led by well-established companies, including:

- ANSYS Inc. (U.S.)

- Autodesk Inc. (U.S.)

- COMSOL Inc. (U.S.)

- Dassault Systèmes (France)

- Hexagon AB (Sweden)

- PTC Inc. (U.S.)

- Siemens Digital Industries Software (Germany)

- Altair Engineering Inc. (U.S.)

- NUMECA International (Belgium)

- Convergent Science (U.S.)

- ESI Group (France)

- Flow Science, Inc. (U.S.)

- CD‑adapco (acquired by Siemens) (U.S.)

- SimScale GmbH (Germany)

- ENGYS Ltd. (U.K.)

- AspenTech (U.S.)

Latest Developments in Global Computational Fluid Dynamics Market

- In May 2025, nTop launched its new CFD solution, nTop Fluids, designed to streamline simulation workflows for engineers and reduce iteration bottlenecks significantly — this advancement enables faster product design cycles, allowing engineers to explore multiple design variations quickly and efficiently. The solution supports industries such as automotive, aerospace, and industrial machinery by accelerating innovation, lowering time-to-market, and improving overall product performance, strengthening the adoption of advanced CFD tools across sectors

- In February 2025, Altair Engineering introduced Altair Inspire CFD, a cloud-based solution tailored for automotive and industrial applications, featuring faster simulation times and highly intuitive interfaces — this release makes CFD technology more accessible to small and medium enterprises, enabling a broader user base to perform high-fidelity simulations. The cloud-based architecture allows for scalable computing, reducing the need for heavy on-premises infrastructure while supporting collaborative workflows and accelerating engineering decision-making

- In June 2025, Siemens expanded Simcenter STAR-CCM+ by integrating advanced AI and GPU acceleration, enhancing the precision and speed of CFD simulations — the AI-driven features improve solver efficiency and reduce setup time, enabling engineers to handle complex fluid dynamics problems with higher accuracy. These enhancements are particularly impactful in aerospace, automotive, and energy industries, where faster, data-driven design iterations translate into cost savings and superior performance of products

- In January 2023, Ansys Inc. released Ansys 2023 R1, which introduced cloud-based options, optimized multi-GPU usage, and support for collaborative model-based systems engineering (MBSE) workflows — this update significantly enhances simulation efficiency for intricate products, enabling teams to conduct high-fidelity simulations in a shorter time frame. The MBSE integration promotes cross-functional collaboration, ensuring that CFD analysis is seamlessly aligned with product design and development processes, increasing the adoption of simulation-driven engineering

- In March 2026, COMSOL Multiphysics unveiled its latest CFD module update, emphasizing multiphysics coupling and real-time simulation analytics — this development allows engineers to integrate fluid dynamics with structural, thermal, and electromagnetic simulations, offering a comprehensive view of product performance under complex operating conditions. By enabling real-time feedback and visualization, this module accelerates iterative testing, reduces the need for physical prototyping, and strengthens CFD adoption across high-tech manufacturing, energy, and aerospace sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Computational Fluid Dynamics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Computational Fluid Dynamics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Computational Fluid Dynamics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.