Global Concealed Weapon Detection Systems Market

Market Size in USD Million

CAGR :

%

USD

242.01 Million

USD

388.65 Million

2025

2033

USD

242.01 Million

USD

388.65 Million

2025

2033

| 2026 –2033 | |

| USD 242.01 Million | |

| USD 388.65 Million | |

|

|

|

|

Concealed Weapon Detection Systems Market Size

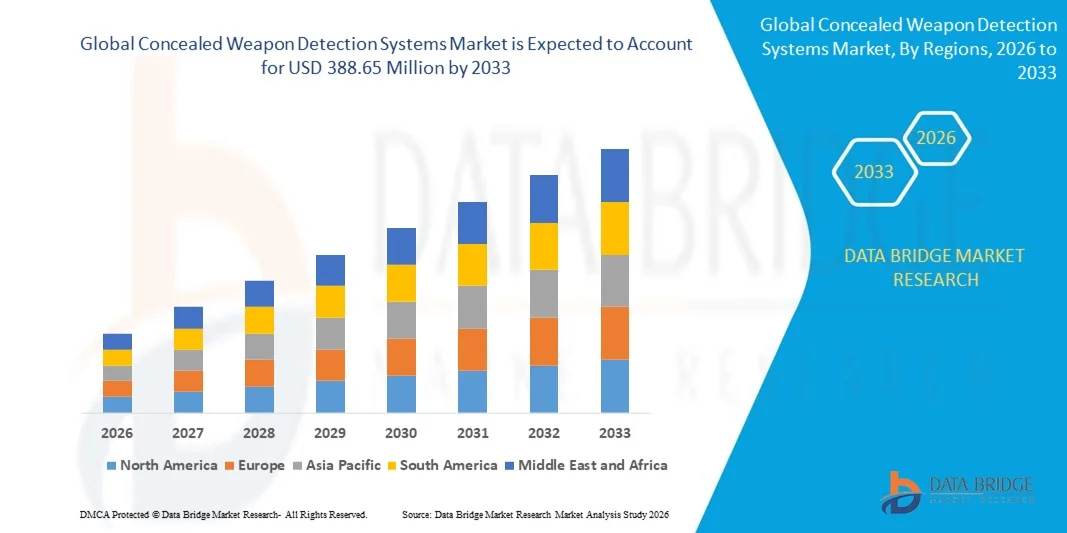

- The global concealed weapon detection systems market size was valued at USD 242.01 million in 2025 and is expected to reach USD 388.65 million by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely driven by rising security concerns across public spaces and critical infrastructure, coupled with increasing investments in advanced surveillance and threat detection technologies by governments and private entities

- Furthermore, the growing need for fast, non-intrusive, and highly accurate screening solutions at airports, transportation hubs, stadiums, and government facilities is accelerating the adoption of concealed weapon detection systems, thereby significantly supporting overall market expansion

Concealed Weapon Detection Systems Market Analysis

- Concealed weapon detection systems, enabling contactless identification of metallic and non-metallic threats, are becoming essential components of modern security frameworks across transportation, defense, and public venues due to their ability to enhance safety without disrupting passenger flow

- The increasing demand for these systems is primarily fueled by heightened public safety awareness, stricter security regulations, and rapid technological advancements in millimeter wave imaging, AI-based threat recognition, and real-time analytics

- North America dominated the concealed weapon detection systems market with a share of 39.5% in 2025, due to heightened security concerns, rising incidents of public safety threats, and strong investments in advanced surveillance technologies

- Asia-Pacific is expected to be the fastest growing region in the concealed weapon detection systems market during the forecast period due to rapid urbanization, increasing passenger traffic, and rising security investments across emerging economies

- Millimeter wave body scanners segment dominated the market with a market share of around 45% in 2025, due to their ability to detect both metallic and non-metallic threats without physical contact. These systems are widely adopted across airports and high-security public venues due to fast screening speeds and high detection accuracy. Regulatory acceptance and continuous technological upgrades further strengthen their dominance

Report Scope and Concealed Weapon Detection Systems Market Segmentation

|

Attributes |

Concealed Weapon Detection Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Concealed Weapon Detection Systems Market Trends

Growing Use of Contactless Weapon Detection

- A major trend in the concealed weapon detection systems market is the increasing adoption of contactless and walkthrough screening technologies that enable rapid threat identification without physical searches. This trend is driven by the need to improve security efficiency while maintaining smooth movement of people across high-traffic public environments

- For instance, Liberty Defense Technologies has deployed its HEXWAVE walkthrough concealed weapon detection system at major U.S. airports and government facilities to enable contactless screening of personnel and visitors. These deployments demonstrate how advanced imaging and AI-driven analysis can enhance detection accuracy while reducing bottlenecks at security checkpoints

- Transportation hubs are increasingly shifting toward non-intrusive screening solutions to address rising passenger volumes and evolving threat profiles. Contactless systems support continuous flow screening, making them suitable for airports, metro stations, and border control environments where efficiency is critical

- Public venues such as stadiums and event arenas are also adopting contactless weapon detection to balance crowd safety with visitor experience. This trend reflects a broader preference for security systems that operate discreetly without creating a perception of excessive surveillance

- Advancements in millimeter wave and passive sensing technologies are further strengthening this trend by improving detection of both metallic and non-metallic threats. These innovations are positioning contactless weapon detection as a core component of modern public safety infrastructure

- The growing reliance on seamless, privacy-conscious screening solutions is reinforcing long-term adoption of contactless detection systems. This trend is shaping procurement strategies across government and commercial sectors focused on scalable and efficient security models

Concealed Weapon Detection Systems Market Dynamics

Driver

Rising Public Safety and Security Regulations

- The concealed weapon detection systems market is strongly driven by increasing public safety concerns and the enforcement of stricter security regulations across transportation and public infrastructure. Governments and regulatory bodies are mandating enhanced screening measures to mitigate risks associated with concealed firearms and other weapons

- For instance, the U.S. Transportation Security Administration continues to invest in advanced screening technologies to strengthen airport and workforce security. Programs supporting next-generation detection systems are accelerating adoption of AI-enabled and contactless weapon detection solutions

- Regulatory requirements for aviation security and critical infrastructure protection are compelling facility operators to upgrade legacy screening systems. These mandates are driving consistent demand for advanced detection platforms that comply with evolving safety standards

- Educational institutions and government buildings are also experiencing increased regulatory pressure to improve on-site security. This is supporting broader deployment of concealed weapon detection systems beyond traditional airport environments

- The continued strengthening of safety regulations across public and private sectors is sustaining long-term investment in concealed weapon detection technologies. This driver is positioning the market for steady expansion as compliance requirements intensify

Restraint/Challenge

High Cost of Deployment

- The concealed weapon detection systems market faces challenges related to the high cost of system deployment and integration across large facilities. Advanced imaging technologies, AI software, and supporting infrastructure significantly increase upfront investment requirements

- For instance, deployment of high-performance systems from vendors such as Rapiscan Systems or Smiths Detection involves substantial capital expenditure for hardware, installation, and system calibration. These costs can limit adoption among budget-constrained institutions and smaller venues

- Ongoing expenses related to system maintenance, software upgrades, and personnel training further add to the total cost of ownership. This creates financial barriers for organizations seeking scalable security solutions

- Integration of concealed weapon detection systems with existing security infrastructure can be complex and resource-intensive. Facilities often need to modify layouts or upgrade complementary systems to ensure optimal performance

- The challenge of balancing advanced detection capabilities with affordability continues to influence purchasing decisions. Addressing cost efficiency while maintaining detection accuracy remains a key constraint shaping market adoption dynamics

Concealed Weapon Detection Systems Market Scope

The market is segmented on the basis of product, type, and application.

- By Product

On the basis of product, the concealed weapon detection systems market is segmented into millimeter wave body scanners, X-ray body scanners, and terahertz body scanners. The millimeter wave body scanners segment dominated the market with the largest revenue share of around 45% in 2025, driven by their ability to detect both metallic and non-metallic threats without physical contact. These systems are widely adopted across airports and high-security public venues due to fast screening speeds and high detection accuracy. Regulatory acceptance and continuous technological upgrades further strengthen their dominance.

The terahertz body scanners segment is anticipated to witness the fastest growth from 2026 to 2033, supported by advancements in passive imaging and enhanced material differentiation capabilities. Terahertz systems offer improved privacy protection and reduced health concerns compared to X-ray technologies. Growing investments in next-generation security screening and pilot deployments at sensitive locations are accelerating their adoption.

- By Type

On the basis of type, the concealed weapon detection systems market is segmented into stationary and mobile systems. The stationary segment accounted for the dominant market share in 2025, owing to its extensive deployment at fixed security checkpoints such as airports, government buildings, and correctional facilities. These systems provide consistent monitoring, higher throughput, and seamless integration with existing security infrastructure. Long operational lifespans and reliability make them a preferred choice for permanent installations.

The mobile segment is expected to register the fastest growth during the forecast period, driven by increasing demand for flexible and rapidly deployable security solutions. Mobile systems are gaining traction at temporary events, pop-up checkpoints, and emergency response scenarios. Their portability, quick setup, and ability to support dynamic security needs are key factors supporting accelerated adoption.

- By Application

On the basis of application, the concealed weapon detection systems market is segmented into transportation infrastructure, correctional facilities, stadiums and sports arenas, military and defence, and others. Transportation infrastructure emerged as the dominant segment in 2025, supported by stringent aviation and transit security regulations. High passenger volumes and the critical need for rapid, non-intrusive screening drive consistent investments in advanced detection systems. Ongoing modernization of airport security globally further sustains this leadership.

The stadiums and sports arenas segment is projected to witness the fastest growth from 2026 to 2033, fueled by rising concerns over public safety at mass gathering venues. Event organizers are increasingly adopting concealed weapon detection to balance security with crowd flow efficiency. The emphasis on unobtrusive screening and enhanced visitor experience is accelerating deployment across entertainment venues.

Concealed Weapon Detection Systems Market Regional Analysis

- North America dominated the concealed weapon detection systems market with the largest revenue share of 39.5% in 2025, driven by heightened security concerns, rising incidents of public safety threats, and strong investments in advanced surveillance technologies

- Security agencies and facility operators in the region prioritize rapid, non-intrusive screening solutions that can handle high footfall while maintaining detection accuracy across transportation hubs and public venues

- This strong adoption is supported by advanced security infrastructure, proactive government initiatives, and high spending on homeland security, positioning concealed weapon detection systems as a critical component across airports, government buildings, and large event venues

U.S. Concealed Weapon Detection Systems Market Insight

The U.S. concealed weapon detection systems market captured the largest revenue share within North America in 2025, driven by stringent security regulations and large-scale deployment across airports, schools, stadiums, and federal facilities. Growing concerns over gun-related violence are accelerating the adoption of AI-enabled and contactless screening technologies. Continuous upgrades in aviation security, coupled with strong defense spending and rapid technology commercialization, are further strengthening market growth.

Europe Concealed Weapon Detection Systems Market Insight

The Europe concealed weapon detection systems market is projected to expand at a steady CAGR during the forecast period, primarily driven by increasing focus on public safety and counter-terrorism measures. Rising investments in transportation security and smart infrastructure are supporting system deployments across airports and rail networks. European countries are emphasizing privacy-compliant and non-invasive screening technologies, supporting broader acceptance across civilian environments.

U.K. Concealed Weapon Detection Systems Market Insight

The U.K. concealed weapon detection systems market is anticipated to grow at a notable CAGR, supported by heightened security requirements at public venues and transportation facilities. Increasing adoption across stadiums, entertainment venues, and urban transit systems is strengthening demand. Government-led initiatives to modernize security screening and improve threat detection efficiency are expected to sustain market momentum.

Germany Concealed Weapon Detection Systems Market Insight

The Germany concealed weapon detection systems market is expected to expand at a considerable CAGR, driven by strong emphasis on public safety, infrastructure protection, and advanced technology adoption. Germany’s focus on precision engineering and data protection supports the uptake of high-accuracy, privacy-focused detection systems. Growing deployments across airports, government buildings, and industrial facilities are contributing to steady market growth.

Asia-Pacific Concealed Weapon Detection Systems Market Insight

The Asia-Pacific concealed weapon detection systems market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, increasing passenger traffic, and rising security investments across emerging economies. Governments are strengthening security frameworks for airports, metro systems, and public venues. Expanding infrastructure development and growing awareness of advanced screening technologies are accelerating regional adoption.

Japan Concealed Weapon Detection Systems Market Insight

The Japan concealed weapon detection systems market is gaining traction due to strong emphasis on public safety, advanced technological capabilities, and high standards for threat prevention. Deployment across transportation hubs and public facilities is increasing as authorities focus on non-disruptive security screening. Integration of detection systems with smart surveillance and analytics platforms is further supporting market growth.

China Concealed Weapon Detection Systems Market Insight

The China concealed weapon detection systems market accounted for the largest revenue share in Asia Pacific in 2025, supported by rapid infrastructure expansion, large-scale public transportation networks, and heightened focus on internal security. Strong government investments in smart city projects and public safety modernization are driving widespread system adoption. The presence of domestic technology providers and large deployment volumes across airports and urban facilities continue to propel market expansion.

Concealed Weapon Detection Systems Market Share

The concealed weapon detection systems industry is primarily led by well-established companies, including:

- Smiths Detection Group Ltd. (U.K.)

- Leidos (U.S.)

- TeraSense Group (U.S.)

- Rapiscan Systems (U.S.)

- TNO (Netherlands)

- QinetiQ (U.K.)

- NUCTECH Company Limited (China)

- Rohde & Schwarz (Germany)

- Liberty Defense (Canada)

- Astrophysics Inc. (U.S.)

- Autoclear, LLC. (U.S.)

- Bruker (U.S.)

- FLIR Systems, Inc. (U.S.)

- Hitachi, Ltd. (Japan)

- Gilardoni S.p.A. (Italy)

- Westminster International Ltd. (U.K.)

- Vidisco Ltd. (Israel)

Latest Developments in Global Concealed Weapon Detection Systems Market

- In June 2025, Liberty Defense Technologies, Inc. successfully completed extensive testing and evaluation of its HEXWAVE concealed weapon detection system at major U.S. judicial and correctional facilities, demonstrating reliable detection of both metallic and non-metallic threats. This milestone reinforces confidence in walkthrough, contactless screening solutions and supports broader market penetration beyond airports into government and correctional infrastructure

- In February 2025, Leidos Holdings, Inc. announced a partnership with SeeTrue to integrate AI-driven threat detection into its ClearScan CT screening systems, strengthening automated identification of concealed weapons and prohibited items. This development highlights the growing role of artificial intelligence in improving screening accuracy, reducing manual intervention, and accelerating adoption of advanced detection technologies across aviation and high-security facilities

- In May 2024, Liberty Defense Technologies, Inc. completed the sale of its HEXWAVE detection system to a major U.S. international airport in New York for TSA worker screening, marking increased deployment of advanced concealed weapon detection for workforce security. This implementation underscores rising demand for efficient, non-intrusive screening solutions within airport operational environments and strengthens the commercial adoption outlook

- In September 2024, Liberty Defense received a contract modification from the TSA adding $1.69 million in funding to continue development of its HD-AIT upgrade kit, supporting enhancements in imaging performance and threat recognition capabilities. This funding reflects sustained government commitment to modernizing screening infrastructure and accelerates innovation within the concealed weapon detection systems market

- In November 2024, Liberty Defense highlighted progress aligned with TSA-led airport security modernization initiatives focused on upgrading legacy screening technologies, signaling increased procurement opportunities for next-generation concealed weapon detection systems. This momentum is expected to drive long-term market growth as security agencies transition toward advanced, AI-enabled, and contactless screening platforms across public venues

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Concealed Weapon Detection Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Concealed Weapon Detection Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Concealed Weapon Detection Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.