Global Consumer Audio Market

Market Size in USD Billion

CAGR :

%

USD

1.31 Billion

USD

3.76 Billion

2025

2033

USD

1.31 Billion

USD

3.76 Billion

2025

2033

| 2026 –2033 | |

| USD 1.31 Billion | |

| USD 3.76 Billion | |

|

|

|

|

Consumer Audio Market Size

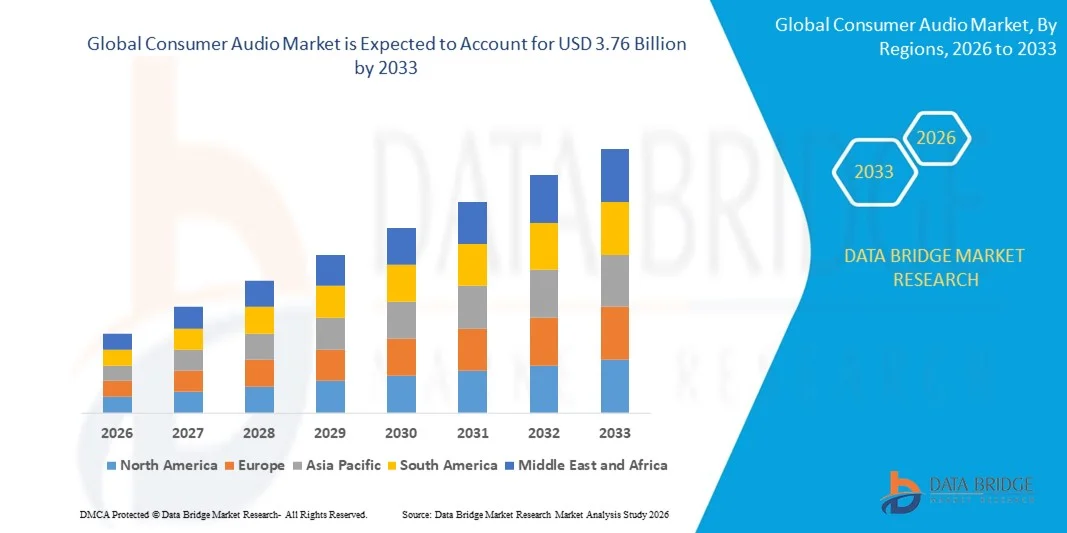

- The global consumer audio market size was valued at USD 1.31 billion in 2025 and is expected to reach USD 3.76 billion by 2033, at a CAGR of 14.10% during the forecast period

- The market growth is largely fueled by the increasing adoption of wireless and smart audio devices, along with rapid technological advancements in headphones, speakers, and sound systems, leading to enhanced digital experiences in both residential and commercial settings

- Furthermore, rising consumer demand for high-quality, portable, and interconnected audio solutions is establishing smart and wireless audio products as essential components of modern entertainment and work-from-home setups. These converging factors are accelerating the adoption of consumer audio devices, thereby significantly boosting the industry's growth

Consumer Audio Market Analysis

- Consumer audio devices, including headphones, speakers, soundbars, and smart audio systems, are increasingly vital for personal entertainment, professional use, and connected home experiences due to their enhanced sound quality, portability, and seamless integration with smartphones, streaming platforms, and smart home ecosystems

- The escalating demand for consumer audio products is primarily fueled by the widespread adoption of smart devices, growing preference for wireless and high-fidelity audio, and increasing interest in immersive sound experiences for music, gaming, and multimedia consumption

- North America dominated the consumer audio market with a share of 45.5% in 2025, due to a growing demand for personal entertainment, gaming, and connected audio devices

- Asia-Pacific is expected to be the fastest growing region in the consumer audio market during the forecast period due to rising urbanization, increasing disposable incomes, and technological adoption in countries such as China, Japan, and India

- Smart devices segment dominated the market with a market share of 54.7% in 2025, due to consumer preference for audio devices that offer voice assistant integration, app control, and AI-enhanced sound customization. Smart audio devices provide seamless connectivity with smartphones, smart home systems, and streaming platforms, creating a more interactive and personalized listening experience

Report Scope and Consumer Audio Market Segmentation

|

Attributes |

Consumer Audio Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Consumer Audio Market Trends

Growing Adoption of Wireless and Smart Audio Devices

- A prominent trend in the consumer audio market is the increasing adoption of wireless and smart audio devices, driven by consumer demand for mobility, convenience, and enhanced audio experiences. These devices are redefining listening habits by providing seamless connectivity, voice control, and integration with smartphones and smart home ecosystems

- For instance, Apple’s AirPods and Sonos smart speakers are widely recognized for their wireless convenience, intuitive controls, and compatibility with digital assistants such as Siri and Alexa. These products have fueled consumer preference for devices that combine portability with high-quality audio performance

- The proliferation of Bluetooth-enabled headphones, true wireless earbuds, and portable speakers is shaping the market by offering users flexible listening options across home, office, and outdoor environments. This trend is supporting the rapid replacement of traditional wired audio devices with smarter, more versatile alternatives

- Streaming services and smart device ecosystems are driving demand for audio hardware capable of high-fidelity playback, multi-device synchronization, and adaptive sound technologies. Consumers increasingly expect seamless experiences across devices, reinforcing innovation in audio processing and software integration

- Brands are focusing on integrating AI-powered features, such as noise cancellation, spatial audio, and adaptive sound profiling, to enhance user experience. These advancements are positioning smart audio products as essential lifestyle accessories that cater to both casual listeners and audiophiles

- The growing convergence of audio, entertainment, and home automation sectors is accelerating the development of multi-functional smart speakers and headphones. This is expanding the market footprint and reinforcing consumer expectations for devices that deliver both convenience and immersive audio experiences

Consumer Audio Market Dynamics

Driver

Increasing Demand for High-Quality and Portable Audio Solutions

- Rising consumer preference for high-quality audio combined with portability is driving the market, as users seek devices that deliver premium sound performance while supporting mobile lifestyles. Manufacturers are responding with compact, battery-efficient devices that maintain audio fidelity across varied use cases

- For instance, Bose offers portable speakers and noise-canceling headphones that provide professional-grade sound in a compact form factor. These products meet the growing need for personal and on-the-go audio solutions across commuting, travel, and home settings

- The rising penetration of smartphones, tablets, and connected devices is increasing demand for wireless audio accessories that integrate seamlessly into digital ecosystems. This trend emphasizes convenience without compromising sound quality, influencing product design and innovation

- Consumers are prioritizing devices capable of supporting multi-room audio setups, voice assistants, and high-resolution streaming. This is encouraging manufacturers to develop solutions that combine portability, smart functionality, and superior audio reproduction

- The increasing awareness of audio quality and immersive listening experiences is driving growth in premium segments. Products offering spatial sound, adaptive equalization, and high-fidelity performance are becoming key purchase drivers for both casual users and audiophiles

Restraint/Challenge

Intense Competition and Rapid Technological Obsolescence

- The consumer audio market faces challenges due to intense competition among established brands and new entrants, which exerts pressure on pricing, differentiation, and market share. Rapid technology evolution requires continuous innovation to maintain relevance in a fast-moving industry

- For instance, companies such as Sony regularly update product lines with advanced features such as noise-canceling algorithms and high-resolution audio support. These frequent upgrades highlight the pace at which existing devices become outdated, creating replacement cycles and consumer hesitation

- The need for frequent software updates, firmware compatibility, and integration with evolving smart home ecosystems increases product complexity. Manufacturers must continuously invest in R&D to maintain feature parity and user satisfaction

- Market saturation in key regions is pushing brands to innovate through design, connectivity, and functionality rather than relying solely on brand recognition. This intensifies competition and forces differentiation through technological advancements

- Consumers’ willingness to adopt new audio technologies is balanced by cost sensitivity and brand loyalty, which can slow adoption of high-end devices. Managing this tension remains a key challenge for sustaining long-term growth in the sector

Consumer Audio Market Scope

The market is segmented on the basis of product type, technology, functionality, and connectivity.

- By Product Type

On the basis of product type, the consumer audio market is segmented into headphones, headsets, speaker systems, soundbars, microphones, and others. The headphones segment dominated the market with the largest market revenue share in 2025, driven by their widespread adoption among individual consumers for personal entertainment, remote work, and gaming. Headphones offer portability, comfort, and advanced sound quality, which make them highly preferred for both casual and professional use. The market also sees strong demand for headphones due to the integration of noise-cancellation and smart features, enhancing user experience and convenience across diverse environments.

The speaker systems segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing home entertainment adoption and the growing preference for immersive audio experiences. For instance, companies such as Bose and Sonos are innovating with multi-room, high-fidelity smart speakers, enabling consumers to enjoy premium sound quality with wireless control. The growing trend of streaming music services and smart home integration also supports the rapid adoption of advanced speaker systems for residential and commercial spaces.

- By Technology

On the basis of technology, the consumer audio market is segmented into smart devices and non-smart devices. The smart devices segment held the largest market revenue share of 54.7% in 2025, driven by consumer preference for audio devices that offer voice assistant integration, app control, and AI-enhanced sound customization. Smart audio devices provide seamless connectivity with smartphones, smart home systems, and streaming platforms, creating a more interactive and personalized listening experience. The adoption of smart devices is further supported by the rising demand for connected lifestyle products in both developed and emerging markets.

The non-smart devices segment is expected to witness the fastest growth from 2026 to 2033 due to their affordability and simplicity for users seeking basic audio solutions. For instance, traditional wired speakers and analog headsets continue to be favored in educational institutions and professional studios where reliability and straightforward functionality are prioritized. Non-smart devices also benefit from brand loyalty and strong resale value in regions with lower smart device penetration.

- By Functionality

On the basis of functionality, the consumer audio market is segmented into Bluetooth, Wi-Fi, Bluetooth+Wi-Fi, Airplay, radio frequency, and others. The Bluetooth segment dominated the market in 2025, driven by the convenience of wireless connectivity, low power consumption, and compatibility with smartphones, tablets, and laptops. Bluetooth-enabled consumer audio products allow easy pairing, portability, and seamless media streaming, making them the most widely adopted functionality among general users. Consumers also prefer Bluetooth devices for their versatility in personal and outdoor use, supported by ongoing improvements in audio quality and transmission range.

The Bluetooth+Wi-Fi segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by demand for hybrid devices offering both local and internet-enabled streaming. For instance, companies such as Sony and JBL are expanding offerings that allow users to switch between Bluetooth for direct device connectivity and Wi-Fi for multi-room or cloud-based playback. This dual-functionality approach is increasingly popular in smart homes and modern entertainment setups, providing flexibility, convenience, and high-quality sound experiences.

- By Connectivity

On the basis of connectivity, the consumer audio market is segmented into wired and wireless. The wireless segment dominated the market in 2025, driven by the growing consumer preference for cable-free convenience, mobility, and ergonomic designs. Wireless audio devices, such as true wireless earbuds and portable speakers, are increasingly integrated with Bluetooth and Wi-Fi technologies to support seamless streaming and smart control features. The adoption of wireless devices is further reinforced by the growing trend of work-from-home setups and mobile entertainment, where untethered audio solutions are highly valued.

The wired segment is expected to witness the fastest growth from 2026 to 2033 due to its reliability, consistent sound quality, and lower latency compared to wireless alternatives. For instance, high-end professional headphones and studio monitors from brands such as Sennheiser and Audio-Technica remain highly preferred in recording studios and professional environments. Wired devices also appeal to audiophiles and gamers seeking uncompromised performance, supporting steady adoption alongside the expansion of high-fidelity audio formats.

Consumer Audio Market Regional Analysis

- North America dominated the consumer audio market with the largest revenue share of 45.5% in 2025, driven by a growing demand for personal entertainment, gaming, and connected audio devices

- Consumers in the region highly value high-quality sound, portability, and seamless integration with smartphones, smart TVs, and home automation systems

- This widespread adoption is further supported by high disposable incomes, a tech-savvy population, and the increasing popularity of wireless and smart audio devices, establishing consumer audio as a preferred solution for both residential and commercial applications

U.S. Consumer Audio Market Insight

The U.S. consumer audio market captured the largest revenue share in 2025 within North America, fueled by rapid adoption of smart headphones, wireless speakers, and multi-room sound systems. Consumers are increasingly prioritizing immersive audio experiences and convenience offered by voice-controlled and app-managed devices. The rising trend of gaming, streaming services, and work-from-home setups is further propelling the market. Moreover, the integration of devices with platforms such as Amazon Alexa, Google Assistant, and Apple AirPlay is significantly contributing to the market’s growth.

Europe Consumer Audio Market Insight

The Europe consumer audio market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising urbanization, increasing disposable incomes, and growing demand for connected and high-fidelity audio devices. Consumers in Europe are drawn to smart speakers, wireless headphones, and soundbars for both entertainment and professional use. The region is witnessing adoption across residential, commercial, and educational sectors, with increasing preference for energy-efficient and multifunctional audio solutions.

U.K. Consumer Audio Market Insight

The U.K. consumer audio market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising home entertainment trends, gaming, and demand for wireless, portable, and smart audio devices. In addition, consumer interest in high-quality sound, convenience, and compatibility with streaming services encourages adoption. The U.K.’s strong e-commerce ecosystem and early adoption of connected devices are expected to continue stimulating market growth.

Germany Consumer Audio Market Insight

The Germany consumer audio market is expected to expand at a considerable CAGR during the forecast period, fueled by strong consumer preference for premium audio equipment, technological innovation, and digital lifestyle adoption. Germany’s developed infrastructure, coupled with increasing awareness of smart devices, supports growth in wireless headphones, speaker systems, and professional audio setups. The integration of consumer audio products with smart home and entertainment ecosystems is becoming increasingly prevalent, catering to both residential and commercial applications.

Asia-Pacific Consumer Audio Market Insight

The Asia-Pacific consumer audio market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising urbanization, increasing disposable incomes, and technological adoption in countries such as China, Japan, and India. The region’s growing interest in home entertainment, smart audio devices, and portable audio solutions is driving demand. Furthermore, APAC’s role as a manufacturing hub for headphones, wireless speakers, and smart audio components is making these products more affordable and accessible to a wider consumer base.

Japan Consumer Audio Market Insight

The Japan consumer audio market is gaining momentum due to the country’s high-tech culture, strong preference for premium audio, and demand for convenience. The adoption of wireless headphones, soundbars, and smart speakers is fueled by the increasing number of smart homes and connected buildings. Integration with IoT devices, including smart TVs and home assistants, is further driving market expansion. Moreover, Japan’s aging population is likely to spur demand for easy-to-use, reliable, and high-quality audio solutions in both residential and commercial sectors.

China Consumer Audio Market Insight

The China consumer audio market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s growing middle class, rapid urbanization, and high adoption of connected devices. China represents one of the largest markets for headphones, speaker systems, and smart audio solutions. The push towards smart homes, availability of cost-effective products, and presence of strong domestic manufacturers are key factors propelling market growth in the region.

Consumer Audio Market Share

The consumer audio industry is primarily led by well-established companies, including:

- HARMAN International (U.S.)

- Apple Inc. (U.S.)

- Bose Corporation (U.S.)

- JVCKENWOOD Corporation (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Panasonic Corporation (Japan)

- Plantronics, Inc. (U.S.)

- Onkyo & Pioneer Corporation (Japan)

- Sennheiser electronic GmbH & Co. KG (Germany)

- Devialet (France)

- Jaybird (U.S.)

- Samsung (South Korea)

- Shure Incorporated (U.S.)

- VOXX International Corp. (U.S.)

- Skullcandy, Inc. (U.S.)

- Zebronics India Pvt. Ltd. (India)

- Earin (Sweden)

- Trüsound Audio (India)

- MIVI (India)

- Audio-Technica (Japan)

- beyerdynamic GmbH & Co. KG (Germany)

- DALI A/S (Denmark)

Latest Developments in Global Consumer Audio Market

- In November 2025, Sony introduced its new WF‑1000XM6 wireless earbuds, featuring enhanced noise cancellation, AI‑driven audio processing, and improved wireless connectivity. This expansion of Sony’s flagship TWS lineup strengthens its position in the premium true wireless segment, elevating user experience through advanced performance and smarter connectivity, which can attract discerning consumers and bolster Sony’s market share in personal audio

- In November 2025, Sony also launched its latest wireless noise-cancelling headphones with AI-powered personalized sound profiles. This move reinforces Sony's commitment to innovation, setting a higher benchmark for premium audio products and enhancing user experience, while positioning the company to capture a larger share of the high-end consumer audio segment

- In October 2025, Bose unveiled a new series of smart speakers with voice recognition and expanded smart home integration. This strategic pivot aligns Bose with the growing trend of interconnected devices, positioning its products as central hubs in smart living setups and enhancing its presence in a market increasingly driven by convenience and ecosystem compatibility

- In September 2025, Apple expanded its AirPods lineup with a new model offering longer battery life and improved sound quality. By continuously refining its core products and deepening ecosystem integration, Apple strengthens its competitive edge in the wireless audio market and ensures sustained consumer loyalty

- In March 2025, Xiaomi launched its Smart Speaker Pro, equipped with advanced AI processing and high-fidelity drivers aimed at premium audio performance. This development underscores Xiaomi’s push to enhance its smart home portfolio, enabling it to compete with established brands while appealing to users seeking high-value, connected audio solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Consumer Audio Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Consumer Audio Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Consumer Audio Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.