Global Content Analytics Market

Market Size in USD Billion

CAGR :

%

USD

9.54 Billion

USD

47.92 Billion

2025

2033

USD

9.54 Billion

USD

47.92 Billion

2025

2033

| 2026 –2033 | |

| USD 9.54 Billion | |

| USD 47.92 Billion | |

|

|

|

|

Content Analytics Market Size

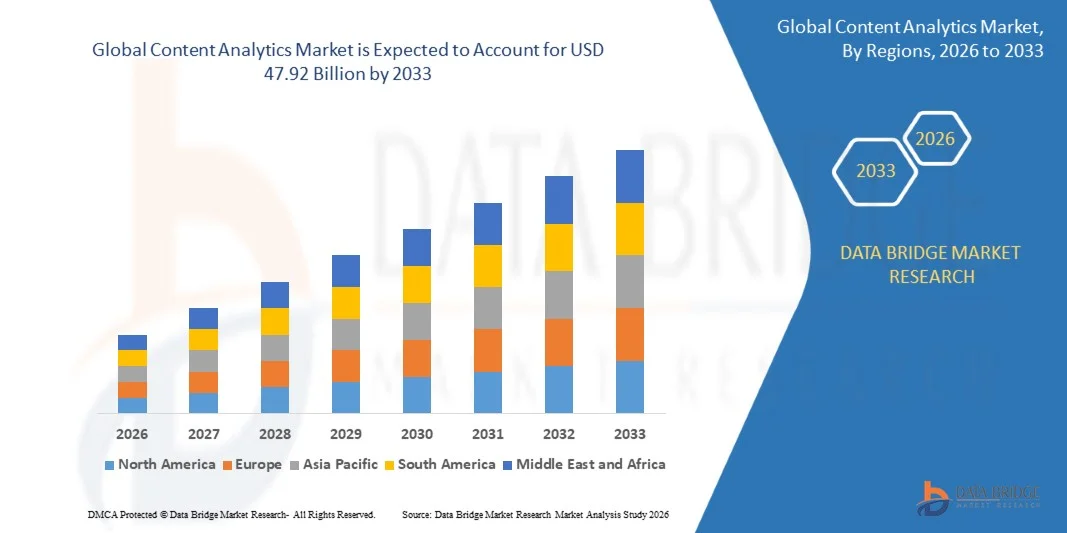

- The global content analytics market size was valued at USD 9.54 billion in 2025 and is expected to reach USD 47.92 billion by 2033, at a CAGR of 22.35% during the forecast period

- The market growth is largely fueled by the increasing adoption of AI, big data, and cloud-based technologies, driving organizations to leverage content analytics for actionable insights and improved decision-making across industries

- Furthermore, rising demand from enterprises for real-time, data-driven solutions to enhance customer engagement, optimize operations, and monitor content performance is accelerating the adoption of content analytics platforms, thereby significantly boosting the industry’s growth

Content Analytics Market Analysis

- Content analytics, enabling the extraction of actionable insights from structured and unstructured data, is becoming a critical tool for enterprises across BFSI, retail, IT, healthcare, and media sectors due to its ability to improve operational efficiency, customer experience, and strategic decision-making

- The escalating demand for content analytics is primarily fueled by the growing reliance on digital content, the need for personalized marketing and customer insights, and the integration of AI and machine learning into analytics platforms to enable predictive and prescriptive insights

- North America dominated the content analytics market with a share of 49.3% in 2025, due to the rapid adoption of data-driven decision-making and digital transformation initiatives across enterprises

- Asia-Pacific is expected to be the fastest growing region in the content analytics market during the forecast period due to rising digital transformation initiatives, urbanization, and increasing adoption of AI and cloud analytics in countries such as China, Japan, and India

- Cloud-based segment dominated the market with a market share of 69% in 2025, due to its scalability, cost-effectiveness, and ease of deployment across distributed teams. Enterprises increasingly prefer cloud-based content analytics for seamless integration with existing IT infrastructure and remote accessibility. Cloud deployment also offers benefits such as automatic updates, enhanced collaboration, and the ability to handle large-scale analytics workloads efficiently. The availability of advanced security protocols and compliance frameworks further strengthens adoption among enterprises managing sensitive data

Report Scope and Content Analytics Market Segmentation

|

Attributes |

Content Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Content Analytics Market Trends

“Rising Adoption of AI-Powered Content Analytics”

- A significant trend in the content analytics market is the growing adoption of AI-driven platforms that allow enterprises to extract actionable insights from vast volumes of structured and unstructured data, improving decision-making and operational efficiency. Organizations are increasingly relying on AI to automate the analysis of customer interactions, social media content, and enterprise documents, enabling more personalized engagement and better business intelligence

- For instance, Adobe’s launch of generative AI tools within Adobe Experience Cloud, including Adobe Content Analytics, empowers marketers to generate tailored content while simultaneously analyzing engagement metrics across multiple channels. These capabilities strengthen strategic decision-making by providing real-time insights into consumer behavior and content performance

- The integration of AI-powered content analytics with existing cloud-based and enterprise platforms is accelerating adoption across sectors such as BFSI, retail, IT, and healthcare. This trend is driving the shift from traditional reporting tools to intelligent, predictive, and prescriptive analytics solutions that deliver real-time, actionable insights

- Enterprises are leveraging content analytics to improve customer experience by analyzing digital interactions across web, social, and mobile channels. This approach enhances personalization, strengthens engagement strategies, and supports revenue optimization through data-driven marketing initiatives

- The rise of AI and machine learning in content analytics also supports automation of repetitive analytical tasks, enabling businesses to focus on strategic insights and creative problem-solving. Organizations adopting these solutions are better positioned to respond to dynamic market conditions and evolving customer expectations

- The increasing reliance on AI-driven content analytics platforms is encouraging vendors to continuously enhance solution offerings with advanced visualization, natural language processing, and predictive modeling features. This trend is reinforcing the central role of content analytics in modern enterprise intelligence strategies

Content Analytics Market Dynamics

Driver

“Increasing Demand for Data-Driven Decision-Making”

- The growing emphasis on data-driven decision-making across industries is a major driver for the content analytics market, as organizations seek to improve operational efficiency, customer engagement, and strategic planning by deriving actionable insights from their content and communications

- For instance, IBM’s launch of Watsonx Assistant for Z and D&B Ask Procurement demonstrates how generative AI and analytics solutions are being used to enhance decision-making and streamline enterprise workflows. These solutions allow businesses to analyze complex datasets and extract insights that inform procurement, risk management, and operational strategies

- The rising adoption of cloud-based content analytics solutions is enabling organizations to process large volumes of data with minimal infrastructure investment, thereby expanding the reach and impact of analytics tools

- The growing importance of personalization in marketing, customer service, and content delivery is encouraging enterprises to adopt content analytics solutions that can provide real-time insights into audience behavior. This helps organizations optimize campaigns, improve conversion rates, and strengthen customer loyalty

- Increasing digitalization, remote work trends, and omnichannel business models are further driving the adoption of content analytics, as enterprises require accurate, timely, and actionable insights across multiple platforms and communication channels

Restraint/Challenge

“Integration Complexity Across Multiple Data Sources”

- A key challenge in the content analytics market is the difficulty of integrating and analyzing data from diverse and heterogeneous sources, including structured databases, unstructured documents, social media platforms, and enterprise communication tools

- For instance, large enterprises implementing solutions from vendors such as SAP or Microsoft often face complexity in consolidating data from legacy systems with modern analytics platforms, requiring significant IT investment and technical expertise

- Ensuring data consistency, security, and accuracy across multiple platforms adds operational complexity, potentially delaying deployment and limiting the full potential of content analytics initiatives

- Organizations must also address challenges related to data privacy regulations, such as GDPR and CCPA, when integrating content from multiple regions or business units, increasing the overall effort and cost of analytics projects

- These integration complexities can hinder scalability and the speed of deriving actionable insights, requiring enterprises to adopt robust implementation strategies and skilled personnel to fully leverage content analytics solutions

Content Analytics Market Scope

The market is segmented on the basis of software, deployment model, application, vertical, and component.

• By Software

On the basis of software, the content analytics market is segmented into SDS server, SDS controller software, data security, and data management. The data management segment dominated the market with the largest revenue share in 2025, driven by its critical role in handling, organizing, and extracting insights from vast volumes of structured and unstructured data. Organizations prioritize data management solutions for their ability to streamline operations, enhance decision-making, and ensure data consistency across multiple sources. Data management software also supports integration with advanced analytics platforms and cloud ecosystems, enabling businesses to leverage real-time insights effectively. The robust features such as metadata management, data quality monitoring, and automated reporting contribute to its widespread adoption.

The SDS controller software segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the increasing need for real-time control and monitoring of data workflows. For instance, IBM’s SDS controller solutions are gaining traction among enterprises seeking to optimize storage and analytics operations. Controller software allows organizations to automate data orchestration, reduce operational complexity, and improve overall system efficiency. Its growing adoption is also driven by compatibility with hybrid and multi-cloud environments, supporting dynamic allocation of computing and storage resources. The segment’s flexibility and ability to support predictive analytics make it a preferred choice for large-scale enterprises.

• By Deployment Model

On the basis of deployment model, the content analytics market is segmented into on-premise and cloud-based solutions. The cloud-based segment held the largest market revenue share of 69% in 2025 due to its scalability, cost-effectiveness, and ease of deployment across distributed teams. Enterprises increasingly prefer cloud-based content analytics for seamless integration with existing IT infrastructure and remote accessibility. Cloud deployment also offers benefits such as automatic updates, enhanced collaboration, and the ability to handle large-scale analytics workloads efficiently. The availability of advanced security protocols and compliance frameworks further strengthens adoption among enterprises managing sensitive data.

The on-premise segment is expected to witness the fastest CAGR from 2026 to 2033, driven by organizations seeking complete control over data storage and processing. For instance, Oracle’s on-premise analytics solutions are widely adopted in sectors with strict regulatory requirements. On-premise solutions provide enhanced data security, low latency processing, and the ability to customize analytics workflows according to organizational needs. The rising focus on data privacy and compliance in industries such as BFSI and government further boosts demand for on-premise deployments. In addition, on-premise models support integration with legacy IT systems, ensuring continuity of enterprise operations.

• By Application

On the basis of application, the content analytics market is segmented into web analytics, speech analytics, social media analytics, text analytics, data backup and disaster recovery, surveillance, storage provisioning, and others. The web analytics segment dominated the market with the largest revenue share in 2025, driven by the growing need to monitor and optimize online presence and user engagement. Businesses rely on web analytics for tracking customer behavior, measuring campaign effectiveness, and enhancing digital marketing strategies. The integration of AI-powered analytics enables predictive insights, personalized recommendations, and improved customer experience. The segment also benefits from real-time dashboards and reporting tools that assist decision-makers in implementing rapid interventions.

The social media analytics segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising social media adoption and increasing brand engagement strategies. For instance, Sprinklr’s social media analytics platform helps enterprises track sentiment, engagement, and competitive performance. Social media analytics allows organizations to extract actionable insights from multiple platforms, enabling targeted campaigns and reputation management. The surge in user-generated content and influencer marketing further drives demand for analytics solutions that can process large volumes of unstructured data. Businesses increasingly leverage these insights to optimize customer interactions and drive brand loyalty.

• By Vertical

On the basis of vertical, the content analytics market is segmented into healthcare, government, IT and telecom, banking, financial services, and insurance (BFSI), travel and hospitality, retail and consumer goods, media and entertainment, and others. The BFSI vertical dominated the market with the largest revenue share in 2025, driven by the need for risk management, fraud detection, and customer-centric analytics solutions. Financial institutions rely on content analytics to monitor transactions, ensure regulatory compliance, and enhance customer experience. Advanced analytics also support predictive modeling, portfolio management, and personalized service offerings. BFSI organizations increasingly integrate analytics platforms with cloud and AI technologies for real-time insights and operational efficiency. The segment’s robust adoption is reinforced by the critical importance of accurate and timely data in financial decision-making.

The retail and consumer goods vertical is expected to witness the fastest CAGR from 2026 to 2033, fueled by the rising need for personalized marketing, inventory optimization, and consumer behavior analysis. For instance, Walmart leverages content analytics to optimize supply chain operations and predict customer demand patterns. Retailers use analytics to track purchase trends, manage promotions, and improve in-store and online customer experiences. Growing e-commerce penetration and omnichannel strategies further drive the adoption of advanced content analytics solutions. Analytics also assists in enhancing loyalty programs and targeted advertising campaigns, increasing overall profitability and customer retention.

• By Component

On the basis of component, the content analytics market is segmented into sales & operation planning, manufacturing analytics, and transportation & logistics analytics. The manufacturing analytics segment dominated the market with the largest revenue share in 2025 due to its role in improving production efficiency, quality control, and predictive maintenance. Manufacturers rely on content analytics to identify bottlenecks, optimize resource utilization, and reduce operational costs. Integration with IoT devices and ERP systems enables real-time monitoring of production lines and data-driven decision-making. Analytics also supports demand forecasting, supply chain optimization, and product lifecycle management, enhancing overall competitiveness. The adoption is further driven by the need to comply with industry standards and safety regulations.

The transportation & logistics analytics segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the growing demand for efficient supply chain management and route optimization. For instance, DHL utilizes advanced logistics analytics to enhance delivery speed and reduce operational costs. Analytics solutions allow transportation companies to track shipments, predict delays, and optimize fleet management. The rising trend of e-commerce and global trade expansion further drives the adoption of analytics in logistics. Predictive and prescriptive analytics capabilities help organizations make proactive decisions, improve customer satisfaction, and minimize disruptions in the supply chain.

Content Analytics Market Regional Analysis

- North America dominated the content analytics market with the largest revenue share of 49.3% in 2025, driven by the rapid adoption of data-driven decision-making and digital transformation initiatives across enterprises

- Organizations in the region highly value advanced analytics capabilities, real-time insights, and seamless integration with existing IT infrastructure and cloud platforms such as AWS and Microsoft Azure

- This widespread adoption is further supported by high IT spending, a technologically advanced workforce, and growing awareness of the strategic benefits of content analytics in improving operational efficiency, customer engagement, and business intelligence

U.S. Content Analytics Market Insight

The U.S. content analytics market captured the largest revenue share in 2025 within North America, fueled by the accelerated adoption of cloud computing, AI, and big data analytics solutions. Enterprises are increasingly prioritizing solutions that provide actionable insights from unstructured and structured data to enhance decision-making. The growing trend of predictive analytics, coupled with demand for mobile and web-based access, further propels market growth. Moreover, the integration of content analytics with business intelligence platforms, CRM systems, and enterprise resource planning (ERP) software is significantly contributing to the market’s expansion.

Europe Content Analytics Market Insight

The Europe content analytics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by regulatory compliance requirements, such as GDPR, and the increasing need for data-driven decision-making in enterprises. Rising digitalization and cloud adoption are fostering the uptake of content analytics solutions. European organizations are drawn to the ability to extract actionable insights from multiple data sources, improving operational efficiency and customer experience. The market is witnessing significant adoption across BFSI, retail, and government sectors, with enterprises leveraging analytics for strategic planning and innovation initiatives.

U.K. Content Analytics Market Insight

The U.K. content analytics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by enterprises’ increasing focus on data monetization and customer experience enhancement. Concerns regarding cybersecurity and data governance are encouraging organizations to adopt robust analytics solutions. The U.K.’s advanced IT infrastructure, high cloud adoption rates, and the presence of analytics service providers are expected to continue supporting market growth. In addition, organizations are leveraging AI-powered analytics for social media monitoring, sentiment analysis, and predictive business insights.

Germany Content Analytics Market Insight

The Germany content analytics market is expected to expand at a considerable CAGR during the forecast period, fueled by the growing demand for operational efficiency, predictive analytics, and automation in enterprises. Germany’s emphasis on technological innovation and digital transformation promotes the adoption of content analytics solutions, particularly in manufacturing, BFSI, and government sectors. Enterprises are increasingly integrating analytics tools with cloud platforms and IoT devices to gain real-time insights. Data security and compliance remain significant factors driving adoption, as organizations prioritize secure, privacy-focused analytics solutions.

Asia-Pacific Content Analytics Market Insight

The Asia-Pacific content analytics market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising digital transformation initiatives, urbanization, and increasing adoption of AI and cloud analytics in countries such as China, Japan, and India. Organizations across the region are leveraging content analytics for business intelligence, customer insights, and operational efficiency. Government programs supporting digital infrastructure and smart city projects are further boosting adoption. The growing number of startups and SMBs utilizing affordable analytics solutions is also expanding market accessibility.

Japan Content Analytics Market Insight

The Japan content analytics market is gaining momentum due to the country’s high-tech ecosystem, digital adoption, and focus on operational efficiency. Enterprises prioritize analytics solutions for real-time monitoring, predictive insights, and enhanced decision-making capabilities. The integration of content analytics with AI, IoT, and cloud-based platforms is accelerating market growth. Moreover, Japan’s aging population and rising demand for automation in enterprise operations are driving adoption across healthcare, retail, and BFSI sectors.

China Content Analytics Market Insight

The China content analytics market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapid digital transformation, urbanization, and expansion of cloud and AI adoption. Enterprises are leveraging content analytics to optimize operations, improve customer engagement, and gain competitive advantage. The government’s push for smart cities, the proliferation of digital services, and the availability of domestic analytics solutions are key factors propelling market growth. China’s growing startup ecosystem and strong IT infrastructure further enhance adoption across multiple industry verticals.

Content Analytics Market Share

The content analytics industry is primarily led by well-established companies, including:

- Adobe (U.S.)

- Everteam (France)

- Genesys (U.S.)

- Verint (U.S.)

- Microsoft (U.S.)

- SAP (Germany)

- TIBCO Software Inc. (U.S.)

- ITyX (Germany)

- Oracle (U.S.)

- Social Annex, Inc. (U.S.)

- SPRINKLR INC. (U.S.)

- ScribbleLive (Canada)

- PathFactory (Canada)

- Uberflip (Canada)

- SnapApp, Inc. (U.S.)

- OneSpot (U.S.)

- Alluresoft, LLC (U.S.)

- Scoop.it Inc. (France)

- Wedia (France)

- Kapost (U.S.)

- Vendasta (Canada)

Latest Developments in Global Content Analytics Market

- In January 2026, ClickHouse secured a $400 M Series D funding round at a $15 B valuation, underscoring strong investor confidence in real-time data processing and analytics capabilities that support AI‑driven applications. This milestone highlights how demand for scalable, high-performance analytics infrastructure — critical for content analytics platforms handling massive data volumes — is accelerating industry growth and enabling more businesses to deploy advanced analytics solutions with lower latency and improved efficiency

- In September 2024, Adobe launched new generative AI tools within Adobe Experience Cloud, including the AI Assistant Content Accelerator and Adobe Content Analytics, designed to empower marketers to generate personalized content and optimize performance through real‑time experimentation and insights. This introduction significantly enhances the content analytics landscape by combining content creation with analytics, enabling brands to both produce tailored content and evaluate engagement metrics continuously, thereby driving increased adoption of analytics capabilities across marketing functions

- In July 2024, ThinkAnalytics partnered with TMT Insights to enhance supply chain transparency for media and entertainment firms using AI‑driven content analytics, aiming to improve end‑to‑end visibility and operational insights. This collaboration highlights growing appetite for sector‑specific analytics solutions that link content insights with business outcomes, expanding the scope of content analytics use cases and driving specialized market growth

- In June 2024, Telefonica Tech of Spain and IBM Corporation announced a collaboration to develop AI, analytics, and data management solutions using the open, hybrid SHARK.X platform, aimed at accelerating digital transformation for enterprises. By blending IBM’s analytics expertise with Telefonica’s infrastructure, this partnership advances the availability of sophisticated analytics and data tools for Spanish enterprises, fostering broader market uptake of integrated analytics and AI solutions and strengthening enterprise data strategies

- In May 2024, IBM introduced two generative AI assistants — IBM Watsonx Assistant for Z and D&B Ask Procurement — built on the Watsonx Orchestrate platform to streamline workflows and enhance decision‑making through analytics and automation. These innovations demonstrate how generative AI is being embedded into enterprise analytics platforms, enabling organizations to derive actionable insights faster and automate complex processes, which further fuels demand for analytics solutions across business functions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.